As homeownership costs continue to increase,

seven in ten homeowners say it has impacted their ability to save

or budget

The majority of homeowners (67%) feel that purchasing a home is

still attainable and 38% say they’re likely to purchase a home in

the next year, according to a recent TD Bank survey, showing

positive views in the housing market amid rising prices and current

interest rates.

TD Bank's 2024 Mortgage Service Index surveyed more than 1,800

homeowners across the country to gather insights and analyze

perceptions around the homebuying and mortgage experience, as well

as attitudes around the housing market.

The survey also found that optimism is reflected even more so

among younger generations, as 84% of Gen Z and 68% of Millennials

say purchasing a home still feels attainable despite the rising

cost of homeownership. Optimism wavered just slightly among Gen

Xers with 66% feeling that purchasing a home was attainable,

followed by 59% of Baby Boomers. As U.S. existing home sales

reached a nearly 20-year low in 2023, these sentiments highlight a

sense of hope among home buyers.

“Although many of the challenges impacting homeownership are

leaving some homeowners weary about the market, it's great to see

borrowers, especially younger generations, remaining steadfast in

navigating the market to find a home that works for them and their

budgets,” said Steve Kaminski, Head of U.S. Residential Lending for

TD Bank. “Owning a home is still an important wealth vehicle for

any generation and it's reassuring that homeowners continue to see

the value in this type of investment."

Increasing costs are taking a toll on homeowners’ personal

finances

As a result of lower inventory levels in several markets, many

of those searching for a home have re-evaluated their budget and

savings expectations. Among respondents who plan to stay in their

current home for less than three years, nearly three-quarters (73%)

increased their initial housing budgets, underscoring mismatched

expectations in the cost of homeownership. Primary reasons for the

increase included: significantly rising home prices in their

desired area (45%), high interest rates (31%) and a lack of options

within their price range (31%).

The increasing costs of homeownership are not only impacting

housing budgets – they are also reshaping how homeowners manage

their finances and make long-term financial plans. Homeowners

reported experiencing cost increases in utilities (83%), home

insurance (81%), property taxes (81%) and repairs (74%). These

rising expenses are putting pressure on personal finances, as 70%

of homeowners indicate that the cost of homeownership has impacted

their ability to save or budget effectively.

The financial strain has broader implications as well, including

impacting homeowners’ ability to contribute to their savings

accounts (33%) or 401(k)s (16%), as well as budget for “fun” (33%),

travel (33%) or monthly expenses (27%). More than one in five (22%)

also said the cost of homeownership has impacted their ability to

invest. And one-third of homeowners (32%) have reduced or stopped

contributing to retirement savings to save for a down payment or

home budget. This trend is particularly prevalent among younger

homeowners; three in five Gen Z homeowners (59%) have lowered or

stopped their 401(k), IRA or other retirement account

contributions, followed by 38% of Millennials as they save for a

down payment or home budget.

If you can’t find it, fix it

Rather than purchasing new homes, many homeowners are focusing

on enhancing their current living spaces, with 25% of homeowners

planning to stay in their current homes forever. Additionally, most

homeowners (73%) plan to embark on home renovations in the future,

with 28% planning to start within the next year. Over seven in ten

(72%) indicate they are currently looking for more space in their

home, and 39% would consider building an addition onto their

existing home rather than moving for more space, given current

interest rates.

Let’s get down (payment) to it

Eighty percent of Gen Z respondents put down less than 20% for a

down payment, compared to 77% of Millennials, 60% of Gen X and 44%

of Baby Boomers.

“It's encouraging so many homeowners understand that 20% down is

not the only option, with many lenders offering low-down payment

products and down payment assistance programs," said Kaminski. "As

younger generations grapple with historically high home values

coupled with larger financial responsibilities and a higher cost of

living, it's important to make every dollar count. Speaking with a

mortgage professional early on may not only help save money on a

down payment but may also help buyers better prioritize and plan

for other financial goals."

As rates remain higher for longer, with the Federal Reserve

considering cuts later this year, the survey found that 42% of Gen

Z said they had interest rates of 5.00% or higher, followed by

Millennials (35%), Gen X (30%) and Baby Boomers (30%).

More than half of homeowners (54%) did not report using a rate

buydown when purchasing their homes. However, 42% of homeowners

found using a rate buydown helped lower their housing costs,

demonstrating that buyers are looking for ways to make

homeownership more affordable.

Buying a home is more stressful than ever, but experienced

advice helps

Seven in ten homeowners (71%) found buying their most recent

home stressful, an uptick from 64% of respondents in 2023. What’s

more, 82% of Gen Z said they felt stressed, compared to 60% of Baby

Boomers who may already have a roadmap of the homebuying

process.

Education can play a role in making homebuyers feel more

confident in their options throughout the process. Two in five

homeowners (43%) felt they required the most education and guidance

during the mortgage process, with nearly one-quarter (24%)

indicating that identifying a loan option was when they felt they

needed the most education and guidance. While 83% felt they had

enough resources to educate themselves, 39% were still unfamiliar

with mortgage affordability/loan programs, highlighting a gap in

knowledge of the homebuying journey.

Over half of the respondents (57%) contacted realtors for

information, education or opinions on the products or services

offered by each bank or lender they considered. Other top sources

included family and friends (37%), bank/lender websites (36%) and

in-person meetings at branches or lender offices (34%), showing

that homeowners prefer learning about their options from industry

professionals and loved ones.

Survey Methodology

This report presents the findings of a CARAVAN® survey conducted

by Big Village Insights among a sample of 1,806 U.S. homeowners who

purchased a home within the past 10 years and acquired a mortgage

when they bought their most recent home. The survey was conducted

from May 28 to June 9, 2024.

About Big Village Insights

Big Village Insights is a global research and analytics business

uncovering not just the ‘what’ but the ‘why’ behind customer

behavior, supporting clients' insights needs with agile tools, CX

research, branding, product innovation, data & analytics, and

more. Big Village Insights is part of Bright Mountain Media. Find

out more at https://big-village.com.

About TD Bank, America's Most Convenient Bank®

TD Bank, America's Most Convenient Bank, is one of the 10

largest banks in the U.S. by assets, providing over 10 million

customers with a full range of retail, small business and

commercial banking products and services at more than 1,100

convenient locations throughout the Northeast, Mid-Atlantic, Metro

D.C., the Carolinas and Florida. In addition, TD Auto Finance, a

division of TD Bank, N.A., offers vehicle financing and dealer

commercial services. TD Bank and its subsidiaries also offer

customized private banking and wealth management services through

TD Wealth®. TD Bank is headquartered in Cherry Hill, N.J. To learn

more, visit www.td.com/us. Find TD Bank on Facebook at

www.facebook.com/TDBank and on Instagram at

www.instagram.com/TDBank_US/.

TD Bank is a subsidiary of The Toronto-Dominion Bank, a top 10

North American bank. The Toronto-Dominion Bank trades on the New

York and Toronto stock exchanges under the ticker symbol "TD". To

learn more, visit www.td.com/us.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240710633928/en/

Monet Irving Corporate Communications Manager

Monet.Irving@td.com

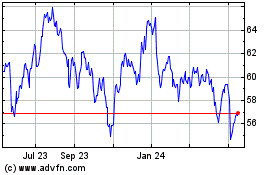

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Oct 2024 to Nov 2024

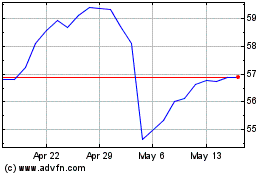

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Nov 2023 to Nov 2024