Form 425 - Prospectuses and communications, business combinations

15 October 2024 - 11:02PM

Edgar (US Regulatory)

Filed by WhiteHawk Income Corp

Pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: PHX Minerals Inc.

Commission File No.: 001-31759

Date: October 15, 2024

Explanatory Note: The following communication

was made available on Twitter by Daniel Herz, Chairman and Chief Executive Officer of WhiteHawk Income Corp (“WhiteHawk”),

at twitter.com/DanielHerz3.

Additional Information

This communication does not constitute an offer to buy or solicitation

of an offer to sell any securities. This communication relates to a proposal which WhiteHawk has made for a combination with PHX Minerals,

Inc. (“PHX”). In furtherance of this proposal and subject to future developments, WhiteHawk (and, if a negotiated transaction

is agreed, PHX) may file one or more registration statements, proxy statements or other documents with the U.S. Securities and Exchange

Commission (“SEC”). This communication is not a substitute for any proxy statement, registration statement, prospectus or

other document WhiteHawk or PHX may file with the SEC in connection with the proposed transaction.

Investors and security holders of WhiteHawk and PHX are urged to read

the proxy statement(s), registration statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and

when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s)

or prospectus(es) (if and when available) will be mailed to stockholders of PHX, as applicable. Investors and security holders will be

able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by PHX through the website

maintained by the SEC at http://www.sec.gov.

This communication is neither a solicitation of a proxy nor a substitute

for any proxy statement or other filings that may be made with the SEC. Nonetheless, WhiteHawk and its executive officers and other members

of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. Additional

information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements

or other documents filed with the SEC if and when they become available. INVESTORS AND SECURITY HOLDERS OF PHX ARE URGED TO READ THESE

AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. These documents (if and when available) may be obtained free of charge from the SEC’s

website at http://www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These statements include projections and estimates and their underlying assumptions,

statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services,

product development and potential, and statements regarding future performance. Such statements are based on WhiteHawk’s management’s

beliefs and assumptions based on information currently available to WhiteHawk’s management. All statements in this communication,

other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,”

“guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,”

and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause WhiteHawk’s

or PHX’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements.

Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in

Part I, Item 1A, “Risk Factors” in PHX’s Annual Reports on Form 10-K filed with the Securities and Exchange Commission

(the “SEC”) for the fiscal year ended December 31, 2023 and in other filings with the SEC. These include, but are not limited

to: (i) the ultimate outcome of any possible transaction between WhiteHawk and PHX, including the possibility that PHX will reject the

proposed transaction with WhiteHawk; (ii) uncertainties as to whether PHX will cooperate with WhiteHawk regarding the proposed transaction;

(iii) the effect of the announcement of the proposed transaction on the ability of WhiteHawk and PHX to operate their respective businesses

and retain and hire key personnel and to maintain favorable business relationships; (iv) the timing of the proposed transaction; (v) the

ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary stockholder approvals); (vi)

other risks related to the completion of the proposed transaction and actions related thereto; (vii) changes in demand for WhiteHawk’s

or PHX’s products or services; (viii) impacts of natural disasters, adverse changes in laws and regulations including governing

property tax, evictions, rental rates, minimum wage levels, and insurance, adverse economic effects from the COVID-19 pandemic, international

military conflicts, or similar events impacting public health and/or economic activity; (ix) adverse impacts to WhiteHawk or PHX and their

respective customers from inflation, unfavorable foreign currency rate fluctuations, changes in federal or state tax laws; and (x) security

breaches, including ransomware, or a failure of WhiteHawk’s or PHX’s respective networks, systems or technology.

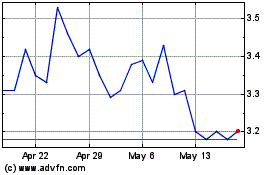

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

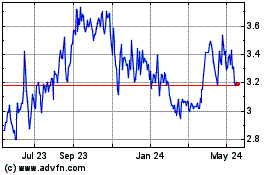

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Dec 2023 to Dec 2024