0001929561FALSE00019295612023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

RXO, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-41514 | 88-2183384 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

| 11215 North Community House Road | 28277 |

Charlotte, NC |

| (Address of principal executive offices) | (Zip Code) |

(980) 308-6058

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.01 per share | | RXO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2023, RXO, Inc. (the “Company”) issued a press release announcing its results of operations for the fiscal quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 7.01. Regulation FD Disclosure.

On November 7, 2023, the Company released a slide presentation related to its results of operations for the fiscal quarter ended September 30, 2023. A copy of this slide presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The slide presentation should be read together with the Company’s filings with the Securities and Exchange Commission, including the Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023 once available.

The information furnished in Items 2.02 and 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: November 7, 2023 | RXO, INC. | |

| | |

| By: | /s/ James E. Harris | |

| | James E. Harris | |

| | Chief Financial Officer | |

Exhibit 99.1

RXO Announces Results for Third-Quarter 2023, Including 18 Percent Brokerage Volume Growth

•Full-truckload brokerage volume increased 13 percent year-over-year and less-than-truckload volume increased 55 percent year-over-year

•Momentum in RXO's brokerage business accelerated as the quarter progressed; set multiple brokerage records in the quarter including total volume, quarterly loads per day and monthly loads per day

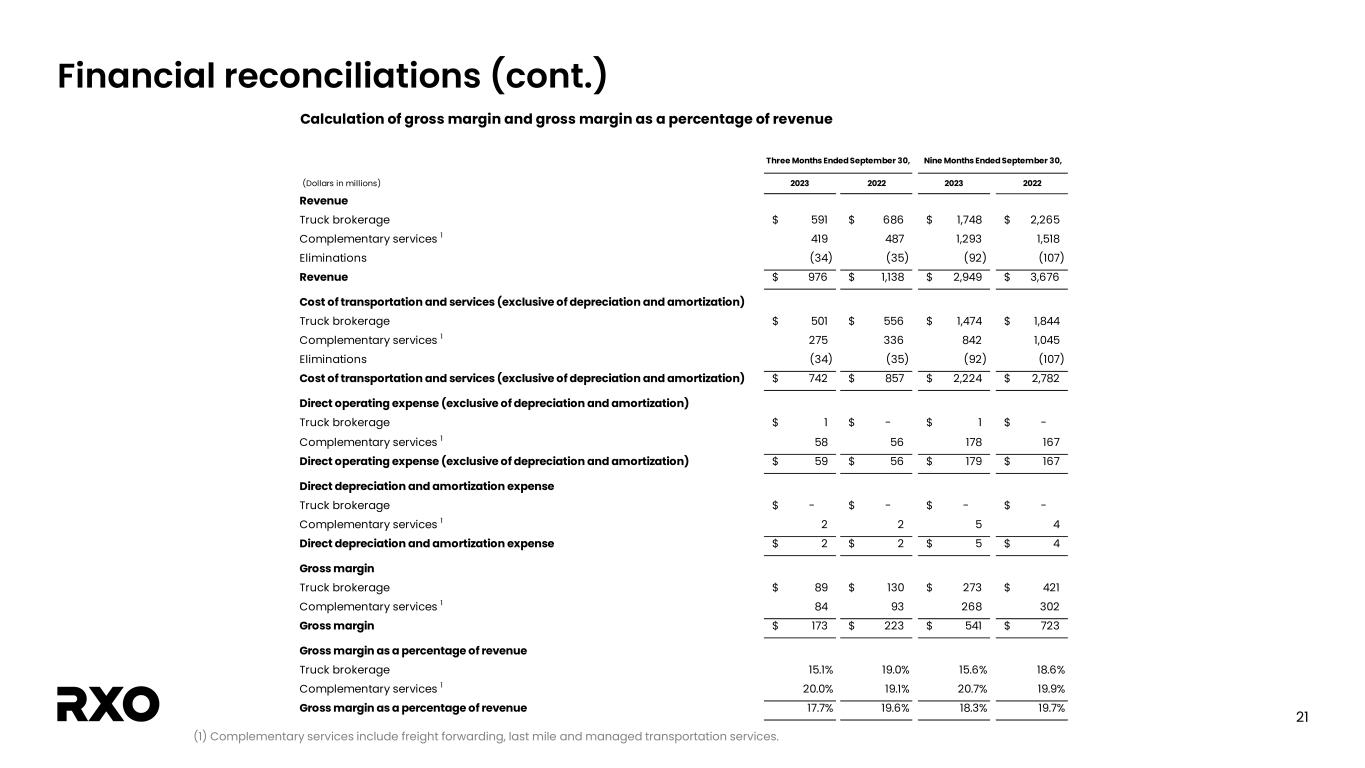

•Companywide gross margin of 17.7 percent; brokerage gross margin of 15.1 percent

CHARLOTTE, N.C. — November 7, 2023 — RXO (NYSE: RXO) today announced its financial results for the third quarter of 2023.

Drew Wilkerson, chief executive officer of RXO, said, “RXO continued to execute well in the third quarter. We achieved a record number of loads per day in our brokerage business and grew brokerage volume by double-digits for the second consecutive quarter. Brokerage gross margin remained strong. Our experienced team, our deep customer relationships, and continued adoption of our cutting-edge, AI-enabled technology all contributed to our results.

“While RXO’s results improved as the third quarter progressed, the market remains soft and we’re monitoring the freight markets closely. We’ll continue to follow our playbook of taking profitable market share while controlling costs and making strategic investments in our business,” Wilkerson said. “In the third quarter, we onboarded new brokerage employees and made significant tech investments. We believe this will enable RXO to continue to achieve outsized growth when the market inflects. RXO is uniquely positioned to outperform.”

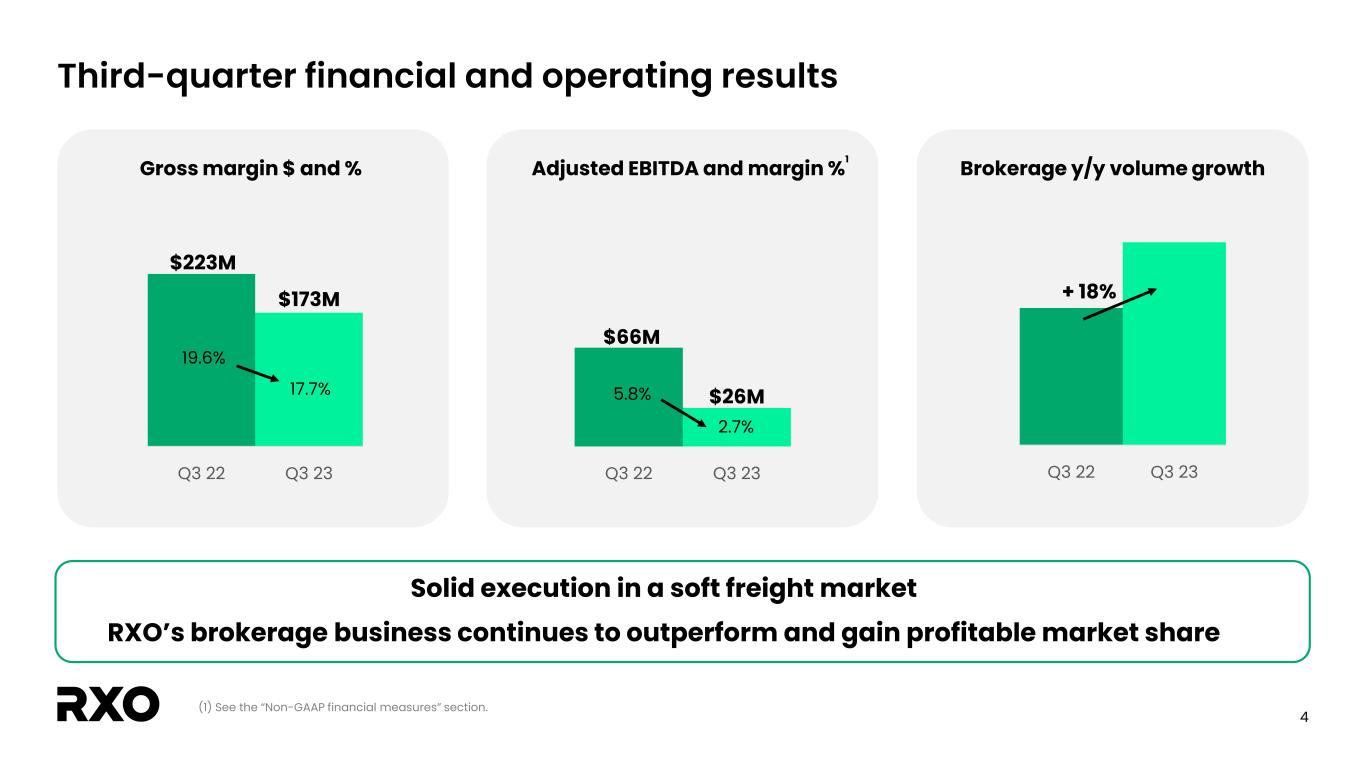

Companywide Results

The company’s revenue was $1.0 billion for the third quarter, compared to $1.1 billion in the third quarter of 2022. Gross margin was 17.7 percent, compared to 19.6 percent in the third quarter of 2022.

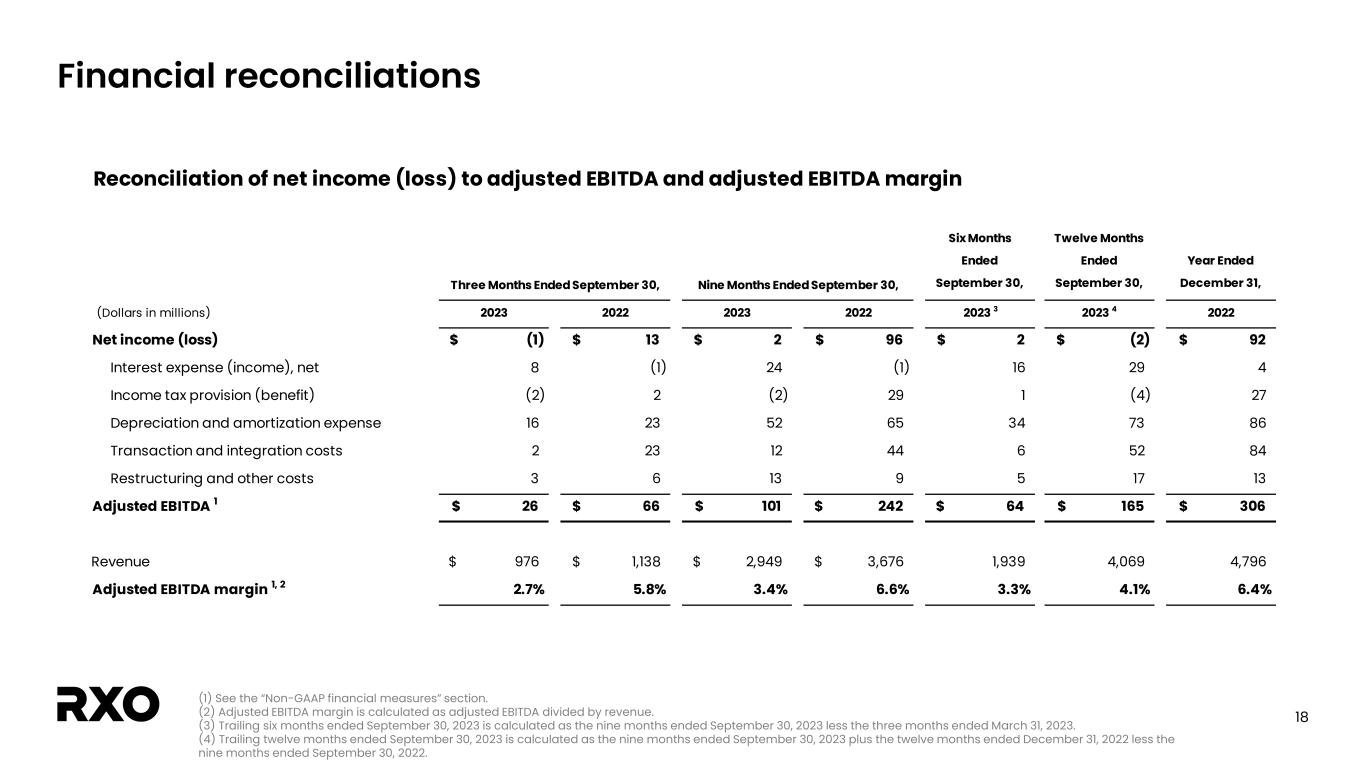

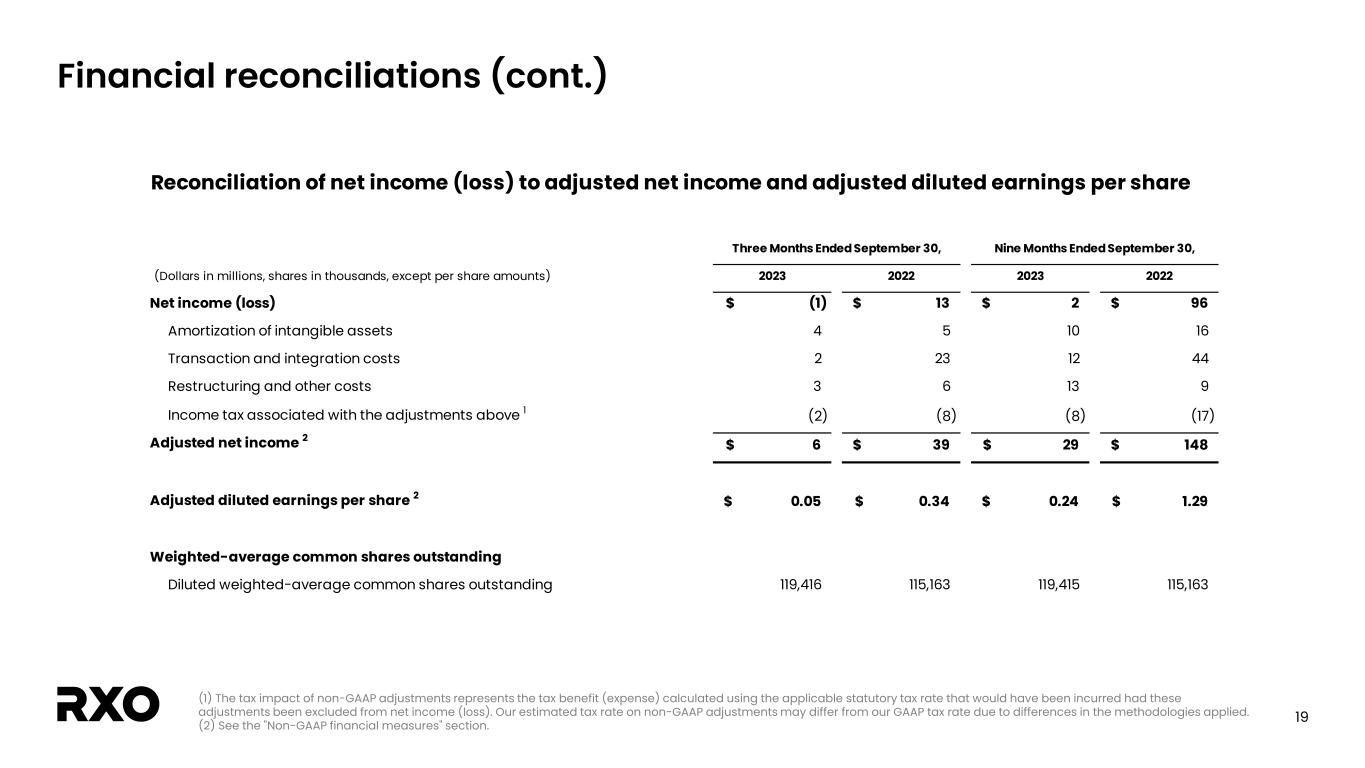

The company reported a third-quarter 2023 GAAP net loss of $1 million, compared to net income of $13 million in the third quarter of 2022. The GAAP net loss included $5 million in transaction, integration, restructuring and other costs. Adjusted net income1 in the quarter was $6 million, compared to $39 million in the third quarter of 2022.

Adjusted EBITDA1 was $26 million, compared to $66 million in the third quarter of 2022. Adjusted EBITDA margin1 was 2.7 percent, compared to 5.8 percent in the third quarter of 2022.

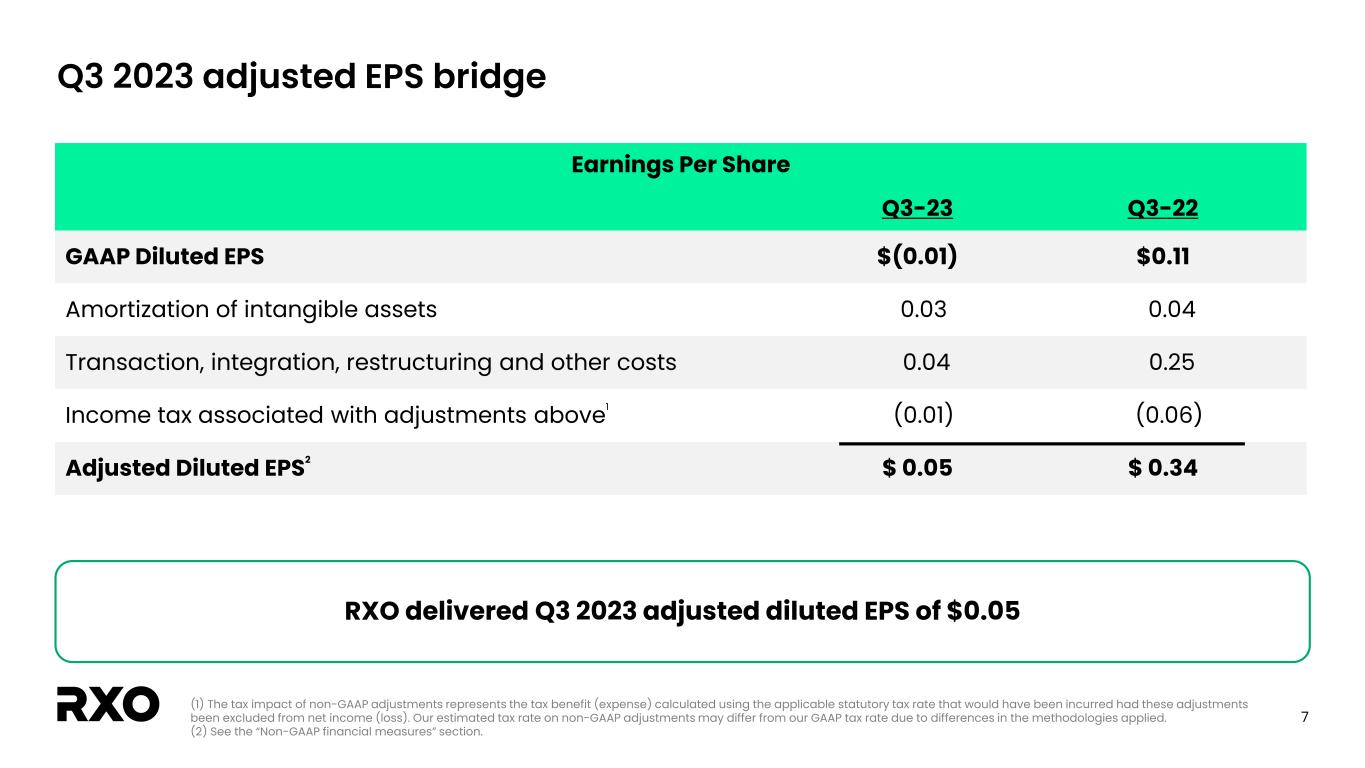

Transaction, integration, restructuring and other costs, and amortization of intangibles, impacted GAAP earnings per share by $0.06, net of tax. For the third quarter, RXO reported a GAAP diluted loss per share of $0.01. Adjusted diluted earnings per share1 were $0.05.

RXO 3Q 2023 Earnings Press Release | 1

Brokerage

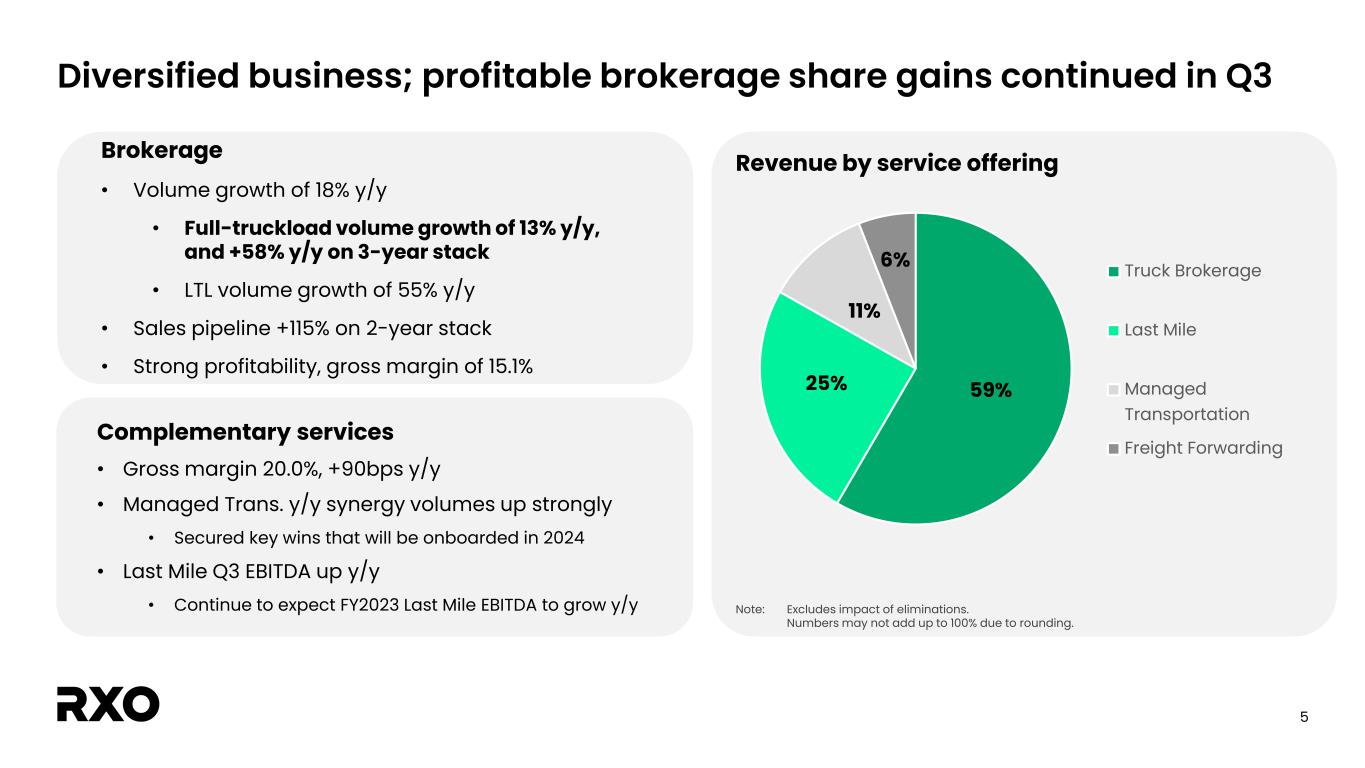

RXO’s brokerage business grew volume 18 percent year-over-year in the third quarter. Brokerage gross margin was 15.1 percent in the third quarter.

Brokerage contract volume increased by 30 percent year-over-year in the third quarter, the result of a strong brokerage sales pipeline, which has increased in size by 115 percent since the third quarter of 2021.

The company expects brokerage volumes to continue to grow on a year-over-year basis in the fourth quarter of 2023.

Complementary Services

RXO’s complementary services gross margin was 20.0% for the quarter, up 90 basis points year-over-year. Loads provided by RXO’s managed transportation business to its brokerage business increased both year-over-year and quarter-over-quarter.

RXO’s last mile business grew EBITDA year-over-year in the third quarter, and the company continues to expect to grow full-year last mile EBITDA year-over-year.

Technology Update

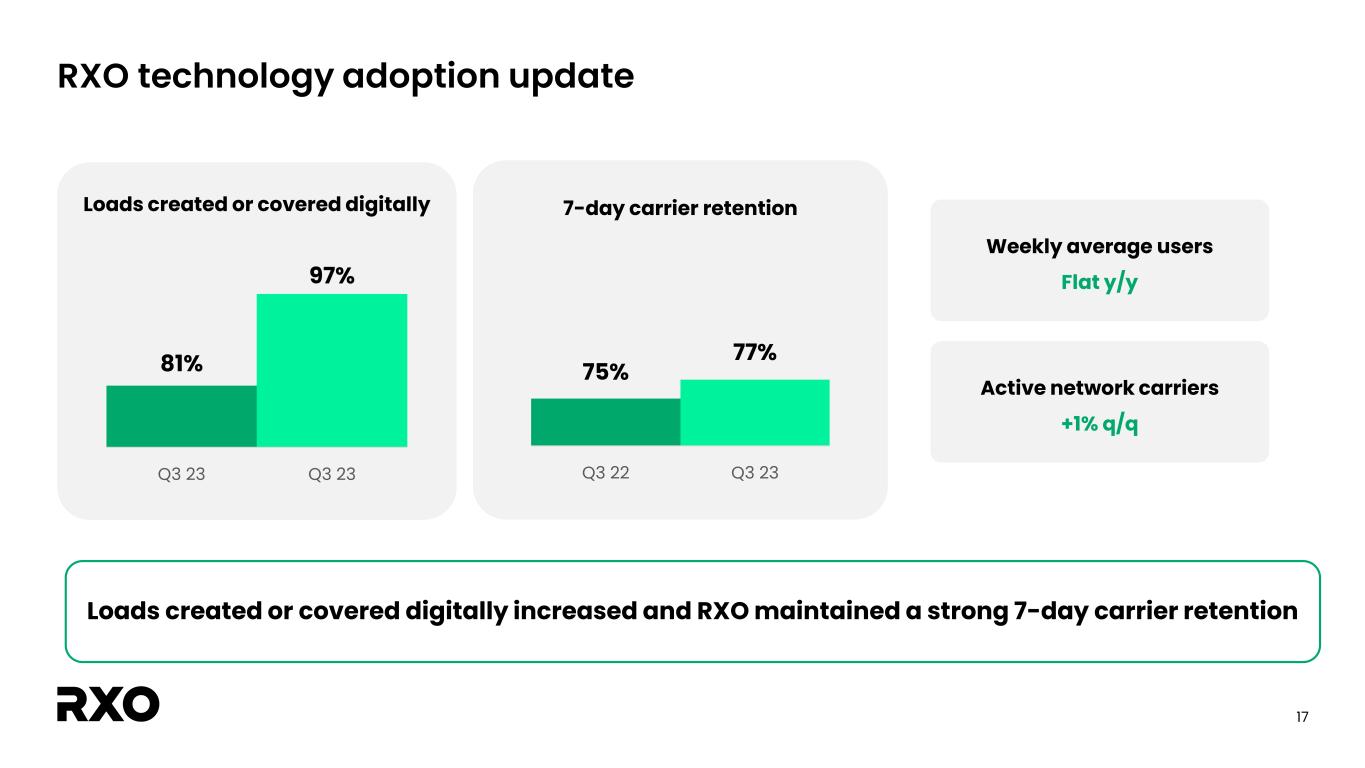

In the third quarter of 2023, 97 percent of RXO’s brokerage loads were created or covered digitally using RXO’s cutting-edge technology platform, up from 81 percent in the third quarter of 2022.

The seven-day carrier retention rate was 77 percent, compared to 75 percent in the third quarter of 2022.

Optimized Capital Structure

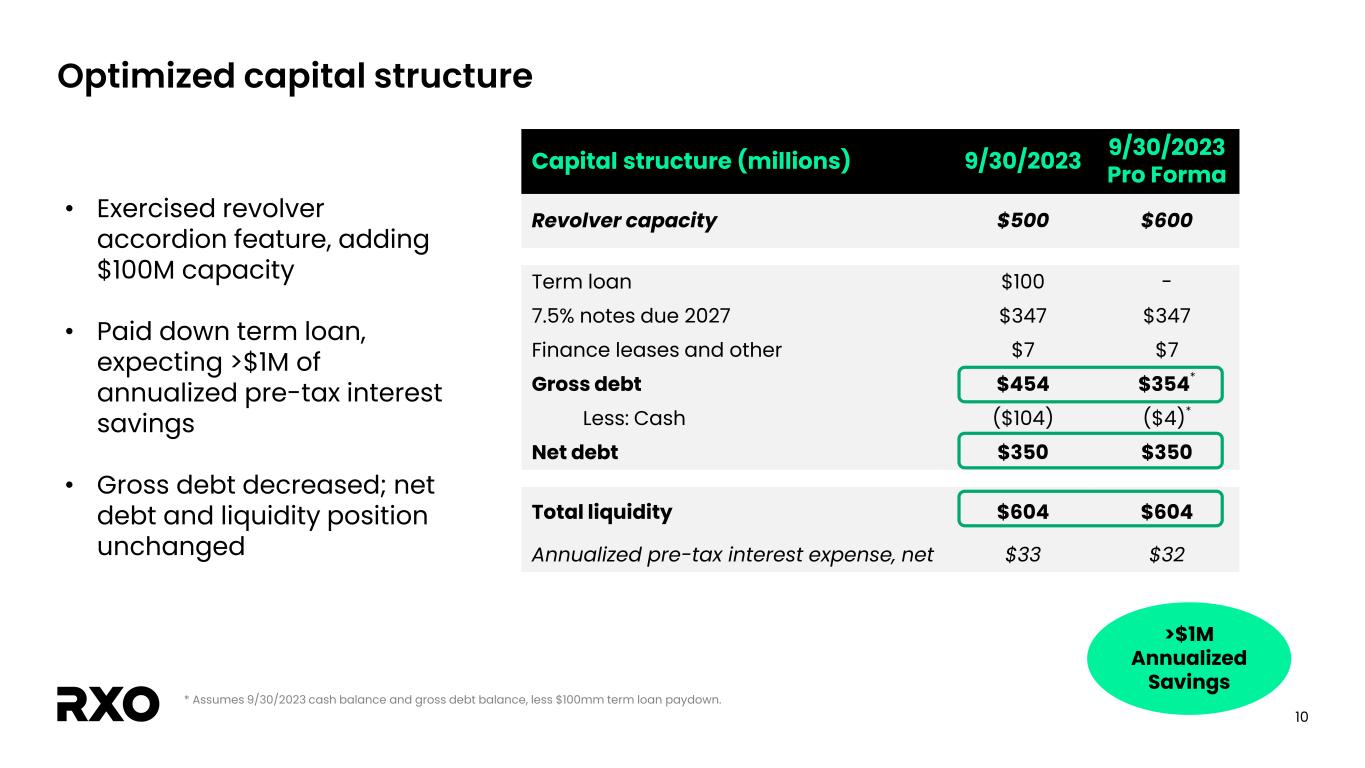

In early November, RXO exercised a feature under its Revolving Credit Agreement that increased total commitments from $500 million to $600 million. RXO simultaneously repaid all outstanding obligations under its Term Loan Credit Agreement. These transactions have no impact to the company’s net debt and liquidity and are expected to save the company more than $1 million per year in pre-tax interest expense.

Conference Call

The company will hold a conference call and webcast on Tuesday, November 7 at 8 a.m. Eastern Standard Time. Participants can call in toll-free (from U.S./Canada) at 1-888-259-6580; international callers dial +1-206-962-3782. The conference ID is 11616211.

A live webcast of the conference call will be available on the investor relations area of the company’s website, http://investors.rxo.com. A replay of the conference call will be available through November 7, 2024, by calling toll-free (from U.S./Canada) 1-877-674-7070; international callers dial +1-416-764-8692. Use the passcode 616211#. Additionally, the call will be archived on http://investors.rxo.com.

About RXO

RXO (NYSE: RXO) is a leading provider of asset-light transportation solutions. RXO offers tech-enabled truck brokerage services together with complementary solutions including managed transportation, freight forwarding and last mile delivery. The company combines massive capacity and cutting-edge technology to move freight efficiently through supply chains. RXO’s proprietary technology connects approximately 10,000 customers with over 100,000 independent carriers across North America. The company is headquartered in Charlotte, N.C. Visit RXO.com for more information and connect with RXO on Facebook, X, LinkedIn, Instagram and YouTube.

1 For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

RXO 3Q 2023 Earnings Press Release | 2

Media Contact

Erin Kelly

erin.kelly@rxo.com

Investor Contact

Kevin Sterling

kevin.sterling@rxo.com

RXO 3Q 2023 Earnings Press Release | 3

Non-GAAP Financial Measures

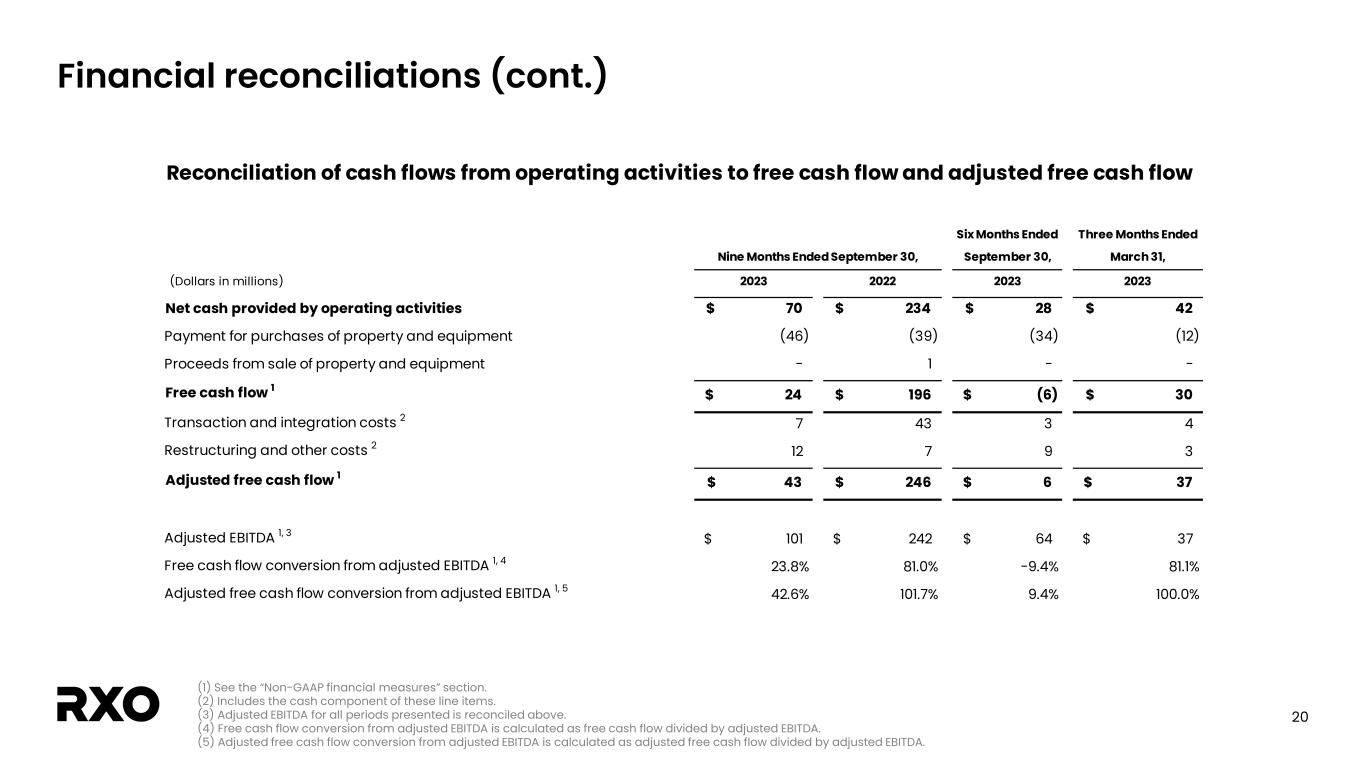

We provide reconciliations of the non-GAAP financial measures contained in this release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

The non-GAAP financial measures in this release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”); adjusted EBITDA margin; and adjusted net income and adjusted diluted earnings per share (“adjusted EPS”).

We believe that these adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not reflect, or are unrelated to, RXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating RXO’s ongoing performance.

We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments that management has determined do not reflect our core operating activities and thereby assist investors with assessing trends in our underlying business. We believe that adjusted net income and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs that management has determined do not reflect our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables, and thereby may assist investors with comparisons to prior periods and assessing trends in our underlying business.

Forward-looking Statements

This release includes forward-looking statements, including statements relating to our continued year-over-year brokerage volume growth in the fourth quarter of 2023. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "predict," "should," "will," "expect," "project," "forecast," "goal," "outlook," "target,” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: competition and pricing pressures; economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID-19 pandemic and government responses to the COVID-19 pandemic; fluctuations in fuel prices; increased carrier prices; severe weather, natural disasters, terrorist attacks or similar incidents that cause material disruptions to our operations or the operations of the third-party carriers and independent contractors with which we contract; our dependence on third-party carriers and independent contractors; labor disputes or organizing efforts affecting our workforce and those of our third-party carriers; legal and regulatory challenges to the status of the third-party carriers with which we contract, and their delivery workers, as independent contractors, rather than employees; litigation that may adversely affect our business or reputation; increasingly stringent laws protecting the environment, including transitional risks relating to climate change, that impact our third-party carriers; governmental regulation and political conditions; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; the impact of potential cyber-attacks and information technology or data security breaches; issues related to our intellectual property rights; our ability to access the capital markets and generate sufficient cash flow to satisfy our debt obligations; our ability to attract and retain qualified personnel; our ability to successfully implement our cost and revenue initiatives and other strategies; our ability to successfully manage our growth; our reliance on certain large customers for a significant portion of our revenue; damage to our reputation through unfavorable publicity; our failure to meet performance levels required by our contracts with our customers; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; a determination by the IRS that the distribution or certain related separation transactions should be treated as taxable transactions; and the impact of the separation on our businesses, operations and results. All forward-looking

RXO 3Q 2023 Earnings Press Release | 4

statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

RXO 3Q 2023 Earnings Press Release | 5

RXO, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in millions, shares in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 976 | | | $ | 1,138 | | | $ | 2,949 | | | $ | 3,676 | |

| Cost of transportation and services (exclusive of depreciation and amortization) | | 742 | | | 857 | | | 2,224 | | | 2,782 | |

| Direct operating expense (exclusive of depreciation and amortization) | | 59 | | | 56 | | | 179 | | | 167 | |

| Sales, general and administrative expense | | 148 | | | 158 | | | 445 | | | 485 | |

| Depreciation and amortization expense | | 16 | | | 23 | | | 52 | | | 65 | |

| Transaction and integration costs | | 2 | | | 23 | | | 12 | | | 44 | |

| Restructuring costs | | 3 | | | 6 | | | 12 | | | 9 | |

| Operating income | | $ | 6 | | | $ | 15 | | | $ | 25 | | | $ | 124 | |

| Other expense | | 1 | | | 1 | | | 1 | | | — | |

| | | | | | | | |

| Interest expense (income), net | | 8 | | | (1) | | | 24 | | | (1) | |

| Income (loss) before income taxes | | $ | (3) | | | $ | 15 | | | $ | — | | | $ | 125 | |

| Income tax provision (benefit) | | (2) | | | 2 | | | (2) | | | 29 | |

| Net income (loss) | | $ | (1) | | | $ | 13 | | | $ | 2 | | | $ | 96 | |

| | | | | | | | |

| Earnings (loss) per share data | | | | | | | | |

| Basic earnings (loss) per share | | $ | (0.01) | | | $ | 0.11 | | | $ | 0.02 | | | $ | 0.83 | |

| Diluted earnings (loss) per share | | $ | (0.01) | | | $ | 0.11 | | | $ | 0.02 | | | $ | 0.83 | |

| | | | | | | | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic weighted-average common shares outstanding | | 116,970 | | 115,163 | | 116,823 | | 115,163 |

| Diluted weighted-average common shares outstanding | | 116,970 | | 115,163 | | 119,415 | | 115,163 |

RXO 3Q 2023 Earnings Press Release | 6

RXO, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| (Dollars in millions, shares in thousands, except per share amounts) | | 2023 | | 2022 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 104 | | | $ | 98 | |

| Accounts receivable, net of allowances of $10 and $13, respectively | | 787 | | | 900 | |

| Other current assets | | 45 | | | 31 | |

| Total current assets | | 936 | | | 1,029 | |

| Long-term assets | | | | |

| Property and equipment, net of $281 and $241 in accumulated depreciation, respectively | | 122 | | | 119 | |

| Operating lease assets | | 173 | | | 159 | |

| Goodwill | | 630 | | | 630 | |

| Identifiable intangible assets, net of $116 and $106 in accumulated amortization, respectively | | 72 | | | 79 | |

| Other long-term assets | | 13 | | | 15 | |

| Total long-term assets | | 1,010 | | | 1,002 | |

| Total assets | | $ | 1,946 | | | $ | 2,031 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 448 | | | $ | 501 | |

| Accrued expenses | | 221 | | | 256 | |

| Current maturities of long-term debt | | 3 | | | 4 | |

| Short-term operating lease liabilities | | 50 | | | 48 | |

| Other current liabilities | | 6 | | | 14 | |

| Total current liabilities | | 728 | | | 823 | |

| Long-term liabilities | | | | |

| Long-term debt and obligations under finance leases | | 451 | | | 451 | |

| Deferred tax liability | | 15 | | | 16 | |

| Long-term operating lease liabilities | | 125 | | | 114 | |

| Other long-term liabilities | | 37 | | | 40 | |

| Total long-term liabilities | | 628 | | | 621 | |

| Commitments and Contingencies | | | | |

| Equity | | | | |

| Preferred stock, $0.01 par value; 10,000 shares authorized; 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | | — | | | — | |

| Common stock, $0.01 par value; 300,000 shares authorized; 117,002 and 116,400 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | 1 | | | 1 | |

| Additional paid-in capital | | 589 | | | 588 | |

| Retained earnings | | 4 | | | 2 | |

| | | | |

| Accumulated other comprehensive loss | | (4) | | | (4) | |

| Total equity | | 590 | | | 587 | |

| Total liabilities and equity | | $ | 1,946 | | | $ | 2,031 | |

RXO 3Q 2023 Earnings Press Release | 7

RXO, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| (In millions) | | 2023 | | 2022 |

| Operating activities | | | | |

| Net income | | $ | 2 | | | $ | 96 | |

| Adjustments to reconcile net income to net cash from operating activities | | | | |

| Depreciation and amortization expense | | 52 | | | 65 | |

| Stock compensation expense | | 16 | | | 9 | |

| Deferred tax benefit | | (1) | | | (8) | |

| Other | | 4 | | | 6 | |

| Changes in assets and liabilities | | | | |

| Accounts receivable | | 114 | | | (10) | |

| Other assets | | (13) | | | 12 | |

| Accounts payable | | (56) | | | 25 | |

| Accrued expenses and other liabilities | | (48) | | | 39 | |

| | | | |

| Net cash provided by operating activities | | 70 | | | 234 | |

| Investing activities | | | | |

| Payment for purchases of property and equipment | | (46) | | | (39) | |

| Proceeds from sale of property and equipment | | — | | | 1 | |

| Other | | (1) | | | — | |

| Net cash used in investing activities | | (47) | | | (38) | |

| Financing activities | | | | |

| Payment for tax withholdings related to vesting of stock compensation awards | | (12) | | | — | |

| Repurchase of common stock | | (2) | | | — | |

| Net transfers to XPO | | — | | | (39) | |

| Repayment of debt and finance leases | | (3) | | | — | |

| Other | | — | | | 1 | |

| Net cash used in financing activities | | (17) | | | (38) | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | | — | | | — | |

| Net increase in cash, cash equivalents and restricted cash | | 6 | | | 158 | |

| Cash, cash equivalents, and restricted cash, beginning of period | | 98 | | | 29 | |

| Cash, cash equivalents, and restricted cash, end of period | | $ | 104 | | | $ | 187 | |

| Supplemental disclosure of cash flow information: | | | | |

| Leased assets obtained in exchange for new operating lease liabilities | | $ | 60 | | | $ | 46 | |

| Leased assets obtained in exchange for new finance lease liabilities | | 1 | | | 8 | |

| Cash paid for income taxes, net | | 25 | | | 3 | |

| Cash paid for interest, net | | 18 | | | — | |

RXO 3Q 2023 Earnings Press Release | 8

RXO, Inc.

Revenue Disaggregated by Service Offering

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Truck brokerage | | $ | 591 | | $ | 686 | | $ | 1,748 | | $ | 2,265 |

| Last mile | | 256 | | 264 | | 757 | | 784 |

| Managed transportation | | 107 | | 122 | | 336 | | 394 |

| Freight forwarding | | 56 | | 101 | | 200 | | 340 |

| Eliminations | | (34) | | (35) | | (92) | | (107) |

| Total | | $ | 976 | | $ | 1,138 | | $ | 2,949 | | $ | 3,676 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

RXO 3Q 2023 Earnings Press Release | 9

RXO, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA Margin

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Net Income (Loss) to Adjusted EBITDA | | | | | | | | |

| Net income (loss) | | $ | (1) | | | $ | 13 | | | $ | 2 | | | $ | 96 | |

| Interest expense (income), net | | 8 | | | (1) | | | 24 | | | (1) | |

| Income tax provision (benefit) | | (2) | | | 2 | | | (2) | | | 29 | |

| Depreciation and amortization expense | | 16 | | | 23 | | | 52 | | | 65 | |

| Transaction and integration costs | | 2 | | | 23 | | | 12 | | | 44 | |

| Restructuring and other costs | | 3 | | | 6 | | | 13 | | | 9 | |

| | | | | | | | |

| | | | | | | | |

Adjusted EBITDA (1) | | $ | 26 | | | $ | 66 | | | $ | 101 | | | $ | 242 | |

| | | | | | | | |

| Revenue | | $ | 976 | | | $ | 1,138 | | | $ | 2,949 | | | $ | 3,676 | |

Adjusted EBITDA margin (1) (2) | | 2.7% | | 5.8% | | 3.4% | | 6.6% |

(1)See the “Non-GAAP Financial Measures” section of the press release.

(2)Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Revenue.

RXO 3Q 2023 Earnings Press Release | 10

RXO, Inc.

Reconciliation of Net Income (Loss) to Adjusted Net Income and Adjusted Diluted Earnings Per Share

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in millions, shares in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Net Income (Loss) to Adjusted Net Income and Adjusted Diluted Earnings Per Share | | | | | | | | |

| Net income (loss) | | $ | (1) | | | $ | 13 | | | $ | 2 | | | $ | 96 | |

| Amortization of intangible assets | | 4 | | | 5 | | | 10 | | | 16 | |

| Transaction and integration costs | | 2 | | | 23 | | | 12 | | | 44 | |

| Restructuring and other costs | | 3 | | | 6 | | | 13 | | | 9 | |

| | | | | | | | |

Income tax associated with adjustments above (1) | | (2) | | | (8) | | | (8) | | | (17) | |

| | | | | | | | |

Adjusted net income (2) | | $ | 6 | | | $ | 39 | | | $ | 29 | | | $ | 148 | |

| | | | | | | | |

Adjusted diluted earnings per share (2) | | $ | 0.05 | | | $ | 0.34 | | | $ | 0.24 | | | $ | 1.29 | |

| | | | | | | | |

| Weighted-average shares outstanding | | | | | | | | |

| Diluted weighted-average shares outstanding | | 119,416 | | 115,163 | | 119,415 | | 115,163 |

(1)The tax impact of non-GAAP adjustments represents the tax benefit (expense) calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net income (loss). Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied.

(2)See the “Non-GAAP Financial Measures” section of the press release.

RXO 3Q 2023 Earnings Press Release | 11

RXO, Inc.

Calculation of Gross Margin and Gross Margin as a Percentage of Revenue

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Truck brokerage | | $ | 591 | | $ | 686 | | $ | 1,748 | | $ | 2,265 |

Complementary services (1) | | 419 | | 487 | | 1,293 | | 1,518 |

| Eliminations | | (34) | | (35) | | (92) | | (107) |

| Revenue | | $ | 976 | | $ | 1,138 | | $ | 2,949 | | $ | 3,676 |

| | | | | | | | |

| Cost of transportation and services (exclusive of depreciation and amortization) | | | | | | | | |

| Truck brokerage | | $ | 501 | | $ | 556 | | $ | 1,474 | | $ | 1,844 |

Complementary services (1) | | 275 | | 336 | | 842 | | 1,045 |

| Eliminations | | (34) | | (35) | | (92) | | (107) |

| Cost of transportation and services (exclusive of depreciation and amortization) | | $ | 742 | | $ | 857 | | $ | 2,224 | | $ | 2,782 |

| | | | | | | | |

| Direct operating expense (exclusive of depreciation and amortization) | | | | | | | | |

| Truck brokerage | | $ | 1 | | $ | — | | $ | 1 | | $ | — |

Complementary services (1) | | 58 | | 56 | | 178 | | 167 |

| Direct operating expense (exclusive of depreciation and amortization) | | $ | 59 | | $ | 56 | | $ | 179 | | $ | 167 |

| | | | | | | | |

| Direct depreciation and amortization expense | | | | | | | | |

| Truck brokerage | | $ | — | | $ | — | | $ | — | | $ | — |

Complementary services (1) | | 2 | | 2 | | 5 | | 4 |

| Direct depreciation and amortization expense | | $ | 2 | | $ | 2 | | $ | 5 | | $ | 4 |

| | | | | | | | |

| Gross margin | | | | | | | | |

| Truck brokerage | | $ | 89 | | $ | 130 | | $ | 273 | | $ | 421 |

Complementary services (1) | | 84 | | 93 | | 268 | | 302 |

| Gross margin | | $ | 173 | | $ | 223 | | $ | 541 | | $ | 723 |

| | | | | | | | |

| Gross margin as a percentage of revenue | | | | | | | | |

| Truck brokerage | | 15.1 | % | | 19.0 | % | | 15.6 | % | | 18.6 | % |

Complementary services (1) | | 20.0 | % | | 19.1 | % | | 20.7 | % | | 19.9 | % |

| Gross margin as a percentage of revenue | | 17.7 | % | | 19.6 | % | | 18.3 | % | | 19.7 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)Complementary services include freight forwarding, last mile and managed transportation services.

RXO 3Q 2023 Earnings Press Release | 12

Third Quarter 2023 Results November 7, 2023

2 Non-GAAP financial measures and forward-looking statements Non-GAAP financial measures We provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this presentation. The non-GAAP financial measures in this presentation include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”); adjusted EBITDA margin; free cash flow and free cash flow as a percentage of adjusted EBITDA (“free cash flow conversion”); adjusted free cash flow and adjusted free cash flow as a percentage of adjusted EBITDA (“adjusted free cash flow conversion”); net debt, gross leverage and net leverage; and adjusted net income and adjusted diluted earnings per share (“adjusted diluted EPS”). We believe that these adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not reflect, or are unrelated to, RXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted diluted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating RXO’s ongoing performance. We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments that management has determined do not reflect our core operating activities and thereby assist investors with assessing trends in our underlying business. We believe that adjusted net income and adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs that management has determined do not reflect our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables, and thereby may assist investors with comparisons to prior periods and assessing trends in our underlying business. We believe that free cash flow, free cash flow conversion, adjusted free cash flow and adjusted free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value, and may assist investors with assessing trends in our underlying business. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We define adjusted free cash flow as free cash flow less cash paid for transaction, integration, restructuring and other costs. We believe that net debt, gross leverage and net leverage are important measures of our overall liquidity position. Net debt is calculated by removing cash and cash equivalents from our reported total debt. Gross leverage is calculated as reported total debt as a ratio of trailing twelve months adjusted EBITDA. Net leverage is calculated as net debt as a ratio of trailing twelve months adjusted EBITDA. Forward-looking statements This presentation includes forward-looking statements, including statements relating to our outlook and financial year 2023 assumptions. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan,“ "predict," "should," "will," "expect," "project," "forecast," "goal," "outlook," "target,” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: competition and pricing pressures; economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID-19 pandemic and government responses to the COVID-19 pandemic; fluctuations in fuel prices; increased carrier prices; severe weather, natural disasters, terrorist attacks or similar incidents that cause material disruptions to our operations or the operations of the third-party carriers and independent contractors with which we contract; our dependence on third-party carriers and independent contractors; labor disputes or organizing efforts affecting our workforce and those of our third-party carriers; legal and regulatory challenges to the status of the third-party carriers with which we contract, and their delivery workers, as independent contractors, rather than employees; litigation that may adversely affect our business or reputation; increasingly stringent laws protecting the environment, including transitional risks relating to climate change, that impact our third-party carriers; governmental regulation and political conditions; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; the impact of potential cyber-attacks and information technology or data security breaches; issues related to our intellectual property rights; our ability to access the capital markets and generate sufficient cash flow to satisfy our debt obligations; our ability to attract and retain qualified personnel; our ability to successfully implement our cost and revenue initiatives and other strategies; our ability to successfully manage our growth; our reliance on certain large customers for a significant portion of our revenue; damage to our reputation through unfavorable publicity; our failure to meet performance levels required by our contracts with our customers; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; a determination by the IRS that the distribution or certain related separation transactions should be treated as taxable transactions; and the impact of the separation on our businesses, operations and results. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

3 Q3 2023 highlights 1 Solid execution in a soft freight market 2 Brokerage gaining profitable share with support from complementary services 3 Continued sales and pipeline momentum 4 Strategic technology and growth investments 5 Strong liquidity position and optimized capital structure

4 Third-quarter financial and operating results Solid execution in a soft freight market RXO’s brokerage business continues to outperform and gain profitable market share Adjusted EBITDA and margin %1 Q3 22 Q3 23 Brokerage y/y volume growth $223M $173M $0 $50 $100 $150 $200 $250 $300 Q3 22 Q3 23 17.7% 19.6% Gross margin $ and % (1) See the “Non-GAAP financial measures” section. + 18% $66M $26M 540.00% 545.00% 550.00% 555.00% 560.00% 565.00% 570.00% 575.00% 580.00% 585.00% 590.00% $0 $20 $40 $60 $80 $100 $120 $140 Q3 22 Q3 23 2.7% 5.8%

5 Diversified business; profitable brokerage share gains continued in Q3 Revenue by service offeringBrokerage • Volume growth of 18% y/y • Full-truckload volume growth of 13% y/y, and +58% y/y on 3-year stack • LTL volume growth of 55% y/y • Sales pipeline +115% on 2-year stack • Strong profitability, gross margin of 15.1% Complementary services • Gross margin 20.0%, +90bps y/y • Managed Trans. y/y synergy volumes up strongly • Secured key wins that will be onboarded in 2024 • Last Mile Q3 EBITDA up y/y • Continue to expect FY2023 Last Mile EBITDA to grow y/y 59%25% 11% 6% Truck Brokerage Last Mile Managed Transportation Freight Forwarding Note: Excludes impact of eliminations. Numbers may not add up to 100% due to rounding.

6 • Onboarded new Brokerage employees in the quarter ‒ Brokerage headcount increased both year-over-year and sequentially • Expanded several brokerage service offerings ‒ Continue to invest in other modes with significant momentum in LTL ‒ Added drop-trailer capacity with Flex Fleet Program, increasing platform stickiness RXO continues to invest in the future – Q3 highlights Growth Technology Productivity • Launched enhancements to RXO Connect™ platform, including: ‒ Enhanced pricing algorithms ‒ ESG dashboards ‒ Dedicated lane capabilities • Continuous improvement helping drive engagement ‒ 97% of Q3 loads were created or covered digitally ‒ 77% 7-day carrier retention • New Natural Language Processing solutions implemented for automated order creation • GenAl pilots for sales enablement and helpdesk / support • Added contract pricing automation for new service types

7 Q3 2023 adjusted EPS bridge Earnings Per Share Q3-23 Q3-22 GAAP Diluted EPS $(0.01) $0.11 Amortization of intangible assets 0.03 0.04 Transaction, integration, restructuring and other costs 0.04 0.25 Income tax associated with adjustments above1 (0.01) (0.06) Adjusted Diluted EPS2 $ 0.05 $ 0.34 RXO delivered Q3 2023 adjusted diluted EPS of $0.05 (1) The tax impact of non-GAAP adjustments represents the tax benefit (expense) calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net income (loss). Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. (2) See the “Non-GAAP financial measures” section.

8 Trailing 6-month cash walks Note: In millions. (1) Adjusted EBITDA and Adjusted FCF are Non-GAAP financial measures. (2) Adjusted EBITDA excludes certain NEO spin-related stock-based compensation. Adj. free cash flow impacted by increased Quick Pay adoption and $15M of tax timing outflows Adjusted free cash flow Cash balance1 $15M of tax timing outflowsIncludes $8M use for increased Quick Pay adoption

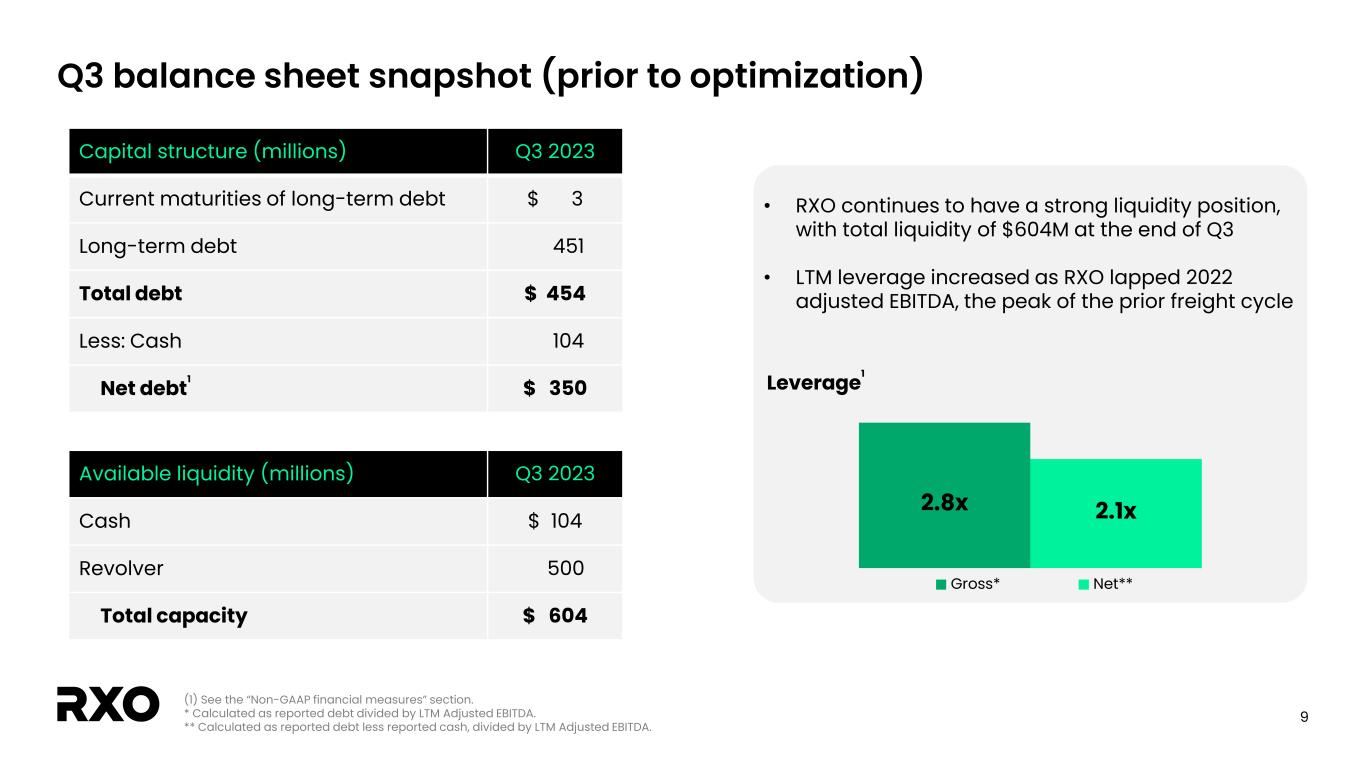

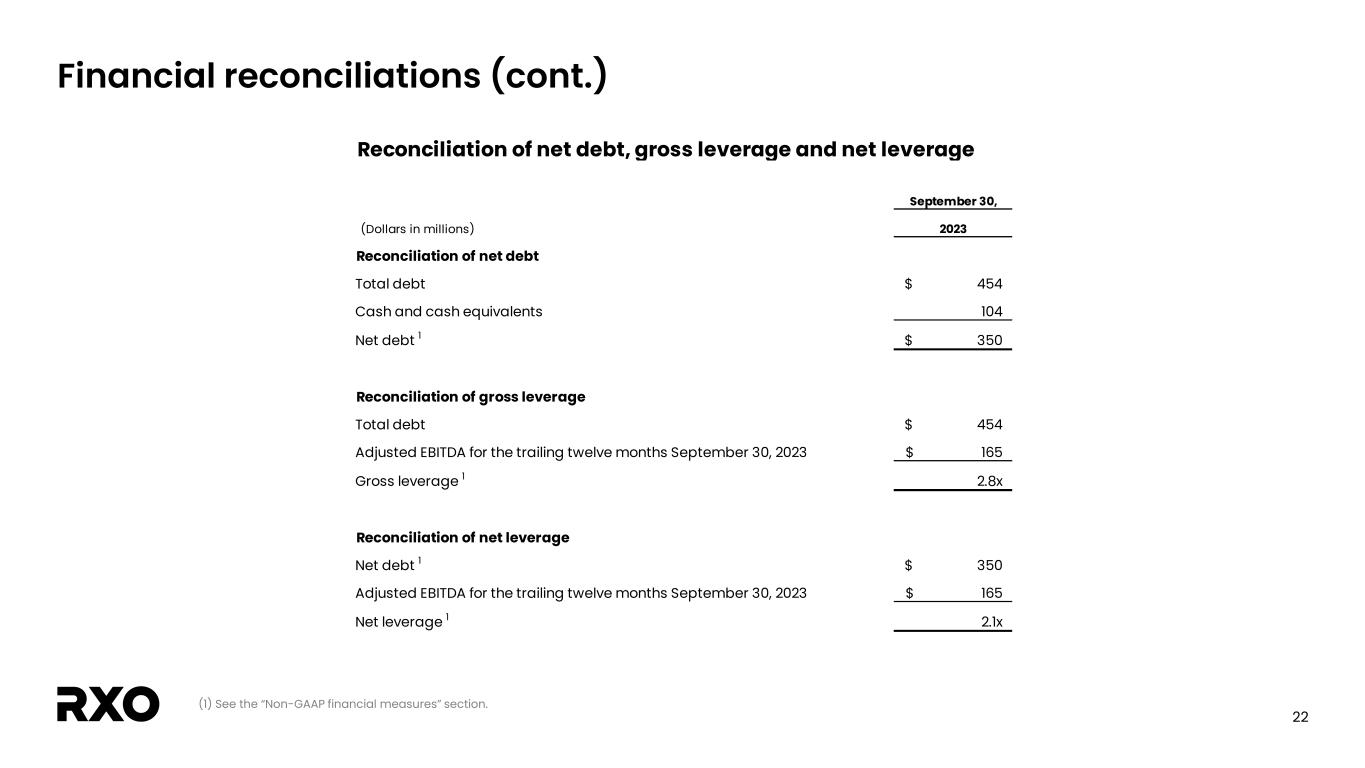

9 Q3 balance sheet snapshot (prior to optimization) 2.8x 2.1x Gross* Net** Capital structure (millions) Q3 2023 Current maturities of long-term debt $ 3 Long-term debt 451 Total debt $ 454 Less: Cash 104 Net debt1 $ 350 Available liquidity (millions) Q3 2023 Cash $ 104 Revolver 500 Total capacity $ 604 (1) See the “Non-GAAP financial measures” section. * Calculated as reported debt divided by LTM Adjusted EBITDA. ** Calculated as reported debt less reported cash, divided by LTM Adjusted EBITDA. Leverage1 • RXO continues to have a strong liquidity position, with total liquidity of $604M at the end of Q3 • LTM leverage increased as RXO lapped 2022 adjusted EBITDA, the peak of the prior freight cycle

10 Optimized capital structure Capital structure (millions) 9/30/2023 9/30/2023 Pro Forma Revolver capacity $500 $600 Term loan $100 - 7.5% notes due 2027 $347 $347 Finance leases and other $7 $7 Gross debt $454 $354* Less: Cash ($104) ($4)* Net debt $350 $350 Total liquidity $604 $604 Annualized pre-tax interest expense, net $33 $32 * Assumes 9/30/2023 cash balance and gross debt balance, less $100mm term loan paydown. • Exercised revolver accordion feature, adding $100M capacity • Paid down term loan, expecting >$1M of annualized pre-tax interest savings • Gross debt decreased; net debt and liquidity position unchanged >$1M Annualized Savings

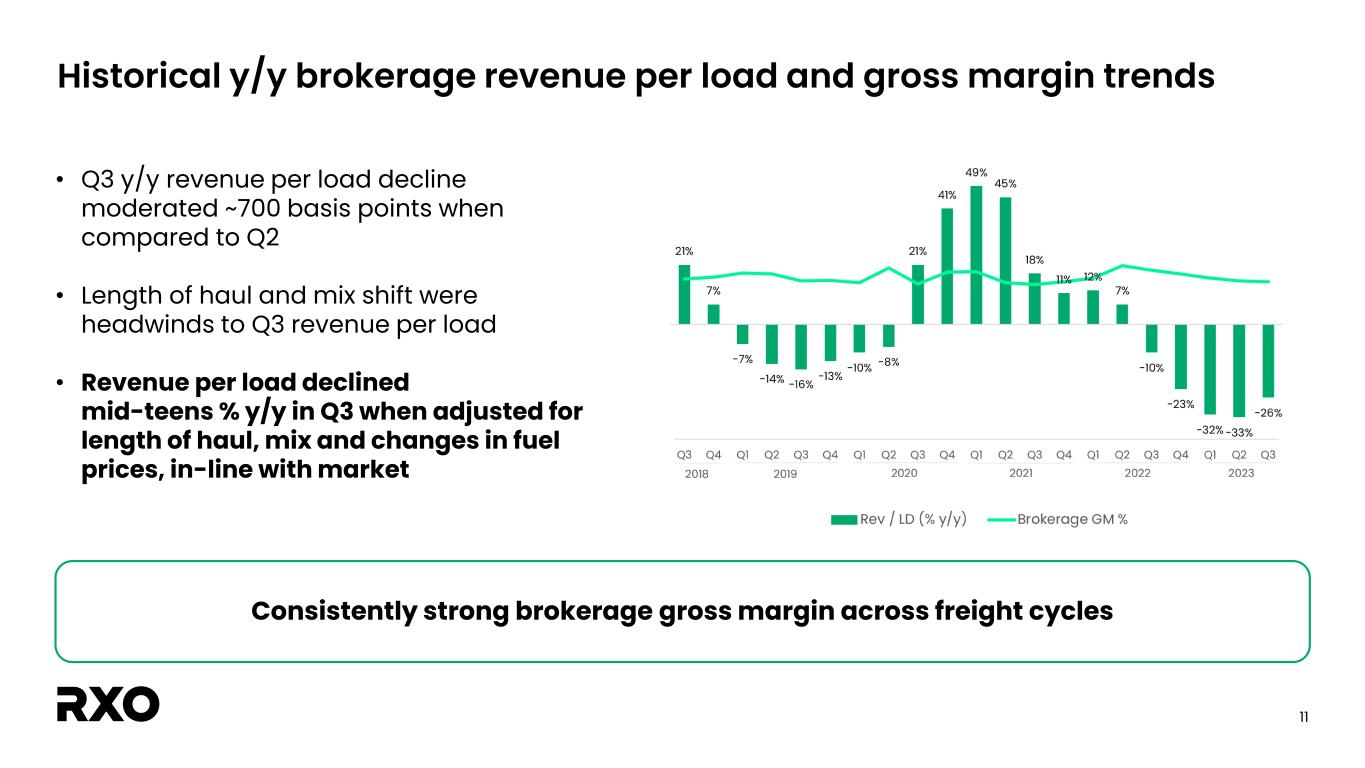

11 Historical y/y brokerage revenue per load and gross margin trends Consistently strong brokerage gross margin across freight cycles • Q3 y/y revenue per load decline moderated ~700 basis points when compared to Q2 • Length of haul and mix shift were headwinds to Q3 revenue per load • Revenue per load declined mid-teens % y/y in Q3 when adjusted for length of haul, mix and changes in fuel prices, in-line with market

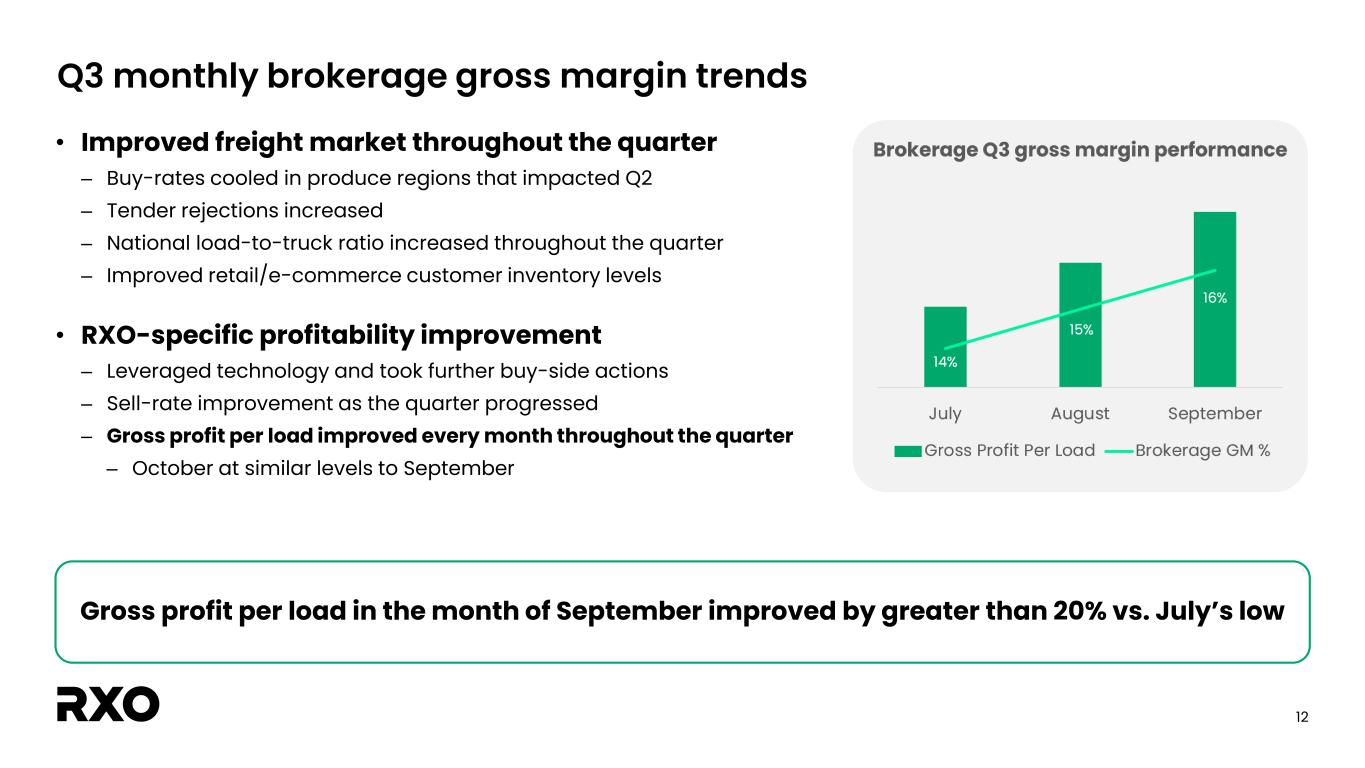

12 Q3 monthly brokerage gross margin trends Gross profit per load in the month of September improved by greater than 20% vs. July’s low • Improved freight market throughout the quarter ‒ Buy-rates cooled in produce regions that impacted Q2 ‒ Tender rejections increased ‒ National load-to-truck ratio increased throughout the quarter ‒ Improved retail/e-commerce customer inventory levels • RXO-specific profitability improvement ‒ Leveraged technology and took further buy-side actions ‒ Sell-rate improvement as the quarter progressed ‒ Gross profit per load improved every month throughout the quarter ‒ October at similar levels to September

13 Historical volumes and gross profit per load trends RXO’s brokerage gross profit per load declines moderated in Q3 2023 with significant volume growth

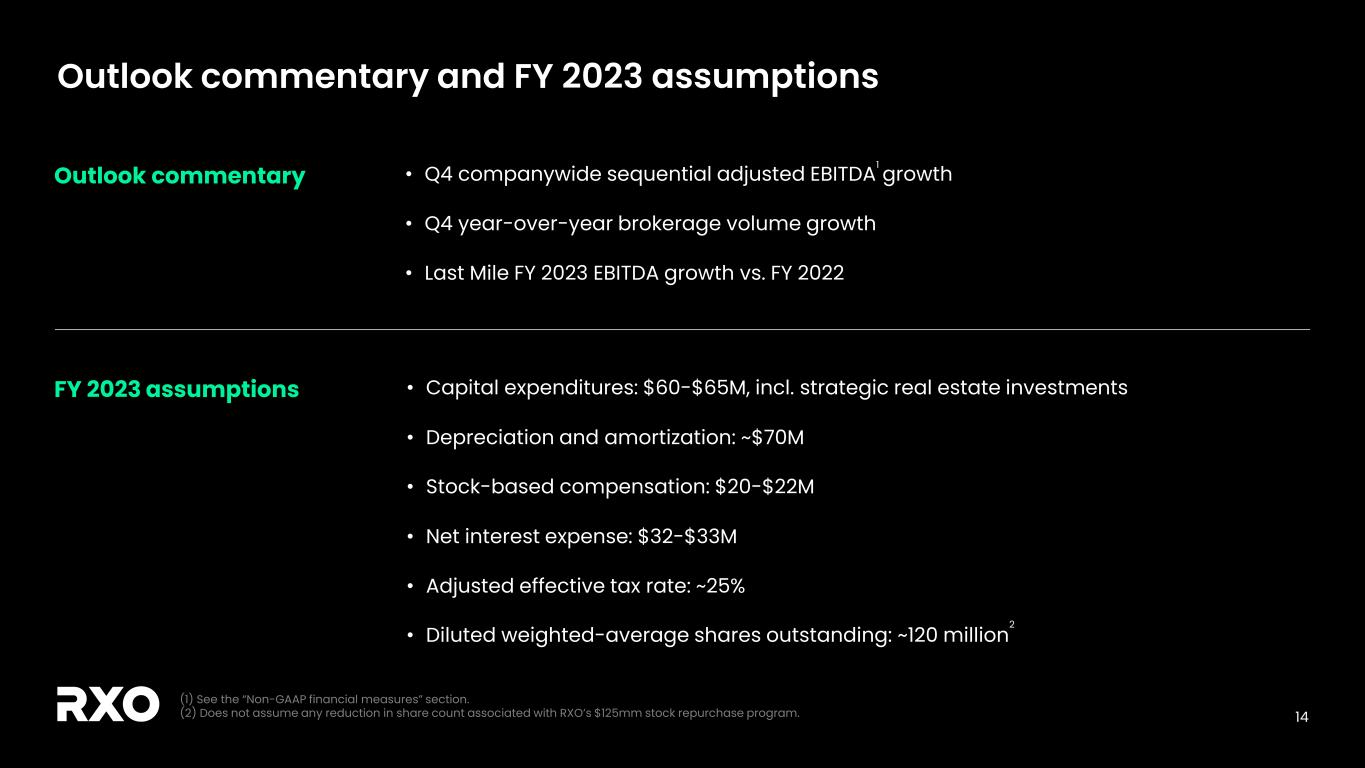

14 Outlook commentary and FY 2023 assumptions • Q4 companywide sequential adjusted EBITDA1 growth • Q4 year-over-year brokerage volume growth • Last Mile FY 2023 EBITDA growth vs. FY 2022 Outlook commentary FY 2023 assumptions • Capital expenditures: $60-$65M, incl. strategic real estate investments • Depreciation and amortization: ~$70M • Stock-based compensation: $20-$22M • Net interest expense: $32-$33M • Adjusted effective tax rate: ~25% • Diluted weighted-average shares outstanding: ~120 million 2 (1) See the “Non-GAAP financial measures” section. (2) Does not assume any reduction in share count associated with RXO’s $125mm stock repurchase program.

15 Key investment highlights 1 Large addressable market with secular tailwinds 2 Track record of above-market growth and high profitability 3 Proprietary technology drives efficiency, volume and margin expansion 4 Long-term relationships with blue-chip customers 5 Market-leading platform with complementary transportation solutions 6 Tiered approach to sales drives multi-faceted growth opportunities 7 Diverse exposure across attractive end markets 8 Experienced and proven leadership team

16 Appendix

17 RXO technology adoption update 81% 97% Q3 23 Q3 23 75% 77% Q3 22 Q3 23 7-day carrier retentionLoads created or covered digitally Loads created or covered digitally increased and RXO maintained a strong 7-day carrier retention Weekly average users Flat y/y Active network carriers +1% q/q

18 Financial reconciliations (1) See the “Non-GAAP financial measures” section. (2) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. (3) Trailing six months ended September 30, 2023 is calculated as the nine months ended September 30, 2023 less the three months ended March 31, 2023. (4) Trailing twelve months ended September 30, 2023 is calculated as the nine months ended September 30, 2023 plus the twelve months ended December 31, 2022 less the nine months ended September 30, 2022. Reconciliation of net income (loss) to adjusted EBITDA and adjusted EBITDA margin Six Months Ended September 30, Twelve Months Ended September 30, Year Ended December 31, (Dollars in millions) 2023 2022 2023 2022 2023 3 2023 4 2022 Net income (loss) (1)$ 13$ 2$ 96$ 2$ (2)$ 92$ Interest expense (income), net 8 (1) 24 (1) 16 29 4 Income tax provision (benefit) (2) 2 (2) 29 1 (4) 27 Depreciation and amortization expense 16 23 52 65 34 73 86 Transaction and integration costs 2 23 12 44 6 52 84 Restructuring and other costs 3 6 13 9 5 17 13 Adjusted EBITDA 1 26$ 66$ 101$ 242$ 64$ 165$ 306$ Revenue 976$ 1,138$ 2,949$ 3,676$ 1,939 4,069 4,796 Adjusted EBITDA margin 1, 2 2.7% 5.8% 3.4% 6.6% 3.3% 4.1% 6.4% Three Months Ended September 30, Nine Months Ended September 30,

19 Financial reconciliations (cont.) (1) The tax impact of non-GAAP adjustments represents the tax benefit (expense) calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net income (loss). Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. (2) See the "Non-GAAP financial measures" section. Reconciliation of net income (loss) to adjusted net income and adjusted diluted earnings per share (Dollars in millions, shares in thousands, except per share amounts) 2023 2022 2023 2022 Net income (loss) (1)$ 13$ 2$ 96$ Amortization of intangible assets 4 5 10 16 Transaction and integration costs 2 23 12 44 Restructuring and other costs 3 6 13 9 Income tax associated with the adjustments above 1 (2) (8) (8) (17) Adjusted net income 2 6$ 39$ 29$ 148$ Adjusted diluted earnings per share 2 0.05$ 0.34$ 0.24$ 1.29$ Weighted-average common shares outstanding Diluted weighted-average common shares outstanding 119,416 115,163 119,415 115,163 Nine Months Ended September 30,Three Months Ended September 30,

20 (1) See the “Non-GAAP financial measures” section. (2) Includes the cash component of these line items. (3) Adjusted EBITDA for all periods presented is reconciled above. (4) Free cash flow conversion from adjusted EBITDA is calculated as free cash flow divided by adjusted EBITDA. (5) Adjusted free cash flow conversion from adjusted EBITDA is calculated as adjusted free cash flow divided by adjusted EBITDA. Financial reconciliations (cont.) Reconciliation of cash flows from operating activities to free cash flow and adjusted free cash flow Six Months Ended September 30, Three Months Ended March 31, (Dollars in millions) 2023 2022 2023 2023 Net cash provided by operating activities 70$ 234$ 28$ 42$ Payment for purchases of property and equipment (46) (39) (34) (12) Proceeds from sale of property and equipment - 1 - - Free cash flow 1 24$ 196$ (6)$ 30$ Transaction and integration costs 2 7 43 3 4 Restructuring and other costs 2 12 7 9 3 Adjusted free cash flow 1 43$ 246$ 6$ 37$ Adjusted EBITDA 1, 3 101$ 242$ 64$ 37$ Free cash flow conversion from adjusted EBITDA 1, 4 23.8% 81.0% -9.4% 81.1% Adjusted free cash flow conversion from adjusted EBITDA 1, 5 42.6% 101.7% 9.4% 100.0% Nine Months Ended September 30,

21 Financial reconciliations (cont.) (1) Complementary services include freight forwarding, last mile and managed transportation services. Calculation of gross margin and gross margin as a percentage of revenue (Dollars in millions) 2023 2022 2023 2022 Revenue Truck brokerage 591$ 686$ 1,748$ 2,265$ Complementary services 1 419 487 1,293 1,518 Eliminations (34) (35) (92) (107) Revenue 976$ 1,138$ 2,949$ 3,676$ Cost of transportation and services (exclusive of depreciation and amortization) Truck brokerage 501$ 556$ 1,474$ 1,844$ Complementary services 1 275 336 842 1,045 Eliminations (34) (35) (92) (107) Cost of transportation and services (exclusive of depreciation and amortization) 742$ 857$ 2,224$ 2,782$ Direct operating expense (exclusive of depreciation and amortization) Truck brokerage 1$ -$ 1$ -$ Complementary services 1 58 56 178 167 Direct operating expense (exclusive of depreciation and amortization) 59$ 56$ 179$ 167$ Direct depreciation and amortization expense Truck brokerage -$ -$ -$ -$ Complementary services 1 2 2 5 4 Direct depreciation and amortization expense 2$ 2$ 5$ 4$ Gross margin Truck brokerage 89$ 130$ 273$ 421$ Complementary services 1 84 93 268 302 Gross margin 173$ 223$ 541$ 723$ Gross margin as a percentage of revenue Truck brokerage 15.1% 19.0% 15.6% 18.6% Complementary services 1 20.0% 19.1% 20.7% 19.9% Gross margin as a percentage of revenue 17.7% 19.6% 18.3% 19.7% Nine Months Ended September 30,Three Months Ended September 30,

22 Financial reconciliations (cont.) (1) See the “Non-GAAP financial measures” section. Reconciliation of net debt, gross leverage and net leverage September 30, (Dollars in millions) 2023 Reconciliation of net debt Total debt 454$ Cash and cash equivalents 104 Net debt 1 350$ Reconciliation of gross leverage Total debt 454$ Adjusted EBITDA for the trailing twelve months September 30, 2023 165$ Gross leverage 1 2.8x Reconciliation of net leverage Net debt 1 350$ Adjusted EBITDA for the trailing twelve months September 30, 2023 165$ Net leverage 1 2.1x

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

RXO (NYSE:RXO)

Historical Stock Chart

From May 2024 to Jun 2024

RXO (NYSE:RXO)

Historical Stock Chart

From Jun 2023 to Jun 2024