0001260221false00012602212024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-32833 | | 41-2101738 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | |

| 1350 Euclid Avenue | Suite 1600, | Cleveland, | Ohio | | 44115 |

| (Address of principal executive offices) | | (Zip Code) |

(216) 706-2960

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol: | | Name of each exchange on which registered: |

| Common Stock, $0.01 par value | | TDG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On August 6, 2024, TransDigm Group Incorporated (“TransDigm Group” or the “Company”) issued a press release (the “Press Release”) announcing its financial results for its third quarter ended June 29, 2024 and certain other information. A copy of this press release is furnished with this Current Report as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this item and in the accompanying exhibit shall not be incorporated by reference into any filing of the Registrant, whether made before or after the date hereof. The information in this item, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

TransDigm Group will host a conference call for investors and security analysts on August 6, 2024, beginning at 11:00 a.m., Eastern Time. To join the call telephonically, please see the detailed instructions within the “Earnings Conference Call” section of the press release furnished with this Current Report as Exhibit 99.1. A live audio webcast of the call can also be accessed online at http://www.transdigm.com. A slide presentation will also be available for reference during the conference call; go to the investor relations page of our website and click on “Presentations.”

The call will be archived on the website and available for replay later that day.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished with this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| TRANSDIGM GROUP INCORPORATED |

| |

| By: | | /s/ Sarah Wynne |

| Name: | | Sarah Wynne |

| Title: | | Chief Financial Officer

(Principal Financial Officer) |

| | |

Dated: August 6, 2024

TransDigm Group Reports Fiscal 2024 Third Quarter Results

Cleveland, Ohio, August 6, 2024/PRNewswire/ -- TransDigm Group Incorporated (NYSE: TDG), a leading global designer, producer and supplier of highly engineered aircraft components, today reported results for the third quarter ended June 29, 2024.

Third quarter highlights include:

•Net sales of $2,046 million, up 17% from $1,744 million in the prior year's quarter;

•Net income of $461 million, up 31% from the prior year's quarter;

•Earnings per share of $7.96, up 30% from the prior year's quarter;

•EBITDA As Defined of $1,091 million, up 19% from $915 million in the prior year's quarter;

•EBITDA As Defined margin of 53.3%;

•Adjusted earnings per share of $9.00, up 24% from $7.25 in the prior year's quarter; and

•Upward revision to fiscal 2024 financial guidance to reflect TransDigm's continued strong performance as well as to include the recent acquisitions of SEI Industries, the CPI Electron Device Business and Raptor Scientific.

Quarter-to-Date Results

Net sales for the quarter increased 17.3%, or $302 million, to $2,046 million from $1,744 million in the comparable quarter a year ago. Organic sales growth as a percentage of net sales was 14.6%.

Net income for the quarter increased $109 million, or 31.0%, to $461 million from $352 million in the comparable quarter a year ago. The increase in net income primarily reflects the increase in net sales described above and the application of our value-driven operating strategy. The increase was partially offset by higher interest expense, income tax expense, and acquisition transaction-related expenses.

Adjusted net income for the quarter increased 25.8% to $521 million, or $9.00 per share, from $414 million, or $7.25 per share, in the comparable quarter a year ago.

EBITDA for the quarter increased 19.9% to $995 million from $830 million for the comparable quarter a year ago. EBITDA As Defined for the quarter increased 19.2% to $1,091 million compared with $915 million in the comparable quarter a year ago. EBITDA As Defined as a percentage of net sales for the quarter was 53.3% compared with 52.5% in the comparable quarter a year ago.

"I am incredibly pleased with the operating results for the third quarter and our continued strong performance," stated Kevin Stein, TransDigm Group's President and Chief Executive Officer. "Total revenue for the quarter ran ahead of our expectations, and revenues sequentially improved in all three of our major market channels - commercial OEM, commercial aftermarket and defense. Our EBITDA As Defined margin improved to 53.3% for the quarter, up approximately 80 basis points from the comparable prior year period. Excluding the results related to SEI Industries and the CPI Electron Device Business, acquired in May and June 2024, respectively, our third quarter EBITDA As Defined margin was approximately 53.6%. As always, we remain focused on our operating strategy, value drivers and effectively managing our cost structure.

Additionally, we are excited to have recently closed the acquisitions of SEI Industries, the CPI Electron Device Business and Raptor Scientific. In the aggregate for these three acquisitions, we have deployed over $2.2 billion of capital in the past three months. These businesses fit well with our long-standing strategy, and we expect each of these acquisitions to create equity value in-line with our long-term private equity-like return objectives."

Acquisition Activities

As previously reported on May 22, 2024, TransDigm completed the acquisition of SEI Industries LTD ("SEI"). SEI is a leading provider of highly engineered products for aerial firefighting and other liquid transportation solutions, such as remote refueling. Their innovative and world renowned Bambi Bucket®, is a proprietary collapsible firefighting bucket used across the globe to combat forest fires, among other applications.

Additionally, on June 6, 2024, TransDigm completed the acquisition of the Electron Device Business of Communications & Power Industries ("CPI"). The CPI Electron Device Business is a leading global manufacturer of electronic components and subsystems primarily serving the aerospace and defense market.

Subsequent to the quarter, on July 31, 2024, TransDigm completed the acquisition of Raptor Scientific. Raptor Scientific is a leading global manufacturer of complex test and measurement solutions primarily serving the aerospace and defense end markets.

Financing Activities

During the quarter, on June 4, 2024, TransDigm successfully repriced the existing approximately $997 million Tranche J term loans maturing February 28, 2031, to bear interest at Term Secured Overnight Financing Rate ("SOFR") plus 2.50% compared to Term SOFR plus 3.25% applicable prior to the repricing. Additionally, TransDigm amended and extended $2,644 million of existing Tranche I term loans maturing August 24, 2028, and converted such loans into Tranche J term loans maturing February 28, 2031.

Year-to-Date Results

Net sales for the thirty-nine week period ended June 29, 2024 increased 21.6%, or $1,021 million, to $5,754 million from $4,733 million in the comparable period a year ago. Organic sales growth as a percentage of net sales for the thirty-nine week period ended June 29, 2024 was 17.7%.

Net income for the thirty-nine week period ended June 29, 2024 increased $363 million, or 41.0%, to $1,248 million from $885 million in the comparable period a year ago. The increase in net income primarily reflects the increase in net sales described above and the application of our value-driven operating strategy. The increase was partially offset by higher income tax expense, interest expense, non-cash stock and deferred compensation expense, acquisition transaction-related expenses, and one-time refinancing costs.

GAAP earnings per share were reduced in fiscal 2024 and 2023 by $1.75 per share and $0.67 per share, respectively, as a result of dividend equivalent payments made during each year. As a reminder, GAAP earnings per share are reduced when TransDigm makes dividend equivalent payments pursuant to its stock option plans. These dividend equivalent payments are made during TransDigm's first fiscal quarter each year and also upon payment of any special dividends.

Adjusted net income for the thirty-nine week period ended June 29, 2024 increased 37.3% to $1,396 million, or $24.15 per share, from $1,017 million, or $17.80 per share, in the comparable period a year ago.

EBITDA for the thirty-nine week period ended June 29, 2024 increased 23.9% to $2,772 million from $2,237 million for the comparable period a year ago. EBITDA As Defined for the period increased 24.3% to $3,023 million compared with $2,432 million in the comparable period a year ago. EBITDA As Defined as a percentage of net sales for the period was 52.5% compared with 51.4% in the comparable period a year ago.

Please see the attached tables for a reconciliation of net income to EBITDA, EBITDA As Defined, and adjusted net income; a reconciliation of net cash provided by operating activities to EBITDA and EBITDA As Defined; and a reconciliation of earnings per share to adjusted earnings per share for the periods discussed in this press release.

Fiscal 2024 Outlook

Mr. Stein stated, “We are raising our full year guidance primarily to reflect our strong third quarter results and current expectations for the remainder of the fiscal year, as well as to include the recent acquisitions of SEI Industries, the CPI Electron Device Business and Raptor Scientific. We are pleased to once more raise our guidance for fiscal 2024 and to see further progression in our primary end markets.”

TransDigm now expects fiscal 2024 financial guidance to be as follows:

•Net sales are anticipated to be in the range of $7,870 million to $7,930 million compared with $6,585 million in fiscal 2023, an increase of 20.0% at the midpoint (an increase of $160 million at the midpoint from prior guidance);

•Net income is anticipated to be in the range of $1,632 million to $1,678 million compared with $1,299 million in fiscal 2023, an increase of 27.4% at the midpoint (an increase of $8 million at the midpoint from prior guidance);

•Earnings per share is expected to be in the range of $26.47 to $27.27 per share based upon weighted average shares outstanding of 57.85 million shares, compared with $22.03 per share in fiscal 2023, which is an increase of 22.0% at the midpoint (an increase of $0.14 per share at the midpoint from prior guidance);

•EBITDA As Defined is anticipated to be in the range of $4,100 million to $4,160 million compared with $3,395 million in fiscal 2023, an increase of 21.6% at the midpoint (an increase of $85 million at the midpoint from prior guidance and corresponding to an EBITDA As Defined margin guide of approximately 52.3% for fiscal 2024);

•Adjusted earnings per share is expected to be in the range of $32.62 to $33.42 per share compared with $25.84 per share in fiscal 2023, an increase of 27.8% at the midpoint (an increase of $0.60 per share at the midpoint from prior guidance); and

•Fiscal 2024 outlook is based on the following market growth assumptions:

◦Commercial OEM revenue growth around 20%;

◦Commercial aftermarket revenue growth in the mid-teens percentage range; and

◦Defense revenue growth in the high-teens percentage range.

Please see the attached Table 6 for a reconciliation of EBITDA, EBITDA As Defined to net income and reported earnings per share to adjusted earnings per share guidance midpoint estimated for the fiscal year ending September 30, 2024. Additionally, please see attached Table 7 for comparison of the current fiscal year 2024 guidance versus the previously issued fiscal year 2024 guidance.

Earnings Conference Call

TransDigm Group will host a conference call for investors and security analysts on August 6, 2024, beginning at 11:00 a.m., Eastern Time. To join the call telephonically, please register for the call at https://register.vevent.com/register/BI33561ee603c24a548ff2010aa7d54671. Once registered, participants will receive the dial-in information and a unique pin to access the call. The dial-in information and unique pin will be sent to the email used to register for the call. The unique pin is exclusive to the registrant and can only be used by one person at a time. A live audio webcast of the call can also be accessed online at http://www.transdigm.com. A slide presentation will also be available for reference during the conference call; go to the investor relations page of our website and click on “Presentations.”

The call will be archived on the website and available for replay at approximately 2:00 p.m., Eastern Time.

About TransDigm Group

TransDigm Group, through its wholly-owned subsidiaries, is a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today. Major product offerings, substantially all of which are ultimately provided to end-users in the aerospace industry, include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, engineered latching and locking devices, engineered rods, engineered connectors and elastomer sealing solutions, databus and power controls, cockpit security components and systems, specialized and advanced cockpit displays, engineered audio, radio and antenna systems, specialized lavatory components, seat belts and safety restraints, engineered and customized interior surfaces and related components, advanced sensor products, switches and relay panels, thermal protection and insulation, lighting and control technology, parachutes, high performance hoists, winches and lifting devices, and cargo loading, handling and delivery systems, specialized flight, wind tunnel and jet engine testing services and equipment, and electronic components used in the generation, amplification, transmission and reception of microwave signals.

Non-GAAP Supplemental Information

EBITDA, EBITDA As Defined, EBITDA As Defined margin, adjusted net income and adjusted earnings per share are non-GAAP financial measures presented in this press release as supplemental disclosures to net income and reported results. TransDigm Group defines EBITDA as earnings before interest, taxes, depreciation and amortization and defines EBITDA As Defined as EBITDA plus certain non-operating items recorded as corporate expenses, including non-cash compensation charges incurred in connection with TransDigm Group's stock incentive or deferred compensation plans, foreign currency gains and losses, acquisition-integration costs, acquisition transaction-related expenses, and refinancing costs. Acquisition-related costs represent accounting adjustments to inventory associated with acquisitions of businesses and product lines that were charged to cost of sales when the inventory was sold; costs incurred to integrate acquired businesses and product lines into the Company’s operations, facility relocation costs and other acquisition-related costs; transaction-related costs for both acquisitions and divestitures comprising deal fees; legal, financial and tax diligence expenses and valuation costs that are required to be expensed as incurred and other acquisition accounting adjustments. TransDigm Group defines adjusted net income as net income plus purchase accounting backlog amortization expense, effects from the sale on businesses, non-cash compensation charges incurred in connection with TransDigm Group's stock incentive or deferred compensation plans, foreign currency gains and losses, acquisition-integration costs, acquisition transaction-related expenses, and refinancing costs. EBITDA As Defined margin represents EBITDA As Defined as a percentage of net sales. TransDigm Group defines adjusted diluted earnings per share as adjusted net income divided by the total outstanding shares for basic and diluted earnings per share. For more information regarding the computation of EBITDA, EBITDA As Defined, adjusted net income and adjusted earnings per share, please see the attached financial tables.

TransDigm Group presents these non-GAAP financial measures because it believes that they are useful indicators of its operating performance. TransDigm Group believes that EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties to measure operating performance among companies with different capital structures, effective tax rates and tax attributes, capitalized asset values and employee compensation structures, all of which can vary substantially from company to company. In addition, analysts, rating agencies and others use EBITDA to evaluate a company’s ability to incur and service debt. EBITDA As Defined is used to measure TransDigm Inc.’s compliance with the financial covenant contained in its credit facility. TransDigm Group’s management also uses EBITDA As Defined to review and assess its operating performance, to prepare its annual budget and financial projections and to review and evaluate its management team in connection with employee incentive programs. Moreover, TransDigm Group’s management uses EBITDA As Defined to evaluate acquisitions and as a liquidity measure. In addition, TransDigm Group’s management uses adjusted net income as a measure of comparable operating performance between time periods and among companies as it is reflective of changes in pricing decisions, cost controls and other factors that affect operating performance.

None of EBITDA, EBITDA As Defined, EBITDA As Defined margin, adjusted net income or adjusted earnings per share is a measurement of financial performance under U.S. GAAP and such financial measures should not be considered as an alternative to net income, operating income, earnings per share, cash flows from operating activities or other measures of performance determined in accordance with U.S. GAAP. In addition, TransDigm Group’s calculation of these non-GAAP financial measures may not be comparable to the calculation of similarly titled measures reported by other companies.

Although we use EBITDA and EBITDA As Defined as measures to assess the performance of our business and for the other purposes set forth above, the use of these non-GAAP financial measures as analytical tools has limitations, and you should not consider any of them in isolation, or as a substitute for analysis of our results of operations as reported in accordance with U.S. GAAP. Some of these limitations are:

| | | | | | | | | | | |

| • | | neither EBITDA nor EBITDA As Defined reflects the significant interest expense, or the cash requirements, necessary to service interest payments on our indebtedness; |

| | | | | | | | | | | |

| • | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and neither EBITDA nor EBITDA As Defined reflects any cash requirements for such replacements; |

| | | | | | | | | | | |

| • | | the omission of the substantial amortization expense associated with our intangible assets further limits the usefulness of EBITDA and EBITDA As Defined; |

| | | | | | | | | | | |

| • | | neither EBITDA nor EBITDA As Defined includes the payment of taxes, which is a necessary element of our operations; and |

| | | | | | | | | | | |

| • | | EBITDA As Defined excludes the cash expense we have incurred to integrate acquired businesses into our operations, which is a necessary element of certain of our acquisitions. |

Forward-Looking Statements

Statements in this press release that are not historical facts, including statements under the heading “Fiscal 2024 Outlook,” are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “may,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” or “continue” and other words and terms of similar meaning may identify forward-looking statements.

All forward-looking statements involve risks and uncertainties that could cause TransDigm Group’s actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, TransDigm Group. These risks and uncertainties include but are not limited to: the sensitivity of our business to the number of flight hours that our customers’ planes spend aloft and our customers’ profitability, both of which are affected by general economic conditions; supply chain constraints; increases in raw material costs, taxes and labor costs that cannot be recovered in product pricing; failure to complete or successfully integrate acquisitions; our indebtedness; current and future geopolitical or other worldwide events, including, without limitation, wars or conflicts and public health crises; cybersecurity threats; risks related to the transition or physical impacts of climate change and other natural disasters or meeting sustainability-related voluntary goals or regulatory requirements; our reliance on certain customers; the United States (“U.S.”) defense budget and risks associated with being a government supplier including government audits and investigations; failure to maintain government or industry approvals; risks related to changes in laws and regulations, including increases in compliance costs; potential environmental liabilities; liabilities arising in connection with litigation; risks and costs associated with our international sales and operations; and other factors. Further information regarding the important factors that could cause actual results to differ materially from projected results can be found in TransDigm Group’s most recent Annual Report on Form 10-K and other reports that TransDigm Group or its subsidiaries have filed with the Securities and Exchange Commission. Except as required by law, TransDigm Group undertakes no obligation to revise or update the forward-looking statements contained in this press release.

| | | | | | | | |

| Contact: | | Investor Relations |

| | 216-706-2945 |

| | ir@transdigm.com |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | | |

| FOR THE THIRTEEN AND THIRTY-NINE WEEK PERIODS ENDED | | Table 1 |

| JUNE 29, 2024 AND JULY 1, 2023 | |

| (Amounts in millions, except per share amounts) | | |

| (Unaudited) | | | | | | | | |

| | Thirteen Week Periods Ended | | Thirty-Nine Week Periods Ended |

| | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| NET SALES | | $ | 2,046 | | | $ | 1,744 | | | $ | 5,754 | | | $ | 4,733 | |

| COST OF SALES | | 826 | | | 715 | | | 2,341 | | | 1,983 | |

| GROSS PROFIT | | 1,220 | | | 1,029 | | | 3,413 | | | 2,750 | |

| SELLING AND ADMINISTRATIVE EXPENSES | | 248 | | | 209 | | | 715 | | | 578 | |

| AMORTIZATION OF INTANGIBLE ASSETS | | 38 | | | 37 | | | 110 | | | 105 | |

| INCOME FROM OPERATIONS | | 934 | | | 783 | | | 2,588 | | | 2,067 | |

| INTEREST EXPENSE—NET | | 316 | | | 291 | | | 943 | | | 872 | |

| REFINANCING COSTS | | 30 | | | 32 | | | 59 | | | 41 | |

| OTHER INCOME | | (14) | | | (9) | | | (24) | | | (12) | |

| | | | | | | | |

| INCOME FROM OPERATIONS BEFORE INCOME TAXES | | 602 | | | 469 | | | 1,610 | | | 1,166 | |

| INCOME TAX PROVISION | | 141 | | | 117 | | | 362 | | | 281 | |

| | | | | | | | |

| | | | | | | | |

| NET INCOME | | 461 | | | 352 | | | 1,248 | | | 885 | |

| LESS: NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | — | | | (1) | | | (2) | | | (2) | |

| NET INCOME ATTRIBUTABLE TO TD GROUP | | $ | 461 | | | $ | 351 | | | $ | 1,246 | | | $ | 883 | |

| NET INCOME APPLICABLE TO TD GROUP COMMON STOCKHOLDERS | | $ | 461 | | | $ | 351 | | | $ | 1,145 | | | $ | 845 | |

| | | | | | | | |

| Earnings per share attributable to TD Group common stockholders: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic and diluted | | $ | 7.96 | | | $ | 6.14 | | | $ | 19.81 | | | $ | 14.80 | |

| Cash dividends declared per common share | | $ | — | | | $ | — | | | $ | 35.00 | | | $ | — | |

| | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic and diluted | | 57.9 | | | 57.2 | | | 57.8 | | | 57.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| SUPPLEMENTAL INFORMATION - RECONCILIATION OF | | |

| EBITDA, EBITDA AS DEFINED TO NET INCOME | | |

| FOR THE THIRTEEN AND THIRTY-NINE WEEK PERIODS ENDED | | Table 2 |

| JUNE 29, 2024 AND JULY 1, 2023 | |

| (Amounts in millions, except per share amounts) | | |

| (Unaudited) | | | | | | | | |

| | Thirteen Week Periods Ended | | Thirty-Nine Week Periods Ended |

| | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| Net Income | | $ | 461 | | | $ | 352 | | | $ | 1,248 | | | $ | 885 | |

| Adjustments: | | | | | | | | |

| Depreciation and amortization expense | | 77 | | | 70 | | | 219 | | | 199 | |

| Interest expense-net | | 316 | | | 291 | | | 943 | | | 872 | |

| Income tax provision | | 141 | | | 117 | | | 362 | | | 281 | |

| EBITDA | | 995 | | | 830 | | | 2,772 | | | 2,237 | |

| Adjustments: | | | | | | | | |

Acquisition transaction-related expenses and adjustments (1) | | 27 | | | 6 | | | 43 | | | 12 | |

Non-cash stock and deferred compensation expense (2) | | 47 | | | 53 | | | 158 | | | 131 | |

Refinancing costs (3) | | 30 | | | 32 | | | 59 | | | 41 | |

| | | | | | | | |

Other, net (4) | | (8) | | | (6) | | | (9) | | | 11 | |

| Gross Adjustments to EBITDA | | 96 | | | 85 | | | 251 | | | 195 | |

| EBITDA As Defined | | $ | 1,091 | | | $ | 915 | | | $ | 3,023 | | | $ | 2,432 | |

EBITDA As Defined, Margin (5) | | 53.3 | % | | 52.5 | % | | 52.5 | % | | 51.4 | % |

| | | | | | | | |

| | |

(1) | | Represents accounting adjustments to inventory associated with acquisitions of businesses and product lines that were charged to cost of sales when inventory was sold; costs incurred to integrate acquired businesses and product lines into TD Group’s operations, facility relocation costs and other acquisition-related costs; transaction-related costs for acquisitions comprising deal fees, legal, financial and tax due diligence expenses, and valuation costs that are required to be expensed as incurred. |

| | |

(2) | | Represents the compensation expense recognized by TD Group under our stock incentive plans and deferred compensation plans. |

| | |

(3) | | Represents costs expensed related to debt financing activities, including new issuances, extinguishments, refinancings and amendments to existing agreements. |

| | |

(4) | | Primarily represents foreign currency transaction (gains) or losses, payroll withholding taxes related to dividend equivalent payments and stock option exercises, non-service related pension costs, deferred compensation payments and other miscellaneous (income) expense. |

| | |

(5) | | The EBITDA As Defined margin represents the amount of EBITDA As Defined as a percentage of net sales. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| SUPPLEMENTAL INFORMATION - RECONCILIATION OF REPORTED | | |

| EARNINGS PER SHARE TO ADJUSTED EARNINGS PER SHARE | | |

| FOR THE THIRTEEN AND THIRTY-NINE WEEK PERIODS ENDED | | Table 3 |

| JUNE 29, 2024 AND JULY 1, 2023 | |

| (Amounts in millions, except per share amounts) | | |

| (Unaudited) | | | | | | | | |

| | Thirteen Week Periods Ended | | Thirty-Nine Week Periods Ended |

| | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| Reported Earnings Per Share | | | | | | | | |

| Net income | | $ | 461 | | | $ | 352 | | | $ | 1,248 | | | $ | 885 | |

| Less: Net income attributable to noncontrolling interests | | — | | | (1) | | | (2) | | | (2) | |

| Net income attributable to TD Group | | 461 | | | 351 | | | 1,246 | | | 883 | |

| Less: Dividends paid on participating securities | | — | | | — | | | (101) | | | (38) | |

| | | | | | | | |

| Net income applicable to TD Group common stockholders—basic and diluted | | $ | 461 | | | $ | 351 | | | $ | 1,145 | | | $ | 845 | |

| Weighted-average shares outstanding under the two-class method | | | | | | | | |

| Weighted-average common shares outstanding | | 56.0 | | | 55.0 | | | 55.7 | | | 54.7 | |

| Vested options deemed participating securities | | 1.9 | | | 2.2 | | | 2.1 | | | 2.4 | |

| Total shares for basic and diluted earnings per share | | 57.9 | | | 57.2 | | | 57.8 | | | 57.1 | |

| | | | | | | | |

| | | | | | | | |

| Earnings per share—basic and diluted | | $ | 7.96 | | | $ | 6.14 | | | $ | 19.81 | | | $ | 14.80 | |

| Adjusted Earnings Per Share | | | | | | | | |

| Net income | | $ | 461 | | | $ | 352 | | | $ | 1,248 | | | $ | 885 | |

| Gross Adjustments to EBITDA | | 96 | | | 85 | | | 251 | | | 195 | |

| Purchase accounting backlog amortization | | 2 | | | 2 | | | 5 | | | 4 | |

Tax adjustment (1) | | (38) | | | (25) | | | (108) | | | (67) | |

| Adjusted net income | | $ | 521 | | | $ | 414 | | | $ | 1,396 | | | $ | 1,017 | |

| Adjusted diluted earnings per share under the two-class method | | $ | 9.00 | | | $ | 7.25 | | | $ | 24.15 | | | $ | 17.80 | |

| Diluted Earnings Per Share to Adjusted Earnings Per Share | | | | | | | | |

| Diluted earnings per share from net income attributable to TD Group | | $ | 7.96 | | | $ | 6.14 | | | $ | 19.81 | | | $ | 14.80 | |

| Adjustments to diluted earnings per share: | | | | | | | | |

| Inclusion of the dividend equivalent payments | | — | | | — | | | 1.75 | | | 0.67 | |

| Acquisition transaction-related expenses and adjustments | | 0.36 | | | 0.10 | | | 0.61 | | | 0.20 | |

| Non-cash stock and deferred compensation expense | | 0.61 | | | 0.70 | | | 2.05 | | | 1.71 | |

| Refinancing costs | | 0.39 | | | 0.42 | | | 0.76 | | | 0.54 | |

Tax adjustment on income from operations before taxes (1) | | (0.23) | | | (0.05) | | | (0.75) | | | (0.28) | |

| Other, net | | (0.09) | | | (0.06) | | | (0.08) | | | 0.16 | |

| Adjusted earnings per share | | $ | 9.00 | | | $ | 7.25 | | | $ | 24.15 | | | $ | 17.80 | |

| | | | | | | | |

| | |

(1) | | For the thirteen and thirty-nine week periods ended June 29, 2024 and July 1, 2023, the Tax adjustment represents the tax effect of the adjustments at the applicable effective tax rate, as well as the impact on the effective tax rate when excluding the excess tax benefits on stock option exercises. Stock compensation expense is excluded from adjusted net income and therefore we have excluded the impact that the excess tax benefits on stock option exercises have on the effective tax rate for determining adjusted net income. |

| | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| SUPPLEMENTAL INFORMATION - RECONCILIATION OF NET CASH | | |

| PROVIDED BY OPERATING ACTIVITIES TO EBITDA, EBITDA AS DEFINED | | |

| FOR THE THIRTY-NINE WEEK PERIODS ENDED | | Table 4 |

| JUNE 29, 2024 AND JULY 1, 2023 | |

| (Amounts in millions) | | |

| (Unaudited) | | | | |

| | Thirty-Nine Week Periods Ended |

| | June 29, 2024 | | July 1, 2023 |

| Net cash provided by operating activities | | $ | 1,473 | | | $ | 913 | |

| Adjustments: | | | | |

| Changes in assets and liabilities, net of effects from acquisitions and sales of businesses | | 218 | | | 345 | |

Interest expense-net (1) | | 912 | | | 842 | |

| Income tax provision-current | | 362 | | | 282 | |

| Loss contract amortization | | 24 | | | 27 | |

Non-cash stock and deferred compensation expense (2) | | (158) | | | (131) | |

Refinancing costs (3) | | (59) | | | (41) | |

| EBITDA | | 2,772 | | | 2,237 | |

| Adjustments: | | | | |

Acquisition transaction-related expenses and adjustments (4) | | 43 | | | 12 | |

Non-cash stock and deferred compensation expense (2) | | 158 | | | 131 | |

Refinancing costs (3) | | 59 | | | 41 | |

Other, net (5) | | (9) | | | 11 | |

| EBITDA As Defined | | $ | 3,023 | | | $ | 2,432 | |

| | | | | | | | |

| | |

(1) | | Represents interest expense, net of interest income, excluding the amortization of debt issuance costs and premium and discount on debt. |

| | |

(2) | | Represents the compensation expense recognized by TD Group under our stock incentive plans and deferred compensation plans. |

| | |

(3) | | Represents costs expensed related to debt financing activities, including new issuances, extinguishments, refinancings and amendments to existing agreements. |

| | |

(4) | | Represents accounting adjustments to inventory associated with acquisitions of businesses and product lines that were charged to cost of sales when inventory was sold; costs incurred to integrate acquired businesses and product lines into TD Group’s operations, facility relocation costs and other acquisition-related costs; transaction-related costs for acquisitions comprising deal fees, legal, financial and tax due diligence expenses, and valuation costs that are required to be expensed as incurred. |

| | |

(5) | | Primarily represents foreign currency transaction (gains) or losses, payroll withholding taxes related to dividend equivalent payments and stock option exercises, non-service related pension costs, deferred compensation payments and other miscellaneous (income) expense. |

| | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| SUPPLEMENTAL INFORMATION - BALANCE SHEET DATA | | Table 5 |

| (Amounts in millions) | |

| (Unaudited) | | | | |

| | June 29, 2024 | | September 30, 2023 |

| Cash and cash equivalents | | $ | 3,360 | | | $ | 3,472 | |

| Trade accounts receivable—Net | | 1,300 | | | 1,230 | |

| Inventories—Net | | 1,878 | | | 1,616 | |

| Current portion of long-term debt | | 78 | | | 71 | |

| Short-term borrowings—trade receivable securitization facility | | 450 | | | 349 | |

| Accounts payable | | 320 | | | 305 | |

| Accrued and other current liabilities | | 1,003 | | | 854 | |

| Long-term debt | | 21,364 | | | 19,330 | |

| Total TD Group stockholders’ deficit | | (2,518) | | | (1,984) | |

| | | | | | | | |

| TRANSDIGM GROUP INCORPORATED |

| SUPPLEMENTAL INFORMATION - RECONCILIATION OF EBITDA, |

| EBITDA AS DEFINED TO NET INCOME AND REPORTED EARNINGS PER |

| SHARE TO ADJUSTED EARNINGS PER SHARE GUIDANCE MIDPOINT |

| FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2024 | Table 6 |

| (Amounts in millions, except per share amounts) |

| (Unaudited) | | |

| | GUIDANCE MIDPOINT |

| | Fiscal Year Ended September 30, 2024 |

| Net Income | | $ | 1,655 | |

| Adjustments: | | |

| Depreciation and amortization expense | | 302 | |

| Interest expense-net | | 1,290 | |

| Income tax provision | | 552 | |

| EBITDA | | 3,799 | |

| Adjustments: | | |

Acquisition transaction-related expenses and adjustments (1) | | 63 | |

Non-cash stock and deferred compensation expense (1) | | 210 | |

Refinancing costs (1) | | 59 | |

Other, net (1) | | (1) | |

| Gross Adjustments to EBITDA | | 331 | |

| EBITDA As Defined | | $ | 4,130 | |

EBITDA As Defined Margin (1) | | 52.3 | % |

| | |

| Earnings per share | | $ | 26.87 | |

| Adjustments to earnings per share: | | |

| Inclusion of the dividend equivalent payments | | 1.75 | |

| Non-cash stock and deferred compensation expense | | 2.73 | |

| Acquisition transaction-related expenses and adjustments | | 0.92 | |

| Refinancing costs | | 0.76 | |

| Other, net | | (0.01) | |

| Adjusted earnings per share | | $ | 33.02 | |

| | |

| Weighted-average shares outstanding | | 57.85 | |

| | | | | | | | |

| | |

(1) | | Refer to Table 2 above for definitions of Non-GAAP measurement adjustments. |

| | | | | | | | | | | | | | | | | | | | |

| TRANSDIGM GROUP INCORPORATED | | |

| SUPPLEMENTAL INFORMATION |

| CURRENT FISCAL YEAR 2024 GUIDANCE VERSUS |

| PRIOR FISCAL YEAR 2024 GUIDANCE | | Table 7 |

| (Amounts in millions, except per share amounts) | |

| (Unaudited) | | | | | | |

| | Current

Fiscal Year 2024 Guidance Issued August 6, 2024 | | Prior

Fiscal Year 2024 Guidance Issued May 7, 2024 | | Change at Midpoint |

| | | | | | |

| Net Sales | | $7,870 to $7,930 | | $7,680 to $7,800 | | $160 |

| | | | | | |

| GAAP Net Income | | $1,632 to $1,678 | | $1,608 to $1,686 | | $8 |

| | | | | | |

| GAAP Earnings Per Share | | $26.47 to $27.27 | | $26.06 to $27.40 | | $0.14 |

| | | | | | |

| EBITDA As Defined | | 4,100 to $4,160 | | $3,995 to $4,095 | | $85 |

| | | | | | |

| Adjusted Earnings Per Share | | $32.62 to $33.42 | | $31.75 to $33.09 | | $0.60 |

| | | | | | |

| Weighted-Average Shares Outstanding | | 57.85 | | 57.85 | — |

| | | | | | |

Document and Entity Information

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

TransDigm Group Incorporated

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32833

|

| Entity Tax Identification Number |

41-2101738

|

| Entity Address, Address Line One |

1350 Euclid Avenue

|

| Entity Address, Address Line Two |

Suite 1600,

|

| Entity Address, City or Town |

Cleveland,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44115

|

| City Area Code |

216

|

| Local Phone Number |

706-2960

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

TDG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001260221

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

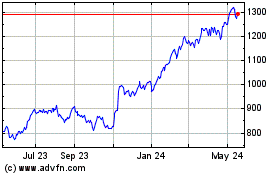

Transdigm (NYSE:TDG)

Historical Stock Chart

From Nov 2024 to Dec 2024

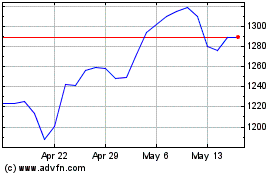

Transdigm (NYSE:TDG)

Historical Stock Chart

From Dec 2023 to Dec 2024