UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name into English)

Aydınevler Mahallesi

İnönü Caddesi No:20

Küçükyalı

Ofispark

34854 Maltepe

Istanbul, Türkiye

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨

Form 40-F

Enclosure: A press release dated May 27, 2024, announcing

the registrant’s first quarter 2024 results and first quarter 2024 IFRS report.

Contents

| |

· | Please

note that all financial data is consolidated and comprises that of Turkcell Iletisim Hizmetleri

A.S. (the “Company”, or “Turkcell”) and its subsidiaries and associates

(together referred to as the “Group”), unless otherwise stated. |

| |

· | We have

four reporting segments: |

| o | "Turkcell Türkiye" which

comprises our telecom, digital services and digital business services related businesses

in Türkiye (as used in our previous releases in periods prior to Q115, this term covered

only the mobile businesses). All non-financial data presented in this press release is unconsolidated

and comprises Turkcell Türkiye only figures, unless otherwise stated. The terms "we",

"us", and "our" in this press release refer only to Turkcell Türkiye,

except in discussions of financial data, where such terms refer to the Group, and except

where context otherwise requires. |

| o | “Turkcell International” which

comprises all of our telecom and digital services-related businesses outside of Türkiye

(BeST and KKTCELL). |

| · | As

of December 31, 2023, our Lifecell, UkrTower, and Global LLC operations in Ukraine have

been classified as a disposal group held for sale and as a discontinued operation. |

| o | “Techfin” which comprises all

of our financial services businesses. |

| o | “Other” which mainly comprises

our non-group call center and energy businesses, retail channel operations, smart devices

management and consumer electronics sales through digital channels and intersegment eliminations. |

| o | Discontinued operations in Ukraine include

Lifecell LLC, LLC Global Bilgi, and LLC Ukrtower. |

| |

· | This press

release provides a year-on-year comparison of our key indicators and figures in parentheses following

the operational and financial results for March 31, 2024 refer to the same item as at and for

the three months ended March 31, 2023. For further details, please refer to our consolidated

financial statements and notes as at and for March 31, 2024, which can be accessed via our

website in the investor relations section (www.turkcell.com.tr). |

| |

· | Selected

financial information presented in this press release for the first quarter of 2023, and 2024 is

based on IFRS figures in TRY terms unless otherwise stated. |

| |

· | In the

tables used in this press release totals may not foot due to rounding differences. The same applies

to the calculations in the text. |

| |

· | Year-on-year

percentage comparisons appearing in this press release reflect mathematical calculation. |

NOTICE

This press release contains the Company’s

financial information for the period ended March 31, 2024 prepared in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”). This press release contains the

Company’s financial information prepared in accordance with International Accounting Standard 29, Financial Reporting in Hyperinflationary

Economies (“IAS29"). Therefore, the financial statement information included in this press release for the periods presented

is expressed in terms of purchasing power of the Turkish Lira as of March 31, 2024. The Company restated all non-monetary items

in order to reflect the impact of the inflation restatement reporting in terms of the measuring unit current as of March 31, 2024.

Comparative financial information has also been restated using the general price index of the current period. This release includes forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, Section 21E of the U.S. Securities Exchange

Act of 1934 and the Safe Harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. This includes, in particular,

and without limitation, our targets for revenue growth, EBITDA margin and operational capex over sales ratio for the full year 2024.

In establishing such guidance and outlooks, the Company has used a certain number of assumptions regarding factors beyond its control

in particular in relation to macro-economic indicators such as expected inflation levels, that may not be realized or achieved. More

generally, all statements other than statements of historical facts included in this press release, including, without limitation, certain

statements regarding our operations, financial position and business strategy may constitute forward-looking statements. Forward-looking

statements generally can be identified by the use of forward-looking terminology such as, among others, "will," "expect,"

"intend," "estimate," "believe," "continue" and “guidance.”

Forward-looking statements are not guarantees

of future performance and involve certain risks and uncertainties that are difficult to predict. In addition, certain forward-looking

statements are based upon assumptions as to future events that may not prove to be accurate. Many factors could cause actual results,

performance or achievements of the Company to be materially different from any future results, performance or achievements that may be

expressed or implied by forward-looking statements. Should one or more of these risks or uncertainties materialize, or underlying assumptions

prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, intended,

planned or projected.

These forward-looking statements are based upon

a number of assumptions and other important factors that could cause our actual results, performance or achievements to differ materially

from our future results, performance or achievements expressed or implied by such forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us are expressly qualified in their entirety by reference to these cautionary statements.

For a discussion of certain factors that may affect the outcome of such forward looking statements, see our Annual Report on Form 20-F

for 2023 filed with the U.S. Securities and Exchange Commission, and in particular the risk factor section therein. These forward-looking

statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

All forward-looking statements in this press release are based on information currently available to the Company and we undertake no

duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The Company makes no representation as to the

accuracy or completeness of the information contained in this press release, which remains subject to verification, completion and change.

No responsibility or liability is or will be accepted by the Company or any of its subsidiaries, board members, officers, employees or

agents as to or in relation to the accuracy or completeness of the information contained in this press release or any other written or

oral information made available to any interested party or its advisers.

FINANCIAL HIGHLIGHTS

| TRY million | |

Q123 | | |

Q124 | | |

y/y% | |

| Revenue | |

| 27,569 | | |

| 30,822 | | |

| 11.8 | % |

| EBITDA1 | |

| 10,354 | | |

| 12,754 | | |

| 23.2 | % |

| EBITDA Margin (%) | |

| 37.6 | % | |

| 41.4 | % | |

| 3.8 | pp |

| EBIT2 | |

| 2,533 | | |

| 3,522 | | |

| 39.0 | % |

| EBIT Margin (%) | |

| 9.2 | % | |

| 11.4 | % | |

| 2.2 | pp |

| Net Income / (Loss) | |

| (269 | ) | |

| 2,635 | | |

| n.m | |

FIRST

QUARTER HIGHLIGHTS

| · | Financial performance accelerated on solid

results: |

| o | Group

revenues up 11.8% year-on-year supported mainly by strong ARPU growth and the larger postpaid

subscriber base of Turkcell Türkiye as well as the contribution of the techfin business,

and digital services & solutions |

| o | EBITDA

up 23.2%, leading to an EBITDA margin of 41.4%; EBIT up 39.0%, resulting in an EBIT margin

of 11.4% |

| o | Net

income was TRY2.6 billion |

| o | Net

leverage3 level at 0.6x; net long FX position of US$158 million |

| · | Solid operational momentum: |

| o | Turkcell

Türkiye subscriber base4 up by 333 thousand net additions |

| o | 472

thousand mobile postpaid net additions |

| o | 50

thousand fixed subscriber net additions; 48 thousand fiber net additions |

| o | 44

thousand new fiber homepasses |

| o | Mobile

ARPU5 growth of 17.1%; residential fiber ARPU growth of 13.7% |

| · | We

have upgraded our revenue growth guidance6 for 2024. Accordingly, we now target

low-double-digit revenue growth rather than high single digit growth. We maintain our EBITDA

margin target of around 42%, and operational capex over sales ratio7 guidance

at around 23% |

| · | General Assembly meeting held on May 2nd: |

| o | TRY6.3

billion dividend distribution was approved; the payment will be made on December 5th |

(1) EBITDA is a non-GAAP financial measure.

See page 14 for the explanation of how we calculate Adjusted EBITDA and its reconciliation to net income.

(2) EBIT is a non-GAAP financial measure

and is equal to EBITDA minus depreciation and amortization expenses.

(3) Starting from Q421, we have revised

the definition of our net debt calculation to include "financial assets” reported under current and non-current assets. Required

reserves held in CBRT balances are also considered in net debt calculation. We believe that these assets are highly

liquid and can be easily converted to cash without significant change in value.

(4) Including mobile, fixed broadband, IPTV,

and wholesale (MVNO&FVNO) subscribers

(5) Excluding M2M

(6) The guidance for the year 2024 includes

the effects of implementing inflation accounting in accordance with IAS 29. Our 2024 guidance has been established using a certain number

of assumptions regarding factors beyond our control, including in relation to macroeconomic indicators such as expected inflation levels.

In particular, our 2024 guidance is based on an assumed annual inflation rate of 37%, applied on a monthly basis. Please note that this

paragraph contains forward-looking statements based on our current estimates and expectations regarding market conditions for each of

our different businesses. No assurance can be given that actual results will be consistent with such estimates and expectations. For

a discussion of factors that may affect our results, see our Annual Report on Form 20-F for 2023 filed with the U.S. Securities

and Exchange Commission, and in particular, the risk factor section therein.

(7) Excluding license fee

For further

details, please refer to our consolidated financial statements and notes as at March 31, 2024 via our website in the Investor

Relations section (www.turkcell.com.tr).

COMMENTS BY CEO, ALİ TAHA

KOÇ, PhD

We are delighted to celebrate our 30th

anniversary as the pioneer of Türkiye's digital transformation. As Turkcell, we have introduced numerous innovations in the industry.

Today, we are entering an era wherein we will solidify our leadership of Türkiye's digital transformation by focusing on our technological

capabilities and bringing global technological advancements to our country. Moreover, we are proud to enter our 30th

year with strong financial and operational results.

A strong start to 2024

Although the first quarter of 2024 was impacted

by economic and geopolitical uncertainties, it was a period where hopes for macroeconomic normalization began to increase. Domestically,

the Central Bank of the Republic of Türkiye's controlled interest rate hikes were monitored amid reaccelerated inflation, while

global attention was on the Fed's cautious approach to interest rate cuts.

In the first quarter of the year, we achieved

strong growth by enlarging our subscriber base with our value-oriented postpaid and fiber subscribers, along with the support of our

digital services and techfin business. Our ongoing inflationary pricing policy has significantly contributed to strengthening our company's

financial performance. Our group revenues increased by 11.8% yearly to TRY 30.8 billion, while EBITDA1 rose by 23.2% to TRY

12.8 billion. The EBITDA margin reached 41.4%, improving 3.8 percentage points. We delivered a TRY 2.6 billion net profit for the quarter.

Our operational performance started the year

strong, led by the mobile segment. We gained 229 thousand net mobile subscribers in the first quarter. While our postpaid subscriber

base posted an increase of net 472 thousand in this quarter, our net addition for the past twelve months surpassed 1.7 million subscribers.

Other sector players also made the price adjustments we made during this period. While aggressive offers from competitors were less observed

this quarter, the Mobile Number Portability (MNP) market volume also contracted compared to the previous quarter. Thanks to the increasing

contribution of sequential price adjustments, the postpaid subscriber base, which expanded to 72%, and our ability to upsell our customers,

our Mobile ARPU2 rose 17.1%. We continued to offer innovative and comprehensive tariffs to our customers. In line with this,

we are now offering the “Smart Control Service” for free, as an example of our strategy based on always being there for our

customers. This service automatically suspends usage when customers reach their package limits, ensuring no additional charges on customers

bills. Despite price adjustments, thanks to these initiatives, our mobile subscriber churn rate reached its lowest level in the past

6 years, at 1.5%.

We maintained our focus on fiber subscribers

in the fixed broadband segment. With demand for high-speed and quality fiber services remaining strong, we gained a net of 48 thousand

fiber subscribers, pushing our fiber subscriber base beyond 2.3 million. Our strategy of shifting customers to 12-month contracts contributed

to limiting the delaying effect of inflation on our growth performance. Thanks to this strategy, the share of 12-month contracted subscribers

in residential fiber base reached 74%. In this quarter, fiber ARPU rose 13.7% yearly. While our total fixed subscriber base surpassed

3.1 million, this quarter's fixed subscriber churn rate reached its lowest level since 2007, at 1.3%.

Digital services continue to drive our financial

performance

The growth of our digital services continues

to support our group revenues. Revenues from the stand-alone paid users of our digital services grew by 32% to TRY 1.6 billion. The number

of stand-alone paid users3 utilizing our digital services amounted to 5.5 million.

Digital Business Services provide cloud-based

software services enabling automation in business processes, end-to-end digitalization, data center services, and next-generation technologies

such as the Internet of Things to our corporate customers. The revenue generated by these services amounted to TRY 2.8 billion this quarter.

The revenues from our cloud services, where we provide value-added services and operate four next-generation data centers with a total

IT capacity of 54 MWs, recorded growth of 48%, reaching TRY 470 million.

Our Techfin segment, with the contributions of

our subsidiaries Financell4 and Paycell, significantly contributed to the group's growth in the first quarter. Financell,

with 1.1 million active customers, reached a loan portfolio of TRY 6.1 billion, and with rising interest rates, its revenues rose 53.5%

yearly. On the other hand, Paycell's revenues, which offer fast and secure payment solutions, increased by 33.2% year-on-year, while

its users5 reached 7.8 million.

We pioneer innovation, social responsibility,

and sustainability

By carrying the 'Turkcell and Technology' focus

to the international domain, we participated in the 'Sustainable Digital Transformation' panel at the GSMA Mobile World Congress in Barcelona.

As Turkcell, we emphasized that we make our operations sustainable and develop products, services, and project solutions that add value

to the economy. Moreover, by opening Call Center and Training Center in Hatay, where Hatay is the most affected city by the February 2023

earthquake, we strengthened our commitment to social responsibility while providing new job opportunities for the region's youth, creating

long-term support with sustainable impact.

As Türkiye's leading technology integrator,

we hold data, energy, artificial intelligence, and cybersecurity in sharp relief. In a digital world, we consider data generated by people

and objects the most valuable raw material. In this context, as Türkiye's largest data center operator, I emphasize our company's

superior position in the industry.

Our Board of Directors TRY 6.3 billion dividend

proposal was approved at the Annual General Assembly meeting of May 2, 2024. We will continue to work with dedication to sustain

our successful financial and operational results while maintaining our robust balance sheet.

We revise our guidance upwards

Considering our first quarter performance, we

revise our guidance6 upwards. We expect low-double-digit growth of Group revenues in real terms in 2024. We maintain our EBITDA

margin expectation of approximately 42% and our operational capex to sales ratio7 target of around 23%.

As we celebrate our company's 30th

anniversary with joy and pride, we confidently advance towards making Turkcell the leader of Türkiye's Digital Century. We will

continue to leverage the opportunities provided by technology to build on our sustainable successes and add value to our country.

(1) EBITDA is a non-GAAP financial measure.

See page 16 for the explanation of how we calculate Adjusted EBITDA and its reconciliation to net income

(2) Excluding M2M

(3) Including IPTV, OTT TV, fizy, lifebox

and GAME+

(4) Following the change in organizational

structure, the revenues of Turkcell Sigorta Aracılık Hizmetleri A.Ş. (Insurance Agency), which was previously managed

under Financell, have are now classified as "Other" in the Techfin segment as of the first quarter of 2023.

(5) 3-month active user

(6) The guidance for the year 2024 includes

the effects of implementing inflation accounting in accordance with IAS 29. Our 2024 guidance has been established using a certain number

of assumptions regarding factors beyond our control, including in relation to macroeconomic indicators such as expected inflation levels.

In particular, our 2024 guidance is based on an assumed annual inflation rate of 37%, applied on a monthly basis. Please note that this

paragraph contains forward-looking statements based on our current estimates and expectations regarding market conditions for each of

our different businesses. No assurance can be given that actual results will be consistent with such estimates and expectations. For

a discussion of factors that may affect our results, see our Annual Report on Form 20-F for 2023 filed with the U.S. Securities

and Exchange Commission, and in particular, the risk factor section therein.

(7) Excluding license fee

FINANCIAL

AND OPERATIONAL REVIEW

Financial Review of Turkcell Group

| Profit & Loss Statement (million

TRY) | |

Q123 | | |

Q124 | | |

y/y% | |

| Revenue | |

| 27,569.1 | | |

| 30,822.3 | | |

| 11.8 | % |

| Cost

of revenue1 | |

| (14,487.4 | ) | |

| (14,948.1 | ) | |

| 3.2 | % |

| Cost

of revenue1/Revenue | |

| (52.5 | )% | |

| (48.5 | )% | |

| 4.0 | pp |

| Gross

Margin1 | |

| 47.5 | % | |

| 51.5 | % | |

| 4.0 | pp |

| Administrative expenses | |

| (916.1 | ) | |

| (1,161.1 | ) | |

| 26.7 | % |

| Administrative expenses/Revenue | |

| (3.3 | )% | |

| (3.8 | )% | |

| (0.5 | )pp |

| Selling and marketing expenses | |

| (1,450.5 | ) | |

| (1,757.9 | ) | |

| 21.2 | % |

| Selling and marketing expenses/Revenue | |

| (5.3 | )% | |

| (5.7 | )% | |

| (0.4 | )pp |

| Net impairment losses on financial and contract assets | |

| (361.2 | ) | |

| (200.9 | ) | |

| (44.4 | )% |

| EBITDA2 | |

| 10,353.9 | | |

| 12,754.3 | | |

| 23.2 | % |

| EBITDA Margin | |

| 37.6 | % | |

| 41.4 | % | |

| 3.8 | pp |

| Depreciation and amortization | |

| (7,820.4 | ) | |

| (9,231.9 | ) | |

| 18.0 | % |

| EBIT3 | |

| 2,533.5 | | |

| 3,522.4 | | |

| 39.0 | % |

| EBIT Margin | |

| 9.2 | % | |

| 11.4 | % | |

| 2.2 | pp |

| Net finance income / (costs) | |

| (872.0 | ) | |

| 160.8 | | |

| n.m | |

| Finance income | |

| 1,456.2 | | |

| 5,477.3 | | |

| 276.1 | % |

| Finance costs | |

| (1,885.5 | ) | |

| (7,964.1 | ) | |

| 322.4 | % |

| Monetary gain / (loss) | |

| (442.8 | ) | |

| 2,647.6 | | |

| n.m | |

| Other income / (expenses) | |

| (232.8 | ) | |

| (218.4 | ) | |

| (6.2 | )% |

| Non-controlling interests | |

| 0.3 | | |

| 5.4 | | |

| n.m | |

| Share of profit of equity accounted investees | |

| 94.0 | | |

| (55.9 | ) | |

| (159.5 | )% |

| Income tax expense | |

| (2,319.1 | ) | |

| (1,320.4 | ) | |

| (43.1 | )% |

| Profit /(loss) from discontinued operations | |

| 526.8 | | |

| 540.6 | | |

| 2.6 | % |

| Net Income | |

| (269.4 | ) | |

| 2,634.6 | | |

| n.m | |

(1) Excluding depreciation and amortization

expenses.

(2) EBITDA is a non-GAAP financial measure.

See page 14 for the explanation of how we calculate Adjusted EBITDA and its reconciliation to net income.

(3) EBIT is a non-GAAP financial measure

and is equal to EBITDA minus depreciation and amortization expenses.

Revenue

of the Group grew by 11.8% year-on-year in Q124. This resulted mainly from expanding postpaid subscribers of Turkcell Türkiye

and price adjustments. Additionally, our digital services & solutions, and techfin business made contributions to overall

revenue growth.

Turkcell Türkiye revenues, comprising 86%

of Group revenues, grew 13.1% to TRY26,516 million (TRY23,455 million).

| - | Consumer business rose4 by 19.5%,

driven mainly by strong postpaid subscriber net additions, rising fiber subscriber base,

price adjustments, and upsell efforts. |

| - | Corporate revenues4 decreased by

1.4% mainly due to fewer large-budget projects as compared to the prior period. |

| - | Standalone digital services revenues from consumer

and corporate segments grew 32.3% driven mainly by an expanding standalone paid user base

compared with the first quarter of 2023, and price adjustments. |

| - | Wholesale revenues decreased 6.1% to TRY1,450

million (TRY1,544 million). |

(4) Following the change in the organizational

structure, the revenues from sole proprietorship subscribers that we define as Merchant, which were previously managed under the Corporate

segment, are being reported under the Consumer segment as of and from the third quarter of 2023. Within this scope, past data has been

revised for comparative purposes.

Turkcell International revenues1, comprising 3% of Group

revenues, increased 2.3% to TRY815 million (TRY797 million).

Techfin segment revenues, comprising 5% of Group

revenues, increased 43.7% to TRY1,513 million (TRY1,053 million). This was driven by 53.5% growth in Financell revenues and 33.2% rise

in Paycell revenues. Please refer to the Techfin section for details.

Other subsidiaries’ revenues, at 6% of

Group revenues, including mainly consumer electronics sales revenues, and non-group energy business revenues, decreased 12.6% to TRY1,979

million (TRY2,263 million).

Cost of revenue (excluding depreciation

and amortization) decreased to 48.5% (52.5%) as a percentage of revenues at the end of the first quarter. This was driven mainly by the

decline in the cost of goods sold (2.9pp), energy cost (1.8pp), and interconnection cost (1.2pp) despite the increase in funding cost

(1.3pp) and personnel expenses (0.6pp) as a percentage of revenues.

Administrative expenses increased to 3.8%

(3.3%) as a percentage of revenues in Q124. This was led by higher personnel expenses.

Selling and marketing expenses increased

to 5.7% (5.3%) as a percentage of revenues in Q124. This was driven by the increase in marketing expenses (0.3pp), and personnel expenses

(0.2pp) despite the decline in selling expenses (0.1pp) as a percentage of revenues.

Net

impairment losses on financial and contract assets was at 0.7% (1.3%) as a percentage of revenues in Q124.

EBITDA2 rose by 23.2% year-on-year

in Q124 leading to an EBITDA margin of 41.4% with a 3.8pp improvement (37.6%).

| - | Turkcell Türkiye’s EBITDA rose 24.4%

to TRY12,027 million (TRY9,671 million) leading to an EBITDA margin of 45.4% (41.2%). |

| - | Turkcell International (excl. Ukraine operations)

EBITDA increased 16.2% to TRY297 million (TRY256 million) driving an EBITDA margin of 36.5%

(32.1%). |

| - | Techfin segment EBITDA declined 17.0% to TRY345

million (TRY416 million) with an EBITDA margin of 22.8% (39.5%). The key factor behind the

year-on-year decline in EBITDA margin was the rise in funding cost for Financell compared

with the first quarter of 2023. |

| - | The EBITDA of other subsidiaries was TRY84

million (TRY11 million) in Q124. |

Depreciation and amortization expenses

increased 18.0% year-on-year in Q124.

Net

finance income of TRY160.8 million (negative TRY872 million) was recorded for Q124, including TRY2.6 billion monetary gain

and net FX losses of TRY2.3 billion.

See Appendix A for details of net foreign exchange

gain and loss.

Other expenses decreased to TRY218 million

(TRY232 million) in Q124.

Income

tax expense increased to TRY1,320 million (TRY2,319 million) due

mainly to a lower corporate and deferred tax expense compared to the previous year.

Profit /(loss) from discontinued operations

of TRY541 million (TRY527 million) was recorded in Q124.

Net

income of the Group was TRY2.6 billion (negative TRY269 million) in Q124. This result was mainly due to significant contributions

from monetary gains and strong performance at the EBITDA level.

Total

cash & debt: Consolidated cash as of March 31, 2024, decreased to TRY48,779 million compared to TRY57,507 million

as of December 31, 2023. Please recall that the second installment of the earthquake donation, eurobond purchasing, personnel bonus

payment, and wireless fee tax were paid in this quarter. Excluding FX swap transactions, 49% of our cash is in US$, 24% in EUR, 1% BYN,

and 25% in TRY.

(1) As of December 31, 2023, our Lifecell,

UkrTower, and Global LLC operations in Ukraine have been classified as a disposal group held for sale and as a discontinued operation.

Therefore, this segment does not include revenues from those.

(2) EBITDA is a non-GAAP financial measure.

See page 14 for the explanation of how we calculate adjusted EBITDA and its reconciliation to net income.

Consolidated debt as of March 31, 2024,

increased to TRY98,050 million from TRY96,750 million as of December 31, 2023 due mainly to the impact of currency movements. Please

note that TRY3,197 million of our consolidated debt is comprised of lease obligations. Please note that 43% of our consolidated debt

is in US$, 33% in EUR, 3% in CNY, and 21% in TRY.

Net debt1 as of March 31, 2024,

increased to TRY33,441 million from TRY27,389 million as of December 31, 2023 with a net debt to EBITDA ratio of 0.6x times.

Turkcell Group had a long FX position of US$158

million at the end of the quarter (Please note that this figure takes hedging portfolio and advance payments into account). The long

FX position of US$158 million is in line with our FX neutral definition, which is between -US$200 million and +US$200 million.

Capital

expenditures: Capital expenditures, including non-operational items, were at TRY7,508 million in Q124.

Operational capital expenditures (excluding license

fees) at the Group level were at 18.2% of total revenues in Q124.

| Capital expenditures (million TRY) | |

Q1232 | | |

Q1243 | |

| Operational Capex | |

| 6,000.0 | | |

| 5,596.7 | |

| License and Related Costs | |

| - | | |

| - | |

| Non-operational Capex (Including

IFRS15& IFRS16) | |

| 2,360.0 | | |

| 1,911.3 | |

| Total Capex | |

| 8,360.0 | | |

| 7,508.0 | |

(1) Starting

from Q421, we have revised the definition of our net debt calculation to include "financial assets” reported under current

and non-current assets. Required reserves held in CBRT balances are also considered in net debt calculation. We believe

that these assets are highly liquid and can be easily converted to cash without significant change in value.

(2) Including Ukraine operations

(3) Excluding Ukraine operations

Operational Review of Turkcell Türkiye

| Summary of Operational

Data | |

Q123 | | |

Q423 | | |

Q124 | | |

y/y

% | | |

q/q% | |

| Number

of subscribers1 (million) | |

| 41.7 | | |

| 42.5 | | |

| 42.8 | | |

| 2.6 | % | |

| 0.7 | % |

| Mobile Postpaid (million) | |

| 25.9 | | |

| 27.2 | | |

| 27.6 | | |

| 6.6 | % | |

| 1.5 | % |

| Mobile M2M (million) | |

| 4.1 | | |

| 4.5 | | |

| 4.6 | | |

| 12.2 | % | |

| 2.2 | % |

| Mobile Prepaid (million) | |

| 11.6 | | |

| 10.8 | | |

| 10.6 | | |

| (8.6 | )% | |

| (1.9 | )% |

| Fiber (thousand) | |

| 2,159.7 | | |

| 2,291.0 | | |

| 2,338.6 | | |

| 8.3 | % | |

| 2.1 | % |

| ADSL (thousand) | |

| 759.0 | | |

| 760.7 | | |

| 762.3 | | |

| 0.4 | % | |

| 0.2 | % |

| Superbox

(thousand)2 | |

| 676.5 | | |

| 719.9 | | |

| 737.6 | | |

| 9.0 | % | |

| 2.5 | % |

| Cable (thousand) | |

| 42.4 | | |

| 38.5 | | |

| 39.2 | | |

| (7.5 | )% | |

| 1.8 | % |

| IPTV (thousand) | |

| 1,309.3 | | |

| 1,409.2 | | |

| 1,450.1 | | |

| 10.8 | % | |

| 2.9 | % |

| Churn

(%)3 | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mobile Churn (%) | |

| 1.7 | % | |

| 2.4 | % | |

| 1.5 | % | |

| (0.2 | )pp | |

| (0.9 | )pp |

| Fixed Churn (%) | |

| 1.5 | % | |

| 1.6 | % | |

| 1.3 | % | |

| (0.2 | )pp | |

| (0.3 | )pp |

| Average mobile data usage per user (GB/user) | |

| 16.2 | | |

| 17.4 | | |

| 17.8 | | |

| 9.9 | % | |

| 2.3 | % |

| (1) | Including mobile, fixed

broadband, IPTV, and wholesale (MVNO&FVNO) subscribers |

| (2) | Superbox subscribers

are included in mobile subscribers. |

| (3) | Churn figures represent

average monthly churn figures for the respective years. |

| ARPU (Average Monthly Revenue per User)

(TRY) | |

Q123 | | |

Q124 | | |

y/y

% | |

| Mobile ARPU, blended | |

| 156.0 | | |

| 180.2 | | |

| 15.5 | % |

| Mobile ARPU, blended (excluding M2M) | |

| 173.4 | | |

| 203.1 | | |

| 17.1 | % |

| Postpaid | |

| 185.5 | | |

| 208.0 | | |

| 12.1 | % |

| Postpaid (excluding M2M) | |

| 218.0 | | |

| 247.0 | | |

| 13.3 | % |

| Prepaid | |

| 91.6 | | |

| 109.3 | | |

| 19.3 | % |

| Fixed Residential ARPU, blended | |

| 202.3 | | |

| 228.9 | | |

| 13.1 | % |

| Residential Fiber

ARPU | |

| 203.9 | | |

| 231.9 | | |

| 13.7 | % |

Turkcell Türkiye's customer base continued

to expand, reaching 42.8 million with a net quarterly addition of 333 thousand, driven by strong postpaid subscriber net addition performance

in the first quarter of the year. This strong performance led us to achieve a total of 1.7 million postpaid net additions in the last

12 months.

On the mobile front, our subscriber base expanded

to 38.2 million on 229 thousand net additions in Q124. This was driven by 472 thousand net additions from the postpaid subscriber base,

which reached 72.3% (69.1%) of total mobile subscribers. We experienced a net decline of 243 thousand in our prepaid subscriber base

quarter-on-quarter, due mainly to the disconnection of 319 thousand prepaid customers in Q124 in accordance with the ICTA regulation.

The market was not overly aggressive compared to previous quarters, but there have been aggressive campaigns by competitors during some

periods of the first quarter. Accordingly, our mobile ARPU (excluding M2M) rose by 17.1% year-on-year thanks to price adjustments, a

larger postpaid subscriber base, and upsell performance in Q124. The average monthly mobile churn rate decreased to 1.5% in Q124, the

lowest level since 2018.

On the fixed front, our subscriber base reached

3.1 million on 50 thousand quarterly net additions. Our fiber subscriber base expanded by 48 thousand quarterly and 179 thousand annual

net additions. Meanwhile, IPTV customers reached to 1.5 million on 41 thousand quarterly and 141 thousand annual net additions.

The average monthly fixed churn rate at 1.3% in Q124 which is the lowest level since 2007. Our residential fiber ARPU growth was 13.7%

year-on-year, mainly on the back of 12-month commitment structure, price adjustments, and efforts to higher tariffs, as well as higher

IPTV pricing.

Average monthly mobile data usage per user rose

9.9% year-on-year to 17.8 GB, with the increasing number and data consumption of 4.5G users in Q124. Accordingly, the average mobile

data usage of 4.5G users reached 18.8 GB in Q124. Total smartphone penetration on our network was at 90% at the end of the quarter. 95%

of those smartphones were 4.5G compatible.

TURKCELL INTERNATIONAL

| BeST1 | |

Q123 | | |

Q124 | | |

y/y% | |

| Number of subscribers (million) | |

| 1.5 | | |

| 1.5 | | |

| - | |

| Active (3 months) | |

| 1.1 | | |

| 1.2 | | |

| 9.1 | % |

| Revenue (million BYN) | |

| 39.3 | | |

| 48.8 | | |

| 24.2 | % |

| EBITDA (million BYN) | |

| 18.2 | | |

| 24.2 | | |

| 33.0 | % |

| EBITDA margin (%) | |

| 46.3 | % | |

| 49.5 | % | |

| 3.2 | pp |

| Net loss (million BYN) | |

| (9.2 | ) | |

| (5.0 | ) | |

| (45.7 | )% |

| Capex (million BYN) | |

| 18.8 | | |

| 25.4 | | |

| 35.1 | % |

| Revenue (million TRY) | |

| 453.9 | | |

| 467.6 | | |

| 3.0 | % |

| EBITDA (million TRY) | |

| 210.0 | | |

| 231.7 | | |

| 10.3 | % |

| EBITDA margin (%) | |

| 46.3 | % | |

| 49.5 | % | |

| 3.2 | pp |

| Net loss (million TRY) | |

| (105.8 | ) | |

| (47.1 | ) | |

| (55.5 | )% |

(1) BeST, in which we hold a 100% stake,

has operated in Belarus since July 2008.

BeST revenues increased 24.2% year-on-year

in local currency terms mainly due to the data and outgoing voice revenues in Q124. BeST registered an EBITDA of BYN24.2 million in the

first quarter, which led to an EBITDA margin increased to 49.5%. BeST’s revenues in TRY terms increased 3.0% year-on-year in Q124.

BeST continued to offer LTE services to all six

regions, encompassing 4.3 thousand sites in Q124. Enhanced LTE coverage has enabled BeST to expand its 4G subscriber base. Accordingly,

4G users reached 83% of the 3-month active subscriber base, which continued to support mobile data consumption and digital services usage.

Additionally, the average monthly data usage among 4G subscribers increased 11% year-on-year, reaching 20.4 GB in Q124.

| Kuzey

Kıbrıs Turkcell2 (million TRY) | |

Q123 | | |

Q124 | | |

y/y% | |

| Number of subscribers (million) | |

| 0.6 | | |

| 0.6 | | |

| - | |

| Revenue | |

| 281.6 | | |

| 300.6 | | |

| 6.7 | % |

| EBITDA | |

| 91.7 | | |

| 81.5 | | |

| (11.1 | )% |

| EBITDA margin (%) | |

| 32.6 | % | |

| 27.1 | % | |

| (5.5 | )pp |

| Net income | |

| 361.5 | | |

| 473.2 | | |

| 30.9 | % |

(2) Kuzey Kıbrıs Turkcell,

in which we hold a 100% stake, has operated in Northern Cyprus since 1999.

Kuzey

Kıbrıs Turkcell revenues rose 6.7% year-on-year in Q124, driven by mobile segment revenues backed by increased

ARPU. In Q124, the EBITDA of Kuzey Kıbrıs Turkcell decreased by

11.1%, leading to an EBITDA margin of 27.1%. The EBITDA was negatively affected by personnel expenses.

TECHFIN

| Paycell Financial Data (million TRY) | |

Q123 | | |

Q124 | | |

y/y% | |

| Revenue | |

| 511.1 | | |

| 681.0 | | |

| 33.2 | % |

| EBITDA | |

| 215.9 | | |

| 318.2 | | |

| 47.4 | % |

| EBITDA Margin (%) | |

| 42.2 | % | |

| 46.7 | % | |

| 4.5 | pp |

| Net Income / (Loss) | |

| (71.7 | ) | |

| 74.0 | | |

| n.m | |

Paycell’s revenue rose by 33.2% year-on-year

for first quarter of 2024. POS solutions supported topline growth thanks to increase in the commission fee per transaction. Accordingly,

Paycell’s EBITDA increased 47.4% year-on-year leading to an EBITDA margin of 46.7% on a 4.5pp improvement in Q124. The primary

factor behind the rise in EBITDA margin was POS expense growth, which lagged behind the increase in revenue. Additionally, the"Pay

Later" mobile payment service was another key factor of revenue growth for Paycell.

The Pay Later service transaction volume (non-group)

increased by 57% year-on-year to TRY2.2 billion in Q124. This service was utilized by 6.0 million active Pay Later users in Q124. Additionally,

Paycell card transaction volume up by 103% year-on-year to TRY5.8 billion. The overall transaction volume for POS solutions also rose

to TRY7.7 billion, with a yearly increase of 51%. Meanwhile, the total transaction volume across all services increased 55% to TRY20.5

billion year-on-year in Q124.

| Financell1

Financial Data (million TRY) | |

Q123 | | |

Q124 | | |

y/y% | |

| Revenue | |

| 548.4 | | |

| 841.7 | | |

| 53.5 | % |

| EBITDA | |

| 230.5 | | |

| 93.8 | | |

| (59.3 | )% |

| EBITDA Margin (%) | |

| 42.0 | % | |

| 11.1 | % | |

| (30.9 | )pp |

| Net interest margin | |

| 3.7 | % | |

| 1.3 | % | |

| (2.4 | )pp |

| Net loss | |

| (140.4 | ) | |

| (94.3 | ) | |

| (32.8 | )% |

(1) Following the change in the organizational

structure, the revenues of Turkcell Sigorta Aracılık Hizmetleri A.Ş. (Insurance Agency), which was previously managed

under the Financell, has been classified from Financell to "Other" in the Techfin segment as of the first quarter of 2023.

Financell’s revenues rose by 53.5% in Q124.

EBITDA decreased 59.3% yielding an EBITDA margin of 11.1%. The primary reason for the decline in EBITDA margin compared to the previous

year was the increase in funding costs.

Financell’s loan portfolio was at TRY6.1

billion in the first quarter of the year. Financell has provided loans to about 30 thousand corporate customers. Financell’s cost

of risk was at 1.7% at the end of the Q1. Financell continued to offer innovative solutions including green loans for solar projects,

car loans, and shopping loans for both individual and corporate customers.

Turkcell Group Subscribers

Turkcell Group registered subscribers amounted

to approximately 56.2 million as of March 31, 2024. This figure is calculated by taking the number of subscribers of Turkcell Türkiye,

and of each of our subsidiaries. It includes the total number of mobile, fiber, ADSL, cable and IPTV subscribers of Turkcell Türkiye,

and the mobile subscribers of lifecell*, BeST, and Kuzey Kıbrıs Turkcell.

| Turkcell Group Subscribers | |

Q123 | | |

Q124 | | |

y/y% | |

| Turkcell

Türkiye subscribers1 (million) | |

| 41.7 | | |

| 42.8 | | |

| 2.6 | % |

| BeST (Belarus) | |

| 1.5 | | |

| 1.5 | | |

| - | |

| Kuzey Kıbrıs Turkcell | |

| 0.6 | | |

| 0.6 | | |

| - | |

| Discontinued operations – lifecell (Ukraine) | |

| 10.8 | | |

| 11.3 | | |

| 4.6 | % |

| Turkcell Group Subscribers (million) | |

| 54.6 | | |

| 56.2 | | |

| 2.9 | % |

(1) Subscribers to more than one service

are counted separately for each service. Including mobile, fixed broadband, IPTV, and wholesale (MVNO&FVNO) subscribers

*Discontinued operations

DISCONTINUED OPERATIONS – lifecell (Ukraine)

Standalone

| lifecell1

Financial Data | |

Q123 | | |

Q124 | | |

y/y% | |

| Revenue (million UAH) | |

| 2,687.4 | | |

| 3,120.5 | | |

| 16.1 | % |

| EBITDA (million UAH) | |

| 1,605.0 | | |

| 1,696.7 | | |

| 5.7 | % |

| EBITDA margin (%) | |

| 59.7 | % | |

| 54.4 | % | |

| (5.3 | )pp |

| Net income (million UAH) | |

| 515.6 | | |

| 582.7 | | |

| 13.0 | % |

| Capex (million UAH) | |

| 638.0 | | |

| 1,008.2 | | |

| 58.0 | % |

| Revenue (million TRY) | |

| 2,335.7 | | |

| 2,510.6 | | |

| 7.5 | % |

| EBITDA (million TRY) | |

| 1,395.0 | | |

| 1,365.1 | | |

| (2.1 | )% |

| EBITDA margin (%) | |

| 59.7 | % | |

| 54.4 | % | |

| (5.3 | )pp |

| Net income (million TRY) | |

| 448.5 | | |

| 468.8 | | |

| 4.5 | % |

(1) Since July 10,

2015, we hold a 100% stake in lifecell. A share transfer agreement was signed on December 29, 2023 for the transfer of all shares,

along with all rights and debts of Lifecell LLC. Discontinued operations in Ukraine include Lifecell LLC, LLC Global Bilgi, and LLC Ukrtower.

The sale of the Ukrainian assets remains subject to the completion of closing conditions. The table presents the financial figures of

Lifecell LLC only.

lifecell (Ukraine) revenues in local currency

terms increased 16.1%, while its EBITDA rose 5.7% resulting in an EBITDA margin of 54.4% in Q124.

In TRY terms, lifecell’s revenue increased

by 7.5% in the first quarter of the year. Net income was up 4.5% to TRY469 million in Q124.

OVERVIEW

OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial

reporting, along with certain macroeconomic indicators, are set out below.

| | |

Q123 | | |

Q423 | | |

Q124 | | |

y/y% | | |

q/q% | |

| GDP Growth (Türkiye) | |

| 4.0 | % | |

| 4.0 | % | |

| n.a | | |

| n.a | | |

| n.a | |

| Consumer Price Index (Türkiye)(yoy) | |

| 50.5 | % | |

| 64.8 | % | |

| 68.5 | % | |

| 18.0 | pp | |

| 3.7 | pp |

| US$ / TRY rate | |

| | | |

| | | |

| | | |

| | | |

| | |

| Closing Rate | |

| 19.1460 | | |

| 29.4382 | | |

| 32.2854 | | |

| 68.6 | % | |

| 9.7 | % |

| Average Rate | |

| 18.8577 | | |

| 28.4905 | | |

| 30.7624 | | |

| 63.1 | % | |

| 8.0 | % |

| EUR / TRY rate | |

| | | |

| | | |

| | | |

| | | |

| | |

| Closing Rate | |

| 20.8021 | | |

| 32.5739 | | |

| 34.8023 | | |

| 67.3 | % | |

| 6.8 | % |

| Average Rate | |

| 20.2424 | | |

| 30.7734 | | |

| 33.3856 | | |

| 64.9 | % | |

| 8.5 | % |

| US$ / UAH rate | |

| | | |

| | | |

| | | |

| | | |

| | |

| Closing Rate | |

| 36.5686 | | |

| 37.9824 | | |

| 39.2214 | | |

| 7.3 | % | |

| 3.3 | % |

| Average Rate | |

| 36.5686 | | |

| 36.6722 | | |

| 38.2281 | | |

| 4.5 | % | |

| 4.2 | % |

| US$ / BYN rate | |

| | | |

| | | |

| | | |

| | | |

| | |

| Closing Rate | |

| 2.8571 | | |

| 3.1775 | | |

| 3.2498 | | |

| 13.7 | % | |

| 2.3 | % |

| Average Rate | |

| 2.7505 | | |

| 3.1809 | | |

| 3.2100 | | |

| 16.7 | % | |

| 0.9 | % |

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS:

We believe Adjusted EBITDA, among other measures, facilitates performance comparisons from period to period and management decision

making. It also facilitates performance comparisons from company to company. Adjusted EBITDA as a performance measure eliminates potential

differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact of changes in

effective tax rates on periods or companies) and the age and book depreciation of tangible and intangible assets (affecting relative

depreciation expense and amortization expense). We also present Adjusted EBITDA because we believe it is frequently used by securities

analysts, investors and other interested parties in evaluating the performance of other mobile operators in the telecommunications industry

in Europe, many of which present Adjusted EBITDA when reporting their results.

Our Adjusted EBITDA definition includes Revenue,

Cost of Revenue excluding depreciation and amortization, Selling and Marketing expenses, Administrative expenses and Net impairment losses

on financial and contract assets, but excludes finance income and expense, other operating income and expense, investment activity income

and expense, share of profit of equity accounted investees and minority interest.

Nevertheless, Adjusted EBITDA has limitations

as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of our results of operations,

as reported under IFRS. The following table provides a reconciliation of Adjusted EBITDA, as calculated using financial data prepared

in accordance with IFRS to net profit, which we believe is the most directly comparable financial measure calculated and presented in

accordance with IFRS.

| Turkcell Group (million TRY) | |

Q123 | | |

Q124 | | |

y/y% | |

| Consolidated profit before minority interest | |

| (269.7 | ) | |

| 2,629.1 | | |

| n.m | |

| Profit /(loss) from discontinued operations | |

| 526.8 | | |

| 540.6 | | |

| 2.6 | % |

| Income tax expense | |

| (2,319.1 | ) | |

| (1,320.4 | ) | |

| (43.1 | )% |

| Consolidated profit before income tax & minority

interest | |

| 1,522.7 | | |

| 3,408.9 | | |

| 123.9 | % |

| Share of profit of equity accounted investees | |

| 94.0 | | |

| (55.9 | ) | |

| (159.5 | )% |

| Finance income | |

| 1,456.2 | | |

| 5,477.3 | | |

| 276.1 | % |

| Finance costs | |

| (1,885.5 | ) | |

| (7,964.1 | ) | |

| 322.4 | % |

| Monetary gain / (loss) | |

| (442.8 | ) | |

| 2,647.6 | | |

| n.m | |

| Other income / (expenses) | |

| (232.8 | ) | |

| (218.4 | ) | |

| (6.2 | )% |

| EBIT | |

| 2,533.5 | | |

| 3,522.4 | | |

| 39.0 | % |

| Depreciation and amortization | |

| 7,820.4 | | |

| 9,231.9 | | |

| 18.0 | % |

| Adjusted EBITDA | |

| 10,353.9 | | |

| 12,754.3 | | |

| 23.2 | % |

RECONCILIATION OF ARPU: ARPU is an

operational measurement tool and the methodology for calculating performance measures such as ARPU varies substantially among operators

and is not standardized across the telecommunications industry, and reported performance measures thus vary from those that may result

from the use of a single methodology. Management believes this measure is helpful in assessing the development of our services over time.

The following table shows the reconciliation of Turkcell Türkiye revenues to such revenues included in the ARPU calculations for

Q1 2023 and Q1 2024.

| Reconciliation of ARPU | |

Q123 | | |

Q124 | |

| Turkcell Türkiye Revenue (million TRY) | |

| 23,455.1 | | |

| 26,515.8 | |

| Telecommunication services revenue | |

| 21,791.0 | | |

| 25,153.8 | |

| Equipment revenue | |

| 1,314.5 | | |

| 1,012.6 | |

| Other* | |

| 349.6 | | |

| 349.4 | |

| Revenues

which are not attributed to ARPU calculation1 | |

| (3,987.5 | ) | |

| (3,631.4 | ) |

| Turkcell

Türkiye revenues included in ARPU calculation2 | |

| 19,118.0 | | |

| 22,535.0 | |

| Mobile blended ARPU (TRY) | |

| 156.0 | | |

| 180.2 | |

| Average number of mobile subscribers during the year (million) | |

| 37.5 | | |

| 38.1 | |

| Fixed residential ARPU (TRY) | |

| 202.3 | | |

| 228.9 | |

| Average number of fixed residential subscribers

during the year (million) | |

| 2.6 | | |

| 2.8 | |

(1) Revenue from fixed corporate and wholesale

business; digital business sales; tower business, and other non-subscriber-based revenues

(2) Revenues from Turkcell Türkiye included in ARPU calculation

comprise telecommunication services revenue, equipment revenue and revenues which are not attributed to ARPU calculation.

*Including call center revenues

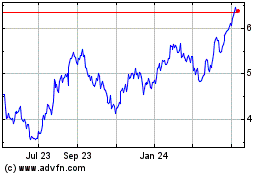

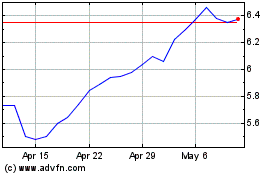

ABOUT TURKCELL: Turkcell is a digital

operator headquartered in Türkiye, serving its customers with its unique portfolio of digital services along with voice, messaging,

data, and IPTV services on its mobile and fixed networks. Turkcell Group companies operate in 4 countries – Türkiye, Belarus,

Northern Cyprus, and Ukraine (discontinued operations) Turkcell launched LTE services in its home country on April 1st,

2016, employing LTE-Advanced and 3 carrier aggregation technologies in 81 cities. Turkcell offers up to 10 Gbps fiber internet speed

with its FTTH services. Turkcell Group reported TRY30.8 billion in revenue in Q124 with total assets of TRY282.3 billion as of March 31,

2024. It has been listed on the NYSE and the BIST since July 2000 and is the only dual-listed company in Türkiye. Read more

at www.turkcell.com.tr.

For further information please contact Turkcell

Investor Relations

Tel: + 90 212 313 1888

investor.relations@turkcell.com.tr |

Corporate Communications:

Tel: + 90 212 313 2321

Turkcell-Kurumsal-Iletisim@turkcell.com.tr |

Appendix

A – Tables

Table: Net foreign exchange gain and loss

details

| Million TRY | |

Q123 | | |

Q124 | | |

y/y% | |

| Net FX loss before hedging | |

| (418.5 | ) | |

| (2,685.1 | ) | |

| 541.6 | % |

| Swap interest income/(expense) | |

| 89.9 | | |

| 184.6 | | |

| 105.3 | % |

| Fair value gain on derivative financial instruments | |

| (203.9 | ) | |

| 193.9 | | |

| n.m | |

| Net FX gain / (loss) after hedging | |

| (532.5 | ) | |

| (2,306.6 | ) | |

| 333.2 | % |

Table: Income tax expense details

| Million TRY | |

Q123 | | |

Q124 | | |

y/y% | |

| Current tax expense | |

| (510.3 | ) | |

| (44.7 | ) | |

| (91.2 | )% |

| Deferred tax income / (expense) | |

| (1,808.8 | ) | |

| (1,275.7 | ) | |

| (29.5 | )% |

| Income tax expense | |

| (2,319.1 | ) | |

| (1,320.4 | ) | |

| (43.1 | )% |

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE-MONTHS INTERIM PERIOD ENDED

31 MARCH 2024

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS INTERIM PERIOD ENDED 31 MARCH 2024

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF

FINANCIAL POSITION AS OF 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Notes | |

31 March 2024 | | |

31 December

2023 | |

| Assets | |

| |

| | | |

| | |

| Property, plant and equipment | |

8 | |

| 76,589,958 | | |

| 76,690,188 | |

| Right-of-use assets | |

10 | |

| 7,654,141 | | |

| 7,060,410 | |

| Intangible assets | |

9 | |

| 66,350,893 | | |

| 67,325,332 | |

| Investment properties | |

| |

| 159,733 | | |

| 163,810 | |

| Trade receivables | |

| |

| 296,973 | | |

| 374,949 | |

| Receivables from financial services | |

| |

| 545,265 | | |

| 682,960 | |

| Contract assets | |

| |

| 107,973 | | |

| 116,538 | |

| Financial assets at fair value through other comprehensive income | |

12 | |

| 4,101,805 | | |

| 121,994 | |

| Financial assets at fair value through profit or loss | |

12 | |

| 772,463 | | |

| 623,058 | |

| Deferred tax assets | |

| |

| 2,007,084 | | |

| 1,298,779 | |

| Investments in equity accounted associate and joint venture | |

20 | |

| 6,697,954 | | |

| 6,753,858 | |

| Other non-current assets | |

| |

| 7,541,662 | | |

| 5,097,744 | |

| Total non-current assets | |

| |

| 172,825,904 | | |

| 166,309,620 | |

| | |

| |

| | | |

| | |

| Inventories | |

| |

| 593,566 | | |

| 621,927 | |

| Trade receivables | |

| |

| 14,178,686 | | |

| 12,571,443 | |

| Due from related parties | |

| |

| 207,673 | | |

| 197,188 | |

| Receivables from financial services | |

| |

| 5,811,066 | | |

| 6,722,146 | |

| Contract assets | |

| |

| 3,570,939 | | |

| 3,672,531 | |

| Derivative financial instruments | |

14 | |

| 2,423,589 | | |

| 2,352,781 | |

| Financial assets at fair value through other comprehensive income | |

12 | |

| 915,837 | | |

| - | |

| Financial assets at fair value through profit or loss | |

12 | |

| 9,362,286 | | |

| 10,205,945 | |

| Cash and cash equivalents | |

11 | |

| 48,778,706 | | |

| 57,507,322 | |

| Other current assets | |

| |

| 4,994,188 | | |

| 4,459,604 | |

| Subtotal | |

| |

| 90,836,536 | | |

| 98,310,887 | |

| Assets held for sale | |

21 | |

| 18,596,150 | | |

| 19,682,519 | |

| Total current assets | |

| |

| 109,432,686 | | |

| 117,993,406 | |

| | |

| |

| | | |

| | |

| Total assets | |

| |

| 282,258,590 | | |

| 284,303,026 | |

The above consolidated statement of financial

position should be read in conjunction with the accompanying notes.

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF

FINANCIAL POSITION AS OF 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Notes | |

31 March

2024 | | |

31 December

2023 | |

| Equity | |

| |

| | | |

| | |

| Share capital | |

| |

| 37,205,301 | | |

| 37,205,301 | |

| Share premium | |

| |

| 8,840 | | |

| 8,840 | |

| Treasury shares | |

| |

| (852,979 | ) | |

| (852,979 | ) |

| Reserves | |

| |

| 6,565,826 | | |

| 6,414,772 | |

| Remeasurements of defined benefit plans | |

| |

| (2,341,184 | ) | |

| (2,355,595 | ) |

| Retained earnings | |

| |

| 102,876,993 | | |

| 100,242,431 | |

| Total equity attributable to equity holders of Turkcell Iletisim Hizmetleri A.S. (“the Company”) | |

| |

| 143,462,797 | | |

| 140,662,770 | |

| Non-controlling interests | |

| |

| (18,392 | ) | |

| (14,905 | ) |

| Total equity | |

| |

| 143,444,405 | | |

| 140,647,865 | |

| | |

| |

| | | |

| | |

| Liabilities | |

| |

| | | |

| | |

| Borrowings | |

13 | |

| 65,177,133 | | |

| 66,675,513 | |

| Trade and other payables | |

| |

| 1,206,009 | | |

| 1,278,012 | |

| Due to related parties | |

| |

| 256 | | |

| 44,112 | |

| Employee benefit obligations | |

| |

| 2,401,018 | | |

| 2,361,479 | |

| Provisions | |

| |

| 1,516,714 | | |

| 1,587,228 | |

| Deferred tax liabilities | |

| |

| 4,294,314 | | |

| 2,630,543 | |

| Contract liabilities | |

| |

| 1,390,263 | | |

| 1,373,474 | |

| Other non-current liabilities | |

| |

| 1,238,677 | | |

| 1,281,197 | |

| Total non-current liabilities | |

| |

| 77,224,384 | | |

| 77,231,558 | |

| | |

| |

| | | |

| | |

| Borrowings | |

13 | |

| 32,872,396 | | |

| 30,074,824 | |

| Current tax liabilities | |

| |

| 242,082 | | |

| 245,516 | |

| Trade and other payables | |

| |

| 18,742,787 | | |

| 23,710,267 | |

| Due to related parties | |

| |

| 479,100 | | |

| 635,668 | |

| Deferred revenue | |

| |

| 415,034 | | |

| 285,361 | |

| Provisions | |

| |

| 909,111 | | |

| 2,273,131 | |

| Contract liabilities | |

| |

| 1,374,499 | | |

| 1,510,232 | |

| Derivative financial instruments | |

14 | |

| 163,941 | | |

| 407,751 | |

| Subtotal | |

| |

| 55,198,950 | | |

| 59,142,750 | |

| Liabilities directly associated with the assets held for sale | |

21 | |

| 6,390,851 | | |

| 7,280,853 | |

| Total current liabilities | |

| |

| 61,589,801 | | |

| 66,423,603 | |

| | |

| |

| | | |

| | |

| Total liabilities | |

| |

| 138,814,185 | | |

| 143,655,161 | |

| | |

| |

| | | |

| | |

| Total equity and liabilities | |

| |

| 282,258,590 | | |

| 284,303,026 | |

The above consolidated statement of financial

position should be read in conjunction with the accompanying notes.

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT

OR LOSS FOR THE THREE MONTHS INTERIM PERIOD ENDED 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Notes | |

31 March

2024 | | |

31 March

2023 | |

| Revenue | |

4 | |

| 29,474,711 | | |

| 26,600,304 | |

| Revenue from financial services | |

4 | |

| 1,347,623 | | |

| 968,814 | |

| Total revenue | |

| |

| 30,822,334 | | |

| 27,569,118 | |

| | |

| |

| | | |

| | |

| Cost of revenue | |

| |

| (23,208,854 | ) | |

| (21,874,211 | ) |

| Cost of revenue from financial services | |

| |

| (971,162 | ) | |

| (433,640 | ) |

| Total cost of revenue | |

| |

| (24,180,016 | ) | |

| (22,307,851 | ) |

| | |

| |

| | | |

| | |

| Gross profit | |

| |

| 6,265,857 | | |

| 4,726,093 | |

| Gross profit from financial services | |

| |

| 376,461 | | |

| 535,174 | |

| Total gross profit | |

| |

| 6,642,318 | | |

| 5,261,267 | |

| | |

| |

| | | |

| | |

| Other income | |

5 | |

| 50,969 | | |

| 104,615 | |

| Selling and marketing expenses | |

| |

| (1,757,911 | ) | |

| (1,450,469 | ) |

| Administrative expenses | |

| |

| (1,161,057 | ) | |

| (916,116 | ) |

| Net impairment losses on financial and contract assets | |

| |

| (200,938 | ) | |

| (361,209 | ) |

| Other expenses | |

5 | |

| (269,353 | ) | |

| (337,408 | ) |

| Operating profit | |

| |

| 3,304,028 | | |

| 2,300,680 | |

| | |

| |

| | | |

| | |

| Finance income | |

6 | |

| 5,477,262 | | |

| 1,456,240 | |

| Finance costs | |

6 | |

| (7,964,100 | ) | |

| (1,885,526 | ) |

| Monetary gain (loss) | |

6 | |

| 2,647,630 | | |

| (442,760 | ) |

| Net finance costs / income | |

| |

| 160,792 | | |

| (872,046 | ) |

| | |

| |

| | | |

| | |

| Share of profit of an associate and a joint venture | |

20 | |

| (55,904 | ) | |

| 94,024 | |

| Profit before income tax from continuing operations | |

21 | |

| 3,408,916 | | |

| 1,522,658 | |

| | |

| |

| | | |

| | |

| Income tax income/ (expense) | |

| |

| (1,320,431 | ) | |

| (2,319,147 | ) |

| Profit for the year from continuing operations | |

| |

| 2,088,485 | | |

| (796,489 | ) |

| | |

| |

| | | |

| | |

| Profit /(loss) from discontinued operations | |

| |

| 540,639 | | |

| 526,829 | |

| | |

| |

| | | |

| | |

| Profit for the year | |

| |

| 2,629,124 | | |

| (269,660 | ) |

| | |

| |

| | | |

| | |

| Profit for the year is attributable to: | |

| |

| | | |

| | |

| Owners of the Company | |

| |

| 2,634,562 | | |

| (269,377 | ) |

| Non-controlling interests | |

| |

| (5,438 | ) | |

| (283 | ) |

| Total | |

| |

| 2,629,124 | | |

| (269,660 | ) |

| | |

| |

| | | |

| | |

| Basic and diluted earnings per share for profit attributable to owners of the Company (in full TL) | |

| |

| 1.21 | | |

| (0.12 | ) |

| Basic and diluted earnings per share for profit from continuing operations attributable to owners of the Company (in full TL) | |

| |

| 0.96 | | |

| (0.36 | ) |

The above consolidated statement of profit or

loss should be read in conjunction with the accompanying notes.

TURKCELL İLETİŞİM HİZMETLERİ A.Ş.

CONDENSED CONSOLIDATED STATEMENT OF OTHER

COMPREHENSIVE INCOME FOR THE THREE MONTHS INTERIM PERIOD ENDED 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Notes | |

31 March

2024 | | |

31 March

2023 | |

| Profit for the period | |

| |

| 2,629,124 | | |

| (269,660 | ) |

| Items that will not be reclassified to profit or loss: | |

| |

| | | |

| | |

| Remeasurements of defined benefit plans | |

| |

| 14,811 | | |

| 234,926 | |

| Income tax relating to remeasurements of defined benefit plans | |

| |

| (400 | ) | |

| (46,894 | ) |

| | |

| |

| 14,411 | | |

| 188,032 | |

| Other comprehensive income/(expense): | |

| |

| | | |

| | |

| Items that may be reclassified to profit or loss: | |

| |

| | | |

| | |

| Exchange differences on translation of foreign operations | |

| |

| (202,984 | ) | |

| 187,567 | |

| Gain on financial assets measured at fair value through other comprehensive income | |

12 | |

| (7,129 | ) | |

| 33,016 | |

| Cash flow hedges - effective portion of changes in fair value | |

| |

| 4,733,424 | | |

| 2,476,474 | |

| Cash flow hedges - reclassified to profit or loss | |

| |

| (4,168,547 | ) | |

| (2,957,508 | ) |

| Cost of hedging reserve - changes in fair value | |

| |

| (1,155,658 | ) | |

| (250,888 | ) |

| Cost of hedging reserve - reclassified to profit or loss | |

| |

| 635,346 | | |

| 378,142 | |

| Loss on hedges of net investments in foreign operations | |

| |

| 35,621 | | |

| 124,124 | |

| Income tax relating to these items | |

| |

| 280,981 | | |

| 341,266 | |

| - Income tax relating to exchange differences | |

| |

| (15,599 | ) | |

| 70,967 | |

| - Income tax relating to cash flow hedges | |

| |

| (317,366 | ) | |

| 22,294 | |

| - Income tax relating to cost of hedging reserve | |

| |

| 409,223 | | |

| 161,420 | |

| - Income tax relating to financial assets measured at fair value | |

12 | |

| 5,172 | | |

| (608 | ) |

| - Income tax relating to hedges of net investments | |

| |

| 199,551 | | |

| 87,193 | |

| | |

| |

| 151,054 | | |

| 332,193 | |

| Other comprehensive income/(loss) for the year, net of income tax | |

| |

| 165,465 | | |

| 520,225 | |

| Total comprehensive income for the year | |

| |

| 2,794,589 | | |

| 250,565 | |

| | |

| |

| | | |

| | |

| Total comprehensive income for the year is attributable to: | |

| |

| | | |

| | |

| Owners of the Company | |

| |

| 2,800,027 | | |

| 250,848 | |

| Non-controlling interests | |

| |

| (5,438 | ) | |

| (283 | ) |

| Total | |

| |

| 2,794,589 | | |

| 250,565 | |

The above consolidated statement

of other comprehensive income should be read in conjunction with the accompanying notes.

TURKCELL İLETİŞİM HİZMETLERİ A.Ş.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE THREE

MONTHS INTERIM PERIOD ENDED 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Share

capital | | |

Treasury

shares | | |

Share

premium | | |

Legal

reserves | | |

Fair

value

reserve | | |

Hedges of

net

investments

in foreign

operations | | |

Hedging

reserve | | |

Cost of

hedging

reserve | | |

Foreign

currency

translation

reserve | | |

Remeasurement

of defined

benefit plans | | |

Retained

earnings | | |

Reserve of

disposal

group

held for

sale | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| Balance at 1 January 2023 | |

| 37,205,301 | | |

| (817,835 | ) | |

| 8,840 | | |

| 28,058,017 | | |

| (269,365 | ) | |

| (5,033,035 | ) | |

| 3,022,062 | | |

| (8,396,289 | ) | |

| (14,615,921 | ) | |

| (2,358,381 | ) | |

| 89,043,438 | | |

| - | | |

| 125,846,832 | | |

| 7,388 | | |

| 125,854,220 | |

| Profit/ (loss) for the year | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (269,377 | ) | |

| - | | |

| (269,377 | ) | |

| (283 | ) | |

| (269,660 | ) |

| Other comprehensive income, net of income tax | |

| - | | |

| - | | |

| - | | |

| - | | |

| 32,408 | | |

| 211,317 | | |

| (458,740 | ) | |

| 288,674 | | |

| 258,534 | | |

| 188,032 | | |

| - | | |

| - | | |

| 520,225 | | |

| - | | |

| 520,225 | |

| Total comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 32,408 | | |

| 211,317 | | |

| (458,740 | ) | |

| 288,674 | | |

| 258,534 | | |

| 188,032 | | |

| (269,377 | ) | |

| - | | |

| 250,848 | | |

| (283 | ) | |

| 250,565 | |

| Transfers to legal reserves | |

| - | | |

| - | | |

| - | | |

| 9,577 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (9,577 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Acquisition of treasury shares | |

| - | | |

| (58,400 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (58,400 | ) | |

| - | | |

| (58,400 | ) |

| Other | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (823 | ) | |

| (823 | ) |

| Balance at 31 March 2023 | |

| 37,205,301 | | |

| (876,235 | ) | |

| 8,840 | | |

| 28,067,594 | | |

| (236,957 | ) | |

| (4,821,718 | ) | |

| 2,563,322 | | |

| (8,107,615 | ) | |

| (14,357,387 | ) | |

| (2,170,349 | ) | |

| 88,764,484 | | |

| - | | |

| 126,039,280 | | |

| 6,282 | | |

| 126,045,562 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 1 January 2024 | |

| 37,205,301 | | |

| (852,979 | ) | |

| 8,840 | | |

| 28,444,800 | | |

| (103,572 | ) | |

| (6,369,179 | ) | |

| 4,861,582 | | |

| (8,528,992 | ) | |

| (18,954,993 | ) | |

| (2,355,595 | ) | |

| 100,242,431 | | |

| 7,065,126 | | |

| 140,662,770 | | |

| (14,905 | ) | |

| 140,647,865 | |

| Profit/ (loss) for the year | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,634,562 | | |

| - | | |

| 2,634,562 | | |

| (5,438 | ) | |

| 2,629,124 | |

| Other comprehensive income, net of income tax | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,957 | ) | |

| 235,172 | | |

| 247,511 | | |

| (111,089 | ) | |

| (218,583 | ) | |

| 14,411 | | |

| - | | |

| - | | |

| 165,465 | | |

| - | | |

| 165,465 | |

| Total comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,957 | ) | |

| 235,172 | | |

| 247,511 | | |

| (111,089 | ) | |

| (218,583 | ) | |

| 14,411 | | |

| 2,634,562 | | |

| - | | |

| 2,800,027 | | |

| (5,438 | ) | |

| 2,794,589 | |

| Discontinnued operations (Not 21) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 507,420 | | |

| - | | |

| - | | |

| (507,420 | ) | |

| - | | |

| - | | |

| - | |

| Other | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| 1,951 | | |

| 1,951 | |

| Balance at 31 March 2024 | |

| 37,205,301 | | |

| (852,979 | ) | |

| 8,840 | | |

| 28,444,800 | | |

| (105,529 | ) | |

| (6,134,007 | ) | |

| 5,109,093 | | |

| (8,640,081 | ) | |

| (18,666,156 | ) | |

| (2,341,184 | ) | |

| 102,876,993 | | |

| 6,557,706 | | |

| 143,462,797 | | |

| (18,392 | ) | |

| 143,444,405 | |

The above consolidated statement of changes in

equity should be read in conjunction with the accompanying notes.

TURKCELL İLETİŞİM HİZMETLERİ

A.Ş.

CONDENSED CONSOLIDATED FINANCIAL STATEMENT

OF CASH FLOWS FOR THE THREE MONTHS INTERIM PERIOD ENDED 31 MARCH 2024

(All amounts

are expressed in thousand of Turkish Lira unless otherwise stated. Currencies other than Turkish Lira are expressed in thousands unless

otherwise stated.)

| | |

Note | |

31 March

2024 | | |

31 March

2023 | |

| Cash flows from operating activities: | |

| |

| | | |

| | |

| Profit for the year from continuing operations | |

| |

| 2,088,485 | | |

| (796,489 | ) |

| Discontinued operations | |

| |

| 540,639 | | |

| 526,829 | |

| Profit for the year | |

| |

| 2,629,124 | | |

| (269,660 | ) |

| | |

| |

| | | |

| | |

| Adjustments for: | |

| |

| | | |

| | |

| Depreciation and impairment of property, plant and equipment and investment properties | |

8-9-10 | |

| 5,868,724 | | |

| 2,993,715 | |

| Amortization of intangible assets and right-of-use assets | |

| |

| 4,095,529 | | |

| 5,517,965 | |

| Impairment on property, plant and equipment and intangible asset | |

| |

| (4,805 | ) | |

| (25,422 | ) |

| Net finance expense | |

| |

| 1,452,345 | | |

| 790,042 | |

| Fair value adjustments to derivatives | |

| |

| 1,606,454 | | |

| 365,448 | |

| Income tax expense | |

| |

| 1,414,785 | | |

| 2,418,928 | |

| Gain on sale of property, plant and equipment | |

| |

| (26,306 | ) | |

| 66,573 | |

| Effects of exchange rate changes and inflation adjustments | |

| |