Pitney Bowes Announces Early Paydown of Remaining 2028 Oaktree Notes

24 January 2025 - 12:00AM

Business Wire

Expects to Report FY2024 Revenue Within

Guidance Range and Adjusted EBIT Above Guidance Range

Continued Progress Stems from Management’s

Focus on Efficiency, Execution and Financial Strength

Pitney Bowes Inc. (NYSE: PBI) (“Pitney Bowes” or the “Company”),

a technology-driven company that provides SaaS shipping solutions,

mailing innovation, and financial services to clients around the

world, announced that today it is paying off the remaining balance

of approximately $97 million in senior secured notes (“2028 Notes”)

issued to Oaktree Capital Management, L.P. (collectively with its

affiliates, “Oaktree”) in July 2023. The repayment, which is being

funded by cash on hand, is part of the Company’s previously

announced strategic initiative to deleverage its balance sheet.

Retiring the 2028 Notes positions Pitney Bowes to benefit from

increased capital allocation flexibility as it continues to

evaluate value-enhancing actions.

Pitney Bowes also announced that it expects to report full year

2024 results within its previously announced revenue guidance range

and beat Adjusted EBIT guidance as outlined in its third quarter

2024 financial results reported in November. The anticipated

outperformance relative to prior Adjusted EBIT guidance is driven

by better-than-expected business performance and non-essential cost

cuts that had been conservatively forecasted to materialize in

fiscal year 2025.

Lance Rosenzweig, Pitney Bowes’ Chief Executive Officer,

commented:

“Our Board of Directors and management team are fully focused on

efficiency, execution and financial strength as we enter the next

phase of Pitney Bowes’ transformation into a stronger, more

streamlined enterprise. Our strengthened balance sheet, driven by

our swift execution of cost out and cash optimization work streams,

and our conviction in the Company’s opportunities going forward

give us confidence to repay the 2028 Notes early. Our anticipated

beat on Adjusted EBIT for 2024 is the result of outperformance in

our business as well as faster-than-expected realization of cost

cuts and efficiency measures – some of which were one-time in

nature – during the final months of the year. As I begin my first

full fiscal year as CEO, I am looking forward to discussing our

results and thoughtfully prepared outlook on next month’s earnings

call.”

The Company will release fourth quarter and full-year 2024

earnings results after market close on Tuesday, February 11, 2025.

The Company will host an investor conference call at 5:00 p.m. ET

on the same day to review its results. For those unable to

participate during the live call, a recording will be made

available on the Company’s website.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world – including more than 90

percent of the Fortune 500. Small businesses to large enterprises,

and government entities rely on Pitney Bowes to reduce the

complexity of sending mail and parcels. For the latest news,

corporate announcements, and financial results, visit

www.pitneybowes.com/us/newsroom. For additional information, visit

Pitney Bowes at www.pitneybowes.com.

Information Regarding Preliminary Results

The preliminary estimated financial information contained in

this release is unaudited and reflects management’s estimates based

solely upon information available to it as of the date of this

release and is not a comprehensive statement of the Company’s

financial results for the three and twelve months ended December

31, 2024. The preliminary estimated financial information presented

herein is subject to change, and the Company’s actual financial

results may differ from such preliminary estimates and such

differences could be material.

Forward-Looking Statements

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about the Company’s expectations related to

future revenue and earnings guidance, future events or conditions,

and expected cost savings, elimination of future losses, and

anticipated deleveraging in connection with Pitney Bowes’ announced

strategic initiatives. Forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties that could cause actual results to differ materially

from those projected. Factors which could cause future financial

performance to differ materially from expectations include, without

limitation, declining physical mail volumes; changes in postal

regulations or the operations and financial health of posts in the

U.S. or other major markets or changes to the broader postal or

shipping markets; the potential adverse effects and risks and

uncertainties associated with the GEC exit and wind-down on the

Company’s operations, management and employees, and the ability to

successfully implement the Company’s 2024 worldwide cost reduction

and optimization initiatives and realize the expected benefits

therefrom, the loss of some of Pitney Bowes’ larger clients in the

Presort Services segments; the loss of, or significant changes to,

United States Postal Service (USPS) commercial programs, or the

Company’s contractual relationships with the USPS or their

performance under those contracts; and other factors as more fully

outlined in the Company's 2023 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission. Pitney

Bowes assumes no obligation to update any forward-looking

statements contained in this document as a result of new

information, events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123999550/en/

Alex Brown investorrelations@pb.com

OR

Longacre Square Partners Joe Germani / Ashley Areopagita

jgermani@longacresquare.com / aareopagita@longacresquare.com

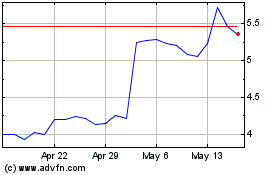

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

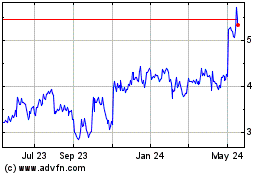

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jan 2024 to Jan 2025