Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 October 2024 - 9:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

FOR THE MONTH OF OCTOBER 2024

COMMISSION FILE NUMBER: 001-33863

XINYUAN REAL ESTATE CO., LTD.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

SUCCESSFUL CONSENT SOLICITATION RELATING TO

THE COMPANY’S SENIOR NOTES DUE 2027

On October 29, 2024, Xinyuan Real Estate

Co., Ltd. (the “Company”) announced that it had received the requisite consents in connection with its previously commenced

consent solicitation (the “Consent Solicitation”) relating to that certain indenture dated August 18, 2023 and as amended

by the supplemental indenture dated as of April 29, 2024 (the “Indenture”) relating to the Company’s 3.0% senior

notes due 2027 (the “Notes”). The Consent Solicitation was made pursuant to a consent solicitation statement dated October 21,

2024 (the “Consent Solicitation Statement”), which is available at: https://www.dfkingltd.com/xinyuan/.

The Company received valid consents in respect

of 88.96% of the aggregate principal amount of the outstanding Notes, which constitutes the requisite consents to (i) amend certain

provisions of the Indenture to (a) remove the minimum cash interest requirement for the interest payment period from and including

March 30, 2024 up to and excluding September 30, 2024, (b) lower the minimum cash interest requirement from 2.0% to 0.2%

per annum for the period from and including September 30, 2024 up to and excluding September 30, 2025 and from 3% to 0.2% per

annum thereafter, and (c) delete certain mandatory redemption provisions that require the Company to redeem certain aggregate outstanding

principal amount of the Notes on September 30, 2025 and on September 30, 2026, respectively (the “Proposed Amendments”),

and (ii) irrevocably and unconditionally waive all defaults under the Indenture which have arisen from the failure of the Company

to make payment of cash interest on the Notes on September 30, 2024 (the “Waiver of Existing Defaults”)

On October 29, 2024, the Company, certain

subsidiary guarantors, and Citicorp International Limited, as trustee, entered into the Second Supplemental Indenture to the Indenture,

to implement the Proposed Amendment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Xinyuan Real Estate Co., Ltd. |

| |

|

|

| |

By: |

/s/ Yong Zhang |

| |

Name: |

Yong Zhang |

| |

Title: |

Chief Executive Officer |

Date: October 29, 2024

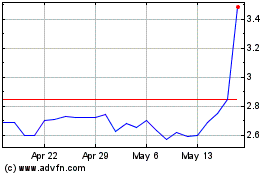

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

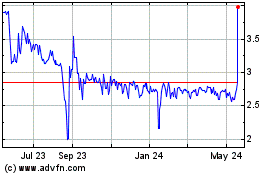

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Nov 2023 to Nov 2024