Q10001949543--12-31falsehttp://fasb.org/us-gaap/2023#AssetsCurrenthttp://fasb.org/us-gaap/2023#AssetsCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrent0001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-01-012023-03-310001949543us-gaap:PerformanceSharesMember2024-03-310001949543str:GasNymexHenryHubRemainingTermFromJanuary2025ToJune2025Memberstr:OilAndGasTwoWayCommodityCollarContractsMember2024-03-310001949543str:RestrictedStockUnitsConvertedToBrighamMergerMember2024-03-310001949543srt:MinimumMemberus-gaap:PerformanceSharesMember2023-01-012023-03-310001949543us-gaap:NoncontrollingInterestMember2022-12-310001949543str:PerformanceStockUnitsConvertedToBrighamMergerMember2023-01-012023-03-310001949543us-gaap:NondesignatedMember2023-12-310001949543us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2024-03-310001949543str:OilAndGasTwoWayCommodityCollarContractsMember2024-01-012024-03-310001949543str:DeferredShareUnitsMember2024-01-012024-03-310001949543us-gaap:PerformanceSharesMember2023-12-310001949543us-gaap:RetainedEarningsMember2024-03-310001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001949543us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001949543us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001949543str:GasNymexHenryHubRemainingTermFromApril2024ToDecember2024Memberstr:OilAndGasTwoWayCommodityCollarContractsMember2024-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2024-01-012024-03-310001949543srt:CrudeOilMember2023-01-012023-03-310001949543us-gaap:AdditionalPaidInCapitalMember2023-03-310001949543us-gaap:RevolvingCreditFacilityMemberstr:BorrowingBaseMember2024-03-3100019495432023-06-300001949543str:SitioOpcoRestrictedStockAwardsMember2023-12-310001949543str:InterestRateDerivativesMember2024-01-012024-03-310001949543us-gaap:CommonClassAMemberstr:ShareRepurchaseProgramMember2024-02-282024-02-280001949543str:CreditAgreementMember2023-02-030001949543str:TwoThousandTwentyEightSeniorNotesMember2023-10-032023-10-030001949543str:CommodityDerivativeLiabilitiesMember2024-03-310001949543us-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001949543str:DeferredShareUnitsMember2024-03-3100019495432022-12-310001949543us-gaap:CommodityContractMember2023-01-012023-03-310001949543us-gaap:NoncontrollingInterestMember2023-12-310001949543str:UnvestedShareBasedCompensationAwardsMember2023-01-012023-03-310001949543str:TargetMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2024-03-310001949543str:OilAndGasSwapContractsMemberstr:OilNymexWtiRemainingTermFromApril2024ToDecember2024Member2024-03-310001949543us-gaap:RetainedEarningsMember2024-01-012024-03-310001949543us-gaap:InterestRateContractMember2023-01-012023-03-310001949543str:DeferredShareUnitsMember2023-01-012023-03-310001949543str:ThresholdMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2023-12-310001949543srt:CrudeOilMember2024-01-012024-03-310001949543str:CommodityDerivativeAssetsMember2023-12-310001949543us-gaap:RetainedEarningsMember2023-01-012023-03-310001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001949543us-gaap:WarrantMember2024-01-012024-03-3100019495432024-01-012024-03-310001949543us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001949543us-gaap:AdditionalPaidInCapitalMember2022-12-310001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-12-310001949543us-gaap:CommonClassCMember2024-05-030001949543us-gaap:RevolvingCreditFacilityMember2023-01-012023-03-310001949543str:PerformanceStockUnitsConvertedToBrighamMergerMember2023-12-310001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310001949543us-gaap:RestrictedStockUnitsRSUMember2024-03-310001949543srt:MaximumMemberus-gaap:PerformanceSharesMember2023-01-012023-03-310001949543str:GasNymexHenryHubRemainingTermFromApril2024ToDecember2024Memberstr:OilAndGasSwapContractsMember2024-03-310001949543str:DeferredShareUnitsMember2023-12-310001949543str:TwoThousandTwentySixSeniorNotesMember2024-01-012024-03-3100019495432022-09-300001949543str:AppalachianAndAnadarkoBasinsDivestitureMember2023-12-012023-12-310001949543str:OilAndGasSwapContractsMemberstr:OilNymexWtiRemainingTermFromJanuary2025ToJune2025Member2024-03-310001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001949543srt:NaturalGasPerThousandCubicFeetMember2024-01-012024-03-310001949543us-gaap:CommonClassCMember2023-12-310001949543us-gaap:NoncontrollingInterestMember2023-03-3100019495432024-02-282024-02-280001949543us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001949543us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2024-01-012024-03-310001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2024-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2023-01-012023-03-310001949543us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2023-01-012023-03-3100019495432022-06-300001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310001949543us-gaap:AdditionalPaidInCapitalMember2023-12-3100019495432024-02-280001949543str:RestrictedStockUnitsConvertedToBrighamMergerMember2024-01-012024-03-310001949543us-gaap:RevolvingCreditFacilityMember2023-12-3100019495432023-01-012023-03-310001949543us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100019495432023-09-300001949543us-gaap:CommonClassAMember2023-01-012023-03-310001949543us-gaap:CommonClassCMember2024-03-310001949543us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2024-03-310001949543us-gaap:CommodityContractMember2024-01-012024-03-310001949543us-gaap:NoncontrollingInterestMember2024-03-310001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-12-310001949543us-gaap:PerformanceSharesMember2024-01-012024-03-310001949543us-gaap:AdditionalPaidInCapitalMember2024-03-310001949543us-gaap:CommonClassAMember2024-05-030001949543str:SitioOpcoRestrictedStockAwardsMember2023-01-012023-03-310001949543str:PerformanceStockUnitsConvertedToBrighamMergerMember2024-03-3100019495432023-03-310001949543str:CommodityDerivativeAssetsMember2024-03-310001949543str:SitioOpcoMember2024-03-310001949543str:SitioOpcoRestrictedStockAwardsMember2024-03-310001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-01-012024-03-3100019495432022-04-012022-06-300001949543str:OilNymexWtiRemainingTermFromJanuary2025ToJune2025Memberstr:OilAndGasTwoWayCommodityCollarContractsMember2024-03-310001949543srt:NaturalGasPerThousandCubicFeetMember2023-01-012023-03-310001949543srt:CrudeOilAndNGLPerBarrelMember2023-01-012023-03-3100019495432023-12-310001949543us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2023-12-310001949543us-gaap:CommonClassAMember2024-01-012024-03-310001949543us-gaap:RevolvingCreditFacilityMember2024-03-310001949543us-gaap:CommonClassAMemberstr:ShareRepurchaseProgramMember2024-01-012024-03-310001949543str:TwoThousandTwentyEightSeniorNotesMember2023-01-012023-12-310001949543str:UnvestedShareBasedCompensationAwardsMember2024-01-012024-03-310001949543srt:CrudeOilAndNGLPerBarrelMember2024-01-012024-03-3100019495432023-07-012023-09-300001949543srt:SubsidiariesMember2024-03-3100019495432024-03-310001949543srt:MaximumMemberus-gaap:CommonClassAMember2024-02-280001949543us-gaap:RetainedEarningsMember2023-12-310001949543srt:MaximumMemberstr:BaseOfRangeMemberus-gaap:PerformanceSharesMember2024-01-012024-03-3100019495432023-10-012023-12-310001949543str:RestrictedStockUnitsConvertedToBrighamMergerMember2023-01-012023-03-310001949543str:RestrictedStockUnitsConvertedToBrighamMergerMember2023-12-310001949543us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-03-310001949543us-gaap:CommonClassCMemberus-gaap:TreasuryStockCommonMember2024-03-310001949543str:SharesOfClassCCommonStockIfConvertedMember2023-01-012023-03-3100019495432022-10-012022-12-310001949543str:SharesOfClassCCommonStockIfConvertedMember2024-01-012024-03-310001949543str:PerformanceStockUnitsConvertedToBrighamMergerMember2024-01-012024-03-310001949543str:TwoThousandTwentySixSeniorNotesMember2023-01-012023-03-310001949543us-gaap:CommonClassAMember2024-03-310001949543us-gaap:NondesignatedMember2024-03-310001949543str:SitioOpcoRestrictedStockAwardsMember2024-01-012024-03-310001949543us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001949543str:OilAndGasSwapContractsMember2024-01-012024-03-3100019495432022-07-012022-09-300001949543us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2024-05-080001949543us-gaap:WarrantMember2023-01-012023-03-310001949543str:CommodityDerivativeLiabilitiesMember2023-12-310001949543srt:MaximumMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001949543us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001949543str:BaseOfRangeMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001949543us-gaap:PerformanceSharesMember2023-01-012023-03-310001949543us-gaap:CommonClassAMember2023-12-3100019495432023-04-012023-06-300001949543us-gaap:RetainedEarningsMember2023-03-310001949543us-gaap:RestrictedStockUnitsRSUMember2023-12-310001949543us-gaap:CommonClassCMemberus-gaap:TreasuryStockCommonMember2023-12-310001949543us-gaap:RetainedEarningsMember2022-12-310001949543us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2022-12-31xbrli:pureiso4217:USDutr:bblutr:bblxbrli:sharesutr:MMBTUiso4217:USDutr:MMBTUiso4217:USD

ROC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-41585

Sitio Royalties Corp.

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware |

88-4140242 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

1401 Lawrence Street, Suite 1750 Denver, CO |

80202 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (720) 640-7620

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

STR |

|

New York Stock Exchange |

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 3, 2024, there were 80,616,480 shares of the registrant’s Class A Common Stock, par value $0.0001 per share, outstanding and there were 73,906,228 shares of the registrant’s Class C Common Stock, par value $0.0001 per share, outstanding.

Table of Contents

GLOSSARY

The following are abbreviations and definitions of certain terms used in this document, which are commonly used in the oil and natural gas industry:

Barrel or Bbl. Stock tank barrel, or 42 U.S. gallons liquid volume, used in this quarterly report in reference to crude oil or other liquid hydrocarbons.

Basin. A large natural depression on the earth’s surface in which sediments generally brought by water accumulate.

BOE. One barrel of oil equivalent, calculated by converting natural gas to oil equivalent barrels at a ratio of six Mcf of natural gas to one Bbl of crude oil. This is an energy content correlation and does not reflect a value or price relationship between the commodities.

BOE/d. BOE per day.

British thermal unit or Btu. The quantity of heat required to raise the temperature of one pound of water by one degree Fahrenheit.

Completion. The process of treating a drilled well followed by the installation of permanent equipment for the production of natural gas or oil, or in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Crude oil. Liquid hydrocarbons retrieved from geological structures underground to be refined into fuel sources.

Development costs. Costs incurred to obtain access to proved reserves and to provide facilities for extracting, treating, gathering and storing crude oil, natural gas and NGLs. For a complete definition of development costs, refer to the SEC’s Regulation S-X, Rule 4-10(a)(7).

Development project. The means by which petroleum resources are brought to the status of economically producible. As examples, the development of a single reservoir or field, an incremental development in a producing field or the integrated development of a group of several fields and associated facilities with a common ownership may constitute a development project.

Differential. An adjustment to the price of crude oil, natural gas or natural gas liquids from an established spot market price to reflect differences in the quality and/or location of crude oil or natural gas.

Dry hole. A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

E&P. Exploration and production.

Economically producible. The term economically producible, as it relates to a resource, means a resource that generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation. For a complete definition of economically producible, refer to the SEC’s Regulation S-X, Rule 4-10(a)(10).

Field. An area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations. For a complete definition of field, refer to the SEC’s Regulation S-X, Rule 4-10(a)(15).

Formation. A layer of rock that has distinct characteristics that differs from nearby rock.

GAAP. Generally accepted accounting principles in the United States.

Gross wells. The number of wells, normalized to a 5,000 foot lateral length basis, where we have ownership in a mineral or royalty interest.

Horizontal drilling. A drilling technique used in certain formations where a well is drilled vertically to a certain depth and then drilled at a right angle within a specified interval.

Horizontal wells. The number of horizontal wells, normalized to a 5,000 foot lateral length basis, where we have ownership in a mineral or royalty interest.

MBbl. Thousand barrels of crude oil or other liquid hydrocarbons.

MBOE. One thousand BOE.

Mcf. One thousand cubic feet of natural gas.

Mcf/d. Mcf per day.

MMBtu. One million British thermal units.

MMcf. One million cubic feet of natural gas.

Natural gas liquids or NGLs. Hydrocarbons found in natural gas that may be extracted as liquefied petroleum gas and natural gasoline.

Net royalty acres or NRAs. Mineral ownership standardized to a 12.5%, or 1/8th, royalty interest.

Operator. The individual or company responsible for the development and/or production of a crude oil or natural gas well or lease.

Play. A geographic area with hydrocarbon potential.

Proved reserves. Those quantities of crude oil, natural gas and NGLs that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the E&P operator must be reasonably certain that it will commence the project within a reasonable time. For a complete definition of proved crude oil and natural gas reserves, refer to the SEC’s Regulation S-X, Rule 4-10(a)(22).

Realized price. The cash market price less all expected quality, transportation and demand adjustments.

Reasonable certainty. A high degree of confidence that quantities will be recovered. For a complete definition of reasonable certainty, refer to the SEC’s Regulation S-X, Rule 4-10(a)(24).

Reserves. Estimated remaining quantities of crude oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering crude oil and natural gas or related substances to market and all permits and financing required to implement the project. Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations).

Reservoir. A porous and permeable underground formation containing a natural accumulation of producible crude oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

Resources. Quantities of crude oil, natural gas and NGLs estimated to exist in naturally occurring accumulations. A portion of the resources may be estimated to be recoverable and another portion may be considered to be unrecoverable. Resources include both discovered and undiscovered accumulations.

Royalty. An interest in a crude oil and natural gas lease that gives the owner the right to receive a portion of the production from the leased acreage (or of the proceeds from the sale thereof), but does not require the owner to pay any portion of the production or development costs on the leased acreage. Royalties may be either landowner’s royalties, which are reserved by the owner of the leased acreage at the time the lease is granted, or overriding royalties, which are usually reserved by an owner of the leasehold in connection with a transfer to a subsequent owner.

SEC. U.S. Securities and Exchange Commission.

SOFR or Term SOFR rate. A borrowing rate equal to the secured overnight financing rate as administered by the Federal Reserve Bank of New York.

Spot market price. The cash market price without reduction for expected quality, transportation and demand adjustments.

Standardized measure. Discounted future net cash flows estimated by applying year end prices to the estimated future production of year-end proved reserves. Future cash inflows are reduced by estimated future production and development costs based on period-end costs to determine pre-tax cash inflows. Future income taxes, if applicable, are computed by applying the statutory tax rate to the excess

of pre-tax cash inflows over our tax basis in the crude oil, natural gas and NGLs properties. Future net cash inflows after income taxes are discounted using a 10% annual discount rate.

Working interest. The right granted to the lessee of a property to develop, produce and own crude oil, natural gas, NGLs or other minerals. The working interest owners bear the exploration, development and operating expenses on either a cash, penalty or carried basis.

WTI. West Texas Intermediate, a grade of crude oil used as a benchmark in oil pricing.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Sitio Royalties Corp.

Condensed Consolidated Balance Sheets

(In thousands, except par and share amounts)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

. |

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,746 |

|

|

$ |

15,195 |

|

Accrued revenue and accounts receivable |

|

|

113,575 |

|

|

|

107,347 |

|

Prepaid assets |

|

|

5,549 |

|

|

|

12,362 |

|

Derivative asset |

|

|

8,080 |

|

|

|

19,080 |

|

Total current assets |

|

|

138,950 |

|

|

|

153,984 |

|

|

|

|

|

|

|

|

Property and equipment |

|

|

|

|

|

|

Oil and natural gas properties, successful efforts method: |

|

|

|

|

|

|

Unproved properties |

|

|

2,622,570 |

|

|

|

2,698,991 |

|

Proved properties |

|

|

2,451,708 |

|

|

|

2,377,196 |

|

Other property and equipment |

|

|

3,791 |

|

|

|

3,711 |

|

Accumulated depreciation, depletion, amortization, and impairment |

|

|

(574,849 |

) |

|

|

(498,531 |

) |

Total property and equipment, net |

|

|

4,503,220 |

|

|

|

4,581,367 |

|

|

|

|

|

|

|

|

Long-term assets |

|

|

|

|

|

|

Deposits for property acquisitions |

|

|

15,000 |

|

|

|

— |

|

Long-term derivative asset |

|

|

797 |

|

|

|

3,440 |

|

Deferred financing costs |

|

|

10,419 |

|

|

|

11,205 |

|

Operating lease right-of-use asset |

|

|

5,655 |

|

|

|

5,970 |

|

Other long-term assets |

|

|

2,807 |

|

|

|

2,835 |

|

Total long-term assets |

|

|

34,678 |

|

|

|

23,450 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

4,676,848 |

|

|

$ |

4,758,801 |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

39,499 |

|

|

$ |

30,050 |

|

Operating lease liability |

|

|

1,721 |

|

|

|

1,725 |

|

Total current liabilities |

|

|

41,220 |

|

|

|

31,775 |

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

|

|

|

|

Long-term debt |

|

|

848,833 |

|

|

|

865,338 |

|

Deferred tax liability |

|

|

255,705 |

|

|

|

259,870 |

|

Non-current operating lease liability |

|

|

5,090 |

|

|

|

5,394 |

|

Other long-term liabilities |

|

|

1,150 |

|

|

|

1,150 |

|

Total long-term liabilities |

|

|

1,110,778 |

|

|

|

1,131,752 |

|

|

|

|

|

|

|

|

Total liabilities |

|

|

1,151,998 |

|

|

|

1,163,527 |

|

|

|

|

|

|

|

|

Commitments and contingencies (see Note 14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Class A Common Stock, par value $0.0001 per share; 240,000,000 shares authorized; 82,636,109 and 82,451,397 shares issued and 82,090,582 and 82,451,397 outstanding at March 31, 2024 and December 31, 2023, respectively |

|

|

8 |

|

|

|

8 |

|

Class C Common Stock, par value $0.0001 per share; 120,000,000 shares authorized; 74,829,822 and 74,965,217 shares issued and 74,803,685 and 74,939,080 outstanding at March 31, 2024 and December 31, 2023, respectively |

|

|

8 |

|

|

|

8 |

|

Additional paid-in capital |

|

|

1,760,949 |

|

|

|

1,796,147 |

|

Accumulated deficit |

|

|

(179,270 |

) |

|

|

(187,738 |

) |

Class A Treasury Shares, 545,527 and 0 shares at March 31, 2024 and December 31, 2023, respectively |

|

|

(13,057 |

) |

|

|

— |

|

Class C Treasury Shares, 26,137 and 26,137 shares at March 31, 2024 and December 31, 2023, respectively |

|

|

(677 |

) |

|

|

(677 |

) |

Noncontrolling interest |

|

|

1,956,889 |

|

|

|

1,987,526 |

|

Total equity |

|

|

3,524,850 |

|

|

|

3,595,274 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

4,676,848 |

|

|

$ |

4,758,801 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Sitio Royalties Corp.

Condensed Consolidated Statements of Income

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

Oil, natural gas and natural gas liquids revenues |

|

$ |

147,971 |

|

|

$ |

145,554 |

|

Lease bonus and other income |

|

|

3,420 |

|

|

|

5,272 |

|

Total revenues |

|

|

151,391 |

|

|

|

150,826 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

76,318 |

|

|

|

67,763 |

|

General and administrative |

|

|

13,011 |

|

|

|

11,676 |

|

Severance and ad valorem taxes |

|

|

12,026 |

|

|

|

10,459 |

|

Total operating expenses |

|

|

101,355 |

|

|

|

89,898 |

|

|

|

|

|

|

|

|

Net income from operations |

|

|

50,036 |

|

|

|

60,928 |

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

Interest expense, net |

|

|

(18,510 |

) |

|

|

(22,203 |

) |

Change in fair value of warrant liability |

|

|

— |

|

|

|

2,358 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

(783 |

) |

Commodity derivatives gains (losses) |

|

|

(10,050 |

) |

|

|

14,763 |

|

Interest rate derivatives losses |

|

|

— |

|

|

|

(160 |

) |

Net income before taxes |

|

|

21,476 |

|

|

|

54,903 |

|

|

|

|

|

|

|

|

Income tax expense |

|

|

(2,784 |

) |

|

|

(7,184 |

) |

|

|

|

|

|

|

|

Net income |

|

|

18,692 |

|

|

|

47,719 |

|

Net income attributable to noncontrolling interest |

|

|

(10,224 |

) |

|

|

(25,066 |

) |

Net income attributable to Class A stockholders |

|

$ |

8,468 |

|

|

$ |

22,653 |

|

|

|

|

|

|

|

|

Net income per Class A common share |

|

|

|

|

|

|

Basic |

|

$ |

0.10 |

|

|

$ |

0.28 |

|

Diluted |

|

$ |

0.10 |

|

|

$ |

0.28 |

|

|

|

|

|

|

|

|

Weighted average Class A common shares outstanding |

|

|

|

|

|

|

Basic |

|

|

82,404 |

|

|

|

80,178 |

|

Diluted |

|

|

82,404 |

|

|

|

80,178 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Sitio Royalties Corp.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

18,692 |

|

|

$ |

47,719 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

76,318 |

|

|

|

67,763 |

|

Amortization of deferred financing costs and long-term debt discount |

|

|

1,294 |

|

|

|

1,345 |

|

Share-based compensation |

|

|

5,104 |

|

|

|

4,684 |

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

(2,358 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

783 |

|

Commodity derivative (gains) losses |

|

|

10,050 |

|

|

|

(14,763 |

) |

Net cash received for commodity derivative settlements |

|

|

3,593 |

|

|

|

5,932 |

|

Interest rate derivative losses |

|

|

— |

|

|

|

160 |

|

Net cash paid for interest rate derivative settlements |

|

|

— |

|

|

|

(39 |

) |

Deferred tax (benefit) expense |

|

|

(4,238 |

) |

|

|

2,751 |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

Accrued revenue and accounts receivable |

|

|

(6,228 |

) |

|

|

14,951 |

|

Prepaid assets |

|

|

6,813 |

|

|

|

(772 |

) |

Other long-term assets |

|

|

343 |

|

|

|

321 |

|

Accounts payable and accrued expenses |

|

|

9,295 |

|

|

|

598 |

|

Operating lease liabilities and other long-term liabilities |

|

|

(296 |

) |

|

|

(250 |

) |

Net cash provided by operating activities |

|

|

120,740 |

|

|

|

128,825 |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of oil and gas properties, net of post-close adjustments |

|

|

1,909 |

|

|

|

1,180 |

|

Deposits for property acquisitions |

|

|

(15,000 |

) |

|

|

— |

|

Other, net |

|

|

(167 |

) |

|

|

(19 |

) |

Net cash provided by (used in) investing activities |

|

|

(13,258 |

) |

|

|

1,161 |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings on credit facilities |

|

|

59,000 |

|

|

|

323,000 |

|

Repayments on credit facilities |

|

|

(76,000 |

) |

|

|

(346,000 |

) |

Repayments on 2026 Senior Notes |

|

|

— |

|

|

|

(11,250 |

) |

Debt issuance costs |

|

|

(48 |

) |

|

|

(7,015 |

) |

Distributions to noncontrolling interest |

|

|

(38,157 |

) |

|

|

(49,206 |

) |

Dividends paid to Class A stockholders |

|

|

(41,950 |

) |

|

|

(48,107 |

) |

Dividend equivalent rights paid |

|

|

(362 |

) |

|

|

(25 |

) |

Repurchases of Class A Common Stock |

|

|

(12,668 |

) |

|

|

— |

|

Cash paid for taxes related to net settlement of share-based compensation awards |

|

|

(746 |

) |

|

|

(44 |

) |

Net cash used in financing activities |

|

|

(110,931 |

) |

|

|

(138,647 |

) |

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

(3,449 |

) |

|

|

(8,661 |

) |

Cash and cash equivalents, beginning of period |

|

|

15,195 |

|

|

|

18,818 |

|

Cash and cash equivalents, end of period |

|

$ |

11,746 |

|

|

$ |

10,157 |

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash transactions: |

|

|

|

|

|

|

Decrease in current liabilities for additions to property and equipment: |

|

$ |

(87 |

) |

|

$ |

(5 |

) |

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for income taxes: |

|

$ |

11 |

|

|

$ |

550 |

|

Cash paid for interest expense: |

|

|

5,180 |

|

|

|

19,515 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Sitio Royalties Corp.

Condensed Consolidated Statements of Equity

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

Class A |

|

|

Class C |

|

|

Additional |

|

|

|

|

|

Class A |

|

|

Class C |

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Common Stock |

|

|

Paid-in |

|

|

Accumulated |

|

|

Treasury Shares |

|

|

Treasury Shares |

|

|

Noncontrolling |

|

|

Total |

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Interest |

|

|

Equity |

|

Balance at January 1, 2023 |

|

|

80,805 |

|

|

$ |

8 |

|

|

|

74,347 |

|

|

$ |

7 |

|

|

$ |

1,750,640 |

|

|

$ |

(9,203 |

) |

|

|

(633 |

) |

|

$ |

(19,085 |

) |

|

|

— |

|

|

$ |

— |

|

|

$ |

2,164,228 |

|

|

$ |

3,886,595 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22,653 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25,066 |

|

|

|

47,719 |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,129 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

555 |

|

|

|

4,684 |

|

Conversion of Class C Common Stock to Class A Common Stock |

|

|

6 |

|

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

|

183 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(183 |

) |

|

|

— |

|

Issuance of Class A Common Stock upon vesting of share-based awards, net of shares withheld for income taxes |

|

|

6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(44 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(44 |

) |

Change in deferred taxes from conversion of Class C Common Stock to Class A Common Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

36 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

36 |

|

Dividends to Class A stockholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(48,107 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(48,107 |

) |

Dividend equivalent rights |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(400 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(400 |

) |

Distributions to noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(49,206 |

) |

|

|

(49,206 |

) |

Cancellation of Treasury Shares |

|

|

(633 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,085 |

) |

|

|

— |

|

|

|

633 |

|

|

|

19,085 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Balance at March 31, 2023 |

|

|

80,184 |

|

|

$ |

8 |

|

|

|

74,341 |

|

|

$ |

7 |

|

|

$ |

1,735,859 |

|

|

$ |

(35,057 |

) |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

$ |

2,140,460 |

|

|

$ |

3,841,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2024 |

|

|

82,451 |

|

|

$ |

8 |

|

|

|

74,965 |

|

|

$ |

8 |

|

|

$ |

1,796,147 |

|

|

$ |

(187,738 |

) |

|

|

— |

|

|

$ |

— |

|

|

|

(26 |

) |

|

$ |

(677 |

) |

|

$ |

1,987,526 |

|

|

$ |

3,595,274 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,468 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,224 |

|

|

|

18,692 |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,543 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

561 |

|

|

|

5,104 |

|

Conversion of Class C Common Stock to Class A Common Stock |

|

|

135 |

|

|

|

— |

|

|

|

(135 |

) |

|

|

— |

|

|

|

3,265 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,265 |

) |

|

|

— |

|

Issuance of Class A Common Stock upon vesting of share-based awards, net of shares withheld for income taxes |

|

|

50 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(607 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(607 |

) |

Change in deferred taxes from conversion of Class C Common Stock to Class A Common Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(73 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(73 |

) |

Dividends to Class A stockholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(41,950 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(41,950 |

) |

Dividend equivalent rights |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(376 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(376 |

) |

Distributions to noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(38,157 |

) |

|

|

(38,157 |

) |

Repurchases of Class A Common Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(546 |

) |

|

|

(13,057 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,057 |

) |

Balance at March 31, 2024 |

|

|

82,636 |

|

|

$ |

8 |

|

|

|

74,830 |

|

|

$ |

8 |

|

|

$ |

1,760,949 |

|

|

$ |

(179,270 |

) |

|

|

(546 |

) |

|

$ |

(13,057 |

) |

|

|

(26 |

) |

|

$ |

(677 |

) |

|

$ |

1,956,889 |

|

|

$ |

3,524,850 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Sitio Royalties Corp.

Notes to Unaudited Condensed Consolidated Financial Statements

1. Basis of Presentation

The unaudited condensed consolidated financial statements of Sitio Royalties Corp., together with its wholly-owned subsidiaries and any entities in which the company owns a controlling interest (collectively, “Sitio” or the “Company”), including Sitio Royalties Operating Partnership, LP (“Sitio OpCo”), have been prepared pursuant to the rules and regulations of the SEC applicable to interim financial information. Accordingly, such consolidated financial statements reflect all adjustments (consisting of normal and recurring accruals) which are, in the opinion of management, necessary for a fair presentation of the financial results for the interim periods presented. Certain information and notes normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. However, management believes that the disclosures included either on the face of the financial statements or in these notes are sufficient to make the interim information presented not misleading. The accompanying unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the financial statements and notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “Annual Report”).

The preparation of unaudited condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 2024.

Except as otherwise indicated or required by the context, all references in this quarterly report to the “Company,” “Sitio,” “we,” “us,” “our” or similar terms refer to (i) for periods prior to the closing of the Company’s merger with Falcon Minerals Corporation in June 2022 (the “Falcon Merger”), the Company’s predecessor and its subsidiaries and (ii) for periods subsequent to the closing of the Falcon Merger, Sitio Royalties Corp. and its subsidiaries. All references in this Quarterly Report on Form 10-Q to “Falcon” refer to Sitio Royalties Corp. and its subsidiaries for periods prior to the Falcon Merger.

2. Summary of Significant Accounting Policies

Significant accounting policies are disclosed in the Company’s consolidated financial statements and notes thereto for the year ended December 31, 2023, presented in the Annual Report. There have been no material changes in such policies or the application of such policies during the three months ended March 31, 2024.

Accounts Payable and Accrued Expenses

The Company’s accounts payable and accrued expenses consisted of the following as of the dates indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Interest expense |

|

$ |

24,209 |

|

|

$ |

12,178 |

|

Ad valorem taxes payable |

|

|

3,616 |

|

|

|

10,364 |

|

Payable to buyer for post-effective monies |

|

|

3,500 |

|

|

|

1,427 |

|

General and administrative |

|

|

3,345 |

|

|

|

1,889 |

|

Payable to sellers for pre-effective monies |

|

|

2,358 |

|

|

|

2,268 |

|

Other taxes payable |

|

|

2,140 |

|

|

|

1,592 |

|

Other |

|

|

331 |

|

|

|

332 |

|

Total accounts payable and accrued expenses |

|

$ |

39,499 |

|

|

$ |

30,050 |

|

3. Revenue from Contracts with Customers

Oil, natural gas, and natural gas liquids revenues

Oil, natural gas and NGL sales revenues are generally recognized when control of the product is transferred to the customer, the performance obligations under the terms of the contracts with customers are satisfied and collectability is reasonably assured. All of the Company’s oil, natural gas and NGL sales are made under contracts with customers (operators). The performance obligations for the Company’s contracts with operators are satisfied at a point in time when control transfers to the operator at the wellhead, at which point payment is unconditional. Accordingly, the Company’s contracts do not give rise to contract assets or liabilities. The Company typically receives payment for oil, natural gas and NGL sales within 30 to 90 days of the month of delivery after initial production from the well. Such periods can extend longer due to factors outside of our control. The Company’s leasing contracts with operators are standard

industry agreements that include variable consideration based on the monthly index price and adjustments that may include counterparty-specific provisions related to volumes, price differentials, discounts and other adjustments and deductions, including charges for gathering and transportation.

During the three months ended March 31, 2024 and 2023, the disaggregated revenues from sales of oil, natural gas and NGLs were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months

Ended March 31, |

|

|

2024 |

|

|

2023 |

|

|

Crude oil sales |

|

$ |

127,293 |

|

|

$ |

117,745 |

|

|

Natural gas sales |

|

|

5,787 |

|

|

|

14,654 |

|

|

NGL sales |

|

|

14,891 |

|

|

|

13,155 |

|

|

Total royalty revenues |

|

$ |

147,971 |

|

|

$ |

145,554 |

|

|

Lease bonus and other income

The Company also earns revenue from lease bonuses, delay rentals, and right-of-way payments. The Company generates lease bonus revenue by leasing its mineral interests to E&P companies. A mineral lease agreement represents our contract with an operator and generally transfers the rights, for a specified period of time, to explore for and develop any oil, natural gas and NGL discovered, grants us a specified royalty interest in the hydrocarbons produced from the leased property, and requires that drilling and completion operations commence within a specified time period. The Company recognizes lease bonus revenues when the lease agreement has been executed and payment is determined to be collectible. At the time the Company executes the lease agreement, the lease bonus payment is delivered to the Company. Upon receipt of the lease bonus payment, the Company will release the recordable original lease documents to the operator. The Company also recognizes revenue from delay rentals to the extent drilling has not started within the specified period and payment has been received. Right-of-way payments are recorded when the agreement has been executed and payment is determined to be collectable. Payments for lease bonus and other income become unconditional upon the execution of an associated agreement. Accordingly, the Company’s lease bonus and other income transactions do not give rise to contract assets or liabilities.

Allocation of transaction price to remaining performance obligations

Oil and natural gas sales

The Company’s right to royalty income does not originate until production occurs and, therefore, is not considered to exist beyond each day’s production. Therefore, there are no remaining performance obligations under any of our royalty income contracts.

Lease bonus and other income

Given that the Company does not recognize lease bonus or other income until an agreement has been executed, at which point its performance obligation has been satisfied, the Company does not record revenue for unsatisfied or partially unsatisfied performance obligations as of the end of the reporting period.

Prior-period performance obligations

The Company records revenue in the month production is delivered to the customer. As a royalty interest owner, the Company has limited visibility into the timing of when new wells start producing as production statements may not be received for 30 to 90 days or more after the date production is delivered. As a result, the Company is required to estimate the amount of production delivered to the customer and the price that will be received for the sale of the product. The expected sales volumes and prices for these properties are estimated and recorded within accrued revenue and accounts receivable in the accompanying consolidated balance sheets. The difference between the Company’s estimates of royalty income and the actual amounts received for oil and natural gas sales are recorded in the month that the royalty payment is received from the operator. For the three months ended March 31, 2024 and 2023, revenue recognized related to performance obligations satisfied in prior reporting periods was primarily attributable to production revisions by operators or amounts for which the information was not available at the time when revenue was estimated.

4. Oil and Natural Gas Properties

The Company owns mineral rights across multiple onshore basins in the United States. These basins include the Permian Basin in West Texas and Southeast New Mexico, the Eagle Ford in South Texas, the DJ Basin in Colorado and Wyoming, and the Williston Basin in North Dakota and Montana. The following is a summary of oil and natural gas properties as of March 31, 2024 and December 31, 2023 (in thousands):

|

|

|

|

|

|

|

|

|

Oil and natural gas properties: |

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Unproved properties |

|

$ |

2,622,570 |

|

|

$ |

2,698,991 |

|

Proved properties |

|

|

2,451,708 |

|

|

|

2,377,196 |

|

Oil and natural gas properties, gross |

|

|

5,074,278 |

|

|

|

5,076,187 |

|

Accumulated depletion and impairment |

|

|

(573,056 |

) |

|

|

(496,879 |

) |

Oil and natural gas properties, net |

|

$ |

4,501,222 |

|

|

$ |

4,579,308 |

|

As presented in the unaudited condensed consolidated statements of cash flows for the three months ended March 31, 2024 and 2023, the Company received proceeds of $1.9 million and $1.2 million related to purchase price adjustments from prior acquisitions, net of acquisition costs.

The Company uses the successful efforts method of accounting for its oil and natural gas properties. Capitalized costs are depleted on a unit of production basis based on proved oil and natural gas reserves. Depletion expense was $76.2 million and $67.6 million for the three months ended March 31, 2024 and 2023, respectively.

5. Acquisitions and Divestitures

In December 2023, the Company divested all of its mineral and royalty interests in the SCOOP and STACK plays in the Anadarko Basin in Oklahoma and the Appalachian Basin in Pennsylvania, Ohio and West Virginia for $113.3 million, net of third-party transaction costs. The proceeds were used to fund repayments on the Company's credit facility and for general corporate purposes.

6. Debt

The following is a summary of long-term debt as of March 31, 2024 and December 31, 2023 (in thousands):

|

|

|

|

|

|

|

|

|

As of March 31, |

|

|

As of December 31, |

|

|

2024 |

|

|

2023 |

|

Sitio Revolving Credit Facility |

$ |

260,000 |

|

|

$ |

277,000 |

|

2028 Senior Notes |

|

600,000 |

|

|

|

600,000 |

|

Less: Unamortized issuance costs |

|

(11,167 |

) |

|

|

(11,662 |

) |

Total long-term debt |

$ |

848,833 |

|

|

$ |

865,338 |

|

Sitio Revolving Credit Facility

Sitio OpCo maintains a revolving credit facility (the “Sitio Revolving Credit Facility”) with a syndicate of financial institutions. As of March 31, 2024, the borrowing base under the Sitio Revolving Credit Facility as determined by the lenders was $850.0 million and the outstanding balance under the Sitio Revolving Credit Facility was $260.0 million.

As of March 31, 2024 and December 31, 2023, the weighted average interest rate related to our outstanding borrowings under the Sitio Revolving Credit Facility was 8.18% and 8.21%, respectively. As of March 31, 2024 and December 31, 2023, the Company had unamortized debt issuance costs of $10.4 million and $11.2 million, respectively, in connection with its entry into the Sitio Revolving Credit Facility, and subsequent amendments. Such costs are capitalized as deferred financing costs within long-term assets and are amortized over the life of the facility. For the three months ended March 31, 2024 and 2023, the Company recognized $799,000 and $618,000, respectively, in interest expense related to the amortization of deferred financing costs under the Sitio Revolving Credit Facility. In connection with the amendment and restatement of the Sitio Revolving Credit Facility in February 2023, certain lenders did not elect to remain a party to the Sitio Revolving Credit Facility. As such, $783,000 of previously capitalized deferred financing costs were written off during the three months ended March 31, 2023.

The Sitio Revolving Credit Facility contains customary affirmative and negative covenants. The Company was in compliance with the terms and covenants of the Sitio Revolving Credit Facility at March 31, 2024 and December 31, 2023.

2028 Senior Notes

As of March 31, 2024 and December 31, 2023, Sitio OpCo had $600.0 million aggregate principal amount of 7.875% senior notes due 2028 (the “2028 Senior Notes”). The 2028 Senior Notes bear interest at an annual rate of 7.875%, which accrues from October 3, 2023 and is payable semi-annually in arrears on May 1 and November 1 of each year, commencing on May 1, 2024. As of March 31, 2024 and December 31, 2023, the Company had unamortized debt issuance costs of $11.2 million and $11.7 million in connection with the issuance of the 2028 Senior Notes. Debt issuance costs are reported as a reduction to long-term debt on our consolidated balance sheets and are amortized over the life of the 2028 Senior Notes. For the three months ended March 31, 2024, the Company recognized

$495,000 of interest expense attributable to the amortization of debt issuance costs related to the 2028 Senior Notes. No such expense was recognized for the three months ended March 31, 2023.

The 2028 Senior Notes contain covenants that limit Sitio OpCo’s ability and the ability of Sitio OpCo’s restricted subsidiaries to engage in certain transactions and activities. The Company was in compliance with the terms and covenants of the 2028 Senior Notes as of March 31, 2024 and December 31, 2023.

2026 Senior Notes

In October 2023, the Company redeemed all of its senior notes due 2026 (the “2026 Senior Notes”). For the three months ended March 31, 2023, the Company recognized $359,000 of interest expense attributable to the amortization of discount and issuance costs related to the 2026 Senior Notes. No such expense was recognized for the three months ended March 31, 2024.

7. Equity

Class A Common Stock

Holders of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), are entitled to one vote per share on all matters to be voted upon by the stockholders and are entitled to ratably receive dividends when and if declared by the Company’s board of directors (the “Board”).

Class C Common Stock

Shares of Class C Common Stock, par value $0.0001 per share (“Class C Common Stock” and, together with Class A Common Stock, the “Common Stock”), are non-economic but entitle the holder to one vote per share. Current holders of Class C Common Stock also hold an equivalent number of common units representing limited partner interests in Sitio OpCo (the “Sitio OpCo Partnership Units”) which receive pro rata distributions. Sitio OpCo Partnership Units are redeemable, at the option of the holder, on a one-for-one basis for shares of Class A Common Stock or, at our election, cash on terms and conditions set forth in the Amended and Restated Limited Partnership Agreement of Sitio OpCo. Upon the redemption by any holder of Sitio OpCo Partnership Units for shares of Class A Common Stock, a corresponding number of shares of Class C Common Stock held by such holder will be canceled. During the three months ended March 31, 2024, 135,395 Sitio OpCo Partnership Units were redeemed for shares of Class A Common Stock, and an equivalent number of shares of Class C Common Stock were canceled. During the three months ended March 31, 2023, 6,270 Sitio OpCo Partnership Units were redeemed for shares of Class A Common Stock, and an equivalent number of shares of Class C Common Stock were canceled.

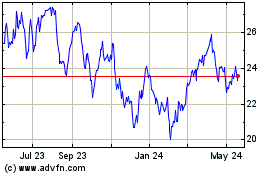

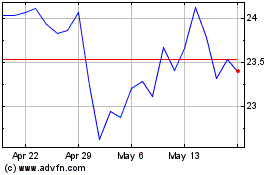

Share Repurchase Program

On February 28, 2024, the Board authorized a share repurchase program that allows us to repurchase up to $200.0 million of our Class A Common Stock and Sitio OpCo Partnership Units (the “Share Repurchase Program”). The shares may be repurchased from time to time through various methods including but not limited to in the open market transactions, through privately negotiated transactions or by other means in accordance with applicable securities laws, certain of which may be made pursuant to trading plans meeting the requirements of Rule 10b5-1 and 10b-18 under the Securities Exchange Act of 1934 (the “Exchange Act”). The 1% U.S. federal excise tax on certain repurchases of stock by publicly traded U.S. corporations enacted as part of the Inflation Reduction Act of 2022 (the “IRA 2022”) applies to repurchases of our Class A Common Stock and Sitio OpCo Partnership Units pursuant to our Share Repurchase Program. The timing of repurchases under the program, as well as the number and value of shares repurchased under the program, will be determined by the Company at its discretion and will depend on a variety of factors, including the market price of our common stock, oil and gas commodity prices, general market and economic conditions, available liquidity, compliance with the Company’s debt and other agreements, applicable legal requirements and other considerations. The exact number of shares to be repurchased by us is not guaranteed, and the program may be modified, suspended or discontinued at any time without prior notice. The Company is not obligated to repurchase any dollar amount or number of shares under the program.

Class A Treasury Shares

During the three months ended March 31, 2024, the Company repurchased 545,527 shares of its Class A Common Stock in connection with the Share Repurchase Program. The shares were recorded at a weighted average price of $23.77 upon repurchase by the Company, inclusive of third-party commissions. As of March 31, 2024, 545,527 shares of Class A Common Stock were held in treasury.

Class C Treasury Shares

As of March 31, 2024, 26,137 shares of Class C Common Stock were held in treasury at a weighted average price of $25.92.

Cash Dividends

The following table summarizes the quarterly dividends related to the Company’s quarterly financial results (in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Total Quarterly Dividend per Class A Common Share |

|

|

Class A Cash Dividends Paid |

|

|

Payment Date |

|

Stockholder Record Date |

December 31, 2023 |

|

$ |

0.51 |

|

|

$ |

41,950 |

|

|

March 28, 2024 |

|

March 15, 2024 |

September 30, 2023 |

|

$ |

0.49 |

|

|

$ |

40,396 |

|

|

November 30, 2023 |

|

November 21, 2023 |

June 30, 2023 |

|

$ |

0.40 |

|

|

$ |

32,705 |

|

|

August 31, 2023 |

|

August 18, 2023 |

March 31, 2023 |

|

$ |

0.50 |

|

|

$ |

40,743 |

|

|

May 31, 2023 |

|

May 19, 2023 |

December 31, 2022 |

|

$ |

0.60 |

|

|

$ |

48,107 |

|

|

March 31, 2023 |

|

March 17, 2023 |

September 30, 2022 |

|

$ |

0.72 |

|

|

$ |

9,148 |

|

|

November 30, 2022 |

|

November 21, 2022 |

June 30, 2022 |

|

$ |

0.71 |

|

|

$ |

9,017 |

|

|

August 31, 2022 |

|

August 18, 2022 |

See “Note 15 – Subsequent Events” for additional information regarding cash dividends.

Earnings per Share

Earnings per share is computed using the two-class method. The two-class method determines earnings per share of common stock and participating securities according to dividends or dividend equivalents and their respective participation rights in undistributed earnings. Participating securities represent certain equity-based compensation awards in which the recipients have non-forfeitable rights to dividend equivalents during the performance period.

The following table sets forth the calculation of basic and diluted earnings per share for the periods indicated (in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

For the Three Months

Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Numerator: |

|

|

|

|

|

|

Net income attributable to Class A stockholders |

|

$ |

8,468 |

|

|

$ |

22,653 |

|

Less: Earnings allocated to participating securities |

|

|

(376 |

) |

|

|

(400 |

) |

Net income attributable to Class A stockholders - basic |

|

$ |

8,092 |

|

|

$ |

22,253 |

|

Plus: net income attributable to noncontrolling interest |

|

|

10,224 |

|

|

|

25,066 |

|

Net income attributable to Class A stockholders - diluted |

|

$ |

18,316 |

|

|

$ |

47,319 |

|

Denominator: |

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

82,404 |

|

|

|

80,178 |

|

Effect of dilutive securities |

|

|

— |

|

|

|

— |

|

Weighted average shares outstanding - diluted |

|

|

82,404 |

|

|

|

80,178 |

|

|

|

|

|

|

|

|

Net income per common share - basic |

|

$ |

0.10 |

|

|

$ |

0.28 |

|

Net income per common share - diluted |

|

$ |

0.10 |

|

|

$ |

0.28 |

|

The Company had the following shares that were excluded from the computation of diluted earnings per share because their inclusion would have been anti-dilutive for the periods presented but could potentially dilute basic earnings per share in future periods (in thousands):

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Warrants |

|

|

— |

|

|

|

5,312 |

|

Unvested share-based compensation awards |

|

|

1,656 |

|

|

|

651 |

|

Shares of Class C Common Stock if converted |

|

|

74,878 |

|

|

|

74,341 |

|

Total |

|

|

76,534 |

|

|

|

80,304 |

|

Diluted net income per share also excludes the effects of Sitio OpCo Partnership Units (and related Class C Common Stock) associated with the earn-out, which are convertible into Class A Common Stock, because they are considered contingently issuable shares and the conditions for issuance were not satisfied as of March 31, 2024.

Earn-Out