- Q4 2024: Net sales of $521 million (+2% actual rates, +4%

constant exchange rates (CER) core growth); diluted EPS of $0.39

and adjusted diluted EPS of $0.61

- Net sales of $525 million CER ahead of outlook for at least

$520 million CER and adjusted diluted EPS of $0.61 CER ahead of

outlook for at least $0.60 CER

- QIAstat-Dx, QuantiFERON and QIAcuity digital PCR continue

double-digit growth pace

- 30.6% adj. operating income margin up 2.6 percentage points

vs. 28.0% in Q4 2023

- FY 2024: Exceeded outlook for sales and adj. EPS; adj.

operating income margin improves 1.8 percentage points to 28.7%

- Free cash flow rises 63% to $506 million

- 2025 outlook for about 4% CER sales growth (about +5% CER

core sales growth) and adj. diluted EPS of at least $2.28 CER;

targeting adj. operating income margin improvement of at least 150

basis points

QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today

announced financial results for the fourth quarter and full-year

2024.

Net sales for Q4 2024 increased 2% to $521 million compared to

Q4 2023, while sales at constant exchange rates (CER) of $525

million rose 3% and were above the outlook for at least $520

million CER and core sales (excluding discontinued products such as

NeuMoDx and Dialunox) rose 4% CER. The adjusted operating income

margin improved by 2.6 percentage points to 30.6%, driven by

efficiency gains and benefits from the NeuMoDx decision, enabling

reinvestments into targeted growth initiatives. Adjusted diluted

earnings per share (EPS) were $0.61, and CER results of $0.61 were

above the outlook for at least $0.60 CER.

QIAGEN expects the solid growth pace in H2 2024 to continue in

2025. Net sales are expected to rise about 4% CER (and core sales

growth of about 5% CER). Adjusted diluted EPS is expected to be at

least $2.28 CER, driven by a goal to improve the adjusted operating

income margin by at least 150 basis points to above 30% while

absorbing lower non-operating income contributions than in

2024.

“Our teams at QIAGEN concluded 2024 with a solid performance in

the fourth quarter, exceeding our outlook for net sales and

profitability. These results underscore the resilience of our

portfolio, with over 85% of sales coming from highly recurring

revenues, and our focus on delivering solid profitable growth in an

ongoing challenging environment,” said Thierry Bernard, CEO of

QIAGEN.

“Our solid sales growth in the second half of 2024 mirrors our

plans for further strong growth in 2025 as we reconfirm our 2028

targets. QIAstat-Dx exceeded expectations with four FDA clearances

for our syndromic testing system in 2024 and one already in 2025,

coupled with over 660 placements in 2024 that was ahead of our

target. QuantiFERON delivered 11% CER growth for 2024, with

significant opportunities for further expansion since only 40% of

the global latent TB testing market has so far been converted from

the outdated skin test. QIAcuity also delivered solid growth

despite challenging instrument purchase trends as we expanded

digital PCR into clinical use in 2024 while expanding our presence

with academia, pharma and other customers.”

“We are pleased with our 2024 results that featured strong free

cash flow combined with solid sales growth and a significant

increase in the outlook for adjusted EPS during the year thanks to

operational profitability improvements. Our confidence in QIAGEN's

future is reflected in the return of about $300 million to

shareholders in January through a synthetic share repurchase. We

remain well-positioned to execute on our 2028 commitments for solid

profitable growth, supported by our differentiated portfolio and

disciplined capital allocation that seeks to strengthen our

business while increasing returns to shareholders,” said Roland

Sackers, CFO of QIAGEN.

Please find a PDF of the full press release incl. tables

here.

Investor presentation and conference call

A conference call is scheduled for Thursday, February 6,

2025, at 16:00 Frankfurt Time / 15:00 London Time / 10:00 New York

Time. A live audio webcast will be accessible in the investor

relations section of the QIAGEN website (www.qiagen.com), with a

recording available after the event. The presentation will be

published ahead of the call in this section: QIAGEN Investor

Relations - Events and Presentations.

Use of adjusted results

QIAGEN reports adjusted results, as well as results on a

constant exchange rate (CER) basis, along with other non-U.S. GAAP

(generally accepted accounting principles) measures, to provide

deeper insights into its performance. These include metrics such as

core sales (excluding discontinued products), adjusted gross

margin, adjusted gross profit, adjusted operating income, adjusted

operating expenses, adjusted operating income margin, adjusted net

income, adjusted net income before taxes, adjusted diluted EPS,

adjusted EBITDA, adjusted EPS, adjusted income taxes, adjusted tax

rate, and free cash flow. Free cash flow is calculated by

subtracting capital expenditures for property, plant and equipment

from cash flow from operating activities. Adjusted results are

non-GAAP financial measures that QIAGEN considers complementary to

GAAP-reported results but not as substitutes. These measures

exclude items that QIAGEN believes are outside of ongoing core

operations, fluctuate significantly between periods, or hinder the

comparability of results with competitors and prior periods. QIAGEN

also uses non-GAAP and constant currency financial measures

internally in planning, forecasting and reporting, and also for

employee compensation. Additionally, adjusted results are used to

compare current performance with historical results, which have

consistently been presented on an adjusted basis.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding company, is the leading

global provider of Sample to Insight solutions, enabling customers

to extract and gain valuable molecular insights from samples

containing the building blocks of life. Our Sample technologies

isolate and process DNA, RNA and proteins from blood, tissue and

other materials. Assay technologies prepare these biomolecules for

analysis while bioinformatics software and knowledge bases can be

used to interpret data to find actionable insights. Automation

solutions bring these processes together into seamless and

cost-effective workflows. QIAGEN serves over 500,000 customers

globally in Life Sciences (academia, pharma R&D and industrial

applications, primarily forensics) and Molecular Diagnostics for

clinical healthcare. As of December 31, 2024, QIAGEN employed more

than 5,700 people in over 35 locations worldwide. For more

information, visit www.qiagen.com.

Forward-Looking Statement

Certain statements in this press release may constitute

forward-looking statements within the meaning of Section 27A of the

U.S. Securities Act of 1933, as amended, and Section 21E of the

U.S. Securities Exchange Act of 1934, as amended. These statements,

including those regarding QIAGEN's products, development timelines,

marketing and / or regulatory approvals, financial and operational

outlook, growth strategies, collaborations and operating results -

such as expected adjusted net sales and adjusted diluted earnings -

are based on current expectations and assumptions. However, they

involve uncertainties and risks. These risks include, but are not

limited to, challenges in managing growth and international

operations (including the effects of currency fluctuations,

regulatory processes and logistical dependencies), variability in

operating results and allocations between customer classes,

commercial development for our products to customers in the Life

Sciences and clinical healthcare, changes in relationships with

customers, suppliers or strategic partners; competition and rapid

technological advancements; fluctuating demand for QIAGEN's

products due to factors such as economic conditions, customer

budgets and funding cycles; obtaining and maintaining regulatory

approvals for our products; difficulties in successfully adapting

QIAGEN's products into integrated solutions and producing these

products; and protecting product differentiation from competitors.

Additional uncertainties may arise from market acceptance of new

products, integration of acquisitions, governmental actions, global

or regional economic developments, natural disasters, political or

public health crises, and other "force majeure" events. There is

also no guarantee that anticipated benefits from acquisitions will

materialize as expected. For a comprehensive overview of risks,

please refer to the “Risk Factors” contained in our most recent

Annual Report on Form 20-F and other reports filed with or

furnished to the U.S. Securities and Exchange Commission.

Source: QIAGEN N.V. Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205648400/en/

Investor Relations John Gilardi +49 152 018 11711

Domenica Martorana +49 152 018 11244 e-mail: ir@QIAGEN.com

Public Relations Thomas Theuringer +49 2103 29 11826 Lisa

Specht +49 2013 29 14181 e-mail: pr@QIAGEN.com

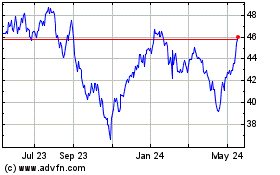

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

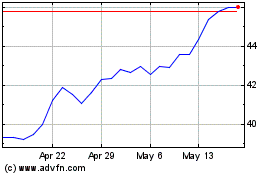

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Mar 2024 to Mar 2025