Diluted earnings per share of $1.18 versus

$0.60 in 3Q23

Adjusted diluted earnings per share of $1.23

versus $0.84 in 3Q23

Synovus Financial Corp. (NYSE: SNV) today reported financial

results for the quarter ended Sept. 30, 2024.

"Our third quarter earnings results demonstrate strong

fundamental trends. We posted an adjusted return on average assets

of 1.3% and adjusted return on tangible common equity of 17.1%

while managing down our adjusted tangible efficiency ratio to 53%.

As we move to a more favorable environment, I remain optimistic

about our ability to accelerate growth given increased loan

production and sustained strong core fee generation. Additionally,

we have further de-risked our balance sheet this quarter, as

evidenced by lower net charge-offs, a reduction in brokered

deposits and a preliminary Common Equity Tier 1 ratio at its

highest in nine years.

Our thoughts are with those affected by the recent hurricanes

across our markets and the broader southeast. We’re committed to

supporting recovery and rebuilding efforts. Together, we’ll

overcome these challenges and build a brighter future,” said

Synovus Chairman, CEO and President Kevin Blair.

Third Quarter 2024 Highlights

- Net income (loss) available to common shareholders was $169.6

million, or $1.18 per diluted share, compared to $(23.7) million or

$(0.16) in second quarter 2024 and $87.4 million or $0.60 in third

quarter 2023. Earnings were impacted by an $8.7 million valuation

adjustment to Visa derivative.

- Adjusted net income available to common shareholders was $177.1

million, or $1.23 per diluted share, compared to $169.6 million or

$1.16 in second quarter 2024 and $122.8 million or $0.84 in third

quarter 2023.

- Pre-provision net revenue was $251.0 million, which was up

sharply as a result of a $257 million securities loss in second

quarter 2024 and up 28% compared to third quarter 2023. Adjusted

pre-provision net revenue of $262.3 million was stable sequentially

and increased $17.7 million, or 7%, compared to third quarter

2023.

- Net interest income increased $5.7 million, or 1%, compared to

the prior quarter and was down $2.4 million, or 1%, compared to

third quarter 2023. The net interest margin expanded 2 basis points

to 3.22% as a result of the May 2024 securities repositioning and

higher asset yields somewhat offset by larger average cash balances

and a deposit mix shift.

- Period-end loans rose $27.3 million from second quarter 2024 as

stronger loan production and core commercial lending growth was

offset by higher loan paydowns and strategic declines in certain

loan categories such as non-relationship syndicated lending and

third-party consumer lending.

- Period-end core deposits (excluding brokered deposits) were

$45.1 billion, an increase of $294.6 million sequentially,

primarily as a result of growth in money market and

interest-bearing demand deposits, offset by a decline in

non-interest-bearing deposits, savings and time deposits. Total

deposit costs increased 4 basis points from second quarter 2024 to

2.72%, primarily due to a shift in the deposit mix.

- Non-interest revenue of $124.0 million increased $252.8 million

sequentially and was up $16.8 million, or 16%, compared to third

quarter 2023. Adjusted non-interest revenue of $121.9 million

declined $5.3 million, or 4%, sequentially and increased $15.7

million, or 15%, compared to third quarter 2023. The sequential

decline in adjusted non-interest revenue was largely from lower

capital markets income partially offset by higher treasury and

payment solutions and wealth revenue. Year-over-year growth came

primarily from higher commercial treasury and payment solutions

fees and capital markets income as well as greater commercial

sponsorship income.

- On a sequential basis, non-interest expense was $313.7 million,

impacted by an $8.7 million valuation adjustment to Visa

derivative. Adjusted non-interest expense was flat sequentially and

declined 1% year over year due to disciplined expense control and a

4% reduction in total headcount.

- Provision for credit losses of $23.4 million declined 11%

sequentially from $26.4 million in second quarter 2024 and fell 68%

year over year compared to $72.6 million in third quarter 2023. The

allowance for credit losses ratio (to loans) of 1.24% was down 1

basis point from the prior quarter.

- The non-performing loan and asset ratios were both higher

sequentially at 0.73%; the net charge-off ratio for the third

quarter 2024 was 0.25%, down from 0.32% in prior quarter while

total past dues were 0.23% of total loans outstanding.

- The preliminary CET1 ratio rose sequentially to 10.65% as core

earnings accretion more than offset the impact of $100 million in

common stock repurchases.

Third Quarter Summary

Reported

Adjusted

(dollars in thousands)

3Q24

2Q24

3Q23

3Q24

2Q24

3Q23

Net income (loss) available to common

shareholders

$

169,628

$

(23,741

)

$

87,423

$

177,120

$

169,617

$

122,770

Diluted earnings (loss) per share(1)

1.18

(0.16

)

0.60

1.23

1.16

0.84

Total revenue

564,720

306,147

550,298

564,051

563,597

550,552

Total loans

43,120,674

43,093,397

43,679,910

NA

NA

NA

Total deposits

50,193,740

50,195,778

50,203,890

NA

NA

NA

Return on avg assets(2)

1.2

%

(0.1

)%

0.6

%

1.3

%

1.2

%

0.9

%

Return on avg common equity(2)

14.4

(2.1

)

8.2

15.0

15.3

11.5

Return on avg tangible common

equity(2)

16.4

(2.2

)

9.7

17.1

17.6

13.5

Net interest margin(3)

3.22

%

3.20

%

3.11

%

NA

NA

NA

Efficiency ratio-TE(3)(4)

55.41

98.15

64.11

52.97

53.05

55.01

NCO ratio-QTD

0.25

0.32

0.61

NA

NA

NA

NPA ratio

0.73

0.60

0.64

NA

NA

NA

(1)

Diluted shares of 146,034 (in thousands)

used to calculate 2Q24 adjusted diluted earnings per share.

(2)

Annualized

(3)

Taxable equivalent

(4)

Adjusted tangible efficiency ratio

NA - not applicable

Balance Sheet

Loans*

(dollars in millions)

3Q24

2Q24

Linked Quarter Change

Linked Quarter %

Change

3Q23

Year/Year Change

Year/Year % Change

Commercial & industrial

$

22,664.0

$

22,536.6

$

127.4

1

%

$

22,781.0

$

(117.0

)

(1

)%

Commercial real estate

12,177.5

12,215.5

(38.0

)

—

12,394.9

(217.4

)

(2

)

Consumer

8,279.2

8,341.3

(62.1

)

(1

)

8,504.1

(224.9

)

(3

)

Total loans

$

43,120.7

$

43,093.4

$

27.3

—

%

$

43,679.9

$

(559.3

)

(1

)%

*Amounts may not total due to rounding

Deposits*

(dollars in millions)

3Q24

2Q24

Linked Quarter Change

Linked Quarter %

Change

3Q23

Year/Year Change

Year/Year % Change

Non-interest-bearing DDA

$

11,129.1

$

11,177.7

$

(48.6

)

—

%

$

12,395.1

$

(1,266.0

)

(10

)%

Interest-bearing DDA

6,821.3

6,621.2

200.1

3

6,276.1

545.2

9

Money market

11,031.5

10,747.9

283.6

3

10,786.3

245.2

2

Savings

983.2

1,009.8

(26.7

)

(3

)

1,132.5

(149.3

)

(13

)

Public funds

7,047.6

7,111.9

(64.3

)

(1

)

6,885.7

161.9

2

Time deposits

8,075.7

8,125.2

(49.5

)

(1

)

6,506.4

1,569.3

24

Brokered deposits

5,105.4

5,402.0

(296.6

)

(5

)

6,221.8

(1,116.3

)

(18

)

Total deposits

$

50,193.7

$

50,195.8

$

(2.0

)

—

%

$

50,203.9

$

(10.2

)

—

%

*Amounts may not total due to rounding

Income Statement Summary**

(in thousands, except per share data)

3Q24

2Q24

Linked Quarter Change

Linked Quarter %

Change

3Q23

Year/Year Change

Year/Year % Change

Net interest income

$

440,740

$

434,998

$

5,742

1

%

$

443,159

$

(2,419

)

(1

)%

Non-interest revenue

123,980

(128,851

)

252,831

NM

107,139

16,841

16

Non-interest expense

313,690

301,801

11,889

4

353,532

(39,842

)

(11

)

Provision for (reversal of) credit

losses

23,434

26,404

(2,970

)

(11

)

72,572

(49,138

)

(68

)

Income (loss) before taxes

$

227,596

$

(22,058

)

$

249,654

NM

$

124,194

$

103,402

83

%

Income tax expense (benefit)

46,912

(7,378

)

54,290

NM

27,729

19,183

69

Net income (loss)

180,684

(14,680

)

195,364

NM

96,465

84,219

87

Less: Net income (loss) attributable to

noncontrolling interest

(871

)

(652

)

(219

)

(34

)

(630

)

(241

)

(38

)

Net income (loss) attributable to Synovus

Financial Corp.

181,555

(14,028

)

195,583

NM

97,095

84,460

87

Less: Preferred stock dividends

11,927

9,713

2,214

23

9,672

2,255

23

Net income (loss) available to common

shareholders

$

169,628

$

(23,741

)

$

193,369

NM

$

87,423

$

82,205

94

%

Weighted average common shares

outstanding, diluted

143,979

145,565

(1,586

)

(1

)%

146,740

(2,761

)

(2

)%

Diluted earnings (loss) per share

$

1.18

$

(0.16

)

$

1.34

NM

$

0.60

$

0.58

97

Adjusted diluted earnings per share(1)

1.23

1.16

0.07

6

0.84

0.39

46

Effective tax rate

20.61

%

33.45

%

22.33

%

(1)

Diluted shares of 146,034 (in thousands)

used to calculate 2Q24 adjusted diluted earnings per share.

**

Amounts may not total due to rounding

NM - not meaningful

Capital Ratios

3Q24

2Q24

3Q23

Common Equity Tier 1 capital (CET1)

ratio

10.65 %

(1)

10.60 %

10.13 %

Tier 1 capital ratio

11.77

(1)

11.72

11.18

Total risk-based capital ratio

13.62

(1)

13.56

13.12

Tier 1 leverage ratio

9.55

(1)

9.44

9.38

Tangible common equity ratio

7.28

6.76

5.90

(1) Ratios are preliminary.

Third Quarter Earnings Conference Call

Synovus will host an earnings highlights conference call with an

accompanying slide presentation at 8:30 a.m. ET on Oct. 17, 2024.

The earnings call can be accessed with the listen-only dial-in

phone number: 833-470-1428 (code: 952762). Shareholders and other

interested parties may also listen to this conference call via

simultaneous internet broadcast. For a link to the webcast, go to

investor.synovus.com/event. The replay will be archived for at

least 12 months and will be available approximately one hour after

the call.

Synovus Financial Corp. is a financial services company

based in Columbus, Georgia, with approximately $60 billion in

assets. Synovus provides commercial and consumer banking and a full

suite of specialized products and services, including wealth

services, treasury management, mortgage services, premium finance,

asset-based lending, structured lending, capital markets and

international banking. As of Sept. 30, 2024, Synovus has 247

branches in Georgia, Alabama, Florida, South Carolina and

Tennessee. Synovus is a Great Place to Work-Certified Company.

Learn more about Synovus at synovus.com.

Forward-Looking Statements

This press release and certain of our other filings with the

Securities and Exchange Commission contain statements that

constitute “forward-looking statements” within the meaning of, and

subject to the protections of, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. All statements other than statements of

historical fact are forward-looking statements. You can identify

these forward-looking statements through Synovus’ use of words such

as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,”

“should,” “predicts,” “could,” “would,” “intends,” “targets,”

“estimates,” “projects,” “plans,” “potential” and other similar

words and expressions of the future or otherwise regarding the

outlook for Synovus’ future business and financial performance

and/or the performance of the banking industry and economy in

general. These forward-looking statements include, among others,

our expectations regarding our future operating and financial

performance; expectations on our growth strategy, expense and

revenue initiatives, capital management, balance sheet management,

and future profitability; expectations on credit quality and

performance; and the assumptions underlying our expectations.

Prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

known and unknown risks and uncertainties which may cause the

actual results, performance or achievements of Synovus to be

materially different from the future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements are based on the information

known to, and current beliefs and expectations of, Synovus’

management and are subject to significant risks and uncertainties.

Actual results may differ materially from those contemplated by

such forward-looking statements. A number of factors could cause

actual results to differ materially from those contemplated by the

forward-looking statements in this press release. Many of these

factors are beyond Synovus’ ability to control or predict.

These forward-looking statements are based upon information

presently known to Synovus’ management and are inherently

subjective, uncertain and subject to change due to any number of

risks and uncertainties, including, without limitation, the risks

and other factors set forth in Synovus’ filings with the Securities

and Exchange Commission, including its Annual Report on Form 10-K

for the year ended Dec. 31, 2023, under the captions “Cautionary

Notice Regarding Forward-Looking Statements” and “Risk Factors” and

in Synovus’ quarterly reports on Form 10-Q and current reports on

Form 8-K. We believe these forward-looking statements are

reasonable; however, undue reliance should not be placed on any

forward-looking statements, which are based on current expectations

and speak only as of the date that they are made. We do not assume

any obligation to update any forward-looking statements as a result

of new information, future developments or otherwise, except as

otherwise may be required by law.

Non-GAAP Financial Measures

The measures entitled adjusted non-interest revenue,

non-interest expense; adjusted revenue taxable equivalent (TE);

adjusted tangible efficiency ratio; adjusted pre-provision net

revenue (PPNR); adjusted return on average assets; adjusted net

income available to common shareholders; adjusted diluted earnings

per share; adjusted return on average common equity; return on

average tangible common equity; adjusted return on average tangible

common equity; and tangible common equity ratio are not measures

recognized under GAAP and therefore are considered non-GAAP

financial measures. The most comparable GAAP measures to these

measures are total non-interest revenue; total non-interest

expense; total revenue; efficiency ratio-TE; PPNR; return on

average assets; net income (loss) available to common shareholders;

diluted earnings (loss) per share; return on average common equity;

and the ratio of total Synovus Financial Corp. shareholders' equity

to total assets, respectively.

Management believes that these non-GAAP financial measures

provide meaningful additional information about Synovus to assist

management and investors in evaluating Synovus’ operating results,

financial strength, the performance of its business, and the

strength of its capital position. However, these non-GAAP financial

measures have inherent limitations as analytical tools and should

not be considered in isolation or as a substitute for analyses of

operating results or capital position as reported under GAAP. The

non-GAAP financial measures should be considered as additional

views of the way our financial measures are affected by significant

items and other factors, and since they are not required to be

uniformly applied, they may not be comparable to other similarly

titled measures at other companies. Adjusted non-interest revenue

and adjusted revenue (TE) are measures used by management to

evaluate non-interest revenue and total revenue exclusive of net

investment securities gains (losses), fair value adjustments on

non-qualified deferred compensation and other items not indicative

of ongoing operations that could impact period-to-period

comparisons. Adjusted non-interest expense and the adjusted

tangible efficiency ratio are measures utilized by management to

measure the success of expense management initiatives focused on

reducing recurring controllable operating costs. Adjusted net

income available to common shareholders, adjusted diluted earnings

per share, adjusted return on average assets, and adjusted return

on average common equity are measures used by management to

evaluate operating results exclusive of items that are not

indicative of ongoing operations and impact period-to-period

comparisons. Return on average tangible common equity and adjusted

return on average tangible common equity are measures used by

management to compare Synovus’ performance with other financial

institutions because it calculates the return available to common

shareholders without the impact of intangible assets and their

related amortization, thereby allowing management to evaluate the

performance of the business consistently. Adjusted PPNR is used by

management to evaluate PPNR exclusive of items that management

believes are not indicative of ongoing operations and impact

period-to-period comparisons. The tangible common equity ratio is

used by stakeholders to assess our capital position. The

computations of these measures are set forth in the tables

below.

Reconciliation of Non-GAAP Financial

Measures

(dollars in thousands)

3Q24

2Q24

3Q23

Adjusted non-interest revenue

Total non-interest revenue

$

123,980

$

(128,851

)

$

107,139

Investment securities (gains) losses,

net

—

256,660

—

Gain on sale of GLOBALT

—

—

(1,929

)

Fair value adjustment on non-qualified

deferred compensation

(2,062

)

(561

)

1,035

Adjusted non-interest revenue

$

121,918

$

127,248

$

106,245

Adjusted non-interest expense

Total non-interest expense

$

313,690

$

301,801

$

353,532

(Loss) gain on other loans held for

sale

—

—

(30,954

)

Gain (loss) on early extinguishment of

debt

—

—

526

Restructuring (charges) reversals

(1,219

)

658

(17,319

)

Valuation adjustment to Visa

derivative

(8,700

)

—

(900

)

Fair value adjustment on non-qualified

deferred compensation

(2,062

)

(561

)

1,035

Adjusted non-interest expense

$

301,709

$

301,898

$

305,920

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

3Q24

2Q24

3Q23

Adjusted revenue (TE) and tangible

efficiency ratio

Adjusted non-interest expense

$

301,709

$

301,898

$

305,920

Amortization of intangibles

(2,907

)

(2,907

)

(3,042

)

Adjusted tangible non-interest expense

$

298,802

$

298,991

$

302,878

Net interest income

$

440,740

$

434,998

$

443,159

Tax equivalent adjustment

1,393

1,351

1,148

Net interest income (TE)

442,133

436,349

444,307

Net interest income

$

440,740

$

434,998

$

443,159

Total non-interest revenue

123,980

(128,851

)

107,139

Total revenue

$

564,720

$

306,147

$

550,298

Tax equivalent adjustment

1,393

1,351

1,148

Total TE revenue

566,113

307,498

551,446

Investment securities losses (gains),

net

—

256,660

—

Gain on sale of GLOBALT

—

—

(1,929

)

Fair value adjustment on non-qualified

deferred compensation

(2,062

)

(561

)

1,035

Adjusted revenue (TE)

$

564,051

$

563,597

$

550,552

Efficiency ratio-TE

55.41

%

98.15

%

64.11

%

Adjusted tangible efficiency ratio

52.97

53.05

55.01

Adjusted pre-provision net

revenue

Net interest income

$

440,740

$

434,998

$

443,159

Total non-interest revenue

123,980

(128,851

)

107,139

Total non-interest expense

(313,690

)

(301,801

)

(353,532

)

Pre-provision net revenue (PPNR)

$

251,030

$

4,346

$

196,766

Adjusted revenue (TE)

564,051

563,597

550,552

Adjusted non-interest expense

(301,709

)

(301,898

)

(305,920

)

Adjusted PPNR

$

262,342

$

261,699

$

244,632

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

3Q24

2Q24

3Q23

Adjusted return on average assets

(annualized)

Net income (loss)

$

180,684

$

(14,680

)

$

96,465

Loss (gain) on other loans held for

sale

—

—

30,954

(Gain) loss on early extinguishment of

debt

—

—

(526

)

Gain on sale of GLOBALT

—

—

(1,929

)

Restructuring charges (reversals)

1,219

(658

)

17,319

Valuation adjustment to Visa

derivative

8,700

—

900

Investment securities losses (gains),

net

—

256,660

—

Tax effect of adjustments(1)

(2,427

)

(62,644

)

(11,371

)

Adjusted net income

$

188,176

$

178,678

$

131,812

Net income (loss) annualized

$

718,808

$

(59,043

)

$

382,714

Adjusted net income annualized

$

748,613

$

718,639

$

522,950

Total average assets

$

59,183,624

$

59,246,849

$

59,916,679

Return on average assets (annualized)

1.2

%

(0.1

)%

0.6

%

Adjusted return on average assets

(annualized)

1.3

1.2

0.9

Adjusted net income available to common

shareholders and adjusted diluted earnings per share

Net income (loss) available to common

shareholders

$

169,628

$

(23,741

)

$

87,423

Gain on sale of GLOBALT

—

—

(1,929

)

Loss (gain) on other loans held for

sale

—

—

30,954

(Gain) loss on early extinguishment of

debt

—

—

(526

)

Restructuring charges (reversals)

1,219

(658

)

17,319

Valuation adjustment to Visa

derivative

8,700

—

900

Investment securities losses (gains),

net

—

256,660

—

Tax effect of adjustments(1)

(2,427

)

(62,644

)

(11,371

)

Adjusted net income available to common

shareholders

$

177,120

$

169,617

$

122,770

Weighted average common shares

outstanding, diluted(2)

143,979

145,565

146,740

Diluted earnings per share

$

1.18

$

(0.16

)

$

0.60

Adjusted diluted earnings per share

1.23

1.16

0.84

(1) An assumed marginal tax rate of 24.5%

for 3Q24 and 2Q24 and 24.3% for 3Q23 was applied.

(2) Diluted shares of 146,034 (in

thousands) used to calculate 2Q24 adjusted diluted earnings per

share.

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

3Q24

2Q24

3Q23

Adjusted return on average common

equity, return on average tangible common equity, and adjusted

return on average tangible common equity (annualized)

Net income (loss) available to common

shareholders

$

169,628

$

(23,741

)

$

87,423

Loss (gain) on other loans held for

sale

—

—

30,954

(Gain) loss on early extinguishment of

debt

—

—

(526

)

Gain on sale of GLOBALT

—

—

(1,929

)

Restructuring charges (reversals)

1,219

(658

)

17,319

Valuation adjustment to Visa

derivative

8,700

—

900

Investment securities losses (gains),

net

—

256,660

—

Tax effect of adjustments(1)

(2,427

)

(62,644

)

(11,371

)

Adjusted net income available to common

shareholders

$

177,120

$

169,617

$

122,770

Adjusted net income available to common

shareholders annualized

$

704,630

$

682,196

$

487,077

Amortization of intangibles, tax effected,

annualized

8,735

8,831

9,131

Adjusted net income available to common

shareholders excluding amortization of intangibles annualized

$

713,365

$

691,027

$

496,208

Net income (loss) available to common

shareholders annualized

$

674,824

$

(95,486

)

$

346,841

Amortization of intangibles, tax effected,

annualized

8,735

8,831

9,131

Net income (loss) available to common

shareholders excluding amortization of intangibles annualized

$

683,559

$

(86,655

)

$

355,972

Total average Synovus Financial Corp.

shareholders' equity less preferred stock

$

4,692,722

$

4,455,198

$

4,223,422

Average goodwill

(480,440

)

(480,902

)

(476,408

)

Average other intangible assets, net

(38,793

)

(41,547

)

(59,016

)

Total average Synovus Financial Corp.

tangible shareholders' equity less preferred stock

$

4,173,489

$

3,932,749

$

3,687,998

Return on average common equity

(annualized)

14.4

%

(2.1

)%

8.2

%

Adjusted return on average common equity

(annualized)

15.0

15.3

11.5

Return on average tangible common equity

(annualized)

16.4

(2.2

)

9.7

Adjusted return on average tangible common

equity (annualized)

17.1

17.6

13.5

(1) An assumed marginal tax rate of 24.5%

for 3Q24 and 2Q24 and 24.3% for 3Q23 was applied.

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

September 30, 2024

December 31, 2023

September 30, 2023

Tangible common equity ratio

Total assets

$

59,589,628

$

59,809,534

$

59,342,930

Goodwill

(480,440

)

(480,440

)

(479,851

)

Other intangible assets, net

(37,207

)

(45,928

)

(49,096

)

Tangible assets

$

59,071,981

$

59,283,166

$

58,813,983

Total Synovus Financial Corp.

shareholders’ equity

$

5,355,976

$

5,119,993

$

4,536,958

Goodwill

(480,440

)

(480,440

)

(479,851

)

Other intangible assets, net

(37,207

)

(45,928

)

(49,096

)

Preferred Stock, no par value

(537,145

)

(537,145

)

(537,145

)

Tangible common equity

$

4,301,184

$

4,056,480

$

3,470,866

Total Synovus Financial Corp.

shareholders’ equity to total assets ratio

8.99

%

8.56

%

7.65

%

Tangible common equity ratio

7.28

6.84

5.90

Amounts may not total due to rounding

Synovus

Exhibit 99.2

INCOME STATEMENT DATA

(Unaudited)

(Dollars in thousands, except per share

data)

Nine Months Ended September

30,

2024

2023

'24 vs '23

% Change

Interest income

$

2,394,459

$

2,262,061

6

%

Interest expense

1,099,876

882,619

25

Net interest income

1,294,583

1,379,442

(6

)

Provision for (reversal of) credit

losses

103,818

143,607

(28

)

Net interest income after provision for

credit losses

1,190,765

1,235,835

(4

)

Non-interest revenue:

Service charges on deposit accounts

68,403

67,836

1

Fiduciary and asset management fees

58,455

59,928

(2

)

Card fees

57,343

51,485

11

Brokerage revenue

63,974

68,043

(6

)

Mortgage banking income

11,395

12,138

(6

)

Capital markets income

31,988

32,589

(2

)

Income from bank-owned life insurance

23,886

21,106

13

Investment securities gains (losses),

net

(256,660

)

1,030

nm

Recovery of NPA

—

13,126

nm

Other non-interest revenue

55,233

25,260

119

Total non-interest revenue

114,017

352,541

(68

)

Non-interest expense:

Salaries and other personnel expense

552,742

551,667

—

Net occupancy, equipment, and software

expense

140,200

131,435

7

Third-party processing and other

services

63,593

64,932

(2

)

Professional fees

34,140

28,707

19

FDIC insurance and other regulatory

fees

37,694

33,266

13

Restructuring charges (reversals)

2,084

16,476

nm

Loss on other loans held for sale

—

50,064

nm

Other operating expenses

107,779

106,019

2

Total non-interest expense

938,232

982,566

(5

)

Income before income taxes

366,550

605,810

(39

)

Income tax expense

76,476

133,242

(43

)

Net income

290,074

472,568

(39

)

Less: Net income (loss) attributable to

noncontrolling interest

(1,960

)

(796

)

146

Net income attributable to Synovus

Financial Corp.

292,034

473,364

(38

)

Less: Preferred stock dividends

31,325

26,254

19

Net income available to common

shareholders

$

260,709

$

447,110

(42

)%

Net income per common share, basic

$

1.80

$

3.06

(41

)%

Net income per common share, diluted

1.79

3.05

(41

)

Cash dividends declared per common

share

1.14

1.14

—

Return on average assets *

0.7

%

1.0

%

(30) bps

Return on average common equity *

7.6

14.2

nm

Weighted average common shares

outstanding, basic

145,039

146,028

(1

)%

Weighted average common shares

outstanding, diluted

145,718

146,683

(1

)

nm - not meaningful

bps - basis points

* - ratios are annualized

Amounts may not total due to rounding

Synovus

INCOME STATEMENT DATA

(Unaudited)

(Dollars in thousands, except per share

data)

2024

2023

Third Quarter

Third

Quarter

Second Quarter

First Quarter

Fourth Quarter

Third Quarter

'24 vs '23

% Change

Interest income

$

810,507

801,242

782,710

788,297

786,039

3

%

Interest expense

369,767

366,244

363,864

351,083

342,880

8

Net interest income

440,740

434,998

418,846

437,214

443,159

(1

)

Provision for (reversal of) credit

losses

23,434

26,404

53,980

45,472

72,572

(68

)

Net interest income after provision for

credit losses

417,306

408,594

364,866

391,742

370,587

13

Non-interest revenue:

Service charges on deposit accounts

23,683

22,907

21,813

22,260

21,385

11

Fiduciary and asset management fees

19,714

19,728

19,013

18,149

20,205

(2

)

Card fees

18,439

19,418

19,486

20,872

18,602

(1

)

Brokerage revenue

20,810

20,457

22,707

21,961

21,387

(3

)

Mortgage banking income

4,033

3,944

3,418

3,019

3,671

10

Capital markets income

10,284

15,077

6,627

6,456

7,980

29

Income from bank-owned life insurance

8,442

8,097

7,347

10,324

6,965

21

Investment securities gains (losses),

net

—

(256,660

)

—

(77,748

)

—

nm

Other non-interest revenue

18,575

18,181

18,477

26,175

6,944

167

Total non-interest revenue

123,980

(128,851

)

118,888

51,468

107,139

16

Non-interest expense:

Salaries and other personnel expense

184,814

179,407

188,521

176,712

179,741

3

Net occupancy, equipment, and software

expense

46,977

46,415

46,808

48,146

45,790

3

Third-party processing and other

services

21,552

21,783

20,258

21,717

21,439

1

Professional fees

10,854

15,655

7,631

11,147

10,147

7

FDIC insurance and other regulatory

fees

7,382

6,493

23,819

61,470

11,837

(38

)

Restructuring charges (reversals)

1,219

(658

)

1,524

1,231

17,319

nm

Loss on other loans held for sale

—

—

—

—

30,954

nm

Other operating expenses

40,892

32,706

34,180

32,435

36,305

13

Total non-interest expense

313,690

301,801

322,741

352,858

353,532

(11

)

Income (loss) before income taxes

227,596

(22,058

)

161,013

90,352

124,194

83

Income tax expense (benefit)

46,912

(7,378

)

36,943

20,779

27,729

69

Net income (loss)

180,684

(14,680

)

124,070

69,573

96,465

87

Less: Net income (loss) attributable to

noncontrolling interest

(871

)

(652

)

(437

)

(768

)

(630

)

38

Net income (loss) attributable to Synovus

Financial Corp.

181,555

(14,028

)

124,507

70,341

97,095

87

Less: Preferred stock dividends

11,927

9,713

9,685

9,696

9,672

23

Net income (loss) available to common

shareholders

$

169,628

(23,741

)

114,822

60,645

87,423

94

%

Net income (loss) per common share,

basic

$

1.19

(0.16

)

0.78

0.41

0.60

98

%

Net income (loss) per common share,

diluted

1.18

(0.16

)

0.78

0.41

0.60

97

Cash dividends declared per common

share

0.38

0.38

0.38

0.38

0.38

—

Return on average assets *

1.2

%

(0.1

)

0.8

0.5

0.6

60 bps

Return on average common equity *

14.4

(2.1

)

10.2

5.9

8.2

nm

Weighted average common shares

outstanding, basic

143,144

145,565

146,430

146,372

146,170

(2

)%

Weighted average common shares

outstanding, diluted

143,979

145,565

147,122

146,877

146,740

(2

)

nm - not meaningful

bps - basis points

* - ratios are annualized

Amounts may not total due to rounding

Synovus

BALANCE SHEET DATA

September 30, 2024

December 31, 2023

September 30, 2023

(Unaudited)

(In thousands, except share data)

ASSETS

Interest-earning deposits with banks and

other cash and cash equivalents

$

1,807,641

$

2,414,103

$

2,101,455

Federal funds sold and securities

purchased under resale agreements

45,971

37,323

36,176

Cash, cash equivalents, and restricted

cash

1,853,612

2,451,426

2,137,631

Investment securities held to maturity

2,622,457

—

—

Investment securities available for

sale

7,554,168

9,788,662

9,237,191

Loans held for sale (includes $36,943,

$47,338 and $48,994 measured at fair value, respectively)

121,470

52,768

66,558

Loans, net of deferred fees and costs

43,120,674

43,404,490

43,679,910

Allowance for loan losses

(484,985

)

(479,385

)

(477,532

)

Loans, net

42,635,689

42,925,105

43,202,378

Cash surrender value of bank-owned life

insurance

1,133,652

1,112,030

1,107,092

Premises, equipment, and software, net

380,267

365,851

364,054

Goodwill

480,440

480,440

479,851

Other intangible assets, net

37,207

45,928

49,096

Other assets

2,770,666

2,587,324

2,699,079

Total assets

$

59,589,628

$

59,809,534

$

59,342,930

LIABILITIES AND EQUITY

Liabilities:

Deposits:

Non-interest-bearing deposits

$

11,561,626

$

12,507,616

$

12,976,574

Interest-bearing deposits

38,632,114

38,231,569

37,227,316

Total deposits

50,193,740

50,739,185

50,203,890

Federal funds purchased and securities

sold under repurchase agreements

94,055

189,074

98,270

Other short-term borrowings

—

3,496

2,362

Long-term debt

2,021,050

1,932,534

2,704,701

Other liabilities

1,902,612

1,801,097

1,772,139

Total liabilities

54,211,457

54,665,386

54,781,362

Equity:

Shareholders' equity:

Preferred stock - no par value. Authorized

100,000,000 shares; issued 22,000,000

537,145

537,145

537,145

Common stock - $1.00 par value. Authorized

342,857,142 shares; issued 172,077,277, 171,360,188 and 170,859,506

respectively; outstanding 141,997,383, 146,705,330 and 146,204,648

respectively

172,077

171,360

170,860

Additional paid-in capital

3,976,706

3,955,819

3,940,507

Treasury stock, at cost; 30,079,894,

24,654,858 and 24,654,858 shares, respectively

(1,167,130

)

(944,484

)

(944,484

)

Accumulated other comprehensive income

(loss), net

(773,786

)

(1,117,073

)

(1,679,404

)

Retained earnings

2,610,964

2,517,226

2,512,334

Total Synovus Financial Corp.

shareholders’ equity

5,355,976

5,119,993

4,536,958

Noncontrolling interest in subsidiary

22,195

24,155

24,610

Total equity

5,378,171

5,144,148

4,561,568

Total liabilities and equity

$

59,589,628

$

59,809,534

$

59,342,930

Synovus

AVERAGE BALANCES, INTEREST, AND

YIELDS/RATES

(Unaudited)

Third Quarter 2024

Second Quarter 2024

Third Quarter 2023

(dollars in thousands)

Average Balance

Interest

Yield/

Rate

Average Balance

Interest

Yield/

Rate

Average Balance

Interest

Yield/

Rate

Assets

Interest earning assets:

Commercial loans (1) (2) (3)

$

34,610,296

$

592,142

6.81

%

$

35,006,497

$

593,715

6.82

%

$

34,990,459

$

579,177

6.57

%

Consumer loans (1) (2)

8,298,130

109,908

5.28

8,358,325

109,206

5.23

8,509,757

108,065

5.06

Less: Allowance for loan losses

(482,863

)

—

—

(492,640

)

—

—

(461,385

)

—

—

Loans, net

42,425,563

702,050

6.59

42,872,182

702,921

6.59

43,038,831

687,242

6.34

Total investment securities(4)

10,420,665

87,643

3.36

10,373,792

78,891

3.04

11,194,291

61,642

2.20

Trading account assets

14,392

246

6.84

8,809

162

7.37

16,186

237

5.86

Other earning assets(5)

1,408,415

18,803

5.24

1,271,953

16,800

5.23

1,237,445

16,369

5.17

FHLB and Federal Reserve Bank stock

170,977

2,113

4.94

189,706

2,687

5.67

244,906

3,783

6.18

Mortgage loans held for sale

34,890

612

7.01

37,364

666

7.13

53,904

879

6.52

Other loans held for sale

83,492

433

2.03

96,180

466

1.92

881,067

17,035

7.57

Total interest earning assets

54,558,394

811,900

5.92

%

54,849,986

802,593

5.89

%

56,666,630

787,187

5.51

%

Cash and due from banks

476,443

531,604

509,511

Premises and equipment

380,003

376,293

365,568

Other real estate

666

18,003

—

Cash surrender value of bank-owned life

insurance

1,128,877

1,121,764

1,102,626

Other assets(6)

2,639,241

2,349,199

1,272,344

Total assets

$

59,183,624

$

59,246,849

$

59,916,679

Liabilities and Equity

Interest-bearing liabilities:

Interest-bearing demand deposits

$

10,834,829

71,786

2.64

%

$

10,789,288

68,809

2.57

%

$

10,114,171

52,983

2.08

%

Money market accounts

13,058,527

104,514

3.18

12,617,120

99,380

3.17

13,147,465

95,339

2.88

Savings deposits

1,007,962

355

0.14

1,036,321

304

0.12

1,178,322

280

0.09

Time deposits

8,437,861

93,052

4.39

8,382,774

93,431

4.48

6,180,584

59,972

3.85

Brokered deposits

5,476,231

75,607

5.49

5,483,298

73,830

5.42

6,442,690

83,486

5.14

Federal funds purchased and securities

sold under repurchase agreements

94,629

369

1.53

114,595

570

1.97

73,344

296

1.58

Other short-term borrowings

2,209

29

5.20

108,946

1,530

5.55

1,722

—

—

Long-term debt

1,385,836

24,055

6.93

1,666,731

28,390

6.79

3,230,374

50,524

6.18

Total interest-bearing liabilities

40,298,084

369,767

3.65

%

40,199,073

366,244

3.66

%

40,368,672

342,880

3.37

%

Non-interest-bearing demand deposits

11,665,661

12,099,256

13,049,343

Other liabilities

1,967,351

1,932,822

1,713,131

Total equity

5,252,528

5,015,698

4,785,533

Total liabilities and equity

$

59,183,624

$

59,246,849

$

59,916,679

Net interest income and net interest

margin, taxable equivalent (7)

$

442,133

3.22

%

$

436,349

3.20

%

$

444,307

3.11

%

Less: taxable-equivalent adjustment

1,393

1,351

1,148

Net interest income

$

440,740

$

434,998

$

443,159

(1)

Average loans are shown net of unearned

income. NPLs are included.

(2)

Interest income includes fees as follows:

Third Quarter 2024 — $12.7 million, Second Quarter 2024 — $12.3

million, and Third Quarter 2023 — $11.8 million.

(3)

Reflects taxable-equivalent adjustments,

using the statutory federal tax rate of 21%, in adjusting interest

on tax-exempt loans to a taxable-equivalent basis.

(4)

Securities are included on an amortized

cost basis with yield and net interest margin calculated

accordingly.

(5)

Includes interest-bearing funds with

Federal Reserve Bank, interest earning deposits with banks, and

federal funds sold and securities purchased under resale

agreements.

(6)

Includes average net unrealized gains

(losses) on investment securities available for sale of $(424.6)

million, $(727.6) million, and $(1.60) billion for the Third

Quarter 2024, Second Quarter 2024, and Third Quarter 2023,

respectively.

(7)

The net interest margin is calculated by

dividing annualized net interest income- TE by average total

interest earning assets.

Synovus

AVERAGE BALANCES, INTEREST, AND

YIELDS/RATES

(Unaudited)

Nine Months Ended September

30,

2024

2023

(dollars in thousands)

Average Balance

Interest

Yield/

Rate

Average Balance

Interest

Yield/

Rate

Assets

Interest earning assets:

Commercial loans (1) (2) (3)

$

34,852,642

$

1,769,316

6.78

%

$

35,216,487

$

1,672,529

6.35

%

Consumer loans (1) (2)

8,363,281

328,681

5.24

8,580,029

316,757

4.92

Less: Allowance for loan losses

(485,540

)

—

—

(457,818

)

—

—

Loans, net

42,730,383

2,097,997

6.56

43,338,698

1,989,286

6.14

Total investment securities(4)

10,646,738

238,440

2.99

11,229,290

183,118

2.17

Trading account assets

11,600

473

5.44

16,302

671

5.49

Other earning assets(5)

1,302,499

51,776

5.23

1,398,211

51,660

4.87

FHLB and Federal Reserve Bank stock

182,793

7,073

5.16

277,136

11,439

5.50

Mortgage loans held for sale

34,012

1,773

6.95

48,398

2,297

6.33

Other loans held for sale

66,109

982

1.95

625,262

26,995

5.69

Total interest earning assets

54,974,134

$

2,398,514

5.83

%

56,933,297

$

2,265,466

5.32

%

Cash and due from banks

510,807

593,023

Premises and equipment

375,574

367,332

Other real estate

6,223

—

Cash surrender value of bank-owned life

insurance

1,121,807

1,096,567

Other assets(6)

2,162,476

1,187,026

Total assets

$

59,151,021

$

60,177,245

Liabilities and Equity

Interest-bearing liabilities:

Interest-bearing demand deposits

$

10,738,505

$

206,010

2.56

%

$

9,702,651

$

118,007

1.63

%

Money market accounts

12,834,830

307,024

3.20

13,665,672

253,351

2.48

Savings deposits

1,033,696

946

0.12

1,274,142

771

0.08

Time deposits

8,241,879

272,976

4.42

4,892,146

121,019

3.31

Brokered deposits

5,565,332

226,778

5.44

6,116,392

214,627

4.69

Federal funds purchased and securities

sold under repurchase agreements

107,546

1,587

1.94

98,212

1,317

1.77

Other short-term borrowings

60,763

2,514

5.44

705,292

24,559

4.59

Long-term debt

1,604,966

82,041

6.80

3,400,156

148,968

5.80

Total interest-bearing liabilities

40,187,517

$

1,099,876

3.66

%

39,854,663

$

882,619

2.96

%

Non-interest-bearing demand deposits

11,944,508

13,972,152

Other liabilities

1,894,545

1,592,230

Total equity

5,124,451

4,758,200

Total liabilities and equity

$

59,151,021

$

60,177,245

Net interest income, taxable equivalent

net interest margin (7)

$

1,298,638

3.16

%

$

1,382,847

3.25

%

Less: taxable-equivalent adjustment

4,055

3,405

Net interest income

$

1,294,583

$

1,379,442

(1)

Average loans are shown net of unearned

income. NPLs are included.

(2)

Interest income includes fees as follows:

2024 — $35.7 million and 2023 — $34.6 million.

(3)

Reflects taxable-equivalent adjustments,

using the statutory federal tax rate of 21%, in adjusting interest

on tax-exempt loans to a taxable-equivalent basis.

(4)

Securities are included on an amortized

cost basis with yield and net interest margin calculated

accordingly.

(5)

Includes interest-bearing funds with

Federal Reserve Bank, interest earning deposits with banks, and

federal funds sold and securities purchased under resale

agreements.

(6)

Includes average net unrealized

gains/(losses) on investment securities available for sale of

$(836.6) million and $(1.53) billion for the nine months ended

September 30, 2024 and 2023, respectively.

(7)

The net interest margin is calculated by

dividing annualized net interest income - TE by average total

interest earning assets.

Synovus

LOANS OUTSTANDING BY TYPE

(Unaudited)

Total Loans

Total Loans

Linked Quarter

Total Loans

Year/Year

(Dollars in thousands)

Loan Type

September 30, 2024

June 30, 2024

% Change

September 30, 2023

% Change

Commercial, Financial, and

Agricultural

$

14,563,913

$

14,519,608

—

%

$

14,498,966

—

%

Owner-Occupied

8,100,084

8,017,004

1

8,281,988

(2

)

Total Commercial &

Industrial

22,663,997

22,536,612

1

22,780,954

(1

)

Multi-Family

4,379,459

4,288,436

2

3,930,617

11

Hotels

1,738,068

1,802,076

(4

)

1,790,094

(3

)

Office Buildings

1,778,698

1,801,945

(1

)

1,911,095

(7

)

Shopping Centers

1,260,460

1,298,967

(3

)

1,327,770

(5

)

Warehouses

837,145

865,359

(3

)

985,723

(15

)

Other Investment Property

1,352,719

1,271,266

6

1,432,456

(6

)

Total Investment Properties

11,346,549

11,328,049

—

11,377,755

—

1-4 Family Construction

190,705

171,335

11

224,091

(15

)

1-4 Family Investment Mortgage

337,425

381,212

(11

)

396,813

(15

)

Total 1-4 Family Properties

528,130

552,547

(4

)

620,904

(15

)

Commercial Development

48,948

65,994

(26

)

64,212

(24

)

Residential Development

67,525

67,231

—

92,209

(27

)

Land Acquisition

186,332

201,666

(8

)

239,773

(22

)

Land and Development

302,805

334,891

(10

)

396,194

(24

)

Total Commercial Real Estate

12,177,484

12,215,487

—

12,394,853

(2

)

Consumer Mortgages

5,323,443

5,371,164

(1

)

5,391,282

(1

)

Home Equity

1,809,286

1,812,940

—

1,784,356

1

Credit Cards

181,386

178,889

1

191,046

(5

)

Other Consumer Loans

965,078

978,305

(1

)

1,137,419

(15

)

Total Consumer

8,279,193

8,341,298

(1

)

8,504,103

(3

)

Total

$

43,120,674

$

43,093,397

—

%

$

43,679,910

(1

)%

NON-PERFORMING LOANS

COMPOSITION

(Unaudited)

Total

Non-performing Loans

Total

Non-performing Loans

Linked Quarter

Total

Non-performing Loans

Year/Year

(Dollars in thousands)

Loan Type

September 30, 2024

June 30, 2024

% Change

September 30, 2023

% Change

Commercial, Financial, and

Agricultural

$

107,004

$

120,107

(11

)%

$

97,468

10

%

Owner-Occupied

48,390

50,977

(5

)

84,505

(43

)

Total Commercial &

Industrial

155,394

171,084

(9

)

181,973

(15

)

Multi-Family

1,692

1,718

(2

)

1,702

(1

)

Office Buildings

78,281

7,350

nm

27,810

181

Shopping Centers

523

541

(3

)

653

(20

)

Warehouses

163

177

(8

)

207

(21

)

Other Investment Property

1,612

1,782

(10

)

572

182

Total Investment Properties

82,271

11,568

nm

30,944

166

1-4 Family Construction

311

311

—

—

nm

1-4 Family Investment Mortgage

2,533

2,749

(8

)

3,386

(25

)

Total 1-4 Family Properties

2,844

3,060

(7

)

3,386

(16

)

Residential Development

268

303

(12

)

267

—

Land Acquisition

1,422

606

135

538

164

Land and Development

1,690

909

86

805

110

Total Commercial Real Estate

86,805

15,537

459

35,135

147

Consumer Mortgages

48,956

48,352

1

43,863

12

Home Equity

15,837

14,947

6

11,620

36

Other Consumer Loans

5,972

6,186

(3

)

7,941

(25

)

Total Consumer

70,765

69,485

2

63,424

12

Total

$

312,964

$

256,106

22

%

$

280,532

12

%

Synovus

CREDIT QUALITY DATA

(Unaudited)

(Dollars in thousands)

2024

2023

Third Quarter

Third

Second

First

Fourth

Third

'24 vs '23

Quarter

Quarter

Quarter

Quarter

Quarter

% Change

Non-performing Loans (NPLs)

$

312,964

256,106

350,450

288,177

280,532

12

%

Other Real Estate and Other Assets

386

823

21,210

—

—

nm

Non-performing Assets (NPAs)

313,350

256,929

371,660

288,177

280,532

12

Allowance for Loan Losses (ALL)

484,985

485,101

492,661

479,385

477,532

2

Reserve for Unfunded Commitments

49,556

53,058

53,579

57,231

55,185

(10

)

Allowance for Credit Losses (ACL)

534,541

538,159

546,240

536,616

532,717

—

Net Charge-Offs - Quarter

27,052

34,485

44,356

41,574

66,822

Net Charge-Offs - YTD

105,893

78,841

44,356

153,342

111,768

Net Charge-Offs / Average Loans - Quarter

(1)

0.25

%

0.32

0.41

0.38

0.61

Net Charge-Offs / Average Loans - YTD

(1)

0.33

0.36

0.41

0.35

0.34

NPLs / Loans

0.73

0.59

0.81

0.66

0.64

NPAs / Loans, ORE and specific other

assets

0.73

0.60

0.86

0.66

0.64

ACL/Loans

1.24

1.25

1.26

1.24

1.22

ALL/Loans

1.12

1.13

1.14

1.10

1.09

ACL/NPLs

170.80

210.13

155.87

186.21

189.90

ALL/NPLs

154.96

189.41

140.58

166.35

170.22

Past Due Loans over 90 days and Still

Accruing

$

4,359

4,460

3,748

5,053

3,792

15

As a Percentage of Loans Outstanding

0.01

%

0.01

0.01

0.01

0.01

Total Past Due Loans and Still

Accruing

$

97,229

129,759

54,814

59,099

54,974

77

As a Percentage of Loans Outstanding

0.23

%

0.30

0.13

0.14

0.13

(1) Ratio is annualized.

SELECTED CAPITAL INFORMATION

(1)

(Unaudited)

(Dollars in thousands)

September 30, 2024

December 31, 2023

September 30, 2023

Common Equity Tier 1 Capital Ratio

10.65

%

10.22

10.13

Tier 1 Capital Ratio

11.77

11.28

11.18

Total Risk-Based Capital Ratio

13.62

13.07

13.12

Tier 1 Leverage Ratio

9.55

9.49

9.38

Total Synovus Financial Corp.

shareholders' equity as a Percentage of Total Assets

8.99

8.56

7.65

Tangible Common Equity Ratio (2) (4)

7.28

6.84

5.90

Book Value Per Common Share (3)

$

33.94

31.24

27.36

Tangible Book Value Per Common Share

(2)

30.29

27.65

23.74

(1) Current quarter regulatory capital

information is preliminary.

(2) Excludes the carrying value of

goodwill and other intangible assets from common equity and total

assets.

(3) Book Value Per Common Share consists

of Total Synovus Financial Corp. shareholders’ equity less

Preferred stock divided by total common shares outstanding.

(4) See "Non-GAAP Financial Measures" for

applicable reconciliation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016977149/en/

Media Contact Audria Belton Media Relations

media@synovus.com

Investor Contact Jennifer H. Demba, CFA Investor

Relations investorrelations@synovus.com

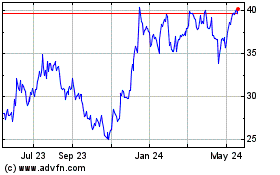

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Jan 2025 to Feb 2025

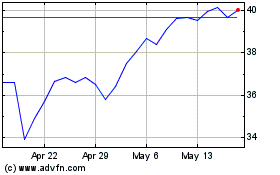

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Feb 2024 to Feb 2025