Radian Comments on Updates to PMIERs

22 August 2024 - 8:52AM

Business Wire

- Implementation of PMIERs Updates is not

expected to materially impact Radian Guaranty’s capital position or

PMIERs cushion

Radian Guaranty Inc., the principal mortgage insurance

subsidiary of Radian Group Inc. (NYSE: RDN), announced that updates

to the Private Mortgage Insurer Eligibility Requirements (PMIERs)

that were issued today by Fannie Mae and Freddie Mac (PMIERs

Updates), are not expected to have a material impact on Radian

Guaranty’s capital position or PMIERs cushion. In addition, given

the limited expected impact, the Company does not believe the

PMIERs Updates will require Radian Guaranty to adjust its

investment portfolio asset allocation. Instead, the Company expects

that any future changes to Radian Guaranty’s investment portfolio

will continue to be made in the ordinary course in pursuit of the

Company’s investment return objectives.

The PMIERs Updates refine the standards for Available Assets

under the PMIERs, which include the most liquid assets of a

mortgage insurer available to pay claims. While the PMIERs do not

prohibit a mortgage insurer from holding any type of assets, the

new updates further limit the Available Asset credit that mortgage

insurers receive under the PMIERs for certain asset types based on

several factors, including, among others, asset class and credit

rating. Under the PMIERs Updates, the impact of reductions in

Available Asset credit resulting from the changes is being

phased-in over a two-year period, with 25% of the calculated

adjustment to be implemented as of March 31, 2025, 50% as of

September 30, 2025, 75% as of March 31, 2026, and 100% as of

September 30, 2026.

At June 30, 2024, Radian Guaranty’s Available Assets under the

PMIERs totaled approximately $6.0 billion, resulting in PMIERs

excess Available Assets over Minimum Required Assets (or a

“cushion”) of $2.2 billion. Based on Radian Guaranty's investment

portfolio as of June 30, 2024, and without giving consideration to

any potential changes in the portfolio other than the normal

amortization of investments, the Company expects the PMIERs Updates

to reduce Radian Guaranty’s PMIERs Available Assets by less than

0.3%, or approximately $20 million, as of March 31, 2025, the

initial implementation date when 25% of the total impact of the

updates is required to be implemented.

As part of the PMIERs Updates, the GSEs also updated the

treatment (or haircut) of Minimum Required Assets under the PMIERs

for loans subject to COVID-19 forbearance plans now that the

COVID-19 national emergency has ended. Effective March 31, 2025,

loans that remain subject to a COVID-19 forbearance plan will no

longer qualify for the COVID-19 haircut to the Minimum Required

Assets and will instead revert to the standard non-performing loan

requirements of PMIERs. As of the March 31, 2025, effective date,

the Company expects the elimination of the haircut related to

COVID-19 forbearance plans to increase Radian Guaranty’s Minimum

Required Assets by less than $10 million.

“PMIERs has been a valuable capital framework for our industry,

promoting the consistent, transparent, and reliable financial

strength of private mortgage insurers through various credit

cycles,” said Chief Executive Officer, Rick Thornberry. “We are

pleased that our relationship with the GSEs and the FHFA helps us

to increase access to mortgage credit and support our customers in

providing affordable, sustainable homeownership opportunities.”

More information on the updated PMIERs guidance may be found on

the FHFA’s website.

About PMIERs

Private mortgage insurers such as Radian Guaranty must meet the

GSEs’ eligibility requirements, or PMIERs, in order to be eligible

to insure loans purchased by the GSEs. The PMIERs were first issued

by the GSEs under oversight of the FHFA and became effective on

December 31, 2015. The PMIERs financial requirements incorporate a

risk-based framework that requires a mortgage insurer’s Available

Assets to meet or exceed its Minimum Required Assets. The PMIERs

financial requirements include increased financial requirements for

defaulted loans, with increasing Minimum Required Assets as

defaults age, as well as for performing loans that present a higher

likelihood of default and/or certain credit characteristics.

About Radian

Radian is ensuring the American dream of homeownership

responsibly and sustainably through products and services that

include industry-leading mortgage insurance and a comprehensive

suite of mortgage, risk, real estate, securitization, and title

services. Powered by technology, informed by data and driven to

deliver new and better ways to transact and manage risk, Radian is

shaping the future of mortgage and real estate services. Learn more

at radian.com.

Forward-Looking Statements

- All statements in this press release that address events,

developments or results that we expect or anticipate may occur in

the future are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the U.S. Private Securities

Litigation Reform Act of 1995. In most cases, forward-looking

statements may be identified by words such as “anticipate,” “may,”

“will,” “could,” “should,” “would,” “expect,” “intend,” “plan,”

“goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “seek,” “strategy,” “future,” “likely” or

the negative or other variations on these words and other similar

expressions. These statements, which may include, without

limitation, projections regarding our future performance and

financial condition, are made on the basis of management’s current

views and assumptions with respect to future events. These

statements speak only as of the date they were made, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. We operate in a changing environment where new risks

emerge from time to time and it is not possible for us to predict

all risks that may affect us. The forward-looking statements in

this press release are not guarantees of future performance, and

the forward-looking statements, as well as our prospects as a

whole, are subject to risks and uncertainties that could cause

actual results to differ materially from those set forth in the

forward-looking statements. These risks and uncertainties include,

without limitation:

- the health of the U.S. housing market generally and changes in

economic conditions that impact the size of the insurable mortgage

market, the credit performance of our insured mortgage portfolio

and our business prospects, including changes resulting from

inflationary pressures, the higher interest rate environment and

the risk of higher unemployment rates, as well as other

macroeconomic stresses and uncertainties, including potential

impacts resulting from political and geopolitical events;

- our ability to maintain an adequate level of capital in our

insurance subsidiaries to satisfy current and future regulatory

requirements;

- any further changes in the charters or business practices of,

or rules or regulations imposed by or applicable to, the GSEs or

loans purchased by the GSEs, or changes in the requirements for

Radian Guaranty to remain an approved insurer to the GSEs, such as

changes in the PMIERs or the GSEs’ interpretation and application

of the PMIERs or other applicable requirements;

- U.S. political conditions, which may be more volatile and

present a heightened risk in Presidential election years, and

legislative and regulatory activity (or inactivity), including

adoption of (or failure to adopt) new laws and regulations, or

changes in existing laws and regulations, or the way they are

interpreted or applied; and

- the possibility that we may fail to estimate accurately,

especially in the event of an extended economic downturn or a

period of extreme market volatility and economic uncertainty, the

likelihood, magnitude and timing of losses in establishing loss

reserves for our mortgage insurance business or to accurately

calculate and/or project our Available Assets and Minimum Required

Assets under the PMIERs, which could be impacted by, among other

things, the type of investments we hold and their credit ratings,

the size and mix of our IIF, the level of defaults in our

portfolio, the reported status of defaults in our portfolio

(including whether they are subject to mortgage forbearance, a

repayment plan or a loan modification trial period), the level of

cash flow generated by our insurance operations and our risk

distribution strategies.

For more information regarding these risks and uncertainties as

well as certain additional risks that we face, you should refer to

“Item 1A. Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023, and to subsequent reports and

registration statements filed from time to time with the U.S.

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821281699/en/

For Investors: Dan Kobell - Phone: 215.231.1113 email:

daniel.kobell@radian.com

For the Media: Rashi Iyer - Phone 215.231.1167 email:

rashi.iyer@radian.com

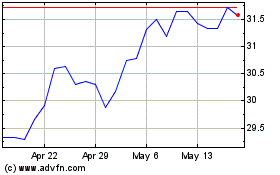

Radian (NYSE:RDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

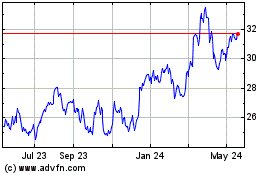

Radian (NYSE:RDN)

Historical Stock Chart

From Nov 2023 to Nov 2024