false

0001549922

0001549922

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 18, 2024

Summit

Midstream Partners, LP

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-35666 |

|

45-5200503 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

910 Louisiana Street, Suite 4200

Houston,

TX 77002

(Address of principal executive office) (Zip Code)

(Registrant’s telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Units |

|

SMLP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 18, 2024, Summit Midstream Partners, LP (the “Partnership”

or “SMLP”) held a special meeting of its unitholders (the “Special Meeting”) in connection with the proposed corporate

reorganization of SMLP to convert from a master limited partnership to a C corporation (the “Corporate Reorganization”),

as disclosed in the proxy statement/prospectus filed with the U.S. Securities and Exchange Commission (the “SEC”) on June

14, 2024 (the “Proxy Statement/Prospectus”). As of the close of business on June 7, 2024, the record date for the Special

Meeting, there were 10,648,686 common units representing limited partnership interests in SMLP (the “Common Units”) outstanding.

A total of 8,334,123 Common Units, or approximately 78.26% of the voting power of the Common Units entitled to vote at the Special Meeting,

were represented in person or by proxy at the Special Meeting, which constituted a quorum to conduct business.

A summary of the matters voted upon at the Special Meeting and the

voting results for each such matter are presented below. The proposals related to each such matter are described in greater detail in

the Proxy Statement/Prospectus.

Proposal 1—Approval of the Merger Proposal

To approve the Agreement and Plan of Merger, dated as of May 31, 2024,

by and among Summit Midstream Corporation (“New Summit”), Summit SMC NewCo, LLC (“Merger Sub”), a wholly-owned

subsidiary of New Summit, the Partnership and Summit Midstream GP, LLC, the general partner of the Partnership, pursuant to which Merger

Sub will be merged with and into the Partnership, with the Partnership continuing as the surviving entity and a wholly-owned subsidiary

of New Summit (the “Merger Proposal”).

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 7,356,420 |

|

972,411 |

|

5,292 |

|

0 |

Proposal 2—Approval of the Advisory Governing Documents Proposals

Proposal 2(A) – To approve, on an advisory, non-binding

basis, a proposal to require that any action required or permitted to be taken by the stockholders of New Summit must be taken at a duly

called annual or special meeting of stockholders of New Summit and may not be taken by any consent in writing by such stockholders.

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 4,481,927 |

|

3,479,401 |

|

12,795 |

|

0 |

Proposal 2(B) – To approve, on an advisory, non-binding

basis, a proposal to provide that special meetings of stockholders of New Summit may be called only by or at the direction of the board

of directors (the “New Summit Board”), the Chairman thereof or the Chief Executive Officer of New Summit.

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 4,762,712 |

|

3,560,862 |

|

10,549 |

|

0 |

Proposal 2(C) – To approve, on an advisory, non-binding

basis, a proposal to provide that the New Summit Board may, without stockholder approval, authorize the issuance of preferred stock, $0.01

par value per share (“Preferred Stock”), from time to time in one or more series, and with respect to each series of Preferred

Stock, fix and state by resolution the designation and the powers, preferences, rights, qualifications, limitations and restrictions relating

to each series of Preferred Stock.

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 6,530,683 |

|

1,788,190 |

|

15,249 |

|

0 |

Proposal 2(D) – To approve, on an advisory, non-binding-basis,

a proposal to provide that the New Summit Board may, without stockholder approval, authorize the issuance of common stock, $0.01 par value

per share (“Blank Check Common Stock”), from time to time in one or more series, and with respect to each series of such Blank

Check Common Stock, fix and state by resolution the designation and the powers, privileges, rights, qualifications, limitations and restrictions

relating to each such series of Blank Check Common Stock.

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 6,000,193 |

|

2,320,118 |

|

13,811 |

|

0 |

Proposal 2(E) – To approve, on an advisory, non-binding

basis, a proposal to adopt the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware

lacks requisite subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts

lack subject matter jurisdiction, the federal district court for the District of Delaware) and any appellate court therefrom as the exclusive

forum for certain stockholder litigation and the federal district courts of the United States of America as the exclusive forum for resolving

any complaint asserting a cause of action arising under the Securities Act of 1933, as amended, against New Summit or any director, officer,

employee or agent of New Summit, unless New Summit consents in writing to the selection of an alternative forum.

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 7,295,901 |

|

1,025,351 |

|

12,871 |

|

0 |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Description |

| 104 |

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

Forward-Looking Statements

This communication contains forward-looking statements that are subject

to a number of risks and uncertainties, many of which are beyond the control of the Partnership and New Summit, which may include statements

about:

| ● | the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement and Plan of Merger

(the “Merger Agreement”); |

| ● | the risk that the failure to consummate the Corporate Reorganization will disrupt ongoing or future strategic alternatives, including

a Potential Transaction (as defined in the Proxy Statement/Prospectus); |

| ● | the outcome of any legal proceedings that may be instituted against the Partnership or New Summit and others relating to the Merger

Agreement; |

| ● | the effect of the announcement of the Corporate Reorganization on the Partnership’s customer relationships, operating results

and business generally; |

| ● | the risks that the proposed Corporate Reorganization disrupts current plans and operations; |

| ● | the amount of the costs, fees, expenses and charges related to the Corporate Reorganization; |

| ● | the failure to satisfy the conditions to the consummation of the Corporate Reorganization; |

| ● | the failure to realize a lower long-term cost of capital and other anticipated benefits of the proposed Corporate Reorganization; |

| ● | the Partnership and New Summit’s ability to access the debt and equity markets, which will depend on general market conditions

and the credit ratings for debt obligations; |

| ● | fluctuations in natural gas, natural gas liquids (“NGLs”) and crude oil prices, including as a result of political or

economic measures taken by various countries or the Organization of the Petroleum Exporting Countries; |

| ● | the extent and success of the Partnership’s and New Summit’s customers’ drilling and completion efforts, as well

as the quantity of natural gas, crude oil, freshwater deliveries, and produced water volumes produced within proximity of the Partnership’s

and New Summit’s assets; |

| ● | failure or delays by the Partnership’s and New Summit’s customers in achieving expected production in their natural gas,

crude oil and produced water projects; |

| ● | competitive conditions in the Partnership’s and New Summit’s industry and their impact on the Partnership’s and

New Summit’s ability to connect hydrocarbon supplies to the Partnership’s and New Summit’s gathering and processing

assets or systems; |

| ● | actions or inactions taken or nonperformance by third parties, including suppliers, contractors, operators, processors, transporters

and customers, including the inability or failure of the Partnership’s and New Summit’s shipper customers to meet their financial

obligations under the Partnership’s and New Summit’s gathering agreements and the Partnership’s and New Summit’s

ability to enforce the terms and conditions of certain of the Partnership’s and New Summit’s gathering agreements in the event

of a bankruptcy of one or more of the Partnership’s and New Summit’s customers; |

| ● | the Partnership’s and New Summit’s ability to divest of certain of the Partnership’s and New Summit’s assets

to third parties on attractive terms, which is subject to a number of factors, including prevailing conditions and outlook in the natural

gas, NGL and crude oil industries and markets; |

| ● | the ability to attract and retain key management personnel; |

| ● | commercial bank and capital market conditions and the potential impact of changes or disruptions in the credit and/or capital markets; |

| ● | changes in the availability and cost of capital and the results of the Partnership’s and New Summit’s financing efforts,

including availability of funds in the credit and/or capital markets; |

| ● | restrictions placed on the Partnership and New Summit by the agreements governing the Partnership’s and New Summit’s debt

and preferred equity instruments; |

| ● | the availability, terms and cost of downstream transportation and processing services; |

| ● | natural disasters, accidents, weather-related delays, casualty losses and other matters beyond the Partnership’s and New Summit’s

control; |

| ● | the current and potential future impact of the COVID-19 pandemic or other pandemics on the Partnership’s and New Summit’s

business, results of operations, financial position or cash flows; |

| ● | operational risks and hazards inherent in the gathering, compression, treating and/or processing of natural gas, crude oil and produced

water; |

| ● | the Partnership’s and New Summit’s ability to comply with the terms of the agreements comprising the Global Settlement

(as defined in the Proxy Statement/Prospectus); |

| ● | weather conditions and terrain in certain areas in which the Partnership and New Summit operate; |

| ● | physical and financial risks associated with climate change; |

| ● | any other issues that can result in deficiencies in the design, installation or operation of the Partnership’s and New Summit’s

gathering, compression, treating, processing and freshwater facilities; |

| ● | timely receipt of necessary government approvals and permits, the Partnership’s and New Summit’s ability to control the

costs of construction, including costs of materials, labor and rights-of-way and other factors that may impact the Partnership’s

and New Summit’s ability to complete projects within budget and on schedule; |

| ● | the Partnership’s and New Summit’s ability to finance the Partnership’s and New Summit’s obligations related

to capital expenditures, including through opportunistic asset divestitures or joint ventures and the impact any such divestitures or

joint ventures could have on the Partnership’s and New Summit’s results; |

| ● | the effects of existing and future laws and governmental regulations, including environmental, safety and climate change requirements

and federal, state and local restrictions or requirements applicable to oil and/or gas drilling, production or transportation; |

| ● | the effects of litigation; |

| ● | changes in general economic conditions; and |

| ● | other factors and uncertainties discussed in Proxy Statement/Prospectus and the Partnership’s filings with the SEC, including

the Partnership’s Annual Report on Form 10-K for the year ended December 31, 2023 and the Partnership’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2024. |

All of these types of statements, other than statements of historical

fact included in this communication, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology

such as “may,” “could,” “should,” “expect,” “plan,” “project,”

“intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “continue,” the negative of such terms or other comparable terminology.

The forward-looking statements contained in the Proxy Statement/Prospectus

are largely based on the Partnership’s expectations, which reflect estimates and assumptions made by the Partnership’s management.

These estimates and assumptions reflect the Partnership’s best judgment based on currently known market conditions and other factors.

Although the Partnership believes such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number

of risks and uncertainties that are beyond the Partnership’s control. In addition, management’s assumptions about future events

may prove to be inaccurate. All readers are cautioned that the forward-looking statements contained in the Proxy Statement/Prospectus

are not guarantees of future performance, and the Partnership’s expectations may not be realized or the forward-looking events and

circumstances may not occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements

due to factors described in the section of the Proxy Statement/Prospectus entitled “Risk Factors.” The forward-looking statements

in the Proxy Statement/Prospectus speak only as of the date of this document; we disclaim any obligation to update such statements unless

required by securities law, and we caution you not to unduly rely on them.

Additional Information and Where to Find It

This communication relates to the proposed Corporate Reorganization

of the Partnership. This communication may be deemed to be solicitation material in respect of the proposed Corporate Reorganization.

The proposed Corporate Reorganization has been submitted to the Partnership’s common unitholders for their consideration. In connection

with the proposed Corporate Reorganization, New Summit has filed with the SEC a Form S-4 containing the Proxy Statement/Prospectus to

be distributed to the Partnership’s common unitholders in connection with the Partnership’s solicitation of proxies for the

vote of the Partnership’s common unitholders in connection with the proposed Corporate Reorganization and other matters as described

in such Proxy Statement/Prospectus. The Proxy Statement/Prospectus also serves as the prospectus relating to the offer of the securities

to be issued to the Partnership’s common unitholders in connection with the completion of the proposed Corporate Reorganization.

The Partnership and New Summit may file other relevant documents with the SEC regarding the proposed Corporate Reorganization. The definitive

Proxy Statement/Prospectus has been mailed to the Partnership’s common unitholders. BEFORE MAKING ANY INVESTMENT DECISION WITH RESPECT

TO THE PROPOSED CORPORATE REORGANIZATION, INVESTORS AND COMMON UNITHOLDERS AND OTHER INTERESTED PERSONS ARE URGED TO READ THE DEFINITIVE

PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED CORPORATE REORGANIZATION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER

RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED CORPORATE REORGANIZATION.

The Proxy Statement/Prospectus, any amendments or supplements thereto

and other relevant materials, and any other documents filed by the Partnership or New Summit with the SEC, may be obtained as such documents

are filed with the SEC free of charge at the SEC’s website at www.sec.gov or by directing a written request to the Partnership at

910 Louisiana Street, Suite 4200, Houston, Texas 77002.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Summit Midstream Partners, LP |

| |

(Registrant) |

| |

|

| |

By: |

Summit Midstream GP, LLC (its general partner) |

| |

|

| Dated: July 19, 2024 |

/s/ William J. Mault |

| |

William J. Mault, Executive Vice President and

Chief Financial

Officer |

7

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

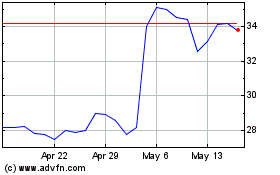

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Mar 2025