- Revenue of $99.3 Million, Consistent Year-over-Year or Up 4% on

a Constant Currency Basis

- Net Loss Per Share of $0.10 or Non-GAAP Earnings Per Share of

$0.02

- ARR of $390 Million, an Increase of 1% Year-over-Year or Up 4%

on a Constant Currency Basis

- Customer Count Increased 6% Year-over-Year to Approximately

2,900

- Cash and Cash Equivalents of $162 Million

- Issues Guidance for Q4 Fiscal 2023

Yext, Inc. (NYSE: YEXT), the Answers Company, today announced

its results for the three months ended October 31, 2022, or the

Company's third quarter of fiscal 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221130005986/en/

(Graphic: Yext)

"I'm pleased with our results for the third quarter, which

highlight our continued focus on execution and profitability," said

Michael Walrath, CEO and Chair of the Board at Yext. "Our value

proposition is resonating with customers across a wide variety of

verticals, including financial services, healthcare, government,

e-commerce and hospitality. While we continue to look for ways to

further optimize our efficiency, we are now operating from a

position of improved strength, and are confident in our ability to

deliver responsible, sustainable growth."

Third Quarter Fiscal 2023 Highlights:

Revenue of $99.3 million, compared to $99.5 million

reported in the third quarter fiscal 2022. Third quarter fiscal

2023 revenue included a negative impact of approximately $3.7

million from foreign currency exchange rates, using a constant

currency basis.

Gross Profit of $73.6 million, a 1% decrease, compared to

$74.3 million reported in the third quarter fiscal 2022. Gross

margin of 74.2%, compared to 74.6% reported in the third quarter

fiscal 2022.

Net Loss and Non-GAAP Net Income/Loss:

- Net loss of $12.3 million, compared to the net loss of $24.9

million in the third quarter fiscal 2022.

- Non-GAAP net income of $2.5 million, compared to the non-GAAP

net loss of $5.5 million in the third quarter fiscal 2022.

Net Loss Per Share and Non-GAAP Net Income/Loss Per

Share:

- Net loss per share attributable to common stockholders, basic

and diluted, of $0.10 based on 123.5 million weighted average basic

and diluted shares outstanding in the third quarter fiscal 2023,

compared to net loss per share attributable to common stockholders,

basic and diluted, of $0.19 based on 128.6 million weighted average

basic and diluted shares outstanding in the third quarter fiscal

2022.

- Non-GAAP net income per share attributable to common

stockholders, basic and diluted, of $0.02 based on 123.5 million

weighted average basic shares outstanding and 124.1 million

weighted average diluted shares outstanding, respectively, in the

third quarter fiscal 2023. This compares to non-GAAP net loss per

share attributable to common stockholders, basic and diluted, of

$0.04 based on 128.6 million weighted average basic and diluted

shares outstanding in the third quarter fiscal 2022.

Balance Sheet: Cash and cash equivalents of $162 million

as of October 31, 2022. Unearned revenue of $153 million as of

October 31, 2022, compared to $151 million as of October 31,

2021.

Remaining Performance Obligations ("RPO"): RPO of $365

million as of October 31, 2022. RPO expected to be recognized over

the next 24 months of $313 million with the remaining balance

expected to be recognized thereafter. RPO does not include amounts

under contract subject to certain accounting exclusions.

Annual Recurring Revenue ("ARR"): ARR increased 1%

year-over-year to $390 million as of October 31, 2022, compared to

$387 million as of October 31, 2021. As of October 31, 2022, ARR

included an approximate $12.4 million negative impact from foreign

currency exchange rates, on a constant currency basis.

Cash Flow: Net cash used in operating activities was

$10.8 million for the three months ended October 31, 2022, compared

to net cash used in operating activities of $9.7 million for the

three months ended October 31, 2021.

Share Repurchase Program: As of October 31, 2022, a total

of 12,405,795 shares have been purchased for a total cost of $69.1

million since the commencement of the share repurchase program.

Readers are encouraged to review the tables labeled

"Reconciliation of GAAP to Non-GAAP Financial Measures" at the end

of this release.

Recent Business Highlights:

- Appointed Tom Nielsen as Yext's Chief Revenue Officer to

accelerate and scale global revenue growth.

- Launched Yext Search in AWS Marketplace to give AWS customers

added flexibility to the software procurement process.

- Announced the availability of Yext's Fall '22 Release for early

access, new features strengthen the Answers Platform and further

develop the Company's best-in-class Listings product.

- Appointed Evan Skorpen as an independent director on Yext's

Board of Directors.

- Announced the addition of new functionality that will allow

restaurant brands to manage pickup and delivery options on their

Google Business Profiles.

- Recognized as an overall winner in the Customer Service

category and won the SaaS Customer Success Award at the 2022

APPEALIE SaaS awards.

- Recognized by KMWorld in its Trend-Setting Products of 2022 and

AI 50 2022: The Companies Empowering Intelligent Knowledge

Management.

- Recognized as one of the 2022 Best Workplaces in Technology™ by

Great Place to Work® and Fortune Magazine, ranking #38 for

large-sized businesses.

Financial Outlook:

Yext is also providing the following guidance for its fourth

fiscal quarter ending January 31, 2023 and the fiscal year ending

January 31, 2023.

- Fourth Quarter Fiscal 2023 Outlook:

- Revenue is projected to be in the range of $100.0 million to

$101.0 million. The fourth quarter revenue guidance does not assume

any additional impact from foreign currency exchange rates.

- Non-GAAP net income per share is projected to be $0.02 to

$0.03, which assumes 123.2 million weighted-average basic shares

outstanding.

- Full Year Fiscal 2023 Outlook:

- Revenue is projected to be in the range of $399.0 million to

$400.0 million. The full year revenue guidance includes an

estimated negative impact of $8.7 million to reflect foreign

currency exchange rate fluctuations since the Company's initial

full year revenue guidance from March 2022.

- Non-GAAP net loss per share is projected to be $0.05 to $0.04,

which assumes 125.5 million weighted-average basic shares

outstanding.

Conference Call

InformationYext will host a conference call today at

5:00 P.M. Eastern Time (2:00 P.M. Pacific Time) to discuss its

financial results with the investment community. A live webcast of

the call will be available on the Yext Investor Relations website

at http://investors.yext.com. A live dial-in is available

domestically at (877) 883-0383 and internationally at (412)

902-6506, passcode 3501413.

A replay will be available domestically at (877) 344-7529 or

internationally at (412) 317-0088, passcode 8524472, until midnight

(ET) December 7, 2022.

About Yext Yext (NYSE: YEXT)

helps organizations answer every question about their business.

Yext’s Answers Platform collects and organizes content into a

Knowledge Graph, then leverages a complementary set of products —

including Listings, Pages, Reviews and Search — to deliver

relevant, actionable answers wherever customers, employees, and

partners look for information. For over 15 years, thousands of

companies worldwide have trusted Yext to create seamless

content-driven experiences at scale across search engines,

websites, mobile apps, and hundreds of other digital touchpoints.

Learn more at yext.com.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995 This release

includes forward-looking statements including, but not limited to,

statements regarding our revenue, non-GAAP net income (loss) and

shares outstanding for our fourth quarter and full year fiscal 2023

in the paragraphs under "Financial Outlook" above, statements

regarding the impact of the COVID-19 pandemic on our business and

results of operations and other statements regarding our

expectations regarding the growth of our company, our market

opportunity, product roadmap, sales efficiency efforts and our

industry. In some cases, you can identify forward-looking

statements by terminology such as "may," "will," "should," "could,"

"expect," "plan," "anticipate," "believe," "estimate," "predict,"

"intend," "potential," "might," "would," "continue," or the

negative of these terms or other comparable terminology. Actual

events or results may differ from those expressed in these

forward-looking statements, and these differences may be material

and adverse.

We have based the forward-looking statements contained in this

release primarily on our current expectations and projections about

future events and trends that we believe may affect our business,

financial condition, results of operations, strategy, short- and

long-term business operations, prospects, business strategy and

financial needs. Our actual results could differ materially from

those stated or implied in forward-looking statements due to a

number of factors, including, but not limited to, the impact of the

COVID-19 pandemic and its variants on U.S. and global markets, our

business, operations, financial results, cash flow, demand for our

products, sales cycles, and customer acquisition and retention; our

ability to renew and expand subscriptions with existing customers

especially enterprise customers and attract new customers

generally; our ability to successfully expand and compete in new

geographies and industry verticals; our ability to expand and scale

our sales force; our ability to expand our service and application

provider network; our ability to develop new product and platform

offerings to expand our market opportunity, including with Yext

Answers; our ability to release new products and updates that are

adopted by our customers; our ability to manage our growth

effectively; weakened or changing global economic conditions; the

number of options exercised by our employees and former employees;

and the accuracy of the assumptions and estimates underlying our

financial projections. For a detailed discussion of these and other

risk factors, please refer to the risks detailed in our filings

with the Securities and Exchange Commission, including, without

limitation, our most recent Quarterly Report on Form 10-Q and

Annual Report on Form 10-K, which are available at

http://investors.yext.com and on the SEC's website at

https://www.sec.gov. Further information on potential risks that

could affect actual results will be included in other filings we

make with the SEC from time to time. Moreover, we operate in a very

competitive and rapidly changing environment. New risks and

uncertainties emerge from time to time and it is not possible for

us to predict all risks and uncertainties that could have an impact

on the forward-looking statements contained in this release. We

cannot assure you that the results, events and circumstances

reflected in the forward-looking statements will be achieved or

occur, and actual results, events or circumstances could differ

materially from those described in the forward-looking

statements.

The forward-looking statements made in this release relate only

to events as of the date on which such statements are made. We

undertake no obligation to update any forward-looking statements

after the date hereof or to conform such statements to actual

results or revised expectations, except as required by law.

Non-GAAP Measurements In

addition to disclosing financial measures prepared in accordance

with U.S. generally accepted accounting principles (GAAP), this

press release and the accompanying tables include non-GAAP cost of

revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating expenses (sales and marketing, research and development,

general and administrative), non-GAAP operating expenses (sales and

marketing, research and development, general and administrative) as

a percentage of revenue, non-GAAP income (loss) from operations,

non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net

income (loss) per share, and non-GAAP net income (loss) as a

percentage of revenue, which are referred to as non-GAAP financial

measures.

These non-GAAP financial measures are not calculated in

accordance with GAAP as they have been adjusted to exclude the

effects of stock-based compensation expenses. Non-GAAP gross

margin, non-GAAP operating expenses (sales and marketing, research

and development, general and administrative) as a percentage of

revenue, non-GAAP operating margin, and non-GAAP net income (loss)

as a percentage of revenue are calculated by dividing the

applicable non-GAAP financial measure by revenue. Non-GAAP net

income (loss) per share is defined as non-GAAP net income (loss) on

a per share basis. See "Reconciliation of GAAP to Non-GAAP

Financial Measures" for a discussion of the applicable

weighted-average shares outstanding.

We believe these non-GAAP financial measures provide investors

and other users of our financial information consistency and

comparability with our past financial performance and facilitate

period-to-period comparisons of our results of operations. With

respect to non-GAAP gross margin, non-GAAP operating expenses

(sales and marketing, research and development, general and

administrative) as a percentage of revenue, non-GAAP operating

margin and non-GAAP net income (loss) as a percentage of revenue,

we believe these non-GAAP financial measures are useful in

evaluating our profitability relative to the amount of revenue

generated, excluding the impact of stock-based compensation

expense. We also believe non-GAAP financial measures are useful in

evaluating our operating performance compared to that of other

companies in our industry, as these metrics eliminate the effects

of stock-based compensation, which may vary for reasons unrelated

to overall operating performance.

In addition, we present non-GAAP constant currency measures of

revenue. Constant currency as it relates to revenue provides a

framework for assessing Company performance which exclude the

effect of foreign currency rate fluctuations. Current period

results for entities reporting in currencies other than U.S.

Dollars (“USD”) are converted into USD at the average monthly

exchange rates in effect during the comparative period, as opposed

to the average monthly exchange rates in effect during the current

period.

We use these non-GAAP financial measures in conjunction with

traditional GAAP measures as part of our overall assessment of our

performance, including the preparation of our annual operating

budget and quarterly forecasts, and to evaluate the effectiveness

of our business strategies. Our definition may differ from the

definitions used by other companies and therefore comparability may

be limited. In addition, other companies may not publish these or

similar metrics. Thus, our non-GAAP financial measures should be

considered in addition to, not as a substitute for, nor superior to

or in isolation from, measures prepared in accordance with

GAAP.

These non-GAAP financial measures may be limited in their

usefulness because they do not present the full economic effect of

our use of stock-based compensation. We compensate for these

limitations by providing investors and other users of our financial

information a reconciliation of the non-GAAP financial measure to

the most closely related GAAP financial measures. However, we have

not reconciled the non-GAAP guidance measures disclosed under

"Financial Outlook" to their corresponding GAAP measures because

certain reconciling items such as stock-based compensation and the

corresponding provision for income taxes depend on factors such as

the stock price at the time of award of future grants and thus

cannot be reasonably predicted. Accordingly, reconciliations to the

non-GAAP guidance measures is not available without unreasonable

effort. We encourage investors and others to review our financial

information in its entirety, not to rely on any single financial

measure and to view non-GAAP net loss/income (loss) and non-GAAP

net income (loss) per share in conjunction with net loss and net

loss per share.

Operating Metrics This press

release also includes certain operating metrics that we believe are

useful in providing additional information in assessing the overall

performance of our business.

Customer count is defined as the total number of customers with

contracts executed as of the last day of the reporting period and a

unique administrative account identifier on the Yext platform.

Generally, we assign unique administrative accounts to each

separate and distinct entity (such as a company or government

institution) or a business unit of a large corporation, that has

its own separate contract with us to access the Yext platform. We

believe that customer count provides insight into our ability to

grow our enterprise and mid-market customer base. As such, customer

count excludes third-party reseller customers and small business

customers as well as customers only receiving free trials.

Annual recurring revenue, or ARR, for Direct customers is

defined as the annualized recurring amount of all contracts in our

enterprise, mid-market and small business customer base as of the

last day of the reporting period. The recurring amount of a

contract is determined based upon the terms of a contract and is

calculated by dividing the amount of a contract by the term of the

contract and then annualizing such amount. The calculation assumes

no subsequent changes to the existing subscription. Contracts

include portions of professional services contracts that are

recurring in nature.

ARR for Third-party Reseller customers is defined as the

annualized recurring amount of all contracts with Third-party

Reseller customers as of the last day of the reporting period. The

recurring amount of a contract is determined based upon the terms

of a contract and is calculated by dividing the amount of a

contract by the term of the contract and then annualizing such

amount. The calculation assumes no subsequent changes to the

existing subscription. The calculation includes the annualized

contractual minimum commitment and excludes amounts related to

overages above the contractual minimum commitment. Contracts

include portions of professional services contracts that are

recurring in nature.

Total ARR is defined as the annualized recurring amount of all

contracts executed as of the last day of the reporting period. The

recurring amount of a contract is determined based upon the terms

of a contract and is calculated by dividing the amount of a

contract by the term of the contract and then annualizing such

amount. The calculation assumes no subsequent changes to the

existing subscription, and where relevant, includes the annualized

contractual minimum commitment and excludes amounts related to

overages above the contractual minimum commitment. Contracts

include portions of professional services contracts that are

recurring in nature.

ARR is independent of historical revenue, unearned revenue,

remaining performance obligations or any other GAAP financial

measure over any period. It should be considered in addition to,

not as a substitute for, nor superior to or in isolation from,

these measures and other measures prepared in accordance with GAAP.

We believe ARR-based metrics provides insight into the performance

of our recurring revenue business model while mitigating for

fluctuations in billing and contract terms.

In addition, we present ARR on a constant currency basis.

Constant currency as it relates to ARR provides a framework for

assessing Company performance which exclude the effect of foreign

currency rate fluctuations. Contracts included in the determination

of ARR in the current period are converted into USD at the exchange

rates in effect at the end of the comparative period, as opposed to

the end of the period exchange rates in effect during the current

period.

YEXT, INC.

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share data)

(Unaudited)

October 31, 2022

January 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

162,268

$

261,210

Accounts receivable, net of allowances of

$995 and $2,042, respectively

68,027

101,607

Prepaid expenses and other current

assets

14,887

13,538

Costs to obtain revenue contracts,

current

30,368

33,998

Total current assets

275,550

410,353

Property and equipment, net

65,308

74,604

Operating lease right-of-use assets

86,617

97,124

Costs to obtain revenue contracts,

non-current

20,619

27,286

Goodwill

4,235

4,572

Intangible assets, net

199

217

Other long term assets

3,578

6,179

Total assets

$

456,106

$

620,335

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable, accrued expenses and

other current liabilities

$

48,252

$

48,432

Unearned revenue, current

153,267

223,427

Operating lease liabilities, current

17,847

18,845

Total current liabilities

219,366

290,704

Operating lease liabilities,

non-current

102,613

113,776

Other long term liabilities

4,276

3,985

Total liabilities

326,255

408,465

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value per

share; 50,000,000 shares authorized at October 31, 2022 and January

31, 2022; zero shares issued and outstanding at October 31, 2022

and January 31, 2022

—

—

Common stock, $0.001 par value per share;

500,000,000 shares authorized at October 31, 2022 and January 31,

2022; 141,658,521 and 137,662,320 shares issued at October 31, 2022

and January 31, 2022, respectively; 122,747,392 and 131,156,986

shares outstanding at October 31, 2022 and January 31, 2022,

respectively

141

137

Additional paid-in capital

886,185

834,429

Accumulated other comprehensive loss

(6,751

)

(187

)

Accumulated deficit

(668,744

)

(610,604

)

Treasury stock, at cost

(80,980

)

(11,905

)

Total stockholders’ equity

129,851

211,870

Total liabilities and stockholders’

equity

$

456,106

$

620,335

YEXT, INC.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(In thousands, except share

and per share data)

(Unaudited)

Three months ended October

31,

Nine months ended October

31,

2022

2021

2022

2021

Revenue

$

99,280

$

99,529

$

298,951

$

289,645

Cost of revenue

25,663

25,255

77,473

73,724

Gross profit

73,617

74,274

221,478

215,921

Operating expenses:

Sales and marketing

49,360

58,548

164,244

172,292

Research and development

17,649

17,986

53,770

50,343

General and administrative

18,740

22,094

60,619

61,284

Total operating expenses

85,749

98,628

278,633

283,919

Loss from operations

(12,132

)

(24,354

)

(57,155

)

(67,998

)

Interest income

587

5

797

15

Interest expense

(211

)

(113

)

(483

)

(403

)

Other (expense) income, net

(156

)

(191

)

111

(1,018

)

Loss from operations before income

taxes

(11,912

)

(24,653

)

(56,730

)

(69,404

)

(Provision for) benefit from income

taxes

(398

)

(273

)

(1,410

)

(745

)

Net loss

$

(12,310

)

$

(24,926

)

$

(58,140

)

$

(70,149

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.10

)

$

(0.19

)

$

(0.46

)

$

(0.55

)

Weighted-average number of shares used in

computing net loss per share attributable to common stockholders,

basic and diluted

123,500,961

128,570,237

126,239,773

126,967,336

Other comprehensive loss:

Foreign currency translation

adjustment

$

(1,127

)

$

(1,586

)

$

(6,548

)

$

(1,239

)

Unrealized loss on marketable securities,

net

(16

)

—

(16

)

—

Total comprehensive loss

$

(13,453

)

$

(26,512

)

$

(64,704

)

$

(71,388

)

YEXT, INC.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Nine months ended October

31,

2022

2021

Operating activities:

Net loss

$

(58,140

)

$

(70,149

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization expense

13,098

12,490

Bad debt expense

381

826

Stock-based compensation expense

48,990

54,455

Amortization of operating lease

right-of-use assets

6,684

6,934

Other, net

1,180

506

Changes in operating assets and

liabilities:

Accounts receivable

30,296

34,317

Prepaid expenses and other current

assets

(1,747

)

965

Costs to obtain revenue contracts

8,173

(8,654

)

Other long term assets

1,232

43

Accounts payable, accrued expenses and

other current liabilities

3,910

3,841

Unearned revenue

(64,786

)

(39,423

)

Operating lease liabilities

(8,158

)

(4,041

)

Other long term liabilities

795

615

Net cash used in operating activities

(18,092

)

(7,275

)

Investing activities:

Capital expenditures

(5,400

)

(12,333

)

Net cash used in investing activities

(5,400

)

(12,333

)

Financing activities:

Proceeds from exercise of stock

options

561

15,869

Repurchase of common stock

(68,695

)

—

Payments for taxes related to net share

settlement of stock-based compensation awards

(1,846

)

—

Payments of deferred financing costs

(284

)

(263

)

Proceeds, net from employee stock purchase

plan withholdings

1,947

4,059

Net cash (used in) provided by financing

activities

(68,317

)

19,665

Effect of exchange rate changes on cash

and cash equivalents

(7,133

)

(942

)

Net decrease in cash and cash

equivalents

(98,942

)

(885

)

Cash and cash equivalents at beginning of

period

261,210

230,411

Cash and cash equivalents at end of

period

$

162,268

$

229,526

YEXT, INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Three months ended October 31,

2022

Costs and

expenses

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

$

25,663

$

(1,176

)

$

24,487

Sales and marketing

$

49,360

$

(5,432

)

$

43,928

Research and development

$

17,649

$

(3,946

)

$

13,703

General and administrative

$

18,740

$

(4,268

)

$

14,472

Three months ended October 31,

2022

Costs and

expenses as a percentage of revenue

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

26

%

(1

)%

25

%

Sales and marketing

50

%

(6

)%

44

%

Research and development

17

%

(3

)%

14

%

General and administrative

19

%

(4

)%

15

%

Three months ended October 31,

2021

Costs and

expenses

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

$

25,255

$

(1,840

)

$

23,415

Sales and marketing

$

58,548

$

(6,757

)

$

51,791

Research and development

$

17,986

$

(5,469

)

$

12,517

General and administrative

$

22,094

$

(5,389

)

$

16,705

Three months ended October 31,

2021

Costs and

expenses as a percentage of revenue

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

25

%

(2

)%

24

%

Sales and marketing

59

%

(7

)%

52

%

Research and development

18

%

(6

)%

12

%

General and administrative

22

%

(5

)%

17

%

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

YEXT, INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Nine months ended October 31,

2022

Costs and

expenses

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

$

77,473

$

(3,899

)

$

73,574

Sales and marketing

$

164,244

$

(17,957

)

$

146,287

Research and development

$

53,770

$

(12,668

)

$

41,102

General and administrative

$

60,619

$

(14,466

)

$

46,153

Nine months ended October 31,

2022

Costs and

expenses as a percentage of revenue

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

26

%

(1

)%

25

%

Sales and marketing

55

%

(6

)%

49

%

Research and development

18

%

(4

)%

14

%

General and administrative

20

%

(5

)%

15

%

Nine months ended October 31,

2021

Costs and

expenses

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

$

73,724

$

(5,597

)

$

68,127

Sales and marketing

$

172,292

$

(19,635

)

$

152,657

Research and development

$

50,343

$

(15,285

)

$

35,058

General and administrative

$

61,284

$

(13,938

)

$

47,346

Nine months ended October 31,

2021

Costs and

expenses as a percentage of revenue

GAAP

Stock-Based Compensation

Expense

Non-GAAP

Cost of revenue

26

%

(2

)%

24

%

Sales and marketing

60

%

(7

)%

53

%

Research and development

17

%

(5

)%

12

%

General and administrative

21

%

(5

)%

16

%

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

YEXT, INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Three months ended October

31,

Nine months ended October

31,

2022

2021

2022

2021

Gross

profit

GAAP gross profit

$

73,617

$

74,274

$

221,478

$

215,921

Plus: Stock-based compensation expense

1,176

1,840

3,899

5,597

Non-GAAP gross profit

$

74,793

$

76,114

$

225,377

$

221,518

Gross

margin

GAAP gross margin

74.2

%

74.6

%

74.1

%

74.5

%

Plus: Stock-based compensation expense

1.1

%

1.9

%

1.3

%

2.0

%

Non-GAAP gross margin

75.3

%

76.5

%

75.4

%

76.5

%

Operating

expenses

GAAP operating expenses

$

85,749

$

98,628

$

278,633

$

283,919

Less: Stock-based compensation expense

(13,646

)

(17,615

)

(45,091

)

(48,858

)

Non-GAAP operating expenses

$

72,103

$

81,013

$

233,542

$

235,061

Operating

expenses as a percentage of revenue

GAAP operating expenses as a percentage of

revenue

86

%

99

%

93

%

98

%

Less: Stock-based compensation expense

(13

)%

(18

)%

(15

)%

(17

)%

Non-GAAP operating expenses as a

percentage of revenue

73

%

81

%

78

%

81

%

Loss from

operations

GAAP loss from operations

$

(12,132

)

$

(24,354

)

$

(57,155

)

$

(67,998

)

Plus: Stock-based compensation expense

14,822

19,455

48,990

54,455

Non-GAAP income (loss) from operations

$

2,690

$

(4,899

)

$

(8,165

)

$

(13,543

)

Operating margin

(Income/loss from operations as a percentage of

revenue)

GAAP operating margin

(12

)%

(24

)%

(19

)%

(24

)%

Plus: Stock-based compensation expense

15

%

19

%

16

%

19

%

Non-GAAP operating margin

3

%

(5

)%

(3

)%

(5

)%

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

YEXT, INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands, except share

and per share data)

(Unaudited)

Three months ended October

31,

2022

2021

GAAP net loss

$

(12,310

)

$

(24,926

)

Plus: Stock-based compensation expense

14,822

19,455

Non-GAAP net income (loss)

$

2,512

$

(5,471

)

GAAP net loss per share attributable to

common stockholders, basic and diluted

$

(0.10

)

$

(0.19

)

Stock-based compensation expense per

share

0.12

0.15

Non-GAAP net income (loss) per share

attributable to common stockholders, basic and diluted (1)

$

0.02

$

(0.04

)

Weighted-average number of shares used in

computing GAAP net loss per share attributable to common

stockholders, basic and diluted

123,500,961

128,570,237

Weighted-average number of shares used in

computing non-GAAP net income (loss) per share attributable to

common stockholders

Basic

123,500,961

128,570,237

Diluted

124,131,014

128,570,237

(1) - For the three months ended October

31, 2022, non-GAAP net income per share attributable to common

stockholders was $0.02 on both a basic and diluted basis, as

calculated based on 123,500,961 weighted-average basic shares

outstanding and 124,131,014 weighted-average diluted shares

outstanding.

Three months ended October

31,

2022

2021

GAAP net loss as a percentage of

revenue

(12.4

)%

(25.0

)%

Plus: Stock-based compensation expense

14.9

%

19.5

%

Non-GAAP net income (loss) as a percentage

of revenue

2.5

%

(5.5

)%

Nine months ended October

31,

2022

2021

GAAP net loss

$

(58,140

)

$

(70,149

)

Plus: Stock-based compensation expense

48,990

54,455

Non-GAAP net loss

$

(9,150

)

$

(15,694

)

GAAP net loss per share attributable to

common stockholders, basic and diluted

$

(0.46

)

$

(0.55

)

Stock-based compensation expense per

share

0.39

0.43

Non-GAAP net loss per share attributable

to common stockholders, basic and diluted

$

(0.07

)

$

(0.12

)

Weighted-average number of shares used in

computing net loss per share attributable to common stockholders,

basic and diluted

126,239,773

126,967,336

Nine months ended October

31,

2022

2021

GAAP net loss as a percentage of

revenue

(19.4

)%

(24.2

)%

Plus: Stock-based compensation expense

16.3

%

18.8

%

Non-GAAP net loss as a percentage of

revenue

(3.1

)%

(5.4

)%

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

YEXT, INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Three months ended October

31,

Constant Currency

Revenue

2022

2021

Growth Rates

Revenue (GAAP)

$

99,280

$

99,529

—

%

Effects of foreign currency rate

fluctuations

3,738

Revenue on a constant currency basis

(Non-GAAP)

$

103,018

4

%

Nine months ended October

31,

2022

2021

Growth Rates

Revenue (GAAP)

$

298,951

$

289,645

3

%

Effects of foreign currency rate

fluctuations

7,906

Revenue on a constant currency basis

(Non-GAAP)

$

306,857

6

%

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

YEXT, INC.

Supplemental

Information

(In thousands)

(Unaudited)

October 31,

Variance

2022

2021

Dollars

Percent

Annual Recurring

Revenue

Direct Customers

$

317,280

$

308,197

$

9,083

3

%

Third-Party Reseller Customers

72,258

78,457

(6,199

)

(8

)%

Total Annual Recurring Revenue

$

389,538

$

386,654

$

2,884

1

%

Oct. 31, 2022

Jul. 31, 2022

Apr. 30, 2022

Jan. 31, 2022

Oct. 31, 2021

Annual Recurring

Revenue Trend

Direct Customers

$

317,280

$

312,129

$

310,312

$

312,132

$

308,197

Third-Party Reseller Customers

72,258

74,857

76,671

78,353

78,457

Total Annual Recurring Revenue

$

389,538

$

386,986

$

386,983

$

390,485

$

386,654

_______________

Note: Numbers rounded for presentation

purposes and may not sum.

SOURCE Yext, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221130005986/en/

Investor Relations: IR@yext.com Public Relations:

PR@yext.com

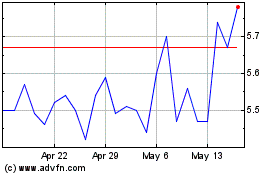

Yext (NYSE:YEXT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Yext (NYSE:YEXT)

Historical Stock Chart

From Feb 2024 to Feb 2025