3 Tech Stocks Part of S&P 500 Index Trading at a Massive Discount

28 January 2022 - 4:08AM

Finscreener.org

The ongoing sell-off in growth

stocks offers investors an opportunity to increase their position

by a sizeable margin. Here, we take a look at three beaten down

tech stocks part of the

S&P 500 Index

that should on your buying list

right now.

Salesforce

Down 28% from record

highs, Salesforce.com (NYSE:

CRM) is now valued at a

market cap of $220 billion. But it has gained 659% in the last 10

years, despite the pullback. Salesforce enjoys a wide economic moat

and its platforms account for 20% of global CRM (customer

relationship management) spending which is more than the combined

market share of other tech heavyweights such as

Microsoft (NASDAQ:

MSFT),

SAP (NYSE:

SAP), Adobe (NASDAQ: ADBE) and Oracle (NYSE:

ORCL).

Last July, it completed the

acquisition of Slack for $28 billion allowing Salesforce to gain

rapid traction in the workforce communications solutions segment.

Analysts expect Salesforce sales to rise by 24.2% year over year to

$26.4 billion in fiscal 2022 and by 20.4% to $31.8 billion in

fiscal 2023 (ending in January). Its sales stood at “just” $10.48

billion in fiscal 2018.

In Q3 of fiscal 2022, Salesforce

reported revenue of $6.86 billion, a year over year increase of

27%. The company aims to touch $50 billion in annual sales by 2026,

which suggests it will have to grow top-line at an annual rate of

17% in the next four years.

Adobe

Adobe stock has returned 1,580%

to investors since January 2012 and is currently trading 25% below

record highs. Valued at a market cap of $245 billion, Adobe is a

company that has a wide economic moat, an expanding portfolio of

products and consistent cash flows.

Similar to most tech stocks,

Adobe has an asset-light model allowing it to grow profit margins

at a higher pace compared to sales. Its creative cloud, experience

cloud and document cloud businesses derive stable revenue growth

and profitability across economic cycles.

In the last five years, Adobe

sales have risen by 116%. Comparatively its net income and free

cash flow have increased by more than 150% in this period. So,

while ADBE stock has crushed broader indices in the past decade,

its forward price to earnings and price to free cash flow ratios

are close to its 5-year median figures.

Adobe has the ability to generate

cash flows consistently as it transitioned towards a

subscription-based business model in 2013, which ensured a

predictable and recurring revenue stream.

Broadcom

The final stock on my list

is Broadcom (NASDAQ: AVGO),

a company valued at a market cap of $223 billion. AVGO stock is

also 20% from all-time highs. Despite recent volatility, Broadcom

has returned close to 2,000% to investors in dividend adjusted

gains. Broadcom also offers investors a tasty dividend yield of

3.1%.

In

fiscal Q4 of 2021

that ended in October, Broadcom

sales were up 15% year over year at $7.4 billion while adjusted

earnings rose by 23% to $7.81 per share. Wall Street forecast sales

of $7.35 billion and earnings of $7.74 per share for the

semiconductor heavyweight in Q4 of 2021.

Broadcom expects revenue of $7.6

billion in Q1 of fiscal 2022, an increase of 14% year over year.

Comparatively, analysts forecast revenue of $7.3 billion in the

quarter ending in January.

Its solid numbers can be

attributed to robust

chip demand from multiple

verticals that include

server storage, networking, broadband, wireless connectivity and

industrials.

Broadcom also increased its

dividend by 14% to $4.10 per share while announcing a share buyback

program worth $10 billion. We can see why AVGO stock remains a top

bet for both income and growth investors.

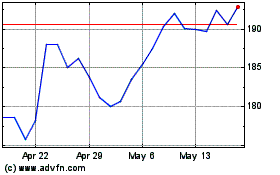

SAP (NYSE:SAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

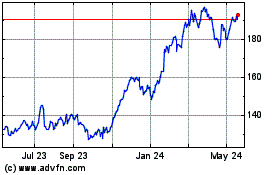

SAP (NYSE:SAP)

Historical Stock Chart

From Feb 2024 to Feb 2025