Trending: Shell to Sell Nigerian Onshore Oil Business

17 January 2024 - 1:33AM

Dow Jones News

1400 GMT - Shell is among the most mentioned companies across

news items over the past four hours, according to Factiva data,

after the energy major agreed to sell its Nigerian onshore oil

business SPDC for up to $2.4 billion. If approved by the

government, the deal would fulfill Shell's long-term goal of

extracting itself from a challenging operating environment in the

Niger Delta. For almost a century, the Anglo-Dutch company has had

operations in Nigeria, but the company has been at odds with local

communities over oil spills and claims of human rights violations

for the past few decades. The buyer--a consortium of five

companies--will pay $1.3 billion initially, before making

additional payments to Shell of up to $1.1 billion. It follows a

string of oil-and-gas giants selling assets in the West African,

oil-rich country. In November, Norway's Equinor finalized the sale

of its Nigerian business to a local company. Two months prior,

Italy's Eni announced plans to sell its onshore operations to a

local entity as well. Dow Jones & Co. owns Factiva.

(christian.moess@wsj.com)

(END) Dow Jones Newswires

January 16, 2024 09:18 ET (14:18 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

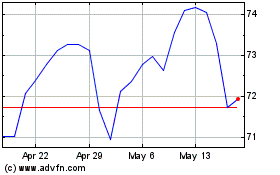

Shell (NYSE:SHEL)

Historical Stock Chart

From May 2024 to Jun 2024

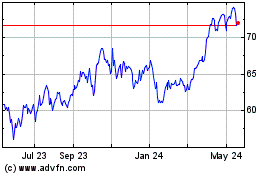

Shell (NYSE:SHEL)

Historical Stock Chart

From Jun 2023 to Jun 2024