0001549346FALSE12/312024Q2430xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:puresstk:channel00015493462024-01-012024-06-3000015493462024-08-0200015493462024-06-3000015493462023-12-3100015493462024-04-012024-06-3000015493462023-04-012023-06-3000015493462023-01-012023-06-300001549346us-gaap:CommonStockMember2024-03-310001549346us-gaap:TreasuryStockCommonMember2024-03-310001549346us-gaap:AdditionalPaidInCapitalMember2024-03-310001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001549346us-gaap:RetainedEarningsMember2024-03-3100015493462024-03-310001549346us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001549346us-gaap:CommonStockMember2024-04-012024-06-300001549346us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001549346us-gaap:RetainedEarningsMember2024-04-012024-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001549346us-gaap:CommonStockMember2024-06-300001549346us-gaap:TreasuryStockCommonMember2024-06-300001549346us-gaap:AdditionalPaidInCapitalMember2024-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001549346us-gaap:RetainedEarningsMember2024-06-300001549346us-gaap:CommonStockMember2023-03-310001549346us-gaap:TreasuryStockCommonMember2023-03-310001549346us-gaap:AdditionalPaidInCapitalMember2023-03-310001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001549346us-gaap:RetainedEarningsMember2023-03-3100015493462023-03-310001549346us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001549346us-gaap:CommonStockMember2023-04-012023-06-300001549346us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001549346us-gaap:RetainedEarningsMember2023-04-012023-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001549346us-gaap:CommonStockMember2023-06-300001549346us-gaap:TreasuryStockCommonMember2023-06-300001549346us-gaap:AdditionalPaidInCapitalMember2023-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001549346us-gaap:RetainedEarningsMember2023-06-3000015493462023-06-300001549346us-gaap:CommonStockMember2023-12-310001549346us-gaap:TreasuryStockCommonMember2023-12-310001549346us-gaap:AdditionalPaidInCapitalMember2023-12-310001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001549346us-gaap:RetainedEarningsMember2023-12-310001549346us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001549346us-gaap:CommonStockMember2024-01-012024-06-300001549346us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001549346us-gaap:RetainedEarningsMember2024-01-012024-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001549346us-gaap:CommonStockMember2022-12-310001549346us-gaap:TreasuryStockCommonMember2022-12-310001549346us-gaap:AdditionalPaidInCapitalMember2022-12-310001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001549346us-gaap:RetainedEarningsMember2022-12-3100015493462022-12-310001549346us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001549346us-gaap:CommonStockMember2023-01-012023-06-300001549346us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001549346us-gaap:RetainedEarningsMember2023-01-012023-06-300001549346us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001549346us-gaap:AccountsReceivableMember2024-06-300001549346us-gaap:OtherAssetsMember2024-06-300001549346sstk:TwoCustomersMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001549346sstk:TwoCustomersMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-06-300001549346us-gaap:ConvertiblePreferredStockMembersstk:ZcoolNetworkTechnologyLimitedMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2018-01-012018-12-310001549346sstk:MeituInc.Member2024-03-270001549346sstk:MeituInc.Member2024-03-272024-03-270001549346us-gaap:FairValueInputsLevel1Member2024-06-300001549346us-gaap:OtherAssetsMember2024-06-300001549346sstk:BackgridUSAInc.AndBackgridLondonLTDMember2024-02-012024-02-010001549346sstk:BackgridUSAInc.AndBackgridLondonLTDMemberus-gaap:TradeNamesMember2024-02-012024-02-010001549346us-gaap:DevelopedTechnologyRightsMembersstk:BackgridUSAInc.AndBackgridLondonLTDMember2024-02-012024-02-010001549346sstk:BackgridUSAInc.AndBackgridLondonLTDMember2024-02-010001549346us-gaap:TrademarksMembersstk:BackgridUSAInc.AndBackgridLondonLTDMember2024-02-010001549346us-gaap:DevelopedTechnologyRightsMembersstk:BackgridUSAInc.AndBackgridLondonLTDMember2024-02-010001549346sstk:GiphyIncMember2023-06-232023-06-230001549346sstk:GiphyIncMembersstk:MandatedPaymentsConsiderationRecurringMember2023-06-232023-06-230001549346sstk:GiphyIncMembersstk:MandatedPaymentsConsiderationNonrecurringMember2023-06-232023-06-230001549346sstk:GiphyIncMembersstk:OtherDeferredConsiderationMember2023-06-232023-06-230001549346sstk:GiphyIncMembersstk:PrecombinationServiceConsiderationMember2023-06-232023-06-230001549346sstk:GiphyIncMember2023-06-230001549346sstk:GiphyIncMemberus-gaap:DevelopedTechnologyRightsMember2023-06-232023-06-230001549346sstk:GiphyIncMemberus-gaap:TradeNamesMember2023-06-232023-06-230001549346sstk:GiphyIncMemberus-gaap:TrademarksMember2023-06-230001549346sstk:GiphyIncMemberus-gaap:DevelopedTechnologyRightsMember2023-06-230001549346sstk:GiphyIncMember2023-07-012023-09-300001549346sstk:GiphyIncMember2023-10-012023-12-310001549346sstk:GiphyIncMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-06-232023-06-230001549346sstk:GiphyIncMember2024-06-300001549346sstk:ComputerEquipmentAndSoftwareMember2024-06-300001549346sstk:ComputerEquipmentAndSoftwareMember2023-12-310001549346us-gaap:FurnitureAndFixturesMember2024-06-300001549346us-gaap:FurnitureAndFixturesMember2023-12-310001549346us-gaap:LeaseholdImprovementsMember2024-06-300001549346us-gaap:LeaseholdImprovementsMember2023-12-310001549346sstk:PropertyAndEquipmentMember2024-04-012024-06-300001549346sstk:PropertyAndEquipmentMember2023-04-012023-06-300001549346sstk:PropertyAndEquipmentMember2024-01-012024-06-300001549346sstk:PropertyAndEquipmentMember2023-01-012023-06-300001549346us-gaap:CostOfSalesMember2024-04-012024-06-300001549346us-gaap:CostOfSalesMember2023-04-012023-06-300001549346us-gaap:CostOfSalesMember2024-01-012024-06-300001549346us-gaap:CostOfSalesMember2023-01-012023-06-300001549346us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001549346us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001549346us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-06-300001549346us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001549346us-gaap:CustomerRelationshipsMember2024-06-300001549346us-gaap:CustomerRelationshipsMember2023-12-310001549346us-gaap:TradeNamesMember2024-06-300001549346us-gaap:TradeNamesMember2023-12-310001549346us-gaap:DevelopedTechnologyRightsMember2024-06-300001549346us-gaap:DevelopedTechnologyRightsMember2023-12-310001549346us-gaap:MediaContentMember2024-06-300001549346us-gaap:MediaContentMember2023-12-310001549346us-gaap:PatentsMember2024-06-300001549346us-gaap:PatentsMember2023-12-310001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-060001549346us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-05-062022-05-060001549346us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:LineOfCreditMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-062022-05-060001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-06-300001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-04-012024-06-300001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-06-300001549346us-gaap:CommonStockMember2023-06-300001549346us-gaap:CommonStockMember2024-01-012024-06-300001549346us-gaap:CommonStockMember2024-04-012024-06-300001549346us-gaap:CommonStockMember2023-01-012023-06-300001549346us-gaap:CommonStockMember2023-04-012023-06-300001549346us-gaap:SubsequentEventMember2024-07-222024-07-220001549346us-gaap:SellingAndMarketingExpenseMember2024-04-012024-06-300001549346us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001549346us-gaap:SellingAndMarketingExpenseMember2024-01-012024-06-300001549346us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001549346us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001549346us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001549346us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001549346us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001549346us-gaap:GeneralAndAdministrativeExpenseMember2024-04-012024-06-300001549346us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001549346us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-300001549346us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001549346us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001549346us-gaap:EmployeeStockOptionMember2024-06-300001549346us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001549346us-gaap:RestrictedStockUnitsRSUMember2024-06-300001549346us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001549346sstk:ECommerceMember2024-04-012024-06-300001549346sstk:ECommerceMember2023-04-012023-06-300001549346sstk:ECommerceMember2024-01-012024-06-300001549346sstk:ECommerceMember2023-01-012023-06-300001549346sstk:EnterpriseMember2024-04-012024-06-300001549346sstk:EnterpriseMember2023-04-012023-06-300001549346sstk:EnterpriseMember2024-01-012024-06-300001549346sstk:EnterpriseMember2023-01-012023-06-3000015493462024-07-012024-06-300001549346srt:NorthAmericaMember2024-04-012024-06-300001549346srt:NorthAmericaMember2023-04-012023-06-300001549346srt:NorthAmericaMember2024-01-012024-06-300001549346srt:NorthAmericaMember2023-01-012023-06-300001549346srt:EuropeMember2024-04-012024-06-300001549346srt:EuropeMember2023-04-012023-06-300001549346srt:EuropeMember2024-01-012024-06-300001549346srt:EuropeMember2023-01-012023-06-300001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2024-04-012024-06-300001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2023-04-012023-06-300001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2024-01-012024-06-300001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2023-01-012023-06-300001549346us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2024-01-012024-06-300001549346us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2023-01-012023-06-300001549346srt:NorthAmericaMember2024-06-300001549346srt:NorthAmericaMember2023-12-310001549346srt:EuropeMember2024-06-300001549346srt:EuropeMember2023-12-310001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2024-06-300001549346sstk:AllRegionsOfTheWorldExceptNorthAmericaAndEuropeMember2023-12-310001549346us-gaap:GeographicConcentrationRiskMembercountry:USsstk:LongLivedTangibleAsstesMember2024-01-012024-06-300001549346us-gaap:GeographicConcentrationRiskMembercountry:USsstk:LongLivedTangibleAsstesMember2023-01-012023-12-310001549346country:IEus-gaap:GeographicConcentrationRiskMembersstk:LongLivedTangibleAsstesMember2024-01-012024-06-300001549346country:IEus-gaap:GeographicConcentrationRiskMembersstk:LongLivedTangibleAsstesMember2023-01-012023-12-310001549346us-gaap:IndemnificationGuaranteeMember2024-06-300001549346sstk:EnvatoMemberus-gaap:SubsequentEventMember2024-07-222024-07-220001549346us-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-222024-07-220001549346us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-220001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-220001549346us-gaap:BaseRateMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-07-222024-07-220001549346us-gaap:BaseRateMembersrt:MaximumMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-222024-07-220001549346us-gaap:SubsequentEventMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-07-222024-07-220001549346srt:MaximumMemberus-gaap:SubsequentEventMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:LineOfCreditMember2024-07-222024-07-220001549346us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-222024-07-220001549346us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-07-222024-07-220001549346sstk:JonOringerMember2024-01-012024-06-300001549346sstk:JonOringerMember2024-04-012024-06-300001549346sstk:JonOringerMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________________________________

FORM 10-Q

___________________________________________________________________________________________________

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35669

_____________________________________________________________________

SHUTTERSTOCK, INC.

(Exact name of registrant as specified in its charter)

________________________________________________________ | | | | | | | | |

| Delaware | | 80-0812659 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

350 Fifth Avenue, 20th Floor

New York, NY 10118

(Address of principal executive offices, including zip code)

(646) 710-3417

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

______________________________________________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

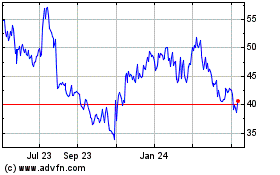

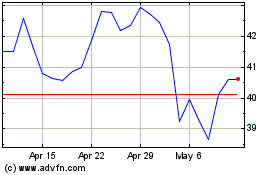

| Common Stock, $0.01 par value per share | SSTK | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | | | |

| | | Emerging growth company | ☐ | | | |

| | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ☐ | Yes | ☒ | No |

| Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. | |

As of August 2, 2024, 35,418,308 shares of the registrant’s common stock, $0.01 par value per share, were outstanding.

Shutterstock, Inc.

FORM 10-Q

Table of Contents

For the Quarterly Period Ended June 30, 2024

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, particularly in the discussion under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact are forward-looking. Examples of forward-looking statements include, but are not limited to, statements regarding guidance, industry prospects, future business, future results of operations or financial condition, future dividends, future stock performance, our ability to consummate acquisitions and integrate the businesses we have acquired or may acquire into our existing operations, new or planned features, products or services, management strategies and our competitive position. You can identify many forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expects,” “aims,” “anticipates,” “believes,” “estimates,” “intends,” “plans,” “predicts,” “projects,” “seeks,” “potential,” “opportunities” and other similar expressions and the negatives of such expressions. However, not all forward-looking statements contain these words. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, our ability to continue to attract and retain customers of, and contributors to, our creative platform; competition in our industry; the effectiveness and efficiency of our marketing efforts; our ability to innovate technologically or develop, market and offer new products and services, or enhance existing technology and products and services; our ability to increase market awareness of our brand and our existing and new products and services; pricing pressure, and increased service, indemnification and working capital requirements; expansion of our operations into new products, services and technologies; the impact of worldwide economic, political and social conditions; social and ethical issues relating to the use of new and evolving technologies, such as AI; our ability to grow our revenues at historical rates; our ability to effectively expand, train, manage changes to and retain our sales force; our ability to effectively manage our growth; our ability to successfully make, integrate and maintain acquisitions and investments; risks related to our personnel; risks related to our use of independent contractors; the non-payment or late payment of amounts due to us and other payment-related risks; the potential impairment of our goodwill or intangible assets; the need to raise additional capital; risks related to our debt; our reliance on information technologies and systems and other risks related to our intellectual property and security vulnerabilities; our international operations and our continued expansion internationally; foreign exchange risk; risks related to regulatory and tax challenges;

our ability to continue to attract and retain customers of, and contributors to, our creative platform; competition in our industry; the effectiveness and efficiency of our marketing efforts; our ability to innovate technologically or develop, market and offer new products and services, or enhance existing technology and products and services; our ability to increase market awareness of our brand and our existing and new products and services; pricing pressure, and increased service, indemnification and working capital requirements; expansion of our operations into new products, services and technologies; the impact of worldwide economic, political and social conditions; social and ethical issues relating to the use of new and evolving technologies, such as AI; our ability to grow our revenues at historical rates; our ability to effectively expand, train, manage changes to and retain our sales force; our ability to effectively manage our growth; our ability to successfully make, integrate and maintain acquisitions and investments; risks related to our personnel; risks related to our use of independent contractors; the non-payment or late payment of amounts due to us and other payment-related risks; the potential impairment of our goodwill or intangible assets; the need to raise additional capital; risks related to our debt; our reliance on information technologies and systems and other risks related to our intellectual property and security vulnerabilities; our international operations and our continued expansion internationally; foreign exchange risk; risks related to regulatory and tax challenges; as well as those risks discussed under the caption “Risk Factors” in our most recently filed Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2024 (our “2023 Form 10-K”) and in our consolidated financial statements, related notes, and the other information appearing elsewhere in the 2023 Form 10-K, this Quarterly Report on Form 10-Q and our other filings with the SEC. Given these risks and uncertainties, you should not place undue reliance on any forward-looking statements. The forward-looking statements contained in this Quarterly Report on Form 10-Q are made only as of the date hereof, and we do not intend, and, except as required by law, we undertake no obligation to update any forward-looking statements contained herein after the date of this report to reflect actual results or future events or circumstances.

Unless the context otherwise indicates, references in this Quarterly Report on Form 10-Q to the terms “Shutterstock,” “the Company,” “we,” “our” and “us” refer to Shutterstock, Inc. and its subsidiaries. “Shutterstock,” “Shutterstock Editorial,” “Asset Assurance,” “Offset,” “Bigstock,” “Rex Features,” “PremiumBeat,” “TurboSquid,” “PicMonkey,” “Pattern89,” “Shotzr,” “Pond5,” “Splash News,” “Giphy,” “Shutterstock Studios,” “Shutterstock Editor,” “Shutterstock.AI,” “Creative Flow,” and “Backgrid” and their logos are registered trademarks and are the property of Shutterstock, Inc. or one of our subsidiaries. All other trademarks, service marks and trade names appearing in this Quarterly Report on Form 10-Q are the property of their respective owners.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Shutterstock, Inc.

Consolidated Balance Sheets

(In thousands, except par value amount)

(unaudited) | | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 74,871 | | | $ | 100,490 | |

| | | |

| | | |

Accounts receivable, net of allowance of $4,616 and $6,335 | 97,442 | | | 91,139 | |

| Prepaid expenses and other current assets | 68,534 | | | 100,944 | |

| | | |

| | | |

| Total current assets | 240,847 | | | 292,573 | |

| Property and equipment, net | 63,069 | | | 64,300 | |

| Right-of-use assets | 15,392 | | | 15,395 | |

| Intangible assets, net | 164,508 | | | 184,396 | |

| Goodwill | 402,774 | | | 383,325 | |

| Deferred tax assets, net | 23,779 | | | 24,874 | |

| Other assets | 93,497 | | | 71,152 | |

| Total assets | $ | 1,003,866 | | | $ | 1,036,015 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 10,545 | | | $ | 9,108 | |

| Accrued expenses | 96,910 | | | 131,443 | |

| Contributor royalties payable | 65,705 | | | 54,859 | |

| | | |

| Deferred revenue | 186,522 | | | 203,463 | |

| Debt | 30,000 | | | 30,000 | |

| Other current liabilities | 42,649 | | | 23,513 | |

| Total current liabilities | 432,331 | | | 452,386 | |

| Deferred tax liability, net | 3,744 | | | 4,182 | |

| | | |

| Lease liabilities | 26,433 | | | 29,404 | |

| Other non-current liabilities | 20,946 | | | 22,949 | |

| Total liabilities | 483,454 | | | 508,921 | |

Commitments and contingencies (Note 14) | | | |

| | | |

| Stockholders’ equity: | | | |

| | | |

Common stock, $0.01 par value; 200,000 shares authorized; 40,286 and 39,982 shares issued and 35,359 and 35,572 shares outstanding as of June 30, 2024 and December 31, 2023, respectively | 402 | | | 399 | |

Treasury stock, at cost; 4,927 and 4,410 shares as of June 30, 2024 and December 31, 2023 | (248,805) | | | (228,213) | |

| Additional paid-in capital | 441,497 | | | 424,229 | |

| Accumulated other comprehensive loss | (13,754) | | | (11,974) | |

| Retained earnings | 341,072 | | | 342,653 | |

| Total stockholders’ equity | 520,412 | | | 527,094 | |

| Total liabilities and stockholders’ equity | $ | 1,003,866 | | | $ | 1,036,015 | |

See Notes to Unaudited Consolidated Financial Statements.

Shutterstock, Inc.

Consolidated Statements of Operations

(In thousands, except for per share data)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenue | $ | 220,053 | | | $ | 208,840 | | | $ | 434,368 | | | $ | 424,120 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Cost of revenue | 91,254 | | | 84,416 | | | 179,458 | | | 162,579 | |

| Sales and marketing | 51,881 | | | 48,392 | | | 108,117 | | | 95,919 | |

| Product development | 19,859 | | | 29,218 | | | 40,910 | | | 44,624 | |

| General and administrative | 36,393 | | | 38,099 | | | 68,471 | | | 71,914 | |

| Total operating expenses | 199,387 | | | 200,125 | | | 396,956 | | | 375,036 | |

| Income from operations | 20,666 | | | 8,715 | | | 37,412 | | | 49,084 | |

| Bargain purchase gain | — | | | 41,940 | | | — | | | 41,940 | |

| | | | | | | |

| Other (expense) / income, net | (4,106) | | | 726 | | | (462) | | | 1,771 | |

| Income before income taxes | 16,560 | | | 51,381 | | | 36,950 | | | 92,795 | |

| Provision for income taxes | 12,935 | | | 1,368 | | | 17,204 | | | 9,939 | |

| Net income | $ | 3,625 | | | $ | 50,013 | | | $ | 19,746 | | | $ | 82,856 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.10 | | | $ | 1.39 | | | $ | 0.55 | | | $ | 2.31 | |

| Diluted | $ | 0.10 | | | $ | 1.37 | | | $ | 0.55 | | | $ | 2.27 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 35,697 | | 36,047 | | 35,644 | | 35,952 |

| Diluted | 35,982 | | 36,406 | | 36,023 | | 36,490 |

See Notes to Unaudited Consolidated Financial Statements.

Shutterstock, Inc.

Consolidated Statements of Comprehensive Income

(In thousands)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net income | $ | 3,625 | | | $ | 50,013 | | | $ | 19,746 | | | $ | 82,856 | |

| Foreign currency translation (loss) / gain | (316) | | | (111) | | | (1,780) | | | 1,308 | |

| | | | | | | |

| Other comprehensive (loss) / income | (316) | | | (111) | | | (1,780) | | | 1,308 | |

| Comprehensive income | $ | 3,309 | | | $ | 49,902 | | | $ | 17,966 | | | $ | 84,164 | |

See Notes to Unaudited Consolidated Financial Statements.

Shutterstock, Inc.

Consolidated Statements of Stockholders’ Equity

(In thousands)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Additional

Paid-in

Capital | | Accumulated

Other

Comprehensive

(Loss) / Income | | Retained

Earnings | | | | |

| | Common Stock | | Treasury Stock | | | | | | | |

| Three Months Ended June 30, 2024 | | Shares | | Amount | | Shares | | Amount | | | | | Total | | |

| Balance at March 31, 2024 | | | 40,013 | | | $ | 399 | | | 4,410 | | | $ | (228,213) | | | $ | 434,416 | | | $ | (13,438) | | | $ | 348,111 | | | $ | 541,275 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Equity-based compensation | | | — | | | — | | | — | | | — | | | 14,976 | | | — | | | — | | | 14,976 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of common stock in connection with employee stock option exercises and RSU vesting | | | 449 | | | 5 | | | — | | | — | | | (5) | | | — | | | — | | | — | | | |

| Common shares withheld for settlement of taxes in connection with equity-based compensation | | | (176) | | | (2) | | | — | | | — | | | (7,890) | | | — | | | — | | | (7,892) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchase of treasury shares | | | — | | | — | | | 517 | | | (20,592) | | | — | | | — | | | — | | | (20,592) | | | |

| Cash dividends paid | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,664) | | | (10,664) | | | |

| Other comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | (316) | | | — | | | (316) | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,625 | | | 3,625 | | | |

| Balance at June 30, 2024 | | | 40,286 | | | $ | 402 | | | 4,927 | | | $ | (248,805) | | | $ | 441,497 | | | $ | (13,754) | | | $ | 341,072 | | | $ | 520,412 | | | |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2023 | | | 39,690 | | | $ | 396 | | | 3,776 | | | $ | (200,008) | | | $ | 395,934 | | | $ | (14,020) | | | $ | 294,232 | | | $ | 476,534 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Equity-based compensation | | | — | | | — | | | — | | | — | | | 14,943 | | | — | | | — | | | 14,943 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of common stock in connection with employee stock option exercises and RSU vesting | | | 317 | | | 3 | | | — | | | — | | | (3) | | | — | | | — | | | — | | | |

| Common shares withheld for settlement of taxes in connection with equity-based compensation | | | (123) | | | (1) | | | — | | | — | | | (8,146) | | | — | | | — | | | (8,147) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchase of treasury shares | | | — | | | — | | | 80 | | | (4,000) | | | — | | | — | | | — | | | (4,000) | | | |

| Cash dividends paid | | | — | | | — | | | — | | | — | | | — | | | — | | | (9,725) | | | (9,725) | | | |

| Other comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | (111) | | | — | | | (111) | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | 50,013 | | | 50,013 | | | |

| Balance at June 30, 2023 | | | 39,884 | | | $ | 398 | | | 3,856 | | | $ | (204,008) | | | $ | 402,728 | | | $ | (14,131) | | | $ | 334,520 | | | $ | 519,507 | | | |

| | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2023 | | | 39,982 | | | $ | 399 | | | 4,410 | | | $ | (228,213) | | | $ | 424,229 | | | $ | (11,974) | | | $ | 342,653 | | | $ | 527,094 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Equity-based compensation | | | — | | | — | | | — | | | — | | | 26,126 | | | — | | | — | | | 26,126 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of common stock in connection with employee stock option exercises and RSU vesting | | | 501 | | | 5 | | | — | | | — | | | (5) | | | — | | | — | | | — | | | |

| Common shares withheld for settlement of taxes in connection with equity-based compensation | | | (197) | | | (2) | | | — | | | — | | | (8,853) | | | — | | | — | | | (8,855) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchase of treasury shares | | | — | | | — | | | 517 | | | (20,592) | | | — | | | — | | | — | | | (20,592) | | | |

| Cash dividends paid | | | — | | | — | | | — | | | — | | | — | | | — | | | (21,327) | | | (21,327) | | | |

| Other comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | (1,780) | | | — | | | (1,780) | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | 19,746 | | | 19,746 | | | |

| Balance at June 30, 2024 | | | 40,286 | | | $ | 402 | | | 4,927 | | | $ | (248,805) | | | $ | 441,497 | | | $ | (13,754) | | | $ | 341,072 | | | $ | 520,412 | | | |

| | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2022 | | | 39,605 | | | $ | 396 | | | 3,776 | | | $ | (200,008) | | | $ | 391,482 | | | $ | (15,439) | | | $ | 271,051 | | | $ | 447,482 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Equity-based compensation | | | — | | | — | | | — | | | — | | | 23,586 | | | — | | | — | | | 23,586 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of common stock in connection with employee stock option exercises and RSU vesting | | | 461 | | | 4 | | | — | | | — | | | (2) | | | — | | | — | | | 2 | | | |

| Common shares withheld for settlement of taxes in connection with equity-based compensation | | | (182) | | | (2) | | | — | | | — | | | (12,338) | | | — | | | — | | | (12,340) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchase of treasury shares | | | — | | | — | | | 80 | | | (4,000) | | | — | | | — | | | — | | | (4,000) | | | |

| Cash dividends paid | | | — | | | — | | | — | | | — | | | — | | | — | | | (19,387) | | | (19,387) | | | |

| Other comprehensive income | | | — | | | — | | | — | | | — | | | — | | | 1,308 | | | — | | | 1,308 | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | 82,856 | | | 82,856 | | | |

| Balance at June 30, 2023 | | | 39,884 | | | $ | 398 | | | 3,856 | | | $ | (204,008) | | | $ | 402,728 | | | $ | (14,131) | | | $ | 334,520 | | | $ | 519,507 | | | |

See Notes to Unaudited Consolidated Financial Statements.

Shutterstock, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(unaudited) | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 19,746 | | | $ | 82,856 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 42,696 | | | 38,102 | |

| | | |

| Deferred taxes | 503 | | | (146) | |

| Non-cash equity-based compensation | 26,126 | | | 23,586 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Bad debt expense | (1,772) | | | 1,025 | |

| Bargain purchase gain | — | | | (41,940) | |

| | | |

| | | |

| Unrealized (gain) / loss on investments, net | (131) | | | — | |

| Changes in operating assets and liabilities: | | | |

| | | |

| Accounts receivable | (3,879) | | | 5,709 | |

| Prepaid expenses and other current and non-current assets | (25,299) | | | (29,834) | |

| | | |

| Accounts payable and other current and non-current liabilities | (16,899) | | | (4,144) | |

| | | |

| Contributor royalties payable | 10,688 | | | 1,822 | |

| | | |

| Deferred revenue | (15,514) | | | 19,553 | |

| Net cash provided by operating activities | $ | 36,265 | | | $ | 96,589 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Capital expenditures | (23,536) | | | (22,870) | |

| | | |

| | | |

| Business combination, net of cash acquired | (19,474) | | | (53,721) | |

| Cash received related to Giphy Retention Compensation | 36,522 | | | 15,752 | |

| | | |

| | | |

| | | |

| | | |

| Acquisition of content | (1,821) | | | (5,252) | |

| | | |

| Security deposit payment | 82 | | | (37) | |

| Net cash used in investing activities | $ | (8,227) | | | $ | (66,128) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| | | |

| | | |

| Repurchase of treasury shares | (20,592) | | | (4,000) | |

| Proceeds from exercise of stock options | — | | | 3 | |

| | | |

| Cash paid related to settlement of employee taxes related to RSU vesting | (8,859) | | | (14,545) | |

| Payment of cash dividends | (21,327) | | | (19,387) | |

| | | |

| | | |

| Proceeds from credit facility | — | | | 30,000 | |

| Repayment of credit facility | — | | | (50,000) | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | $ | (50,778) | | | $ | (57,929) | |

| | | |

| Effect of foreign exchange rate changes on cash | (2,879) | | | (540) | |

| Net decrease in cash and cash equivalents | (25,619) | | | (28,008) | |

| | | |

| Cash and cash equivalents, beginning of period | 100,490 | | | 115,154 | |

| Cash and cash equivalents, end of period | $ | 74,871 | | | $ | 87,146 | |

| | | |

| Supplemental Disclosure of Cash Information: | | | |

| Cash paid for income taxes | $ | 12,560 | | | $ | 6,795 | |

| Cash paid for interest | 1,005 | | | 429 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See Notes to Unaudited Consolidated Financial Statements.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

(1) Summary of Operations and Significant Accounting Policies

Summary of Operations

Shutterstock, Inc. (the “Company” or “Shutterstock”) is a leading global creative platform connecting brands and businesses to high quality content.

The Company’s platform brings together users and contributors of content by providing readily-searchable content that customers pay to license and by compensating contributors as their content is licensed. Contributors upload their content to the Company’s web properties in exchange for royalty payments based on customer download activity. Beyond content, customers also leverage the Company’s platform to assist with the entire creative process from ideation through creative execution.

Digital content licensed to customers for their creative needs includes images, footage, music, and 3D models (the Company’s “Content” offering). Content revenues represent the majority of the Company’s business and are supported by the Company’s searchable creative platform and driven by the Company’s large contributor network.

In addition, customers have needs that are beyond traditional content license products and services. These include (i) licenses to metadata associated with the Company’s images, footage, music tracks and 3D models through the Company’s data offering, (ii) distribution and advertising services from the Company’s Giphy business, which consists of GIFs (graphics interchange format visuals) that serve as a critical ingredient in text- and message- based conversations and in contextual advertising settings, (iii) specialized solutions for high-quality content matched with production tools and services through Shutterstock Studios and (iv) other tailored white-glove services (collectively, the Company’s “Data, Distribution, and Services” offerings).

The Company’s Content offering includes:

•Images - consisting of photographs, vectors and illustrations. Images are typically used in visual communications, such as websites, digital and print marketing materials, corporate communications, books, publications and other similar uses.

•Footage - consisting of video clips, premium footage filmed by industry experts and cinema grade video effects, available in HD and 4K formats. Footage is often integrated into websites, social media, marketing campaigns and cinematic productions.

•Music - consisting of high-quality music tracks and sound effects, which are often used to complement images and footage.

•3 Dimensional (“3D”) Models - consisting of 3D models, used in a variety of industries such as advertising, media and video production, gaming, retail, education, design and architecture.

•Generative AI Content - consisting of images generated from algorithms trained with high-quality, ethically sourced content. Customers can generate images by entering a description of their desired content into model prompts.

On February 1, 2024, the Company acquired Backgrid USA, Inc. and Backgrid London, Ltd. (collectively “Backgrid”). Backgrid supplies media organizations with real-time celebrity content. See Note 3 Acquisitions.

Basis of Presentation

The unaudited condensed consolidated financial statements and accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, these financial statements do not include all information and footnotes required by GAAP for complete financial statements.

The interim Consolidated Balance Sheet as of June 30, 2024, and the Consolidated Statements of Operations, Comprehensive Income and Stockholders’ Equity for the three and six months ended June 30, 2024 and 2023, and the Consolidated Statements of Cash Flows for the six months ended June 30, 2024 and 2023 are unaudited. The Consolidated Balance Sheet as of December 31, 2023, included herein, was derived from the audited financial statements as of that date, but does not include all disclosures required by GAAP. These unaudited interim financial statements have been prepared on a basis consistent with the Company’s annual financial statements and, in the opinion of management, reflect all adjustments, which include all normal recurring adjustments necessary to fairly state the Company’s financial position as of June 30, 2024, and its

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

consolidated results of operations, comprehensive income, stockholders’ equity and cash flows for the three and six months ended June 30, 2024 and 2023. The financial data and the other financial information disclosed in the notes to the financial statements related to these periods are also unaudited. The results of operations for the six months ended June 30, 2024 are not necessarily indicative of the results to be expected for the fiscal year ending December 31, 2024 or for any other future annual or interim period.

These financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto as of and for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K, which was filed with the SEC on February 26, 2024. The unaudited consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Certain immaterial changes in presentation have been made to conform the prior period presentation to current period reporting.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the financial statements. Actual results could differ from those estimates. Such estimates include, but are not limited to, the determination of the allowance for doubtful accounts, the volume of expected unused licenses for our subscription-based products, the assessment of recoverability of property and equipment, the fair value of acquired goodwill and intangible assets, the amount of non-cash equity-based compensation, the assessment of recoverability of deferred tax assets, the measurement of income tax and contingent non-income tax liabilities and the determination of the incremental borrowing rate used to calculate the lease liability.

Cash and Cash Equivalents

The Company’s cash and cash equivalents consist primarily of bank deposits.

Accounts Receivable and Allowance for Doubtful Accounts

The Company’s accounts receivable consists of customer obligations due under normal trade terms, carried at their face value less an allowance for doubtful accounts, if required. The Company determines its allowance for doubtful accounts and credit losses based on an evaluation of (i) the aging of its accounts receivable considering historical receivables loss rates, (ii) on a customer-by-customer basis, where appropriate, and (iii) the economic environments in which the Company operates.

For certain Data, Distribution, and Services transactions, the Company has $69.9 million of unbilled receivables of which $38.0 million are recorded in Accounts Receivable and $31.9 million are recorded in Other Assets, as of June 30, 2024.

During the six months ended June 30, 2024, the Company recorded bad debt recovery of $1.8 million. As of June 30, 2024 and December 31, 2023, the Company’s allowance for doubtful accounts was approximately $4.6 million and $6.3 million, respectively. The allowance for doubtful accounts is included as a reduction of accounts receivable on the Consolidated Balance Sheets.

The Company has certain customer arrangements that contain financing elements. Interest income earned from these financing receivables is recorded on the effective interest method and is included within interest income on the Consolidated Statements of Operations. As of June 30, 2024 and December 31, 2023, approximately $12.6 million and $16.0 million of financing receivables, respectively, were included in accounts receivable and other assets on the Consolidated Balance Sheets.

In addition, as of June 30, 2024 and December 31, 2023, two customers accounted for approximately 29% of the accounts receivable balance.

Chargeback and Sales Refund Allowance

The Company establishes a chargeback allowance and sales refund reserve allowance based on factors surrounding historical credit card chargeback trends, historical sales refund trends and other information. As of June 30, 2024 and December 31, 2023, the Company’s combined allowance for chargebacks and sales refunds was $0.4 million, which was included as a component of other current liabilities on the Consolidated Balance Sheets.

Revenue Recognition

A significant portion of the Company’s revenue is earned from the license of content. Content licenses are generally purchased on a monthly or annual basis, whereby a customer pays for a predetermined quantity of content that may be

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

downloaded over a specific period of time, or, on a transactional basis, whereby a customer pays for individual content licenses at the time of download. The Company also generates revenue from tools available through the Company’s platform.

For contracts that contain multiple performance obligations, the Company allocates the transaction price to each performance obligation based on a relative standalone selling price. The standalone selling price is determined based on the price at which the performance obligation is sold separately, or if not observable through past transactions, is estimated taking into account available information including internally approved pricing guidelines and pricing information of comparable products.

The Company recognizes revenue upon the satisfaction of performance obligations. The Company recognizes revenue on both its subscription-based and transaction-based products when content is downloaded by a customer, at which time the license is provided. In addition, the Company estimates expected unused licenses for subscription-based products and recognizes the revenue associated with the unused licenses as digital content is downloaded and licenses are obtained for such content by the customer during the subscription period. The estimate of unused licenses is based on historical download activity and future changes in the estimate could impact the timing of revenue recognition of the Company’s subscription products. For revenue associated with tools available through the Company’s platform, revenue is recognized on a straight-line basis over the subscription period. The Company expenses contract acquisition costs as incurred, to the extent that the amortization period would otherwise be one year or less.

For customers making electronic payments, collectability is probable at the time the order or contract is entered. A significant portion of the Company’s customers purchase products by making electronic payments with a credit card at the time of the transaction. Customer payments received in advance of revenue recognition are contract liabilities and are recorded as deferred revenue. Customers that do not pay in advance are invoiced and are required to make payments under standard credit terms. Collectability for customers who pay on credit terms allowing for payment beyond the date at which service commences, is based on a credit evaluation for certain new customers and transaction history with existing customers.

The Company recognizes revenue gross of contributor royalties because the Company is the principal in the transaction as it is the party responsible for the performance obligation and it controls the product or service before transferring it to the customer. The Company also licenses content to customers through third-party resellers. Third-party resellers sell the Company’s products directly to customers as the principal in those transactions. Accordingly, the Company recognizes revenue net of costs paid to resellers.

The Company also reports revenue net of return and chargeback allowances. These allowances are based off historical trends when available.

(2) Fair Value Measurements and Long-term Investments

Fair Value Measurements

The Company had no assets or liabilities requiring fair value hierarchy disclosures as of June 30, 2024 or December 31, 2023, except as noted below.

Other Fair Value Measurements

The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate fair value because of the short-term nature of these instruments. Debt consists of principal amounts outstanding under our credit facility, which approximates fair value as underlying interest rates are reset regularly based on current market rates and is classified as Level 2. The Company’s non-financial assets, which include long-lived assets, intangible assets and goodwill, are not required to be measured at fair value on a recurring basis. However, if the Company is required to evaluate a non-financial asset for impairment, whether due to certain triggering events or because annual impairment testing is required, a resulting asset impairment would require that the non-financial asset be recorded at fair value.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

Long-term Investments

Investment in Meitu, Inc. (“Meitu”)

In 2018, the Company invested $15.0 million in convertible preferred shares issued by ZCool Technologies Limited (“ZCool”) (the “Preferred Shares”). ZCool’s primary business is the operation of an e-commerce platform in the People’s Republic of China (the “PRC”) whereby customers can pay to license content contributed by creative professionals. ZCool and its affiliates have been the exclusive distributor of Shutterstock content in China since 2014. The Company used the measurement alternative and the investment in ZCool was reported at cost, adjusted for impairments or any observable price changes in ordinary transactions with identical or similar investments.

On March 27, 2024, ZCool was acquired by Meitu, and the Company’s Preferred Shares in ZCool were exchanged for $18.4 million of Meitu common shares, resulting in an investment carrying value increase of $3.4 million, which is recorded in Other (expense) / income, net in the Consolidated Statement of Operations. Meitu’s primary business is the provision of online advertising and other internet value added services in the PRC, and its common shares are publicly traded on the Main Board of The Stock Exchange of Hong Kong Limited. This investment is recorded at fair value on a recurring basis, with changes in fair value being recorded in Other (expense) / income, net in the Consolidated Statement of Operations. Its fair value level hierarchy and amount at June 30, 2024 are as follows:

| | | | | |

| As of June 30, 2024 |

| Hierarchy Level: | Fair Value |

| Level 1 | $ | 15,130 | |

Other Long-Term Investments

In connection with its Data, Distribution, and Services business, the Company may receive equity instruments in addition to cash for revenue contract consideration. As of June 30, 2024, the Company has $23.8 million recorded in Other Assets in the Consolidated Balance Sheet from equity instruments received. There were no customer equity instruments recorded at December 31, 2023. The Company estimated the value of these equity instruments based on issuers’ recent market transactions. The Company will use the measurement alternative for fair value since the equity instruments do not have a readily determinable fair value and will report the instruments at cost, adjusted for impairments or any observable price changes in ordinary transactions with identical or similar investments.

As of June 30, 2024 and December 31, 2023, the Company also had a long-term investment in an equity security with no readily determinable fair value totaling $5.0 million. The Company uses the measurement alternative for fair value and the investment’s carrying value is reported at cost, adjusted for impairments or any observable price changes in ordinary transactions with identical or similar investments.

(3) Acquisitions

Backgrid

On February 1, 2024, the Company completed its acquisition of all of the outstanding shares of Backgrid USA, Inc. and Backgrid London LTD, (collectively, “Backgrid”), for approximately $20 million, subject to customary working capital adjustments. The total purchase price was paid with existing cash on hand. In connection with the acquisition, the Company incurred approximately $1.5 million of transaction costs in total, which are included in general and administrative expenses on the Consolidated Statements of Operations.

Backgrid supplies media organizations with real-time celebrity content. The Company believes this acquisition expands Shutterstock Editorial’s Newsroom offering of editorial images and footage across celebrity, red carpet and live-events.

The identifiable intangible assets, trademark and developed technology, have useful lives of approximately 10 years and 5 years, respectively. The goodwill arising from the transaction is primarily attributable to expected operational synergies and is not deductible for income tax purposes.

The Backgrid transaction was accounted for using the acquisition method and, accordingly, the results of the acquired business have been included in the Company’s results of operations from the acquisition date. The fair value of consideration transferred in this business combination has been allocated to the intangible and tangible assets acquired and liabilities assumed at the acquisition date, with the remaining unallocated amount recorded as goodwill. The identifiable intangible assets of this

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

acquisition are being amortized on a straight-line basis. The fair value of the trademark and developed technology was determined using the excess earnings and relief-from-royalty methods.

The aggregate purchase price for this acquisition has been allocated to the assets acquired and liabilities assumed as follows (in thousands):

| | | | | |

| Assets acquired and liabilities assumed: | Backgrid |

| Cash and cash equivalents | $ | 1,718 | |

| Accounts receivable | 732 | |

| Other assets | 77 | |

| |

| Intangible assets: | |

| Trade name | 300 | |

| Developed technology | 900 | |

| Intangible assets | 1,200 | |

| Goodwill | 19,843 | |

| |

| Total assets acquired | $ | 23,570 | |

| |

| |

| Contributor royalties payable | (849) | |

| Accrued expenses | (1,302) | |

| Deferred tax liability | (271) | |

| |

| Total liabilities assumed | (2,422) | |

| Net assets acquired | $ | 21,148 | |

Giphy, Inc.

On May 22, 2023, the Company entered into a Stock Purchase Agreement with Meta Platforms, Inc. (“Meta”) dated May 22, 2023 (the “Purchase Agreement”). On June 23, 2023, the Company completed its acquisition of all of the outstanding shares of Giphy, Inc. (“Giphy”) from Meta. The consideration paid by the Company pursuant to the Purchase Agreement was $53 million in net cash, in addition to cash acquired, assumed debt and other working capital adjustments. The consideration was paid with existing cash on hand. Giphy is a New York-based company that operates a collection of GIFs and stickers that supplies casual conversational content. The Company believes its acquisition of Giphy extends Shutterstock’s audience touchpoints beyond primarily professional marketing and advertising use cases and expands into casual conversations.

In January 2023, the United Kingdom Competition and Markets Authority (the “CMA”) issued its final order requiring Meta to divest its ownership of Giphy, which Meta acquired in 2020. In connection with the closing of the acquisition, whose terms were preapproved by the CMA, the Company and Meta entered into a transitional services agreement (the “TSA”) pursuant to which Meta is responsible for certain costs related to retention of Giphy employees, including (i) recurring salary, bonus, and benefits through August 2024, which would be $35.6 million if all employees are retained through August 2024, and (ii) nonrecurring items, totaling $87.9 million, comprised of one-time employment inducement bonuses and the cash value of unvested Meta equity awards (collectively, the “Giphy Retention Compensation”) and certain costs related to technology and integration expenses, totaling $30 million to be paid in $1.25 million monthly installments through May 2025.

The Giphy Retention Compensation will be paid to the individuals for being employees of the Company subsequent to the completion of the acquisition. Accordingly, it was determined that the payments by the Company are for future service requirements and will be reflected as operating expenses, less any amounts earned by the employees prior to the acquisition, in the Company’s Statements of Operations as incurred. The Giphy Retention Compensation is reflected as a reduction of the purchase price and has been funded into an escrow account.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

The Giphy purchase price was calculated as follows:

| | | | | |

| Purchase Price |

| Purchase price | $ | 53,000 | |

| Cash acquired and other working capital adjustments | 4,750 | |

| Cash paid on closing | $ | 57,750 | |

| |

Fair value of Giphy Retention Compensation contingent consideration1 | (98,723) | |

Fair value of consideration attributable to pre-combination service2 | 34,972 | |

| |

| Net purchase price | $ | (6,001) | |

1 - This amount consists of $123.5 million of Giphy Retention Compensation, adjusted for $18.9 million of income tax obligations associated with the receipt of the Giphy Retention Compensation and $5.9 million for the time value of money.

2 - Relates to the cash value of replaced unvested Meta equity awards attributable to pre-combination services.

Upon closing of the acquisition, the Company also entered into an agreement with Meta whereby the Company will provide Meta with access to Giphy content that is displayed through an API for a period of two years. The Company determined that the API arrangement represents a transaction separate from the business combination and was priced below market. Therefore, the Company allocated $30 million of the purchase price to these services, which represents the step-up to fair market value. This amount has been recognized in deferred revenue and will be recognized as revenue over-time as the API is provided.

The identifiable intangible assets, which include developed technology and the trade name have weighted average useful lives of approximately 7 years and 15 years, respectively. The fair value of the developed technology was determined using the cost to recreate method, and the fair value of the trade name was determined using the relief-from-royalty method.

The Giphy transaction was accounted for using the acquisition method and, accordingly, the results of the acquired business have been included in the Company’s results of operations from the acquisition date. The fair value of consideration transferred in this business combination has been allocated to the intangible and tangible assets acquired and liabilities assumed at the acquisition date, with the excess of the fair value of the net assets acquired over the net consideration received recorded as a bargain purchase gain. The identifiable intangible assets of these acquisitions are being amortized on a straight-line basis.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

The aggregate purchase price for this acquisition has been allocated to the assets acquired and liabilities assumed as follows (in thousands):

| | | | | |

| Assets acquired and liabilities assumed: | Giphy |

| Cash and cash equivalents | $ | 4,030 | |

| |

| Prepaid expenses and other current assets | 1,416 | |

| |

| Right of use assets | 1,243 | |

| Intangible assets: | |

| |

| Trade name | 21,000 | |

Developed technology2 | 19,500 | |

| |

| Intangible assets | 40,500 | |

| |

Deferred tax asset1 | 1,463 | |

| Other assets | 1,647 | |

| Total assets acquired | $ | 50,299 | |

| |

| Accounts payable, accrued expenses and other liabilities | (4,949) | |

| |

| |

| |

| Lease liability | (1,090) | |

| Total liabilities assumed | (6,039) | |

| Net assets acquired | $ | 44,260 | |

| Net purchase price | (6,001) | |

| Bargain purchase gain | $ | 50,261 | |

1 - During the three months ended September 30, 2023, the Company revised its preliminary allocation of the Giphy purchase price to the assets acquired and liabilities assumed by $9.9 million associated with additional information analyzed related to the deferred income tax balances. The measurement and allocation of the purchase price is preliminary and will be finalized within the allowable measurement period once the Company finalizes its assessment of fair value of intangible assets, income tax balances and other assets acquired and liabilities assumed.

2 - During the three months ended December 31, 2023, the Company revised its preliminary allocation of the Giphy purchase price to the assets acquired and liabilities assumed by $1.6 million associated with additional information analyzed related to the valuation of the Developed Technology asset. The measurement and allocation of the purchase price is preliminary and will be finalized within the allowable measurement period once the Company finalizes its assessment of fair value of intangible assets, income tax balances and other assets acquired and liabilities assumed.

The Company recognized a non-taxable bargain purchase gain of $50.3 million, representing the excess of the fair value of the net assets acquired in addition to the net consideration to be received from Meta. The bargain purchase gain is the result of the CMA’s regulatory order requiring Meta’s divestiture of Giphy and the Giphy Retention Compensation payments. In connection with the acquisition, the Company incurred approximately $3.0 million of transaction costs, which are included in general and administrative expenses on the Consolidated Statements of Operations.

As of June 30, 2024, Shutterstock’s receivable of $43.7 million, is against an escrow fully funded by Meta. $31.5 million and $12.2 million are included within Prepaid expenses and other current assets and Other assets, respectively, on the Consolidated Balance Sheet.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

Pro-Forma Financial Information (unaudited)

The following unaudited pro forma consolidated financial information (in thousands) reflects the results of operations of the Company for the three and six months ended June 30, 2024 and 2023, respectively, as if the Backgrid acquisition had been completed on January 1, 2023, and as if the Giphy acquisition had been completed on January 1, 2022, after giving effect to certain purchase accounting adjustments, primarily related to Giphy Retention Compensation - non-recurring, intangible assets and transaction costs. These pro forma results have been prepared for comparative purposes only and are based on estimates and assumptions that have been made solely for purposes of developing such pro forma information and are not necessarily indicative of what the Company’s operating results would have been, had the acquisitions actually taken place at the beginning of the previous annual period. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

| As Reported | $ | 220,053 | | | $ | 208,840 | | | $ | 434,368 | | | $ | 424,120 | |

| Pro Forma | 220,053 | | | 217,626 | | | 435,312 | | | 441,692 | |

| Income before income taxes | | | | | | | |

| As Reported | $ | 16,560 | | | $ | 51,381 | | | $ | 36,950 | | | $ | 92,795 | |

| Pro Forma | 18,164 | | | 15,793 | | | 41,194 | | | 44,557 | |

(4) Property and Equipment

Property and equipment is summarized as follows (in thousands): | | | | | | | | | | | |

| | As of June 30, 2024 | | As of December 31, 2023 |

| Computer equipment and software | $ | 326,551 | | | $ | 308,473 | |

| Furniture and fixtures | 10,901 | | | 10,829 | |

| Leasehold improvements | 19,887 | | | 19,153 | |

| Property and equipment | 357,339 | | | 338,455 | |

| Less accumulated depreciation | (294,270) | | | (274,155) | |

| Property and equipment, net | $ | 63,069 | | | $ | 64,300 | |

Depreciation expense related to property and equipment was $10.4 million and $9.1 million for the three months ended June 30, 2024 and 2023, respectively, and $20.7 million and $18.2 million for the six months ended June 30, 2024 and 2023, respectively. Cost of revenues included depreciation expense of $10.0 million and $8.7 million for the three months ended June 30, 2024 and 2023, respectively, and $19.9 million and $17.3 million for the six months ended June 30, 2024 and 2023, respectively. General and administrative expense included depreciation expense of $0.4 million for the three months ended June 30, 2024 and 2023, and $0.8 million and $0.9 million for the six months ended June 30, 2024 and 2023, respectively.

Capitalized Internal-Use Software

The Company capitalized costs related to the development of internal-use software of $9.6 million and $11.3 million for the three months ended June 30, 2024 and 2023, respectively, and $18.6 million and $21.6 million for the six months ended June 30, 2024 and 2023, respectively. Capitalized amounts are included as a component of property and equipment under computer equipment and software on the Consolidated Balance Sheets.

The portion of total depreciation expense related to capitalized internal-use software was $9.8 million and $8.4 million for the three months ended June 30, 2024 and 2023, respectively, and $19.4 million and $16.8 million for the six months ended June 30, 2024 and 2023, respectively. Depreciation expense related to capitalized internal-use software is included in cost of revenue in the Consolidated Statements of Operations.

As of June 30, 2024 and December 31, 2023, the Company had capitalized internal-use software of $59.5 million and $60.3 million, respectively, net of accumulated depreciation, which was included in property and equipment, net.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

(5) Goodwill and Intangible Assets

Goodwill

The Company’s goodwill balance is attributable to its Content reporting unit and is tested for impairment annually on October 1 or upon a triggering event. No triggering events were identified during the six months ended June 30, 2024.

The following table summarizes the changes in the carrying value of the Company’s goodwill balance during the six months ended June 30, 2024 (in thousands): | | | | | | | | | |

| | Goodwill | | | | |

| Balance as of December 31, 2023 | $ | 383,325 | | | | | |

| Goodwill related to acquisitions | 19,843 | | | | | |

| Foreign currency translation adjustment | (394) | | | | | |

| | | | | |

| Balance as of June 30, 2024 | $ | 402,774 | | | | | |

Intangible Assets

Intangible assets, all of which are subject to amortization, consisted of the following as of June 30, 2024 and December 31, 2023 (in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 | | | | As of December 31, 2023 |

| | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Weighted

Average Life

(Years) | | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount |

| Amortizing intangible assets: | | | | | | | | | | | | | |

| Customer relationships | $ | 89,734 | | | $ | (30,471) | | | $ | 59,263 | | | 12 | | $ | 90,350 | | | $ | (26,982) | | | $ | 63,368 | |

| Trade name | 38,132 | | | (10,483) | | | 27,649 | | | 12 | | 37,937 | | | (9,272) | | | 28,665 | |

| Developed technology | 116,296 | | | (74,315) | | | 41,981 | | | 5 | | 115,914 | | | (61,376) | | | 54,538 | |

| Contributor content | 67,424 | | | (31,895) | | | 35,529 | | | 8 | | 65,628 | | | (27,897) | | | 37,731 | |

| | | | | | | | | | | | | |

| Patents | 259 | | | (173) | | | 86 | | | 18 | | 259 | | | (165) | | | 94 | |

| | | | | | | | | | | | | |

| Total | $ | 311,845 | | | $ | (147,337) | | | $ | 164,508 | | | | | $ | 310,088 | | | $ | (125,692) | | | $ | 184,396 | |

Amortization expense was $11.0 million and $10.1 million for the three months ended June 30, 2024 and 2023, respectively, and $22.0 million and $19.9 million for the six months ended June 30, 2024 and 2023, respectively. Cost of revenue included amortization expense of $10.0 million and $9.4 million for the three months ended June 30, 2024 and 2023, respectively, and $20.0 million and $18.6 million for the six months ended June 30, 2024 and 2023, respectively. General and administrative expense included amortization expense of $1.0 million and $0.7 million for the three months ended June 30, 2024 and 2023, respectively, and $2.0 million and $1.3 million for the six months ended June 30, 2024 and 2023, respectively.

The Company determined that there was no indication of impairment of the intangible assets for any period presented. Estimated amortization expense is: $16.1 million for the remaining six months of 2024, $27.6 million in 2025, $25.3 million in 2026, $19.1 million in 2027, $16.5 million in 2028, $15.4 million in 2029 and $44.5 million thereafter.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)

(6) Accrued Expenses

Accrued expenses consisted of the following (in thousands): | | | | | | | | | | | |

| As of June 30, 2024 | | As of December 31, 2023 |

| Compensation | $ | 45,782 | | | $ | 75,752 | |

| Non-income taxes | 23,329 | | | 23,702 | |

| | | |

| Website hosting and marketing fees | 8,612 | | | 11,804 | |

| | | |

| | | |

| | | |

| Other expenses | 19,187 | | | 20,185 | |

| Total accrued expenses | $ | 96,910 | | | $ | 131,443 | |

As of June 30, 2024 and December 31, 2023, compensation-related accrued expenses included amounts due to Giphy employees for compensation earned pre-acquisition and severance costs associated with workforce optimizations. Approximately $1.2 million and $7.7 million of severance costs associated with workforce optimization is included within accrued expenses as of June 30, 2024 and December 31, 2023, respectively.

(7) Debt

On May 6, 2022, the Company entered into a five-year $100 million unsecured revolving loan facility (the “Credit Facility”) with Bank of America, N.A., as Administrative Agent and other lenders. The Credit Facility includes a letter of credit sub-facility and a swingline facility and it also permits, subject to the satisfaction of certain conditions, up to $100 million of additional revolving loan commitments with the consent of the Administrative Agent.

At the Company’s option, revolving loans accrue interest at a per annum rate based on either (i) the base rate plus a margin ranging from 0.125% to 0.500%, determined based on the Company’s consolidated leverage ratio or (ii) the Term Secured Overnight Financing Rate (“SOFR”) (for interest periods of 1, 3 or 6 months) plus a margin ranging from 1.125% to 1.5%, determined based on the Company’s consolidated leverage ratio. The Company is also required to pay an unused commitment fee ranging from 0.150% to 0.225%, determined based on the Company’s consolidated leverage ratio. In connection with the execution of this agreement, the Company paid debt issuance costs of approximately $0.6 million.

As of June 30, 2024 and December 31, 2023, the Company had $30 million of outstanding borrowings under the Credit Facility. As of June 30, 2024, the Company had a remaining borrowing capacity of $68 million, net of standby letters of credit. For the three and six months ended June 30, 2024, the Company recognized interest expense of $0.6 million and $1.1 million, respectively.

The Credit Facility contains financial covenants and requirements restricting certain of the Company’s activities, which are usual and customary for this type of credit facility. The Company is also required to maintain compliance with a consolidated leverage ratio and a consolidated interest coverage ratio, in each case, determined in accordance with the terms of the Credit Facility. As of June 30, 2024, the Company was in compliance with these covenants.

(8) Stockholders’ Equity and Equity-Based Compensation

Stockholders’ Equity

Common Stock

The Company issued approximately 273,000 and 194,000 shares of common stock during the three months ended June 30, 2024 and 2023, respectively, related to the exercise of stock options and the vesting of Restricted Stock Units.

Treasury Stock

In June 2023, the Company’s Board of Directors approved a share repurchase program (the “2023 Share Repurchase Program”), providing authorization to repurchase up to $100 million of its common stock.

Shutterstock, Inc.

Notes to Consolidated Financial Statements

(unaudited)