New TransUnion Analysis Finds More Than 4% of U.S. Attempted Ecommerce Transactions Between Thanksgiving and Cyber Monday Suspected to be Fraudulent

06 December 2024 - 12:00AM

As millions of consumers took advantage of Black Friday and Cyber

Monday deals this past week, a new analysis from TransUnion (NYSE:

TRU) found that 4.6% of attempted ecommerce transactions globally

were suspected to be Digital Fraud from this Thanksgiving to Cyber

Monday. Based on proprietary insights from TransUnion’s global

intelligence network, TransUnion found that the global suspected

Digital Fraud rate was down from 6.0% during the same period in

2023. For attempted ecommerce transactions where the consumer was

in the U.S., 4.2% were suspected of Digital Fraud during the 2024

holiday shopping period. That’s down from 5.8% during the same

period in 2023.

The analysis reviewed attempted ecommerce transactions from

across the globe during the Cyber Five period, which consists of

the days between November 28 (Thanksgiving Day) and December 2

(Cyber Monday), 2024.

The study determined that the average number of suspected

Digital Fraud attempts on any given day during that holiday period

globally was 30.2% lower than the same period in 2023 and 5.9%

lower than during the rest of 2024 (Jan. 1, 2024, to Nov. 27,

2024).

|

The Percentage of Suspected Ecommerce Fraud during the

Cyber Five vs. Overall |

|

Location |

Cyber Five 2024 (Nov. 28 –

Dec. 2) |

All 2024 prior to Nov. 28 |

Cyber Five 2023 (Nov. 23 – 27) |

All2023 prior to Nov. 27 |

Cyber Five 2022 (Nov. 24 – 28) |

All2022 prior to Nov. 24 |

|

U.S. |

4.2 |

% |

7.1 |

% |

5.8 |

% |

6.6 |

% |

3.1 |

% |

5.5 |

% |

|

Globally |

4.6 |

% |

7.5 |

% |

6.0 |

% |

12.5 |

% |

4.3 |

% |

6.8 |

% |

Source: TransUnion TruValidate™

“The late U.S. Thanksgiving holiday along with the general

lengthening of the holiday shopping season were factors in the

overall decline in transactions and the concurrent downtick in

suspected fraud during the Cyber Five,” said Steve Yin, global head

of fraud at TransUnion. “For online retailers, this speaks to the

need to maintain diligence year-round. For the remainder of this

holiday shopping season, and beyond, online retailers must continue

to implement tools that maintain a friction-right experience,

wherein both business and consumer are protected without major

disruption.”

The greatest fraud disruptions globally during Cyber Five

occurred on Thursday, November 28 with 5.3% of all attempted

digital transactions on that day suspected to be Digital Fraud. The

study also revealed the suspected Digital Fraud rate for each day

in the holiday shopping period for attempted transactions where the

consumer was in the U.S. during the transaction. Similar to global

data, the suspected Digital Fraud attempt rate was the highest on

Thanksgiving Day, Thursday, November 28 during the holiday shopping

period in the U.S.

|

The Suspected Digital Fraud Rate Varies for Each Day of the

Holiday Shopping Weekend |

|

Day |

U.S. |

Globally |

|

Thursday, Nov. 28th |

5.4 |

% |

5.3 |

% |

|

Friday, Nov. 29th |

3.7 |

% |

4.5 |

% |

|

Saturday, Nov. 30th |

3.7 |

% |

4.2 |

% |

|

Sunday, Dec. 1st |

5.2 |

% |

4.6 |

% |

|

Monday, Dec. 2nd |

3.6 |

% |

4.5 |

% |

Source: TransUnion TruValidate

As part of this analysis, TransUnion also determined the top

signals indicating risk of fraudulent ecommerce transactions during

the holiday shopping season globally. This year, unusually high

transaction volume from a single device and devices being newly

associated with an account were among the leading indicators for

potential fraud attempts.

Many Holiday Shoppers Remain Concerned About Digital

Fraud

The decrease in suspected Digital Fraud came as a majority of

U.S. consumers indicated they were at least moderately concerned

about being victimized by Digital Fraud during this holiday

shopping season. TransUnion’s Q4 2024 US Consumer Pulse Study

found that 64% of survey respondents indicated that they were

extremely, very or moderately concerned about digital fraud during

this busy shopping period.

“The winter holidays are always hugely impactful to retailers’

bottom lines, and our recent survey indicates that consumers may be

particularly eager to buy this holiday shopping season,” said Yin.

“It’s as important as ever for retailers to equip themselves with

the tools they need to detect fraud early. These tools can help

minimize fraudulent transactions while at the same time protecting

legitimate transactions. Retailers should seek to implement

holistic fraud solutions that can verify customer identity and

authenticity as early as possible during a transaction.”

TransUnion came to its conclusions about Digital Fraud based on

intelligence from its identity and fraud product suite that helps

secure trust across channels and delivers efficient consumer

experiences – TransUnion TruValidate. The rate or

percentage of suspected Digital Fraud attempts reflects those which

TransUnion customers determined met one of the following

conditions: 1) denial in real time due to fraudulent indicators, 2)

denial in real time for corporate policy violations, 3) fraudulent

upon customer investigation, or 4) a corporate policy violation

upon customer investigation — compared to all transactions

assessed. The country and regional analyses examined transactions

in which the consumer or suspected fraudster was located in a

select country and region when conducting a transaction. Global

statistics represent every country worldwide.

To find out how this data varies by select countries and more,

TransUnion’s holiday fraud trends can be found here.

Consumers interested in obtaining their TransUnion credit

report, credit score, and accessing additional credit planning

tools can click here. Learn more about how TransUnion® helps

individuals and families protect against identity theft here.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with

over 13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the world.

http://www.transunion.com/business

|

Contact |

Dave Blumberg |

|

|

TransUnion |

|

E-mail |

david.blumberg@transunion.com |

|

Telephone |

312-972-6646 |

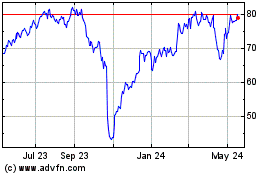

TransUnion (NYSE:TRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

TransUnion (NYSE:TRU)

Historical Stock Chart

From Jan 2024 to Jan 2025