000076682912/312024Q3FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharessjw:subsidiarysjw:wellxbrli:puresjw:peoplesjw:serviceConnection00007668292024-01-012024-09-3000007668292024-10-2100007668292024-07-012024-09-3000007668292023-07-012023-09-3000007668292023-01-012023-09-3000007668292024-09-3000007668292023-12-310000766829us-gaap:CommonStockMember2023-12-310000766829us-gaap:AdditionalPaidInCapitalMember2023-12-310000766829us-gaap:RetainedEarningsMember2023-12-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000766829us-gaap:RetainedEarningsMember2024-01-012024-03-3100007668292024-01-012024-03-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000766829us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000766829us-gaap:CommonStockMember2024-01-012024-03-310000766829us-gaap:CommonStockMember2024-03-310000766829us-gaap:AdditionalPaidInCapitalMember2024-03-310000766829us-gaap:RetainedEarningsMember2024-03-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100007668292024-03-310000766829us-gaap:RetainedEarningsMember2024-04-012024-06-3000007668292024-04-012024-06-300000766829us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000766829us-gaap:CommonStockMember2024-04-012024-06-300000766829us-gaap:CommonStockMember2024-06-300000766829us-gaap:AdditionalPaidInCapitalMember2024-06-300000766829us-gaap:RetainedEarningsMember2024-06-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-3000007668292024-06-300000766829us-gaap:RetainedEarningsMember2024-07-012024-09-300000766829us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000766829us-gaap:CommonStockMember2024-07-012024-09-300000766829us-gaap:CommonStockMember2024-09-300000766829us-gaap:AdditionalPaidInCapitalMember2024-09-300000766829us-gaap:RetainedEarningsMember2024-09-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000766829us-gaap:CommonStockMember2022-12-310000766829us-gaap:AdditionalPaidInCapitalMember2022-12-310000766829us-gaap:RetainedEarningsMember2022-12-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100007668292022-12-310000766829us-gaap:RetainedEarningsMember2023-01-012023-03-3100007668292023-01-012023-03-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000766829us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000766829us-gaap:CommonStockMember2023-01-012023-03-310000766829us-gaap:CommonStockMember2023-03-310000766829us-gaap:AdditionalPaidInCapitalMember2023-03-310000766829us-gaap:RetainedEarningsMember2023-03-310000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100007668292023-03-310000766829us-gaap:RetainedEarningsMember2023-04-012023-06-3000007668292023-04-012023-06-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000766829us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000766829us-gaap:CommonStockMember2023-04-012023-06-300000766829us-gaap:CommonStockMember2023-06-300000766829us-gaap:AdditionalPaidInCapitalMember2023-06-300000766829us-gaap:RetainedEarningsMember2023-06-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000007668292023-06-300000766829us-gaap:RetainedEarningsMember2023-07-012023-09-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000766829us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000766829us-gaap:CommonStockMember2023-07-012023-09-300000766829us-gaap:CommonStockMember2023-09-300000766829us-gaap:AdditionalPaidInCapitalMember2023-09-300000766829us-gaap:RetainedEarningsMember2023-09-300000766829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-3000007668292023-09-300000766829sjw:WarehouseBuildingMember2024-04-012024-04-300000766829sjw:OfficeBuildingLandAndParkingLotMember2024-06-012024-06-300000766829sjw:TennesseePropertiesMember2023-12-3100007668292023-08-140000766829us-gaap:FairValueInputsLevel2Member2024-09-300000766829us-gaap:FairValueInputsLevel2Member2023-12-310000766829us-gaap:FairValueInputsLevel3Member2024-09-300000766829us-gaap:FairValueInputsLevel3Member2023-12-310000766829us-gaap:FairValueInputsLevel1Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-09-300000766829us-gaap:FairValueInputsLevel1Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000766829us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300000766829us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300000766829us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300000766829us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300000766829sjw:RegulatoryAssetImpairmentMember2024-04-012024-06-300000766829us-gaap:GeneralAndAdministrativeExpenseMember2024-04-012024-06-300000766829us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300000766829us-gaap:DeferredIncomeTaxChargesMember2024-09-300000766829us-gaap:DeferredIncomeTaxChargesMember2023-12-310000766829us-gaap:PensionAndOtherPostretirementPlansCostsMember2024-09-300000766829us-gaap:PensionAndOtherPostretirementPlansCostsMember2023-12-310000766829sjw:BusinessCombinationsDebtPremiumMember2024-09-300000766829sjw:BusinessCombinationsDebtPremiumMember2023-12-310000766829sjw:EmployeeBenefitCostsMember2024-09-300000766829sjw:EmployeeBenefitCostsMember2023-12-310000766829sjw:MontereyWaterRevenueAdjustmentMechanismMWRAMMember2024-09-300000766829sjw:MontereyWaterRevenueAdjustmentMechanismMWRAMMember2023-12-310000766829sjw:CustomerAssistanceProgramBalancingAccountMember2024-09-300000766829sjw:CustomerAssistanceProgramBalancingAccountMember2023-12-310000766829sjw:CatastrophicEventMemorandumAccountsCemaMember2024-09-300000766829sjw:CatastrophicEventMemorandumAccountsCemaMember2023-12-310000766829sjw:A2022GeneralRateCaseInterimMemorandumAccountMember2024-09-300000766829sjw:A2022GeneralRateCaseInterimMemorandumAccountMember2023-12-310000766829sjw:RevenueAdjustmentMechanismsMember2024-09-300000766829sjw:RevenueAdjustmentMechanismsMember2023-12-310000766829sjw:WaterSupplyCostsMember2024-09-300000766829sjw:WaterSupplyCostsMember2023-12-310000766829sjw:OtherRegulatoryAssetsMember2024-09-300000766829sjw:OtherRegulatoryAssetsMember2023-12-310000766829sjw:CostOfRemovalMember2024-09-300000766829sjw:CostOfRemovalMember2023-12-310000766829us-gaap:DeferredIncomeTaxChargesMember2024-09-300000766829us-gaap:DeferredIncomeTaxChargesMember2023-12-310000766829sjw:UnrecognizedPensionsAndOtherPostretirementBenefitsMember2024-09-300000766829sjw:UnrecognizedPensionsAndOtherPostretirementBenefitsMember2023-12-310000766829sjw:RevenueAdjustmentMechanismsMember2024-09-300000766829sjw:RevenueAdjustmentMechanismsMember2023-12-310000766829sjw:WaterSupplyCostsMember2024-09-300000766829sjw:WaterSupplyCostsMember2023-12-310000766829sjw:OtherRegulatoryLiabilitiesMember2024-09-300000766829sjw:OtherRegulatoryLiabilitiesMember2023-12-310000766829srt:MinimumMember2024-01-012024-09-300000766829srt:MaximumMember2024-01-012024-09-300000766829sjw:AtTheMarketOfferingMember2021-11-170000766829sjw:AtTheMarketOfferingMember2024-07-012024-09-300000766829sjw:AtTheMarketOfferingMember2024-01-012024-09-300000766829sjw:AtTheMarketOfferingMember2021-11-172024-09-300000766829sjw:AtTheMarketOfferingMember2024-09-300000766829us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300000766829sjw:A6.46SeniorNoteSeries2023Membersjw:ConnecticutWaterCompanyMemberus-gaap:SeniorNotesMember2023-11-150000766829sjw:A5.63SeniorNotesSeriesQMembersjw:SanJoseWaterCompanyMemberus-gaap:SeniorNotesMember2024-07-310000766829sjw:A5.78SeniorNotesDue2054Membersjw:ConnecticutWaterCompanyMemberus-gaap:SeniorNotesMember2024-07-3100007668292024-09-012024-09-300000766829srt:ScenarioForecastMember2024-10-012024-12-310000766829sjw:CTWSEmployeesMember2024-01-012024-09-300000766829us-gaap:PensionPlansDefinedBenefitMember2024-07-012024-09-300000766829us-gaap:PensionPlansDefinedBenefitMember2023-07-012023-09-300000766829us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-07-012024-09-300000766829us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-07-012023-09-300000766829us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-09-300000766829us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-09-300000766829us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-09-300000766829us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersjw:IncentivePlanMember2024-09-300000766829sjw:EmployeeStockPurchasePlanMember2024-07-012024-09-300000766829sjw:EmployeeStockPurchasePlanMember2023-07-012023-09-300000766829sjw:EmployeeStockPurchasePlanMember2024-01-012024-09-300000766829sjw:EmployeeStockPurchasePlanMember2023-01-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMember2024-07-012024-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMember2023-07-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMember2024-01-012024-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMember2023-01-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MinimumMember2023-07-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MaximumMember2023-07-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MinimumMember2024-01-012024-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MinimumMember2023-01-012023-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MaximumMember2024-01-012024-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMembersrt:MaximumMember2023-01-012023-09-300000766829us-gaap:PerformanceSharesMember2024-07-012024-09-300000766829us-gaap:PerformanceSharesMember2023-07-012023-09-300000766829us-gaap:PerformanceSharesMember2024-01-012024-09-300000766829us-gaap:PerformanceSharesMember2023-01-012023-09-300000766829us-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-09-300000766829us-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-09-300000766829sjw:MarketbasedRSUMembersrt:MinimumMember2024-01-012024-09-300000766829sjw:MarketbasedRSUMembersrt:MaximumMember2024-01-012024-09-300000766829sjw:RestrictedStockAndDeferredRestrictedStockMember2024-09-300000766829sjw:EmployeeStockPurchasePlanMember2024-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2024-07-012024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2024-07-012024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2024-07-012024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2024-07-012024-09-300000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2024-07-012024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2024-07-012024-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2023-07-012023-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2023-07-012023-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2023-07-012023-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2023-07-012023-09-300000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2023-07-012023-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2023-07-012023-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2024-01-012024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2024-01-012024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2024-01-012024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2024-01-012024-09-300000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2024-01-012024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2024-01-012024-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2023-01-012023-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2023-01-012023-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2023-01-012023-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2023-01-012023-09-300000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2023-01-012023-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2023-01-012023-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2024-09-300000766829us-gaap:RegulatedOperationMembersjw:ReportableSegmentOneMember2023-12-310000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentOneMember2023-12-310000766829sjw:ReportableSegmentOneMember2024-09-300000766829sjw:ReportableSegmentOneMember2023-12-310000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2024-09-300000766829us-gaap:UnregulatedOperationMembersjw:ReportableSegmentTwoMember2023-12-310000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:AllOtherSegmentsMember2023-12-310000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2024-09-300000766829us-gaap:RegulatedOperationMemberus-gaap:CorporateMember2023-12-310000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2024-09-300000766829us-gaap:UnregulatedOperationMemberus-gaap:CorporateMember2023-12-310000766829sjw:KTWaterDevelopmentLtdMembersjw:TexasWaterMember2023-08-140000766829sjw:SouthernComalCountyTexasMembersjw:KTWaterDevelopmentLtdMembersjw:TexasWaterMember2023-08-140000766829sjw:KTWaterDevelopmentLtdMember2023-08-142023-08-140000766829sjw:KTWaterResourceLPMember2023-08-142023-08-140000766829sjw:KTWaterResourceLPMember2023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-8966

SJW GROUP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 77-0066628 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

110 West Taylor Street, San Jose, CA | | 95110 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 279-7800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | SJW | | New York Stock Exchange LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Non-accelerated filer ☐

Accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of October 21, 2024, there were 33,253,536 shares of the registrant’s Common Stock outstanding.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. These forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors:

•the effect of water, utility, environmental and other governmental policies and regulations, including regulatory actions concerning rates, authorized return on equity, authorized capital structures, capital expenditures, per- and polyfluroralkyl substances (“PFAS”) and other decisions;

•changes in demand for water and other services;

•unanticipated weather conditions and changes in seasonality including those affecting water supply and customer usage;

•the effect of the impacts of climate change;

•unexpected costs, charges or expenses;

•our ability to successfully evaluate investments in new business and growth initiatives;

•contamination of our water supplies and damage or failure of our water equipment and infrastructure;

•the risk of work stoppages, strikes and other labor-related actions;

•catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, hurricanes, terrorist acts, physical attacks, cyber-attacks, epidemic or other similar occurrences;

•changes in general economic, political, business and financial market conditions;

•the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings, changes in interest rates, compliance with regulatory requirements, compliance with the terms and conditions of our outstanding indebtedness and general market and economic conditions; and

•legislative and general market and economic developments.

The risks, uncertainties and other factors may cause the actual results, performance or achievements of SJW Group to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Results for a quarter are not indicative of results for a full year due to seasonality and other factors. In addition, actual results, performance or achievements are subject to other risks and uncertainties that relate more broadly to our overall business, including those more fully described in our filings with the SEC, including our most recent reports on Form 10-K, Form 10-Q and Form 8-K. Forward-looking statements are not guarantees of future performance, and speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

PART I. FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Operating revenue | $ | 225,063 | | | 204,843 | | | $ | 550,619 | | | 499,025 | |

Operating expense: | | | | | | | |

| Production Expenses: | | | | | | | |

| Purchased water | 54,310 | | | 46,044 | | | 118,631 | | | 101,054 | |

| Power | 3,396 | | | 2,785 | | | 8,560 | | | 7,363 | |

| Groundwater extraction charges | 25,081 | | | 21,398 | | | 54,759 | | | 46,751 | |

| Other production expenses | 12,919 | | | 12,415 | | | 36,020 | | | 36,379 | |

| Total production expenses | 95,706 | | | 82,642 | | | 217,970 | | | 191,547 | |

| Administrative and general | 25,708 | | | 23,888 | | | 71,964 | | | 71,759 | |

| Maintenance | 8,512 | | | 6,457 | | | 23,080 | | | 18,813 | |

| Property taxes and other non-income taxes | 9,361 | | | 8,795 | | | 26,610 | | | 25,092 | |

| Depreciation and amortization | 27,423 | | | 26,455 | | | 84,159 | | | 78,872 | |

| | | | | | | |

| Total operating expense | 166,710 | | | 148,237 | | | 423,783 | | | 386,083 | |

Operating income | 58,353 | | | 56,606 | | | 126,836 | | | 112,942 | |

Other (expense) income: | | | | | | | |

| Interest on long-term debt and other interest expense | (17,516) | | | (16,744) | | | (53,394) | | | (48,913) | |

Pension non-service credit (cost) | 940 | | | (740) | | | 2,829 | | | (906) | |

| | | | | | | |

| Other, net | (1,197) | | | 1,661 | | | 2,659 | | | 7,042 | |

| Income before income taxes | 40,580 | | | 40,783 | | | 78,930 | | | 70,165 | |

| Provision for income taxes | 1,928 | | | 4,561 | | | 7,883 | | | 4,127 | |

Net income | 38,652 | | | 36,222 | | | 71,047 | | | 66,038 | |

Other comprehensive income (loss), net | — | | | 318 | | | (442) | | | 420 | |

Comprehensive income | $ | 38,652 | | | 36,540 | | | $ | 70,605 | | | 66,458 | |

| | | | | | | |

Earnings per share | | | | | | | |

| Basic | $ | 1.17 | | | 1.14 | | | $ | 2.19 | | | 2.10 | |

| Diluted | $ | 1.17 | | | 1.13 | | | $ | 2.18 | | | 2.09 | |

Dividends per share | $ | 0.40 | | | 0.38 | | | $ | 1.20 | | | 1.14 | |

Weighted average shares outstanding | | | | | | | |

| Basic | 32,896,967 | | | 31,862,518 | | | 32,458,666 | | | 31,436,077 | |

| Diluted | 32,982,580 | | | 31,934,636 | | | 32,530,954 | | | 31,526,732 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

Assets | | | |

Utility plant: | | | |

| Land | $ | 44,646 | | | 41,415 | |

| Depreciable plant and equipment | 4,141,490 | | | 3,967,911 | |

Construction work in progress | 203,040 | | | 106,980 | |

| Intangible assets | 64,372 | | | 35,946 | |

| Total utility plant | 4,453,548 | | | 4,152,252 | |

| Less: accumulated depreciation and amortization | 1,047,631 | | | 981,598 | |

| Net utility plant | 3,405,917 | | | 3,170,654 | |

| | | |

| Nonutility properties and real estate investments | 1,352 | | | 13,350 | |

| Less: accumulated depreciation and amortization | 97 | | | 194 | |

Net nonutility properties and real estate investments | 1,255 | | | 13,156 | |

| | | |

Current assets: | | | |

| Cash and cash equivalents | 3,967 | | | 9,723 | |

| | | |

| Accounts receivable: | | | |

Customers, net of allowances for uncollectible accounts of $848 and $6,551 on September 30, 2024 and December 31, 2023, respectively | 75,849 | | | 67,870 | |

| Income tax | 11,262 | | | 5,187 | |

| Other | 6,286 | | | 3,684 | |

| Accrued unbilled utility revenue | 68,342 | | | 49,543 | |

| Assets held for sale | — | | | 40,850 | |

| Prepaid expenses | 15,411 | | | 11,110 | |

Current regulatory assets | 828 | | | 4,276 | |

| Other current assets | 5,331 | | | 6,146 | |

| Total current assets | 187,276 | | | 198,389 | |

Other assets: | | | |

| Regulatory assets, less current portion | 253,162 | | | 235,910 | |

| Investments | 18,213 | | | 16,411 | |

Postretirement benefit plans | 39,387 | | | 33,794 | |

Other intangible asset | — | | | 28,386 | |

| Goodwill | 640,311 | | | 640,311 | |

| Other | 6,781 | | | 8,056 | |

| Total other assets | 957,854 | | | 962,868 | |

Total assets | $ | 4,552,302 | | | 4,345,067 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

Capitalization and liabilities | | | |

Capitalization: | | | |

| Stockholders’ equity: | | | |

Common stock, $0.001 par value; authorized 70,000,000 shares; issued and outstanding shares 33,226,735 on September 30, 2024 and 32,023,004 on December 31, 2023 | $ | 33 | | | 32 | |

| Additional paid-in capital | 804,848 | | | 736,191 | |

| Retained earnings | 527,575 | | | 495,383 | |

| Accumulated other comprehensive income | 1,349 | | | 1,791 | |

| Total stockholders’ equity | 1,333,805 | | | 1,233,397 | |

| Long-term debt, less current portion | 1,673,715 | | | 1,526,699 | |

| Total capitalization | 3,007,520 | | | 2,760,096 | |

| | | |

Current liabilities: | | | |

| Lines of credit | 93,235 | | | 171,500 | |

| Current portion of long-term debt | 8,088 | | | 48,975 | |

| Accrued groundwater extraction charges, purchased water and power | 38,433 | | | 24,479 | |

| Accounts payable | 44,480 | | | 46,121 | |

| Accrued interest | 19,549 | | | 15,816 | |

| Accrued payroll | 12,180 | | | 12,229 | |

| | | |

| Current regulatory liabilities | 1,770 | | | 3,059 | |

| Other current liabilities | 26,314 | | | 20,795 | |

| Total current liabilities | 244,049 | | | 342,974 | |

| | | |

Deferred income taxes | 268,370 | | | 238,528 | |

Advances for construction | 150,546 | | | 146,582 | |

Contributions in aid of construction | 336,559 | | | 326,451 | |

Postretirement benefit plans | 48,158 | | | 46,836 | |

Regulatory liabilities, less current portion | 473,899 | | | 461,108 | |

Other noncurrent liabilities | 23,201 | | | 22,492 | |

Commitments and contingencies | | | |

Total capitalization and liabilities | $ | 4,552,302 | | | 4,345,067 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income | | | | Total

Stockholders’

Equity |

Number of

Shares | | Amount | |

Balances, December 31, 2023 | 32,023,004 | | | $ | 32 | | | 736,191 | | | 495,383 | | | 1,791 | | | | | 1,233,397 | |

| Net income | — | | | — | | | — | | | 11,699 | | | — | | | | | 11,699 | |

Unrealized loss on investment, net of tax of $163 | — | | | — | | | — | | | — | | | (442) | | | | | (442) | |

| Stock-based compensation | — | | | — | | | 1,538 | | | (9) | | | — | | | | | 1,529 | |

| Issuance of restricted and deferred stock units | 30,432 | | | — | | | (1,215) | | | — | | | — | | | | | (1,215) | |

| Employee stock purchase plan | 21,755 | | | — | | | 1,101 | | | — | | | — | | | | | 1,101 | |

| Common stock issuance, net of costs | 126,025 | | | — | | | 7,006 | | | — | | | — | | | | | 7,006 | |

Dividends paid ($0.40 per share) | — | | | — | | | — | | | (12,824) | | | — | | | | | (12,824) | |

Balances, March 31, 2024 | 32,201,216 | | | 32 | | | 744,621 | | | 494,249 | | | 1,349 | | | | | 1,240,251 | |

| Net income | — | | | — | | | — | | | 20,696 | | | — | | | | | 20,696 | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 1,275 | | | (8) | | | | | | | 1,267 | |

| Issuance of restricted and deferred stock units | 9,083 | | | — | | | (2) | | | — | | | — | | | | | (2) | |

| Common stock issuance, net of costs | 458,605 | | | 1 | | | 25,295 | | | — | | | — | | | | | 25,296 | |

Dividends paid ($0.40 per share) | — | | | — | | | — | | | (12,900) | | | — | | | | | (12,900) | |

| Balances, June 30, 2024 | 32,668,904 | | | 33 | | | 771,189 | | | 502,037 | | | 1,349 | | | | | 1,274,608 | |

| Net income | — | | | — | | | — | | | 38,652 | | | — | | | | | 38,652 | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 1,566 | | | (8) | | | — | | | | | 1,558 | |

| Issuance of restricted and deferred stock units | 1,388 | | | — | | | (1) | | | — | | | — | | | | | (1) | |

| Employee stock purchase plan | 21,098 | | | — | | | 1,087 | | | — | | | — | | | | | 1,087 | |

| Common stock issuance, net of costs | 535,345 | | | — | | | 31,007 | | | — | | | — | | | | | 31,007 | |

Dividends paid ($0.40 per share) | — | | | — | | | — | | | (13,106) | | | — | | | | | (13,106) | |

| Balances, September 30, 2024 | 33,226,735 | | | $ | 33 | | | 804,848 | | | 527,575 | | | 1,349 | | | | | 1,333,805 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | | | Total

Stockholders’

Equity |

Number of

Shares | | Amount | |

Balances, December 31, 2022 | 30,801,912 | | | $ | 31 | | | 651,004 | | | 458,356 | | | 1,477 | | | | | 1,110,868 | |

| Net income | — | | | — | | | — | | | 11,530 | | | — | | | | | 11,530 | |

Unrealized gain on investment, net of taxes of $0 | — | | | — | | | — | | | — | | | 93 | | | | | 93 | |

| Stock-based compensation | — | | | — | | | 1,199 | | | (22) | | | — | | | | | 1,177 | |

| Issuance of restricted and deferred stock units | 38,776 | | | — | | | (1,538) | | | — | | | — | | | | | (1,538) | |

| Employee stock purchase plan | 16,410 | | | — | | | 1,080 | | | — | | | — | | | | | 1,080 | |

| Common stock issuance, net of costs | 570,026 | | | — | | | 40,997 | | | — | | | — | | | | | 40,997 | |

Dividends paid ($0.38 per share) | — | | | — | | | — | | | (11,722) | | | — | | | | | (11,722) | |

Balances, March 31, 2023 | 31,427,124 | | | 31 | | | 692,742 | | | 458,142 | | | 1,570 | | | | | 1,152,485 | |

| Net income | — | | | — | | | — | | | 18,286 | | | — | | | | | 18,286 | |

Unrealized gain on investment, net of taxes of $(37) | — | | | — | | | — | | | — | | | 8 | | | | | 8 | |

| Stock-based compensation | — | | | — | | | 1,139 | | | (17) | | | | | | | 1,122 | |

| Issuance of restricted and deferred stock units | 13,429 | | | — | | | (20) | | | — | | | — | | | | | (20) | |

| Common stock issuance, net of costs | 290,477 | | | 1 | | | 22,781 | | | — | | | — | | | | | 22,782 | |

Dividends paid ($0.38 per share) | — | | | — | | | — | | | (11,947) | | | — | | | | | (11,947) | |

| Balances, June 30, 2023 | 31,731,030 | | | 32 | | | 716,642 | | | 464,464 | | | 1,578 | | | | | 1,182,716 | |

| Net income | — | | | — | | | — | | | 36,222 | | | — | | | | | 36,222 | |

Unrealized gain on investment, net of taxes of $193 | — | | | — | | | — | | | — | | | 318 | | | | | 318 | |

| Stock-based compensation | — | | | — | | | 1,238 | | | (8) | | | — | | | | | 1,230 | |

| Issuance of restricted and deferred stock units | 14,840 | | | — | | | (706) | | | — | | | — | | | | | (706) | |

| Employee stock purchase plan | 17,712 | | | — | | | 1,061 | | | — | | | — | | | | | 1,061 | |

| Common stock issuance, net of costs | 169,421 | | | — | | | 11,505 | | | — | | | — | | | | | 11,505 | |

Dividends paid ($0.38 per share) | — | | | — | | | — | | | (12,093) | | | — | | | | | (12,093) | |

| Balances, September 30, 2023 | 31,933,003 | | | $ | 32 | | | 729,740 | | | 488,585 | | | 1,896 | | | | | 1,220,253 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW Group and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands) | | | | | | | | | | | |

| | Nine months ended September 30, |

| | 2024 | | 2023 |

| Operating activities: | | | |

| Net income | $ | 71,047 | | | 66,038 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 85,811 | | | 80,544 | |

| Deferred income taxes | 27,142 | | | 12,996 | |

| Stock-based compensation | 4,379 | | | 3,576 | |

| Allowance for equity funds used during construction | (1,750) | | | (1,649) | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable and accrued unbilled utility revenue | (26,509) | | | (26,782) | |

| Accounts payable and other current liabilities | (2,271) | | | 557 | |

| Accrued groundwater extraction charges, purchased water and power | 13,954 | | | 13,463 | |

| Tax receivable and payable, and other accrued taxes | (17,960) | | | 690 | |

| Postretirement benefits | (2,363) | | | (1,851) | |

| Regulatory assets and liabilities excluding cost of removal, income tax temporary differences, and postretirement benefits | 836 | | | 16,092 | |

| Other changes, net | 1,750 | | | (4,371) | |

| Net cash provided by operating activities | 154,066 | | | 159,303 | |

| Investing activities: | | | |

| Additions to utility plant: | | | |

| Company-funded | (252,275) | | | (195,937) | |

| Contributions in aid of construction | (18,757) | | | (13,604) | |

| Additions to nonutility assets and real estate investments | — | | | (24,244) | |

| Cost to retire utility plant, net of salvage | (2,286) | | | (908) | |

Proceeds from sale of real estate investments | 40,669 | | | — | |

| Payments for business acquisitions | — | | | (7,286) | |

| Other changes, net | (29) | | | 238 | |

| Net cash used in investing activities | (232,678) | | | (241,741) | |

| Financing activities: | | | |

| Borrowings on line of credit | 156,000 | | | 102,655 | |

| Repayments on line of credit | (235,149) | | | (133,800) | |

| Long-term borrowings | 150,329 | | | 70,000 | |

| Repayments of long-term borrowings | (43,053) | | | (3,062) | |

| Issuance of common stock, net of issuance costs | 63,309 | | | 75,284 | |

| | | |

| Dividends paid | (38,830) | | | (35,762) | |

| Receipts of advances and contributions in aid of construction | 22,304 | | | 18,889 | |

| Refunds of advances for construction | (2,113) | | | (2,148) | |

| Other changes, net | 59 | | | (895) | |

| Net cash provided by financing activities | 72,856 | | | 91,161 | |

| Net change in cash and cash equivalents | (5,756) | | | 8,723 | |

| Cash and cash equivalents, beginning of period | 9,723 | | | 12,344 | |

| | | |

| | | |

| Cash and cash equivalents, end of period | $ | 3,967 | | | 21,067 | |

| Cash paid during the period for: | | | |

| Interest | $ | 52,299 | | | 44,132 | |

Interest, net of amounts capitalized | $ | 49,716 | | | 42,199 | |

| Income taxes | $ | 1,292 | | | 818 | |

| Supplemental disclosure of non-cash activities: | | | |

| Accrued payables for additions to utility plant | $ | 35,970 | | | 26,315 | |

| Utility property installed by developers | $ | 699 | | | 1,295 | |

Proceeds receivable from sale of real estate investments | $ | 2,801 | | | — | |

Accrued selling expenses on sale of real estate investments | $ | 2,201 | | | — | |

| Seller financing in asset acquisition, net of discount | $ | — | | | 15,400 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2024

(in thousands, except share and per share data)

Note 1.General

In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (consisting only of normal, recurring adjustments) necessary for a fair presentation of the results for the interim periods.

The unaudited interim financial information has been prepared in accordance with accounting principles generally accepted in the United States of America and in accordance with the instructions for Form 10-Q and Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission. The Notes to Consolidated Financial Statements in SJW Group’s 2023 Annual Report on Form 10-K should be read in conjunction with the accompanying unaudited condensed consolidated financial statements.

SJW Group is a holding company with five wholly owned subsidiaries: San Jose Water Company (“SJWC”), SJWTX Holdings, Inc., SJW Land Company, SJWNE LLC, and National Water Utility Service, LLC (“National Water Utility”). SJWTX Holdings, Inc., is a holding company for its wholly owned subsidiaries, SJWTX, Inc., doing business as The Texas Water Company (“TWC”), Texas Water Operation Services, LLC, (“TWOS”) and Texas Water Resources, LLC (“TWR”). SJWNE LLC is the holding company for Connecticut Water Service, Inc. (“CTWS”) whose wholly owned subsidiaries are The Connecticut Water Company (“CWC”), The Maine Water Company (“MWC”), New England Water Utility Services, Inc. (“NEWUS”), and Chester Realty, Inc. National Water Utility is the contracting entity for shared services among the SJW Group affiliates formed in October 2024. SJWC, CWC, TWC, TWOS, TWR, MWC, NEWUS and National Water Utility are referred to as “Water Utility Services.” SJW Land Company and Chester Realty, Inc. are collectively referred to as “Real Estate Services.”

Revenue

Water sales are seasonal in nature and influenced by weather conditions. The timing of precipitation and climatic conditions can cause seasonal water consumption by customers to vary significantly. Due to the seasonal nature of the water business, the operating results for interim periods are not indicative of the operating results for a 12-month period. Revenue is generally higher in the warm, dry summer months when water usage and sales are greater, and lower in the winter months when cooler temperatures and increased precipitation curtail water usage resulting in lower sales.

SJW Group’s revenue components are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue from contracts with customers | $ | 216,677 | | | 211,716 | | | $ | 539,790 | | | 507,276 | |

| Alternative revenue programs, net | 7,369 | | | 957 | | | 6,847 | | | (2,638) | |

| Other balancing and memorandum accounts and regulatory mechanisms, net | (1,432) | | | (9,260) | | | (1,019) | | | (9,906) | |

| Rental income | 2,449 | | | 1,430 | | | 5,001 | | | 4,293 | |

| $ | 225,063 | | | 204,843 | | | $ | 550,619 | | | 499,025 | |

Nonutility Properties and Real Estate Investments

The major components of nonutility properties and real estate investments as of September 30, 2024 and December 31, 2023, are as follows:

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Land | $ | 915 | | | 4,137 | |

Wholesale water supply assets | — | | | 8,465 | |

| Buildings and improvements | 437 | | | 748 | |

| | | |

| Subtotal | 1,352 | | | 13,350 | |

| Less: accumulated depreciation and amortization | 97 | | | 194 | |

| Total | $ | 1,255 | | | 13,156 | |

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

In March 2023, SJW Land Company entered into a broker agreement to sell its warehouse, office building, and land property located in Knoxville, Tennessee. The company reclassified the Tennessee properties from held-and-used to held-for-sale at March 31, 2023. The company recorded the Tennessee properties at the lower of their carrying value or estimated fair value less cost to sell, and also stopped recording depreciation on assets held for sale. SJW Group's broker provided the estimated fair value of the Tennessee properties.

In April 2024, SJW Land Company completed the sale of a warehouse building of the Tennessee properties for $27,000. The pre-tax gain on the sale was $6,918. In June 2024, SJW Land Company completed the sale of an office building, land, and parking lot of the Tennessee properties for $17,000. The pre-tax loss on the sale was $7,887. The net pre-tax loss associated with these transactions for the nine months ended September 30, 2024 was $969 and is included in the “Other, net” line on the condensed consolidated statements of comprehensive income. A portion of the proceeds from these sales totaling $2,801 is being held in escrow pending completion of certain post-closing obligations. As a result of these two transactions, the sale of the Tennessee properties is complete and the company does not have any other assets held for sale.

The sale of the Tennessee properties does not represent a strategic shift that has or will have a major effect on SJW Group; therefore, the sale does not qualify for treatment as a discontinued operation.

The Tennessee properties are included in SJW Group’s “Real Estate Services” reportable segment in Note 9, “Segment and Non-Tariffed Business Reporting”. The following represents the major components of the Tennessee properties that were recorded in assets held-for-sale on the condensed consolidated balance sheets as of December 31, 2023: | | | | | |

| December 31,

2023 |

| Land | $ | 13,170 | |

| Buildings and improvements | 44,950 | |

| |

| Subtotal | 58,120 | |

| Less: accumulated depreciation and amortization | 17,270 | |

| Total | $ | 40,850 | |

In August 2023, a non-regulated subsidiary, TWR, acquired eight wells and the associated water rights of KT Water Resources, LLC, as discussed in Note 10, “Acquisitions”. In connection with a transaction in the third quarter of 2024, TWC purchased these assets from TWR for use in utility operations. Accordingly, SJW Group reclassified $28,386 related to indefinite life water rights from other intangible assets to utility plant intangible assets and $11,684 from nonutility property to utility plant. Fair Value Measurement

The following instruments are not measured at fair value on SJW Group’s condensed consolidated balance sheets as of September 30, 2024, but require disclosure of their fair values: cash and cash equivalents, accounts receivable and accounts payable. The estimated fair value of such instruments as of September 30, 2024 approximates their carrying value as reported on the condensed consolidated balance sheets. There have been no changes in valuation techniques during the three and nine months ended September 30, 2024. The fair value of these instruments would be categorized as Level 2 in the fair value hierarchy, with the exception of cash and cash equivalents, which would be categorized as Level 1.

The fair value of SJW Group’s long-term debt was $1,534,801 and $1,394,412 as of September 30, 2024 and December 31, 2023, respectively, and was determined using a discounted cash flow analysis, based on the current rates for similar financial instruments of the same duration and creditworthiness of the company. Of the total fair value of long-term debt at September 30, 2024 and December 31, 2023, $1,518,400 and $1,378,683, respectively, would be categorized as Level 2 in the fair value hierarchy and $16,401 and $15,729, respectively, would be categorized as Level 3 in the fair value hierarchy.

CTWS’s additional retirement benefits under the supplemental executive retirement plans and retirement contracts are funded by investment assets held by a Rabbi Trust. The fair value of the money market funds, mutual funds and fixed income

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

investments in the Rabbi Trust was $2,952 and $2,833 as of September 30, 2024 and December 31, 2023, respectively, and are categorized as Level 1 in the fair value hierarchy.

Earnings per Share

Basic earnings per share is calculated using income available to common stockholders, divided by the weighted average number of shares outstanding during the period. Diluted earnings per share is calculated using income available to common stockholders divided by the weighted average number of shares of common stock including both shares outstanding and shares potentially issuable in connection with restricted common stock awards under SJW Group’s long-term incentive plans, shares potentially issuable under the performance stock plans assumed through the business combination with CTWS, and shares potentially issuable under SJW Group’s employee stock purchase plans. For the three months ended September 30, 2024 and 2023, 485 and 1,826 anti-dilutive restricted common stock units were excluded from the diluted earnings per share calculation, respectively. For the nine months ended September 30, 2024 and 2023, 5,289 and 12,524 anti-dilutive restricted common stock units were excluded from the diluted earnings per share calculation, respectively.

Accounts Receivable

During the second quarter of 2024, SJW Group recorded a reduction to its allowance for credit losses of $7,822, of which $3,960 resulted in a reduction to regulatory assets and $3,862 was recorded through administrative and general expense ($2,782 net of tax or $0.09 per diluted share for the nine months ended September 30, 2024).

New Accounting Standards

The recently issued accounting standards that have not yet been adopted by the company as of September 30, 2024 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Standard | | Description | | Date of Adoption | | Application | | Effect on the Condensed Consolidated Financial Statements |

Accounting Standards Update (“ASU”) 2023-07 “Improvements to Reportable Segment Disclosures” | | The ASU requires disclosure of significant segment expenses, extends certain annual disclosures to interim periods, and requires additional qualitative disclosures regarding the chief operating decision maker. | | The ASU is effective for SJW Group beginning with its annual financial statements for the year ending December 31, 2024. Early adoption is permitted. | | Retrospective | | SJW Group is currently evaluating the requirements of ASU 2023-07. |

ASU 2023-09 “Improvements to Income Tax Disclosures” | | The ASU amends certain income tax disclosure requirements, including adding requirements to present the reconciliation of income tax expense computed at the statutory rate to actual income tax expense using both percentages and amounts and providing a disaggregation of income taxes paid. Further, certain disclosures are eliminated, including the current requirement to disclose information on changes in unrecognized tax benefits in the next 12 months. | | The ASU is effective for SJW Group beginning with its annual financial statements for the year ending December 31, 2025. Early adoption is permitted. | | Prospective, with retrospective application also permitted. | | SJW Group is currently evaluating the requirements of ASU 2023-09. |

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

Note 2.Regulatory Matters

Regulatory assets and liabilities are comprised of the following as of September 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Regulatory assets: | | | |

Income tax temporary differences (a) | $ | 173,671 | | | 157,669 | |

Unrecognized pensions and other postretirement benefits (b) | 24,593 | | | 24,593 | |

Business combinations debt premium (c) | 12,948 | | | 14,855 | |

Employee benefit costs (d) | 5,433 | | | 9,815 | |

Monterey Water Revenue Adjustment Mechanism (“MWRAM”) (e) | 10,327 | | | 9,361 | |

Customer Assistance Program (“CAP”) balancing account (f) | 6,683 | | | 5,457 | |

Catastrophic event memorandum accounts (“CEMA”) (g) | 975 | | | 4,819 | |

2022 general rate case interim memorandum account (h) | 3,354 | | | 4,571 | |

Revenue adjustment mechanisms (n) | 2,528 | | | — | |

Water supply costs (i) | — | | | 583 | |

Other (j) | 13,478 | | | 8,463 | |

Total regulatory assets | 253,990 | | | 240,186 | |

Less: current regulatory assets (k) | 828 | | | 4,276 | |

Total regulatory assets, less current portion | $ | 253,162 | | | 235,910 | |

Regulatory liabilities: | | | |

Cost of removal (l) | 360,176 | | | 346,418 | |

Future income tax benefits due to customers (m) | 85,966 | | | 88,610 | |

Unrecognized pensions and other postretirement benefits (b) | 20,515 | | | 20,196 | |

Revenue adjustment mechanisms (n) | 1,770 | | | 5,536 | |

Water supply costs (i) | 3,648 | | | — | |

Other (o) | 3,594 | | | 3,407 | |

Total regulatory liabilities | 475,669 | | | 464,167 | |

Less: current regulatory liabilities (p) | 1,770 | | | 3,059 | |

Total regulatory liabilities, less current portion | $ | 473,899 | | | 461,108 | |

___________________________________(a)Consists primarily of temporary income tax differences that are flowed through to customers, which will be recovered in future rates as these temporary differences reverse. The company expects to recover regulatory assets related to plant depreciation income tax temporary differences over the lives of the plant assets, which are between 4 to 100 years.

(b)Represents actuarial losses and gains and prior service cost that have not yet been recognized as components of net periodic benefit cost for certain pension and other postretirement benefit plans.

(c)Consists of debt fair value adjustments recognized through purchase accounting for the completed merger with CTWS in 2019.

(d)Includes deferrals of pension and other postretirement benefit expense and cost of accrued benefits for vacation.

(e)MWRAM is described in the following section.

(f)Represents costs associated with SJWC’s CAP.

(g)The California Public Utilities Commission (“CPUC”) has authorized water utilities to activate CEMA accounts in order to track savings and costs related to SJWC’s response to catastrophic events, which includes external labor and materials, increases in bad debt from suspension of shutoffs for non-payment, waived deposits and reconnection fees, and divergence from actual versus authorized usage. At December 31, 2023, the balance primarily relates to increased bad debt expenses associated with SJWC’s response to COVID-19.

(h)Represents the difference between revenues collected in interim rates in effect as of January 1, 2022 and revenues that would result from rates authorized in SJWC’s 2022 general rate case retroactive to January 1, 2022.

(i)Reflects primarily SJWC’s Full Cost Balancing Account which tracks differences in actual water supply costs compared to amounts assumed in base rates, including applicable changes and variations in costs and quantities that affect the overall mix of the water supply.

(j)Other includes other balancing and memorandum accounts and regulatory mechanisms, deferred costs for certain information technology activities, asset retirement obligations, tank painting, well reconditioning and rate case expenses.

(k)As of September 30, 2024, primarily relates to the current portion of CWC’s deferred well redevelopment and rate case costs. As of December 31, 2023, primarily relates to the current portion of MWRAM.

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

(l)Represents amounts collected in rates from customers for estimated costs to retire assets at the end of their expected useful lives before the costs are incurred.

(m)On December 22, 2017 the Tax Cuts and Jobs Act of 2017 (the "Tax Act”) was signed into law. The Tax Act included a reduction in the federal income tax rate from 35% to 21%. The rate reduction was effective on January 1, 2018 and resulted in a regulatory liability for the excess deferred income taxes. The benefit of amortization of excess deferred income taxes flows back to the customers under current normalization rules and agreed upon methods with the commissions.

(n)Consists of Water Rate Adjustment mechanism (“WRA”) and Water Conservation Memorandum Account (“WCMA”),which are described in the following section.

(o)Other includes other balancing and memorandum accounts, other regulatory mechanisms and accrued tank painting costs.

(p)As of September 30, 2024 and December 31, 2023, primarily relates to the current portion of WRA.

SJWC has established balancing accounts for the purpose of tracking the under-collection or over-collection associated with expense changes and the revenue authorized by the CPUC to offset those expense changes. SJWC has been authorized for the use of the Full Cost Balancing Account to track water supply costs and energy consumption. The MWRAM balancing account tracks the difference between the revenue received for actual metered sales through the tiered volumetric rate and the revenue that would have been received with the same actual metered sales if a uniform rate would have been in effect.

SJWC also maintains memorandum accounts to track impacts due to catastrophic events, certain unforeseen water quality expenses related to new federal and state water quality standards, energy efficiency, water conservation, water tariffs, and other approved activities or as directed by the CPUC. The WCMA allows SJWC to track lost revenue, net of related water costs, associated with reduced sales due to water conservation and associated calls for water use reductions, both mandatory and voluntary. SJWC records the lost revenue captured in the WCMA balancing accounts. Applicable drought surcharges collected are used to offset the revenue losses tracked in the WCMA. All balancing accounts and memorandum accounts not included for recovery or refund in the current general rate case will be reviewed by the CPUC in SJWC’s next general rate case or at the time an individual account balance reaches a threshold of 2% of authorized revenue, whichever occurs first.

CWC has been authorized by the Connecticut Public Utilities Regulatory Authority (“PURA”) to utilize a WRA, a decoupling mechanism, to mitigate risk associated with changes in demand. The WRA is used to reconcile actual water demands with the demands projected in the most recent general rate case and allows the company to implement a surcharge or sur-credit as necessary to recover or refund the revenues approved in the general rate case. The WRA allows the company to defer, as a regulatory asset or liability, the amount by which actual revenues deviate from the revenues allowed in the most recent general rate proceedings.

As of September 30, 2024 and December 31, 2023, SJW Group’s regulatory assets not earning a return primarily included unrecognized pensions and other postretirement benefits and business combination debt premiums. The total amount of regulatory assets not earning a return at September 30, 2024 and December 31, 2023, either by interest on the regulatory asset or as a component of rate base at the allowed rate of return, was $41,962 and $43,141, respectively.

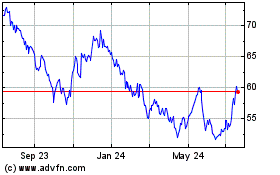

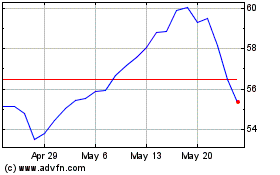

Note 3.Capitalization

In March 2023, SJW Group entered into Amendment No. 1 to the equity distribution agreement (the “Equity Distribution Agreement”), dated November 17, 2021, between SJW Group and J.P. Morgan Securities LLC, Janney Montgomery Scott LLC, RBC Capital Markets, LLC and Wells Fargo Securities, LLC, pursuant to which the company may offer and sell shares of its common stock, $0.001 par value per share, from time to time in “at-the-market” offerings, having an aggregate gross sales price of up to $240,000. For the three and nine months ended September 30, 2024, SJW Group issued and sold a total of 535,345 and 1,119,975 shares of common stock, respectively, at a weighted average price of $59.17 and $57.70 per share, respectively, and received $31,007 and $63,309 in net proceeds, respectively, under the Equity Distribution Agreement. Since the inception of the Equity Distribution Agreement, SJW Group has issued and sold 3,124,632 shares of common stock at a weighted average price of $67.88 for a total net proceeds of $207,307 and has $27,889 of aggregate gross sales price of shares remaining to issue under the Equity Distribution Agreement as of September 30, 2024.

Note 4.Lines of Credit and Long-Term Liabilities

SJW Group’s contractual obligations and commitments include senior notes, bank term loans, revenue bonds, state revolving fund loans and other obligations.

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

Lines of Credit

In August 2024, SJW Group, SJWC, TWC, and CTWS entered into an amendment to its credit agreement with JPMorgan Chase Bank and a syndicate of banks, which provided, among other matters, for an extension of the maturity date from August 2, 2028 to August 2, 2029.

The weighted average interest rate on short-term borrowings outstanding at September 30, 2024, was 6.61%, compared to 6.48% at December 31, 2023.

As of September 30, 2024, the unused portion of the lines of credit was $256,765.

Long-term Financing Agreements

On November 15, 2023, CWC entered into a note purchase agreement with certain institutional investors, pursuant to which the company sold an aggregate principal amount of $25,000 of its 6.46% Senior Notes, Series 2023 (“Series 2023 Notes”). The Series 2023 Notes are unsecured obligations of CWC and are due on January 1, 2054. Interest is payable semi-annually in arrears on January 15th and July 15th of each year. The closing of the notes purchase agreement occurred in January 2024.

On July 31, 2024, SJWC entered into and closed a note purchase agreement with certain institutional investors, pursuant to which the company sold an aggregate principal amount of $75,000 of its 5.63% Senior Notes, Series Q (“Series Q Notes”). The Series Q Notes are unsecured obligations of SJWC and are due on July 31, 2054. Interest is payable semi-annually in arrears on January 31st and July 31st of each year. The Series Q Notes are also subject to customary events of default.

On July 31, 2024, CWC entered into a note purchase agreement with certain institutional investors, pursuant to which the company sold $50,000 of its 5.78% Senior Notes, Series 2024 (“Series 2024 Notes”). The Series 2024 Notes are unsecured obligations of CWC and are due on July 31, 2054. Interest is payable semi-annually in arrears on January 31st and July 31st of each year. The closing of the notes purchase agreement occurred in August 2024.

Note 5.Income Taxes

For the three and nine months ended September 30, 2024, income tax expense was $1,928 and $7,883, respectively. Income tax expense for the three and nine months ended September 30, 2023 was $4,561 and $4,127, respectively. The effective consolidated income tax rates were 5% and 11% for the three months ended September 30, 2024 and 2023, respectively, and 10% and 6% for the nine months ended September 30, 2024 and 2023, respectively. The lower effective tax rate for the three months ended September 30, 2024 was primarily due to a tax accounting method change related to the repairs deduction. The higher effective tax rate for the nine months ended September 30, 2024 was primarily due to lower discrete tax benefits in 2024.

SJW Group had unrecognized tax benefits, before the impact of deductions of state taxes, excluding interest and penalties, of approximately $4,920 and $4,511 as of September 30, 2024 and December 31, 2023, respectively. SJW Group currently does not expect uncertain tax positions to change significantly over the next 12 months, except in the case of a lapse of the statute of limitations.

Note 6.Commitments and Contingencies

SJW Group is subject to ordinary routine litigation incidental to its business. In October 2023, CWC, a subsidiary of SJW Group, was named as a defendant in a class action lawsuit alleging that the water provided by CWC contained contaminants. CWC intends to vigorously defend itself in this lawsuit. At this time, SJW Group is unable to provide a reasonable estimate of any loss.

In September 2024, SJWC entered into a 12-year agreement with the City of Cupertino effective on October 1, 2024 pursuant to which SJWC will operate the City of Cupertino municipal water system, replacing the previous agreement with the City of Cupertino. The agreement can be extended for an additional term of eight years. In accordance with the new agreement, SJWC will pay an upfront concession fee of $22,100 in the fourth quarter of 2024. Additionally, SJWC agreed to pay an annual investment rent of $1,800, subject to increases each year based on a specified construction cost index.

Note 7.Benefit Plans

SJW Group maintains noncontributory defined benefit pension plans for its eligible employees. SJWC employees hired before March 31, 2008 and CWC and MWC employees hired before January 1, 2009 are entitled to benefits under the pension plans

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

based on the employee’s years of service and compensation. For SJWC employees hired on or after March 31, 2008, benefits are determined using a cash balance formula based upon compensation credits and interest credits for each employee. Starting in 2023, TWC employees are also eligible to participate under SJWC’s cash balance plan. Certain employees hired before March 1, 2012, and covered by a plan merged into the CWC plan in 2013 are also entitled to benefits based on the employee’s years of service and compensation. CTWS employees hired on or after January 1, 2009, are entitled to an additional 1.5% of eligible compensation to their company sponsored savings plan. SJW Group does not have multi-employer plans.

In addition, senior management hired before March 31, 2008, for SJWC and January 1, 2009 for CWC, are eligible to receive additional retirement benefits under supplemental executive retirement plans and retirement contracts. SJWC’s senior management hired on or after March 31, 2008, are eligible to receive additional retirement benefits under SJWC’s Cash Balance Executive Supplemental Retirement Plan. The supplemental retirement plans and Cash Balance Executive Supplemental Retirement Plan are non-qualified plans in which only senior management and other designated members of management may participate. SJW Group also provides health care and life insurance benefits for retired employees under employer-sponsored postretirement benefits that are not pension plans.

The components of net periodic benefit costs for the defined benefit plans and other postretirement benefits for the three and nine months ended September 30, 2024 and 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Pension Benefits | | Other Benefits |

| Three months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Service cost | $ | 1,666 | | | 1,892 | | | $ | 166 | | | 160 | |

| Interest cost | 3,613 | | | 3,557 | | | 295 | | | 317 | |

| Expected return on assets | (4,463) | | | (3,442) | | | (267) | | | (217) | |

Amortization of actuarial (gain) loss | (18) | | | 554 | | | (161) | | | (87) | |

| Amortization of prior service cost | 4 | | | 4 | | | — | | | — | |

| Total | $ | 802 | | | 2,565 | | | $ | 33 | | | 173 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Pension Benefits | | Other Benefits |

| Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Service cost | $ | 4,997 | | | 5,676 | | | $ | 498 | | | 480 | |

| Interest cost | 10,839 | | | 10,672 | | | 886 | | | 951 | |

| Expected return on assets | (13,389) | | | (11,580) | | | (801) | | | (651) | |

Amortization of actuarial (gain) loss | (53) | | | 1,662 | | | (483) | | | (263) | |

| Amortization of prior service cost | 11 | | | 11 | | | — | | | — | |

| Total | $ | 2,405 | | | 6,441 | | | $ | 100 | | | 517 | |

For the three and nine months ended September 30, 2024, SJW Group has made $2,258 and $4,516, respectively, of contributions to such plans. SJW Group does not expect to make any additional required and discretionary cash contributions to the pension plans and other postretirement benefit plans for the remainder of 2024.

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

Note 8.Equity Plans

SJW Group’s long-term incentive plans provide employees, non-employee board members or the board of directors of any parent or subsidiary, consultants, and other independent advisors who provide services to the company or subsidiary the opportunity to acquire an equity interest in SJW Group. SJW Group also maintains stock plans in connection with its acquisition of CTWS which are no longer granting new stock awards. In addition, shares are issued to employees under SJW Group’s employee stock purchase plan (“ESPP”). As of September 30, 2024, 187,810 shares are issuable upon the vesting of outstanding restricted stock units and deferred restricted stock units and an additional 1,038,040 shares are available for award issuances under the long-term incentive plans.

A summary of compensation costs charged to income, by award type, and proceeds from the ESPP, are presented below for the three and nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Compensation costs charged to income: | | | | | | | | | | | |

| ESPP | $ | 259 | | | 187 | | | $ | 454 | | | 378 | | | | | |

| Restricted stock and deferred restricted stock | 1,307 | | | 1,051 | | | 3,925 | | | 3,198 | | | | | |

| Total compensation costs charged to income | $ | 1,566 | | | 1,238 | | | $ | 4,379 | | | 3,576 | | | | | |

| ESPP proceeds | $ | 1,087 | | | 1,061 | | | $ | 2,188 | | | 2,141 | | | | | |

Restricted Stock and Deferred Restricted Stock

For the three months ended September 30, 2024, there was no grant activity of service-based restricted stock awards. For the three months ended September 30, 2023, SJW Group granted 968 one-year and three-year service-based restricted stock awards with a weighted average grant date fair value per unit of $63.96. For the nine months ended September 30, 2024 and 2023, SJW Group granted 64,482 and 38,310, respectively, one-year and three-year service-based restricted stock awards with a weighted average grant date fair value per unit of $56.70 and $76.88, respectively.

For the three months ended September 30, 2024 and 2023, there was no grant activity of performance-based or market-based restricted stock awards. For the nine months ended September 30, 2024 and 2023, SJW Group granted 45,763 and 31,345 target units, respectively, of performance-based and market-based restricted stock awards with a weighted average grant date fair value per unit of $55.60 and $80.05, respectively. Based upon actual attainment relative to the target performance metric, the number of shares issuable can range between 0% to 150% of the target number of shares for performance-based restricted stock awards, or between 0% and 200% of the target number of shares for market-based restricted stock awards.

As of September 30, 2024, the total unrecognized compensation costs related to restricted and deferred restricted stock plans was $6,739. This cost is expected to be recognized over a weighted average period of 1.77 years.

Employee Stock Purchase Plan

The total unrecognized compensation costs related to the semi-annual offering period that ends January 31, 2025, for the ESPP is approximately $135. This cost is expected to be recognized during the fourth quarter of 2024.

Note 9.Segment and Non-Tariffed Business Reporting

SJW Group is a holding company with five subsidiaries: (i) SJWC, (ii) SJWTX Holdings, Inc., a holding company for TWC, its consolidated variable interest entity, Acequia Water Supply Corporation, TWOS and TWR, (iii) SJW Land Company, (iv) SJWNE LLC, a holding company for CTWS and its subsidiaries, CWC, MWC, NEWUS and Chester Realty, Inc., and (v) National Water Utility. The first segment provides water utility and utility-related services to its customers through SJW Group’s subsidiaries, SJWC, CWC, TWC, MWC, NEWUS, and National Water Utility together referred to as “Water Utility Services.” Water Utility Services’ activities are water utility operations with both regulated and non-tariffed businesses. The second segment consists of property management and investment activity conducted by SJW Land Company and Chester Realty, Inc., referred to as “Real Estate Services.”

SJW Group’s reportable segments have been determined based on information used by the chief operating decision maker. SJW Group’s chief operating decision maker includes the Chairman, President and Chief Executive Officer, and his executive staff.

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

The executive staff reviews financial information presented on a consolidated basis that is accompanied by disaggregated information about operating revenue, net income and total assets, by subsidiary.

The following tables set forth information relating to SJW Group’s reportable segments and distribution of regulated and non-tariffed business activities within the reportable segments. Certain allocated assets, such as goodwill, revenue and expenses have been included in the reportable segment amounts. Other business activity of SJW Group not included in the reportable segments is included in the “All Other” category.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For Three Months Ended September 30, 2024 |

| | Water Utility Services (1) | | Real Estate Services | | All Other (2) | | SJW Group |

| | Regulated | | Non-tariffed | | Non-tariffed | | Non-tariffed | | Regulated | | Non-tariffed | | Total |

| Operating revenue | $ | 220,938 | | | 4,103 | | | 22 | | | — | | | 220,938 | | | 4,125 | | | 225,063 | |

| Operating expense | 161,929 | | | 2,799 | | | 205 | | | 1,777 | | | 161,929 | | | 4,781 | | | 166,710 | |

| Operating income (loss) | 59,009 | | | 1,304 | | | (183) | | | (1,777) | | | 59,009 | | | (656) | | | 58,353 | |

| Net income (loss) | 43,751 | | | 915 | | | 34 | | | (6,048) | | | 43,751 | | | (5,099) | | | 38,652 | |

| Depreciation and amortization | 27,113 | | | 85 | | | 1 | | | 224 | | | 27,113 | | | 310 | | | 27,423 | |

| Interest on long-term debt and other interest expense | 11,516 | | | 75 | | | — | | | 5,925 | | | 11,516 | | | 6,000 | | | 17,516 | |

| Provision (benefit) for income taxes | 1,182 | | | 389 | | | 15 | | | 342 | | | 1,182 | | | 746 | | | 1,928 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For Three Months Ended September 30, 2023 |

| | Water Utility Services (1) | | Real Estate Services | | All Other (2) | | SJW Group |

| | Regulated | | Non-tariffed | | Non-tariffed | | Non-tariffed | | Regulated | | Non-tariffed | | Total |

| Operating revenue | $ | 199,537 | | | 3,876 | | | 1,430 | | | — | | | 199,537 | | | 5,306 | | | 204,843 | |

| Operating expense | 144,102 | | | 2,337 | | | 691 | | | 1,107 | | | 144,102 | | | 4,135 | | | 148,237 | |

| Operating income (loss) | 55,435 | | | 1,539 | | | 739 | | | (1,107) | | | 55,435 | | | 1,171 | | | 56,606 | |

| Net income (loss) | 37,545 | | | 2,198 | | | 563 | | | (4,084) | | | 37,545 | | | (1,323) | | | 36,222 | |

| Depreciation and amortization | 26,147 | | | 84 | | | 1 | | | 223 | | | 26,147 | | | 308 | | | 26,455 | |

| Interest on long-term debt and other interest expense | 10,839 | | | 112 | | | — | | | 5,793 | | | 10,839 | | | 5,905 | | | 16,744 | |

| Provision (benefit) for income taxes | 5,933 | | | 428 | | | 196 | | | (1,996) | | | 5,933 | | | (1,372) | | | 4,561 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For Nine Months Ended September 30, 2024 |

| | Water Utility Services (1) | | Real Estate Services | | All Other (2) | | SJW Group |

| | Regulated | | Non-tariffed | | Non-tariffed | | Non-tariffed | | Regulated | | Non-tariffed | | Total |

| Operating revenue | $ | 537,899 | | | 10,146 | | | 2,574 | | | — | | | 537,899 | | | 12,720 | | | 550,619 | |

| Operating expense | 411,959 | | | 6,788 | | | 1,391 | | | 3,645 | | | 411,959 | | | 11,824 | | | 423,783 | |

| Operating income (loss) | 125,940 | | | 3,358 | | | 1,183 | | | (3,645) | | | 125,940 | | | 896 | | | 126,836 | |

| Net income (loss) | 82,307 | | | 2,145 | | | 617 | | | (14,022) | | | 82,307 | | | (11,260) | | | 71,047 | |

| Depreciation and amortization | 83,231 | | | 255 | | | 3 | | | 670 | | | 83,231 | | | 928 | | | 84,159 | |

| Interest on long-term debt and other interest expense | 35,095 | | | 520 | | | — | | | 17,779 | | | 35,095 | | | 18,299 | | | 53,394 | |

| Provision (benefit) for income taxes | 10,203 | | | 1,008 | | | 213 | | | (3,541) | | | 10,203 | | | (2,320) | | | 7,883 | |

SJW GROUP AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

September 30, 2024

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For Nine Months Ended September 30, 2023 |

| | Water Utility Services (1) | | Real Estate Services | | All Other (2) | | SJW Group |

| | Regulated | | Non-tariffed | | Non-tariffed | | Non-tariffed | | Regulated | | Non-tariffed | | Total |

| Operating revenue | $ | 485,334 | | | 9,398 | | | 4,293 | | | — | | | 485,334 | | | 13,691 | | | 499,025 | |

| Operating expense | 375,647 | | | 5,540 | | | 2,251 | | | 2,645 | | | 375,647 | | | 10,436 | | | 386,083 | |

| Operating income (loss) | 109,687 | | | 3,858 | | | 2,042 | | | (2,645) | | | 109,687 | | | 3,255 | | | 112,942 | |

| Net income (loss) | 71,277 | | | 3,412 | | | 1,532 | | | (10,183) | | | 71,277 | | | (5,239) | | | 66,038 | |

| Depreciation and amortization | 77,644 | | | 253 | | | 305 | | | 670 | | | 77,644 | | | 1,228 | | | 78,872 | |

| Interest on long-term debt and other interest expense | 32,232 | | | 112 | | | — | | | 16,569 | | | 32,232 | | | 16,681 | | | 48,913 | |

| Provision (benefit) for income taxes | 8,759 | | | 1,071 | | | 581 | | | (6,284) | | | 8,759 | | | (4,632) | | | 4,127 | |

____________________

(1) The “Water Utility Services” category for the three and nine months ended September 30, 2024 and 2023, includes the accounts of SJWC, CWC, TWC, MWC, and NEWUS on a stand-alone basis.

(2) The “All Other” category for the three and nine months ended September 30, 2024 and 2023, includes the accounts of SJW Group, SJWNE LLC, CTWS and SJWTX Holdings, Inc. on a stand-alone basis.

SJW Group’s assets by segment are as follows:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

Water Utility Services: | | | |

Regulated | $ | 4,496,972 | | | 4,199,172 | |

Non-tariffed | 1,424 | | | 43,532 | |

Total water utility services | 4,498,396 | | | 4,242,704 | |

Real Estate Services | 849 | | | 44,222 | |

All Other | 53,057 | | | 58,141 | |

Total assets | $ | 4,552,302 | | | 4,345,067 | |

| | | |

| Regulated | $ | 4,496,972 | | | 4,199,172 | |

| Non-tariffed | 55,330 | | | 145,895 | |

| Total assets | $ | 4,552,302 | | | 4,345,067 | |

Note 10.Acquisitions