Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

08 May 2024 - 6:15AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant

to Rule 433

supplementing the Preliminary Prospectus Supplement dated

May 7, 2024 and the Prospectus dated May 2, 2022

Registration No. 333-264613

W. P. Carey Inc.

€650,000,000

4.250% Senior Notes due 2032

| Issuer: |

W. P. Carey Inc. |

| |

|

| Offering Format: |

SEC Registered |

| |

|

| Security Type: |

Senior Unsecured Fixed Rate Notes |

| |

|

| Aggregate Principal Amount: |

€650,000,000 |

| |

|

| Stated Maturity Date: |

July 23, 2032 |

| |

|

| Coupon: |

4.250% per year |

| |

|

| Public Offering Price: |

99.526%, plus accrued and unpaid interest, if any, from the Settlement Date |

| |

|

| Mid-Swap Yield: |

2.722% |

| |

|

| Spread to Mid-Swap Yield: |

+160 basis points |

| |

|

| Benchmark Government Security: |

DBR 0.000% due February 15, 2032 |

| |

|

| Benchmark Government Security Price: |

83.320% |

| |

|

| Spread to Benchmark Government Security: |

+194.6 basis points |

| |

|

| Yield to Maturity (annual): |

4.322% |

| |

|

| Interest Payment Dates: |

July 23 of each year, commencing July 23, 2024 (short first coupon) |

| |

|

| Day Count Convention: |

Actual/Actual (ICMA) |

| |

|

| Optional Redemption: |

At any time prior to April 23, 2032 (i.e., three months prior to the Stated Maturity Date), make-whole call based on the Comparable Government Bond Rate plus 30 basis points; if redeemed on or after April 23, 2032 (i.e., three months prior to the Stated Maturity Date), at 100% of the aggregate principal amount of the Notes to be redeemed; plus, in each case, accrued and unpaid interest, if any, on the principal amount of the notes to be redeemed to, but not including, such redemption date. |

| Listing: |

The Issuer intends to list the notes on the Official List of the Irish Stock Exchange plc, trading as Euronext Dublin and admit the notes to trading on its Global Exchange Market. |

| |

|

| Joint Book-Running Managers: |

Merrill Lynch International |

| |

Barclays Bank PLC |

| |

RBC Europe Limited |

| |

Wells Fargo Securities International Limited |

| |

|

| Senior Co-Managers: |

Citizens JMP Securities, LLC |

| |

Regions Securities LLC |

| |

Scotiabank (Ireland) Designated Activity Company |

| |

|

| Co-Managers: |

Banco Bilbao Vizcaya Argentaria, S.A. |

| |

BNP Paribas |

| |

Mizuho International plc |

| |

|

| ISIN/Common Code: |

XS2819335311 / 281933531 |

| |

|

| UK MiFIR Product Governance: |

Manufacturer target market (UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels) |

| |

|

| PRIIPs: |

No EU PRIIPs or UK PRIIPs key information document (KID) has been prepared as not available to retail in the EEA or in the UK |

| |

|

| Denominations: |

€100,000 x €1,000 |

| |

|

| Trade Date: |

May 7, 2024 |

| |

|

| Settlement Date; Settlement and Trading: |

May 16, 2024, through the facilities of Euroclear Bank SA/NV, as operator of the Euroclear System, and Clearstream Banking, S.A. |

| |

|

| Expected Ratings: |

Baa1 (Stable) by Moody’s Investors Service, Inc. and BBB+ (Stable) by Standard & Poor’s* |

Terms

used herein but not defined shall have the respective meanings as set forth in the Issuer’s preliminary prospectus supplement dated

May 7, 2024.

*

A securities rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time.

Each securities rating should be evaluated independently of any other security rating.

We

expect to deliver the Notes against payment for the Notes on or about May 16, 2024. Under the E.U. Central Securities Depositaries

Regulation, trades in the secondary market generally are required to settle in two London business days unless the parties to a trade

expressly agree otherwise. Also under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally

are required to settle in two New York business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers

who wish to trade Notes before the second business day prior to delivery being required will be required to specify alternative settlement

arrangements to prevent a failed settlement.

UK

MiFIR - professionals/ECPs-only / No PRIIPs or UK PRIIPs KID – Manufacturer target market (UK MiFIR product governance)

is eligible counterparties and professional clients only (all distribution channels). No PRIIPs or UK PRIIPs key information document

(KID) has been prepared as not available to retail in the EEA or UK.

The communication

of this pricing term sheet and any other document or materials relating to the issue of the Notes offered hereby is not being made, and

such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the United Kingdom's

Financial Services and Markets Act 2000, as amended (the “FSMA”). Accordingly, this pricing term sheet and such other documents

and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. This pricing term

sheet and such other documents and/or materials are for distribution only to persons who (i) have professional experience in matters relating

to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), (ii) fall within Article

49(2)(a) to (d) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are other persons to whom it may otherwise

lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”).

This pricing term sheet is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons.

Any investment or investment activity to which this pricing term sheet and any other document or materials relates will be engaged in

only with relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this pricing term

sheet, any such relevant document or materials or any of their contents.

The

Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for

the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and

other documents that the Issuer has filed with the SEC, including the prospectus supplement relating to the notes, for more complete information

about the issuer and this offering. You may get these documents for free by visiting the SEC Web site at www.sec.gov. Alternatively, the

Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement

relating to the notes if you request it by contacting Merrill Lynch International toll-free

at +1-800-294-1322, Barclays Bank PLC toll-free at + 1-866-603-5847, RBC Europe Limited at +1-855-495-9846 and Wells Fargo Securities

International Limited at +44-20-3942-8537.

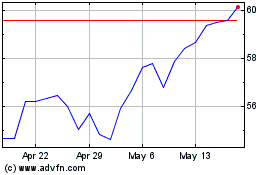

WP Carey (NYSE:WPC)

Historical Stock Chart

From Apr 2024 to May 2024

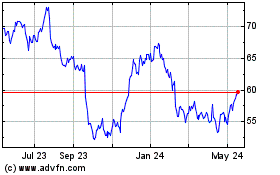

WP Carey (NYSE:WPC)

Historical Stock Chart

From May 2023 to May 2024