0001604665false00016046652024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 5, 2024

Westlake Chemical Partners LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36567 | | 32-0436529 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 2801 Post Oak Boulevard, | Suite 600 | | 77056 |

| Houston, | Texas | | |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant's telephone number, including area code: (713) 585-2900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common units representing limited partnership interests | WLKP | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Item 2.02. Results of Operations and Financial Condition.

On November 5, 2024, Westlake Chemical Partners LP (the "Partnership") issued a press release announcing its 2024 third quarter results. A copy of the press release is furnished with this Current Report as Exhibit 99.1.

The information furnished pursuant to this Current Report, including Exhibit 99.1, shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing by Westlake Chemical Partners LP under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, unless specifically identified as being incorporated therein.

Item 7.01. Regulation FD Disclosure.

The Partnership is holding a conference call on November 5, 2024 to discuss its 2024 third quarter results. Information about the call can be found in the press release furnished with this Current Report as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished herewith:

104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WESTLAKE CHEMICAL PARTNERS LP |

| | | | By: Westlake Chemical Partners GP LLC |

| Date: | November 5, 2024 | | By: | /S/ JEAN-MARC GILSON |

| | | | Jean-Marc Gilson President, Chief Executive Officer and Director |

EXHIBIT 99.1

WESTLAKE CHEMICAL PARTNERS LP

Contact—(713) 585-2900

Investors—Steve Bender

Media—L. Benjamin Ederington

Westlake Chemical Partners LP Announces Third Quarter 2024 Results

•Celebrated 10th anniversary as a publicly traded master limited partnership having grown the quarterly distribution 71% since IPO

•Declared quarterly distribution of $0.4714 per unit; 41st consecutive quarterly distribution

HOUSTON--(BUSINESS WIRE)--Westlake Chemical Partners LP (NYSE: WLKP) (the "Partnership") today reported net income attributable to the Partnership in the third quarter of 2024 of $18.1 million, or $0.51 per limited partner unit, an increase of $4.9 million compared to the third quarter 2023 net income of $13.2 million. Cash flows from operating activities in the third quarter of 2024 were $126.1 million, an increase of $25.2 million compared to third quarter 2023 cash flows from operating activities of $100.9 million, due to higher net income. For the three months ended September 30, 2024, MLP distributable cash flow was $17.9 million, an increase of $4.3 million compared to third quarter 2023 MLP distributable cash flow of $13.6 million. The increase in MLP distributable cash flow and associated trailing twelve-month coverage ratio was due to higher net income in addition to lower maintenance capital expenditures.

Third quarter 2024 net income attributable to the Partnership of $18.1 million increased by $3.7 million compared to second quarter 2024 net income of $14.4 million, primarily due to higher third-party ethylene sales volume with higher margin on these sales. Third quarter 2024 cash flows from operating activities of $126.1 million increased by $4.2 million compared to second quarter 2024 cash flows from operating activities of $121.9 million. Third quarter 2024 MLP distributable cash flow of $17.9 million increased by $0.8 million compared to second quarter 2024 MLP distributable cash flow of $17.1 million, primarily due to the higher net income.

"We are pleased with the Partnership's performance for the third quarter of 2024. During the quarter, third-party ethylene sales prices and margins improved to their highest quarterly average in years, in part due to weather events and production outages at other producers. In an effort to better capture these attractive third-party margins we opportunistically made the decision to defer the planned turnaround at our Petro 1 ethylene unit to the first quarter of 2025 while also shifting third-party sales volumes planned for later in the year into the third quarter. As a result, we were pleased with the improvement in our third quarter distributable cash flow compared to recent quarters," said Jean-Marc Gilson, President and Chief Executive Officer. "Looking ahead to the remainder of 2024, with most of our planned third-party ethylene sales volumes for the year already booked, and as maintenance capital spending increases to support the upcoming Petro 1 turnaround in early 2025, we expect some moderation in our distributable cash flow in the fourth quarter. However, the improved outlook for third-party ethylene margins and continued execution of our ethylene sales contract with Westlake position us well for continued predictable cash flow and distributions to our unitholders, which we have demonstrated since our IPO ten years ago."

On October 30, 2024, the Partnership announced that the Board of Directors of Westlake Chemical Partners GP LLC had approved a quarterly distribution for the third quarter of 2024 of $0.4714 per unit to be payable on November 27, 2024 to unitholders of record as of November 12, 2024, representing the 41st consecutive quarterly distribution to our unitholders. MLP distributable cash flow provided trailing twelve-month coverage of 1.03x the declared distributions for the third quarter of 2024, which was higher than the trailing twelve-month coverage ratio of 0.96x at the end of the second quarter of 2024. Since our IPO in July of 2014 our cumulative coverage ratio is 1.08x.

OpCo's Ethylene Sales Agreement with Westlake is designed to provide for stable and predictable cash flows. The agreement provides that 95% of OpCo's ethylene production is sold to Westlake for a cash margin of $0.10 per pound, net of operating costs, maintenance capital expenditures and reserves for future turnaround expenditures.

The statements in this release and the related teleconference relating to matters that are not historical facts, such as those with respect to the timing of the anticipated Petro 1 turnaround, results of our turnaround reserves and activities, our future coverage ratio, our outlook for third-party ethylene margins, our expectations regarding feedstock and energy costs, the ability to deliver value, returns, predictable cash flows and distributions to unitholders, the expectation that strong distributions will continue, and the nature of the sales agreement with Westlake, are forward-looking statements. These forward-looking statements are subject to significant risks and uncertainties. Actual results could differ materially, based on factors including, but not limited to, operating difficulties; the volume of ethylene that we are able to sell; the price at which we are able to sell ethylene; changes in the price and availability of feedstocks; changes in prevailing economic conditions; actions and commitments of Westlake Corporation; actions of third parties; the timing and results of capital expenditures, including turnaround activities; inclement or hazardous weather conditions, including flooding, and the physical impacts of climate change; environmental hazards; changes in laws and regulations (or the interpretation thereof); inability to acquire or maintain necessary permits; inability to obtain necessary production equipment or replacement parts; technical difficulties or failures; labor disputes; difficulty collecting receivables; inability of our customers to take delivery; fires, explosions or other industrial accidents; our ability to borrow funds and access capital markets; and other risk factors. For more detailed information about the factors that could cause actual results to differ materially, please refer to the Partnership's Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC in February 2024, and the Partnership's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, which was filed with the SEC in August 2024.

This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat one hundred percent (100.0%) of the Partnership's distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. Accordingly, the Partnership's distributions to non-U.S. investors are subject to federal income tax withholding at the highest applicable effective tax rate.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial measures, such as MLP distributable cash flow, coverage ratio and EBITDA. For this purpose, a non-GAAP financial measure is generally defined by the Securities and Exchange Commission ("SEC") as a numerical measure of a registrant's historical or future financial performance, financial position or cash flows that (1) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or (2) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. We report our financial results in accordance with U.S. GAAP, but believe that certain non-GAAP financial measures, such as MLP distributable cash flow, coverage ratio and EBITDA, provide useful supplemental information to investors regarding the underlying business trends and performance of our ongoing operations and are useful for period-over-period comparisons of such operations. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with U.S. GAAP. We define MLP distributable cash flow as distributable cash flow less distributable cash flow attributable to Westlake Corporation's noncontrolling interest in OpCo and distributions attributable to the incentive distribution rights holder. MLP distributable cash flow does not reflect changes in working capital balances. We define EBITDA as net income before interest expense, income taxes, depreciation and amortization. MLP distributable cash flow, coverage ratio and EBITDA are non-GAAP supplemental financial measures that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess our operating performance as compared to other publicly traded partnerships, our ability to incur and service debt and fund capital expenditures and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. Reconciliations of MLP distributable cash flow to net income and to net cash provided by operating activities and of EBITDA to net income, income from operations and net cash provided by operating activities can be found in the financial schedules at the end of this press release.

Westlake Chemical Partners LP

Westlake Chemical Partners is a limited partnership formed by Westlake Corporation to operate, acquire and develop ethylene production facilities and other qualified assets. Headquartered in Houston, the Partnership owns a 22.8% interest in Westlake Chemical OpCo LP. Westlake Chemical OpCo LP's assets consist of three ethylene production facilities in Calvert City, Kentucky, and Lake Charles, Louisiana, and an ethylene pipeline. For more information about Westlake Chemical Partners LP, please visit http://www.wlkpartners.com.

Westlake Chemical Partners LP Conference Call Information:

A conference call to discuss Westlake Chemical Partners' third quarter 2024 results will be held Tuesday, November 5th, 2024 at 1:00 PM Eastern Time (12:00 PM Central Time). To access the conference call, please register at: https://register.vevent.com/register/BId643f8e14d904c4dbc8954f14daeb022. A dial-in will be provided upon registration.

The conference call will also be available via webcast at: https://edge.media-server.com/mmc/p/sdd3kqrb and the earnings release can be obtained via the Partnership web page at: https://investors.wlkpartners.com/corporate-profile/default.aspx.

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | (In thousands of dollars, except per unit data) |

| Revenue | | | | | | | | |

| Net sales—Westlake Corporation ("Westlake") | | $ | 215,799 | | | $ | 289,303 | | | $ | 690,535 | | | $ | 771,349 | |

| Net co-products, ethylene and other sales—third parties | | 61,196 | | | 32,361 | | | 155,301 | | | 122,169 | |

| Total net sales | | 276,995 | | | 321,664 | | | 845,836 | | | 893,518 | |

| Cost of sales | | 160,052 | | | 228,683 | | | 525,481 | | | 606,742 | |

| Gross profit | | 116,943 | | | 92,981 | | | 320,355 | | | 286,776 | |

| Selling, general and administrative expenses | | 7,254 | | | 6,741 | | | 21,936 | | | 21,884 | |

| Income from operations | | 109,689 | | | 86,240 | | | 298,419 | | | 264,892 | |

| Other income (expense) | | | | | | | | |

| Interest expense—Westlake | | (6,698) | | | (6,437) | | | (19,930) | | | (19,869) | |

| Other income, net | | 1,325 | | | 1,272 | | | 3,916 | | | 3,153 | |

| Income before income taxes | | 104,316 | | | 81,075 | | | 282,405 | | | 248,176 | |

| Provision for income taxes | | 216 | | | 222 | | | 633 | | | 607 | |

| Net income | | 104,100 | | | 80,853 | | | 281,772 | | | 247,569 | |

| Less: Net income attributable to noncontrolling interest in Westlake Chemical OpCo LP ("OpCo") | | 85,964 | | | 67,647 | | | 234,376 | | | 207,585 | |

| Net income attributable to Westlake Partners | | $ | 18,136 | | | $ | 13,206 | | | $ | 47,396 | | | $ | 39,984 | |

| | | | | | | | |

| Net income per limited partner unit attributable to Westlake Partners (basic and diluted) | | | | | | | | |

| Common units | | $ | 0.51 | | | $ | 0.37 | | | $ | 1.35 | | | $ | 1.14 | |

| | | | | | | | |

| Distributions declared per unit | | $ | 0.4714 | | | $ | 0.4714 | | | $ | 1.4142 | | | $ | 1.4142 | |

| | | | | | | | |

| MLP distributable cash flow | | $ | 17,879 | | | $ | 13,620 | | | $ | 51,906 | | | $ | 46,156 | |

| | | | | | | | |

| Distributions declared | | | | | | | | |

| Limited partner units—publicly and privately held | | $ | 9,954 | | | $ | 9,949 | | | $ | 29,855 | | | $ | 29,841 | |

| Limited partner units—Westlake | | 6,657 | | | 6,658 | | | 19,971 | | | 19,973 | |

| Total distributions declared | | $ | 16,611 | | | $ | 16,607 | | | $ | 49,826 | | | $ | 49,814 | |

| EBITDA | | $ | 139,126 | | | $ | 115,738 | | | $ | 386,756 | | | $ | 349,947 | |

WESTLAKE CHEMICAL PARTNERS LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| | | | |

| | (In thousands of dollars) |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 60,208 | | | $ | 58,619 | |

| Receivable under the Investment Management Agreement—Westlake | | 109,540 | | | 94,444 | |

| Accounts receivable, net—Westlake | | 44,885 | | | 49,565 | |

| Accounts receivable, net—third parties | | 22,511 | | | 18,701 | |

| Inventories | | 3,751 | | | 4,432 | |

| Prepaid expenses and other current assets | | 667 | | | 442 | |

| Total current assets | | 241,562 | | | 226,203 | |

| Property, plant and equipment, net | | 908,992 | | | 943,843 | |

| Other assets, net | | 144,141 | | | 146,796 | |

| Total assets | | $ | 1,294,695 | | | $ | 1,316,842 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities (accounts payable and accrued and other liabilities) | | $ | 53,291 | | | $ | 56,335 | |

| | | | |

| Long-term debt payable to Westlake | | 399,674 | | | 399,674 | |

| Other liabilities | | 3,916 | | | 4,583 | |

| Total liabilities | | 456,881 | | | 460,592 | |

| Common unitholders—publicly and privately held | | 472,296 | | | 473,513 | |

| Common unitholder—Westlake | | 48,020 | | | 48,993 | |

| | | | |

| General partner—Westlake | | (242,572) | | | (242,572) | |

| | | | |

| Total Westlake Partners partners' capital | | 277,744 | | | 279,934 | |

| Noncontrolling interest in OpCo | | 560,070 | | | 576,316 | |

| Total equity | | 837,814 | | | 856,250 | |

| Total liabilities and equity | | $ | 1,294,695 | | | $ | 1,316,842 | |

WESTLAKE CHEMICAL PARTNERS LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| | | | |

| | (In thousands of dollars) |

| Cash flows from operating activities | | | | |

| Net income | | $ | 281,772 | | | $ | 247,569 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | | |

| Depreciation and amortization | | 84,421 | | | 81,902 | |

| Net loss on disposition and other | | 2,227 | | | 4,352 | |

| Other balance sheet changes | | (15,888) | | | 10,505 | |

| Net cash provided by operating activities | | 352,532 | | | 344,328 | |

| Cash flows from investing activities | | | | |

| Additions to property, plant and equipment | | (35,497) | | | (33,979) | |

| | | | |

| Investments with Westlake under the Investment Management Agreement | | (15,000) | | | (164,116) | |

| Maturities of investments with Westlake under the Investment Management Agreement | | — | | | 145,000 | |

| | | | |

Net cash used for investing activities | | (50,497) | | | (53,095) | |

| Cash flows from financing activities | | | | |

| | | | |

| Proceeds from debt payable to Westlake | | 163,000 | | | 155,250 | |

| Repayment of debt payable to Westlake | | (163,000) | | | (155,250) | |

| Distributions to noncontrolling interest retained in OpCo by Westlake | | (250,622) | | | (240,333) | |

| Distributions to unitholders | | (49,824) | | | (49,813) | |

| Net cash used for financing activities | | (300,446) | | | (290,146) | |

Net increase in cash and cash equivalents | | 1,589 | | | 1,087 | |

| Cash and cash equivalents at beginning of period | | 58,619 | | | 64,782 | |

| Cash and cash equivalents at end of period | | $ | 60,208 | | | $ | 65,869 | |

WESTLAKE CHEMICAL PARTNERS LP

RECONCILIATION OF MLP DISTRIBUTABLE CASH FLOW TO NET INCOME

AND NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (In thousands of dollars) |

| Net cash provided by operating activities | | $ | 121,896 | | | $ | 126,071 | | | $ | 100,925 | | | $ | 352,532 | | | $ | 344,328 | |

| Changes in operating assets and liabilities and other | | (33,870) | | | (21,971) | | | (20,072) | | | (70,760) | | | (96,759) | |

| Net income | | 88,026 | | | 104,100 | | | 80,853 | | | 281,772 | | | 247,569 | |

| Add: | | | | | | | | | | |

| Depreciation, amortization and disposition of property, plant and equipment | | 29,869 | | | 28,528 | | | 32,242 | | | 86,662 | | | 86,340 | |

| Less: | | | | | | | | | | |

| Contribution to turnaround reserves | | (8,672) | | | (11,903) | | | (7,565) | | | (32,051) | | | (21,838) | |

| Maintenance capital expenditures | | (9,306) | | | (17,753) | | | (22,862) | | | (34,808) | | | (37,407) | |

| Distributable cash flow attributable to noncontrolling interest in OpCo | | (82,782) | | | (85,093) | | | (69,048) | | | (249,669) | | | (228,508) | |

| MLP distributable cash flow | | $ | 17,135 | | | $ | 17,879 | | | $ | 13,620 | | | $ | 51,906 | | | $ | 46,156 | |

WESTLAKE CHEMICAL PARTNERS LP

RECONCILIATION OF EBITDA TO NET INCOME, INCOME FROM OPERATIONS AND NET CASH

PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (In thousands of dollars) |

| Net cash provided by operating activities | | $ | 121,896 | | | $ | 126,071 | | | $ | 100,925 | | | $ | 352,532 | | | $ | 344,328 | |

| Changes in operating assets and liabilities and other | | (33,870) | | | (21,971) | | | (20,072) | | | (70,760) | | | (96,759) | |

| Net income | | 88,026 | | | 104,100 | | | 80,853 | | | 281,772 | | | 247,569 | |

| Less: | | | | | | | | | | |

| Other income, net | | 1,257 | | | 1,325 | | | 1,272 | | | 3,916 | | | 3,153 | |

| Interest expense—Westlake | | (6,651) | | | (6,698) | | | (6,437) | | | (19,930) | | | (19,869) | |

| Provision for income taxes | | (207) | | | (216) | | | (222) | | | (633) | | | (607) | |

| Income from operations | | 93,627 | | | 109,689 | | | 86,240 | | | 298,419 | | | 264,892 | |

| Add: | | | | | | | | | | |

| Depreciation and amortization | | 28,315 | | | 28,112 | | | 28,226 | | | 84,421 | | | 81,902 | |

| Other income, net | | 1,257 | | | 1,325 | | | 1,272 | | | 3,916 | | | 3,153 | |

| EBITDA | | $ | 123,199 | | | $ | 139,126 | | | $ | 115,738 | | | $ | 386,756 | | | $ | 349,947 | |

v3.24.3

Cover Page

|

Nov. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 05, 2024

|

| Entity Registrant Name |

Westlake Chemical Partners LP

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36567

|

| Entity Tax Identification Number |

32-0436529

|

| Entity Address, Address Line One |

2801 Post Oak Boulevard,

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

713

|

| Local Phone Number |

585-2900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common units representing limited partnership interests

|

| Trading Symbol |

WLKP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001604665

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

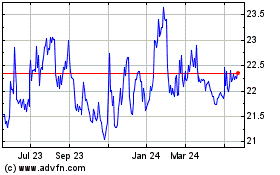

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Dec 2024 to Jan 2025

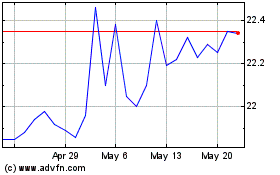

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Jan 2024 to Jan 2025