PennantPark Investment Corporation Announces Upsize of Joint Venture

06 September 2024 - 6:05AM

PennantPark Investment Corporation (“PNNT”) (NYSE: PNNT) today

announced it has agreed to expand its investment in PennantPark

Senior Loan Fund, LLC (“PSLF” or the “JV”), its unconsolidated

joint venture with the private credit investment business of

Pantheon Ventures (UK) LLP (“Pantheon”). This strategic transaction

further strengthens the partnership between PNNT and Pantheon,

which was put into place over four years ago, and has generated

strong returns to date.

PNNT has agreed to invest an additional

$52.5 million in capital, and Pantheon has agreed to invest an

additional $75.0 million of capital, thereby resulting in a pro

forma JV ownership of 54.8% and 45.2%, respectively.

In addition, PSLF is increasing its senior

secured credit facility provided by BNP Paribas from $325 million

to $400 million, thereby allowing the JV to scale its investment

portfolio to over $1.5 billion, representing a nearly $500 million

increase in the JV’s investment capacity.

“We are proud of the partnership and the strong

returns the JV has generated,” stated Art Penn, Chief Executive

Officer of PNNT. “The core middle market represents a

differentiated investment opportunity for investors in direct

lending. The increase in the JV will position PNNT’s shareholders

to benefit from investments in today’s attractive vintage of core

middle market senior secured loans.”

ABOUT PENNANTPARK INVESTMENT CORPORATION

PennantPark Investment Corporation is a business

development company which principally invests in U.S. middle-market

private companies in the form of first lien secured debt, second

lien secured debt, subordinated debt and equity investments.

PennantPark Investment Corporation is managed by PennantPark

Investment Advisers, LLC.

ABOUT PENNANTPARK INVESTMENT ADVISERS, LLC

PennantPark Investment Advisers, LLC is a

leading middle market credit platform, managing approximately

$8.0 billion of investible capital, including leverage. Since

its inception in 2007, PennantPark Investment Advisers, LLC has

provided investors access to middle market credit by offering

private equity firms and their portfolio companies as well as other

middle-market borrowers a comprehensive range of creative and

flexible financing solutions. PennantPark Investment Advisers,

LLC is headquartered in Miami, and has offices in New York,

Chicago, Houston, Los Angeles and Amsterdam.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. You should understand that under

Section 27A(b)(2)(B) of the Securities Act of 1933, as

amended, and Section 21E(b)(2)(B) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995

do not apply to forward-looking statements made in periodic reports

PennantPark Investment Corporation files under the Exchange Act.

All statements other than statements of historical facts included

in this press release are forward-looking statements and are not

guarantees of future performance or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including those described from time to time in filings

with the Securities and Exchange Commission. PennantPark Investment

Corporation undertakes no duty to update any forward-looking

statement made herein. You should not place undue influence on such

forward-looking statements as such statements speak only as of the

date on which they are made.

CONTACT:Richard T. Allorto, Jr.PennantPark

Investment Corporation(212) 905-1000www.pennantpark.com

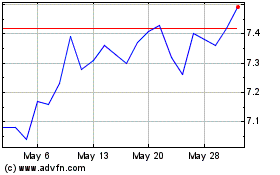

PennantPark Investment (NYSE:PNNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

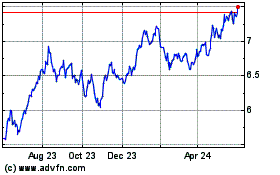

PennantPark Investment (NYSE:PNNT)

Historical Stock Chart

From Dec 2023 to Dec 2024