Continued Focus on Realignment Priorities

Company Institutes Additional Cost Reduction

Programs

Strategic Review Process Remains Ongoing

- Q2 2024 sales update

- 2024 year to date bookings of $21 million; >40% of orders

from existing customers

- $17 million in backlog exiting Q2 2024

- Continued defense sector expansion – >20% of 1H’24

shipments

- Reduced quarterly operating expenses

- Down 37% year over year

- Instituted additional cost control programs - ~30% headcount

reduction

- Improved year over year operating cash flow in Q2 2024

- Operating and financial conditions remain challenging

Velo3D, Inc. (NYSE: VLD), a leading additive manufacturing

technology company for mission-critical metal parts, today

announced financial results for its second quarter ended June 30,

2024.

“Our second quarter results reflected continued execution on our

strategic priorities as we added to our year-to-date bookings,

maintained a healthy backlog and reduced our operating expenses,”

said Brad Kreger, CEO of Velo3D. “Specifically, we continued to

expand our defense and space sector footprint during the quarter

and expect to add to our backlog in these important industries in

the second half of the year. We also further executed on our

re-alignment efforts as we reduced our quarterly operating costs by

37% year over year and improved our manufacturing and operational

efficiency. However, while we have made significant financial and

operational progress year to date, we have made the difficult

decision to right size the business as we expect industry

conditions to remain challenging into the second half of 2024.”

“Our second quarter results also reflected the impact of delays

in the funding of certain governmental projects with those system

orders now expected in the second half of the year. While we still

expect to close these transactions, these delays have negatively

impacted our revenue forecast for the balance of the year. As a

result, we have instituted a number of material cost reduction

programs to reduce expenses and manage our liquidity, including a

headcount reduction of approximately 30%. We expect these programs

to drive significant annual operating savings and we continue to

look at various options to support our balance sheet during our

ongoing the strategic review process.”

“Looking forward, we believe the continued focus on our key

priorities will position us well to capitalize on the increasing

industry demand for leading-edge additive manufacturing solutions,”

concluded Kreger.

($ in Millions, except percentages and

per-share data)

2nd Quarter 2024

2nd Quarter 2023

GAAP revenue

$10.3

$25.1

GAAP gross margin

(28.0)%

10.1%

GAAP net loss1

($0.2)

($23.2)

GAAP net loss per share - basic and

diluted

($0.02)

($4.10)

Non-GAAP net loss2

($21.7)

($19.3)

Non-GAAP net loss per basic and diluted

share2

($2.57)

($3.42)

- Information about Velo3D’s use of non-GAAP information,

including a reconciliation to U.S. GAAP, is provided at the end of

this release under “Non-GAAP Financial Information”. The non-GAAP

financial measures presented in this release should not be

considered as the sole measure of the company’s performance and

should not be considered in isolation from, or as a substitute for,

comparable financial measures calculated in accordance with

generally accepted accounting principles accepted in the United

States.

- Non-GAAP net loss and non-GAAP net loss per diluted share

exclude stock-based compensation expense, fair value adjustments

for the Company’s warrants, and contingent earnout.

Summary of Second Quarter 2024 Results

Revenue for the second quarter was $10.3 million. System revenue

increased compared to the first quarter of 2024, primarily driven

by a mix shift to the company’s higher priced Sapphire XC systems.

Support services and recurring payment revenue declined

sequentially compared to the first quarter of 2024 due to the

expiration of certain lease contracts as well as a slight reduction

in customers with active field service contracts.

Gross margin for the second quarter was negative 28% and

primarily reflected the impact of lower fixed cost absorption as

certain systems orders were delayed to the second half of 2024.

GAAP operating expenses for the second quarter were $17.6

million compared to $28.2 million in the second quarter of 2023.

Non-GAAP operating expenses, excluding stock-based compensation

expense of $3.8 million, was $13.8 million, down 37% compared to

the second quarter of 2023.

Net loss for the quarter was $0.2 million and reflected a

non-cash gain of $27.1 million on the change in the fair value of

warrants and contingent earnout liabilities. Non-GAAP net loss was

$21.7 million in the three months ended June 30, 2024. Adjusted

EBITDA for the quarter, was negative $15.0 million. For more

information regarding the company’s non-GAAP financial measures,

see “Non-GAAP Financial Information” below.

Second quarter cash flow, excluding financing activities, was in

line with the company's forecast and improved more than 70% on a

year over year basis. The company ended the quarter with $3 million

in cash and cash equivalents.

Guidance

Given the uncertainty of timing of the company’s deferred orders

and other factors, the company is withdrawing its previously

announced financial guidance for fiscal year 2024.

About Velo3D:

Velo3D is a metal 3D printing technology company. 3D

printing—also known as additive manufacturing (AM)—has a unique

ability to improve the way high-value metal parts are built.

However, legacy metal AM has been greatly limited in its

capabilities since its invention almost 30 years ago. This has

prevented the technology from being used to create the most

valuable and impactful parts, restricting its use to specific

niches where the limitations were acceptable.

Velo3D has overcome these limitations so engineers can design

and print the parts they want. The company’s solution unlocks a

wide breadth of design freedom and enables customers in space

exploration, aviation, power generation, energy, and semiconductor

to innovate the future in their respective industries. Using

Velo3D, these customers can now build mission-critical metal parts

that were previously impossible to manufacture. The fully

integrated solution includes the Flow print preparation software,

the Sapphire family of printers, and the Assure quality control

system—all of which are powered by Velo3D’s Intelligent Fusion

manufacturing process. The company delivered its first Sapphire

system in 2018 and has been a strategic partner to innovators such

as SpaceX, Aerojet Rocketdyne, Lockheed Martin, Avio, and General

Motors. Velo3D has been named as one of Fast Company’s Most

Innovative Companies for 2023. For more information, please visit

Velo3D.com, or follow the company on LinkedIn or Twitter.

VELO, VELO3D, SAPPHIRE and INTELLIGENT FUSION, are registered

trademarks of Velo3D, Inc.; and WITHOUT COMPROMISE, FLOW, FLOW

DEVELOPER, and ASSURE are trademarks of Velo3D, Inc. All Rights

Reserved © Velo3D, Inc.

Amounts herein pertaining to June 30, 2024 represent a

preliminary estimate as of the date of this earnings release and

may be revised upon filing our Quarterly Report on Form 10-Q with

the Securities and Exchange Commission (the “SEC”). More

information on our results of operations for the three months ended

June 30, 2024 will be provided upon filing our Quarterly Report on

Form 10-Q with the SEC.

Forward-Looking Statements:

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1996. The company’s actual

results may differ from its expectations, estimates and projections

and consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as “expect”,

“estimate”, “project”, “budget”, “forecast”, “anticipate”,

“intend”, “plan”, “may”, “will”, “could”, “should”, “believes”,

“predicts”, “potential”, “continue”, and similar expressions are

intended to identify such forward-looking statements. These

forward-looking statements include, without limitation, the

company's expectations regarding its performance during the

remainder of 2024, the company's strategic realignment and

initiatives, the company’s expectations regarding its liquidity and

capital requirements, the company’s expectations regarding the

timing of deferred orders, the company’s expectations regarding its

potential cost savings, and the company’s other expectations,

beliefs, intentions or strategies for the future. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. You should carefully consider

the risks and uncertainties described in the “Risk Factors” section

of the company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 (the “FY 2023 10-K”), which was filed by

the company with the SEC on April 4, 2024, the “Risk Factors”

section of the company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024, which will be filed by the company

with the SEC no later than August 19, 2024 (the “Q2 2024 10-Q"),

and the other documents filed by the company from time to time with

the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to

differ materially from those contained in the forward-looking

statements. Most of these factors are outside the company’s control

and are difficult to predict. Factors that may cause such

differences include, but are not limited to: (1) the inability of

the company to execute its business plan, which may be affected by,

among other things, competition, the company’s liquidity

position//lack of available cash, the ability of the company to

grow and manage growth profitably, maintain relationships with

customers and suppliers and retain its key employees; (2) the

company’s ability to continue as a going concern; (3) the company’s

ability to maintain its listing on the New York Stock Exchange; (4)

the company’s ability to service and comply with its indebtedness;

(5) the company’s ability to raise additional capital in the

near-term; (6) the possibility that the company may be adversely

affected by other economic, business, and/or competitive factors;

and (7) other risks and uncertainties described in the FY 2023 10-K

and the Q2 2024 10-Q, including those under “Risk Factors” therein,

and in the company’s other filings with the SEC. The company

cautions that the foregoing list of factors is not exclusive and

not to place undue reliance upon any forward-looking statements,

including projections, which speak only as of the date made. The

company does not undertake or accept any obligation to release

publicly any updates or revisions to any forward-looking statements

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is

based.

Non-GAAP Financial Information

The information in the table below sets forth the non-GAAP

financial measures that the company uses in this release. Because

of the limitations associated with these non-GAAP financial

measures, “Non-GAAP Net Loss”, “EBITDA”, “Adjusted EBITDA” and

“Non-GAAP Operating Expenses”, should not be considered in

isolation or as a substitute for performance measures calculated in

accordance with GAAP. The company compensates for these limitations

by relying primarily on its GAAP results and using Non-GAAP Net

Loss, EBITDA, Adjusted EBITDA, and Non-GAAP Operating Expenses on a

supplemental basis. You should review the reconciliation of the

non-GAAP financial measures below and not rely on any single

financial measure to evaluate the company's business.

The following tables reconcile Net income (loss) to Non-GAAP Net

Loss, EBITDA, and Adjusted EBITDA and Total Operating Expenses to

Non-GAAP Operating Expenses during the periods below:

Velo3D, Inc.

NON-GAAP Net Loss

Reconciliation

(Unaudited)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(In thousands, except for

percentages)

% of Rev

% of Rev

% of Rev

% of Rev

Revenue

$

10,344

100.0

%

$

25,134

100.0

%

$

20,130

100.0

%

$

51,821

100.0

%

Gross Profit

(2,897

)

(28.0

)%

2,536

10.1

%

(5,712

)

(28.4

)%

5,068

9.8

%

Net Income (Loss)

$

(172

)

(1.7

)%

$

(23,201

)

(92.3

)%

$

(28,486

)

(141.5

)%

$

(59,526

)

(114.9

)%

Stock-based compensation

4,247

41.1

%

6,535

26.0

%

9,334

46.4

%

12,771

24.6

%

(Gain) Loss on fair value of warrants

(25,310

)

(244.7

)%

(828

)

(3.3

)%

(22,690

)

(112.7

)%

1,725

3.3

%

(Gain) Loss on fair value of contingent

earnout liabilities

(1,824

)

(17.6

)%

(1,843

)

(7.3

)%

(1,387

)

(6.9

)%

7,810

15.1

%

Non-cash cost of issuance of common stock

warrants on BEPO Offering

1,313

12.7

%

—

—

%

1,313

6.5

%

—

—

%

Non-GAAP Net Loss

$

(21,746

)

(210.2

)%

$

(19,337

)

(76.9

)%

$

(41,916

)

(208.2

)%

$

(37,220

)

(71.8

)%

Velo3D, Inc.

NON-GAAP Adjusted EBITDA

Reconciliation

(Unaudited)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(In thousands, except for

percentages)

% of Rev

% of Rev

% of Rev

% of Rev

Revenue

$

10,344

100.0

%

$

25,134

100.0

%

$

20,130

100.0

%

$

51,821

100.0

%

Net Income (Loss)

(172

)

(1.7

)%

(23,201

)

(92.3

)%

(28,486

)

(141.5

)%

(59,526

)

(114.9

)%

Interest expense

5,463

52.8

%

344

1.4

%

9,360

46.5

%

564

1.1

%

Provision for income taxes

(4

)

(0.0

)%

—

—

%

—

—

%

—

—

%

Depreciation and amortization

1,311

12.7

%

1,466

5.8

%

2,707

13.4

%

3,026

5.8

%

EBITDA

$

6,598

63.8

%

$

(21,391

)

(85.1

)%

$

(16,419

)

(81.6

)%

$

(55,936

)

(107.9

)%

Stock-based compensation

4,247

41.1

%

6,535

26.0

%

9,334

46.4

%

12,771

24.6

%

(Gain) Loss on fair value of warrants

(25,310

)

(244.7

)%

(828

)

(3.3

)%

(22,690

)

(112.7

)%

1,725

3.3

%

(Gain) Loss on fair value of contingent

earnout liabilities

(1,824

)

(17.6

)%

(1,843

)

(7.3

)%

(1,387

)

(6.9

)%

7,810

15.1

%

Non-cash cost of issuance of common stock

warrants on BEPO Offering

1,313

12.7

%

—

—

%

1,313

6.5

%

—

—

%

Adjusted EBITDA

$

(14,976

)

(144.8

)%

$

(17,527

)

(69.7

)%

$

(29,849

)

(148.3

)%

$

(33,630

)

(64.9

)%

Velo3D, Inc.

NON-GAAP Adjusted Operating

Expenses Reconciliation

(Unaudited)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(In thousands, except for

percentages)

% of Rev

% of Rev

% of Rev

% of Rev

Revenue

$

10,344

100.0

%

$

25,134

100.0

%

$

20,130

100.0

%

$

51,821

100.0

%

Operating expenses

Research and development

4,545

43.9

%

12,238

48.7

%

9,588

47.6

%

22,655

43.7

%

Selling and marketing

4,273

41.3

%

6,108

24.3

%

9,082

45.1

%

12,282

23.7

%

General and administrative

8,823

85.3

%

9,896

39.4

%

17,606

87.5

%

20,087

38.8

%

Total operating expenses

17,641

170.5

%

28,242

112.4

%

36,276

180.2

%

55,024

106.2

%

Stock-based compensation in operating

expenses

3,839

37.1

%

6,091

24.2

%

8,342

41.4

%

12,060

23.3

%

Adjusted operating expenses

$

13,802

133.4

%

$

22,151

88.1

%

$

27,934

138.8

%

$

42,964

82.9

%

Velo3D, Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(In thousands, except share

and per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

3D Printer

$

8,679

$

23,190

$

16,339

$

47,638

Recurring payment

292

35

762

610

Support services

1,373

1,909

3,029

3,573

Total Revenue

10,344

25,134

20,130

51,821

Cost of revenue

3D Printer

10,744

20,052

20,138

42,220

Recurring payment

232

335

547

782

Support services

2,265

2,211

5,157

3,751

Total cost of revenue

13,241

22,598

25,842

46,753

Gross profit (loss)

(2,897

)

2,536

(5,712

)

5,068

Operating expenses

Research and development

4,545

12,238

9,588

22,655

Selling and marketing

4,273

6,108

9,082

12,282

General and administrative

8,805

9,896

17,588

20,087

Total operating expenses

17,623

28,242

36,258

55,024

Loss from operations

(20,520

)

(25,706

)

(41,970

)

(49,956

)

Interest expense

(5,463

)

(344

)

(9,360

)

(564

)

Gain (loss) on fair value of warrants

25,310

828

22,690

(1,725

)

Gain (loss) on fair value of contingent

earnout liabilities

1,824

1,843

1,387

(7,810

)

Other income, net

(1,327

)

178

(1,233

)

529

Income (loss) before provision for income

taxes

(176

)

(23,201

)

(28,486

)

(59,526

)

Provision for income taxes

4

—

—

—

Net income (loss)

$

(172

)

$

(23,201

)

$

(28,486

)

$

(59,526

)

Net income (loss) per share:

Basic

$

(0.02

)

$

(4.10

)

$

(3.55

)

$

(10.63

)

Diluted

$

(0.02

)

$

(4.10

)

$

(3.55

)

$

(10.63

)

Shares used in computing net income (loss) per share: Basic

8,475,386

5,659,601

8,015,722

5,598,386

Diluted

8,475,386

5,659,601

8,015,722

5,598,386

Velo3D, Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except share

and per share data)

June 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

2,462

$

24,494

Short-term investments

699

6,621

Accounts receivable, net

8,338

9,583

Inventories

59,521

60,816

Contract assets

8,861

7,510

Prepaid expenses and other current

assets

2,289

4,000

Total current assets

82,170

113,024

Property and equipment, net

14,186

16,326

Equipment on lease, net

3,958

6,667

Other assets

16,338

17,782

Total assets

$

116,652

$

153,799

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

14,008

$

15,854

Accrued expenses and other current

liabilities

5,864

6,491

Debt – current portion

24,592

21,191

Contract liabilities

4,090

5,135

Total current liabilities

48,554

48,671

Long-term debt – less current portion

—

11,941

Contingent earnout liabilities

69

1,456

Warrant liabilities

4,933

11,835

Other noncurrent liabilities

10,977

11,556

Total liabilities

64,533

85,459

Commitments and contingencies (Note

13)

Stockholders’ equity:

Common stock, $0.00001 par value -

500,000,000 shares authorized at June 30, 2024 and December 31,

2023, 8,611,219 and 7,502,478 shares issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively

2

2

Additional paid-in capital

437,642

425,471

Accumulated other comprehensive loss

(2

)

(96

)

Accumulated deficit

(385,523

)

(357,037

)

Total stockholders’ equity

52,119

68,340

Total liabilities and stockholders’

equity

$

116,652

$

153,799

Velo3D, Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities

Net loss

$

(28,486

)

$

(59,526

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

2,707

2,983

Amortization of debt discount and deferred

financing costs

8,281

43

Stock-based compensation

9,334

12,771

(Gain) loss on fair value of warrants

(22,690

)

1,725

(Gain) loss on fair value of contingent

earnout liabilities

(1,387

)

7,810

Non-cash cost of issuance of common stock

warrants on BEPO Offering

1,313

—

Realized loss on available for sale

securities

21

—

Changes in assets and liabilities

Accounts receivable

1,245

(5,099

)

Inventories

3,891

3,538

Contract assets

(1,351

)

(8,323

)

Prepaid expenses and other current

assets

1,871

3,609

Other assets

1,369

292

Accounts payable

(2,391

)

(1,716

)

Accrued expenses and other liabilities

(595

)

(6,249

)

Contract liabilities

(345

)

(9,422

)

Other noncurrent liabilities

(1,279

)

(1,214

)

Net cash used in operating activities

(28,492

)

(58,778

)

Cash flows from investing

activities

Purchase of property and equipment

(8

)

(690

)

Production of equipment for lease to

customers

—

(3,694

)

Sales of available for sale securities

2,474

—

Proceeds from maturity of

available-for-sale investments

3,500

29,984

Net cash provided by investing

activities

5,966

25,600

Cash flows from financing

activities

Proceeds from ATM offering, net of

issuance costs

—

15,591

Proceeds from revolver facility

—

14,000

Proceeds from equipment loans

—

1,600

Repayment of equipment loans

—

(1,467

)

Proceeds from BEPO Offering, net of

issuance costs

10,675

—

Repayment of secured notes

(10,500

)

—

Issuance of common stock upon exercise of

stock options

315

350

Net cash provided by financing

activities

490

30,074

Effect of exchange rate changes on cash

and cash equivalents

4

(11

)

Net change in cash and cash

equivalents

(22,032

)

(3,115

)

Cash and cash equivalents and restricted

cash at beginning of period

25,294

32,783

Cash and cash equivalents and restricted

cash at end of period

$

3,262

$

29,668

The following table provides a reconciliation of cash, cash

equivalents, and restricted cash reported within the condensed

consolidated balance sheets to the total of such amounts shown on

the condensed consolidated statements of cash flows:

June 30,

2024

2023

Cash and cash equivalents

$

2,462

$

28,868

Restricted cash (Other assets)

800

800

Total cash and cash equivalents and

restricted cash

$

3,262

$

29,668

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814795329/en/

Investor Relations: Velo3D Bob Okunski, VP Investor Relations

investors@velo3d.com

Media Contact: Velo3D Dan Sorensen, Senior Director of PR

dan.sorensen@velo3d.com

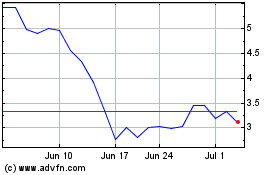

Velo3D (NYSE:VLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Velo3D (NYSE:VLD)

Historical Stock Chart

From Nov 2023 to Nov 2024