- Delivers $0.64 of GAAP diluted earnings per share (EPS), a

year-over-year increase of $0.06; adjusted diluted EPS (non-GAAP)

of $0.66, a year-over-year increase of $0.08

- Invests $158 million in infrastructure during the first half of

2024, or approximately 48% of 2024 capital budget

- Agreement in principle reached on California general rate case

(GRC)

- Updates 2024 GAAP guidance to $2.66 to $2.76 diluted EPS.

Reaffirms 2024 guidance range of $2.68 to $2.78 for adjusted

diluted EPS (non-GAAP)

- Declares $0.40 cash dividend per share of common stock

SJW Group (NYSE: SJW) today reported financial results for the

second quarter ended June 30, 2024.

"We are pleased with our financial results for the quarter,

which demonstrate the benefits of our national platform combined

with the strength of our local water utility operations," stated

SJW Group Chair, CEO, and President, Eric W. Thornburg. "We

continued to deliver on our growth strategy by investing in our

water supply and infrastructure across our footprint, as well as

reaching an all-party settlement agreement in principle on almost

all issues in our California general rate case. I would also like

to acknowledge our Connecticut team, who were recognized by

regulators and rating agencies alike, for delivering a strong and

responsive rate case filing and engaging as constructive

participants in the recently resolved proceeding." Thornburg added,

"Overall, our strong operating performance and continued strategic

execution position us well for future success as we deliver on our

commitment to provide high-quality and reliable water service to

our customers and communities."

Second Quarter Operating Results

Net income prepared in accordance with U.S. generally accepted

accounting principles (GAAP) for the quarter ended June 30, 2024

was $20.7 million, or $0.64 diluted EPS, a 13% increase compared to

$18.3 million, or $0.58, in the same quarter last year. Adjusting

for real estate transactions, SJW Group's adjusted net income

(non-GAAP) in the second quarter of 2024 was $21.3 million, or

$0.66 per diluted share (non-GAAP), an increase in adjusted diluted

EPS of 14% from the prior year.

Adjusted net income is a non-GAAP measure representing GAAP net

income excluding special items. The difference between 2024 GAAP

net income and adjusted net income for the quarter was due to a

loss on the sale of real estate of $0.6 million, net of tax. A full

reconciliation of GAAP net income to adjusted net income for the

quarter is included in the tables at the end of this news

release.

Operating revenue for the second quarter was $176.2 million

compared to $156.9 million for the same quarter last year. The

increase was largely driven by rate increases of $13.0 million,

primarily in California; customer growth in Texas; higher customer

usage of $3.8 million driven primarily by weather conditions; and

by $2.2 million from regulatory mechanism adjustments. We are

currently experiencing severe to extreme drought in our Texas

service area and water usage restrictions will likely impact

revenue in 2024.

Operating expenses for the quarter ended June 30, 2024 were

$135.6 million, up 8% compared to $125.7 million for the same

quarter last year. This change in operating expenses primarily

reflects:

- An increase in water production expenses of $8.6 million

compared to the same quarter last year;

- An increase in depreciation and amortization of $2.2 million

primarily due to utility plant additions; and

- An increase in maintenance costs of $1.6 million primarily due

to adjustments to certain regulatory assets as a result of the

final decision in the Connecticut general rate case and increased

security costs; offset by,

- A decrease in administrative and general expenses of $3.1

million primarily due to decreases in the allowance for

uncollectible customer accounts and higher allocations to

construction activities, partially offset by inflationary

increases.

The effective consolidated income tax rates for the second

quarter of 2024 and 2023 were approximately 15% and (9)%,

respectively. The higher effective tax rate in the 2024 period was

primarily due to the partial release of an uncertain tax position

reserve in the second quarter of 2023.

Year-to-Date Operating Results

Net income prepared in accordance with U.S. generally accepted

accounting principles (GAAP) for the six months through June 30,

2024 was $32.4 million compared to $29.8 million in the same period

of 2023. GAAP diluted EPS for the six months was $1.00, an increase

of 5% compared $0.95 diluted EPS in the same period last year.

Non-GAAP adjusted net income for the six months through June 30,

2024 was $33.0 million compared to $28.8 million in same period

last year. Non-GAAP adjusted diluted EPS for the first six months

was $1.02, an increase of 11% compared to $0.92 adjusted diluted

EPS in the same period last year.

Operating revenue year-to-date was $325.6 million compared to

$294.2 million for the same period last year. The increase was

largely driven by rate increases of $23.0 million, primarily in

California; higher customer usage of $5.6 million driven primarily

by weather conditions and the end of mandatory water conservation

requirements in California in April 2023; growth in customers,

primarily in Texas, of $1.6 million; and $1.5 million due to

regulatory mechanism adjustments.

Operating expenses for the first six months of 2024 were $257.1

million, which was up 8% compared to $237.8 million for the same

period last year. This change in operating expenses primarily

reflects:

- An increase in water production expenses of $13.4 million

compared to the same period last year;

- An increase in depreciation and amortization of $4.3 million

primarily due to utility plant additions; and

- An increase of maintenance costs of $2.2 million primarily due

to adjustments to certain regulatory assets as a result of the

final decision in the Connecticut GRC and increased security costs;

offset by,

- A decrease in administrative and general expenses of $1.6

million primarily due to decreases in the allowance for

uncollectible customer accounts and higher allocations to

construction activities, partially offset by inflationary

increases.

The effective consolidated income tax rates for the first half

of 2024 and 2023 were approximately 16% and (1)%, respectively. The

higher effective tax rate in the 2024 period was primarily due to

the partial release of an uncertain tax position reserve in the

second quarter of 2023.

Capital Expenditures

Through the second quarter of 2024, SJW Group invested $158

million in infrastructure and water supply. The company has a

capital expenditures budget of $332 million in 2024 and plans to

invest more than $1.6 billion in capital over the next five years

to build and maintain its water and wastewater operations,

including approximately $230 million to install treatment for per-

and polyfluoroalkyl substances (PFAS), subject to regulatory

approvals and availability of funding.

San Jose Water has begun installation on a $100 million advanced

metering infrastructure (AMI) project that was approved by the

California Public Utilities Commission (CPUC) in 2022. The project

is separate from the GRC capital budget approved by the CPUC. The

bulk of the AMI installation is expected to be between 2024 and

2026 with approximately $27 million expended in 2024.

Rate Activity and Regulatory Updates

California

On June 14, 2024, San Jose Water notified the CPUC that it had

reached an all-party settlement agreement in principle with the

Public Advocates Office and Water Rate Advocates for Transparency,

Equity and Sustainability (WRATES) on all but two policy issues in

its 2025 through 2027 GRC application. The formal settlement motion

and agreement will be submitted by August 19, 2024. Briefs on the

two policy issues, which are expected to be fully litigated, will

also be submitted by August 19.

The company's GRC application filed with the CPUC in January

2024 proposed an increase over current authorized revenues of

approximately $55.2 million, or 11.1%, in 2025; approximately $22.0

million, or 4.0%, in 2026; and approximately $25.8 million, or

4.5%, in 2027. San Jose Water is also proposing a 3-year $540

million capital expenditure program focused on:

- Treating PFAS in drinking water;

- Reducing greenhouse gas emissions through solar generation,

energy storage systems, continued electrification of our vehicle

fleet, and expansion of our advanced leak detection program;

and

- Advancing the CPUC’s Environmental and Social Justice Action

Plan by improving access to high-quality water service, climate

resiliency, and economic and workforce development.

A decision on the GRC and/or the settlement agreement is

expected by the CPUC in fourth quarter of 2024 and new rates are

anticipated to be effective on January 1, 2025.

On June 12, 2024, the CPUC approved advice letter 609, which

increased the authorized revenue requirement by $28.3 million, or

5.3%, to offset the increases to purchased potable water charges,

the groundwater extraction fee, and purchased recycled water

charges from its water wholesalers effective July 1, 2024.

On June 21, 2024, the CPUC approved advice letter 610/610A,

which requested a $4.8 million addition to rate base and a $768,000

revenue increase related to the AMI project that was effective on

July 1, 2024. The project is expected to deliver significant

benefits to customers and the environment, such as early

identification of costly water leaks.

Connecticut

On June 28, 2024, the Connecticut Public Utilities Regulatory

Authority (PURA) issued a final decision on Connecticut Water's GRC

that was filed on October 3, 2023. PURA's decision provided

for:

- An increase in the annual revenue requirement of $6.5 million,

or 5.5%;

- An opportunity to earn additional revenue of $1.1 million for

meeting certain performance metrics;

- A return on equity of 9.3%, which is up from 9.0% in the last

GRC;

- A capital structure of 53% equity and 47% debt, which is

similar to the last GRC; and

- Approval of the company's proposal to expand the existing

customer financial assistance program.

As part of the GRC process, the Water Infrastructure and

Conservation Adjustment (WICA) infrastructure recovery charge was

reset to zero and the prior WICA of 7.41% was rolled into base

rates.

Connecticut Water had requested a $21.4 million, or

approximately 18.1%, increase in authorized revenues in the GRC.

The new rates were effective on July 1, 2024.

Maine

On June 24, 2024, Maine Water filed for increases in the Water

Infrastructure Charge in both the Freeport and Oakland divisions.

The Maine Public Utilities Commission is expected to issue a

decision in the third quarter of 2024.

Force for Good

In May 2024, San Jose Water secured $9.1 million in arrearage

relief for its customers from the California Water and Wastewater

Arrearage Program. A prior payment of $6.2 million was received in

February 2022. The funds have been applied to the accounts of

eligible customers who experienced financial hardship due to

COVID.

In June 2024, PURA approved Connecticut Water's request to

expand income-eligibility for the Water Rate Assistance Program

(WRAP), a first of its kind program in the state that offers water

bill discounts for income-eligible customers. The expansion allows

Connecticut Water to serve more customers and provide greater

discounts to eligible WRAP customers.

2024 Guidance

The following table includes a reconciliation of the company's

2024 diluted EPS guidance (GAAP) to adjusted diluted EPS guidance

(non-GAAP):

2024 Earnings Guidance

Estimated Diluted EPS Guidance on a GAAP

Basis

$

2.66

to

2.76

Adjustments:

Loss on sale of real estate investments,

net of tax

0.02

0.02

Adjusted EPS Guidance (non-GAAP)

$

2.68

to

2.78

In addition, we reiterate our non-linear long-term diluted EPS

growth of 5% to 7%, anchored off 2022's diluted EPS of $2.43.

Our guidance is subject to risks and uncertainties, including,

without limitation, those factors outlined in the “Forward Looking

Statements” of this release and the “Risk Factors” section of the

company’s annual and quarterly reports filed with the Securities

and Exchange Commission.

Dividend

On July 24, 2024, the directors of SJW Group declared a

quarterly cash dividend on common stock of $0.40 per share, payable

on September 3, 2024, to shareholders of record at the close of

business on August 5, 2024. Dividends have been paid on SJW Group’s

and its predecessor’s common stock for more than 80 consecutive

years. For 56 consecutive years, our stockholders have received an

increase in their calendar year dividend, which places us in an

exclusive group of companies on the New York Stock Exchange.

Financial Results Call Information

Eric W. Thornburg, president, chief executive officer, and board

chair, and Andrew F. Walters, chief financial officer, treasurer,

and interim principal accounting officer, will review results for

the second quarter of 2024 in a live webcast presentation at 11

a.m. Pacific Daylight Time, or 2 p.m. Eastern Daylight Time, on

Thursday, July 25, 2024.

Interested parties may access the webcast and related

presentation materials at the website www.sjwgroup.com. An archive

of the webcast will be available until October 21, 2024.

Non-GAAP Financial Measures

SJW Group's net income and diluted EPS are prepared in

accordance with GAAP and represent the earnings as reported to the

Securities and Exchange Commission. Adjusted net income and

Adjusted diluted EPS are non-GAAP measures representing GAAP

earnings adjusted to exclude the effects of real estate

transactions and costs associated with mergers and acquisition

activities, if any, which management believes are not

representative of our core business activities. These non-GAAP

financial measures are provided as additional information for

investors to evaluate the performance of SJW Group's ongoing

business activities. SJW Group uses adjusted net income and/or

adjusted diluted EPS as the primary performance measurements when

communicating with analysts and investors regarding our outlook and

results. Adjusted net income and Adjusted diluted EPS are also used

internally to measure performance. However, these non-GAAP

financial measures may be different from non-GAAP financial

measures used by other companies, even when the same or similarly

titled terms are used to identify such measures, limiting their

usefulness for comparative purposes. Further, these non-GAAP

financial measures should be considered as a supplement to the

financial information prepared on a GAAP basis rather than an

alternative to the respective GAAP financial measures.

About SJW Group

SJW Group is among the largest investor-owned pure-play water

and wastewater utilities in the United States, providing

life-sustaining and high-quality water service to nearly 1.5

million people. SJW Group’s locally led and operated water

utilities - San Jose Water Company in California, The Connecticut

Water Company in Connecticut, The Maine Water Company in Maine, and

SJWTX, Inc. (dba The Texas Water Company) in Texas - possess the

financial strength, operational expertise, and technological

innovation to safeguard the environment, deliver outstanding

service to customers, and provide opportunities to employees. SJW

Group remains focused on investing in its operations, remaining

actively engaged in its local communities, and delivering continued

sustainable value to its stockholders. For more information about

SJW Group, please visit www.sjwgroup.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, as

amended. Some of these forward-looking statements can be identified

by the use of forward-looking words such as “believes,” “expects,”

“estimates,” “anticipates,” “intends,” “seeks,” “plans,”

“projects,” “may,” “should,” “will,” or the negative of those words

or other comparable terminology. These forward-looking statements

are only predictions and are subject to risks, uncertainties, and

assumptions that are difficult to predict.

These forward-looking statements involve a number of risks,

uncertainties and assumptions including, but not limited to, the

following factors: (1) the effect of water, utility, environmental

and other governmental policies and regulations, including

regulatory actions concerning rates, authorized return on equity,

authorized capital structures, capital expenditures, PFAS and other

decisions; (2) changes in demand for water and other services; (3)

unanticipated weather conditions and changes in seasonality

including those affecting water supply and customer usage; (4) the

effect of the impact of climate change; (5) unexpected costs,

charges or expenses; (6) our ability to successfully evaluate

investments in new business and growth initiatives; (7)

contamination of our water supplies and damage or failure of our

water equipment and infrastructure; (8) the risk of work stoppages,

strikes and other labor-related actions; (9) catastrophic events

such as fires, earthquakes, explosions, floods, ice storms,

tornadoes, hurricanes, terrorist acts, physical attacks,

cyber-attacks, epidemic, or similar occurrences; (10) changes in

general economic, political, business and financial market

conditions; (11) the ability to obtain financing on favorable

terms, which can be affected by various factors, including credit

ratings, changes in interest rates, compliance with regulatory

requirements, compliance with the terms and conditions of our

outstanding indebtedness, and general market and economic

conditions; and (12) legislative, and general market and economic

developments. The risks, uncertainties and other factors may cause

the actual results, performance or achievements of SJW Group to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements.

Results for a quarter are not indicative of results for a full

year due to seasonality and other factors. Other factors that may

cause actual results, performance or achievements to materially

differ are described in SJW Group’s most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on

Form 8-K filed with the SEC. Forward-looking statements are not

guarantees of performance, and speak only as of the date made. SJW

Group undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, or otherwise.

SJW Group

Condensed Consolidated Statements

of Comprehensive Income

(Unaudited)

(in thousands, except share and

per share data)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Operating revenue

$

176,174

156,886

$

325,556

294,182

Operating expense:

Production Expenses:

Purchased water

38,129

32,592

64,321

55,010

Power

2,737

2,379

5,164

4,578

Groundwater extraction charges

17,552

14,994

29,678

25,353

Other production expenses

12,052

11,921

23,101

23,964

Total production expenses

70,470

61,886

122,264

108,905

Administrative and general

20,468

23,527

46,256

47,871

Maintenance

7,881

6,298

14,568

12,356

Property taxes and other non-income

taxes

8,419

7,896

17,249

16,297

Depreciation and amortization

28,366

26,121

56,736

52,417

Total operating expense

135,604

125,728

257,073

237,846

Operating income

40,570

31,158

68,483

56,336

Other (expense) income:

Interest on long-term debt and other

interest expense

(18,294

)

(16,397

)

(35,878

)

(32,169

)

Pension non-service credit (cost)

939

(102

)

1,889

(166

)

Other, net

1,205

2,115

3,856

5,381

Income before income taxes

24,420

16,774

38,350

29,382

Provision for income taxes

3,724

(1,512

)

5,955

(434

)

Net income

20,696

18,286

32,395

29,816

Other comprehensive income (loss), net

—

9

(442

)

102

Comprehensive income

$

20,696

18,295

$

31,953

29,918

Earnings per share

Basic

$

0.64

0.58

$

1.00

0.96

Diluted

$

0.64

0.58

$

1.00

0.95

Dividends per share

$

0.40

0.38

$

0.80

0.76

Weighted average shares outstanding

Basic

32,397,501

31,499,068

32,237,115

31,219,324

Diluted

32,460,894

31,594,494

32,302,741

31,319,248

SJW Group

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except share and

per share data)

June 30, 2024

December 31,

2023

Assets

Utility plant:

Land

$

41,415

41,415

Depreciable plant and equipment

4,077,009

3,967,911

Construction work in progress

159,084

106,980

Intangible assets

35,986

35,946

Total utility plant

4,313,494

4,152,252

Less accumulated depreciation and

amortization

1,030,065

981,598

Net utility plant

3,283,429

3,170,654

Nonutility properties and real estate

investments

13,376

13,350

Less accumulated depreciation and

amortization

96

194

Net nonutility properties and real estate

investments

13,280

13,156

Current assets:

Cash and cash equivalents

22,804

9,723

Accounts receivable:

Customers, net of allowances for

uncollectible accounts of $802 and $6,551 on June 30, 2024 and

December 31, 2023, respectively

70,238

67,870

Income tax

—

5,187

Other

5,584

3,684

Accrued unbilled utility revenue

57,822

49,543

Assets held for sale

—

40,850

Prepaid expenses

9,856

11,110

Current regulatory assets

1,057

4,276

Other current assets

5,818

6,146

Total current assets

173,179

198,389

Other assets:

Regulatory assets, less current

portion

238,963

235,910

Investments

17,368

16,411

Postretirement benefit plans

36,816

33,794

Other intangible asset

28,386

28,386

Goodwill

640,311

640,311

Other

7,695

8,056

Total other assets

969,539

962,868

Total assets

$

4,439,427

4,345,067

SJW Group

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except share and

per share data)

June 30, 2024

December 31,

2023

Capitalization and liabilities

Capitalization:

Stockholders’ equity:

Common stock, $0.001 par value; authorized

70,000,000 shares; issued and outstanding shares 32,668,904 on June

30, 2024 and 32,023,004 on December 31, 2023

$

33

32

Additional paid-in capital

771,189

736,191

Retained earnings

502,037

495,383

Accumulated other comprehensive income

1,349

1,791

Total stockholders’ equity

1,274,608

1,233,397

Long-term debt, less current portion

1,549,587

1,526,699

Total capitalization

2,824,195

2,760,096

Current liabilities:

Lines of credit

217,495

171,500

Current portion of long-term debt

9,023

48,975

Accrued groundwater extraction charges,

purchased water and power

32,581

24,479

Accounts payable

37,932

46,121

Accrued interest

15,582

15,816

Accrued payroll

10,683

12,229

Income tax payable

2,059

—

Current regulatory liabilities

1,930

3,059

Other current liabilities

22,848

20,795

Total current liabilities

350,133

342,974

Deferred income taxes

240,903

238,528

Advances for construction

144,087

146,582

Contributions in aid of construction

333,611

326,451

Postretirement benefit plans

47,516

46,836

Regulatory liabilities, less current

portion

475,293

461,108

Other noncurrent liabilities

23,689

22,492

Commitments and contingencies

Total capitalization and liabilities

$

4,439,427

4,345,067

SJW Group

Reconciliation of Non-GAAP

Financial Measures

(Unaudited)

(in thousands, except per share

data)

2024 Earnings Guidance

Estimated Diluted EPS Guidance on a GAAP

Basis

$

2.66

to

2.76

Adjustments:

Loss on sale of real estate investments,

net of tax

0.02

0.02

Adjusted EPS Guidance (non-GAAP)

$

2.68

to

2.78

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Reported GAAP Net Income

$

20,696

18,286

32,395

29,816

Adjustments:

Loss (gain) on sale of real estate

investments1

909

—

909

(1,473

)

Tax effect of above adjustment2

(291

)

—

(291

)

412

Adjusted Net Income (non-GAAP)

$

21,314

18,286

33,013

28,755

Reported GAAP Diluted Earnings Per

Share

$

0.64

0.58

1.00

0.95

Adjustments:

Loss (gain) on sale of real estate

investments, net of tax

0.02

—

0.02

(0.03

)

Adjusted Diluted Earnings Per Share

(non-GAAP)

$

0.66

0.58

1.02

0.92

1

Included in the "Other, net" line on the

condensed consolidated statements of comprehensive income.

2

The tax effect on all adjustments is

calculated at the applicable statutory rate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724496356/en/

Andrew F. Walters Chief Financial Officer, Treasurer and Interim

Principal Accounting Officer 408.279.7818

Andrew.Walters@sjwater.com

Daniel J. Meaney, APR Director of Investor Relations

860.664.6016 Daniel.Meaney@ctwater.com

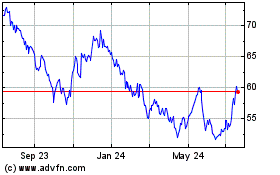

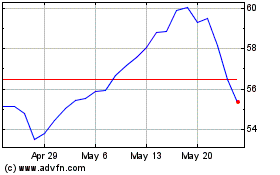

SJW (NYSE:SJW)

Historical Stock Chart

From Dec 2024 to Jan 2025

SJW (NYSE:SJW)

Historical Stock Chart

From Jan 2024 to Jan 2025