- Current report filing (8-K)

27 May 2010 - 10:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2010

THE WESTERN UNION COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32903

|

|

20-4531180

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

12500 East Belford Avenue

Englewood, Colorado

|

|

80112

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(866)

405-5012

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.05. Costs Associated with Exit or Disposal Activities.

On May 25, 2010, the Board of Directors of the Western Union Company (the “Company”) approved a multi-phase proposal (the

“Restructuring Plan”) designed to improve the Company’s business processes and to leverage its cost structure. The Restructuring Plan contemplates the reduction of the Company’s overall headcount and the migration and

consolidation of positions from various facilities, primarily within the United States and Europe, to regionalized operating centers. If implemented as proposed, approximately 175 positions will be eliminated and approximately 550 positions will be

migrated and consolidated. If implemented as proposed, the Company expects to incur approximately $75 million of costs related to the Restructuring Plan consisting of approximately $55 million for severance and employee related benefits,

approximately $10 million for facility closures, and approximately $10 million for other expenses. Included in estimated expenses are approximately $2 million of non-cash expenses related to fixed asset and leasehold improvement write-offs and

accelerated depreciation at impacted facilities. Subject to complying with and undertaking the necessary individual and collective employee information and consultation obligations as may be required by local law for potentially affected employees,

the Company expects all of these activities and associated expenses to occur over the next 18 months and to be completed by December, 2011 with a significant majority of these costs expected to be incurred in the Company’s fiscal year ended

December 31, 2010. The Company expects the total Restructuring Plan costs of approximately $75 million to be offset by annual expense savings of approximately $50 million beginning in 2012, following completion of the Restructuring Plan as

currently anticipated. The foregoing figures are the Company’s estimates and are subject to change as the proposed Restructuring Plan is implemented and the employee information and consultation process is undertaken.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

On May 26, 2010, as part of the Restructuring Plan, the Company notified Ranjana

Clark that her position with the Company would be eliminated and that her employment would cease on June 30, 2010. Upon her departure, Ms. Clark will be eligible for benefits under the Company’s existing Severance / Change in Control

Policy (Executive Committee Level), which are described in the Company’s 2010 Proxy Statement.

Safe Harbor Compliance Statement

for Forward-Looking Statements

This Form 8-K contains certain statements that are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those

expressed in, or implied by, our forward-looking statements. Words such as “expects,” “intends,” “anticipates,” “believes,” “estimates,” “guides,” “provides guidance,”

“provides outlook” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. Readers of this

filing by The Western Union Company (the “Company,” “Western Union,” “we,” “our” or “us”) should not rely solely on the forward-looking statements and should consider all uncertainties and risks

discussed in the Risk Factors

section and throughout the Annual Report on Form 10-K for the year ended December 31, 2009. The statements are only as of the date they are made, and the Company undertakes no obligation to

update any forward-looking statement.

Possible events or factors that could cause results or performance to differ materially from those

expressed in our forward-looking statements include the following: changes in immigration laws, patterns and other factors related to migrants; our ability to adapt technology in response to changing industry and consumer needs or trends; our

failure to develop and introduce new products, services and enhancements, and gain market acceptance of such products; the failure by us, our agents or subagents to comply with our business and technology standards and contract requirements or

applicable laws and regulations, especially laws designed to prevent money laundering and terrorist financing, and/or changing regulatory or enforcement interpretations of those laws; failure to comply with the settlement agreement with the State of

Arizona; changes in United States or foreign laws, rules and regulations including the Internal Revenue Code, and governmental or judicial interpretations thereof; changes in general economic conditions and economic conditions in the regions and

industries in which we operate; adverse movements and volatility in capital markets and other events which affect our liquidity, the liquidity of our agents or clients, or the value of, or our ability to recover our investments or amounts payable to

us; political conditions and related actions in the United States and abroad which may adversely affect our businesses and economic conditions as a whole; interruptions of United States government relations with countries in which we have or are

implementing material agent contracts; our ability to resolve tax matters with the Internal Revenue Service and other tax authorities consistent with our reserves; mergers, acquisitions and integration of acquired businesses and technologies into

our company, and the realization of anticipated financial benefits from these acquisitions; changes in, and failure to manage effectively exposure to, foreign exchange rates, including the impact of the regulation of foreign exchange spreads on

money transfers and payment transactions; failure to maintain sufficient amounts or types of regulatory capital to meet the changing requirements of our regulators worldwide; our ability to maintain our agent network and business relationships under

terms consistent with or more advantageous to us than those currently in place; failure to implement agent contracts according to schedule; deterioration in consumers’ and clients’ confidence in our business, or in money transfer providers

generally; failure to manage credit and fraud risks presented by our agents, clients and consumers or non-performance by our banks, lenders, other financial services providers or insurers; any material breach of security of or interruptions in any

of our systems; adverse rating actions by credit rating agencies; liabilities and unanticipated developments resulting from litigation and regulatory investigations and similar matters, including costs, expenses, settlements and judgments; failure

to compete effectively in the money transfer industry with respect to global and niche or corridor money transfer providers, banks and other money transfer services providers, including telecommunications providers, card associations, card-based

payment providers and electronic and internet providers; our ability to protect our brands and our other intellectual property rights; our failure to manage the potential both for patent protection and patent liability in the context of a rapidly

developing legal framework for intellectual property protection; cessation of various services provided to us by third-party vendors; changes in industry standards affecting our business; changes in accounting standards, rules and interpretations;

our ability to attract and retain qualified key employees and to manage our workforce successfully; significantly slower growth or declines in the money transfer market

and other markets in which we operate; adverse consequences from our spin-off from First Data Corporation; decisions to downsize, sell or close units, or to transition operating activities from

one location to another or to third parties, particularly transitions from the United States to other countries; decisions to change our business mix; catastrophic events; and management’s ability to identify and manage these and other risks.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Dated: May 27, 2010

|

|

|

|

THE WESTERN UNION COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Sarah J. Kilgore

|

|

|

|

|

|

|

|

|

|

Sarah J. Kilgore

Senior

Vice President and

Assistant Secretary

|

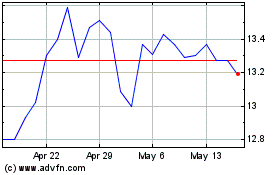

Western Union (NYSE:WU)

Historical Stock Chart

From Oct 2024 to Nov 2024

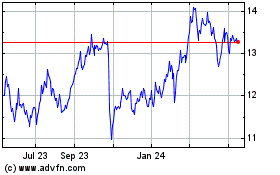

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2023 to Nov 2024