Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

26 November 2024 - 8:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to

§ 240.14a-12 |

Summit Materials, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary

materials. |

| ☐ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following communication was posted on LinkedIn, by Summit

Materials, Inc. on November 25, 2024:

Cautionary Note Regarding Forward-Looking Statements

This communication

includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties.

Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify

forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,”

“should,” “seeks,” “intends,” “trends,” “plans,” “estimates,”

“projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions.

All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial

results are forward-looking statements. Such forward-looking statements include but are not limited to statements about the transactions

contemplated by the Agreement and Plan of Merger among Summit Materials, Inc. (the “Company”), Quikrete Holdings, Inc.

(“Purchaser”) and Soar Subsidiary, Inc. (the “Merger”), including statements that are not historical

facts. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance

or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking

statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed

assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of

course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant uncertainties inherent

in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us

or any other person that the results or conditions described in such statements or our objectives and plans will be realized. Important

factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements,

including but not limited to the factors discussed in the section entitled “Risk Factors” in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 30, 2023, and Quarterly Report on Form 10-Q for the fiscal quarter ended March 30, 2024,

each as filed with the SEC, and any factors discussed in the section entitled “Risk Factors” in any of our subsequently filed

SEC filings; and the following: (i) the occurrence of any event, change, or other circumstance that could give rise to the right of one

or both of the parties to terminate the definitive transaction agreement between the Company and Purchaser, including in circumstances

requiring the Company to pay a termination fee; (ii) potential litigation relating to the Merger that could be instituted against the

parties to the definitive transaction agreement or their respective directors or officers, including the effects of any outcomes related

thereto; (iii) the possibility that the Merger does not close when expected or at all because required regulatory, shareholder, or other

approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (iv) reputational risk and potential

adverse reactions of customers, employees or other business partners and the businesses generally, including those resulting from the

announcement of the Merger; (v) the risk that any announcements relating to the Merger could have adverse effects on the market price

of the Company’s common stock; (vi) significant transaction costs associated with the Merger; and (vii) the diversion of management’s

attention and time from ongoing business operations and opportunities on Merger-related matters. All subsequent written and oral forward-looking

statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

Any forward-looking statement that we make herein speaks only as of the date of this Schedule 14A.

We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or

otherwise, except as required by law.

Additional Information and Where to Find It

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates

to the Merger. In connection with the Merger, the Company plans to file with the Securities and Exchange Commission (“SEC”)

a proxy statement on Schedule 14A (the “Proxy Statement”). This Schedule 14A is not a substitute for the Proxy Statement

or any other document that the Company may file with the SEC and send to its shareholders in connection with the Merger. The Merger will

be submitted to the Company’s shareholders for their consideration. Before making any voting decision, the Company’s shareholders

are urged to read all relevant documents filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or

supplements to those documents, when they become available, because they will contain important information about the Company and the

Merger.

The Company’s

shareholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about the Company,

free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by the Company with

the SEC may be obtained, without charge, by contacting the Company through its website at https://investors.summit-materials.com/corporate-profile/default.aspx.

Participants in the Solicitation

The Company, its directors, executive

officers and other persons related to the Company may be deemed to be participants in the solicitation of proxies from the Company’s

shareholders in connection with the Merger. Information about the directors and executive officers of the Company and their ownership

of common stock of the Company is set forth in the section entitled “Our Stockholders—Holdings of Major Stockholders”

in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 8, 2024 (and

which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001621563/000114036124018480/ny20019511x1_def14a.htm).Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with

the Merger when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

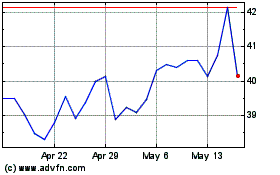

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Dec 2024 to Jan 2025

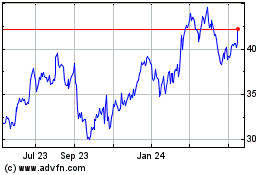

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Jan 2024 to Jan 2025