Pitney Bowes Announces Significant Progress on Deleveraging Initiative with Paydown of $100M of Oaktree Notes

20 November 2024 - 12:00AM

Business Wire

Pitney Bowes Inc. (NYSE: PBI) (“Pitney Bowes” or the “Company”),

a technology-driven company that provides SaaS shipping solutions,

mailing innovation, and financial services to clients around the

world, today announced that it has repaid $100 million of the $275

million in senior secured notes (“2028 Notes”) issued by Oaktree

Capital Management, L.P. (“Oaktree”), the balance of which was $272

million as of September 30, 2024. The partial payment of the 2028

Notes is part of the Company’s previously announced strategic

initiative to deleverage its balance sheet. The repayment was

funded by cash on hand.

Lance Rosenzweig, Pitney Bowes’ Chief Executive Officer,

commented: “Our accelerated progress on our strategic initiatives

of exiting GEC, reducing costs and optimizing our cash position is

enabling us to take concrete steps to deleverage our balance sheet.

The partial payment of our Oaktree 2028 Notes is the first step

towards reducing interest payments and freeing up capital for other

value-enhancing initiatives. We will have an update in the

near-term on our plans to retire the remainder of the Oaktree 2028

Notes and continue to look for additional ways to deleverage as we

build a more efficient and profitable organization.”

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world – including more than 90

percent of the Fortune 500. Small businesses to large enterprises,

and government entities rely on Pitney Bowes to reduce the

complexity of sending mail and parcels. For the latest news,

corporate announcements, and financial results, visit

www.pitneybowes.com/us/newsroom. For additional information, visit

Pitney Bowes at www.pitneybowes.com.

Forward-Looking Statements

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about the Company’s expectations related to

the DRF bankruptcy proceedings, future revenue and earnings

guidance, future events or conditions, and expected cost savings,

elimination of future losses, and anticipated deleveraging in

connection with Pitney Bowes’ announced strategic initiatives.

Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that could cause actual results

to differ materially from those projected. Factors which could

cause future financial performance to differ materially from

expectations include, without limitation, declining physical mail

volumes; changes in postal regulations or the operations and

financial health of posts in the U.S. or other major markets or

changes to the broader postal or shipping markets; the potential

adverse effects and risks and uncertainties associated with the GEC

exit and wind-down on the Company’s operations, management and

employees, and the ability to successfully implement the Company’s

2024 worldwide cost reduction and optimization initiatives and

realize the expected benefits therefrom, the loss of some of Pitney

Bowes’ larger clients in the Presort Services segments; the loss

of, or significant changes to, United States Postal Service (USPS)

commercial programs, or the Company’s contractual relationships

with the USPS or their performance under those contracts; and other

factors as more fully outlined in the Company's 2023 Form 10-K

Annual Report and other reports filed with the Securities and

Exchange Commission during 2024. Pitney Bowes assumes no obligation

to update any forward-looking statements contained in this document

as a result of new information, events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119569103/en/

Alex Brown investorrelations@pb.com OR Longacre Square Partners

Joe Germani jgermani@longacresquare.com

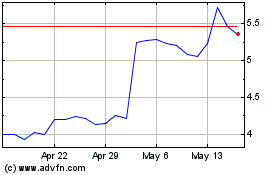

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

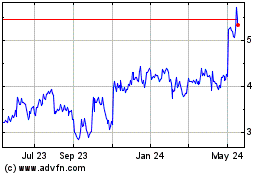

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Nov 2023 to Nov 2024