All financial figures are in Canadian dollars unless otherwise

noted. This news release refers to certain financial measures and

ratios that are not specified, defined or determined in accordance

with Generally Accepted Accounting Principles ("GAAP"), including

net revenue; adjusted earnings before interest, taxes, depreciation

and amortization ("adjusted EBITDA"); adjusted cash flow from

operating activities; adjusted cash flow from operating activities

per common share; and proportionately consolidated debt-to-adjusted

EBITDA. For more information see "Non-GAAP and Other Financial

Measures" herein.

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) announced today its financial and operating results

for the fourth quarter and full year of 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250227832623/en/

Highlights

- Record Results - reported 2024 full year earnings of

$1,874 million, record full year adjusted EBITDA of $4,408 million,

and record full year adjusted cash flow from operating activities

of $3,265 million ($5.70 per share). Reported fourth quarter

earnings of $572 million, record quarterly adjusted EBITDA of

$1,254 million, and record quarterly adjusted cash flow from

operating activities of $922 million ($1.59 per share).

- Business Updates - developments during and following the

fourth quarter included:

- Pembina Gas Infrastructure ("PGI") closed separate transactions

with Whitecap Resources Inc. ("Whitecap") and Veren Inc. ("Veren")

that included asset acquisitions and funding of up to a total of

$700 million ($420 million net to Pembina) for new infrastructure

development.

- In November 2024, the northeast British Columbia ("NEBC") MPS

Expansion was placed into service on time and under budget, adding

to Pembina's record of strong project execution.

- Pembina continues to successfully contract the Nipisi Pipeline

to serve growing volumes from the Clearwater area and recently

contracted an additional 25,000 bbl/d of capacity on a long-term

basis.

- Pembina continues to advance a process with multiple parties to

remarket its contracted Cedar LNG Project capacity and has received

non-binding proposals covering well in excess of its contracted

capacity.

- Pembina is advancing development work on various capital

efficient projects to meet its ethane supply commitments below the

low end of the capital range previously communicated, and respond

to growing demand for services, including the de-ethanizer

expansion at RFS III, the Taylor-to-Gordondale pipeline expansion,

and the Fox-to-Namao pipeline expansion.

- Pembina has entered into agreements for a 50 percent interest

in the Greenlight Electricity Centre Limited Partnership, which is

developing a power generation facility to serve data centre

customers.

- Pembina has secured the sole natural gas liquids ("NGL")

extraction rights from the Yellowhead Mainline natural gas pipeline

and is advancing engineering of an up to 500 MMcf/d straddle

facility.

- Common Share Dividend Declared - the board of directors

declared a common share cash dividend for the first quarter of 2025

of $0.69 per share to be paid, subject to applicable law, on March

31, 2025, to shareholders of record on March 17, 2025.

Financial and Operational Overview

3 Months Ended December

31

12 Months Ended December

31

($ millions, except where noted)

2024

2023

2024

2023

Revenue(1)

2,145

1,836

7,384

6,331

Net revenue(1)(2)

1,383

1,142

4,776

3,973

Gross profit

1,024

850

3,316

2,840

Adjusted EBITDA(2)

1,254

1,033

4,408

3,824

Earnings

572

698

1,874

1,776

Earnings per common share – basic

(dollars)

0.92

1.21

3.00

3.00

Earnings per common share – diluted

(dollars)

0.92

1.21

3.00

2.99

Cash flow from operating activities

902

880

3,214

2,635

Cash flow from operating activities per

common share – basic (dollars)

1.55

1.60

5.61

4.79

Adjusted cash flow from operating

activities(2)

922

747

3,265

2,646

Adjusted cash flow from operating

activities per common share – basic (dollars)(2)

1.59

1.36

5.70

4.81

Capital expenditures

242

177

955

606

(1)

Comparative 2023 period has been

adjusted. See "Accounting Policies & Estimates - Change in

Accounting Policies" in Pembina's Management's Discussion and

Analysis dated February 27, 2025 for the three and twelve months

ended December 31, 2024 and Note 4 to the Consolidated Financial

Statements for the year ended December 31, 2024.

(2)

Refer to "Non-GAAP and Other

Financial Measures".

Financial and Operational Overview by Division

3 Months Ended December

31

12 Months Ended December

31

2024

2023

2024

2023

($ millions, except where noted)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Pipelines

2,790

534

686

2,652

677

617

2,711

1,907

2,533

2,538

1,840

2,234

Facilities

877

177

373

801

143

324

837

666

1,347

768

610

1,213

Marketing & New Ventures

349

245

234

299

204

173

327

569

724

271

435

597

Corporate

—

(212)

(39)

—

(209)

(81)

—

(1,422)

(196)

—

(696)

(220)

Income tax expense/recovery

—

(172)

—

—

(117)

—

—

154

—

—

(413)

—

Total

572

1,254

698

1,033

1,874

4,408

1,776

3,824

(1)

Volumes for the Pipelines and

Facilities divisions are revenue volumes, which are physical

volumes plus volumes recognized from take-or-pay commitments.

Volumes are stated in mboe/d, with natural gas volumes converted to

mboe/d from MMcf/d at a 6:1 ratio. Volumes for Marketing & New

Ventures are marketed crude and NGL volumes.

(2)

Refer to "Non-GAAP and Other

Financial Measures".

For further details on the Company's significant assets,

including definitions for capitalized terms used herein that are

not otherwise defined, refer to Pembina's Annual Information Form

for the year ended December 31, 2024, and Pembina's Management's

Discussion and Analysis dated February 27, 2025 for the three and

twelve months ended December 31, 2024, filed at www.sedarplus.ca

(filed with the U.S. Securities and Exchange Commission at

www.sec.gov under Form 40-F) and on Pembina's website at

www.pembina.com.

Financial & Operational Highlights

Adjusted EBITDA

Pembina reported record quarterly adjusted EBITDA of $1,254

million in the fourth quarter and record full year adjusted EBITDA

of $4,408 million. This represents a $221 million or 21 percent

increase, and a $584 million or 15 percent increase, respectively,

over the same periods in the prior year. For both the fourth

quarter and full year, reported adjusted EBITDA compared to the

prior periods is largely due to the positive net impacts of

increased ownership in Alliance and Aux Sable (the "Alliance/Aux

Sable Acquisition"), higher NGL margins, and volume growth across

the business, partially offset by lower net revenue on the Cochin

Pipeline. Additional factors impacting fourth quarter and full year

results in each division are discussed below.

2024 results exceeded Pembina's most recent 2024 adjusted EBITDA

guidance range of $4.225 billion to $4.325 billion. Relative to the

midpoint of the guidance range, actual results reflect the

following:

- the timing of capital recovery recognition on certain assets

within Pipelines and at PGI, resulting in a recognition in the

fourth quarter of previously deferred revenue ($37 million);

- lower general & administrative expense primarily due to

lower long-term incentive costs during the fourth quarter ($30

million);

- stronger results from the marketing business due to a

significant improvement in NGL frac spreads ($46 million); and

- stronger fourth quarter results in the Pipelines and Facilities

divisions ($20 million).

Pipelines reported adjusted EBITDA of $686 million for the

fourth quarter, representing a $69 million or 11 percent increase

compared to the same period in the prior year, reflecting the net

impact of the following factors:

- higher contribution from Alliance due to increased ownership

following the Alliance/Aux Sable Acquisition and higher demand on

seasonal contracts;

- higher revenue related to the timing of capital recovery

recognition on certain Pipeline assets ($23 million);

- higher volumes on the Nipisi Pipeline;

- net revenues on the Peace Pipeline system were consistent as

higher contracted volumes and contractual inflation adjustments on

tolls were largely offset by earlier recognition of take-or-pay

deferred revenue during the first half of 2024; and

- lower net revenue on the Cochin Pipeline, largely due to lower

firm tolls and lower interruptible demand resulting from a narrower

condensate price differential between western Canada and the U.S.

Gulf Coast.

Pipelines reported adjusted EBITDA of $2,533 million for the

full year, representing a $299 million or 13 percent increase

compared to the same period in the prior year, reflecting the net

impact of the following factors:

- higher contribution from Alliance due to increased ownership

following the Alliance/Aux Sable Acquisition and higher demand on

seasonal contracts;

- no impacts in 2024 from the Northern Pipeline system outage and

the wildfires, which affected 2023;

- higher revenue and volumes, primarily on the Peace Pipeline

system and on the Nipisi Pipeline;

- contractual inflation adjustments on tolls;

- higher net revenue related to the timing of capital recovery

recognition on certain Pipelines assets ($23 million); and

- lower net revenue and volumes on the Cochin Pipeline.

Facilities reported adjusted EBITDA of $373 million for the

fourth quarter, representing a $49 million or 15 percent increase

over the same period in the prior year, reflecting the net impact

of the following factors:

- the inclusion within Facilities of adjusted EBITDA from Aux

Sable following the Alliance/Aux Sable Acquisition; and

- higher contribution from PGI assets, due to higher revenue

associated with the oil batteries acquired in the fourth quarter of

2024, higher volumes at certain PGI assets, and the timing of

capital recovery recognition ($14 million).

Facilities reported adjusted EBITDA of $1,347 million for the

full year, representing a $134 million or 11 percent increase over

the same period in the prior year, reflecting the net impact of the

following factors:

- the inclusion within Facilities of adjusted EBITDA from Aux

Sable following the Alliance/Aux Sable Acquisition;

- higher contribution from PGI assets, due to higher revenue

associated with the oil batteries acquired in the fourth quarter of

2024, higher volumes at certain PGI assets, and the timing of

capital recovery recognition ($14 million);

- no impacts in 2024 from the Northern Pipeline system outage and

the wildfires, which affected volumes in 2023; and

- a gain on the recognition of a finance lease, which affected

2023 only.

Marketing & New Ventures reported adjusted EBITDA of $234

million for the fourth quarter, representing a $61 million or 35

percent increase compared to the same period in the prior year,

reflecting the net impact of the following factors:

- higher net revenue from contracts with customers due to

increased ownership interest in Aux Sable;

- higher NGL margins; and

- lower realized gains on commodity-related derivatives.

Marketing & New Ventures reported adjusted EBITDA of $724

million for the full year, representing a $127 million or 21

percent increase compared to the same period in the prior year,

reflecting the net impact of the following factors:

- higher net revenue from contracts with customers due to

increased ownership interest in Aux Sable following the

Alliance/Aux Sable Acquisition;

- higher NGL margins;

- lower realized gains on commodity-related derivatives; and

- the nine-day unplanned outage at Aux Sable in July 2024.

Corporate reported adjusted EBITDA of negative $39 million for

the fourth quarter, representing a $42 million or 52 percent

increase compared to the same period in the prior year, reflecting

lower incentive costs.

Corporate reported adjusted EBITDA of negative $196 million for

the full year, representing a $24 million or 11 percent increase

over the same period in the prior year, reflecting lower general

and administrative expense, primarily due to lower consulting costs

and lower incentive costs.

Earnings

Pembina reported fourth quarter earnings of $572 million and

full year earnings of $1,874 million. This represents a $126

million or 18 percent decrease, and a $98 million or six percent

increase, respectively, over the same periods in the prior

year.

Pipelines had earnings in the fourth quarter of $534 million,

representing a $143 million or 21 percent decrease over the prior

period. Pipelines had earnings for the full year of $1,907 million,

representing a $67 million or four percent increase over the prior

year. In addition to the factors impacting adjusted EBITDA, as

noted above, the change in earnings in both the fourth quarter and

full year was due to the reversal of a previous impairment related

to the Nipisi Pipeline, which impacted the fourth quarter of

2023.

Facilities had earnings in the fourth quarter of $177 million

representing a $34 million or 24 percent increase over the prior

year. Facilities had earnings for the full year of $666 million

representing a $56 million or nine percent increase over the prior

year. In addition to the factors impacting adjusted EBITDA, as

noted above, the change in earnings in both the fourth quarter and

full year was due to unrealized gains recognized by PGI on interest

rate derivative financial instruments compared to unrealized losses

in 2023.

Marketing & New Ventures had earnings in the fourth quarter

of $245 million representing a $41 million or 20 percent increase

over the prior year. In addition to the factors impacting adjusted

EBITDA, as noted above, the change in earnings in the fourth

quarter was due to unrealized losses on commodity-related

derivatives, compared to unrealized gains in the prior period, and

unrealized gains on interest rate derivative financial instruments,

recognized by Cedar LNG.

Marketing & New Ventures had earnings for the full year of

$569 million representing a $134 million or 31 percent increase,

over the prior year. In addition to the factors impacting adjusted

EBITDA, as noted above, the change in full year earnings was due to

unrealized gains on interest rate derivative financial instruments

recognized by Cedar LNG; gains associated with the derecognition of

the provision related to financial assurances provided by Pembina,

which were assumed by Cedar LNG following the positive final

investment decision ("FID") in June 2024; larger unrealized losses

on commodity-related derivatives, primarily related to renewable

power purchase agreements and crude oil, and higher

depreciation.

In addition to the changes in earnings for each division

discussed above, the change in both the fourth quarter and full

year earnings compared to the prior period was due to higher

interest expense and higher income tax expense. The change in full

year earnings was further affected by the loss on Alliance/Aux

Sable Acquisition, higher acquisition fees and integration costs,

and an income tax recovery in 2024 compared to an expense in

2023.

Cash Flow From Operating Activities

Cash flow from operating activities of $902 million for the

fourth quarter and $3,214 million for the full year represent a

three percent and 22 percent increase, respectively, over the same

periods in the prior year.

The increase in the fourth quarter was primarily driven by

higher operating results, partially offset by the change in

non-cash working capital, and lower distributions from equity

accounted investees and higher net interest paid, both largely as a

result of the Alliance/Aux Sable Acquisition.

The increase in the full year was primarily driven by higher

operating results, the change in non-cash working capital, and an

increase in payments collected through contract liabilities,

partially offset by lower distributions from equity accounted

investees, higher net interest paid, higher taxes paid, and higher

share-based payments.

On a per share (basic) basis, cash flow from operating

activities was $1.55 per share for the fourth quarter and $5.61 per

share for the full year. This represents a decrease of three

percent and an increase of 17 percent, respectively, compared to

the same periods in the prior year, due to the same factors noted

above, as well as additional common shares issued in connection

with the Alliance/Aux Sable Acquisition financing.

Adjusted Cash Flow From Operating Activities

Adjusted cash flow from operating activities of $922 million for

the fourth quarter and $3,265 million for the full year, represent

a 23 percent increase over the same periods in the prior year.

The increase in the fourth quarter was primarily driven by the

same items impacting cash flow from operating activities, discussed

above, excluding the change in non-cash working capital, combined

with lower accrued share-based payment expense, partially offset by

higher income tax expense.

The increase in the full year was primarily driven by the same

items impacting cash flow from operating activities, discussed

above, excluding the change in non-cash working capital, taxes

paid, and share-based payments, combined with lower current income

tax expense, partially offset by higher accrued share-based payment

expense, distributions to non-controlling interest, and higher

preferred dividends paid.

On a per share (basic) basis, adjusted cash flow from operating

activities was $1.59 per share for the fourth quarter and $5.70 per

share for the full year. This represents an increase of 17 percent

and 19 percent, respectively, compared to the same periods in the

prior year, due to the same factors noted above, as well as

additional common shares issued in connection with the Alliance/Aux

Sable Acquisition financing.

Volumes

Total Pipelines and Facilities volumes of 3,667 mboe/d for the

fourth quarter and 3,548 mboe/d for the full year represent an

increase of six percent and seven percent, respectively, over the

same periods in the prior year.

Pipelines volumes of 2,790 mboe/d in the fourth quarter

represent a five percent increase compared to the same period in

the prior year, primarily reflecting the Alliance/Aux Sable

Acquisition, the reactivation of the Nipisi Pipeline, lower volumes

on the Peace Pipeline system due to earlier recognition of

take-or-pay deferred revenue in the first half of 2024, which more

than offset the increase from higher contracted volumes, and lower

volumes on the Cochin Pipeline largely due to lower interruptible

demand.

Pipelines volumes of 2,711 mboe/d for the full year represent a

seven percent increase compared to the same period in the prior

year, primarily reflecting the Alliance/Aux Sable Acquisition, the

reactivation of the Nipisi Pipeline, no impact of the Northern

Pipeline system outage and the wildfires, which impacted 2023 only,

higher volumes on the Peace Pipeline system due to higher

contracted volumes, and lower volumes on the Cochin Pipeline.

Facilities volumes of 877 mboe/d in the fourth quarter represent

a nine percent increase compared to the same period in the prior

year, reflecting volumes now being recognized at Aux Sable

following the Alliance/Aux Sable Acquisition.

Facilities volumes of 837 mboe/d for the full year represent a

nine percent increase compared to the same period in the prior

year, reflecting volumes now being recognized at Aux Sable

following the Alliance/Aux Sable Acquisition, no impact of the

Northern Pipeline system outage, which impacted 2023 only, higher

interruptible and contracted volumes on certain PGI assets,

partially offset by lower volumes due to a planned outage and a

rail strike at the Redwater Complex.

Marketed NGL volumes of 252 mboe/d in the fourth quarter and 228

mboe/d for the full year represents a 16 percent and 23 percent

increase, respectively, compared to the same periods in the prior

year, reflecting higher propane, ethane, and butane sales largely

due to the increase in Pembina's ownership interest in Aux Sable.

The increase in the full year was also impacted by lower supply

volumes from the Redwater Complex in 2023 due to the Northern

Pipeline system outage.

Marketed crude oil volumes of 96 mboe/d in the fourth quarter

and 99 mboe/d for the full year represents a 17 percent and 15

percent increase, respectively, compared to the same periods in the

prior year, reflecting increased blending opportunities due to

favourable price differentials.

Executive Overview

Successful Strategy Execution

2024 was marked by several accomplishments that highlight the

successful execution of Pembina's strategy and our focus on

strengthening the existing franchise, increasing our exposure to

lighter hydrocarbons and resilient end-use markets, and accessing

global market pricing for Canadian energy products. Highlights

included:

- Growing our presence in resilient northeast U.S. natural gas

and NGL markets by fully consolidating ownership of Alliance and

Aux Sable.

- Furthering global market access for Canadian natural gas

producers by reaching a positive FID on the Cedar LNG Project.

- Adding capital efficient, timely, and certain capacity to

accommodate growing Western Canadian Sedimentary Basin ("WCSB")

production through completion of the Phase VIII Peace Pipeline

Expansion.

- Supporting growth-focused Montney and Duvernay area customers

with tailored solutions through two PGI transactions.

- Capitalizing on new long-term, stable demand for ethane from

Alberta’s growing petrochemical industry by entering a 50,000

barrel per day ethane supply agreement with Dow Chemical Canada

("Dow").

- Commercial successes across the business, including executing

incremental contracts or renewing contracts for:

- approximately 170 mboe/d of pipeline transportation, primarily

on Alliance Pipeline, Peace Pipeline, and Nipisi Pipeline;

- over six million barrels of storage at the Edmonton

Terminals;

- approximately 200 MMcf/d of gas processing, primarily at

Musreau, Patterson Creek, and K3; and

- additional fractionation services across the Redwater

Complex.

Preliminary 2024 data suggests annual production growth in

British Columbia and Alberta of approximately four percent, with

NGL and condensate growth having outpaced other hydrocarbons.

Pembina's assets play an essential role in the basin, and as such

the Company's conventional pipeline and gas processing volume

growth roughly mirrored year-over-year basin growth, and asset

utilization has continued to rise.

The Pembina Advantage

Our portfolio of high-quality assets, combined with the breadth

of our capabilities, provides an unmatched service offering for our

customers. We provide fully integrated, end-to-end solutions across

all products – natural gas, NGL (ethane, propane and butane),

condensate, and crude oil. Through our unique combination of

strategically-placed assets and strong customer and community

relationships we have built strong competitive advantages, allowing

us to capitalize on opportunities and serve our customers better.

Successfully meeting the needs of our customers will underpin

Pembina’s future success and in turn our ability to deliver

industry-leading returns to our investors, remain an

employer-of-choice to a highly engaged workforce, and have a

positive net impact within our communities.

Looking Ahead: Our Vision for 2025 and

Beyond

Pembina operates at the heart of the WCSB, one of North

America’s most significant hydrocarbon-producing regions.

Significant and multi-year volume growth in WCSB production is

expected through the balance of the decade due to a variety of

catalysts driving transformational change across the Canadian

energy industry. First among them is the development of LNG export

facilities, including our own Cedar LNG Project. Currently approved

and future LNG projects will connect the basin’s vast natural gas

reserves to high-demand global markets, particularly in Asia,

ensuring long-term demand that is expected to spur significant

additional production. Other developments include the recent

completion of the Trans Mountain Pipeline expansion that added

roughly 600,000 barrels per day of new oil export capacity and will

in turn drive additional condensate demand, the development of new

West Coast NGL export projects, new petrochemical facilities

creating significant demand for ethane and propane, and the

potential for rising intra-basin demand for natural gas to power a

new and potentially significant data center industry.

Our integrated value chain provides a full suite of midstream

and transportation services across all of these commodities, and

therefore we believe Pembina is best positioned to benefit from the

growth we are seeing and expect to continue to see in the WCSB.

Throughout 2025 we are focused on:

- Continuing our relentless efforts on safe, reliable, and

cost-effective operations;

- Enhancing utilization of existing assets and continuing to

renew, and sign incremental new, contracts; most notably we are

seeing momentum and demand for services across the Peace Pipeline

system, Nipisi Pipeline, the Redwater Complex, and PGI assets;

- Executing in flight projects safely and on time and on budget,

including Cedar LNG, RFS IV, the Wapiti Expansion, and the K3

Cogeneration Facility; and

- Advancing capital efficient expansions that include

infrastructure to support the Dow Supply Agreement, and expansions

to support volume growth in NEBC.

We are excited about the opportunities that lie ahead and look

forward to sharing our progress over the coming year.

Business Updates

Greenlight Electricity Centre

Pembina has entered into agreements for a 50 percent interest in

the Greenlight Electricity Centre Limited Partnership ("Greenlight

LP"), which is developing a gas-fired combined cycle power

generation facility to be located in Alberta’s Industrial Heartland

and constructed in multiple 450 MW phases, up to 1,800 MW (the

"Greenlight Electricity Centre"). This project would be constructed

on land owned by Pembina, adjacent to its Redwater Complex.

Greenlight LP will be owned equally by Pembina and Kineticor

Holdings LP#3, a subsidiary of OPTrust.

The Greenlight Electricity Centre has been, and will continue to

be, developed on behalf of Greenlight LP by Kineticor Asset

Management LP ("Kineticor"). Kineticor successfully developed the

Cascade power facility near Edson, Alberta, a gas-fired combined

cycle power generation facility capable of generating up to 900 MW

of power. Greenlight LP is in active discussions with data center

customers to commercially underpin the project and believes the

lands within Alberta’s Industrial Heartland are well suited given

their proximity to transmission and utility infrastructure.

With generation interconnection applications currently in stage

3 of the AESO process, Greenlight LP could be in a position to

place a facility into service as early as 2029.

In addition, Pembina is well positioned to leverage its existing

and future value chain to further support this project. The

proximity of Alliance Pipeline offers a potential accretive

expansion opportunity to provide natural gas supply to the

Greenlight Electricity Centre, and the potential future development

of the Alberta Carbon Grid may provide a future emissions reduction

solution.

Yellowhead Mainline Extraction

Opportunity

Pembina has secured the sole extraction rights from the

Yellowhead Mainline, a one billion cubic feet per day natural gas

delivery pipeline that is under construction by ATCO.

Pembina is currently advancing engineering of an up to 500

MMcf/d straddle facility at which up to 25,000 bpd of NGL mix would

be extracted from the natural gas stream and transported to the

Fort Saskatchewan, Alberta area for fractionation and sale. The

straddle facility would be located on Pembina owned lands.

Pembina has significant experience building and operating

liquids extraction facilities and currently operates assets with

approximately 1.8 bcf/d (1.5 bcf/d net to Pembina) of extraction

capacity through its Empress and Younger facilities.

Alliance Pipeline

Alliance continues to work collaboratively with its stakeholders

through the Canada Energy Regulator ("CER") review process and

remains focused on delivering the highest standards of service that

customers have come to expect. Alliance will work expeditiously

throughout 2025 with shippers towards a negotiated solution, in

accordance with all CER direction. The CER has ordered that the

current tolls shall be deemed interim tolls until resolution of the

matter.

2025 Guidance

In December 2024, Pembina announced a 2025 adjusted EBITDA

guidance range of $4.2 billion to $4.5 billion, which relative to

2024 reflects the impacts of continued volume growth across the

WCSB, new assets acquired or placed into service, and the full year

impact of the consolidation of the Alliance and Aux Sable assets,

partially offset primarily by the full year impact of the

recontracting of the Cochin Pipeline, and normalization of

commodity margins in the marketing business.

Despite proposed tariffs on U.S. energy imports, Pembina does

not expect any material near-term impacts given the highly

contracted, take-or-pay nature of its business.

The 2025 adjusted EBITDA guidance range reflects quarterly

seasonality in Pembina's business including:

- higher contribution from Alliance in the first and fourth

quarters due to the ability to transport higher volumes during

colder periods;

- higher integrity and geotechnical costs on the conventional

pipeline assets in the third and fourth quarters; and

- stronger first and fourth quarter results in the NGL marketing

business.

Pembina continues to execute its strategy within a fully funded

model and consistent with its financial guardrails. At December 31,

2024, the ratio of proportionately consolidated debt-to-adjusted

EBITDA on a trailing twelve-month basis was 3.5 times, at the low

end of the Company's targeted range, and reflecting only three

quarters of contribution from the Alliance/Aux Sable Acquisition.

Within the 2025 adjusted EBITDA guidance range, Pembina expects to

generate positive free cash flow, with all 2025 capital investment

program scenarios being fully funded by cash flow from operating

activities, net of dividends. Further, the Company is forecasting a

year-end 2025 proportionately consolidated debt-to-adjusted EBITDA

ratio of 3.3 to 3.6 times.

Projects and New Developments

Pipelines

- In November 2024, the NEBC MPS Expansion was placed into

service on time and under the $90 million budget, adding to

Pembina's record of strong project execution. This expansion

includes a new mid-point pump station, terminal upgrades, and

additional storage, which support approximately 40,000 bpd of

incremental capacity on the NEBC Pipeline system. This expansion

will fulfill customer demand in light of growing production volumes

from NEBC and previously announced long-term midstream service

agreements with three premier NEBC Montney producers.

- Pembina continues to successfully contract the Nipisi Pipeline

to serve growing volumes from the Clearwater area. Pembina recently

contracted an additional 25,000 bbl/d of capacity on a long-term

basis commencing in the first half of 2026 and expects the pipeline

to be highly utilized in 2026. With the expectation of continued

growth from the Clearwater play, Pembina is currently evaluating

opportunities to increase egress capacity, including the

optimization or expansion of the Nipisi Pipeline and the

re-purposing of existing underutilized assets.

- Pembina is developing additional expansions to support growing

WCSB production and demand for services on its conventional

pipelines.

- On April 23, 2024, Pembina filed its project application for

the Taylor-to-Gordondale Project (an expansion of the Pouce Coupe

system) with the Canada Energy Regulator ("CER") and has entered

the assessment phase of the CER's regulatory process with the

hearing scheduled to commence in June 2025.

- Pembina is evaluating an expansion of the Peace Pipeline system

to add up to approximately 200,000 bpd of capacity to its market

delivery pipelines from Fox Creek-to-Namao (the "Fox Creek-to-Namao

Peace Pipeline Expansion"). The current total capacity of the Peace

Pipeline and Northern Pipeline systems is approximately 1.1 million

bpd and Pembina has the ability to through the relatively low-cost

addition of pump stations on these mainlines to bring the total

capacity of these systems to 1.3 million bpd.

- Pembina continues to advance further expansions to support

volume growth in NEBC, including new pipelines and terminal

upgrades.

Facilities

- Pembina is constructing a new 55,000 bpd propane-plus

fractionator ("RFS IV") at its existing Redwater Complex. RFS IV

will leverage the design, engineering and operating best practices

of the existing facilities at the Redwater Complex. Fabrication and

construction activities continued in the fourth quarter of 2024,

while piling and foundation work was completed for the associated

rail yard scope. RFS IV is expected to be in-service in the first

half of 2026 and is trending on time and on budget.

- PGI is developing an expansion (the "Wapiti Expansion") that

will increase natural gas processing capacity at the Wapiti Plant

by 115 mmcf/d (gross to PGI). During the fourth quarter of 2024,

engineering and equipment fabrication progressed and early works

construction commenced. The Wapiti Expansion is expected to be

in-service in the first half of 2026 and is trending on time and on

budget.

- PGI is developing a 28 MW cogeneration facility at its K3 Plant

(the "K3 Cogeneration Facility"), which is expected to reduce

overall operating costs by providing power and heat to the gas

processing facility, while reducing customers’ exposure to power

prices. Early works construction activities have commenced. The K3

Cogeneration Facility is expected to be in-service in the first

half of 2026 and is trending on time and on budget.

- Pembina continues to evaluate the various options available to

meet its ethane supply commitment under the agreement with Dow.

Pembina is seeking to fulfill its commitment in the most capital

efficient manner possible and is evaluating a portfolio of

opportunities, including the addition of a de-ethanizer tower at

RFS III within the Redwater Complex. By leveraging its existing

assets and capabilities, Pembina now expects the total capital

investment required to be less than $300 million, below the low end

of the range previously communicated, resulting in improved capital

efficiency as there is no change to the forecasted adjusted EBITDA

contribution associated with the Dow Supply Agreement.

- Effective October 9, 2024, PGI closed its acquisition from

Veren of four batteries in the Gold Creek and Karr areas. Veren has

entered into a 15 year take-or-pay agreement for capacity at the

acquired batteries, which also includes an area-of-dedication to

PGI for gathering and processing services for all volumes Veren

produces out of the Gold Creek and Karr areas. Liquids from the

batteries and the Patterson Creek Gas Plant will continue to be

transported on Pembina’s Peace Pipeline system and the NGL will be

processed at Pembina’s Redwater Facility under previously

established agreements. As part of this transaction, PGI also

committed to fund capital up to $300 million ($180 million net to

Pembina) for future battery and gathering infrastructure in the

Gold Creek and Karr areas, which is expected to be in service in

the first half of 2026. Separately, during the fourth quarter of

2024, PGI executed a long term, take-or-pay agreement with Veren to

provide approximately 95 MMcf/d of gas processing service in

support of their Duvernay development at PGI's Duvernay and KA

Plants. This further solidifies PGI’s contracted volumes in the

Kaybob area.

- Effective December 31, 2024, PGI closed its acquisition of a 50

percent working interest in Whitecap’s 15-07 Kaybob Complex (the

"Kaybob Complex"). Whitecap entered into a long-term take-or-pay

agreement for PGI’s capacity in the Kaybob Complex and committed to

an area of dedication to PGI for all volumes Whitecap produces out

of the area. Whitecap has also entered into additional long-term

take-or-pay contracts with PGI at the Musreau gas plant within the

Cutbank Complex ("Musreau") and the K3 gas plant. PGI anticipates

funding up to $400 million ($240 million net to Pembina) for future

infrastructure development for Whitecap’s Lator area development,

including a new battery and gathering laterals (the "Lator

Infrastructure"), which is expected to be in service in late 2026 /

early 2027. All NGL produced through the Kaybob Complex and Lator

Infrastructure developments will flow through Pembina’s downstream

infrastructure and are covered under a combination of new and

extended long-term transportation, fractionation, and marketing

services agreements, as well as an area-of-dedication for future

growth.

Marketing & New Ventures

- Pembina and its partner, the Haisla Nation, are constructing

the Cedar LNG Project, a 3.3 million tonnes per annum ("mtpa")

floating LNG facility in Kitimat, British Columbia. Site clearing

and civil works on the marine terminal site commenced in the third

quarter of 2024 and construction of the floating LNG facility is

expected to begin in mid-2025. The anticipated in-service date of

the Cedar LNG Project is in late 2028. Pembina has entered into an

agreement with Cedar LNG for 1.5 mtpa of capacity and previously

acknowledged its intent to remarket that capacity to third parties.

In late 2024, Pembina initiated remarketing discussions with a

broad range of potential customers, including both LNG portfolio

players and Canadian producers. Pembina has received non-binding

proposals covering well in excess of its contracted capacity and is

in the process of shortlisting preferred counterparties to

transition to definitive agreements. The market response received

thus far has been very positive and reflects the de-risking of the

project and the capacity.

Fourth Quarter 2024 Conference Call & Webcast

Pembina will host a conference call on Friday, February 28,

2025, at 8:00 a.m. MT (10:00 a.m. ET) for interested investors,

analysts, brokers and media representatives to discuss results for

the fourth quarter of 2024. The conference call dial-in numbers for

Canada and the U.S. are 1-289-819-1520 or 1-800-549-8228. A

recording of the conference call will be available for replay until

Friday, March 7, 2025, at 11:59 p.m. ET. To access the replay,

please dial either 1-289-819-1325 or 1-888-660-6264 and enter the

password 56189 #.

A live webcast of the conference call can be accessed on

Pembina's website at www.pembina.com under Investor

Centre/Presentations & Events, or by entering:

https://events.q4inc.com/attendee/641370033 in your web browser.

Shortly after the call, an audio archive will be posted on the

website for a minimum of 90 days.

Quarterly Common Share Dividend

Pembina's board of directors has declared a common share cash

dividend for the first quarter of 2025 of $0.69 per share to be

paid, subject to applicable law, on March 31, 2025, to shareholders

of record on March 17, 2025. The common share dividends are

designated as "eligible dividends" for Canadian income tax

purposes. For non-resident shareholders, Pembina's common share

dividends should be considered "qualified dividends" and may be

subject to Canadian withholding tax.

For shareholders receiving their common share dividends in U.S.

funds, the cash dividend is expected to be approximately

U.S.$0.4812 per share (before deduction of any applicable Canadian

withholding tax) based on a currency exchange rate of 0.6974. The

actual U.S. dollar dividend will depend on the Canadian/U.S. dollar

exchange rate on the payment date and will be subject to applicable

withholding taxes.

Quarterly dividend payments are expected to be made on the last

business day of March, June, September and December to shareholders

of record on the 15th day of the corresponding month, if, as and

when declared by the board of directors. Should the record date

fall on a weekend or on a statutory holiday, the record date will

be the next succeeding business day following the weekend or

statutory holiday.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation

and midstream service provider that has served North America's

energy industry for more than 70 years. Pembina owns an extensive

network of strategically-located assets, including hydrocarbon

liquids and natural gas pipelines, gas gathering and processing

facilities, oil and natural gas liquids infrastructure and

logistics services, and an export terminals business. Through our

integrated value chain, we seek to provide safe and reliable energy

solutions that connect producers and consumers across the world,

support a more sustainable future and benefit our customers,

investors, employees and communities. For more information, please

visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so

the world can thrive.

Pembina is structured into three Divisions: Pipelines Division,

Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock

exchanges under PPL and PBA, respectively. For more information,

visit www.pembina.com.

Forward-Looking Statements and Information

This news release contains certain forward-looking statements

and forward-looking information (collectively, "forward-looking

statements"), including forward-looking statements within the

meaning of the "safe harbor" provisions of applicable securities

legislation, that are based on Pembina's current expectations,

estimates, projections and assumptions in light of its experience

and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as

"continue", "anticipate", "schedule", "will", "expects",

"estimate", "potential", "planned", "future", "outlook",

"strategy", "project", "plan", "commit", "maintain", "focus",

"ongoing", "believe" and similar expressions suggesting future

events or future performance.

In particular, this news release contains forward-looking

statements, including certain financial outlooks, pertaining to,

without limitation, the following: Pembina's 2025 guidance,

including anticipated 2025 adjusted EBITDA and year-end 2025

proportionately consolidated debt-to-adjusted EBITDA ratio, as well

as the factors impacting such future results; expected cash flow

from operating activities in 2025 and the uses thereof; future

pipeline, processing, fractionation and storage facility and system

operations and throughput levels; treatment under existing and

potential governmental policies and regulations, including

expectations regarding their impact on Pembina; Pembina's strategy

and the development of new business initiatives and growth

opportunities, including the anticipated benefits therefrom and the

expected timing thereof; expectations about current and future

market conditions, industry activities and development

opportunities, as well as the anticipated benefits thereof,

including general market conditions outlooks and industry

developments; expectations about future demand for Pembina's

infrastructure and services, including expectations in respect of

customer contracts, future volume growth in the WCSB and the

drivers thereof, increased utilization and future tolls and

volumes; expectations relating to the development of Pembina's new

projects and developments, including the Cedar LNG Project, RFS IV,

the Wapiti Expansion, the K3 Cogeneration Facility, the Greenlight

Electricity Centre and the Yellowhead Mainline Extraction project,

including the outcomes, timing and anticipated benefits thereof;

statements regarding commercial discussions regarding the

assignment of Pembina's contracted capacity for the Cedar LNG

Project, including the timing and results thereof; expectations in

respect of PGI's infrastructure development commitments, including

the amounts and timing thereof; statements regarding optimization

and expansion opportunities being evaluated or pursued by Pembina,

including future actions taken by Pembina in connection with such

opportunities and the outcomes thereof; Pembina's future common

share dividends, including the timing, amount and expected tax

treatment thereof; planning, construction, locations, capital

expenditure and funding estimates, schedules, regulatory and

environmental applications and anticipated approvals, expected

capacity, incremental volumes, contractual arrangements, completion

and in-service dates, sources of product, activities, benefits and

operations with respect to new construction of, or expansions on

existing pipelines, systems, gas services facilities, processing

and fractionation facilities, terminalling, storage and hub

facilities and other facilities or energy infrastructure, as well

as the impact of Pembina's new projects on its future financial

performance; and expectations regarding existing and future

commercial agreements, including the expected timing and benefit

thereof.

The forward-looking statements are based on certain factors and

assumptions that Pembina has made in respect thereof as at the date

of this news release regarding, among other things: oil and gas

industry exploration and development activity levels and the

geographic region of such activity; the success of Pembina's

operations; prevailing commodity prices, interest rates, carbon

prices, tax rates, exchange rates and inflation rates; the ability

of Pembina to maintain current credit ratings; the availability and

cost of capital to fund future capital requirements relating to

existing assets, projects and the repayment or refinancing of

existing debt as it becomes due; future operating costs;

geotechnical and integrity costs; that any third-party projects

relating to Pembina's growth projects will be sanctioned and

completed as expected; assumptions with respect to our intention to

complete share repurchases, including the funding thereof, existing

and future market conditions, including with respect to Pembina's

common share trading price, and compliance with respect to

applicable securities laws and regulations and stock exchange

policies; that any required commercial agreements can be reached in

the manner and on the terms expected by Pembina; that all required

regulatory and environmental approvals can be obtained on

acceptable terms and in a timely manner; that counterparties will

comply with contracts in a timely manner; that there are no

unforeseen events preventing the performance of contracts or the

completion of the relevant projects; prevailing regulatory, tax and

environmental laws and regulations; maintenance of operating

margins; the amount of future liabilities relating to lawsuits and

environmental incidents; and the availability of coverage under

Pembina's insurance policies (including in respect of Pembina's

business interruption insurance policy).

Although Pembina believes the expectations and material factors

and assumptions reflected in these forward-looking statements are

reasonable as of the date hereof, there can be no assurance that

these expectations, factors and assumptions will prove to be

correct. These forward-looking statements are not guarantees of

future performance and are subject to a number of known and unknown

risks and uncertainties including, but not limited to: the

regulatory environment and decisions, including the outcome of

regulatory hearings, and Indigenous and landowner consultation

requirements; the impact of competitive entities and pricing;

reliance on third parties to successfully operate and maintain

certain assets; reliance on key relationships, joint venture

partners and agreements; labour and material shortages; the

strength and operations of the oil and natural gas production

industry and related commodity prices; non-performance or default

by contractual counterparties ; actions by governmental or

regulatory authorities, including changes in laws and treatment

(including uncertainty with respect to the interpretation of the

recently enacted Bill C-59 and related amendments to the

Competition Act (Canada)), changes in royalty rates, regulatory

decisions, changes in regulatory processes or increased

environmental regulation; the ability of Pembina to acquire or

develop the necessary infrastructure in respect of future

development projects; Pembina's ability to realize the anticipated

benefits of recent acquisitions; fluctuations in operating results;

adverse general economic and market conditions, including potential

recessions in Canada, North America and worldwide resulting in

changes, or prolonged weaknesses, as applicable, in interest rates,

foreign currency exchange rates, inflation, commodity prices,

supply/demand trends and overall industry activity levels; new

Canadian and/or U.S. trade policies or barriers, including the

imposition of new tariffs, duties or other trade restrictions;

constraints on the, or the unavailability of, adequate supplies,

infrastructure or labour; the political environment in North

American and elsewhere, including changes in trade relations

between Canada and the U.S., and public opinion thereon; the

ability to access various sources of debt and equity capital;

adverse changes in credit ratings; counterparty credit risk;

technology and cyber security risks; natural catastrophes; and

certain other risks detailed in Pembina's Annual Information Form

and Management's Discussion and Analysis, each dated February 27,

2025 for the year ended December 31, 2024 and from time to time in

Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

This list of risk factors should not be construed as exhaustive.

Readers are cautioned that events or circumstances could cause

results to differ materially from those predicted, forecasted or

projected by forward-looking statements contained herein. The

forward-looking statements contained in this news release speak

only as of the date of this news release. Pembina does not

undertake any obligation to publicly update or revise any

forward-looking statements or information contained herein, except

as required by applicable laws. Management approved the 2025

guidance contained herein on December 12, 2024. The purpose of the

2025 guidance is to assist readers in understanding Pembina's

expected and targeted financial results, and this information may

not be appropriate for other purposes. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

Non-GAAP and Other Financial Measures

Throughout this news release, Pembina has disclosed certain

financial measures and ratios that are not specified, defined or

determined in accordance with GAAP and which are not disclosed in

Pembina's financial statements. Non-GAAP financial measures either

exclude an amount that is included in, or include an amount that is

excluded from, the composition of the most directly comparable

financial measure specified, defined and determined in accordance

with GAAP. Non-GAAP ratios are financial measures that are in the

form of a ratio, fraction, percentage or similar representation

that has a non-GAAP financial measure as one or more of its

components. These non-GAAP financial measures and non-GAAP ratios,

together with financial measures and ratios specified, defined and

determined in accordance with GAAP, are used by management to

evaluate the performance and cash flows of Pembina and its

businesses and to provide additional useful information respecting

Pembina's financial performance and cash flows to investors and

analysts.

In this news release, Pembina has disclosed the following

non-GAAP financial measures and non-GAAP ratios: net revenue,

adjusted EBITDA, adjusted EBITDA from equity accounted investees,

adjusted cash flow from operating activities, adjusted cash flow

from operating activities per common share, and proportionately

consolidated debt-to-adjusted EBITDA. The non-GAAP financial

measures and non-GAAP ratios disclosed in this news release do not

have any standardized meaning under International Financial

Reporting Standards ("IFRS") and may not be comparable to similar

financial measures or ratios disclosed by other issuers. Such

financial measures and ratios should not, therefore, be considered

in isolation or as a substitute for, or superior to, measures and

ratios of Pembina's financial performance, or cash flows specified,

defined or determined in accordance with IFRS, including revenue,

earnings, cash flow from operating activities and cash flow from

operating activities per share.

Except as otherwise described herein, these non-GAAP financial

measures and non-GAAP ratios are calculated on a consistent basis

from period to period. Specific reconciling items may only be

relevant in certain periods.

Below is a description of each non-GAAP financial measure and

non-GAAP ratio disclosed in this news release, together with, as

applicable, disclosure of the most directly comparable financial

measure that is determined in accordance with GAAP to which each

non-GAAP financial measure relates and a quantitative

reconciliation of each non-GAAP financial measure to such directly

comparable GAAP financial measure. Additional information relating

to such non-GAAP financial measures and non-GAAP ratios, including

disclosure of the composition of each non-GAAP financial measure

and non-GAAP ratio, an explanation of how each non-GAAP financial

measure and non-GAAP ratio provides useful information to investors

and the additional purposes, if any, for which management uses each

non-GAAP financial measure and non-GAAP ratio; an explanation of

the reason for any change in the label or composition of each

non-GAAP financial measure and non-GAAP ratio from what was

previously disclosed; and a description of any significant

difference between forward-looking non-GAAP financial measures and

the equivalent historical non-GAAP financial measures, is contained

in the "Non-GAAP & Other Financial Measures" section of the

management's discussion and analysis of Pembina dated February 27,

2025 for the year ended December 31, 2024 (the "MD&A"), which

information is incorporated by reference in this news release. The

MD&A is available on SEDAR+ at www.sedarplus.ca, EDGAR at

www.sec.gov and Pembina's website at www.pembina.com.

Net Revenue

Net revenue is a non-GAAP financial measure which is defined as

total revenue less cost of goods. The most directly comparable

financial measure to net revenue that is determined in accordance

with GAAP and disclosed in Pembina's financial statements is

revenue.

3 Months Ended December 31

Pipelines

Facilities

Marketing & New

Ventures(1)

Corporate &

Inter-segment

Eliminations

Total(1)

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Revenue

948

737

320

248

1,133

1,030

(256)

(179)

2,145

1,836

Cost of goods sold

5

11

—

—

919

821

(162)

(138)

762

694

Net revenue

943

726

320

248

214

209

(94)

(41)

1,383

1,142

12 Months Ended December 31

Pipelines

Facilities

Marketing & New

Ventures(1)

Corporate &

Inter-segment

Eliminations

Total(1)

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Revenue

3,386

2,707

1,127

909

3,796

3,293

(925)

(578)

7,384

6,331

Cost of goods sold

40

17

—

—

3,198

2,736

(630)

(395)

2,608

2,358

Net revenue

3,346

2,690

1,127

909

598

557

(295)

(183)

4,776

3,973

(1)

Comparative 2023 period has been

adjusted. See "Accounting Policies & Estimates - Change in

Accounting Policies" in Pembina's Management's Discussion and

Analysis dated February 27, 2025 for the three and twelve months

ended December 31, 2024 and Note 4 to the Consolidated Financial

Statements for the year ended December 31, 2024.

Adjusted Earnings Before Interest, Taxes,

Depreciation and Amortization

Adjusted EBITDA is a non-GAAP financial measure and is

calculated as earnings before net finance costs, income taxes,

depreciation and amortization (included in operations and general

and administrative expense), and unrealized gains or losses from

derivative instruments. The exclusion of unrealized gains or losses

from derivative instruments eliminates the non-cash impact of such

gains or losses.

Adjusted EBITDA also includes adjustments to earnings for

non-controlling interest, losses (gains) on disposal of assets,

transaction costs incurred in respect of acquisitions, dispositions

and restructuring, impairment charges or reversals in respect of

goodwill, intangible assets, investments in equity accounted

investees and property, plant and equipment, certain non-cash

provisions and other amounts not reflective of ongoing operations.

These additional adjustments are made to exclude various non-cash

and other items that are not reflective of ongoing operations.

Following completion of the Alliance/Aux Sable Acquisition,

Pembina revised the definition of adjusted EBITDA to deduct

earnings for the 14.6 percent non-controlling interest in the Aux

Sable U.S. operations. Pembina's subsequent acquisition of the

remaining interest in Aux Sable's U.S. operations in the third

quarter of 2024 resulted in all of Aux Sable's results being

included in the adjusted EBITDA calculation beginning on August 1,

2024.

3 Months Ended December 31

Pipelines

Facilities

Marketing &

New Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Earnings (loss)

534

677

177

143

245

204

(212)

(209)

572

698

Income tax expense

—

—

—

—

—

—

—

—

172

117

Adjustments to share of profit from equity

accounted investees and other

—

45

136

135

(74)

6

—

—

62

186

Net finance costs (income)

5

6

2

3

5

(4)

151

111

163

116

Depreciation and amortization

148

109

55

46

17

12

15

11

235

178

Unrealized loss (gain) from derivative

instruments

—

—

—

—

41

(46)

—

—

41

(46)

Impairment reversal

—

(231)

—

—

—

—

—

—

—

(231)

Transaction and integration costs in

respect of acquisitions

—

—

—

—

—

—

7

2

7

2

Gain on disposal of assets, other non-cash

provisions, and other

(1)

11

3

(3)

—

1

—

4

2

13

Adjusted EBITDA

686

617

373

324

234

173

(39)

(81)

1,254

1,033

Adjusted EBITDA per common share – basic

(dollars)

2.16

1.87

12 Months Ended December 31

Pipelines

Facilities

Marketing &

New Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Earnings (loss)

1,907

1,840

666

610

569

435

(1,422)

(696)

1,874

1,776

Income tax (recovery) expense

—

—

—

—

—

—

—

—

(154)

413

Adjustments to share of profit (loss) from

equity accounted investees and other

46

172

486

438

(16)

84

—

—

516

694

Net finance costs

24

28

10

9

9

4

518

425

561

466

Depreciation and amortization

560

414

183

159

64

46

55

44

862

663

Unrealized loss from derivative

instruments

—

—

—

—

170

32

—

—

170

32

Non-controlling interest(1)

—

—

—

—

(12)

—

—

—

(12)

—

Loss on Alliance/Aux Sable Acquisition

—

—

—

—

—

—

616

—

616

—

Impairment reversal

—

(231)

—

—

—

—

—

—

—

(231)

Transaction and integration costs in

respect of acquisition

—

—

—

—

—

—

25

2

25

2

Derecognition of insurance contract

provision

—

—

—

—

(34)

—

—

—

(34)

—

Gain on disposal of assets, other non-cash

provisions, and other

(4)

11

2

(3)

(26)

(4)

12

5

(16)

9

Adjusted EBITDA

2,533

2,234

1,347

1,213

724

597

(196)

(220)

4,408

3,824

Adjusted EBITDA per common share – basic

(dollars)

7.69

6.95

(1)

Presented net of adjusting

items.

Adjusted EBITDA from Equity Accounted

Investees

In accordance with IFRS, Pembina's jointly controlled

investments are accounted for using equity accounting. Under equity

accounting, the assets and liabilities of the investment are

presented net in a single line item in the Consolidated Statement

of Financial Position, "Investments in Equity Accounted Investees".

Net earnings from investments in equity accounted investees are

recognized in a single line item in the Consolidated Statement of

Earnings and Comprehensive Income "Share of Profit from Equity

Accounted Investees". The adjustments made to earnings, in adjusted

EBITDA above, are also made to share of profit from investments in

equity accounted investees. Cash contributions and distributions

from investments in equity accounted investees represent Pembina's

share paid and received in the period to and from the investments

in equity accounted investees.

To assist in understanding and evaluating the performance of

these investments, Pembina is supplementing the IFRS disclosure

with non-GAAP proportionate consolidation of Pembina's interest in

the investments in equity accounted investees. Pembina's

proportionate interest in equity accounted investees has been

included in adjusted EBITDA.

3 Months Ended December 31

Pipelines

Facilities

Marketing &

New Ventures

Total

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

Share of profit from equity accounted

investees

—

31

59

48

74

15

133

94

Adjustments to share of profit from equity

accounted investees:

Net finance costs (income)

—

7

37

84

(74)

—

(37)

91

Income tax expense (recovery)

—

—

23

(13)

—

—

23

(13)

Depreciation and amortization

—

38

66

60

—

6

66

104

Unrealized (gain) loss on

commodity-related derivative financial instruments

—

—

(3)

7

—

—

(3)

7

Transaction costs incurred in respect of

acquisitions and non-cash provisions

—

—

13

(3)

—

—

13

(3)

Total adjustments to share of profit from

equity accounted investees

—

45

136

135

(74)

6

62

186

Adjusted EBITDA from equity accounted

investees

—

76

195

183

—

21

195

280

12 Months Ended December 31

Pipelines

Facilities

Marketing &

New Ventures

Total

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

Share of profit (loss) from equity

accounted investees

42

109

231

233

55

(26)

328

316

Adjustments to share of profit (loss) from

equity accounted investees:

Net finance costs (income)

7

22

175

160

(23)

1

159

183

Income tax expense

—

—

73

41

—

—

73

41

Depreciation and amortization

39

150

221

207

7

25

267

382

Unrealized loss on commodity-related

derivative financial instruments

—

—

2

16

—

—

2

16

Transaction costs incurred in respect of

acquisitions and non-cash provisions

—

—

15

14

—

58

15

72

Total adjustments to share of profit from

equity accounted investees

46

172

486

438

(16)

84

516

694

Adjusted EBITDA from equity accounted

investees

88

281

717

671

39

58

844

1,010

Adjusted Cash Flow from Operating

Activities and Adjusted Cash Flow from Operating Activities per

Common Share

Adjusted cash flow from operating activities is a non-GAAP

financial measure which is defined as cash flow from operating

activities adjusting for the change in non-cash operating working

capital, adjusting for current tax and share-based compensation

payment, and deducting distributions to non-controlling interest

and preferred share dividends paid. Adjusted cash flow from

operating activities deducts distributions to non-controlling

interest and preferred share dividends paid because they are not

attributable to common shareholders. The calculation has been

modified to include current tax and share-based compensation

payment as it allows management to better assess the obligations

discussed below.

Following completion of the Alliance/Aux Sable Acquisition,

Pembina revised the definition of adjusted cash flow from operating

activities to deduct distributions related to non-controlling

interest in the Aux Sable U.S. operations. On August 1, 2024,

Pembina acquired the remaining interest in Aux Sable's U.S.

operations.

Management believes that adjusted cash flow from operating

activities provides comparable information to investors for

assessing financial performance during each reporting period.

Management utilizes adjusted cash flow from operating activities to

set objectives and as a key performance indicator of the Company's

ability to meet interest obligations, dividend payments and other

commitments.

Adjusted cash flow from operating activities per common share is

a non-GAAP ratio which is calculated by dividing adjusted cash flow

from operating activities by the weighted average number of common

shares outstanding.

3 Months Ended December

31

12 Months Ended December

31

($ millions, except per share amounts)

2024

2023

2024

2023

Cash flow from operating activities

902

880

3,214

2,635

Cash flow from operating activities per

common share – basic (dollars)

1.55

1.60

5.61

4.79

Add (deduct):

Change in non-cash operating working

capital

73

(54)

43

210

Current tax expense

(73)

(54)

(261)

(325)

Taxes paid, net of foreign exchange

52

49

404

236

Accrued share-based payment expense

(3)

(44)

(82)

(67)

Share-based compensation payment

5

—

91

77

Preferred share dividends paid

(34)

(30)

(132)

(120)

Distributions to non-controlling

interest

—

—

(12)

—

Adjusted cash flow from operating

activities

922

747

3,265

2,646

Adjusted cash flow from operating

activities per common share – basic (dollars)

1.59

1.36

5.70

4.81

Proportionately Consolidated

Debt-to-Adjusted EBITDA

Proportionately Consolidated Debt-to-Adjusted EBITDA is a

non-GAAP ratio that management believes is useful to investors and

other users of Pembina’s financial information in the evaluation of

the Company’s debt levels and creditworthiness.

As at December 31

($ millions, except as noted)

2024

2023

Loans and borrowings (current)

1,525

650

Loans and borrowings (non-current)

10,535

9,253

Loans and borrowings of equity accounted

investees

3,333

2,805

Proportionately consolidated debt

15,393

12,708

Adjusted EBITDA

4,408

3,824

Proportionately consolidated

debt-to-adjusted EBITDA (times)

3.5

3.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227832623/en/

For further information: Investor Relations (403) 231-3156

1-855-880-7404 e-mail: investor-relations@pembina.com

www.pembina.com

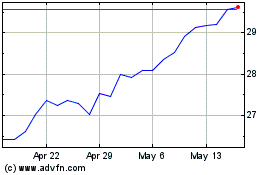

PPL (NYSE:PPL)

Historical Stock Chart

From Feb 2025 to Mar 2025

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Mar 2025