false

0000095029

0000095029

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 1, 2023

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation) |

001-10435

(Commission File Number) |

06-0633559

(IRS Employer Identification Number) |

| One Lacey Place, Southport, Connecticut |

06890 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(203) 259-7843

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

RGR |

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition |

On November 1, 2023, the Company issued a press release

to stockholders and other interested parties regarding financial results for the third quarter ended September 30, 2023. A copy of the

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Current Report on Form 8-K

and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

(the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

STURM, RUGER & COMPANY, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ THOMAS A. DINEEN |

| |

|

Name: |

Thomas A. Dineen |

| |

|

Title: |

Principal Financial Officer, |

| |

|

|

Principal Accounting Officer, |

| |

|

|

Senior Vice President, Treasurer and |

| |

|

|

Chief Financial Officer |

Dated: November 1, 2023

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

STURM, RUGER & COMPANY, INC. REPORTS THIRD

QUARTER

DILUTED EARNINGS OF 42¢ PER SHARE AND

DECLARES QUARTERLY DIVIDEND OF 17¢ PER SHARE

SOUTHPORT, CONNECTICUT,

November 1, 2023--Sturm, Ruger & Company, Inc. (NYSE-RGR) announced today that for the third quarter of 2023, net sales were $120.9

million and diluted earnings were 42¢ per share. For the corresponding period in 2022, net sales were $139.4 million and diluted

earnings were $1.03 per share.

For the nine months

ended September 30, 2023, net sales were $413.2 million and diluted earnings were $2.13 per share. For the corresponding period in 2022,

net sales were $446.6 million and diluted earnings were $3.90 per share.

The Company also announced

today that its Board of Directors declared a dividend of 17¢ per share for the third quarter for stockholders of record as of November

15, 2023, payable on November 29, 2023. This dividend varies every quarter because the Company pays a percentage of earnings rather than

a fixed amount per share. This dividend is approximately 40% of net income.

Chief Executive Officer

Christopher J. Killoy commented on the third quarter of 2023, “Our third quarter sales and profitability decreased from last year,

as overall firearms demand declined, creating a challenging, promotion-rich marketplace. We remained focused on the long-term, offering

only modest promotions and adjusting the production rates on various product lines to better match demand, which reduced our overall production.

While our decreased production hindered current period profitability, it resulted in only a nominal increase in our inventories and essentially

flat distributor inventories during this seasonally slow quarter. Our debt-free balance sheet and diverse product offerings have us well

positioned to capitalize when the firearms market rebounds.”

Mr. Killoy continued,

“Our strategy remains unchanged as we stay focused on long-term shareholder value. To that end, new product development continues

to be our priority. Earlier this week, we introduced the Ruger-made Marlin Dark Series lever-action rifles that will appeal to a broad

variety of firearms enthusiasts interested in a more modern look and features to enhance the rifles’ classic design. In addition

to our traditional new product introductions in 2023, including the Marlin 336 and 1894 Classic lever-action rifles and the Super Wrangler

revolver, we continue to offer a variety of limited run distributor exclusive models across many of our product lines. We are also capitalizing

on the opportunity to offer new Ruger pistols in California for the first time in 10 years, brought about by some recent changes in the

pistol requirements. To date, four Ruger pistols were added to the California roster of certified handguns, including a Mark IV pistol,

SR22 pistol, LCP pistol, and MAX-9 pistol. We look forward to introducing exciting new firearms in both the Ruger and Marlin brands and

offering additional pistols to the California market in the coming months.”

Mr. Killoy concluded

with an update from last week’s National Association of Sporting Goods Wholesalers Annual Exposition, “We were thrilled to

be recognized by our wholesale customers with three industry awards at this year’s NASGW Show in Columbus, Ohio. We were named “Firearms

Manufacturer of the Year”, and awarded “Best New Rifle” and “Best New Overall Product” for the Marlin Model

336. This was a great testament to our 1,800 loyal and hard-working associates.”

Mr. Killoy made the

following observations related to the Company’s third quarter 2023 performance:

| · | The estimated unit sell-through of the Company’s

products from independent distributors to retailers decreased 8% in the first nine months of 2023 compared to the prior year period. For

the same period, NICS background checks, as adjusted by the National Shooting Sports Foundation, decreased 7%. |

| · | Sales of new products, including the MAX-9 pistol, LCP MAX pistol, Marlin lever-action rifles, LC Carbine,

Small-Frame Autoloading Rifle, Super Wrangler revolver, and the Security-380 pistol, represented $90.5 million or 22.7% of firearm sales

in the first nine months of 2023. New product sales include only major new products that were introduced in the past two years. |

| · | Our profitability declined in the third quarter

of 2023 from the third quarter of 2022 as our gross margin decreased from 28% to 20%. The lower margin was driven by: |

| o | unfavorable deleveraging of fixed costs resulting from decreased production, |

| o | increased sales promotional activity, |

| o | cost increases in materials, commodities, services, wages, energy, fuel and transportation, and |

| o | a product mix shift toward products with relatively lower margins. |

| · | During the third quarter of 2023, the Company’s

finished goods inventory and distributor inventories of the Company’s products increased 16,100 units and 1,000 units, respectively. |

| · | Cash provided by operations during the nine months of 2023 was $17.3 million. At September 30, 2023, our

cash and short-term investments totaled $120 million. Our current ratio is 4.5 to 1 and we have no debt. |

| · | In the first nine months of 2023, capital expenditures totaled $11.6 million related to new product introductions

and upgrades to our manufacturing equipment and facilities. We expect our 2023 capital expenditures to approximate $20 million. |

| · | In the first nine months of 2023, the Company returned $107.8 million to its shareholders through the

payment of our quarterly dividends and a $5.00 per share special dividend paid in January. |

| · | At September 30, 2023, stockholders’ equity was $335.5 million, which equates to a book value of

$18.92 per share, of which $6.77 per share was cash and short-term investments. |

Today, the Company

filed its Quarterly Report on Form 10-Q for the third quarter of 2023. The financial statements included in this Quarterly Report on Form

10-Q are attached to this press release.

Tomorrow, November

2, 2023, Sturm, Ruger will host a webcast at 9:00 a.m. ET to discuss the third quarter operating results. Interested parties can listen

to the webcast via this link or by visiting Ruger.com/corporate. Those who wish to ask questions during the webcast will need to pre-register

prior to the meeting.

The Quarterly Report

on Form 10-Q for the third quarter of 2023 is available on the SEC website at SEC.gov and the Ruger website at Ruger.com/corporate. Investors

are urged to read the complete Quarterly Report on Form 10-Q to ensure that they have adequate information to make informed investment

judgments.

About Sturm, Ruger & Co., Inc.

Sturm, Ruger & Co., Inc. is one of the nation's

leading manufacturers of rugged, reliable firearms for the commercial sporting market. With products made in America, Ruger offers consumers

almost 800 variations of more than 40 product lines, across both the Ruger and Marlin brands. For almost 75 years, Ruger has been a model

of corporate and community responsibility. Our motto, “Arms Makers for Responsible Citizens®,” echoes our commitment

to these principles as we work hard to deliver quality and innovative firearms.

The Company may, from time to time, make forward-looking

statements and projections concerning future expectations. Such statements are based on current expectations and are subject to certain

qualifying risks and uncertainties, such as market demand, sales levels of firearms, anticipated castings sales and earnings, the need

for external financing for operations or capital expenditures, the results of pending litigation against the Company, the impact of future

firearms control and environmental legislation, and accounting estimates, any one or more of which could cause actual results to differ

materially from those projected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events or circumstances

after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in thousands)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 13,559 | | |

$ | 65,173 | |

| Short-term investments | |

| 106,451 | | |

| 159,132 | |

| Trade receivables, net | |

| 59,899 | | |

| 65,449 | |

| | |

| | | |

| | |

| Gross inventories | |

| 150,021 | | |

| 129,294 | |

| Less LIFO reserve | |

| (64,969 | ) | |

| (59,489 | ) |

| Less excess and obsolescence reserve | |

| (5,781 | ) | |

| (4,812 | ) |

| Net inventories | |

| 79,271 | | |

| 64,993 | |

| | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 14,780 | | |

| 7,091 | |

| Total Current Assets | |

| 273,960 | | |

| 361,838 | |

| | |

| | | |

| | |

| Property, plant and equipment | |

| 458,332 | | |

| 447,126 | |

| Less allowances for depreciation | |

| (388,531 | ) | |

| (370,273 | ) |

| Net property, plant and equipment | |

| 69,801 | | |

| 76,853 | |

| | |

| | | |

| | |

| Deferred income taxes | |

| 10,167 | | |

| 6,109 | |

| Other assets | |

| 46,422 | | |

| 39,963 | |

| Total Assets | |

$ | 400,350 | | |

$ | 484,763 | |

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Continued)

(Dollars in thousands, except per share data)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| | |

| | |

| |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Trade accounts payable and accrued expenses | |

$ | 29,736 | | |

$ | 35,658 | |

| Dividends payable | |

| — | | |

| 88,343 | |

| Contract liabilities with customers | |

| 1,436 | | |

| 1,031 | |

| Product liability | |

| 406 | | |

| 235 | |

| Employee compensation and benefits | |

| 23,142 | | |

| 30,160 | |

| Workers’ compensation | |

| 6,467 | | |

| 6,469 | |

| Income taxes payable | |

| — | | |

| 1,171 | |

| Total Current Liabilities | |

| 61,187 | | |

| 163,067 | |

| | |

| | | |

| | |

| Employee compensation | |

| 1,484 | | |

| 1,846 | |

| Product liability accrual | |

| 46 | | |

| 73 | |

| Lease liability | |

| 2,328 | | |

| 3,039 | |

| | |

| | | |

| | |

| Contingent liabilities | |

| — | | |

| — | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock, non-voting, par value $1: | |

| | | |

| | |

| Authorized shares 50,000; none issued | |

| — | | |

| — | |

| Common Stock, par value $1: | |

| | | |

| | |

Authorized shares – 40,000,000

2023 – 24,437,020 issued,

17,722,682 outstanding

2022 – 24,378,568 issued,

17,664,230 outstanding | |

| 24,437 | | |

| 24,378 | |

| Additional paid-in capital | |

| 45,828 | | |

| 45,075 | |

| Retained earnings | |

| 410,852 | | |

| 393,097 | |

Less: Treasury stock – at cost

2023 – 6,714,338 shares

2022 – 6,714,338 shares | |

| (145,812 | ) | |

| (145,812 | ) |

| Total Stockholders’ Equity | |

| 335,305 | | |

| 316,738 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 400,350 | | |

$ | 484,763 | |

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (UNAUDITED)

(Dollars in thousands, except per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30,

2023 | | |

October 1,

2022 | | |

September 30,

2023 | | |

October 1,

2022 | |

| | |

| | |

| | |

| | |

| |

| Net firearms sales | |

$ | 120,368 | | |

$ | 138,771 | | |

$ | 411,114 | | |

$ | 444,615 | |

| Net castings sales | |

| 525 | | |

| 619 | | |

| 2,036 | | |

| 2,003 | |

| Total net sales | |

| 120,893 | | |

| 139,390 | | |

| 413,150 | | |

| 446,618 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of products sold | |

| 96,165 | | |

| 100,521 | | |

| 311,788 | | |

| 306,087 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 24,728 | | |

| 38,869 | | |

| 101,362 | | |

| 140,531 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling | |

| 8,669 | | |

| 8,763 | | |

| 27,702 | | |

| 25,828 | |

| General and administrative | |

| 9,733 | | |

| 10,247 | | |

| 31,898 | | |

| 30,927 | |

| Total operating expenses | |

| 18,402 | | |

| 19,010 | | |

| 59,600 | | |

| 56,755 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 6,326 | | |

| 19,859 | | |

| 41,762 | | |

| 83,776 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,454 | | |

| 730 | | |

| 4,147 | | |

| 951 | |

| Interest expense | |

| (122 | ) | |

| (88 | ) | |

| (177 | ) | |

| (205 | ) |

| Other income, net | |

| 431 | | |

| 490 | | |

| 1,082 | | |

| 2,092 | |

| Total other income, net | |

| 1,763 | | |

| 1,132 | | |

| 5,052 | | |

| 2,838 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 8,089 | | |

| 20,991 | | |

| 46,814 | | |

| 86,614 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income taxes | |

| 658 | | |

| 2,602 | | |

| 8,848 | | |

| 17,236 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income and comprehensive income | |

$ | 7,431 | | |

$ | 18,389 | | |

$ | 37,966 | | |

$ | 69,378 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

$ | 0.42 | | |

$ | 1.04 | | |

$ | 2.14 | | |

$ | 3.93 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per share | |

$ | 0.42 | | |

$ | 1.03 | | |

$ | 2.13 | | |

$ | 3.90 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding - Basic | |

| 17,722,682 | | |

| 17,668,435 | | |

| 17,705,280 | | |

| 17,643,473 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding - Diluted | |

| 17,889,089 | | |

| 17,825,797 | | |

| 17,828,710 | | |

| 17,770,120 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash dividends per share | |

$ | 0.36 | | |

$ | 0.47 | | |

$ | 6.10 | | |

$ | 2.01 | |

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

| | |

Nine Months Ended | |

| | |

September 30,

2023 | | |

October 1,

2022 | |

| | |

| | |

| |

| Operating Activities | |

| | | |

| | |

| Net income | |

$ | 37,966 | | |

$ | 69,378 | |

| Adjustments to reconcile net income to cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 19,576 | | |

| 20,120 | |

| Stock-based compensation | |

| 2,968 | | |

| 5,053 | |

| (Gain) loss on sale of assets | |

| (4 | ) | |

| 15 | |

| Deferred income taxes | |

| (4,058 | ) | |

| (1,908 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade receivables | |

| 5,550 | | |

| (4,326 | ) |

| Inventories | |

| (14,278 | ) | |

| (17,655 | ) |

| Trade accounts payable and accrued expenses | |

| (5,967 | ) | |

| (5,315 | ) |

| Contract liability with customers | |

| 405 | | |

| — | |

| Employee compensation and benefits | |

| (8,129 | ) | |

| (11,774 | ) |

| Product liability | |

| 144 | | |

| (340 | ) |

| Prepaid expenses, other assets and other liabilities | |

| (15,704 | ) | |

| (2,985 | ) |

| Income taxes payable | |

| (1,171 | ) | |

| — | |

| Cash provided by operating activities | |

| 17,298 | | |

| 50,263 | |

| | |

| | | |

| | |

| Investing Activities | |

| | | |

| | |

| Property, plant and equipment additions | |

| (11,637 | ) | |

| (17,206 | ) |

| Proceeds from sale of assets | |

| 5 | | |

| 41 | |

| Purchases of short-term investments | |

| (141,410 | ) | |

| (200,378 | ) |

| Proceeds from maturities of short-term investments | |

| 194,091 | | |

| 235,041 | |

| Cash provided by investing activities | |

| 41,049 | | |

| 17,498 | |

| | |

| | | |

| | |

| Financing Activities | |

| | | |

| | |

| Remittance of taxes withheld from employees related to share-based compensation | |

| (2,156 | ) | |

| (3,371 | ) |

| Repurchase of common stock | |

| — | | |

| (107 | ) |

| Dividends paid | |

| (107,805 | ) | |

| (35,474 | ) |

| Cash used for financing activities | |

| (109,961 | ) | |

| (38,952 | ) |

| | |

| | | |

| | |

| (Decrease) increase in cash and cash equivalents | |

| (51,614 | ) | |

| 28,809 | |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 65,173 | | |

| 21,044 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 13,559 | | |

$ | 49,853 | |

Non-GAAP Financial Measures

In an effort to provide investors

with additional information regarding its financial results, the Company refers to various United States generally accepted accounting

principles (“GAAP”) financial measures and two non-GAAP financial measures, EBITDA and EBITDA margin, which management believes

provides useful information to investors. These non-GAAP financial measures may not be comparable to similarly titled financial measures

being disclosed by other companies. In addition, the Company believes that the non-GAAP financial measures should be considered in addition

to, and not in lieu of, GAAP financial measures. The Company believes that EBITDA and EBITDA margin are useful to understanding its operating

results and the ongoing performance of its underlying business, as EBITDA provides information on the Company’s ability to meet

its capital expenditure and working capital requirements, and is also an indicator of profitability. The Company believes that this reporting

provides better transparency and comparability to its operating results. The Company uses both GAAP and non-GAAP financial measures to

evaluate the Company’s financial performance.

EBITDA is defined as earnings

before interest, taxes, and depreciation and amortization. The Company calculates this by adding the amount of interest expense, income

tax expense, and depreciation and amortization expenses that have been deducted from net income back into net income, and subtracting

the amount of interest income that was included in net income from net income to arrive at EBITDA. The Company calculates EBITDA margin

by dividing EBITDA by total net sales.

Non-GAAP Reconciliation

– EBITDA

EBITDA

(Unaudited, dollars in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30,

2023 | | |

October 1,

2022 | | |

September 30,

2023 | | |

October 1,

2022 | |

| | |

| | |

| | |

|

|

|

|

| |

| Net income | |

$ | 7,431 | | |

$ | 18,389 | | |

$ | 37,966 | | |

$ | 69,378 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 658 | | |

| 2,602 | | |

| 8,848 | | |

| 17,236 | |

| Depreciation and amortization expense | |

| 6,530 | | |

| 6,656 | | |

| 19,576 | | |

| 20,120 | |

| Interest income | |

| (1,454 | ) | |

| (730 | ) | |

| (4,147 | ) | |

| (951 | ) |

| Interest expense | |

| 122 | | |

| 88 | | |

| 177 | | |

| 205 | |

| EBITDA | |

$ | 13,287 | | |

$ | 27,005 | | |

$ | 62,420 | | |

$ | 105,988 | |

| EBITDA margin | |

| 11.0% | | |

| 19.4% | | |

| 15.1% | | |

| 23.7% | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

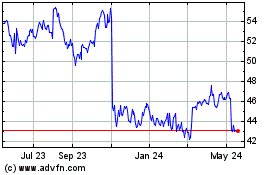

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Apr 2024 to May 2024

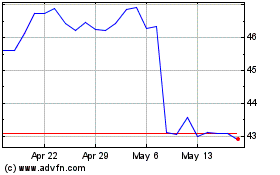

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From May 2023 to May 2024