Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

26 August 2020 - 6:46AM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant ¨

Filed

by a Party other than the Registrant þ

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| þ |

Definitive Additional Materials |

| ¨ |

Soliciting Material Under Rule 14a-12 |

Pioneer Floating Rate Trust

(Name of Registrant as Specified In Its

Charter)

Saba

Capital Management, L.P.

Boaz

R. Weinstein

Charles

I. Clarvit

Stephen

G. Flanagan

Frederic

Gabriel

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| þ |

No fee required. |

| |

|

| ¨ |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

PIONEER FLOATING RATE TRUST (PHD) A PRESENTATION TO INSHAREHOLDER SERVICES INC. AUGUST 25, 2020

Summary Total Shareholder Return Performance vs. Benchmark Shareholder Proposals Election of Directors Termination of Investment Manager Saba’s Slate of Qualified Independent Nominees As the largest investor in PHD, Saba’s interests are aligned with all shareholders. PHD’s performance has been substantially worse than its benchmark. Saba’s slate of nominees are qualified and independent. Saba Capital PAGE 2 Strictly Private and Confidential

Total Shareholder Returns Sources : Bloomberg When evaluating the performance of a fund manager, it’s important to observe the total return of your investment (this includes distributions paid) and compare this to the total return of your manager’s benchmark. Through this you will be able to determine if your manager is earning the fees you are paying them to manage your money. The table below shows that while Pioneer is taking millions in advisory fees from shareholders they are significantly underperforming their benchmark. Period Underperformance Vs. Benchmark i 1 Year - 2.1% 2 Year - 3.8% 3 Year - 8.3% Since IPO - 24.7% i Portfolio (Market Price) vs. S&P LSTA Leveraged Loan Index, Bloomberg, L.P. 6/30/2020 Year - To - Date Performance Vs. Benchmark - 5.7 % Saba Capital PAGE 3 Strictly Private and Confidential

Current Trustees Name of Trustee Total Compensation from Pioneer Funds Shares Owned of Pioneer Floating Rate Trust (PHD) i Lisa M. Jones Pioneer Employee – undisclosed None Kenneth J. Taubes Pioneer Employee – undisclosed None John E. Baumgardner, Jr. $20,604 each year None Diane P. Durnin $61,108 each year None Benjamin M. Friedman $288,500 each year None Lorraine H. Monchak $279,250 each year None Thomas J. Perna $365,500 each year None Marguerite A. Piret $271,750 each year None Fred J. Ricciardi $256,250 each year None i Pioneer Floating Rate Trust, PREC14A 7/20/20 Saba Capital PAGE 4 Strictly Private and Confidential

Termination of Advisory Agreement Plan Saba Capital PAGE 5 Strictly Private and Confidential Saba has a thoughtful and organized plan surrounding this proposal that we believe will benefit all of PHD’s shareholders. Our involvement in recent similar shareholder votes is evidence to our thoughtfulness on these matters, including but not limited to: • Potential new investment advisors • Revised fee structures • Existing and new service providers • Alternative options for fund structure

LEGEND

Saba Capital

Management, L.P. (“Saba Capital”), Boaz R. Weinstein , Charles I. Clarvit, Stephen G. Flanagan and Frederic Gabriel

(collectively, the “Participants”) have filed with the Securities and Exchange Commission (the “SEC”)

a definitive proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies from the

shareholders of Pioneer Floating Rate Trust (the “Fund”). All shareholders of the Fund are advised to read the definitive

proxy statement and other documents related to the solicitation of proxies by the Participants as they contain important information,

including additional information related to the Participants. The definitive proxy statement and an accompanying proxy card is

being furnished to some or all of the Fund’s shareholders and will be, along with other relevant documents, available at

no charge on the SEC website at http://www.sec.gov/.

Information

about the Participants and a description of their direct or indirect interests by security holdings is contained in the definitive

proxy statement on Schedule 14A filed by Saba Capital with the SEC on July 29, 2020 and the amendment to the definitive proxy

statement on Scheduled 14A filed by Saba Capital with the SEC on August 18, 2020. These documents are available free of charge

from the source indicated above.

This regulatory filing also includes additional resources:

p20-1632dfan14a.pdf

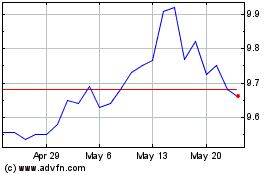

Pioneer Floating Rate (NYSE:PHD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pioneer Floating Rate (NYSE:PHD)

Historical Stock Chart

From Jul 2023 to Jul 2024