Second Quarter 2023

Highlights

- Revenue was $410.3 million, an increase of 25% and a quarterly

record; Operating income was $87.3 million, an increase of 26%; and

Adjusted OIBDA1 was $140.7 million, an increase of 54% and a

quarterly record

- Returned $9.8 million of capital to shareholders through

dividend payments

- Viewership for WWE’s weekly flagship programs, SmackDown and

Raw, increased 26% and 19%, respectively, in the P18-49 demo,

significantly outperforming overall broadcast and cable television,

which both declined 12%

- Each WWE premium live event (WrestleMania, Backlash and Night

of Champions) set global unique viewership records with

year-over-year increases of 29%, 34% and 45%, respectively

- Live Events revenue increased 51% over the prior year period,

reflecting continued strong demand for domestic and international

events. North American Live Event average attendance was 9,870, an

increase of 45% and a quarterly record

- In July, Money in the Bank was held at The O2 in London. Money

in the Bank was WWE’s highest-grossing arena event in company

history. Money in the Bank also set new records for viewership,

sponsorship revenue, merchandise revenue and social media

activity

WWE and Endeavor Transaction

Highlights

- As previously disclosed, on April 3, 2023, WWE and Endeavor

announced an agreement to combine WWE and UFC to form a new,

publicly listed company. The new company will be named “TKO Group

Holdings, Inc.”

- As previously disclosed, in June 2023, the applicable waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of

1976, as amended, expired. In addition, all required foreign

regulatory approvals were obtained during the second quarter

- The transaction is expected to close in the second half of

2023. The transaction is subject to the satisfaction of customary

closing conditions

2023 Business Outlook2

- The Company reaffirms its expectations for 2023, which target

record revenue and an Adjusted OIBDA range of $395 to $410 million,

which would be an all-time record

WWE (NYSE: WWE) today announced financial results for its second

quarter ended June 30, 2023.

“We generated strong financial results in the quarter,

highlighted by record quarterly revenue and Adjusted OIBDA.

Operationally, we continue to effectively execute our strategy,

including staging the most successful WrestleMania of all time in

early April. WrestleMania, as well as our other premium live events

such as Backlash, Night of Champions and Money in the Bank all

delivered record viewership. Our weekly flagship programs, Raw,

SmackDown and NXT, delivered strong double-digit growth in

viewership, significantly outpacing overall industry performance,”

said Nick Khan, WWE Chief Executive Officer. “Strategically, in

early April, we entered into a historic agreement with Endeavor to

combine WWE with UFC to create a one-of-a-kind global sports and

entertainment company. We believe that bringing these two iconic

and highly complementary brands together will allow us to create

incremental value for our shareholders.”

Frank Riddick, WWE President & Chief Financial Officer,

added “In the quarter, we exceeded the high end of our guidance.

Adjusted OIBDA was $141 million on revenue of $410 million. Our

financial performance was favorably impacted by a shift in the

timing of the staging of a large-scale international event. Our

results in the quarter also reflected strong consumer demand for

our live events, which benefited performance across our various

lines of business.”

Second-Quarter Consolidated

Results

Revenue increased 25%, or $82.1 million, to $410.3

million, primarily due to the timing of the staging of a

large-scale international event, an increase in revenue related to

the media rights fees for the Company’s premium live events and

flagship weekly programming, and higher live events revenue.

Operating Income increased 26%, or $18.0 million, to

$87.3 million, reflecting the increase in revenue partially offset

by an increase in operating expenses. The increase in operating

expenses primarily reflected an increase in content creation costs,

including the timing of a large-scale international event, and the

impact of certain costs related to the Company’s strategic

alternatives review and recently announced agreement with Endeavor.

(See the “WWE and Endeavor Transaction” discussion for further

details.) The Company’s operating income margin remained flat at

21%.

Adjusted OIBDA increased 54%, or $49.2 million, to $140.7

million. The Company’s Adjusted OIBDA margin increased to 34% from

28%.

Net Income was $52.0 million, or $0.67 per diluted share,

an increase from $49.0 million, or $0.58 per diluted share,

primarily reflecting the increase in operating performance

partially offset by an increase in the Company’s effective tax

rate.

Cash flows generated by operating activities were $77.0

million, an increase from $56.9 million, primarily due to higher

net income and lower working capital requirements.

Free Cash Flow3 was $31.1 million, an increase of $21.7

million from $9.4 million, primarily due to the increase in cash

flows generated by operating activities. For the three months ended

June 30, 2023, the Company incurred $31.7 million of capital

expenditures related to its new headquarter facility. Excluding the

capital expenditures related to the new headquarter facility, Free

Cash Flow for the three months ended June 30, 2023 was $62.8

million.

Cash, cash equivalents and short-term investments were

$523.8 million as of June 30, 2023. The Company currently estimates

debt capacity under its revolving line of credit of $200

million.

Results by Operating

Segment

The schedule below reflects WWE’s performance by operating

segment (in millions):

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Net Revenue:

Media

$

320.3

$

243.1

$

546.0

$

521.2

Live Events

62.0

41.0

94.6

64.1

Consumer Products

28.0

44.1

67.3

76.3

Total Net Revenue

$

410.3

$

328.2

$

707.9

$

661.6

Operating Income (Loss):

Media

$

107.3

$

78.4

$

180.9

$

195.8

Live Events

33.1

13.2

39.2

15.2

Consumer Products

11.1

15.9

32.5

27.1

Corporate

(64.2

)

(38.2

)

(112.2

)

(76.4

)

Total Operating Income

$

87.3

$

69.3

$

140.4

$

161.7

Adjusted OIBDA:

Media

$

126.1

$

90.7

$

213.9

$

218.9

Live Events

34.5

13.8

41.5

16.6

Consumer Products

12.5

16.5

34.7

28.4

Corporate

(32.4

)

(29.5

)

(65.2

)

(60.7

)

Total Adjusted OIBDA

$

140.7

$

91.5

$

224.9

$

203.2

Media

Second-Quarter 2023

Revenue increased 32%, or $77.2 million, to $320.3

million, primarily due to the timing of a large-scale international

event and, to a lesser extent, an increase in revenue related to

the contractual escalation of media rights fees for the Company’s

flagship weekly programming, Raw and SmackDown, and premium live

events. During the quarter, approximately $7 million of incremental

Network revenue was recorded as a result of a change in the premium

live events calendar.

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Media Revenue:

Network (a)

$

80.1

$

67.0

$

131.5

$

125.7

Core content rights fees (b)

154.8

148.5

308.7

287.6

Advertising and sponsorship (c)

18.9

17.9

34.5

37.7

Other (d)

66.5

9.7

71.3

70.2

Total Revenue

$

320.3

$

243.1

$

546.0

$

521.2

(a)

Network revenue consists primarily of

license fees from the global distribution of WWE Network content

associated with our licensed partner agreements.

(b)

Core content rights fees consist primarily

of licensing revenue from the distribution of our flagship

programs, Raw and SmackDown, as well as NXT programming, through

global broadcast, pay television and digital platforms.

(c)

Advertising and sponsorship revenue within

the Media segment consists primarily of advertising revenue from

the Company’s content on third-party social media platforms and

sponsorship fees from sponsors who promote products utilizing the

Company’s media platforms, including promotion on the Company’s

digital websites and on-air promotional media spots.

(d)

Other revenue within the Media segment

reflects revenue from the distribution of other WWE content,

including, but not limited to, certain live in-ring programming

content in international markets, scripted, reality and other

programming.

Operating income increased 37%, or $28.9 million, to

$107.3 million, as the increase in revenue (as described above) was

partially offset by an increase in operating expenses. The increase

in operating expenses primarily reflected an increase in content

creation costs, including the timing of a large-scale international

event, as well as an increase in stock-based compensation.

Adjusted OIBDA increased 39%, or $35.4 million, to $126.1

million.

Live Events

Second-Quarter 2023

Revenue increased 51%, or $21.0 million, to $62.0

million, primarily due to an increase in ticket sales, both

domestically and internationally, and an increase in advertising

and sponsorship revenue. There were 53 total ticketed live events

in the current quarter, consisting of 43 events in North America

and 10 events in international markets. Average attendance at the

Company’s North America events was approximately 9,900. In the

prior year period, the Company staged 59 total ticketed live

events, consisting of 55 events in North America and 4 events in

international markets. Average attendance at the Company’s North

America events was approximately 6,800.

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Live Events Revenue:

North American ticket sales

$

40.3

$

34.9

$

70.5

$

54.8

International ticket sales

6.4

2.2

6.4

2.2

Advertising and sponsorship (e)

8.8

1.6

9.8

2.7

Other (f)

6.5

2.3

7.9

4.4

Total Revenue

$

62.0

$

41.0

$

94.6

$

64.1

(e)

Advertising and sponsorship revenue within

the Live Events segment consists primarily of fees from advertisers

and sponsors that promote products utilizing the Company’s live

events (i.e., presenting sponsor of fan engagement events and

advertising signage at events).

(f)

Other revenue within the Live Events

segment reflects revenue from the sale of travel packages

associated with the Company’s global live events, and commissions

earned through secondary ticketing.

Operating income increased 151%, or $19.9 million, to

$33.1 million, as a result of the increase in revenues (as

described above) and relatively flat event-related expenses.

Adjusted OIBDA increased 150%, or $20.7 million, to $34.5

million.

Consumer Products

Second-Quarter 2023

Revenue decreased 37%, or $16.1 million, to $28.0

million, primarily reflecting a decrease in licensing and eCommerce

revenue. Licensing revenue primarily reflected a decrease in video

gaming and collectibles revenue. The year-over-year change in

eCommerce revenue reflected the previously disclosed transition of

our digital retail platform to Fanatics.

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Consumer Products Revenue:

Consumer product licensing

$

15.6

$

22.6

$

42.4

$

42.6

eCommerce

4.6

12.9

8.4

20.6

Venue merchandise

7.8

8.6

16.5

13.1

Total Revenue

$

28.0

$

44.1

$

67.3

$

76.3

Operating income decreased 30%, or $4.8 million, to $11.1

million, primarily reflecting the decrease in revenue (as described

above) partially offset by a decrease in operating expenses. The

decrease in operating expenses was primarily due to lower expenses

related to the transition of eCommerce operations to Fanatics.

Adjusted OIBDA decreased 24%, or $4.0 million, to $12.5

million.

2023 Business Outlook2

In February, the Company issued its outlook for 2023 Adjusted

OIBDA. The Company reaffirms its expectations for 2023 Adjusted

OIBDA in the range of $395 - $410 million, which would be an

all-time record result. The Company also reaffirms its expectation

to generate record revenue in 2023. This anticipated performance

reflects an expected increase in media rights fees for the

Company’s flagship weekly programming and premium live events, as

well as a full live events touring schedule, including two

large-scale international events, and an increase in advertising

and sponsorship revenues. The Company anticipates that 2023

operating expenses will reflect an increase in costs to support the

creation of content partially offset by a decline in eCommerce and

venue merchandise expenses, as a result of the transition of the

Company’s digital retail platform and venue merchandise business to

Fanatics, as well as a decline in third-party original programming

expenses, due to the timing of the production of premium WWE-themed

series and specials.

Third Quarter 2023 Business

Outlook2

The Company estimates third quarter 2023 Adjusted OIBDA of $75 -

$85 million. The Company also anticipates that third quarter

results will reflect a year-over-year decrease in revenue. The

decrease in revenue primarily reflects an expected decline in

revenue at the Consumer Products segment and a decline in

third-party original programming revenue, due to the timing of the

production of premium WWE-themed series. The expected decline in

Consumer Products revenue relates to the timing of revenue recorded

as a result of the early termination of an agreement for our

licensed collectibles, as well as the transition of the Company’s

digital retail platform and venue merchandise business to

Fanatics.

WWE and Endeavor

Transaction

As previously disclosed, in January, Vincent K. McMahon, the

Company’s Executive Chairman and shareholder with a controlling

interest, along with WWE’s management team and Board of Directors,

announced the intent to undertake a review of strategic

alternatives with the goal of maximizing value for all WWE

shareholders. On April 3, 2023, WWE and Endeavor Group Holdings,

Inc. (“Endeavor”) announced an agreement to combine WWE and UFC to

form a new, publicly listed company. The transaction is expected to

close in the second half of 2023. The transaction is subject to the

satisfaction of customary closing conditions. For the three and six

months ended June 30, 2023, the Company’s consolidated pre-tax

results included $18.8 million and $25.4 million, respectively, of

expenses related to the strategic alternatives review and agreement

with Endeavor.

Convertible Senior Notes

During the second quarter, the Company issued an aggregate of

8.5 million shares of its Class A common stock and paid

approximately $4 million in cash, which represented the premium and

accrued interest paid to investors, for approximately $211 million

principal amount of its outstanding 3.375% Convertible Senior Notes

due 2023 (the “Notes”). In connection with and following the

issuance of the shares, the Company entered into agreements to

terminate all of the convertible note hedge and warrant

transactions that were previously entered into in connection with

the issuance of the Notes. As a result of these terminations, the

Company received net cash proceeds of approximately $51 million.

For the three and six months ended June 30, 2023, the Company’s

consolidated pre-tax results included a loss of $5.4 million

associated with the cash premiums paid to investors in excess of

the amount of cash or common stock issuable under the original

terms of the Company’s convertible notes, as well as accrued

interest and advisor fees incurred upon execution of the related

conversions. As of June 30, 2023, an aggregate of approximately $4

million principal amount of the Notes remained outstanding.

Return of Capital to

Shareholders

The Company returned $9.8 million of capital to shareholders in

dividends in the second quarter of 2023. There were no share

repurchases under the Company’s existing stock repurchase program

in the second quarter of 2023. Under the Company’s existing stock

repurchase program, approximately 5.3 million shares have been

repurchased to-date at an average price of $54.09 per share. As of

June 30, 2023, the Company had $211 million available under its

existing $500 million stock repurchase authorization. As a result

of the transaction with Endeavor (see the “WWE and Endeavor

Transaction” discussion for further details), the Company currently

has no plans to resume the program.

Other Matters

During the three and six months ended June 30, 2023, the Company

incurred $5.3 million and $7.1 million, respectively, of expenses

related to costs incurred in connection with and/or arising from

the investigation conducted by the Special Committee of members of

the Company’s Board of Directors, related revisions to the

Company’s financial statements and other related matters. Mr.

McMahon has agreed to review in good faith and reimburse the

Company for all reasonable costs incurred in connection with and/or

arising from the investigation conducted by the Special Committee,

related revisions to the Company’s financial statements and other

related matters. To date, Mr. McMahon has paid approximately $17.4

million to reimburse the Company for costs that have been incurred

and paid by the Company. Please see the Company’s SEC filings,

including, but not limited to, its annual report on Form 10-K and

quarterly reports on Form 10-Q for further details and ongoing

risks regarding this matter.

Notes

(1)

The definition of Adjusted OIBDA can be

found in the Non-GAAP Measures section of the release on page 8. A

reconciliation of Operating Income to Adjusted OIBDA for the three

and six-month periods ended June 30, 2023 and 2022 can be found in

the Supplemental Information in this release on page 15.

(2)

The Company’s business model and expected

results will continue to be subject to significant execution and

other risks, including risks related to the consummation of the

pending business combination with UFC in the expected timeline or

at all; risks relating to the Special Committee investigation and

related matters noted above; the impact of COVID-19 on WWE’s

business, results of operations and financial condition; entering,

maintaining and renewing major distribution agreements; WWE

Network; uncertainties associated with international markets and

risks inherent in large live events, and other risk factors

disclosed in our annual report on Form 10-K for the year ended

December 31, 2022. In addition, WWE is unable to provide a

reconciliation of third quarter or full year 2023 guidance to GAAP

measures as, at this time, WWE cannot accurately determine all of

the adjustments that would be required. See Supplemental

Information in this release on page 16.

(3)

The definition of Free Cash Flow can be

found in the Non-GAAP Measures section of the release on page 8. A

reconciliation of Net Cash Provided by Operating Activities to Free

Cash Flow for the three and six-month periods ended June 30, 2023

and 2022 can be found in the Supplemental Information in this

release on page 17.

Non-GAAP Measures

The Company defines Adjusted OIBDA as operating income

excluding depreciation and amortization, stock-based compensation

expense, certain impairment charges and other non-recurring items

that management deems would impact the comparability of results

between periods. Adjusted OIBDA includes amortization and

depreciation expenses directly related to supporting the operations

of our segments, including content production asset amortization,

depreciation and amortization of costs related to content delivery

and technology assets utilized for the WWE Network, as well as

amortization of right-of-use assets related to finance leases of

equipment used to produce and broadcast our live events. The

Company believes the presentation of Adjusted OIBDA is relevant and

useful for investors because it allows them to view the Company’s

segment performance in the same manner as the primary method used

by management to evaluate segment performance and to make decisions

regarding the allocation of resources. Additionally, the Company

believes that Adjusted OIBDA is a primary measure used by media

investors, analysts and peers for comparative purposes.

Adjusted OIBDA is a non-GAAP financial measure and may be

different from similarly titled non-GAAP financial measures used by

other companies. WWE views operating income as the most directly

comparable GAAP measure. Adjusted OIBDA (and other non-GAAP

measures such as Adjusted Operating Income, Adjusted Net

Income and Adjusted EPS which are defined as the GAAP

measures excluding certain non-recurring items that management

deems would impact the comparability of results between periods)

should not be considered in isolation from, or as a substitute for,

operating income, net income, EPS or other GAAP measures, such as

operating cash flow, as an indicator of operating performance or

liquidity.

The Company defines Free Cash Flow as net cash provided

by operating activities less cash used for capital expenditures.

WWE views net cash provided by operating activities as the most

directly comparable GAAP measure. Although it is not a recognized

measure of liquidity under U.S. GAAP, Free Cash Flow provides

useful information regarding the amount of cash WWE’s continuing

business generates after capital expenditures and is available for

reinvesting in the business, debt service, share repurchases and

payment of dividends.

Additional Information

As previously announced WWE will host a conference call at 8:30

a.m. ET on August 2, 2023, to discuss its second quarter 2023

results. All interested parties are welcome to listen to a live

webcast that will be hosted through the Company’s website at

corporate.wwe.com/investors.

Participants can access the conference call by dialing

1-855-200-4993 (toll free) or 1-323-794-2092 from outside the U.S.

(conference ID for both lines: 6100232). Please reserve a line 5-10

minutes prior to the start time of the conference call.

The earnings presentation referenced during the call will be

made available on August 2, 2023, at corporate.wwe.com/investors. A replay of the call

will be available approximately two hours after the conference call

concludes and can be accessed on the Company’s website.

Additional business metrics are made available to investors on

the corporate website - corporate.wwe.com/investors.

About WWE

WWE, a publicly traded company (NYSE: WWE), is an integrated

media organization and recognized leader in global entertainment.

The Company consists of a portfolio of businesses that create and

deliver original content 52 weeks a year to a global audience. WWE

is committed to family-friendly entertainment on its television

programming, premium live events, digital media, and publishing

platforms. WWE’s TV-PG programming can be seen in more than 1

billion homes worldwide in 25 languages through world-class

distribution partners including NBCUniversal, FOX Sports, BT Sport,

Sony India and Rogers. The award-winning WWE Network includes all

premium live events, scheduled programming and a massive

video-on-demand library and is currently available in more than 180

countries. In the United States, NBCUniversal’s streaming service,

Peacock, is the exclusive home to WWE Network.

Additional information on WWE can be found at wwe.com and corporate.wwe.com.

Trademarks: All WWE programming,

talent names, images, likenesses, slogans, wrestling moves,

trademarks, logos and copyrights are the exclusive property of WWE

and its subsidiaries. All other trademarks, logos and copyrights

are the property of their respective owners.

Forward-Looking Statements: This

press release contains, and oral statements made from time to time

by our representatives may contain, forward-looking statements

pursuant to the safe harbor provisions of the Securities Litigation

Reform Act of 1995. Forward looking statements include statements

regarding our outlook regarding future financial results, the

impact of recent changes to management and our board of directors

(the "Board"); the timing and outcome of the Company's media and

other rights negotiations including major domestic programming

licenses before their expirations through 2024; the Company's

pending business combination with UFC, our plans to remediate

identified material weaknesses in our disclosure control and

procedures and our internal control over financial reporting, and

regulatory, investigative or enforcement inquiries, subpoenas or

demands arising from, related to, or in connection with these

matters. The words "may," "will," “could," “anticipate," "plan,"

"continue," "project," "intend," "estimate," "believe," “expect,"

“outlook," "target," "goal,'' "guidance" and similar expressions

are intended to identify forward-looking statements, although not

all forward-looking statements contain such words. These statements

relate to future possible events, as well as our plans, objectives,

expectations and intentions and are not historical facts and

accordingly involve known and unknown risks and uncertainties and

other factors that may cause the actual results or the performance

by us to be materially different from expected future results or

performance expressed or implied by any forward-looking

statements.

These forward-looking statements are subject to uncertainties

relating to, without limitation, the consummation of the pending

business combination with UFC in the expected timeline or at all;

diversion of management's time and attention due to the pending

business combination with UFC; the availability of sufficient cash

at the close of our transaction with UFC to distribute to

shareholders of the new public company in line with current

expectations; possible disruptions in our content delivery and

online operations and our those of our business partners; privacy

norms and regulations; our need to continue to develop creative and

entertaining programs and events; our need to retain and continue

to recruit key performers; the possibility of a decline in the

popularity of our brand of sports entertainment; possible adverse

changes in the regulatory atmosphere and related private sector

initiatives; the highly competitive, rapidly changing and

increasingly fragmented nature of the markets in which we operate

and/or our inability to compete effectively, especially against

competitors with greater financial resources or marketplace

presence; uncertainties associated with international markets

including possible disruptions and reputational risks; our

difficulty or inability to promote and conduct our live events

and/or other businesses if we do not comply with applicable

regulations; our dependence on our intellectual property rights,

our need to protect those rights, and the risks of our infringement

of others’ intellectual property rights; potential substantial

liability in the event of accidents or injuries occurring during

our physically demanding events; large public events as well as

travel to and from such events; our expansion into new or

complementary businesses, strategic investments and/or

acquisitions; our accounts receivable; the construction and move to

our new leased corporate and media production headquarters;

litigation and other actions, investigations or proceedings; a

change in the tax laws of key jurisdictions; inflationary pressures

and interest rate changes; our indebtedness including our

convertible notes; our potential failure to meet market

expectations for our financial performance; our share repurchase

program; the impact of actions by Mr. McMahon (our controlling

shareholder, whose interests could conflict with those of our Class

A common stockholders); the substantial number of shares are

eligible for sale by the McMahons and the sale, or the perception

of possible sales, of those shares could cause our stock price to

decline; and the volatility in trading prices of our Class A common

stock. In addition. our dividend and share repurchases are

dependent on a number of factors, including among other things, our

liquidity and historical and projected cash flow, strategic plan

(including alternative uses of capital), our financial results and

condition, contractual and legal restrictions, general economic and

competitive conditions and such other factors as our Board may

consider relevant.

Forward-looking statements made by the Company speak only as of

the date made and are subject to change without any obligation on

the part of the Company to update or revise them. Undue reliance

should not be placed on these statements. For more information

about risks and uncertainties associated with the Company's

business, please refer to any documents filed, or to be filed, by

the Company with the SEC, including, but not limited to, the

"Management's Discussion and Analysis of Financial Condition and

Results of Operations" and "Risk Factors" sections of our annual

reports on Form 10‑K and 10‑K/A and quarterly reports on Form

10‑Q/A and Form 10‑Q, and the “Questions and Answers About the

Transactions” and “Risk Factors” sections of our Form S-4.

World Wrestling Entertainment,

Inc.

Consolidated Income

Statements

(In millions, except per share

data)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Net revenues

$

410.3

$

328.2

$

707.9

$

661.6

Operating expenses

229.2

196.9

404.8

377.6

Marketing and selling expenses

25.2

20.1

41.6

38.5

General and administrative expenses

58.6

32.4

102.1

64.6

Depreciation and amortization

10.0

9.5

19.0

19.2

Operating income

87.3

69.3

140.4

161.7

Interest expense

4.9

4.7

9.2

11.0

Other (expense) income, net

(1.6

)

(0.2

)

0.9

0.1

Income before income taxes

80.8

64.4

132.1

150.8

Provision for income taxes

28.8

15.4

43.4

35.7

Net income

$

52.0

$

49.0

$

88.7

$

115.1

Earnings per share:

Basic

$

0.67

$

0.66

$

1.16

$

1.54

Diluted

$

0.67

$

0.58

$

1.18

$

1.35

Weighted average common shares

outstanding:

Basic

77.9

74.3

76.2

74.5

Diluted

79.3

87.9

77.5

87.7

Dividends declared per common share (Class

A and B)

$

0.12

$

0.12

$

0.24

$

0.24

World Wrestling Entertainment,

Inc.

Consolidated Balance

Sheets

(In millions)

(Unaudited)

As of

June 30,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

317.7

$

220.2

Short-term investments, net

206.1

258.5

Accounts receivable, net

161.9

112.4

Inventory

2.2

2.9

Prepaid expenses and other current

assets

55.6

33.2

Total current assets

743.5

627.2

Property and equipment, net

372.4

329.1

Finance lease right-of-use assets, net

292.2

296.6

Operating lease right-of-use assets,

net

14.2

16.3

Content production assets, net

10.9

16.5

Investment securities

12.0

11.8

Deferred income tax assets, net

38.4

45.6

Other assets, net

23.6

12.5

Total assets

$

1,507.2

$

1,355.6

Liabilities and Stockholders'

Equity

Current liabilities:

Current portion of long-term debt

$

0.5

$

0.4

Finance lease liabilities

10.8

11.7

Operating lease liabilities

2.7

3.6

Convertible debt

4.3

214.1

Accounts payable and accrued expenses

129.3

122.9

Deferred revenues

49.3

79.8

Total current liabilities

196.9

432.5

Long-term debt

20.6

20.8

Finance lease liabilities

363.7

364.9

Operating lease liabilities

12.1

13.2

Other non-current liabilities

4.6

7.0

Total liabilities

597.9

838.4

Commitments and contingencies

Stockholders' equity:

Class A common stock

0.5

0.4

Class B convertible common stock

0.3

0.3

Additional paid-in capital

744.9

424.0

Accumulated other comprehensive income

1.3

0.2

Retained earnings

162.3

92.3

Total stockholders’ equity

909.3

517.2

Total liabilities and stockholders'

equity

$

1,507.2

$

1,355.6

World Wrestling Entertainment,

Inc.

Consolidated Statements of

Cash Flows

(In millions)

(Unaudited)

Six Months Ended

June 30,

2023

2022

OPERATING ACTIVITIES:

Net income

$

88.7

$

115.1

Adjustments to reconcile net income to net

cash provided by operating activities:

Amortization and impairments of content

production assets

13.0

16.9

Depreciation and amortization

21.0

23.8

Other amortization

5.5

6.6

Stock-based compensation

33.0

20.6

Benefit from deferred income taxes

6.9

(1.7

)

Induced conversion expense related to

convertible notes

5.4

—

Other non-cash adjustments

4.0

1.4

Cash provided by (used in) changes in

operating assets and liabilities:

Accounts receivable

(50.2

)

(10.3

)

Inventory

0.6

3.5

Prepaid expenses and other assets

(19.9

)

1.1

Content production assets

(7.3

)

(19.9

)

Accounts payable, accrued expenses and

other liabilities

19.4

(2.6

)

Deferred revenues

(30.5

)

(3.8

)

Net cash provided by operating

activities

89.6

150.7

INVESTING ACTIVITIES:

Purchases of property and equipment and

other assets

(79.1

)

(71.6

)

Purchases of short-term investments

(87.1

)

(188.8

)

Proceeds from sales and maturities of

investments

141.2

132.0

Purchase of investment securities

(0.2

)

(0.1

)

Other

—

4.3

Net cash used in investing activities

(25.2

)

(124.2

)

FINANCING ACTIVITIES:

Repayment of debt

(0.2

)

(0.2

)

Repayment of finance leases

(7.9

)

(6.9

)

Dividends paid

(18.7

)

(17.8

)

Net proceeds from partial unwind of

convertible note hedge and warrants

49.1

—

Payment in settlement of convertible debt

notes inducement

(5.4

)

—

Proceeds from tenant improvement

allowances

0.5

13.1

Proceeds from controlling stockholder

contributions

17.4

—

Taxes paid related to net settlement upon

vesting of equity awards

(3.1

)

(0.6

)

Proceeds from issuance of stock

1.4

1.2

Repurchase and retirement of common

stock

—

(40.0

)

Net cash provided by (used in) financing

activities

33.1

(51.2

)

NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS

97.5

(24.7

)

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

220.2

134.8

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

317.7

$

110.1

NON-CASH INVESTING AND FINANCING

TRANSACTIONS:

Purchases of property and equipment

recorded in accounts payable and accrued expenses

$

13.4

$

28.2

Controlling stockholder contributions

$

10.0

$

2.7

Convertible notes exchanged for common

stock

$

210.7

$

—

World Wrestling Entertainment,

Inc.

Supplemental Information –

Reconciliation of Adjusted Net Income

(In millions, except per share

data)

(Unaudited)

Three Months Ended June

30,

2023

2022

As Reported

Other Adjustments (1)

Loss on Inducement (2)

Adjusted

As Reported

Other Adjustments (1)

Adjusted

Operating income

$

87.3

$

24.1

$

—

$

111.4

$

69.3

$

1.7

$

71.0

Interest expense

4.9

—

—

4.9

4.7

—

4.7

Other (expense) income, net

(1.6)

—

5.4

3.8

(0.2)

—

(0.2)

Income before taxes

80.8

24.1

5.4

110.3

64.4

1.7

66.1

Provision for income taxes

28.8

8.6

1.9

39.3

15.4

0.4

15.8

Net income

$

52.0

$

15.5

$

3.5

$

71.0

$

49.0

$

1.3

$

50.3

Earnings per share - diluted

$

0.67

$

0.20

$

0.04

$

0.91

$

0.58

$

0.01

$

0.59

Six Months Ended June

30,

2023

2022

As Reported

Other Adjustments (1)

Loss on Inducement (2)

Adjusted

As Reported

Other Adjustments (1)

Adjusted

Operating income

$

140.4

$

32.5

$

—

$

172.9

$

161.7

$

1.7

$

163.4

Interest expense

9.2

—

—

9.2

11.0

—

11.0

Other income, net

0.9

—

5.4

6.3

0.1

—

0.1

Income before taxes

132.1

32.5

5.4

170.0

150.8

1.7

152.5

Provision for income taxes

43.4

10.7

1.8

55.9

35.7

0.4

36.1

Net income

$

88.7

$

21.8

$

3.6

$

114.1

$

115.1

$

1.3

$

116.4

Earnings per share - diluted

$

1.18

$

0.28

$

0.05

$

1.51

$

1.35

$

0.01

$

1.36

(1)

During the three and six months ended June

30, 2023, the Company’s consolidated pre-tax results included $18.8

million and $25.4 million, respectively, of legal and professional

fees associated with the Company’s strategic alternatives review

and recently announced agreement with Endeavor, as well as $5.3

million and $7.1 million, respectively, of expenses related to

costs incurred in connection with and/or arising from the

investigation conducted by the Special Committee of members of the

Company’s Board of Directors, related revisions to the Company’s

financial statements and other related matters. During the three

and six months ended June 30, 2022, the Company’s consolidated

pre-tax results included $1.7 million of expenses related to costs

incurred in connection with and/or arising from the investigation

conducted by the Special Committee of members of the Company’s

Board of Directors, related revisions to the Company’s financial

statements and other related matters.

(2)

During the three and six months ended June

30, 2023, the Company’s consolidated pre-tax results included a

loss on inducement of $5.4 million associated with the cash

premiums paid to investors in excess of the amount of cash or

common stock issuable under the original terms of the Company’s

convertible notes, as well as accrued interest and advisor fees

incurred upon execution of the related conversions.

World Wrestling Entertainment,

Inc.

Supplemental Information –

Reconciliation of Adjusted OIBDA

(In millions, except per share

data)

(Unaudited)

Three Months Ended June 30,

2023

Operating Income

(Loss)

Depreciation &

Amortization

Stock-based

Compensation

Other Adjustments (1)

Adjusted OIBDA

Media

$

107.3

$

4.3

$

14.5

$

—

$

126.1

Live Events

33.1

0.1

1.3

—

34.5

Consumer Products

11.1

—

1.4

—

12.5

Corporate

(64.2

)

5.6

2.1

24.1

(32.4

)

Total

$

87.3

$

10.0

$

19.3

$

24.1

$

140.7

Three Months Ended June 30,

2022

Operating Income

(Loss)

Depreciation &

Amortization

Stock-based

Compensation

Other Adjustments (1)

Adjusted OIBDA

Media

$

78.4

$

3.6

$

8.7

$

—

$

90.7

Live Events

13.2

0.1

0.5

—

13.8

Consumer Products

15.9

—

0.6

—

16.5

Corporate

(38.2

)

5.8

1.2

1.7

(29.5

)

Total

$

69.3

$

9.5

$

11.0

$

1.7

$

91.5

Six Months Ended June 30,

2023

Operating Income

(Loss)

Depreciation &

Amortization

Stock-based

Compensation

Other Adjustments (1)

Adjusted OIBDA

Media

$

180.9

$

8.7

$

24.3

$

—

$

213.9

Live Events

39.2

0.1

2.2

—

41.5

Consumer Products

32.5

0.1

2.1

—

34.7

Corporate

(112.2

)

10.1

4.4

32.5

(65.2

)

Total

$

140.4

$

19.0

$

33.0

$

32.5

$

224.9

Six Months Ended June 30,

2022

Operating Income

(Loss)

Depreciation &

Amortization

Stock-based

Compensation

Other Adjustments (1)

Adjusted OIBDA

Media

$

195.8

$

7.2

$

15.9

$

—

$

218.9

Live Events

15.2

0.1

1.3

—

16.6

Consumer Products

27.1

0.1

1.2

—

28.4

Corporate

(76.4

)

11.8

2.2

1.7

(60.7

)

Total

$

161.7

$

19.2

$

20.6

$

1.7

$

203.2

(1)

During the three and six months ended June

30, 2023, the Company’s consolidated pre-tax results included $18.8

million and $25.4 million, respectively, of legal and professional

fees associated with the Company’s strategic alternatives review

and recently announced agreement with Endeavor, as well as $5.3

million and $7.1 million, respectively, of expenses related to

costs incurred in connection with and/or arising from the

investigation conducted by the Special Committee of members of the

Company’s Board of Directors, related revisions to the Company’s

financial statements and other related matters. During the three

and six months ended June 30, 2022, the Company’s consolidated

pre-tax results included $1.7 million of expenses related to costs

incurred in connection with and/or arising from the investigation

conducted by the Special Committee of members of the Company’s

Board of Directors, related revisions to the Company’s financial

statements and other related matters.

World Wrestling Entertainment,

Inc.

Supplemental Information –

Reconciliation of Business Outlook

(In millions, except per share

data)

(Unaudited)

Reconciliation of Adjusted OIBDA to

Operating Income

Q2 2023

Q2 2023 YTD

Q3 2023

FY 2023

Adjusted OIBDA

$

140.7

$

224.9

$75 - $85

$395 - $410

Depreciation & amortization (1)

(10.0

)

(19.0

)

—

—

Stock-based compensation (1)

(19.3

)

(33.0

)

—

—

Other operating income items (1)

(24.1

)

(32.5

)

—

—

Operating income (U.S. GAAP

Basis)

$

87.3

$

140.4

Not estimable

Not estimable

(1)

Because of the nature of these items, WWE

is unable to estimate the amounts of any adjustments for these

items for periods after June 30, 2023 due to its inability to

forecast if or when such items will occur. These items are

inherently unpredictable and may not be reliably quantified.

World Wrestling Entertainment,

Inc.

Supplemental Information -

Free Cash Flow

(In millions)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Net cash provided by operating

activities

$

77.0

$

56.9

$

89.6

$

150.7

Less cash used for capital

expenditures:

Purchases of property and equipment and

other assets (1)

(45.9

)

(47.5

)

(79.1

)

(71.6

)

Free Cash Flow (1)

$

31.1

$

9.4

$

10.5

$

79.1

(1)

Purchases of property and equipment and

other assets includes $31.7 million and $42.4 million of capital

expenditures related to the Company’s new headquarter facility for

the three months ended June 30, 2023 and 2022, respectively.

Excluding the capital expenditures related to the Company’s new

headquarter facility, Free Cash Flow was $62.8 million and $51.8

million for the three months ended June 30, 2023 and 2022,

respectively. Purchases of property and equipment and other assets

includes $61.3 million and $55.5 million of capital expenditures

related to the Company’s new headquarter facility for the six

months ended June 30, 2023 and 2022, respectively. Excluding the

capital expenditures related to the Company’s new headquarter

facility, Free Cash Flow was $71.8 million and $134.6 million for

the six months ended June 30, 2023 and 2022, respectively. The

Company received $10.8 million and $13.1 million related to tenant

improvement allowances associated with construction of its new

headquarter facility for the three and six months ended June 30,

2022, respectively. These tenant improvement allowances are

included as a component of Net Cash Used in Financing Activities

within our Consolidated Statements of Cash Flows and therefore

excluded from Free Cash Flow.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230801187779/en/

Investors: Seth Zaslow 203-352-1026

Media: Chris Legentil 203-352-8793

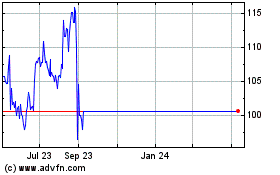

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

From Feb 2025 to Mar 2025

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

From Mar 2024 to Mar 2025