Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

12 September 2024 - 11:11AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed Pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement Dated September 9, 2024

Registration Statement No. 333-282001

PERRIGO FINANCE UNLIMITED COMPANY

$715,000,000 6.125% Senior Notes due 2032 (the “USD Notes”)

€350,000,000 5.375% Senior Notes due 2032 (the “Euro Notes” and together with the USD

Notes, the “Notes”)

Pricing Term Sheet

September 11, 2024

Pricing Term Sheet,

dated September 11, 2024, to Preliminary Prospectus Supplement, dated September 9, 2024 (the “Preliminary Prospectus Supplement”), of Perrigo Finance Unlimited Company. The information in this Pricing Term Sheet supplements the

Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement only to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used in this Pricing

Term Sheet but not defined herein have the meanings given them in the Preliminary Prospectus Supplement.

Terms Applicable to the USD

Notes

|

|

|

| Issuer: |

|

Perrigo Finance Unlimited Company |

|

|

| Guarantors: |

|

Perrigo Company plc (the “Parent”) and those subsidiaries of the Parent that provide guarantees under the Senior Secured Credit Facilities, which consist of certain of the Parent’s direct and indirect wholly-owned

subsidiaries organized in the United States, Ireland, Belgium and England and Wales |

|

|

| Ratings*: |

|

Ba3 by Moody’s Investors Service, Inc. B+

by Standard & Poor’s Ratings Services BB by Fitch Ratings Inc. |

|

|

| Security: |

|

6.125% Senior Notes due 2032 |

|

|

| Principal Amount: |

|

$715,000,000 |

|

|

| Trade Date: |

|

September 11, 2024 |

|

|

| Expected Settlement Date: |

|

September 17, 2024 (T+4**) |

|

|

| Maturity Date: |

|

September 30, 2032 |

|

|

| Interest Payment Dates: |

|

Semi-annually in arrears on March 30 and September 30 of each year, commencing March 30, 2025 |

|

|

|

|

|

| Coupon: |

|

6.125% |

|

|

| Issue Price: |

|

100.000% of the principal amount, plus accrued and unpaid interest, if any, from September 17, 2024 |

|

|

| Yield to Maturity: |

|

6.125% |

|

|

| Gross Proceeds: |

|

$715,000,000 |

|

|

| Net Proceeds to Issuer, Before Expenses: |

|

$707,778,500 |

|

|

| Optional Redemption: |

|

On and after September 30, 2027, the Issuer may redeem the USD Notes in whole at any time, or in part from time to time, at its option, at the redemption prices (expressed as percentages of principal amount of the USD Notes to

be redeemed) set forth below, plus accrued and unpaid interest thereon, if any, to but not including the applicable Redemption Date, if redeemed during the twelve-month period beginning on the September 30 of each of the years indicated

below: |

|

|

|

|

|

|

|

| |

|

Year: |

|

Price: |

|

| |

2027 |

|

|

103.063 |

% |

| |

2028 |

|

|

101.531 |

% |

| |

2029 and thereafter |

|

|

100.000 |

% |

|

|

|

|

|

|

|

At any time prior to September 30, 2027, the Issuer may redeem the USD Notes in whole at any time, or in part from time to time, at its

option, at a redemption price equal to 100% of the principal amount of the USD Notes redeemed plus the Applicable Premium (as defined below) as of, and accrued and unpaid interest, if any, to but not including the Redemption Date.

“Applicable Premium” means, with respect to any USD Notes on any Redemption

Date, the greater of: (1) 1.0% of the principal amount of such note; and (2) the excess, if any, of (a) the present value at such Redemption Date of (i) the redemption price of such note at September 30, 2027 (such redemption

price being set forth in the table appearing above), plus (ii) all required interest payments due on such note through September 30, 2027 (excluding accrued but unpaid interest to the Redemption Date), computed using a discount rate equal

to the Adjusted Treasury Rate as of such Redemption Date plus 50 basis points; over (b) the principal amount of such note. |

|

|

|

|

|

| Optional Redemption with Equity Proceeds: |

|

Prior to September 30, 2027, the Issuer may, at its option, on one or more occasions, redeem up to 40% of the aggregate principal amount of USD Notes at a redemption price equal to 106.125% of the aggregate principal amount

thereof, plus accrued and unpaid interest thereon, if any, to but not including the applicable Redemption Date, with an amount equal to the net cash proceeds of one or more Equity Offerings. |

|

|

| Change of Control Triggering Event: |

|

101% |

|

|

| Minimum Denominations: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

|

|

| CUSIP / ISIN: |

|

71429M AD7 / US71429MAD74 |

|

|

| USD Joint Book-Running Managers: |

|

BofA Securities, Inc. J.P. Morgan Securities

LLC Wells Fargo Securities, LLC Morgan Stanley & Co.

LLC HSBC Securities (USA) Inc. |

|

|

| USD Co-Managers: |

|

ING Financial Markets LLC BNP Paribas

Securities Corp. Goldman Sachs & Co. LLC Mizuho

Securities USA LLC Capital One Securities, Inc. Goodbody

Stockbrokers UC Huntington Securities, Inc. MUFG Securities

Americas Inc. PNC Capital Markets LLC SG Americas Securities,

LLC |

Terms Applicable to the Euro Notes

|

|

|

|

|

| Issuer: |

|

Perrigo Finance Unlimited Company |

|

|

| Guarantors: |

|

The Parent and those subsidiaries of the Parent that provide guarantees under the Senior Secured Credit Facilities, which consist of certain of the Parent’s direct and indirect wholly-owned subsidiaries organized in the United

States, Ireland, Belgium and England and Wales |

|

|

| Ratings*: |

|

Ba3 by Moody’s Investors Service, Inc. B+

by Standard & Poor’s Ratings Services BB by Fitch Ratings Inc. |

|

|

|

|

|

|

|

| Security: |

|

5.375% Senior Notes due 2032 |

|

|

| Principal Amount: |

|

€350,000,000 |

|

|

| Trade Date: |

|

September 11, 2024 |

|

|

| Expected Settlement Date: |

|

September 17, 2024 (T+4**) |

|

|

| Maturity Date: |

|

September 30, 2032 |

|

|

| Interest Payment Dates: |

|

Annual in arrears on March 30 of each year, commencing March 30, 2025 |

|

|

| Coupon: |

|

5.375% |

|

|

| Issue Price: |

|

100.000% of the principal amount, plus accrued and unpaid interest, if any, from September 17, 2024 |

|

|

| Yield to Maturity: |

|

5.375% |

|

|

| Gross Proceeds: |

|

€350,000,000 |

|

|

| Net Proceeds to Issuer, Before Expenses: |

|

€346,412,500 |

|

|

| Optional Redemption: |

|

On and after September 30, 2027, the Issuer may redeem the Euro Notes in whole at any time, or in part from time to time, at its option, at the redemption prices (expressed as percentages of principal amount of the

Euro Notes to be redeemed) set forth below, plus accrued and unpaid interest thereon, if any, to but not including the applicable Redemption Date, if redeemed during the twelve-month period beginning on the September 30 of each of the years

indicated below: |

|

|

|

|

|

|

|

| |

|

Year: |

|

Price: |

|

| |

2027 |

|

|

102.688 |

% |

| |

2028 |

|

|

101.344 |

% |

| |

2029 and thereafter |

|

|

100.000 |

% |

|

|

|

|

|

At any time prior to September 30, 2027, the Issuer may redeem the Euro Notes in whole at any time, or in part from time to time, at its option, at a redemption price equal to 100% of the principal amount of the Euro Notes

redeemed plus the Applicable Premium (as defined below) as of, and accrued and unpaid interest, if any, to but not including the Redemption Date. |

|

|

|

|

|

|

|

“Applicable Premium” means, with respect to any Euro Notes on any Redemption Date, the greater of: (1) 1.0% of the principal amount of such note; and (2) the excess, if any, of (a) the present value at such

Redemption Date of (i) the redemption price of such note at September 30, 2027 (such redemption price being set forth in the table appearing above), plus (ii) all required interest payments due on such note through September 30,

2027 (excluding accrued but unpaid interest to the Redemption Date), computed using a discount rate equal to the Comparable Government Bond Rate as of such Redemption Date plus 50 basis points; over (b) the principal amount of such

note. |

|

|

| Optional Redemption with Equity Proceeds: |

|

Prior to September 30, 2027, the Issuer may, at its option, on one or more occasions, redeem up to 40% of the aggregate principal amount of Euro Notes at a redemption price equal to 105.375% of the aggregate principal amount

thereof, plus accrued and unpaid interest thereon, if any, to but not including the applicable Redemption Date, with an amount equal to the net cash proceeds of one or more Equity Offerings. |

|

|

| Change of Control Triggering Event: |

|

101% |

|

|

| Minimum Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

|

| ISIN / Common Code: |

|

XS2903463987 / 290346398 |

|

|

| Euro Joint Physical Book-Running Managers: |

|

BofA Securities Europe SA HSBC Securities (USA)

Inc. J.P. Morgan Securities plc |

|

|

| Euro Joint Book-Running Managers: |

|

ING Financial Markets LLC Morgan

Stanley & Co. LLC Wells Fargo Securities International Limited |

|

|

| Euro Co-Managers: |

|

BNP Paribas Securities Corp. Goldman

Sachs & Co. LLC Mizuho International plc Capital One

Securities, Inc. Goodbody Stockbrokers UC Huntington

Securities, Inc. MUFG Securities (Europe) N.V. PNC Capital

Markets LLC SG Americas Securities, LLC |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or

withdrawn at any time. |

| ** |

The Issuer expects that delivery of the Notes will be made to investors on or about September 17, 2024,

which will be the fourth business day following the date of this prospectus supplement (such settlement being referred to as “T+4”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary

market are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes offered hereby prior to the date that is one business day preceding the settlement

date will be required, by virtue of the fact that the notes offered hereby initially settle in T+4, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes offered hereby

who wish to trade the notes offered hereby during such period should consult their advisors. |

The Parent, the Issuer and the Subsidiary Guarantors have filed a registration statement (including a

prospectus and a prospectus supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the Parent has

filed with the SEC and incorporated by reference into the registration statement for more complete information about the Parent, the Issuer, the Subsidiary Guarantors and this offering. You may get these documents for free by visiting EDGAR on the

SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement if you request it by calling BofA Securities toll-free

at 1-800-294-1322 or by emailing BofA Securities at dg.prospectus_requests@bofa.com.

This communication does not constitute an offer to sell the notes and is not a solicitation of an offer to buy the notes in any jurisdiction where the

offer or sale is prohibited, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities.

Manufacturer target market (MiFID II product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs

key information document (KID) pursuant to Regulation (EU) 1286/2014 has been prepared as not available to retail in EEA.

Manufacturer target

market (UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No UK PRIIPs key information document (KID) pursuant to Regulation (EU) 1286/2014 as it forms part of UK domestic law by

virtue of the EUWA has been prepared as not available to retail in the UK.

Any disclaimers or other notices that may appear below are not

applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg email or another communication system.

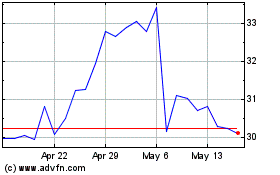

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

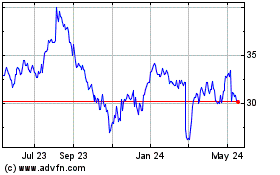

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Nov 2023 to Nov 2024