Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

15 May 2024 - 4:56AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-270467

Medium-Term Notes, Series CC

€500,000,000 Floating Rate Notes due May 21, 2028

€750,000,000 4.009% Fixed-to-Floating Rate Notes due

May 21, 2032

Final Terms and Conditions

May 14, 2024

|

|

|

| Issuer: |

|

U.S. Bancorp |

|

|

| Legal Entity Identifier: |

|

N1GZ7BBF3NP8GI976H15 |

|

|

| Note Type: |

|

SEC Registered Senior Notes |

|

|

| Title of Securities: |

|

Floating Rate Notes due 2028 (the “2028 Notes”)

4.009% Fixed-to-Floating Rate Notes due 2032 (the “2032 Notes” and,

together with the 2028 Notes, the “Notes”) |

|

|

| Expected Ratings*: |

|

A3 (Negative) (Moody’s) / A (Stable) (S&P) / A (Stable) (Fitch) / AA (Negative) (DBRS) |

|

|

| Specified Currency: |

|

Euro (€) |

|

|

| Trade Date: |

|

May 14, 2024 |

|

|

| Issue Date (Settlement): |

|

May 21, 2024 (T+5) |

|

|

| Currency of Payment: |

|

All payments of principal of, premium, if any, and interest on, the Notes, including any payments made upon any redemption of the Notes, will be payable in euro. If the euro is unavailable in the Issuer’s good faith judgment

due to the imposition of exchange controls or other circumstances beyond its control or is no longer used by the member states of the European Monetary Union that have adopted the euro as their currency or is no longer used for the settlement of

transactions by public institutions of or within the international banking community (and is not replaced by another currency), then all payments in respect of the Notes may be made in U.S. dollars until the euro is again available to the Issuer or

so used. |

|

|

| Payment of Additional Amounts: |

|

The Issuer will, subject to certain exceptions and limitations, pay as additional amounts such amounts as are necessary in order that the net amount of such payment of the principal of and interest on a Note to a holder who is a

U.S. alien, after deduction for any present or future tax, assessment or governmental charge of a relevant jurisdiction, or a political subdivision or authority thereof or therein, imposed by withholding with respect to the payment, will not be less

than the amount provided for in such Note to be then due and payable. |

|

|

| Redemption for Tax Reasons: |

|

The Issuer may redeem all, but not less than all, of the Notes in the event of certain changes in the tax laws of a relevant jurisdiction, or a political subdivision or authority thereof or therein, that would obligate the Issuer to

pay additional amounts as described above. This redemption would be at a redemption price equal to 100% of the principal amount of the Notes, together with accrued and unpaid interest thereon to, but excluding, the Redemption Date. |

|

|

| Authorized Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

|

|

|

|

|

|

|

| Clearing and Settlement: |

|

Euroclear/Clearstream, Luxembourg |

|

|

| Listing: |

|

Application will be made to list the 2028 Notes on the New York Stock Exchange under the symbol “USB/28” and the 2032 Notes on the New York Stock Exchange under the symbol “USB/32,” although the Issuer cannot

guarantee such listings will be obtained. |

|

|

| Prohibition of Sales to EEA and UK

Retail Investors: |

|

Applicable |

|

|

| UK MiFIR Target Market: |

|

Manufacturer target market (UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels) |

|

|

| Joint Book-Running Managers: |

|

Barclays Bank PLC J.P. Morgan Securities

plc UBS AG London Branch U.S. Bancorp Investments,

Inc. |

|

| Floating Rate Notes due 2028 |

|

|

| Principal Amount: |

|

€500,000,000 |

|

|

| Maturity Date: |

|

May 21, 2028 |

|

|

| Interest Rate: |

|

The Base Rate as determined on the applicable Interest Determination Date plus the Spread per annum payable in arrears for each quarterly Interest Period. |

|

|

| Base Rate: |

|

EURIBOR determined for each quarterly Interest Period calculated in accordance with the terms and provisions set forth under “Description of Notes—Floating Rate Notes—Base Rates—EURIBOR” in

U.S. Bancorp’s prospectus supplement dated April 21, 2023 (the “prospectus supplement”). |

|

|

| Index Maturity: |

|

Three months |

|

|

| Spread: |

|

+80.0 basis points |

|

|

| Initial Interest Rate: |

|

The Base Rate, determined as of May 17, 2024 (the second T2 Business Day (as defined in the preliminary pricing supplement to which this offering of Notes relates) immediately prior to the Issue Date), plus the

Spread. |

|

|

| Interest Periods: |

|

Each quarterly period from, and including, an Interest Payment Date (or, in the case of the first Interest Period, the Issue Date) to, but excluding, the next Interest Payment Date (or, in the case of the final Interest Period, the

Maturity Date of the 2028 Notes or, if the 2028 Notes are redeemed earlier, the Redemption Date). |

|

|

| Interest Payment Dates: |

|

February 21, May 21, August 21 and November 21 of each year, commencing on August 21, 2024 and ending on the Maturity Date of the 2028 Notes. |

|

|

| Interest Reset Dates: |

|

Each Interest Payment Date |

|

|

| Interest Determination Dates: |

|

The second T2 Business Day prior to the first day of each applicable Interest Period. |

|

|

| Day Count Convention: |

|

Actual/360 |

|

|

| Business Days: |

|

New York and T2 Business Day |

|

|

| Business Day Convention: |

|

Modified Following Business Day Convention |

|

|

| Issue Price: |

|

100.000% |

|

|

| Agents’ Commission: |

|

0.150% |

|

|

| All-In Price: |

|

99.850% |

|

|

| Net Proceeds to Issuer (Before Expenses): |

|

€499,250,000 |

|

|

|

| Optional Redemption: |

|

The Issuer may redeem the 2028 Notes at its option (a) in whole, but not in part, on May 21, 2027 (one year prior to the Maturity

Date of the 2028 Notes), or (b) in whole at any time or in part from time to time, on or after April 21, 2028 (one month prior to the Maturity Date of the 2028 Notes) and prior to the Maturity Date of the 2028 Notes, in each case at a

redemption price equal to 100% of the principal amount of the 2028 Notes to be redeemed, plus accrued and unpaid interest thereon to, but excluding, the Redemption Date. See “Description of Notes—Redemption” in the accompanying

prospectus supplement and “Supplemental Description of the Notes—Optional Redemption” in the preliminary pricing supplement to which this offering of Notes relates.

Notice of any redemption will be provided at least 10 but not more than 60 days before

the Redemption Date to each holder of 2028 Notes to be redeemed. |

|

|

| ISIN/Common Code/CUSIP: |

|

XS2823936039 / 282393603 / 902973BD7 |

|

| 4.009%

Fixed-to-Floating Rate Notes due 2032 |

|

|

| Principal Amount: |

|

€750,000,000 |

|

|

| Maturity Date: |

|

May 21, 2032 |

|

|

| Reset Date: |

|

May 21, 2031 |

|

|

| Fixed Rate Period: |

|

From and including the Issue Date to, but excluding, the Reset Date. |

|

|

| Floating Rate Period: |

|

From and including the Reset Date to, but excluding, the Maturity Date of the 2032 Notes. |

|

|

| Fixed Interest Rate: |

|

During the fixed rate period, 4.009% per annum payable in arrears for each annual Interest Period. |

|

|

| Floating Interest Rate: |

|

During the floating rate period, the Floating Base Rate as determined on the applicable Interest Determination Date plus the Floating Rate Spread per annum payable in arrears for each quarterly Interest Period. |

|

|

| Floating Base Rate: |

|

EURIBOR determined for each quarterly Interest Period during the floating rate period calculated in accordance with the terms and provisions set forth under “Description of Notes—Floating Rate Notes—Base

Rates—EURIBOR” in the prospectus supplement. |

|

|

| Index Maturity: |

|

Three months |

|

|

| Floating Rate Spread: |

|

+125.2 basis points |

|

|

| Interest Periods: |

|

With respect to the fixed rate period, each annual period from, and including, an Interest Payment Date (or, in the case of the first

Interest Period during the fixed rate period, the Issue Date) to, but excluding, the next Interest Payment Date (or, in the case of the final Interest Period during the fixed rate period, the Reset Date or, if the 2032 Notes are redeemed earlier,

the Redemption Date). With respect to the floating rate period, each quarterly

period from, and including, an Interest Payment Date (or, in the case of the first Interest Period during the floating rate period, the Reset Date) to, but excluding, the next Interest Payment Date (or, in the case of the final Interest Period

during the floating rate period, the Maturity Date of the 2032 Notes or, if the 2032 Notes are redeemed earlier, the Redemption Date). |

|

|

| Interest Payment Dates: |

|

With respect to the fixed rate period, May 21 of each year, commencing on May 21, 2025 and ending on the Reset Date.

With respect to the floating rate period, February 21, May 21, August 21

and November 21 of each year, commencing on August 21, 2031 and ending on the Maturity Date of the 2032 Notes. |

|

|

|

| Interest Reset Dates: |

|

Each Interest Payment Date commencing May 21, 2031, provided that the May 21, 2031 Interest Reset Date shall not be adjusted for a non-Business Day. |

|

|

| Interest Determination Dates: |

|

With respect to each Interest Period during the floating rate period, the second T2 Business Day prior to the first day of each applicable Interest Period. |

|

|

| Day Count Convention: |

|

With respect to the fixed rate period, ICMA Actual/Actual (as described in the rulebook of the International Capital Market Association).

With respect to the floating rate period, Actual/360. |

|

|

| Business Days: |

|

New York and T2 Business Day |

|

|

| Business Day Convention: |

|

With respect to the fixed rate period, Following Unadjusted Business Day Convention.

With respect to the floating rate period, Modified Following Business Day

Convention. |

|

|

| Mid-Swap Yield: |

|

2.809% |

|

|

| Spread to Mid-Swap: |

|

+120.0 basis points |

|

|

| Benchmark Bund: |

|

DBR 0.000% due February 15, 2031 |

|

|

| Benchmark Bund Yield/Price: |

|

2.461% / 84.865 |

|

|

| Spread to Benchmark Bund: |

|

+154.8 basis points |

|

|

| Yield to Maturity: |

|

4.009% |

|

|

| Issue Price: |

|

100.000% |

|

|

| Agents’ Commission: |

|

0.300% |

|

|

| All-In Price: |

|

99.700% |

|

|

| Net Proceeds to Issuer (Before Expenses): |

|

€747,750,000 |

|

|

| Optional Redemption: |

|

The Issuer may redeem the 2032 Notes at its option on or after November 17, 2024 (180 days after the Issue Date of the 2032 Notes) and

prior to the Reset Date (one year prior to the Maturity Date of the 2032 Notes), in whole or in part, at any time and from time to time, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal

to the greater of:

(1) 100% of the principal amount of the 2032 Notes to be redeemed; and

(2) (a) the sum of the

present values of the remaining scheduled payments of principal and interest thereon discounted to the Redemption Date (assuming the 2032 Notes to be redeemed matured on the Reset Date) on an annual basis (based on an ICMA Actual/Actual (as

described in the rulebook of the International Capital Market Association) day count convention) at the Comparable Government Bond Rate (as defined in the preliminary pricing supplement to which this offering of Notes relates) plus 25.0 basis points

less (b) interest accrued to, but excluding, the Redemption Date, plus, in

either case, accrued and unpaid interest thereon to, but excluding, the Redemption Date.

In addition, the Issuer may redeem the 2032 Notes at its option, (a) in whole, but not in part, on the Reset Date, or (b) in whole at any time or in

part from time to time, on or after March 19, 2032 (two months prior to the Maturity Date of the 2032 Notes) and prior to the Maturity Date of the 2032 Notes, in each case at a redemption price equal to 100% of the principal amount of the 2032

Notes to be redeemed, plus accrued and unpaid interest thereon to, but excluding, the Redemption Date.

Notice of any redemption will be provided at least 10 but not more than 60 days before the Redemption Date to each holder of 2032 Notes to be

redeemed. |

|

|

| ISIN/Common Code/CUSIP: |

|

XS2823993261 / 282399326 / 902973BE5 |

| * |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time. |

The offering is being made pursuant to an effective registration statement on Form S-3 (registration statement No. 333-270467), including a prospectus supplement and a prospectus, filed with the U.S. Securities and Exchange Commission (the

“SEC”). Before you invest, you should read the prospectus supplement and the prospectus and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may obtain these documents

for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the joint book-running managers can arrange to send you the prospectus supplement and the prospectus if you request them by contacting Barclays Bank PLC toll-free at +1-888-603-5847, J.P. Morgan Securities plc (for non-U.S. investors) collect at +44-20-7134-2468 or J.P. Morgan Securities LLC (for U.S. investors) collect at

+1-212-834-4533, UBS AG London Branch toll-free at

+44-20-7567-2479 or U.S. Bancorp Investments, Inc. toll-free at

+1-877-558-2607.

The

Issuer expects that delivery of the Notes will be made against payment therefor on or about May 21, 2024, which is the fifth business day following the date of this Final Terms and Conditions Sheet. Under the E.U. Central Securities

Depositaries Regulation, trades in the secondary market generally are required to settle in two London business days unless the parties to a trade expressly agree otherwise. Also under Rule 15c6-1 of the

Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to

the second business day prior to May 21, 2024 will be required to specify alternative settlement arrangements to prevent a failed settlement.

The communication of this Final Terms and Conditions Sheet and any other document or materials relating to the issue of the Notes offered hereby is not

being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”). Accordingly, this

Final Terms and Conditions Sheet and such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. This Final Terms and Conditions Sheet and such other documents and/or

materials are for distribution only to persons who (i) have professional experience in matters relating to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), (ii) fall within Article 49(2)(a) to (d) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are

other persons to whom they may otherwise lawfully be distributed under the Financial Promotion Order (all such persons together being referred to as “relevant persons”). This Final Terms and Conditions Sheet and such documents and/or

materials are directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this Final Terms and Conditions Sheet and any other document or materials

relates will be engaged in only with relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this Final Terms and Conditions Sheet or any other documents and/or materials relating to the issue of

the Notes offered hereby or any of their contents.

PROHIBITION OF SALES TO EEA RETAIL INVESTORS – The Notes are not intended to be offered,

sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”). For these purposes, “retail investor” means a person who is one (or

more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”) or (ii) a customer within the meaning of Directive (EU) 2016/97, as amended, where that customer would

not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently, no key information document required by Regulation (EU) No. 1286/2014, as amended (the “PRIIPs Regulation”) for offering or

selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and, therefore, offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs

Regulation.

PROHIBITION OF SALES TO UNITED KINGDOM RETAIL INVESTORS – The Notes are not intended to be offered, sold or otherwise made

available to (and should not be offered, sold or otherwise made available to) any retail investor in the United Kingdom (the “UK”). For these purposes, a “retail investor” means a person who is one (or more) of: (i) a retail

client, as defined in point (8) of Article 2 of Regulation (EU) No. 2017/565 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended (the “EUWA”) or (ii) a customer within the meaning of the provisions of the Financial Services and

Markets Act 2000, as amended (the “FSMA”) of the UK and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No. 1286/2014 as it forms part of UK domestic law by virtue of

the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and, therefore, offering or selling the Notes or otherwise making them available to

any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

UK MiFIR product governance / eligible counterparties and

professional investors only target market - Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes

is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue of the EUWA; and (ii) all channels

for distribution of the Notes) to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “UK distributor”) should take into consideration the

manufacturers’ target market assessment; however, a UK distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook is responsible for undertaking its own target market assessment in respect of the Notes (by

either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

Notification

under Section 309B(1)(c) of the Securities and Futures Act 2001 (2020 Revised Edition) of Singapore (as amended, the “SFA”) - In connection with Section 309B(1) of the SFA and the Securities and Futures (Capital Markets Products)

Regulations 2018 of Singapore (as amended, the “CMP Regulations 2018”), the Issuer has determined the classification of the Notes as “prescribed capital markets products” (as defined in the CMP Regulations 2018) and

“Excluded Investment Products” (as defined in Monetary Authority of Singapore (the “MAS”) Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products). This notification constitutes notice to “relevant persons” for purposes of Section 309B(1)(c) of the SFA.

Stabilization: FCA/ICMA.

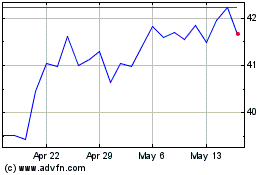

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2024 to May 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From May 2023 to May 2024