UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2022

Commission File Number: 001-38353

PagSeguro Digital Ltd.

(Name of Registrant) Conyers Trust Company (Cayman) Limited,

Cricket Square, Hutchins Drive, P.O. Box 2681,

Grand Cayman, KY1-1111, Cayman Islands

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(7):

Yes ☐ No ☒

PAGS reports Third Quarter 2022 Results

Net Income | GAAP of R$ 380 million, +18% y/y

Net Income | Non-GAAP of R$ 411 million

São Paulo, November 22, 2022 – PagSeguro Digital Ltd. (“PAGS” or “we”) announced today its third quarter results for the period ended September 30, 2022. The consolidated financial statements are presented in Reais (R$) and prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). For further information about certain of the metrics and indicators in this release, please consult the Glossary available at the end of this release.

3Q22 Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenue and Income | | | | PagSeguro TPV | | | | PagBank TPV | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 4.04 Billion | | | | R$ 90.3 Billion | | | | R$ 105.1 Billion | |

| | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | GAAP | | | | PagSeguro Monthly TPV / Merchant | | | | Total Deposits | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 380 Million | | | | R$ 4.1 K | | | | R$ 19.4 Billion | |

| | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | Non-GAAP | | | | PagSeguro Revenue | | | | Credit Portfolio | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 411 Million | | | | R$ 3.7 Billion | | | | R$ 2.7 Billion | |

| | | | | | | | | | |

| | | | |

To our shareholders

We are delighted to announce another quarter of strong results and remarkable achievements, consolidating our disruptive position and our commitment to long-term sustainable growth.

We ended the third quarter with 26 million PagBank clients, the second largest digital bank in Brazil. PagBank cash-in surpassed 40 billion reais, and Total Deposits reached almost 20 billion reais just 3 years after its creation.

We are the market share expansion winner in Payments this year. While the industry volume grew +30% in the first nine months of 2022, PagSeguro TPV grew +50%, +92 bps vs. 4Q21 based on ABECS criteria, considering only cards TPV (debit, credit and prepaid) and not including Pix QR code, “boletos” (bank slips) and vouchers. We also executed the highest repricing in the industry (+42 bps vs. 4Q21) with no additional churn, reinforcing our unique and superior value proposition.

Remaining the longtail segment leader, we have diversified our set of financial services (PagBank) and payments solutions to explore a much larger market. Our unique and complete value proposition includes:

•One app, One platform, One customer care: banking and payments;

•PagBank: wide range of financial services;

•Complete set of payments acceptance: cards, pix, boletos and wire transfers;

•Omnichannel solutions: in-store, online and self-service;

•Value-added services: loyalty, sales management, reconciliation and delivery;

•Most efficient salesforce: HUBs and digital.

We have been highly disciplined and efficient, always balancing growth with profitability. I remain extremely excited for the next chapters of PAGS taking advantage of digital financial disruption in Brazil.

Alexandre Magnani, Chief Executive Officer

| | | | | | | | | | | | | | | | | | | | | | | |

| PagBank Operational KPIs | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| PagBank TPV | R$ Billion | | 105.1 | 58.8 | 79% | | 85.5 | 23% |

| Credit Porfolio | R$ Billion | | 2.7 | 1.6 | 71% | | 2.3 | 17% |

| Active Clients | # Million | | 15.8 | 12.2 | 29% | | 15.1 | 4% |

| ARPAC | | R$ 90 | R$ 83 | 8% | | R$ 90 | 0% |

| | | | | | | | | | | | | | | | | | | | | | | |

| PagSeguro Operational KPIs | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| PagSeguro TPV | R$ Billion | | 90.3 | 66.8 | 35% | | 89.2 | 1% |

| Monthly TPV per Merchant | R$ Thousand | | 4.1 | 2.9 | 39% | | 3.9 | 4% |

| Gross Take Rate | | 4.11% | 3.73% | 38 bps | | 4.04% | 7 bps |

| Net Take Rate | | 2.59% | 2.15% | 44 bps | | 2.51% | 8 bps |

| | | | | | | | | | | | | | | | | | | | | | | |

| Financial KPIs | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Total Revenue and Income¹ | | 4,035 | | 2,776 | | 45% | | 3,911 | | 3% |

| PagSeguro | | 3,713 | | 2,491 | | 49% | | 3,606 | | 3% |

| PagBank | | 339 | | 259 | | 31% | | 314 | | 8% |

| (-) Transactional Costs | | (1,424) | | (1,112) | | 28% | | (1,414) | | 1% |

| (-) Financial Expenses | | (921) | | (210) | | 338% | | (756) | | 22% |

| (-) Chargeback | | (273) | | (130) | | 110% | | (270) | | 1% |

| (+) FX Expenses | | 12 | | 19 | | -33% | | 9 | | 42% |

| (-) Other Financial Income | | (46) | | (46) | | 1% | | (45) | | 3% |

| Gross Profit | | 1,384 | | 1,297 | | 7% | | 1,434 | | -3% |

| | | | | | | |

| (-) Operating Expenses | | (615) | | (555) | | 11% | | (603) | | 2% |

| Adjusted EBITDA | | 770 | | 742 | | 4% | | 831 | | -7% |

| PagSeguro | | 869 | | 778 | | 12% | | 927 | | -6% |

| PagBank | | (99) | | (36) | | 172% | | (96) | | 3% |

| | | | | | | |

| (-) POS Write-off | | (41) | | 0 | | n.a. | | (93) | | -56% |

| (-) D&A | | (290) | | (200) | | 45% | | (276) | | 5% |

| (+/-) Other Income (Expense), Net | | 34 | | 27 | | 24% | | 36 | | -7% |

| (-) Income Tax | | (61) | | (150) | | -59% | | (95) | | -35% |

| Net Income | Non-GAAP | | 411 | | 419 | | -2% | | 403 | | 2% |

| (-) Non-GAAP Effects | | (31) | | (97) | | -68% | | (36) | | -15% |

| Net Income | GAAP | | 380 | | 321 | | 18% | | 367 | | 4% |

| EPS | | R$ 1.16 | R$ 0.97 | 20% | | R$ 1.10 | 5% |

1. Including Other Financial Income.

New Products

Following our mission to disrupt and democratize payments and financial services in Brazil, we present our new products, services, and features, to keep expanding our two-sided ecosystem and increasing clients’ engagement.

Below, we share the details of our main initiatives launched in the third quarter of 2022.

PagSeguro

| | | | | | | | |

| | |

| Tap on Phone | PagTotem & Moderninha Smart 2 | Automatic Savings |

•Integrated solution in PagVendas ◦Tap on Phone ◦Payment Link ◦Pix QR Code

•Reducing Capex deployment | •Fostering one-stop-shop solution •Exploring a much larger market •Increasing VAS usage ◦PagVendas ◦ClubPag

•Diversifying POS suppliers | •Auto split settlement between ◦Balance Account ◦Savings Account

•% savings based on merchants’ decision •Unlocking secured credit card offering |

PagBank

| | | | | | | | |

| | |

| Credit Card backed by Balance Account | Bancassurance | Financial Education (“Trilha do Rendimento”) |

•Expanding credit offering •Addressing new and existing clients •Credit card limit tied to balance account •No NPLs | •New insurance products: ◦Pix ◦Credit Cards •Cross-selling opportunity •Distribution of 3rd-party products | •Financial education through gamification •Daily prizes for accomplished missions •Fostering PagBank deposits |

Operational Performance

PAGS

| | | | | |

| Total Payment Volume (TPV) | Net Take Rate |

| R$ Billion | % of PagSeguro TPV |

| |

PAGS TPV totaled R$195.4 billion, an increase of +56% vs. 3Q21 due to the growth of +35% in PagSeguro TPV and +79% in PagBank TPV, mainly driven by the maturation of merchant cohorts’ and market share gains in payments combined with deeper engagement with PagBank services.

PAGS Net Take Rate totaled 2.90% in 3Q22, an increase of +48 bps vs. 3Q21 and +15 bps vs. 2Q22. This increase reflects the ongoing repricing process, which is mainly applicable to our prepayment services. As a result, Financial Income yield increased +48 bps y/y. In addition, PagBank revenues continue to contribute to the sustainability of consolidated take rates. Excluding one-time positive effect on Transactions Costs, related to PagPhone’s reimbursement, PAGS Net Take Rate totaled 2.84%.

PagSeguro

| | | | | |

| PagSeguro TPV | Net Take Rate |

| R$ Billion | % of PagSeguro TPV |

| |

PagSeguro TPV totaled R$ 90.3 billion, an increase of +35% vs. 3Q21 mainly due to:

(i)larger share of wallet, driven by the migration from cash to electronic payments, leading to higher TPV per merchant;

(ii)maturation of existing cohorts, due to increasing productivity of our sales channels;

(iii)market share gains, boosted by HUBs execution exploring a much larger market; partially offset by:

(iv)weaker industry growth mainly due to deflation in Brazil in the 3Q22, and tougher comps.

As a result, PagSeguro market share grew +92 bps vs. 4Q21 based on ABECS criteria, considering only cards TPV (debit, credit and prepaid) and not including Pix QR code, “boletos” (bank slips) and vouchers, showing the results of PAGS efforts and strategies to prioritize merchants engaged with PagBank with higher recurrence.

PagSeguro Gross Take Rate totaled 4.11% and Net Take Rate totaled 2.65%. Excluding one-time positive effect on Transactions Costs, related to PagPhone’s reimbursement, PagSeguro Net Take Rate totaled 2.59%, +8bps higher than 2Q22 and +24bps higher than 1Q22.

This increase is mainly related to:

(i)ongoing repricing strategy to offset Brazilian Interest Rate hikes;

(ii)TPV mix towards credit cards transactions which have higher take rates;

partially offset by:

(iii)TPV mix by merchant profile, given our moving upmarket strategy.

| | | | | |

| Active Merchants | Monthly TPV per Merchant |

| # Million | R$ Thousand |

| |

PagSeguro ended the quarter with 7.3 million Active Merchants, the highest Active Merchants base in the Brazilian Acquiring Industry, -5% lower as compared to 3Q21. Since the beginning of the year, PagSeguro has been adopting a more selective acquisition strategy by increasing POS prices (reducing POS subsidies), focusing on clients with better unit economics, higher activation, and deeper engagement with PagBank.

Average Monthly TPV per Merchant totaled R$ 4.1 thousand, up +39% y/y, mainly related to larger share of wallet from merchants, due to more selective acquisition strategy in online sales channel, higher productivity of sales channels and market share gains.

PagBank

| | | | | |

| PagBank TPV | PagBank Cash-in |

| R$ Billion | R$ Billion |

| |

PagBank TPV totaled R$ 105.1 billion, an increase of +79% vs. 3Q21. This growth is mainly related to deepening clients’ engagement with day-to-day banking (deposits, bill payments, mobile top-up, Pix), cards spending and credit underwriting. The number of Pix transactions by PagBank clients accounted for 9.5% of total Pix transactions in Brazil, an increase of 2.5x in cash-in volumes when compared to the same period last year. The deeper engagement of our clients reflects our new products and services strategy, increasing the penetration of digital transactions replacing cash transactions.

PagBank Cash-in totaled R$ 41.9 billion, an increase of +131% in comparison with 3Q21. Most of the cash-in was driven by Pix transactions, and the Company has been working on advertising our investment products and other initiatives that positively contribute to foster growth in deposits.

| | | | | |

| Credit Portfolio | Total Deposits |

| R$ Billion | R$ Billion |

| |

PagBank Credit Portfolio reached R$ 2.7 billion in 3Q22, +71% vs. 3Q21. The increase in the quarter was mostly driven by secured loans underwriting such as Payroll Loans, FGTS early prepayment and our newest Secured Credit Card. Secured products reached 35% of share in the Credit Portfolio, resulting in a better-balanced portfolio.

Total Deposits reached R$ 19.4 billion, an increase of +171% vs. 3Q21. This increase reflects our superior value proposition to our merchants, demonstrated by the 50% increase in checking accounts (following TPV growth trends), and to our consumers as a digital and complete bank, with more clients considering PagBank as their primary bank, positively impacting cash-in and increasing deposits.

| | | | | | | | | | | | | | | | | | | | | | | |

| R$ Billion | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Total Deposits | | 19.4 | | 7.2 | | 171 | % | | 15.5 | | 25 | % |

| Checking Accounts | | 6.7 | | 4.5 | | 50 | % | | 6.1 | | 11 | % |

| Merchant's Payment Account | | 0.8 | | 0.7 | | 22 | % | | 0.8 | | 6 | % |

| Account Balances | | 5.9 | | 3.8 | | 55 | % | | 5.3 | | 11 | % |

| Savings Accounts | | 12.7 | | 2.7 | | 374 | % | | 9.4 | | 35 | % |

| Certificate of Deposits | | 10.2 | | 2.2 | | 374 | % | | 7.0 | | 46 | % |

| Interbank Deposits | | 2.2 | | 0.3 | | 649 | % | | 2.2 | | 3 | % |

| Corporate Securities | | 0.2 | | 0.2 | | -4 | % | | 0.2 | | -13 | % |

| | | | | |

| PagBank Clients | PagBank Active Clients |

| # Million | # Million |

| |

PagBank ended the quarter with 25.9 million clients, an increase of +32% vs. 3Q21, and Active Clients of 15.8 million, an increase of +29% vs. 3Q21. This increase is mainly related to higher penetration in consumers segment which represents 58% of PagBank clients vs. 47% in 3Q21. This increase also reflects PagBank releasing new products and best-in-class user experience.

Financial Performance

Total Revenue and Income

R$ Million

Total Revenue and Income reached R$ 4,035 million in 3Q22, an increase of +45% from R$ 2,776 million reported in 3Q21, as described below:

(i)Transaction Activities and Other Services:

Revenues from Transaction Activities and Other Services in 3Q22 amounted to R$ 2,292 million, an increase of +28% vs. 3Q21, due to:

↑ PagSeguro TPV growth of +35% y/y, reaching R$ 90.3 billion in 3Q22;

↑ PagBank Net Revenues growth of +31%, totaling R$ 339 million in 3Q22.

(ii)Financial Income:

Financial Income, which represents the discount fees we withhold from credit card transactions in installments for the early payment of accounts receivable, reached R$ 1,697 million, an increase of +81%, mainly due to:

↑ Increasing volume of credit transactions in PagSeguro TPV;

↑ Longer duration of installments in the TPV mix vs. 3Q21;

↑ Ongoing repricing while balancing client relationship.

(iii)Other Financial Income:

Other Financial Income reached R$ 46 million in 3Q22, flat compared to 3Q21, due to:

↑ Increase in interest on Cash and Cash Equivalents plus Financial Investments due to the higher Brazilian Basic Interest Rate (SELIC) as compared to 3Q21.

↓ Deductions from Other Financial Income amounted to R$ 30 million in 3Q22 from R$ 2.2 million in 3Q21. This increase is mainly due to new taxation legislation imposed by BCB Resolution nº 33 of 10/29/2020, which was implemented in January 2022 and changed prepayment to merchants through a fund revenue recognition to Financial Assets resulting in a tax of 4.65% vs. 0.00% charged previously. This effect will continue impacting PAGS’ results going forward.

Transaction Costs

R$ Million

Transaction Costs reached R$ 1,424 million in 3Q22, an increase of +28% from R$ 1,112 million reported in 3Q21. As a percentage of the total of our Revenues from Transaction Activities and Other Services, Transaction Costs remained stable in 62.1% in 3Q22 same as 3Q21.

When including one-time positive effect on cost of R$ 53 million, related to PagPhone’s reimbursement, Transaction Costs (GAAP) totaled R$ 1,372 million.

The increase is mainly related to:

↑ Interchange Fees paid to Card Issuers in 3Q22, totaled R$ 1,159 million, an increase of +41% y/y, mainly driven by the increase in TPV higher penetration on small and medium businesses (SMBs) segment and higher share of credit card volumes;

↑ Card Scheme Fees in 3Q22 totaled R$ 220 million, representing an increase of +34% y/y.

Financial Expenses

| | | | | |

| Financial Expenses | Bridge |

| R$ Million | R$ Million |

| |

|

|

Financial Expenses totaled R$ 921 million in 3Q22, up +339% vs. 3Q21. This increase is mainly explained by:

(i)R$ 637 million additional expenses related to the Brazilian Basic Interest Rate (SELIC) hikes; and

(ii)R$ 74 million related to the TPV growth with higher credit card mix;

Chargebacks

R$ Million

Chargebacks reached a total of R$ 273 million in 3Q22, up +110% vs. 3Q21. As a percentage of Total Revenues and Income, Chargebacks increased by +210 bps to 6.8% in 3Q22, up from 4.7% in 3Q21. This increase was mainly due to PagSeguro TPV higher exposure to credit cards, which have a higher likelihood of fraudulent transactions and additional provisions in PagBank Credit operation.

Gross Profit

R$ Million

Gross Profit totaled R$ 1,384 million in 3Q22, up +7% from R$ 1,297 million presented in 3Q21. This increase is mainly related to volume gains, successes stemming from PAGS’ repricing strategy, operating leverage captured by PAGS, diligent credit underwriting strategy more focused on payroll products with longer duration, partially offset by the increase in the average interest rate of the quarter, driving up financial expenses.

Operating Expenses

Non-GAAP | R$ Million

Operating Expenses which include Personnel Expenses, Marketing and Advertising and Other Expenses, totaled R$ 615 million, an increase of +11% compared to R$ 555 million in 3Q21. As a percentage of Total Revenue and Income, Operating Expenses represented 15% vs. 20% in 3Q21, showing PAGS ability to capture operating leverage.

When including non-GAAP expenses of R$ 95 million, Operating Expenses (GAAP) totaled R$ 710 million.

The increase is mainly related to:

↑ Personnel Expenses reached R$ 235 million, up +21% vs. 3Q21. This amount excludes LTIP adjustment of R$ 43 million in 3Q22 and R$ 141 million in 3Q21. As a percentage of Total Revenues and Income, non-GAAP Personnel Expenses were 5.8% in 3Q22, a decrease of -1.2% compared to 7.0% reported in 3Q21.

When including non-GAAP Expenses of R$ 43 million, GAAP Personal Expenses totaled R$ 278 million;

↓ Marketing and Advertising totaled R$ 200 million in 3Q22, down -5% from R$ 210 million presented in 3Q21. As a percentage of Total Revenues and Income, Marketing and Advertising expenses decreased by 260 bps to 5.0% in 3Q22, from 7.6% in 3Q21. This decrease was mainly due to the Company's decision of being more selective to attract new clients with better unit economics and LTV/CAC ratio;

↑ Other Expenses reached R$ 180 million in 3Q22, an increase of +20% from R$ 150 million reported in 3Q21. As a percentage of Total Revenues and Income, Other Expenses was 5.7% in 3Q22, an increase of +20 bps when compared to 5.5% reported in 3Q21.

When including non-GAAP expenses of R$ 52 million, GAAP Other Expenses totaled R$ 232 million.

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Operating Expenses | | (615) | | (555) | | 11 | % | | (603) | | 2 | % |

| Personnel Expenses | | (235) | | (195) | | 21 | % | | (241) | | -3 | % |

| Marketing and Advertising | | (200) | | (210) | | -5 | % | | (167) | | 19 | % |

| Other (Expenses) Income, Net | | (180) | | (150) | | 20 | % | | (195) | | -8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Operating Expenses | | (710) | | (699) | | 1 | % | | (654) | | 8 | % |

| Personnel Expenses | | (278) | | (336) | | -17 | % | | (292) | | -5 | % |

| Marketing and Advertising | | (200) | | (210) | | -5 | % | | (167) | | 19 | % |

| Other (Expenses) Income, Net | | (232) | | (153) | | 51 | % | | (195) | | 19 | % |

POS Write-off

R$ Million

In September 2019, we changed our business model from selling POS devices to subscription to follow the industry’s best standards and to improve merchant’s user experience in terms of:

• POS delivery for new merchants; and

• POS maintenance and replacement for existing merchants.

At that time, we strategically prepared for the launch of more than 300 HUBs with a salesforce of 3,000 to have the best SLAs in the market, providing a superior value proposition to focus not only on pricing (POS, MDR and prepayment) itself.

Between 2020 and 2021, the COVID-19 pandemic changed merchants’ transaction profile into PAGS ecosystem, adding more complexity to understanding merchants’ engagement and activity level. Now we have a better understanding of merchants’ activity and we started to write-off POS devices since the last quarter. In 3Q22 this value amounted to R$ 41 million vs. R$ 93 million in 2Q22.

Depreciation and Amortization

Non-GAAP | R$ Million

Depreciation and Amortization reached R$ 290 million up +45%, from R$200 million in 3Q21. These amounts exclude M&A expenses related to the amortization of fair value assets acquired as well as expenses for external consulting, accounting, and legal services in the amount of R$ 4.6 million in 3Q22 and R$ 3.5 million in 3Q21.

Including Non-GAAP expenses mentioned above, Depreciation and Amortization totaled R$ 294 million in the quarter, up +45% when compared to the R$ 203 million reported in 3Q21.

Adjusted EBITDA

R$ Million

Adjusted EBITDA amounted to R$ 770 million in 3Q22, up +4% vs. 3Q21, reflecting the ongoing repricing strategy carried out by PAGS during the period and operating leverage gains on HUBs and PagBank operations.

Income Tax and Social Contribution Reconciliation

GAAP

| | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Profit for the period before Taxes | | 425 | | 421 | | 1 | % | | 443 | | -4 | % |

| Statutory Rate | | 34 | % | 34 | % | 0 | % | | 34 | % | 0 | % |

| Expected Income Tax and Social Contribution | | (145) | | (143) | | 1 | % | | (151) | | -4 | % |

| Income Tax and Social contribution effect on: | | | | | | | |

| R&D and Tech Innovation Benefit - Law 11,196/05 (i) | | 63 | | 42 | | 51 | % | | 59 | | 6 | % |

| Taxation of Income abroad (ii) | | 35 | | 1 | | n.a. | | 29 | | 22 | % |

| Other | | 2 | | 1 | | 65 | % | | (13) | | n.a. |

| Income Tax and Social Contribution Expenses | | (45) | | (100) | | -55 | % | | (76) | | -41 | % |

| Effective Tax Rate | | 11 | % | 24 | % | (0.6) p.p. | | 17 | % | (6.5) p.p. |

| Income Tax and Social Contribution – Current | | 2 | | (8) | | -121 | % | | 1 | | -100 | % |

| Income Tax and Social Contribution – Deferred | | (47) | | (92) | | -49 | % | | (76) | | -39 | % |

(i) Refers to the benefit granted by the Technological Innovation Law (“Lei do Bem”), which reduces the income tax charges, based on the amount invested by the PagSeguro group on specific intangible assets, see Note 13 in our Form 6-K related to our consolidated Financial Statements, published on the date hereof.

(ii) Some entities and investment funds adopt different taxation regimes according to the applicable rules in their jurisdictions.

Income Tax and Social Contribution amounted to an expense of R$ 45 million in 3Q22, representing a decrease of -55%, from an expense of R$ 100 million presented in 3Q21. Our Effective Tax Rate (ETR) decreased by -1,310 bps to 10.6% in 3Q22 from 23.7% in 3Q21. In both periods, the difference between the Effective Income Tax and Social Contribution Rate and the Rate computed by applying the Brazilian federal statutory rate was mainly related to the Technological Innovation Law (“Lei do Bem”), which reduces income tax charges based on investments made in innovation and technology, such as those made by PagSeguro Brazil, our Brazilian operating subsidiary.

Additionally, in 2Q22 we experienced another effect related to Taxation of Income abroad, Certain entities or investment funds adopt different taxation regimes according to the applicable rules in their respective jurisdictions, which resulted in a decrease in our ETR by 8.2% for 3Q22.

| | | | | |

| Net Income GAAP | Non-GAAP |

| R$ Million | R$ Million |

| |

| |

Net Income for the quarter amounted to R$ 411 million on a non-GAAP basis, a decrease of -2%, from R$ 418 million reported in 3Q21, reflecting PAGS repricing process during the period, operating leverage gains on HUBs and PagBank operations and higher investment on marketing related to PagBank products launching.

Including Non-GAAP expenses of R$ 31 million, Net Income on a GAAP basis totaled R$ 380 million in the quarter, up +18% when compared to R$ 321 million reported in 3Q21, benefited by the items listed above and lower volume in share-based compensation.

Adjusted EBITDA and Non-GAAP Net Income Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Net Income | GAAP | | 271 | | 272 | | 322 | | 301 | | 350 | | 367 | | 380 | |

| (+) Income Tax and Social Contribution | | 89 | | 66 | | 100 | | 67 | | 67 | | 76 | | 45 | |

(+) LTIP Expenses3 | | 80 | | 106 | | 141 | | 44 | | 28 | | 51 | | 43 | |

| (+) POS Write-off | | 0 | | 0 | | 0 | | 0 | | 0 | | 93 | | 41 | |

| (+) Depreciation and Amortization | | 158 | | 182 | | 203 | | 226 | | 249 | | 281 | | 294 | |

| (-) Other Financial Income | | (35) | | (35) | | (46) | | (44) | | (42) | | (45) | | (46) | |

(+) M&A Expenses4 | | 0 | | 2 | | 4 | | 0 | | 0 | | 0 | | 0 | |

| (+) FX Expenses | | 9 | | 36 | | 19 | | 17 | | 13 | | 9 | | 12 | |

(+) PagPhone net realizable value reversal1 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | (53) | |

(-) Software's disposals3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 29 | |

(-) Boleto Flex impairment3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 13 | |

(-) Agreement with POS supplier3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 10 | |

| Adjusted EBITDA | | 573 | | 629 | | 742 | | 612 | | 665 | | 831 | | 770 | |

(+) Tax Provision Reversal3 | | (29) | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

(+) Digital Losses2 | | 73 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

(+) PagPhone write-off3 | | 0 | | 0 | | 0 | | 139 | | 0 | | 0 | | 0 | |

| Adjusted EBITDA | Recurring | | 617 | | 629 | | 742 | | 751 | | 665 | | 831 | | 770 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Net Income | GAAP | | 271 | | 272 | | 322 | | 301 | | 350 | | 367 | | 380 | |

(+) LTIP Expenses3 | | 80 | | 106 | | 141 | | 44 | | 28 | | 51 | | 43 | |

(+) M&A Expenses4 | | 5 | | 5 | | 6 | | 6 | | 5 | | 5 | | 5 | |

| (+) Income Tax and Social Contribution | | (29) | | (38) | | (50) | | (17) | | (11) | | (19) | | (16) | |

(+) PagPhone net realizable value reversal1 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | (35) | |

(-) Software's disposals3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 19 | |

(-) Boleto Flex impairment3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 8 | |

(-) Agreement with POS supplier3 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 7 | |

| Net Income | Non-GAAP | | 327 | | 345 | | 419 | | 334 | | 371 | | 403 | | 411 | |

(+) Tax Provision Reversal3 | | (19) | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

(+) Digital Losses2 | | 48 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

(+) PagPhone write-off3 | | 0 | | 0 | | 0 | | 92 | | 0 | | 0 | | 0 | |

| Net Income | Recurring | | 356 | | 345 | | 419 | | 426 | | 371 | | 403 | | 411 | |

Non-GAAP expenses booked in:

1. Transaction Costs;

2. Chargebacks;

3. Operating Expenses;

4. Depreciation and Amortization.

Cash Flow Analysis

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Earnings before Income Taxes | | 425 | | 421 | | 1 | % | | 443 | | -4 | % |

| Expenses (Revenues) not affecting Cash | | 1,238 | | 537 | | 130 | % | | 1,032 | | 20 | % |

| Net Cash provided by (used in) Operating Activities | | 1,071 | | 363 | | 195 | % | | 231 | | 364 | % |

| Net Cash provided by (used in) Investing Activities | | (498) | | (432) | | 15 | % | | (509) | | -2 | % |

| Net Cash provided by (used in) Financing Activities | | (361) | | (4) | | n.a. | | (13) | | n.a. |

| Increase (Decrease) in Cash and Cash Equivalents | | 213 | | (73) | | n.a. | | (291) | | n.a. |

| Cash and Cash Equivalents at the beginning of the Period | | 1,192 | | 1,196 | | 0 | % | | 1,483 | | -20 | % |

| Cash and Cash Equivalents at the end of the Period | | 1,404 | | 1,122 | | 25 | % | | 1,192 | | 18 | % |

Cash and Cash Equivalents at the beginning of 3Q22 amounted to R$ 1,192 million and ended the period amounted to R$ 1,404 million, representing a decrease of R$ 212 million. Earnings before Income Taxes in 3Q22 was R$ 425 million, +1% vs. 3Q21.

The Revenues, Income and Expenses which did not affect our cash flows, totaled a positive amount of R$ 1,238 million in 3Q22. This increase of 130% vs. 3Q21 is mainly explained by:

▪Increase in Chargebacks, mainly related to PagSeguro TPV growth and provisions for PagBank Credit operations, both totaling R$ 273 million, an increase of +110% vs. 3Q21;

▪Increase in Depreciation and Amortization amounted to R$ 294 million, an increase of +45% vs. 3Q21;

▪Increase in Interest accrued of Financial Assets and Liabilities totaling R$ 509 million vs. R$ 42 million in 3Q21, mainly related to interest paid on PagBank deposits/ Company’s borrowings;

▪Increase in Disposal of Property, Equipment and Intangible Assets, mainly explained by the write-offs of POS devices and software totaling R$ 84 million during 3Q22.

Net Cash provided by (used in) | Operating Activities

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Net Cash provided by (used in) Operating Activities | | 1,071 | | 363 | | 195 | % | | (287) | | n.a. |

| Earnings before Income Taxes | | 425 | | 421 | | 1 | % | | (416) | | n.a. |

| Expenses (Revenues) not affecting Cash | | 1,238 | | 537 | | 130 | % | | (756) | | n.a. |

| Changes in Operating Assets and Liabilities | | (1,548) | | (878) | | 76 | % | | 1,523 | | n.a. |

| Income Tax and Social Contribution paid | | (7) | | (3) | | 121 | % | | 40 | | n.a. |

| Interest Income received | | 963 | | 286 | | 237 | % | | (678) | | n.a. |

Net Cash provided in Operating Activities in 3Q22 totaled R$ 1,071 million, a decrease of 195% vs. 3Q21.

The adjustments for changes in Operating Assets and Liabilities in 3Q22 amounted to negative cash flow of R$ 1,548 million, mainly due to:

▪Accounts receivable, mainly related to receivables derived from transactions where we act as the financial intermediary in operations with the issuing banks, which is presented net of Transaction Costs and Financial Expenses we incur when we elect to receive early payment of the accounts receivable owed to us by card issuers, consists of the difference between the opening and closing balances of the Accounts Receivable item of Current Assets and Non-current Assets on our Balance Sheet (R$ 35,533 million at September 30, 2022 compared to R$ 31,536 million at June 30, 2022) excluding Interest Income Received in cash and Chargebacks, which are presented separately in the statement of Cash Flows. Accounts Receivable represented negative cash flow of R$ 5,230 million in the three months ended September 30, 2022

▪Payables to third parties, which is presented net of Revenue from Transaction Activities and Financial Income we receive when merchants elect to receive early payments, consists of the difference between the opening and closing balances of the Payables to Third Parties item of Current Liabilities on our Balance Sheet (R$ 15,179 million as of September 30, 2022 compared to R$ 14,360 million as at June 30, 2022). Payables to Third Parties represented a positive cash flow of R$ 561 million in the three months ended September 30, 2022;

▪Receivables from (Payables to) related Parties, consists of the difference between the opening and closing balances of the Payables to related Parties excluding Interest Paid, which are presented separately in the statement of Cash Flows. (R$ 451 million as at June 30, 2022 compared to R$ 270 million as at June 30, 2022). Receivables from (Payables to) related Parties represented positive cash flow of R$ 171 million in the three months ended September 30, 2022;

▪Salaries and Social Charges consist of the amounts that were recorded on our Statement of Income, but which remained unpaid at the end of the period. This item represented positive cash flow of R$ 49 million in the three months ended September 30, 2022

▪Trade Payables item consists of the difference between the opening and closing balances of trade payables (R$ 372 million on September 30, 2022, compared to R$ 507 million on June 30, 2022). Trade payables represented a negative cash flow of R$ 146 million in the three months ended September 30, 2022.

▪Taxes and contributions item consists of sales taxes (ISS. ICMS. PIS and COFINS). This item represented positive cash flow of R$ 9 million in the three months ended September 30, 2022.

▪Financial Investments (mandatory guarantee) item consists of the minimum amount that we need to maintain as required by the Brazilian Central Bank. This item represented a negative cash flow of R$ 0.3 million in the three months ended September 30, 2022.

▪Taxes Recoverable item consists of withholding taxes and recoverable taxes on transaction activities and other services and purchase of POS devices. This item represented positive cash flow of R$ 14 million in the three months ended September 30, 2022.

▪Deposits consists of issued certificates of deposit. excluding paid interest income paid to, which are presented separately in the statement of cash flows. This item represented a positive cash flow of R$ 2,992 million in the three months ended September 30, 2022.

•We paid income tax and social contribution in cash totaling R$ 7 million and recorded positive cash flow of R$ 963 million related to interest income received in cash in the three months ended September 30, 2022.

▪Interest Income received consisted of interest recorded under Accounts Receivable (monthly), which related to fees charged from merchants, considering the Brazilian monthly Interest Rate over PAGS Accounts Receivable. Interest Income amounted to R$ 963 million, representing an increase of 237% vs. 3Q21 mainly explained by the hike in the Brazilian Basic Interest rate (SELIC) and acquiring TPV growth.

Net Cash provided by (used in) | Investing Activities

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Net Cash provided by (used in) Investing Activities | | (498) | | (432) | | 15 | % | | (509) | | -2 | % |

| Amount paid on Acquisitions, Net of Cash Acquired | | 0 | | (44) | | n.a. | | 0 | | n.a. |

| Purchases of Property and Equipment | | (247) | | (226) | | 9 | % | | (341) | | -28 | % |

| Purchases and Development of Intangible Assets | | (256) | | (202) | | 26 | % | | (234) | | 9 | % |

| Acquisition of Financial Investments | | 4 | | 38 | | -89 | % | | 66 | | -94 | % |

| Redemption of Financial Investments | | 0 | | 2 | | n.a. | | 0 | | n.a. |

Net Cash used in Investing Activities in 3Q22, totaled R$ 498 million, representing a decrease of 15% vs. 3Q21, mainly due to:

▪Purchases of Property and Equipment of R$ 247 million, an increase of 9% y/y, mainly related to POS device purchases.

▪Purchases and Development of Intangible Assets of R$ 256 million, an increase of 26% y/y, which represent purchases of third-party software and salaries and other amounts that we invested to develop software and technology internally, which we capitalize as intangible assets.

▪Acquisition of Financial Investments, which positively impacted on the cash flow in R$ 4 million.

Net Cash provided by (used in) | Financing Activities

| | | | | | | | | | | | | | | | | | | | | | | |

GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

Net Cash provided by (used in) Financing Activities | | (361) | | (4) | | n.a. | | (13) | | n.a. |

Payment of Borrowings | | (250) | | 0 | n.a. | | 0 | n.a. |

Payment of Borrowings Interest | | (8) | | 0 | n.a. | | (7) | | 19 | % |

Payment of Leases | | (4) | | (4) | | 0 | % | | (6) | | -25 | % |

Acquisition of Treasury Shares | | (98) | | 0 | n.a. | | 0 | n.a. |

Net Cash used in Financing Activities in 3Q22, totaled R$ 361 million, this increase vs. R$ 4 million is related to payments of borrowings and its interests in the amount of R$ 258 million, payments of R$ 4 million in connection with leases and R$ 98 million to shares repurchase.

Appendix

Selected Capsule Balance Sheet Data*

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Total Assets | | 43,276 | | 26,960 | | 61 | % | | 39,196 | | 10 | % |

| Current Assets | | 37,709 | | 23,007 | | 64 | % | | 33,955 | | 11 | % |

| Cash & Financial Investments | | 2,478 | | 2,123 | | 17 | % | | 2,239 | | 11 | % |

| Account Receivables | | 34,570 | | 20,123 | | 72 | % | | 31,025 | | 11 | % |

| Others | | 661 | | 762 | | -13 | % | | 692 | | -4 | % |

| Non-Current Assets | | 5,567 | | 3,953 | | 41 | % | | 5,241 | | 6 | % |

| Account Receivables | | 731 | | 180 | | 307 | % | | 512 | | 43 | % |

| PP&E & Intangible Assets | | 4,671 | | 3,616 | | 29 | % | | 4,546 | | 3 | % |

| Others | | 164 | | 157 | | 4 | % | | 183 | | -10 | % |

| Liabilities and Equity | | 43,276 | | 26,960 | | 61 | % | | 39,196 | | 10 | % |

| Current Liabilities | | 28,287 | | 14,821 | | 91 | % | | 24,681 | | 15 | % |

| Payables to Third Parties | | 8,214 | | 6,575 | | 25 | % | | 8,278 | | -1 | % |

| Checking Accounts | | 6,734 | | 4,493 | | 50 | % | | 6,081 | | 11 | % |

| Savings Accounts | | 10,795 | | 2,458 | | 339 | % | | 7,689 | | 40 | % |

| Borrowings | | 987 | | 0 | | n.a. | | 1,206 | | -18 | % |

| Others | | 1,558 | | 1,294 | | 20 | % | | 1,426 | | 9 | % |

| Non-Current Liabilities | | 3,477 | | 1,683 | | 107 | % | | 3,326 | | 5 | % |

| Saving Accounts | | 1,843 | | 212 | | 770 | % | | 1,735 | | 6 | % |

| Others | | 1,634 | | 1,471 | | 11 | % | | 1,591 | | 3 | % |

| Equity | | 11,512 | | 10,457 | | 10 | % | | 11,189 | | 3 | % |

Balance Sheet Reconciliation

1. Cash & Cash Investments: Cash and Cash Equivalents + Financial Investments;

2. Others: Inventories + Taxes Recoverable + Other Receivables;

3. PP&E & Intangible Assets: Property and Equipment + Intangible Assets;

4.Others: Judicial Deposits + Prepaid Expenses + Deferred Income Tax and Social Contribution + Investments;

5. Payables to Third Parties: Payable to Third Parties – Checking Accounts;

6. Savings Accounts: Current Deposits;

7. Others: Trade Payables + Payables to Related Parties + Derivative Financial Instruments + Salaries and Social Charges + Taxes and Contributions + Provision for Contingencies + Deferred Revenue + Other Liabilities

8. Savings Accounts: Non-current Deposits;

9. Others: Deferred Income Tax and Social Contribution + Provision for Contingencies + Deferred Revenue + Other Liabilities;

10. Equity: Capital Reserve + Other Comprehensive Income + Equity Valuation Adjustments + Profit Retention Reserve + Treasury Shares.

* This selected capsule balance sheet data is presented only to facilitate a general overview of highlights of our financial performance for the periods indicated for informational purposes. For our complete Balance Sheet information, see our consolidated financial statements prepared in accordance with IFRS as issued by the IASB, in our Form 6-K related to the Financial Statements, published on the date hereof.

Selected Capsule Income Statement Data*

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Total Revenues and Income | | 4,035 | | 2,776 | | 45 | % | | 3,911 | | 3 | % |

| Transaction Activities and Other Services | | 2,292 | | 1,998 | | 15 | % | | 2,545 | | -10 | % |

| Financial Income | | 1,697 | | 954 | | 78 | % | | 1,660 | | 2 | % |

| Other Financial Income | | 46 | | 46 | | 1 | % | | 45 | | 3 | % |

| Total Costs and Expenses | | (3,563) | | (2,207) | | 61 | % | | (3,413) | | 4 | % |

| Cost of Sales and Services | | (1,911) | | (1,491) | | 28 | % | | (1,896) | | 1 | % |

| Selling Expenses | | (531) | | (368) | | 44 | % | | (499) | | 6 | % |

| Administrative Expenses | | (141) | | (138) | | 3 | % | | (153) | | -8 | % |

| Financial Expenses | | (921) | | (210) | | 339 | % | | (756) | | 22 | % |

| Other Expenses, Net | | (59) | | (2) | | n.a. | | (109) | | -46 | % |

| Income Tax and Social Contribution | | (61) | | (150) | | -59 | % | | (95) | | -35 | % |

| Current income tax and social contribution | | 2 | | (8) | | n.a. | | 1 | | 203 | % |

| Deferred income tax and social contribution | | (63) | | (142) | | -56 | % | | (95) | | -34 | % |

| % Tax Rate | | 13 | % | 26 | % | (13.4) p.p. | | 19 | % | (6.1) p.p. |

| Net Income | Non-GAAP | | 411 | | 419 | | -2 | % | | 403 | | 2 | % |

| Non-GAAP effects | | (31) | | (97) | | -68 | % | | (36) | | -15 | % |

| Net Income | GAAP | | 380 | | 322 | | 18 | % | | 367 | | 4 | % |

* This selected capsule income statement data is presented only to facilitate a general overview of highlights of our financial performance for the periods indicated for informational purposes. For our complete Income Statement information, see our consolidated financial statements prepared in accordance with IFRS as issued by the IASB, in our Form 6-K related to the Financial Statements, published on the date hereof.

Basic and Diluted EPS

| | | | | | | | | | | | | | | | | | | | | | | |

| Earnings Per Share Reconciliation | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Net Income attributable to: | | | | | | | |

| Owners of the Company | R$ Million | | 380 | | 321 | | 18 | % | | 367 | | 4 | % |

| Non-controlling interests | R$ Million | | — | | 0.2 | | — | | | — | | — | |

| Weighted avg. number of Outstanding Common Shares | # Million | | 327 | | 330 | | -1 | % | | 332 | | -1 | % |

| Weighted avg. number of common shares diluted | # Million | | 329 | | 332 | | -1 | % | | 333 | | -1 | % |

| Basic Earnings per common share | R$ | | 1.1639 | | 0.9727 | | 20 | % | | 1.1059 | | 5 | % |

| Diluted Earnings per common share | R$ | | 1.1562 | | 0.9669 | | 20 | % | | 1.1012 | | 5 | % |

Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | | 3Q22 | 3Q21 | Var. y/y | | 2Q22 | Var. q/q |

| Earnings before Income Taxes | | 425 | | 421 | | 1 | % | | 443 | | -4 | % |

| Expenses (Revenues) not affecting Cash | | 1,238 | | 537 | | 130 | % | | 1,032 | | 20 | % |

| Depreciation and Amortization | | 294 | | 203 | | 45 | % | | 281 | | 5 | % |

| Chargebacks | | 273 | | 130 | | 110 | % | | 270 | | 1 | % |

| Accrual of Provision for Contingencies | | 17 | | 7 | | 138 | % | | 5 | | 280 | % |

| Reversal of Taxes and Contributions | | 0 | | 0 | | n.a. | | 0 | | n.a. |

| Share based Long Term Incentive Plan (LTIP) | | 37 | | 141 | | -74 | % | | 40 | | -7 | % |

| Loss on Disposal of Property, Equipment and Intangible Assets | | 84 | | 8 | | 924 | % | | 103 | | -18 | % |

| Interest accrued | | 509 | | 41 | | n.a. | | 336 | | 51 | % |

| Other Financial Cost, Net | | 23 | | 6 | | 261 | % | | (3) | | n.a. |

| Changes in Operating Assets and Liabilities | | (1,548) | | (878) | | 76 | % | | (2,089) | | -26 | % |

| Account Receivables | | (4,999) | | (2,997) | | 67 | % | | (6,775) | | -26 | % |

| Financial Investments (Mandatory Guarantee) | | 0 | | (19) | | -98 | % | | 48 | | n.a. |

| Inventories | | (4) | | (22) | | -81 | % | | 1 | | n.a. |

| Taxes Recoverable | | 14 | | 37 | | -61 | % | | 38 | | -63 | % |

| Other Receivables | | 56 | | 7 | | 741 | % | | 30 | | 89 | % |

| Deferred Revenue | | (6) | | (19) | | -66 | % | | (7) | | -5 | % |

| Other Payables | | (1) | | (37) | | -98 | % | | 0 | | 827 | % |

| Payables to Third Parties | | 329 | | 1,199 | | -73 | % | | 989 | | -67 | % |

| Trade Payables | | (146) | | 33 | | n.a. | | (52) | | 183 | % |

| Receivables from (Payables to) Related Parties | | 171 | | 81 | | 110 | % | | (19) | | n.a. |

| Deposits | | 2,992 | | 855 | | 250 | % | | 3,580 | | -16 | % |

| Salaries and Social Charges | | 49 | | 14 | | 257 | % | | 68 | | -28 | % |

| Taxes and Contributions | | 9 | | (7) | | n.a. | | 11 | | -20 | % |

| Provision for Contingencies | | (11) | | (3) | | 264 | % | | (2) | | 474 | % |

| Income Tax and Social Contribution paid | | (7) | | (3) | | 121 | % | | (40) | | -83 | % |

| Interest Income received | | 963 | | 286 | | 237 | % | | 885 | | 9 | % |

| Net Cash provided by (used in) Operating Activities | | 1,071 | | 363 | | 195 | % | | 231 | | 364 | % |

| Amount paid on Acquisitions, Net of Cash Acquired | | 0 | | (44) | | n.a. | | 0 | | n.a. |

| Purchases of Property and Equipment | | (247) | | (226) | | 9 | % | | (341) | | -28 | % |

| Purchases and Development of Intangible Assets | | (256) | | (202) | | 26 | % | | (234) | | 9 | % |

| Acquisition of Financial Investments | | 4 | | 38 | | -89 | % | | 66 | | -94 | % |

| Redemption of Financial Investments | | 0 | | 2 | | n.a. | | 0 | | n.a. |

| Net Cash provided by (used in) Investing Activities | | (498) | | (432) | | 15 | % | | (509) | | -2 | % |

| Payment of Borrowings | | (250) | | 0 | | n.a. | | 0 | | n.a. |

| Payment of Borrowings Interest | | (8) | | 0 | | n.a. | | (7) | | 19 | % |

| Payment of Leases | | (4) | | (4) | | 0 | % | | (6) | | -25 | % |

| Acquisition of Treasury Shares | | (98) | | 0 | | n.a. | | 0 | | n.a. |

| Net Cash provided by (used in) Financing Activities | | (361) | | (4) | | n.a. | | (13) | | n.a. |

| Increase (Decrease) in Cash and Cash Equivalents | | 213 | | (73) | | n.a. | | (291) | | n.a. |

| Cash and Cash Equivalents at the beginning of the Period | | 1,192 | | 1,196 | | 0 | % | | 1,483 | | -20 | % |

| Cash and Cash Equivalents at the end of the Period | | 1,404 | | 1,122 | | 25 | % | | 1,192 | | 18 | % |

Glossary

Active Merchants: At least one transaction in the last twelve months.

Adjusted EBITDA: GAAP Net Income + Income Tax and Social Contribution – Other Financial Income + POS Write-off + Depreciation and Amortization + FX Expenses + M&A Expenses + LTIP Expenses. Please see the Supplemental Information for a reconciliation of this adjusted financial measure.

ARPAC: Sum of LTM revenues / Average of active clients over the last 5 quarters.

Cash-in: Wire transfers + Pix transfers

Gross Profit

•PagSeguro: (MDR Revenue + Prepayment Revenue) – (Transaction Costs + Card Scheme Fee + Financial Expenses + Chargeback).

•PagBank: (Net Interest Income + Revenue form Services) – Provision for Losses.

Gross Take Rate

•PagSeguro: (Net Revenue from Transaction Activities and Other Services + Financial Income) / PagSeguro TPV. Excluding revenues and costs originated by membership fees.

•PagBank: (Net Interest Income + Revenue form Services) / PagBank Monetizable TPV.

Monthly TPV per Merchant: PagSeguro TPV / Average Active Merchants of last two quarters.

Net Interest Income: Interest Income – Cost of Funding + Float.

Net Take Rate

•PagSeguro: (Net Revenue from Transaction Activities and Other Services + Financial Income - Transaction Costs) / PagSeguro TPV. Excluding revenues and costs originated by membership fees.

•PagBank: (Net Interest Income + Revenue form Services - Transaction Costs) / PagBank Monetizable TPV.

PagBank Clients: Number of bank accounts registered at Brazilian Central Bank.

PagBank Active Clients: Active clients using one additional digital account feature/service beyond acquiring and consumers with a balance in their digital account on the last day of the month.

PagBank Revenues: composed by Interest Income, Interchange from PagBank cards, transaction fees from day-to-day banking (bill payments, mobile-top ups, among others).

Total Payment Volume (TPV): PagSeguro TPV + PagBank TPV.

•PagSeguro: Includes PagSeguro’s TPV, which is the value of payments successfully processed through our payments´ecosystem for new clients that are under zero MDR promotion and volumes that generates any type of revenues (MDR, fees, prepayment) and, net of payment reversals, not including PagBank TPV;

•PagBank: Includes prepaid card top-ups, cash cards spending, credit cards, mobile top-ups, wire transfers to third-party, cash-in through boletos, bill payments, tax collections, P2P transactions, QR Code transactions, credit underwriting, Super App and GMV.

Non-GAAP disclosure

This press release includes certain non-GAAP measures. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. These non-GAAP measures are provided to enhance investors' overall understanding of our current financial performance and its prospects for the future. Specifically, we believe the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses, as the case may be, that may not be indicative of our core operating results and business outlook.

These measures may be different from non-GAAP financial measures used by other companies. The presentation of this non-GAAP financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered separately from, or as a substitute for, our financial information prepared and presented in accordance with IFRS as issued by the IASB. Non-GAAP measures have limitations in that they do not reflect all the amounts associated with our results of operations as determined in accordance with IFRS. These measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures.

Non-GAAP results consist of our GAAP results as adjusted to exclude the following items:

LTIP expenses: This consists of expenses for equity awards under our two long-term incentive plans (LTIP and LTIP-Goals). We exclude LTIP expenses from our non-GAAP measures primarily because they are non-cash expenses and the related employer payroll taxes depend on our stock price and the timing and size of exercises and vesting of equity awards, over which management has limited to no control, and as such management does not believe these expenses correlate to the operation of our business.

M&A expenses: This consists of expenses for mergers & acquisitions (“M&A”) transactions, including, among others, expenses for external consulting, accounting and legal services in connection with due diligence and negotiating M&A documentation for our acquisitions, as well as amortization and write-downs of the fair value of certain acquired assets. We exclude M&A expenses from our non-GAAP measures primarily because such expenses are non-recurring and do not correlate to the operation of our business.

Non-recurring adjustments: This consists of one-time adjustments related to PagPhone sales, PagPhone inventory provisions and tax impairment. We exclude non-recurring adjustments from our non-GAAP measures primarily because such items are non-recurring and do not correlate to the operation of our business.

Income tax and social contribution on LTIP expenses, M&A expenses and non-recurring adjustments: This represents the income tax effect related to the LTIP expenses, M&A expenses and non-recurring adjustments mentioned above.

For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, see the tables elsewhere in this press release under the following headings: “Reconciliation of Total Expenses to non-GAAP recurring Total Expenses,” “Reconciliation of Income Tax and Social Contribution to non-GAAP recurring Income Tax and Social Contribution,” “Reconciliation of Net Income to non-GAAP recurring Net Income,” “Adjusted EBITDA and Non-GAAP Net Income Reconciliation,” “Reconciliation of Basic and diluted EPS to non-GAAP Basic and diluted EPS,” and “Reconciliation of GAAP Measures to non-GAAP Measures.”

Earnings Webcast

PagSeguro Digital Ltd. (NYSE:PAGS) will host a conference call and earnings webcast on November 22, 2022, at 5:00 pm ET.

Event Details

HD Web Phone: Click here

Dial–in (Brazil): +55 (11) 4090-1621 | +55 11 3181-8565.

Dial–in (US and other countries): +1 (412) 717-9627 | +1 (844) 204-8942

Password: PagBank PagSeguro

Webcast: https://choruscall.com.br/pagseguro/3q22.htm

Contacts:

Investor Relations:

ir@pagseguro.com

investors.pagseguro.com

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may,” or similar expressions are generally intended to identify forward-looking statements. We cannot guarantee that such statements will prove correct. These forward-looking statements speak only as of the date hereof and are based on our current plans, estimates of future events, expectations and trends (including trends related to the global and Brazilian economies and capital markets, as well as the continuing economic, financial, political and public health effects of the coronavirus, or the COVID-19, pandemic.) that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares, and are subject to several known and unknown uncertainties and risks, many of which are beyond our control. As consequence, current plans, anticipated actions and future financial position and results of operations may differ significantly from those expressed in any forward-looking statements in this press release. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented. In light of the risks and uncertainties described above, the future events and circumstances discussed in this press release might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements. To obtain further information on factors that may lead to results different from those forecast by us, please consult the reports we file with the U.S. Securities and Exchange Commission (SEC) and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in our annual report on Form 20-F.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 22, 2022

| | | | | | | | |

| PagSeguro Digital Ltd. |

| |

| By: | /s/ Artur Schunck |

| Name: | Artur Schunck |

| Title: | Chief Financial Officer, Chief Accounting Officer and Investor Relations Officer |

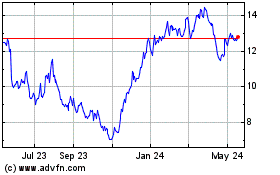

PagSeguro Digital (NYSE:PAGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

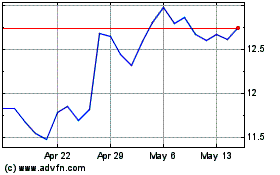

PagSeguro Digital (NYSE:PAGS)

Historical Stock Chart

From Nov 2023 to Nov 2024