0001519401false00015194012024-12-112024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 11, 2024 |

Regional Management Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35477 |

57-0847115 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

979 Batesville Road, Suite B |

|

Greer, South Carolina |

|

29651 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (864) 448-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.10 par value |

|

RM |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

A copy of the presentation to be used by management of Regional Management Corp. (the “Company”) in meetings with bankers, investors, and others commencing on December 12, 2024 is attached to this Current Report on Form 8-K as Exhibit 99.1 and is also available at the Company’s website at www.regionalmanagement.com.

The information set forth in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. The information in this Item 7.01 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Regional Management Corp. |

|

|

|

|

Date: |

December 11, 2024 |

By: |

/s/ Harpreet Rana |

|

|

|

Harpreet Rana

Executive Vice President and Chief Financial Officer |

Investor Presentation December 12th, 2024

Legal Disclosures This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning financial outlook or future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing Regional Management's growth strategy, and opening new branches as planned; Regional Management's convenience check strategy; Regional Management's policies and procedures for underwriting, processing, and servicing loans; Regional Management's ability to collect on its loan portfolio; Regional Management's insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of Regional Management’s custom scorecards; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; the geographic concentration of Regional Management's loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets Regional Management serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses; any future public health crises, including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support Regional Management's operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of Regional Management's common stock, including volatility in the market price of shares of Regional Management's common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in Regional Management's charter documents and applicable state law. The foregoing factors and others are discussed in greater detail in the Company's filings with the SEC. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. This presentation also contains certain non-GAAP measures. Please refer to the Appendix accompanying this presentation for a reconciliation of non-GAAP measures to the most comparable GAAP measures. 2

Investment Highlights Strong balance sheet supports capital returns Geographic, product, and channel expansion drive growth Omni-channel growth strategy with abundant market opportunity Controlled growth with stable credit using advanced credit tools Modern infrastructure and digital capabilities Deep management experience through credit cycles High customer satisfaction and loyalty Scale, digital capabilities, and lighter footprint will drive operating leverage 3

Strategic Imperatives Expand margins and maximize cash flows from loan portfolio Pricing increases, mix shift to higher-APR loans, and improving credit performance expected to drive strong revenue yields Deployment of barbell strategy of growth in higher-quality, auto-secured loans and higher-margin small loans Investment in data and analytics and improved credit decisioning will create better net credit loss outcomes Execute on long-term growth strategies to increase revenues Geographic expansion has increased addressable market by 80% since 2020; significant opportunities for growth remain in existing 19 states and from future new state entry Digital investments widen the marketing funnel, improve the customer experience, and enhance the omni-channel operating model Return to 10% to 12% receivables growth in 2025 Closely manage expenses and drive improved operating efficiency Continue to exercise expense discipline to improve operating leverage as the company grows Investments in digital initiatives, technology, data and analytics, artificial intelligence, and centralized support create more efficient operations Geographic expansion, higher-balance auto-secured lending, and portfolio growth initiatives drive scale Maintain a strong balance sheet, ample liquidity and borrowing capacity, and consistent capital return Diversified sources of funding with staggered revolving maturities support growth and protect against short-term disruptions in credit markets 82% of debt is at a fixed rate, with a weighted-average coupon of 4.3% and a weighted-average revolving duration of 1.1 years (1) Consistent capital return to shareholders through quarterly dividend and stock repurchases (1) As of 09/30/2024 Focused on consistent execution of our core business, including: Originating high-quality loans within tightened credit box Closely managing expenses Maintaining a strong balance sheet Expect to emerge from current economic cycle as a stronger company: Larger, higher-quality portfolio Improved operating efficiencies Well positioned for future growth and delivery of attractive returns to shareholders 4

Growth and Capabilities 5 Our continued investment in growth and strategic initiatives, including data and analytical capabilities and technological modernization, will drive 10% to 12% receivables growth in 2025 and create additional, sustainable growth, improved credit performance, and greater productivity, operating efficiency, and leverage over the long-term Technology Migrated to cloud-based architecture Developed new credit decisioning engine for front-end operations that will significantly improve decisioning time and drive operational efficiencies (to be deployed in 2025 and early 2026) Approximately 20% of 3Q 2024 branch origination volume was funded with ACH Digital document retention is driving improved operating efficiency Data and Analytics New Snowflake centralized data mart driving enhanced analytics and improved efficiencies Deployed next-generation risk and response acquisition model to optimize direct mail programs Will soon begin to deploy next generation risk model leveraging machine learning for branch and digital originations to drive better credit decisions and outcomes In 2025, expect to improve economics of mailable universe by deploying new customer lifetime value profitability model Market Expansion Expect to open 15 to 20 new branches from 4Q 2024 through end of 2025 Return to opening 20 to 25 new branches annually in 2026 and beyond New branches opened between one and three years are averaging $6.7 million of receivables vs. the company average of $5.4 million (1) Plan to enter an additional state in late 2025 Expect to roughly double state presence over the long term, from 19 states to ~40 states Digital 29% of new customer originations were sourced digitally and closed in the branch in 3Q 2024 Plan to expand fully digital end-to-end loan origination test to additional states in the second half of 2025 and 2026 Continue to enhance our digital customer contact through texting, emailing, and auto-dialer capabilities Based on September 30, 2024 ending net finance receivables

Excess Capital Consistently Returned to Shareholders Proven business model capable of generating excess capital to return to shareholders and to reinvest in strategic initiatives that will generate sustainable, long-term profitable growth Cumulative dividends and common stock repurchases reflect activity after December 31, 2020; excludes dividend and stock repurchases before January 1, 2021 This is a non-GAAP measure. Refer to the Appendix for a discussion of how management utilizes this non-GAAP measure In millions 6 7.1% CAGR Capital Generation, Net of Capital Return Investors have an opportunity to build a position in RM while RM stock trades near tangible book value per share The company’s Board of Directors recently authorized a stock repurchase program allowing for the repurchase of up to $30 million of its outstanding common stock. The authorization will continue through December 31, 2026

Company Overview Founded 1987 NYSE Listed: RM 340 branches 19 states Total receivables of $1.8 billion Multi-channel marketing: branches, digital, and direct mail Legacy States (prior to 2021) 2021 New States (IL, UT) 2022 New States (MS, IN, CA, LA) Potential Future State Expansion Geographic footprint and net finance receivables as of 9/30/2024 Diversified consumer finance company operating under the name “Regional Finance” Provide installment loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders Goal to consistently grow finance receivables and soundly manage portfolio risk, while providing customers with attractive, safe, easy-to-understand loan products serving their varied financial needs 2023 New States (AZ) (ID – entered digitally in 2022 and branch in 2023) 7

Abundant Total Addressable Market Approximately 72 million Americans generally align with Regional’s customer base (1)(3) $91 billion market opportunity – RM has less than 2% market share and increased its addressable market by over 80% since 2020; still significant runway for growth $4.7 Trillion Consumer Finance Market (2) 28% of US Population with FICO Between 550 & 700 (3) Personal Installment Loans Account for ~$91 billion (1) Adult US Population sourced from US Census Bureau www.census.gov/library/stories/2021/08/united-states-adult-population-grew-faster-than-nations-total-population-from-2010-to-2020.html Sourced from Equifax US National Consumer Credit Trends Report; June 2023, sourced from June 2023 publication Sourced from Arkali, Can. “Average U.S. FICO® Score Stays Steady at 716” FICO.com, 30 Aug. 2022, www.fico.com/blogs/average-us-fico-score-stays-steady-716-missed-payments-and-consumer-debt-rises Student Loans (31%) Auto Loans (34%) Credit Cards (21%) Other (11%) Personal Lending (3%) 8

Serving Our Customers Best Excellent net promoter score of 61 (1) 90+% favorable ratings for key attributes (1): Loan process was quick, easy, and understandable People are professional, responsive, respectful, knowledgeable, helpful, and friendly 92% of customers would apply to Regional Finance first the next time they need a loan Continued investment in digital channels, remote servicing options, and focus on delivering positive customer experience has allowed us to maintain strong metrics Origination Needs Demographics Top-Notch Customer Service Average Age (2) 55 Years Annual Income (2) $53,000 Some College or Advanced Degree (1) 57% (1) Fall 2024 Customer Satisfaction Survey (performed by third-party and commissioned by RM) (2) Based on 3Q 2024 origination volume 9

Product Offerings Multi-Channel Acquisition Small Loans Large Loans In Branch $976.9MM Originated 69% Large/31% Small Direct Mail $437.2MM Originated Convenience Check Loans Digital $172.4MM Originated Digital Lead Generation Partnership Affiliates Customer Need Short-term cash needs Bill payment Back-to-school expenses Auto repair Characteristics Size: $500 to $2,500 Average Origination: ~$2,100 Average Origination APR: 45.4% Portfolio Outstanding Balance: $524.8MM # of Loans: 303,900 Customer Need Debt consolidation Medical expenses Home repairs Characteristics Size: >$2,500 Average Origination: ~$5,900 Average Origination APR: 30.7% Portfolio Outstanding Balance: $1.3B # of Loans: 252,200 Originations metrics reflect trailing twelve months (4Q 23 - 3Q 24); portfolio data is as of 9/30/2024. Over last several quarters, deployed a barbell strategy of growth in auto-secured loans (a large loan segment) and higher-margin small loans (particularly loans with APRs greater than 36%) Auto-secured loans are available for higher credit quality customers, carry lower APRs, and have lowest loss rates of all product segments Higher-margin small loans enable greater access to credit while generating a margin sufficient to address higher credit risk and to meet return hurdles Barbell strategy contributed to year-over-year increase in interest and fee yield of 90 basis points in the third quarter 2024 Meanwhile, net credit loss rate improved by 40 basis points year-over-year in the third quarter 2024, despite an estimated 30 basis point negative impact from growth in the higher-margin small loan segment 10

Financial Overview: Originations In millions In millions In millions 11 Branch originations in 3Q 24 were up year-over-year by 5.3%, while digital originations remained relatively flat year-over-year Direct mail originations were down year-over-year by 9.1%, as we de-emphasized large loan convenience check offers to new borrowers as part of credit tightening Generated sequential portfolio growth of $46 million, or 2.6%, to $1.82 billion in 3Q 24, an annualized growth rate of 10.4% Achieved year-over-year portfolio growth of $69 million, or 3.9%, in 3Q 24; higher-margin small loan business growth of $51 million outpaced large loan growth of $22 million As of September 30, 2024, 82% of the portfolio carried an APR at or below 36%, down from 85% as of the prior-year period due to product mix shift to higher-margin small loan business

Record total revenue of $146.3 million grew 3.9% year-over-year, inclusive of a 250 basis point impact from lower insurance income due to personal property insurance claims and reserves of $3.5 million related to hurricane activity Despite the impact of the hurricanes on revenue, revenue grew in line with ANR growth of 4.1% due to higher interest and fee yield, which increased 90 basis points year-over-year from the impact of pricing changes, growth in our higher-margin small loan business, and improved credit performance Higher-margin small loan yields increased by 120 basis points year-over-year, while large loan yields increased by 40 basis points year-over-year Total revenue yield decreased by 10 basis points year-over-year inclusive of an 80 basis point impact due to lower insurance income from personal property insurance claims and reserves Total Revenue ($ in millions) Financial Overview: Revenue and Average Net Finance Receivables Average Net Finance Receivables ($ in millions) Total Revenue and Interest & Fee Yields *See appendix for glossary (1) Hurricane impact represents the unfavorable impact from hurricane activity on total revenue yield in 3Q 24 12

Reflects the impact of government stimulus Financial Overview: Credit Portfolio credit quality and performance has improved in 2024; higher-quality originations in the front book make up a larger portion of portfolio, continue to perform in line with expectations, and are delivering at lower loss levels than stressed back book vintages Net credit loss rate peaked in 2023, with gradual improvements in 2024; expect continued improvement in portfolio quality and credit loss performance in 2025 3Q 24 delinquency of 6.9% improved 40 basis points from 3Q 23 3Q 24 30+ delinquency was inclusive of an estimated 40 basis point benefit from special borrower assistance programs related to hurricane activity and an estimated 20 basis point negative impact from growth in higher-margin small loan business 30+ days past due of $126.0 million compares favorably to loan loss reserves of $192.1 million as of 3Q 24 3Q 24 net credit loss rate of 10.6%, down 40 basis points from 3Q 23, is inclusive of an estimated 30 basis point negative impact from growth in higher-margin small loan business 13 (1) Loan sale impacts – increase/(decrease) represents the unfavorable impact on the net credit loss rate in 4Q 22 and 4Q 23, and the estimated favorable impact in 1Q 23 and 1Q 24 Reflects the impact of government stimulus

Financial Overview: Credit (Front Book 86% of Total Portfolio) 14 Higher-credit-quality ENR from the front book is performing as expected and becoming a larger portion of the portfolio Front book was 86% of the total portfolio, an increase from 83% as of June 30, 2024 Front book was 81% of the 30+ delinquent loan receivables Front and back book delinquencies were 6.5% and 10.0%, respectively; front book continues to mature Loans from the back book represent 17% of 30+ delinquent loan receivables as of September 30, 2024; back book loans are expected to represent only 8% to 10% of the total portfolio by the end of 2024 Front and back book loan loss reserves were 84% and 15% of total loan loss reserves, respectively Front and back book loan loss reserve rates* were 10.2% and 13.4%, respectively Total delinquency over 30 days was 6.9% Total portfolio loan loss reserve rate was 10.6% *See appendix for glossary Reserved at 13.4% Reserved at 10.2% 30+ DQ at 6.5% 30+ DQ at 10.0% $1,820 $126 (1) $192 (2) Reserved at 6.9% 30+ DQ at 8.1%

Financial Overview: Continued Focus on Operating Leverage & Expense Control G&A expense increased only $0.4 million, or 0.6%, from 3Q 23, while the operating expense ratio decreased 50 basis points due to continued disciplined expense management 3Q 24 year-over-year total revenue growth outpaced G&A expense growth by 15.0x Operating Expense ($ in millions) Operating Expense Ratio ($ in millions) 15

Financial Overview: Key Financial Results In millions In millions Net Income In millions Challenging macroeconomic conditions have impacted recent returns and profitability levels Continued growth in account base and portfolio in controlled and profitable manner 3Q 24 year-over-year total revenue growth outpaced G&A expense growth by 15.0x Enhanced prequalification capabilities and tighter integration with digital affiliate partners drive better digital leads Digital initiatives, new state expansion, and new product development have driven strong growth 16

3Q 24 Highlights *See appendix for glossary 557,400 Customer Accounts Up 5.1% YoY $1.82 billion Net Finance Receivables Up 3.9% YoY $426 million Origination Volume Up 0.3% YoY 13.9% Operating Expense Ratio* Down 50 basis points YoY 29.9% Interest and Fee Yield* Up 90 basis points YoY 6.9% 30+ Delinquencies 10.6% Net Credit Loss Rate* Down 40 basis points YoY 1.7% Return on Assets* $0.76 Diluted Earnings Per Share Inclusive of estimated hurricane impacts of $0.42 per share 3.7% Dividend Yield* 3Q 24 $0.30 dividend per share $482 million Unused Capacity Substantial bandwidth to fund growth 82% Fixed-Rate Debt Weighted-average revolving duration of 1.1 years 17

As of September 30, 2024, total unused capacity was $482 million(1) (subject to borrowing base) Available liquidity of $155 million as of September 30, 2024 Fixed-rate debt represented 82% of total debt as of September 30, 2024, with a weighted-average coupon of 4.3% and a weighted-average revolving duration of 1.1 years Strong Funding Profile Unused Debt Capacity ($ in millions) Fixed vs. Variable Debt Funded Debt Ratios (1) Unused capacity increased by $50 million on October 3, 2024 (2) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure *See appendix for glossary (1) 18 In November 2024, the company paid off its RMIT 2022-2B securitization with proceeds from the closing of a new $250 million securitization transaction. The new RMIT 2024-2 securitization has a 2-year revolving period and a weighted-average coupon of 5.34%.

Long-Term, Sustainable, and Profitable Growth Geographic Expansion Accelerated Innovation Product and Channel Expansion Identified states with favorable economics for expansion Continue to identify opportunities to optimize branch network within existing footprint Continue to drive scale using centralized originations and servicing Deploy new technology to further omni-channel experience Leverage data and analytics to improve credit underwriting, customer acquisition and retention, and back-office capabilities Execute on distribution of larger auto-secured loans, higher-margin small loans, and end-to-end digital originations Assess new product offerings in the marketplace National scale should enable additional strategic partnerships 19

Appendix

3Q 24 Results and Outlook 21 Prior to discrete items, such as any tax impacts of equity compensation Key Metrics 3Q 24 Results 4Q 24 Outlook ENR Growth $46.0 million ~$65.0 - $70.0 million ANR Growth $44.0 million ~$63.5 million Total Revenue Yield 10 basis points sequential decrease ~60 basis points sequential increase Net Credit Losses $47.6 million ~$50.5 million Reserves as % of ENR 10.6% ~10.5% G&A Expense $62.5 million ~$65.5 million Interest Expense $19.4 million ~$20.5 million Effective Tax Rate 24.6% ~24.5%(1)

Non-GAAP Financial Measures In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), this presentation contains certain non-GAAP financial measures. The company’s management utilizes non-GAAP measures as additional metrics to aid in, and enhance, its understanding of the company’s financial results. Capital generation, including capital return, is a non-GAAP measure that adjusts GAAP measures to add back dividends and stock repurchases to equity. Management uses this capital measure to evaluate capital generation and return of capital to shareholders. Tangible equity and funded debt-to-tangible equity ratio are non-GAAP measures that adjust GAAP measures to exclude intangible assets. Management uses these equity measures to evaluate and manage the company’s capital and leverage position. The company also believes that these equity measures are commonly used in the financial services industry and provide useful information to users of the company’s financial statements in the evaluation of its capital and leverage position. As a result, the company believes that the non-GAAP measures that it has presented will allow for a better evaluation of the operating performance of the business. This non-GAAP financial information should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. In addition, the company’s non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies. The following tables provide a reconciliation of GAAP measures to non-GAAP measures. 22

Glossary 23 ANR – average net finance receivables Back book – loans originated from 4Q 21 to 3Q 22 and all delinquent renewals associated with loans originated prior to 4Q 22 Cost of funds – annualized interest expense as a percentage of average net finance receivables Debt balance – the balance for each respective debt agreement, composed of principal balance and accrued interest Dividend yield – annualized dividends per share divided by the closing share price as of the last day of the quarter DQ % – delinquent loans outstanding as a percentage of ending net finance receivables Efficiency ratio – total G&A expenses divided by total revenue ENR – ending net finance receivables Front book – loans originated during or after 4Q 22 excluding delinquent renewals associated with loans originated prior to 4Q 22 Funded debt ratio – total debt divided by total assets Interest and fee yield – annualized interest and fee income as a percentage of average net finance receivables Loan loss reserve rate – loan loss reserves as a percentage of ending net finance receivables Loan sale (“LS”) impacts – the unfavorable impacts of the loan sales on net credit loss rates in 4Q 22 and 4Q 23 and the estimated favorable impacts to 1Q 23 and 1Q 24 Net credit loss rate – annualized net credit losses as a percentage of average net finance receivables Operating expense ratio – annualized general and administrative expenses as a percentage of average net finance receivables Other book – loans originated prior to 4Q 21 Return on assets (ROA) – annualized net income as a percentage of average total assets Return on equity (ROE) – annualized net income as a percentage of average stockholders’ equity Total revenue yield – annualized total revenue as a percentage of average net finance receivables WAC – weighted-average coupon

v3.24.3

Document And Entity Information

|

Dec. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2024

|

| Entity Registrant Name |

Regional Management Corp.

|

| Entity Central Index Key |

0001519401

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35477

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

57-0847115

|

| Entity Address, Address Line One |

979 Batesville Road, Suite B

|

| Entity Address, City or Town |

Greer

|

| Entity Address, State or Province |

SC

|

| Entity Address, Postal Zip Code |

29651

|

| City Area Code |

(864)

|

| Local Phone Number |

448-7000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

RM

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

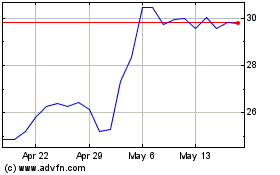

Regional Management (NYSE:RM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Regional Management (NYSE:RM)

Historical Stock Chart

From Jan 2024 to Jan 2025