- Net income of $8.4 million and diluted

earnings per share of $0.86, up 37% from $0.63 in the prior-year

period -

- Year-over-year growth in customer accounts,

originations, and revenue of 7%; revenue growth driven by 5% ending

net receivables growth and 80 bps increase in total revenue yield

-

- 30+ day contractual delinquency rate of 6.9%

as of June 30, 2024 -

- Continued expense discipline with operating

expense ratio of 13.8% -

Regional Management Corp. (NYSE: RM), a diversified consumer

finance company, today announced results for the second quarter

ended June 30, 2024.

“We are very pleased with our quarterly and year-to-date

results,” said Robert W. Beck, President and Chief Executive

Officer of Regional Management Corp. “We delivered $8.4 million of

net income in the second quarter, or $0.86 of diluted EPS. We grew

our portfolio by $29 million sequentially to $1.8 billion in the

quarter, up 5.0% from the prior year. Our interest and fee yield

increased 110 basis points year-over-year from a combination of

increased pricing, growth of our higher-margin small loan

portfolio, and improved credit performance. Our larger portfolio

and stronger yield combined to drive total revenue to $143 million

in the second quarter, up 7% from last year. At the same time, we

have maintained a tight grip on G&A expense while still

investing in our growth and strategic initiatives. Together, these

strong line item outcomes drove net income up 40% compared to the

second quarter of last year.”

“Along with our strong first half results, we continue to

carefully manage our portfolio’s credit quality and performance,”

added Mr. Beck. “Our 30+ day delinquency rate remained stable at

6.9% at the end of the quarter, 20 basis points better

sequentially. Our net credit loss rate improved 40 basis points

from the prior year, as the front book continues to perform in line

with our expectations and makes up a larger portion of our total

portfolio. We grew our small loan portfolio by $61 million, or 14%,

year-over-year, representing more than 70% of our total portfolio

growth over the past year. Our portfolio of loans with greater than

36% APR grew from 14% to 17% of the total portfolio over that same

time period. While these portfolios naturally come with higher

delinquencies and credit losses, it is an excellent trade given the

stronger margins and bottom-line returns that the portfolios

generate.”

“We had a very successful first half of 2024, posting strong

top- and bottom-line results despite the continued impacts of

inflation on credit performance,” continued Mr. Beck. “We remain

well-positioned to operate effectively through the current economic

cycle. As we expect credit losses to improve in the second half of

the year, we are excited to begin increasing our investment in our

strategic initiatives and portfolio growth, including through the

opening of ten new branch locations before year-end and continued

expansion of our higher-margin and auto-secured loan portfolios. We

look forward to continuing to deliver strong returns to our

shareholders while also investing in the business in a way that

will enable us to achieve additional, sustainable growth, improved

credit performance, and greater productivity, operating efficiency,

and leverage over the long-term.”

Second Quarter 2024 Highlights

- Net income for the second quarter of 2024 was $8.4 million and

diluted earnings per share was $0.86, up 37% from $0.63 in the

prior-year period.

- Net finance receivables as of June 30, 2024 were $1.8 billion,

an increase of $84.8 million, or 5.0%, from the prior-year period.

- Large loan net finance receivables of $1.3 billion increased

$28.0 million, or 2.3%, from the prior-year period and represented

71.4% of the total loan portfolio, compared to 73.3% in the

prior-year period.

- Small loan net finance receivables of $505.6 million increased

$61.1 million, or 13.7%, from the prior-year period and represented

28.5% of the total loan portfolio, compared to 26.3% in the

prior-year period.

- Net finance receivables with annual percentage rates (APRs)

above 36% increased to 17.2% of the portfolio from 13.9% in the

prior-year period.

- Total loan originations were $426.1 million in the second

quarter of 2024, an increase of $27.1 million, or 6.8%, from the

prior-year period, due to controlled growth from credit-tightening

actions.

- Total revenue for the second quarter of 2024 was $143.0

million, an increase of $9.5 million, or 7.1%, from the prior-year

period, primarily due to an increase in interest and fee income of

$9.8 million related to higher average net finance receivables and

110 basis points of higher interest and fee yield compared to the

prior-year period.

- The increase in interest and fee yield is attributable to

increased pricing, growth of the higher-margin small loan

portfolio, and improved credit performance.

- Total revenue yield increased 80 basis points year-over-year,

30 basis points lower than the increase in interest and fee yield

due to lower insurance revenues.

- Provision for credit losses for the second quarter of 2024 was

$53.8 million, an increase of $1.3 million, or 2.4%, from the

prior-year period, due to higher net credit losses from higher

average net receivables ($0.6 million) and a lower provision

release compared to the prior-year period ($0.7 million).

- Annualized net credit losses as a percentage of average net

finance receivables for the second quarter of 2024 were 12.7%, a 40

basis point improvement compared to 13.1% in the prior-year period.

The second quarter 2024 net credit loss rate is inclusive of a 20

basis point impact from growth of the higher-rate, small loan

portfolio.

- The provision for credit losses for the second quarter of 2024

included a reserve reduction of $1.7 million primarily due to

changes in estimated future macroeconomic impacts on credit losses,

partially offset by portfolio growth during the quarter.

- Allowance for credit losses was $185.4 million as of June 30,

2024, or 10.5% of net finance receivables, a 20 basis point

decrease sequentially from 10.7% due to improved portfolio credit

quality and expectations for improving future macroeconomic

conditions.

- As of June 30, 2024, 30+ day contractual delinquencies totaled

$122.7 million, or 6.9% of net finance receivables, a 20 basis

point improvement sequentially and comparable to June 30, 2023. The

second quarter 2024 delinquency rate is inclusive of a 10 basis

point impact from growth of the higher-rate, small loan

portfolio.

- General and administrative expenses for the second quarter of

2024 were $60.1 million, an increase of $3.2 million from the

prior-year period. The operating expense ratio (annualized general

and administrative expenses as a percentage of average net finance

receivables) for the second quarter of 2024 was 13.8%. The

prior-year period included an insurance settlement benefit,

improving general and administrative expenses and the operating

expense ratio in the prior-year period by $1.0 million and 20 basis

points, respectively.

Third Quarter 2024 Dividend

The company’s Board of Directors has declared a dividend of

$0.30 per common share for the third quarter of 2024. The dividend

will be paid on September 12, 2024 to shareholders of record as of

the close of business on August 21, 2024. The declaration and

payment of any future dividend is subject to the discretion of the

Board of Directors and will depend on a variety of factors,

including the company’s financial condition and results of

operations.

Liquidity and Capital Resources

As of June 30, 2024, the company had net finance receivables of

$1.8 billion and debt of $1.4 billion. The debt consisted of:

- $145.7 million on the company’s $355 million senior revolving

credit facility,

- $21.4 million on the company’s aggregate $375 million revolving

warehouse credit facilities, and

- $1.2 billion through the company’s asset-backed

securitizations.

As of June 30, 2024, the company’s unused capacity to fund

future growth on its revolving credit facilities (subject to the

borrowing base) was $564 million, or 77.3%, and the company had

available liquidity of $149.4 million, including unrestricted cash

on hand and immediate availability to draw down cash from its

revolving credit facilities. As of June 30, 2024, the company’s

fixed-rate debt as a percentage of total debt was 88%, with a

weighted-average coupon of 4.2% and a weighted-average revolving

duration of 1.2 years.

The company had a funded debt-to-equity ratio of 4.0 to 1.0 and

a stockholders’ equity ratio of 19.3%, each as of June 30, 2024. On

a non-GAAP basis, the company had a funded debt-to-tangible equity

ratio of 4.2 to 1.0, as of June 30, 2024. Please refer to the

reconciliations of non-GAAP measures to comparable GAAP measures

included at the end of this press release.

Conference Call Information

Regional Management Corp. will host a conference call and

webcast today at 5:00 PM ET to discuss these results.

The dial-in number for the conference call is (855) 327-6837

(toll-free) or (631) 891-4304 (direct). Please dial the number 10

minutes prior to the scheduled start time.

*** A supplemental slide presentation will be made available

on Regional’s website prior to the earnings call at

www.RegionalManagement.com. ***

In addition, a live webcast of the conference call will be

available on Regional’s website at www.RegionalManagement.com.

A webcast replay of the call will be available at

www.RegionalManagement.com for one year following the call.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company that provides attractive, easy-to-understand

installment loan products primarily to customers with limited

access to consumer credit from banks, thrifts, credit card

companies, and other lenders. Regional Management operates under

the name “Regional Finance” online and in branch locations in 19

states across the United States. Most of its loan products are

secured, and each is structured on a fixed-rate, fixed-term basis

with fully amortizing equal monthly installment payments, repayable

at any time without penalty. Regional Management sources loans

through its multiple channel platform, which includes branches,

centrally managed direct mail campaigns, digital partners, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not statements

of historical fact but instead represent Regional Management

Corp.’s expectations or beliefs concerning future events.

Forward-looking statements include, without limitation, statements

concerning financial outlooks or future plans, objectives, goals,

projections, strategies, events, or performance, and underlying

assumptions and other statements related thereto. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,”

and similar expressions may be used to identify these

forward-looking statements. Such forward-looking statements speak

only as of the date on which they were made and are about matters

that are inherently subject to risks and uncertainties, many of

which are outside of the control of Regional Management. As a

result, actual performance and results may differ materially from

those contemplated by these forward-looking statements. Therefore,

investors should not place undue reliance on forward-looking

statements.

Factors that could cause actual results or performance to differ

from the expectations expressed or implied in forward-looking

statements include, but are not limited to, the following: managing

growth effectively, implementing Regional Management’s growth

strategy, and opening new branches as planned; Regional

Management’s convenience check strategy; Regional Management’s

policies and procedures for underwriting, processing, and servicing

loans; Regional Management’s ability to collect on its loan

portfolio; Regional Management’s insurance operations; exposure to

credit risk and repayment risk, which risks may increase in light

of adverse or recessionary economic conditions; the implementation

of evolving underwriting models and processes, including as to the

effectiveness of Regional Management's custom scorecards; changes

in the competitive environment in which Regional Management

operates or a decrease in the demand for its products; the

geographic concentration of Regional Management’s loan portfolio;

the failure of third-party service providers, including those

providing information technology products; changes in economic

conditions in the markets Regional Management serves, including

levels of unemployment and bankruptcies; the ability to achieve

successful acquisitions and strategic alliances; the ability to

make technological improvements as quickly as competitors; security

breaches, cyber-attacks, failures in information systems, or

fraudulent activity; the ability to originate loans; reliance on

information technology resources and providers, including the risk

of prolonged system outages; changes in current revenue and expense

trends, including trends affecting delinquencies and credit losses;

any future public health crises, including the impact of such

crisis on our operations and financial condition; changes in

operating and administrative expenses; the departure, transition,

or replacement of key personnel; the ability to timely and

effectively implement, transition to, and maintain the necessary

information technology systems, infrastructure, processes, and

controls to support Regional Management’s operations and

initiatives; changes in interest rates; existing sources of

liquidity may become insufficient or access to these sources may

become unexpectedly restricted; exposure to financial risk due to

asset-backed securitization transactions; risks related to

regulation and legal proceedings, including changes in laws or

regulations or in the interpretation or enforcement of laws or

regulations; changes in accounting standards, rules, and

interpretations and the failure of related assumptions and

estimates; the impact of changes in tax laws and guidance,

including the timing and amount of revenues that may be recognized;

risks related to the ownership of Regional Management’s common

stock, including volatility in the market price of shares of

Regional Management’s common stock; the timing and amount of future

cash dividend payments; and anti-takeover provisions in Regional

Management’s charter documents and applicable state law.

The foregoing factors and others are discussed in greater detail

in Regional Management’s filings with the Securities and Exchange

Commission. Regional Management will not update or revise

forward-looking statements to reflect events or circumstances after

the date of this press release or to reflect the occurrence of

unanticipated events or the non-occurrence of anticipated events,

whether as a result of new information, future developments, or

otherwise, except as required by law. Regional Management is not

responsible for changes made to this document by wire services or

Internet services.

Regional Management Corp. and

Subsidiaries

Consolidated Statements of

Income

(Unaudited)

(dollars in thousands, except

per share amounts)

Better (Worse)

Better (Worse)

2Q 24

2Q 23

$

%

YTD 24

YTD 23

$

%

Revenue

Interest and fee income

$

127,898

$

118,083

$

9,815

8.3

%

$

256,716

$

238,490

$

18,226

7.6

%

Insurance income, net

10,507

11,203

(696

)

(6.2

)%

21,481

22,162

(681

)

(3.1

)%

Other income

4,620

4,198

422

10.1

%

9,136

8,210

926

11.3

%

Total revenue

143,025

133,484

9,541

7.1

%

287,333

268,862

18,471

6.9

%

Expenses

Provision for credit losses

53,802

52,551

(1,251

)

(2.4

)%

100,225

100,219

(6

)

—

Personnel

37,097

36,419

(678

)

(1.9

)%

74,917

75,016

99

0.1

%

Occupancy

6,149

6,158

9

0.1

%

12,524

12,446

(78

)

(0.6

)%

Marketing

4,836

3,844

(992

)

(25.8

)%

9,151

7,223

(1,928

)

(26.7

)%

Other

12,054

10,475

(1,579

)

(15.1

)%

23,992

21,534

(2,458

)

(11.4

)%

Total general and administrative

60,136

56,896

(3,240

)

(5.7

)%

120,584

116,219

(4,365

)

(3.8

)%

Interest expense

17,865

16,224

(1,641

)

(10.1

)%

35,369

33,006

(2,363

)

(7.2

)%

Income before income taxes

11,222

7,813

3,409

43.6

%

31,155

19,418

11,737

60.4

%

Income taxes

2,777

1,790

(987

)

(55.1

)%

7,505

4,706

(2,799

)

(59.5

)%

Net income

$

8,445

$

6,023

$

2,422

40.2

%

$

23,650

$

14,712

$

8,938

60.8

%

Net income per common share:

Basic

$

0.88

$

0.64

$

0.24

37.5

%

$

2.47

$

1.57

$

0.90

57.3

%

Diluted

$

0.86

$

0.63

$

0.23

36.5

%

$

2.41

$

1.53

$

0.88

57.5

%

Weighted-average common shares

outstanding:

Basic

9,613

9,399

(214

)

(2.3

)%

9,591

9,363

(228

)

(2.4

)%

Diluted

9,863

9,566

(297

)

(3.1

)%

9,805

9,595

(210

)

(2.2

)%

Return on average assets (annualized)

1.9

%

1.4

%

2.7

%

1.7

%

Return on average equity (annualized)

10.0

%

7.6

%

14.1

%

9.3

%

Regional Management Corp. and

Subsidiaries

Consolidated Balance

Sheets

(Unaudited)

(dollars in thousands, except

par value amounts)

Increase (Decrease)

2Q 24

2Q 23

$

%

Assets

Cash

$

4,323

$

10,330

$

(6,007

)

(58.2

)%

Net finance receivables

1,773,743

1,688,937

84,806

5.0

%

Unearned insurance premiums

(46,081

)

(49,059

)

2,978

6.1

%

Allowance for credit losses

(185,400

)

(181,400

)

(4,000

)

(2.2

)%

Net finance receivables, less unearned

insurance premiums and allowance for credit losses

1,542,262

1,458,478

83,784

5.7

%

Restricted cash

138,891

131,132

7,759

5.9

%

Lease assets

35,144

34,996

148

0.4

%

Intangible assets

19,264

13,949

5,315

38.1

%

Property and equipment

13,411

14,689

(1,278

)

(8.7

)%

Deferred tax assets, net

12,376

15,278

(2,902

)

(19.0

)%

Restricted available-for-sale

investments

2,157

20,298

(18,141

)

(89.4

)%

Other assets

21,224

24,466

(3,242

)

(13.3

)%

Total assets

$

1,789,052

$

1,723,616

$

65,436

3.8

%

Liabilities and Stockholders’

Equity

Liabilities:

Debt

$

1,378,449

$

1,344,855

$

33,594

2.5

%

Unamortized debt issuance costs

(5,616

)

(6,923

)

1,307

18.9

%

Net debt

1,372,833

1,337,932

34,901

2.6

%

Lease liabilities

37,286

37,150

136

0.4

%

Accounts payable and accrued expenses

34,030

27,032

6,998

25.9

%

Total liabilities

1,444,149

1,402,114

42,035

3.0

%

Stockholders’ equity:

Preferred stock ($0.10 par value, 100,000

shares authorized, none issued or outstanding)

—

—

—

—

Common stock ($0.10 par value, 1,000,000

shares authorized, 14,962 shares issued and 10,156 shares

outstanding at June 30, 2024 and 14,636 shares issued and 9,829

shares outstanding at June 30, 2023)

1,496

1,464

32

2.2

%

Additional paid-in capital

126,373

116,202

10,171

8.8

%

Retained earnings

367,216

354,346

12,870

3.6

%

Accumulated other comprehensive loss

(39

)

(367

)

328

89.4

%

Treasury stock (4,807 shares at June 30,

2024 and June 30, 2023)

(150,143

)

(150,143

)

—

—

Total stockholders’ equity

344,903

321,502

23,401

7.3

%

Total liabilities and stockholders’

equity

$

1,789,052

$

1,723,616

$

65,436

3.8

%

Regional Management Corp. and

Subsidiaries

Selected Financial

Data

(Unaudited)

(dollars in thousands, except

per share amounts)

Net Finance

Receivables

2Q 24

1Q 24

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

2Q 23

YoY $ Inc (Dec)

YoY % Inc (Dec)

Large loans

$

1,266,032

$

1,250,647

$

15,385

1.2

%

$

1,238,031

$

28,001

2.3

%

Small loans

505,640

490,830

14,810

3.0

%

444,590

61,050

13.7

%

Retail loans

2,071

2,809

(738

)

(26.3

)%

6,316

(4,245

)

(67.2

)%

Total net finance receivables

$

1,773,743

$

1,744,286

$

29,457

1.7

%

$

1,688,937

$

84,806

5.0

%

Number of branches at period end

343

343

—

—

347

(4

)

(1.2

)%

Net finance receivables per branch

$

5,171

$

5,085

$

86

1.7

%

$

4,867

$

304

6.2

%

Averages and Yields

2Q 24

1Q 24

2Q 23

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Large loans

$

1,255,729

26.1

%

$

1,263,491

26.0

%

$

1,223,339

26.0

%

Small loans

490,615

37.3

%

491,911

37.8

%

443,601

34.5

%

Retail loans

2,433

16.6

%

3,341

15.8

%

7,191

16.6

%

Total interest and fee yield

$

1,748,777

29.3

%

$

1,758,743

29.3

%

$

1,674,131

28.2

%

Total revenue yield

$

1,748,777

32.7

%

$

1,758,743

32.8

%

$

1,674,131

31.9

%

(1) Annualized interest and fee income as a percentage of

average net finance receivables.

Components of Increase in

Interest and Fee Income

2Q 24 Compared to 2Q

23

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Large loans

$

2,105

$

380

$

10

$

2,495

Small loans

4,057

3,129

331

7,517

Retail loans

(197

)

1

(1

)

(197

)

Product mix

(700

)

846

(146

)

—

Total increase in interest and fee

income

$

5,265

$

4,356

$

194

$

9,815

Loans Originated (1)

2Q 24

1Q 24

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

2Q 23

YoY $ Inc (Dec)

YoY % Inc (Dec)

Large loans

$

254,779

$

185,074

$

69,705

37.7

%

$

249,514

$

5,265

2.1

%

Small loans

171,282

141,281

30,001

21.2

%

149,460

21,822

14.6

%

Total loans originated

$

426,061

$

326,355

$

99,706

30.6

%

$

398,974

$

27,087

6.8

%

(1) Represents the principal balance of loan originations and

refinancings.

Other Key Metrics

2Q 24

1Q 24

2Q 23

Net credit losses

$

55,502

$

46,723

$

54,951

Percentage of average net finance

receivables (annualized)

12.7

%

10.6

%

13.1

%

Provision for credit losses

$

53,802

$

46,423

$

52,551

Percentage of average net finance

receivables (annualized)

12.3

%

10.6

%

12.6

%

Percentage of total revenue

37.6

%

32.2

%

39.4

%

General and administrative expenses

$

60,136

$

60,448

$

56,896

Percentage of average net finance

receivables (annualized)

13.8

%

13.7

%

13.6

%

Percentage of total revenue

42.0

%

41.9

%

42.6

%

Same store results (1):

Net finance receivables at period-end

$

1,759,075

$

1,733,237

$

1,636,131

Net finance receivable growth rate

4.5

%

3.4

%

7.2

%

Number of branches in calculation

338

340

329

(1) Same store sales reflect the change in year-over-year sales

for the comparable branch base. The comparable branch base includes

those branches open for at least one year.

Contractual

Delinquency

2Q 24

1Q 24

2Q 23

Allowance for credit losses

$

185,400

10.5

%

$

187,100

10.7

%

$

181,400

10.7

%

Current

1,497,219

84.4

%

1,489,510

85.4

%

1,433,787

84.9

%

1 to 29 days past due

153,788

8.7

%

130,578

7.5

%

138,810

8.2

%

Delinquent accounts:

30 to 59 days

34,924

1.9

%

30,020

1.7

%

33,676

2.0

%

60 to 89 days

27,689

1.6

%

25,409

1.5

%

24,931

1.5

%

90 to 119 days

21,607

1.2

%

23,460

1.3

%

20,041

1.1

%

120 to 149 days

19,333

1.1

%

22,163

1.3

%

18,087

1.1

%

150 to 179 days

19,183

1.1

%

23,146

1.3

%

19,605

1.2

%

Total contractual delinquency

$

122,736

6.9

%

$

124,198

7.1

%

$

116,340

6.9

%

Total net finance receivables

$

1,773,743

100.0

%

$

1,744,286

100.0

%

$

1,688,937

100.0

%

1 day and over past due

$

276,524

15.6

%

$

254,776

14.6

%

$

255,150

15.1

%

Contractual Delinquency by

Product

2Q 24

1Q 24

2Q 23

Large loans

$

76,432

6.0

%

$

78,055

6.2

%

$

74,637

6.0

%

Small loans

46,015

9.1

%

45,804

9.3

%

40,894

9.2

%

Retail loans

289

14.0

%

339

12.1

%

809

12.8

%

Total contractual delinquency

$

122,736

6.9

%

$

124,198

7.1

%

$

116,340

6.9

%

Income Statement Quarterly

Trend

2Q 23

3Q 23

4Q 23

1Q 24

2Q 24

QoQ $ B(W)

YoY $ B(W)

Revenue

Interest and fee income

$

118,083

$

125,018

$

126,190

$

128,818

$

127,898

$

(920

)

$

9,815

Insurance income, net

11,203

11,382

10,985

10,974

10,507

(467

)

(696

)

Other income

4,198

4,478

4,484

4,516

4,620

104

422

Total revenue

133,484

140,878

141,659

144,308

143,025

(1,283

)

9,541

Expenses

Provision for credit losses

52,551

50,930

68,885

46,423

53,802

(7,379

)

(1,251

)

Personnel

36,419

39,832

42,024

37,820

37,097

723

(678

)

Occupancy

6,158

6,315

6,268

6,375

6,149

226

9

Marketing

3,844

4,077

4,474

4,315

4,836

(521

)

(992

)

Other

10,475

11,880

12,030

11,938

12,054

(116

)

(1,579

)

Total general and administrative

56,896

62,104

64,796

60,448

60,136

312

(3,240

)

Interest expense

16,224

16,947

17,510

17,504

17,865

(361

)

(1,641

)

Income before income taxes

7,813

10,897

(9,532

)

19,933

11,222

(8,711

)

3,409

Income taxes

1,790

2,077

(1,958

)

4,728

2,777

1,951

(987

)

Net income (loss)

$

6,023

$

8,820

$

(7,574

)

$

15,205

$

8,445

$

(6,760

)

$

2,422

Net income (loss) per common share:

Basic

$

0.64

$

0.94

$

(0.80

)

$

1.59

$

0.88

$

(0.71

)

$

0.24

Diluted

$

0.63

$

0.91

$

(0.80

)

$

1.56

$

0.86

$

(0.70

)

$

0.23

Weighted-average shares outstanding:

Basic

9,399

9,429

9,437

9,569

9,613

(44

)

(214

)

Diluted

9,566

9,650

9,437

9,746

9,863

(117

)

(297

)

Balance Sheet Quarterly

Trend

2Q 23

3Q 23

4Q 23

1Q 24

2Q 24

QoQ $ Inc (Dec)

YoY $ Inc (Dec)

Total assets

$

1,723,616

$

1,765,340

$

1,794,527

$

1,756,748

$

1,789,052

$

32,304

$

65,436

Net finance receivables

$

1,688,937

$

1,751,009

$

1,771,410

$

1,744,286

$

1,773,743

$

29,457

$

84,806

Allowance for credit losses

$

181,400

$

184,900

$

187,400

$

187,100

$

185,400

$

(1,700

)

$

4,000

Debt

$

1,344,855

$

1,372,748

$

1,399,814

$

1,358,795

$

1,378,449

$

19,654

$

33,594

Other Key Metrics Quarterly

Trend

2Q 23

3Q 23

4Q 23

1Q 24

2Q 24

QoQ Inc (Dec)

YoY Inc (Dec)

Interest and fee yield (annualized)

28.2

%

29.0

%

28.8

%

29.3

%

29.3

%

—

1.1

%

Efficiency ratio (1)

42.6

%

44.1

%

45.7

%

41.9

%

42.0

%

0.1

%

(0.6

)%

Operating expense ratio (2)

13.6

%

14.4

%

14.8

%

13.7

%

13.8

%

0.1

%

0.2

%

30+ contractual delinquency

6.9

%

7.3

%

6.9

%

7.1

%

6.9

%

(0.2

)%

—

Net credit loss ratio (3)

13.1

%

11.0

%

15.1

%

10.6

%

12.7

%

2.1

%

(0.4

)%

Book value per share

$

32.71

$

33.61

$

33.02

$

34.10

$

33.96

$

(0.14

)

$

1.25

(1) General and administrative expenses as a percentage of total

revenue. (2) Annualized general and administrative expenses as a

percentage of average net finance receivables. (3) Annualized net

credit losses as a percentage of average net finance

receivables.

Averages and Yields

YTD 24

YTD 23

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Large loans

$

1,259,611

26.1

%

$

1,219,464

26.0

%

Small loans

491,262

37.6

%

455,659

34.8

%

Retail loans

2,887

16.1

%

8,068

17.7

%

Total interest and fee yield

$

1,753,760

29.3

%

$

1,683,191

28.3

%

Total revenue yield

$

1,753,760

32.8

%

$

1,683,191

31.9

%

Components of Increase in

Interest and Fee Income

YTD 24 Compared to YTD

23

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Large loans

$

5,219

$

407

$

13

$

5,639

Small loans

6,193

6,378

498

13,069

Retail loans

(459

)

(64

)

41

(482

)

Product mix

(954

)

1,175

(221

)

—

Total increase in interest and fee

income

$

9,999

$

7,896

$

331

$

18,226

Loans Originated (1)

YTD 24

YTD 23

YTD $ Inc (Dec)

YTD % Inc (Dec)

Large loans

$

439,853

$

443,085

$

(3,232

)

(0.7

)%

Small loans

312,563

258,944

53,619

20.7

%

Retail loans

—

146

(146

)

(100.0

)%

Total loans originated

$

752,416

$

702,175

$

50,241

7.2

%

(1) Represents the principal balance of loan originations and

refinancings.

Other Key Metrics

YTD 24

YTD 23

Net credit losses

$

102,225

$

97,619

Percentage of average net finance

receivables (annualized)

11.7

%

11.6

%

Provision for credit losses

$

100,225

$

100,219

Percentage of average net finance

receivables (annualized)

11.4

%

11.9

%

Percentage of total revenue

34.9

%

37.3

%

General and administrative expenses

$

120,584

$

116,219

Percentage of average net finance

receivables (annualized)

13.8

%

13.8

%

Percentage of total revenue

42.0

%

43.2

%

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with

generally accepted accounting principles (“GAAP”), this press

release contains certain non-GAAP financial measures. The company’s

management utilizes non-GAAP measures as additional metrics to aid

in, and enhance, its understanding of the company’s financial

results. Tangible equity and the funded debt-to-tangible equity

ratio are non-GAAP measures that adjust GAAP measures to exclude

intangible assets. Management uses these equity measures to

evaluate and manage the company’s capital and leverage position.

The company also believes that these equity measures are commonly

used in the financial services industry and provide useful

information to users of the company’s financial statements in the

evaluation of its capital and leverage position.

This non-GAAP financial information should be considered in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP. In

addition, the company’s non-GAAP measures may not be comparable to

similarly titled non-GAAP measures of other companies. The

following tables provide a reconciliation of GAAP measures to

non-GAAP measures.

2Q 24

Debt

$

1,378,449

Total stockholders' equity

344,903

Less: Intangible assets

19,264

Tangible equity (non-GAAP)

$

325,639

Funded debt-to-equity ratio

4.0

x

Funded debt-to-tangible equity ratio

(non-GAAP)

4.2

x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731871271/en/

Investor Relations Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

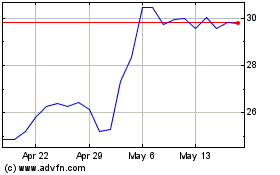

Regional Management (NYSE:RM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Regional Management (NYSE:RM)

Historical Stock Chart

From Nov 2023 to Nov 2024