Company Updates Full Year Guidance Following

Continued Strong Business Performance and Accelerated

Execution of Cost Initiatives

Pitney Bowes Inc. (NYSE: PBI), a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world, today announced the Company’s

financial results for the third quarter of fiscal year 2024 and

provided a progress update on the strategic initiatives announced

on May 22, 2024. The Company also updated its full year guidance

for Fiscal Year 2024 following continued strong business

performance and accelerated execution of cost initiatives.

Third Quarter Financial

Highlights

- Revenue was $499 million, down 1% year-over-year

- GAAP EPS was a loss of $0.75, including a loss of $1.42 per

share from discontinued operations

- Adjusted EPS was $0.21, an improvement of $0.05 over the prior

year

- Net loss of $138 million, including a $261 million loss from

discontinued operations

- Adjusted EBIT was $103 million, up 22% versus the prior

year

- GAAP cash from operating activities was $66 million

- Free Cash Flow was $75 million, an improvement of $19 million

year-over-year; Free Cash Flow excludes $29 million of

restructuring payments in the third quarter

Update on Strategic

Initiatives

- GEC Exit: The wind-down process is progressing as

expected and should be largely complete by year-end. The Company

remains focused on resolving legacy obligations in the most

efficient manner possible and continues to target approximately

$150 million in one-time costs from the wind-down. These exit costs

are anticipated to improve go-forward earnings by approximately

$136 million annually.

- Cost Rationalization: The Company accelerated the

execution of its cost reduction initiatives and, as of the end of

the third quarter, had removed $90 million in annualized costs. The

Company is increasing its net annual cost savings forecast to $150

million to $170 million.

- Cash Optimization: The Company has largely completed its

overseas cash repatriation, bringing $117 million back to the U.S.

year-to-date. Additionally, the GEC wind-down is stabilizing cash

flows and, once complete, is estimated to result in a reduction of

the amount of unrestricted cash the Company maintains by

approximately $100 million. Further, the Company’s initiative to

purchase captive lease receivables at Pitney Bowes Bank accelerated

the realization of $31 million of net cash year-to-date. The

Company continues to identify additional ways to optimize cash and

expects to realize an additional $100 million in cash optimization

over the next several years associated with initiatives at Pitney

Bowes Bank.

- Balance Sheet Deleveraging: Progress on exiting GEC,

reducing non-essential expenses, and optimizing cash positions has

positioned the Company to pay down debt in the coming quarters. The

Company has more than $100 million of excess cash on the balance

sheet that can be used to reduce debt. Discussions are ongoing with

the Company’s current and prospective lending partners to identify

ways to strategically deleverage on favorable terms.

Lance Rosenzweig, Chief Executive Officer and a member of the

Board, commented:

“Our positive third quarter results reflect the sustained

strength of our core, cash-generating businesses. Pitney Bowes

achieved $103 million in Adjusted EBIT for the third quarter,

representing 22% year-over-year improvement on relatively steady

revenue. We drove significant improvements in segment-level EBIT

during the quarter. This strong performance validates our emphasis

on efficiency and our commitment to becoming a more streamlined

organization.

We also continued to build on our momentum with respect to our

four previously announced strategic initiatives. We are working on

an accelerated basis to complete these initiatives and solidify the

turnaround of this storied brand. As we approach the end of 2024,

we remain committed to increasing profitability, ensuring that we

are effectively managing our capital and building a solid

foundation for improved financial strength in 2025 – while

continually exploring all paths to maximizing value for

shareholders.”

Earnings per share results are summarized in the table

below:

Third Quarter

2024

2023

GAAP EPS

($0.75)

($0.07)

Discontinued Operations

$1.42

$0.17

Restructuring Charges

$0.13

$0.06

Foreign Currency Gain on

Intercompany Loans

$0.08

-

Strategic Review Costs (1)

$0.01

-

Asset Impairment

$0.05

-

Charges in connection with GEC

Restructuring

$0.16

-

Tax benefit from affiliate

reorganization

($0.89)

-

Loss on debt refinancing

$0.01

-

Adjusted EPS

$0.21

$0.16

(1)

Strategic Review Costs include legal, accounting and other expenses

related to the strategic review of GEC, including preparation for a

potential GEC exit.

Discontinued Operations

As a result of the Global Ecommerce exit process announced last

quarter, a majority of the Global Ecommerce reporting segment is

now reported as discontinued operations in the Condensed

Consolidated Financial Statements. Prior periods have been recast

to conform to the current period presentation.

The remaining portion of the Global Ecommerce reportable segment

that did not qualify for discontinued operations treatment is now

reported in an "Other" category. Included in this category are

operations that the Company is currently in the process of exiting

and a smaller continuing operation.

Business Segment

Reporting

SendTech Solutions SendTech Solutions offers physical and

digital shipping and mailing technology solutions, financing,

services, supplies and other applications for small and medium

businesses, retail, enterprise, and government clients around the

world to help simplify and save on the sending, tracking and

receiving of letters, parcels and flats.

Third Quarter

($ millions)

2024

2023

% Change

Reported

Revenue

$313

$327

(4%)

Adjusted Segment EBITDA

$114

$109

5%

Adjusted Segment EBIT

$104

$99

5%

Revenue decline was driven by a decrease in the Company’s

mailing install base and near-term headwinds related to the

Company’s product migration. Shipping-related revenue grew 8%,

driven by a 29% increase in business services revenue.

Simplification and cost reduction initiatives drove higher

Adjusted Segment EBITDA and EBIT. Mail and shipping revenues and

EBIT were negatively impacted by efforts to migrate customers from

arrangements that recognize revenue upfront to SaaS type

arrangements that drive recurring revenue and profit.

Presort Services Presort Services provides sortation

services that enable clients to qualify for USPS workshare

discounts in First Class Mail, Marketing Mail, Marketing Mail Flats

and Bound Printed Matter.

Third Quarter

($ millions)

2024

2023

% Change

Reported

Revenue

$166

$152

9%

Adjusted Segment EBITDA

$55

$37

47%

Adjusted Segment EBIT

$46

$29

59%

Presort sorted 3.7 billion pieces of mail in the quarter,

growing volumes by 3% year-over-year. Higher volumes and revenue

per piece expansion drove revenue growth.

Higher revenue per piece, continued labor and transportation

cost productivity, and cost reductions drove growth in Adjusted

Segment EBITDA and EBIT.

Updated Full Year 2024

Guidance

The Company now expects full-year revenue to decline at a

low-single-digit rate.

The Company is also raising its full-year Adjusted EBIT guidance

to $355 to $360 million.

Conference Call and

Webcast

Management of Pitney Bowes will discuss the Company’s results in

a broadcast over the Internet today at 5:00 p.m. ET. Instructions

for listening to the earnings results via the Web are available on

the Investor Relations page of the Company’s website at

www.pitneybowes.com.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world – including more than 90

percent of the Fortune 500. Small businesses to large enterprises,

and government entities rely on Pitney Bowes to reduce the

complexity of sending mail and parcels. For the latest news,

corporate announcements, and financial results, visit

www.pitneybowes.com/us/newsroom. For additional information, visit

Pitney Bowes at www.pitneybowes.com.

Adjusted Segment EBIT Adjusted Segment EBIT is the

primary measure of profitability and operational performance at the

segment level. Adjusted Segment EBIT includes segment revenues and

related costs and expenses attributable to the segment, but

excludes interest, taxes, restructuring charges, goodwill and asset

impairment charges, corporate expenses, and other items not

allocated to a business segment. We also report Adjusted Segment

EBITDA as an additional useful measure of segment profitability and

operational performance, which is calculated as Adjusted Segment

EBIT plus depreciation and amortization expense of the segment.

Use of Non-GAAP Measures Pitney Bowes’ financial results

are reported in accordance with generally accepted accounting

principles (GAAP). Pitney Bowes also discloses certain non-GAAP

measures, such as revenue growth on a constant currency basis,

adjusted earnings before interest and taxes (Adjusted EBIT),

adjusted earnings before interest, taxes, depreciation and

amortization (Adjusted EBITDA), adjusted earnings per share

(Adjusted EPS) and free cash flow.

Revenue growth is presented on a constant currency basis to

exclude the impact of changes in foreign currency exchange rates

since the prior period under comparison. Constant currency is

calculated by converting the current period non-U.S. dollar

denominated revenue using the prior year’s exchange rate for the

comparable quarter. We believe that excluding the impacts of

currency exchange rates provides investors a better understanding

of the underlying revenue performance.

Adjusted EBIT, Adjusted EBITDA and Adjusted EPS exclude the

impact of restructuring charges, goodwill and asset impairment

charges, foreign currency gains and losses on intercompany loans,

certain costs associated with the Ecommerce Restructuring, gains

and losses related to acquisitions and dispositions, gains and

losses on debt redemptions and other unusual items that we believe

are not indicative to our core business operations.

Free cash flow adjusts cash flow from operations calculated in

accordance with GAAP for capital expenditures, restructuring

payments and other special items. Management believes free cash

flow provides investors better insight into the amount of cash

available for other discretionary uses.

Complete reconciliations of non-GAAP measures to comparable GAAP

measures can be found in the attached financial schedules and at

the Company's web site at

https://www.investorrelations.pitneybowes.com/.

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about future revenue and earnings guidance,

future events or conditions, and expected cost savings, elimination

of future losses, and anticipated deleveraging in connection with

Pitney Bowes’ announced strategic initiatives. Forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that could cause actual results to differ

materially from those projected. Factors which could cause future

financial performance to differ materially from expectations

include, without limitation, declining physical mail volumes;

changes in postal regulations or the operations and financial

health of posts in the U.S. or other major markets or changes to

the broader postal or shipping markets; the potential adverse

effects and risks and uncertainties associated with the GEC exit

and wind-down on the Company’s operations, management and

employees, and the ability to successfully implement the Company’s

2024 worldwide cost reduction and optimization initiatives and

realize the expected benefits therefrom, the loss of some of Pitney

Bowes’ larger clients in the Presort Services segments; the loss

of, or significant changes to, United States Postal Service (USPS)

commercial programs, or the Company’s contractual relationships

with the USPS or their performance under those contracts; and other

factors as more fully outlined in the Company's 2023 Form 10-K

Annual Report and other reports filed with the Securities and

Exchange Commission during 2024. Pitney Bowes assumes no obligation

to update any forward-looking statements contained in this document

as a result of new information, events or developments.

Note: Consolidated statements of income; revenue, adjusted

segment EBIT and adjusted segment EBITDA by business segment; and

reconciliations of GAAP to non-GAAP measures for the three and nine

months ended September 30, 2024 and 2023, and consolidated balance

sheets at September 30, 2024 and December 31, 2023 are attached. We

have not provided a reconciliation of our future expectations as to

Adjusted EBIT as such reconciliation is not available without

unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107086529/en/

For Investors:

Alex Brown investorrelations@pb.com

For Media:

Longacre Square Partners Joe Germani

jgermani@longacresquare.com

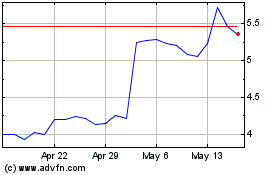

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

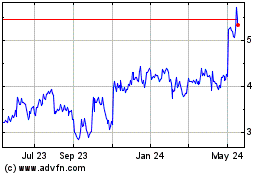

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Nov 2023 to Nov 2024