0001474432false00014744322024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2024

_____________________________________

Pure Storage, Inc.

(Exact name of Registrant as Specified in Its Charter)

_____________________________________ | | | | | | | | | | | | | | | | | |

| Delaware | | 001-37570 | | 27-1069557 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer Identification No.) |

| | | | | |

2555 Augustine Dr. Santa Clara, California 95054 |

| (Address of Principal Executive Offices and Zip Code) |

(800) 379-7873

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| |

| |

| |

___________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | | PSTG | | New York Stock Exchange LLC |

________________________________________

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On December 3, 2024, Pure Storage, Inc. ("Pure") issued a press release and will hold a conference call regarding its financial results for the quarter ended November 3, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

This information, including the exhibit(s) hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Pure is making reference to non-GAAP financial information in the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release. These non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Pure Storage, Inc. |

| (Registrant) |

| | | | | |

Date: | | December 3, 2024 | By: | | /s/ Kevan Krysler |

| | | | | Kevan Krysler |

| | | | | Chief Financial Officer |

Exhibit 99.1

Pure Storage Announces Third Quarter Fiscal 2025 Financial Results

Awarded industry-first design win from a top-four hyperscaler

SANTA CLARA, Calif. — December 3, 2024 — Today Pure Storage (NYSE: PSTG), the IT pioneer that delivers the world’s most advanced data storage technologies and services, announced financial results for its third quarter fiscal year 2025 ended November 3, 2024.

“Pure Storage has achieved another industry first in our journey of data storage innovation with a transformational design win for our DirectFlash technology in a top-four hyperscaler,” said Pure Storage Chairman and CEO Charles Giancarlo. “This win is the vanguard for Pure Flash technology to become the standard for all hyperscaler online storage, providing unparalleled performance and scalability while also reducing operating costs and power consumption.”

Third Quarter Financial Highlights

•Revenue $831.1 million, an increase of 9% year-over-year

•Subscription services revenue $376.4 million, up 22% year-over-year

•Subscription annual recurring revenue (ARR) $1.6 billion, up 22% year-over-year

•Remaining performance obligations (RPO) $2.4 billion, up 16% year-over-year

•GAAP gross margin 70.1%; non-GAAP gross margin 71.9%

•GAAP operating income $59.7 million; non-GAAP operating income $167.3 million

•GAAP operating margin 7.2%; non-GAAP operating margin 20.1%

•Q3 operating cash flow $97.0 million; free cash flow $35.2 million

•Total cash, cash equivalents, and marketable securities $1.6 billion

•Returned approximately $182 million in the third quarter to stockholders through share repurchases of 3.6 million shares

“Our third quarter results exceeded our expectations on revenue and operating income, demonstrating the sustaining strength of our business models,” said Kevan Krysler, Pure Storage CFO. “We remain focused on driving both near-term results and long-term value creation through disciplined investments and innovation that position Pure as the leader in transforming the data storage landscape.”

Third Quarter Company Highlights

•Leading the Hyperscale Opportunity: With its industry-first design win with a top-four hyperscaler, Pure Storage is extending its DirectFlash® technology into massive scale environments today dominated by hard disks. The unmatched capabilities of Pure's DirectFlash® technology deliver new levels of innovation, performance, and scalability to an industry with demanding requirements, enabling hyperscalers to fully modernize their infrastructure, significantly improve operational efficiency, and dramatically free up scarce electrical power.

Pure Storage also deepened its collaboration with Kioxia, a global leader of NAND Flash technology, to develop cutting-edge technology and manufacturing capacity to address the growing need for high-performance, scalable storage infrastructure for tomorrow's hyperscale environments.

•Advancing Enterprise AI: Pure Storage expanded its ability to serve the world’s largest AI training environments with recent certification of FlashBlade//S500 with NVIDIA DGX SuperPOD, which optimizes performance, power, and space efficiency. Pure also entered into a strategic partnership with CoreWeave to better serve AI customers by making Pure Storage available as a standard option within the CoreWeave dedicated cloud environment. With its introduction of the new Pure Storage GenAI Pod, Pure Storage is providing a set of full-stack solutions which reduce the time, cost, and expertise required to deploy generative AI projects.

•Delivering Platform Innovation: With the Pure Storage platform, Pure is driving the biggest shift in enterprise storage since Flash. Pure Storage will be delivering v2.0 of Pure Fusion™ in its fourth quarter, which will enable customers to create their own enterprise data cloud, opening their data storage environment like the hyperscalers operate theirs. During the quarter Pure Storage unveiled solutions enabling seamless VMware migrations to Microsoft Azure, delivering enterprise-scale flexibility. And the new Pure Storage FlashArray™ with AWS Outposts brings together Amazon Web Services and Pure’s enterprise-grade storage on AWS Outposts, giving customers the flexibility to run cloud services on an enterprise-grade storage platform within their own data centers.

Industry Recognition and Accolades

•Leader for Fifth Consecutive Year in the 2024 Gartner® Magic Quadrant™ for Primary Storage Platforms

•Leader for Fourth Consecutive Year in the 2024 Gartner® Magic Quadrant™ for File and Object Storage Platforms

•Forbes Most Trusted Companies in America 2025 (Ranked #144)

•Fortune Best Places to Work in Technology 2024 (Ranked #14)

Fourth Quarter and FY25 Guidance

| | | | | |

Q4FY25 |

| Revenue | $867M |

| Revenue YoY Growth Rate | 9.7% |

| Non-GAAP Operating Income | $135M |

| Non-GAAP Operating Margin | 15.6% |

| | | | | |

| FY25 |

| Revenue | $3.15B |

| Revenue YoY Growth Rate | 11.5% |

| |

| |

| Non-GAAP Operating Income | $540M |

| Non-GAAP Operating Margin | 17% |

These statements are forward-looking and actual results may differ materially. Refer to the Forward Looking Statements section below for information on the factors that could cause our actual results to differ materially from these statements. Pure has not reconciled its guidance for non-GAAP operating income and non-GAAP operating margin to their most directly comparable GAAP measures because certain items that impact these measures are not within Pure’s control and/or cannot be reasonably predicted. Accordingly, reconciliations of these non-GAAP financial measures guidance to the corresponding GAAP measures are not available without unreasonable effort.

Conference Call Information

Pure will host a teleconference to discuss the third quarter fiscal 2025 results at 2:00 pm PT today, December 3, 2024. A live audio broadcast of the conference call will be available on the Pure Storage Investor Relations website. Pure will also post its earnings presentation and prepared remarks to this website concurrent with this release.

A replay will be available following the call on the Pure Storage Investor Relations website or for two weeks at 1-800-770-2030 (or 1-647-362-9199 for international callers) with passcode 5667482.

Additionally, Pure is scheduled to participate at the following investor conferences:

Wells Fargo 8th Annual TMT Summit

Date: Wednesday, December 4, 2024

Time: 1:30 p.m. PT / 4:30 p.m. ET

Chief Technology Officer Rob Lee

27th Annual Needham Growth Conference

Date: Thursday, January 16, 2025

Time: 9:45 a.m. PT / 12:45 p.m. ET

Founder & Chief Visionary Officer John "Coz" Colgrove

Chief Financial Officer Kevan Krysler

The presentations will be webcast live and archived on Pure's Investor Relations website at investor.purestorage.com.

----

About Pure Storage

Pure Storage (NYSE: PSTG) delivers the industry’s most advanced data storage platform to store, manage, and protect the world’s data at any scale. With Pure Storage, organizations have ultimate simplicity and flexibility, saving time, money, and energy. From AI to archive, Pure Storage delivers a cloud experience with one unified Storage as-a-Service platform across on premises, cloud, and hosted environments. Our platform is built on our Evergreen architecture that evolves with your business – always getting newer and better with zero planned downtime, guaranteed. Our customers are actively increasing their capacity and processing power while significantly reducing their carbon and energy footprint. It’s easy to fall in love with Pure Storage, as evidenced by the highest Net Promoter Score in the industry. For more information, visit www.purestorage.com.

Connect with Pure

Blog

LinkedIn

Twitter

Facebook

Pure Storage, the Pure P Logo, Portworx, and the marks on the Pure Storage Trademark List are trademarks or registered trademarks of Pure Storage Inc. in the U.S. and/or other countries. The Trademark List can be found at purestorage.com/trademarks. Other names may be trademarks of their respective owners.

Forward Looking Statements

This press release contains forward-looking statements regarding our products, business and operations, including but not limited to our views relating to our opportunity with hyperscale and AI environments, our ability to meet hyperscalers' performance and price requirements, our ability to meet the needs of hyperscalers for the entire spectrum of their online storage use cases, the timing and magnitude of large orders, including sales to hyperscalers, the timing and amount of revenue from hyperscaler licensing and support services, future period financial and business results, demand for our products and subscription services, including Evergreen//One, the relative sales mix between our subscription and consumption offerings and traditional capital expenditure sales, our technology and product strategy, specifically customer priorities around sustainability, the environmental and energy saving benefits to our customers of using our products, our ability to perform during current macro conditions and expand market share, our sustainability goals and benefits, the impact of inflation, economic or supply chain disruptions, our expectations regarding our product and technology differentiation, new customer acquisition, and other statements regarding our products, business, operations and results. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements.

Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption "Risk Factors" and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, which are available on our Investor Relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information is also set forth in our Annual Report on Form 10-K for the year ended February 4, 2024. All information provided in this release and in the attachments is as of December 3, 2024, and Pure undertakes no duty to update this information unless required by law.

Key Performance Metric

Subscription ARR is a key business metric that refers to total annualized contract value of all active subscription agreements on the last day of the quarter, plus on-demand revenue for the quarter multiplied by four.

Non-GAAP Financial Measures

To supplement our unaudited condensed consolidated financial statements, which are prepared and presented in accordance with GAAP, Pure uses the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, and free cash flow.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain expenses such as stock-based compensation expense, payments to former shareholders of acquired companies, payroll tax expense related to stock-based activities, amortization of debt issuance costs related to debt, and amortization of intangible assets acquired from acquisitions that may not be indicative of our ongoing core business operating results. Pure believes that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when analyzing historical performance and liquidity and planning, forecasting, and analyzing future periods. The presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

For a reconciliation of these non-GAAP financial measures to GAAP measures, please see the tables captioned "Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures" and "Reconciliation from net cash provided by operating activities to free cash flow," included at the end of this release.

Contacts

Paul Ziots -- Investor Relations, Pure Storage

ir@purestorage.com

Penny Bruce -- Global Communications, Pure Storage

pr@purestorage.com

###

PURE STORAGE, INC.

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

| | | | | | | | | | | | | | |

| | At the End of |

| | Third Quarter of Fiscal 2025 | | Fiscal 2024 |

| | | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 894,569 | | | $ | 702,536 | |

| Marketable securities | | 753,960 | | | 828,557 | |

Accounts receivable, net of allowance of $956 and $1,060 | | 578,224 | | | 662,179 | |

| Inventory | | 41,571 | | | 42,663 | |

| Deferred commissions, current | | 86,839 | | | 88,712 | |

| Prepaid expenses and other current assets | | 204,485 | | | 173,407 | |

| Total current assets | | 2,559,648 | | | 2,498,054 | |

| Property and equipment, net | | 431,353 | | | 352,604 | |

| Operating lease right-of-use-assets | | 157,574 | | | 129,942 | |

| Deferred commissions, non-current | | 210,671 | | | 215,620 | |

| Intangible assets, net | | 23,039 | | | 33,012 | |

| Goodwill | | 361,427 | | | 361,427 | |

| Restricted cash | | 11,249 | | | 9,595 | |

| Other assets, non-current | | 99,504 | | | 55,506 | |

| Total assets | | $ | 3,854,465 | | | $ | 3,655,760 | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 102,021 | | | $ | 82,757 | |

| Accrued compensation and benefits | | 155,652 | | | 250,257 | |

| Accrued expenses and other liabilities | | 141,846 | | | 135,755 | |

| Operating lease liabilities, current | | 47,941 | | | 44,668 | |

| Deferred revenue, current | | 897,174 | | | 852,247 | |

| Debt, current | | 100,000 | | | — | |

| Total current liabilities | | 1,444,634 | | | 1,365,684 | |

| Long-term debt | | — | | | 100,000 | |

| Operating lease liabilities, non-current | | 146,390 | | | 123,201 | |

| Deferred revenue, non-current | | 784,282 | | | 742,275 | |

| Other liabilities, non-current | | 68,573 | | | 54,506 | |

| Total liabilities | | 2,443,879 | | | 2,385,666 | |

| Stockholders’ equity: | | | | |

| Common stock and additional paid-in capital | | 2,821,010 | | | 2,749,627 | |

| Accumulated other comprehensive income (loss) | | 1,023 | | | (3,782) | |

| Accumulated deficit | | (1,411,447) | | | (1,475,751) | |

| Total stockholders' equity | | 1,410,586 | | | 1,270,094 | |

| Total liabilities and stockholders' equity | | $ | 3,854,465 | | | $ | 3,655,760 | |

PURE STORAGE, INC.

Condensed Consolidated Statements of Operations

(in thousands, except per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter of Fiscal | | First Three Quarters of Fiscal |

| | 2025 | | 2024 | | 2025 | | 2024 |

| | | | | | | | |

| Revenue: | | | | | | | |

| Product | $ | 454,735 | | | $ | 453,277 | | | $ | 1,204,714 | | | $ | 1,161,978 | |

| Subscription services | 376,337 | | | 309,561 | | | 1,083,608 | | | 878,838 | |

| Total revenue | 831,072 | | | 762,838 | | | 2,288,322 | | | 2,040,816 | |

| | | | | | | |

| Cost of revenue: | | | | | | | |

Product (1) | 154,970 | | | 126,770 | | | 385,446 | | | 343,588 | |

Subscription services (1) | 93,180 | | | 83,321 | | | 284,168 | | | 244,541 | |

| Total cost of revenue | 248,150 | | | 210,091 | | | 669,614 | | | 588,129 | |

| Gross profit | 582,922 | | | 552,747 | | | 1,618,708 | | | 1,452,687 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

Research and development (1) | 200,086 | | | 182,100 | | | 589,396 | | | 549,923 | |

Sales and marketing (1) | 255,830 | | | 231,707 | | | 757,069 | | | 696,885 | |

General and administrative (1) | 67,319 | | | 64,729 | | | 213,551 | | | 192,944 | |

Restructuring and impairment (2) | — | | | — | | | 15,901 | | | 16,766 | |

| Total operating expenses | 523,235 | | | 478,536 | | | 1,575,917 | | | 1,456,518 | |

| | | | | | | |

| Income (loss) from operations | 59,687 | | | 74,211 | | | 42,791 | | | (3,831) | |

| Other income (expense), net | 17,156 | | | 5,184 | | | 50,684 | | | 23,619 | |

Income before provision for income taxes | 76,843 | | | 79,395 | | | 93,475 | | | 19,788 | |

| Income tax provision | 13,204 | | | 9,006 | | | 29,171 | | | 23,915 | |

| Net income (loss) | $ | 63,639 | | | $ | 70,389 | | | $ | 64,304 | | | $ | (4,127) | |

| | | | | | | |

| Net income (loss) per share attributable to common stockholders, basic | $ | 0.19 | | | $ | 0.22 | | | $ | 0.20 | | | $ | (0.01) | |

| Net income (loss) per share attributable to common stockholders, diluted | $ | 0.19 | | | $ | 0.21 | | | $ | 0.19 | | | $ | (0.01) | |

| | | | | | | |

| Weighted-average shares used in computing net income (loss) per share attributable to common stockholders, basic | 327,675 | | | 314,153 | | | 325,530 | | | 309,842 | |

| Weighted-average shares used in computing net income (loss) per share attributable to common stockholders, diluted | 340,564 | | | 330,255 | | | 341,490 | | | 309,842 | |

(1) Includes stock-based compensation expense as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Cost of revenue -- product | $ | 3,216 | | | $ | 1,443 | | | $ | 9,443 | | | $ | 7,056 | |

| Cost of revenue -- subscription services | 7,800 | | | 6,849 | | | 24,632 | | | 19,347 | |

| Research and development | 49,227 | | | 43,908 | | | 150,390 | | | 126,225 | |

| Sales and marketing | 24,393 | | | 19,209 | | | 72,330 | | | 55,883 | |

| General and administrative | 16,436 | | | 16,557 | | | 62,161 | | | 46,732 | |

| Total stock-based compensation expense | $ | 101,072 | | | $ | 87,966 | | | $ | 318,956 | | | $ | 255,243 | |

| | | | | | | |

(2) Includes expenses for severance and termination benefits related to workforce realignment and lease impairment and abandonment charges associated with cease-use of our former corporate headquarters.

PURE STORAGE, INC.

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter of Fiscal | | First Three Quarters of Fiscal |

| | 2025 | | 2024 | | 2025 | | 2024 |

| | | | | | | | |

| Cash flows from operating activities | | | | | | | |

| Net income (loss) | $ | 63,639 | | | $ | 70,389 | | | $ | 64,304 | | | $ | (4,127) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 29,272 | | | 31,647 | | | 99,099 | | | 91,560 | |

| | | | | | | |

| Stock-based compensation expense | 101,072 | | | 87,966 | | | 318,956 | | | 255,243 | |

| Noncash portion of lease impairment and abandonment | — | | | — | | | 3,270 | | | 16,766 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | 2,381 | | | (2,815) | | | 5,107 | | | (5,844) | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable, net | (161,723) | | | (111,190) | | | 83,998 | | | (23,959) | |

| Inventory | 5,071 | | | 818 | | | (1,590) | | | 5,278 | |

| Deferred commissions | 669 | | | (9,501) | | | 6,822 | | | (19,061) | |

| Prepaid expenses and other assets | (40,008) | | | 20,044 | | | (67,014) | | | 19,686 | |

| Operating lease right-of-use assets | 9,383 | | | 7,634 | | | 25,911 | | | 27,269 | |

| Accounts payable | 33,755 | | | 7,533 | | | 20,597 | | | 33,844 | |

| Accrued compensation and other liabilities | 7,781 | | | 4,767 | | | (70,951) | | | (52,757) | |

| Operating lease liabilities | (12,096) | | | (8,324) | | | (30,353) | | | (21,457) | |

| Deferred revenue | 57,797 | | | 59,464 | | | 86,934 | | | 110,856 | |

| Net cash provided by operating activities | 96,993 | | | 158,432 | | | 545,090 | | | 433,297 | |

| | | | | | | |

| Cash flows from investing activities | | | | | | | |

Purchases of property and equipment (1) | (61,788) | | | (45,062) | | | (170,641) | | | (151,591) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Purchases of marketable securities and other | (43,632) | | | (105,108) | | | (314,083) | | | (351,725) | |

| Sales of marketable securities | 12,817 | | | 3,747 | | | 61,241 | | | 52,495 | |

| Maturities of marketable securities | 131,994 | | | 109,196 | | | 329,978 | | | 495,899 | |

| | | | | | | |

| Net cash provided by (used in) investing activities | 39,391 | | | (37,227) | | | (93,505) | | | 45,078 | |

| | | | | | | |

| Cash flows from financing activities | | | | | | | |

Proceeds from exercise of stock options | 3,426 | | | 3,056 | | | 21,194 | | | 32,904 | |

| Proceeds from issuance of common stock under employee stock purchase plan | 26,408 | | | 23,870 | | | 51,736 | | | 45,089 | |

| | | | | | | |

Proceeds from borrowings | — | | | 6,890 | | | — | | | 106,890 | |

| Principal payments on borrowings and finance lease obligations | (1,786) | | | (7,515) | | | (5,721) | | | (584,582) | |

| Tax withholding on vesting of equity awards | (54,905) | | | (4,755) | | | (141,591) | | | (16,582) | |

| Repurchases of common stock | (181,999) | | | (22,460) | | | (181,999) | | | (114,341) | |

| Net cash used in financing activities | (208,856) | | | (914) | | | (256,381) | | | (530,622) | |

| | | | | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (72,472) | | | 120,291 | | | 195,204 | | | (52,247) | |

| Cash, cash equivalents and restricted cash, beginning of period | 979,807 | | | 418,860 | | | 712,131 | | | 591,398 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 907,335 | | | $ | 539,151 | | | $ | 907,335 | | | $ | 539,151 | |

(1) Includes capitalized internal-use software costs of $6.0 million and $5.1 million for the third quarter of fiscal 2025 and 2024 and $15.8 million and $15.7 million for the first three quarters of fiscal 2025 and 2024.

Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures

The following table presents non-GAAP gross margins by revenue source before certain items (in thousands except percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter of Fiscal 2025 | | Third Quarter of Fiscal 2024 |

| | | GAAP

results | | GAAP

gross

margin (a) | | Adjustment | | | | Non-

GAAP

results | | Non-

GAAP

gross

margin (b) | | GAAP

results | | GAAP

gross

margin (a) | | Adjustment | | | | Non-

GAAP

results | | Non-

GAAP

gross

margin (b) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | $ | 3,216 | | | (c) | | | | | | | | | | $ | 1,443 | | | (c) | | | | |

| | | | | | 103 | | | (d) | | | | | | | | | | 75 | | | (d) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 3,306 | | | (e) | | | | | | | | | | 3,306 | | | (e) | | | | |

| Gross profit --product | | $ | 299,765 | | | 65.9 | % | | $ | 6,625 | | | | | $ | 306,390 | | | 67.4 | % | | $ | 326,507 | | | 72.0 | % | | $ | 4,824 | | | | | $ | 331,331 | | | 73.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 7,800 | | | (c) | | | | | | | | | | $ | 6,849 | | | (c) | | | | |

| | | | | | 368 | | | (d) | | | | | | | | | | 329 | | | (d) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit -- subscription services | | $ | 283,157 | | | 75.2 | % | | $ | 8,168 | | | | | $ | 291,325 | | | 77.4 | % | | $ | 226,240 | | | 73.1 | % | | $ | 7,178 | | | | | $ | 233,418 | | | 75.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 11,016 | | | (c) | | | | | | | | | | $ | 8,292 | | | (c) | | | | |

| | | | | | 471 | | | (d) | | | | | | | | | | 404 | | | (d) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 3,306 | | | (e) | | | | | | | | | | 3,306 | | | (e) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total gross profit | | $ | 582,922 | | | 70.1 | % | | $ | 14,793 | | | | | $ | 597,715 | | | 71.9 | % | | $ | 552,747 | | | 72.5 | % | | $ | 12,002 | | | | | $ | 564,749 | | | 74.0 | % |

(a) GAAP gross margin is defined as GAAP gross profit divided by revenue.

(b) Non-GAAP gross margin is defined as non-GAAP gross profit divided by revenue.

(c) To eliminate stock-based compensation expense.

(d) To eliminate payroll tax expense related to stock-based activities.

(e) To eliminate amortization expense of acquired intangible assets.

The following table presents certain non-GAAP consolidated results before certain items (in thousands, except per share amounts and percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter of Fiscal 2025 | | Third Quarter of Fiscal 2024 |

| | GAAP

results | | GAAP

operating

margin (a) | | Adjustment | | | | Non-

GAAP

results | | Non-

GAAP

operating

margin (b) | | GAAP

results | | GAAP

operating

margin (a) | | Adjustment | | | Non-

GAAP

results | | Non-

GAAP

operating

margin (b) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | $ | 101,072 | | | (c) | | | | | | | | | | $ | 87,966 | | | (c) | | | | |

| | | | | — | | | | | | | | | | | | | 580 | | | (d) | | | | |

| | | | | 2,991 | | | (e) | | | | | | | | | | 2,604 | | | (e) | | | | |

| | | | | 3,536 | | | (f) | | | | | | | | | | 3,718 | | | (f) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Operating income | $ | 59,687 | | | 7.2 | % | | $ | 107,599 | | | | | $ | 167,286 | | | 20.1 | % | | $ | 74,211 | | | 9.7 | % | | $ | 94,868 | | | | $ | 169,079 | | | 22.2 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | $ | 101,072 | | | (c) | | | | | | | | | | $ | 87,966 | | | (c) | | | | |

| | | | | — | | | | | | | | | | | | | 580 | | | (d) | | | | |

| | | | | | 2,991 | | | (e) | | | | | | | | | | 2,604 | | | (e) | | | | |

| | | | | 3,536 | | | (f) | | | | | | | | | | 3,718 | | | (f) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 154 | | | (g) | | | | | | | | | | 153 | | | (g) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net income | $ | 63,639 | | | | | $ | 107,753 | | | | | $ | 171,392 | | | | | $ | 70,389 | | | | | $ | 95,021 | | | | $ | 165,410 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net income per share -- diluted | $ | 0.19 | | | | | | | | | $ | 0.50 | | | | | $ | 0.21 | | | | | | | | $ | 0.50 | | | | |

Weighted-average shares used in per share calculation -- diluted | 340,564 | | | | | — | | | | | 340,564 | | | | | 330,255 | | | | | — | | | | 330,255 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(a) GAAP operating margin is defined as GAAP operating income divided by revenue.

(b) Non-GAAP operating margin is defined as non-GAAP operating income divided by revenue.

(c) To eliminate stock-based compensation expense.

(d) To eliminate payments to former shareholders of acquired company.

(e) To eliminate payroll tax expense related to stock-based activities.

(f) To eliminate amortization expense of acquired intangible assets.

(g) To eliminate amortization expense of debt issuance costs related to our debt.

Reconciliation from net cash provided by operating activities to free cash flow (in thousands except percentages, unaudited):

| | | | | | | | | | | | | | | | | |

| | Third Quarter of Fiscal | | | | |

| | 2025 | | 2024 | | | | | | |

| Net cash provided by operating activities | $ | 96,993 | | | $ | 158,432 | | | | | | | |

Less: purchases of property and equipment (1) | (61,788) | | | (45,062) | | | | | | | |

| Free cash flow (non-GAAP) | $ | 35,205 | | | $ | 113,370 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) Includes capitalized internal-use software costs of $6.0 million and $5.1 million for the third quarter of fiscal 2025 and 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

pstg_CoverPageAbstract |

| Namespace Prefix: |

pstg_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

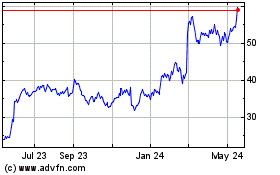

Pure Storage (NYSE:PSTG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pure Storage (NYSE:PSTG)

Historical Stock Chart

From Feb 2024 to Feb 2025