UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(Amendment

No. 2)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR

13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

Zhihu Inc.

(Name of Subject Company (Issuer))

Zhihu Inc.

(Name of Filing Person (Issuer))

Class A

Ordinary Shares

par value US$0.000125 per share

(Title of Class of Securities)

KYG989MJ1017

(ISIN Number of Class of Securities)

American Depositary Shares

each

representing three Class A Ordinary Shares, par value US$0.000125 per share

(Title of Class of Securities)

98955N

207

(CUSIP Number of Class of Securities)

Han Wang

Chief Financial Officer

Zhihu Inc.

18 Xueqing Road

Haidian District, Beijing 100083

People’s Republic of China

+86 (10) 8271-6603

with copy to:

Shu Du, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

c/o 42/F, Edinburgh Tower

The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700

(Name, address, and telephone number of person

authorized to receive notices and communications on behalf of the filing person)

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the

following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| x |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

Schedule TO

This

Amendment No. 2 to the Schedule TO (“Amendment No. 2”) amends and supplements the Tender Offer Statement

on Schedule TO that was initially filed with the Securities and Exchange Commission (the “SEC”) on September 9, 2024,

by Zhihu Inc. (the “Company”), an exempted company with limited liability incorporated under the laws of the Cayman Islands.

This Amendment No. 2 relates to an update on a director’s intention to accept the all cash tender offers by the Company for

a part of the Class A ordinary shares (including in the form of ADSs) in which he is interested in. All capitalized terms used but

not specifically defined in this Amendment No. 2 shall have the meanings ascribed to such terms in the U.S. Offer to Purchase.

The

information contained in the Schedule TO, as supplemented and amended by the information contained in Item 4 below, is incorporated

herein by reference. Except as specifically provided herein, this Amendment No. 2 does not modify any of the information previously

reported on the Schedule TO.

| Item 4. | Terms of the Transaction |

Item

4 of the Schedule TO is hereby amended and supplemented by adding the following information:

| (b) | Purchases. On October 23, 2024, the Company updated that it was informed by Mr. Dahai Li, a director of the

Company, of his current intention to accept the Offers related to a part of the Class A ordinary shares (including in the form of

ADSs) in which he is interested in. |

* Previously

filed.

† Filed

herewith.

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

| (a)(1)(A)* |

|

U.S. Offer to Purchase, dated as of September 9, 2024. |

| |

|

|

| (a)(1)(B)* |

|

ADS Letter of Transmittal. |

| |

|

|

| (a)(1)(C)* |

|

Form of Acceptance. |

| |

|

|

| (a)(1)(D)* |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies, and other Nominees. |

| |

|

|

| (a)(1)(E)* |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies, and other Nominees. |

| |

|

|

| (a)(1)(F)* |

|

Form of Withdrawal. |

| |

|

|

| (a)(1)(G)* |

|

Notice of Extraordinary General Meeting. |

| |

|

|

| (a)(1)(H)* |

|

Form of Proxy for the Extraordinary General Meeting. |

| |

|

|

| (a)(1)(I)* |

|

Form of Voting Instruction Card for Holders of American Depositary Shares. |

| |

|

|

| (a)(5)(A) |

|

Announcement made by the Company in accordance with Rule 3.5 of the Code on Takeovers and Mergers of Hong Kong, dated as of July 19, 2024 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by the Company with the SEC on July 19, 2024). |

| |

|

|

| (a)(5)(B) |

|

Announcement made by the Company in accordance with Rule 8.2 of the Code on Takeovers and Mergers of Hong Kong, dated as of August 9, 2024 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by the Company with the SEC on August 9, 2024). |

| |

|

|

| (a)(5)(C)* |

|

Press Release issued by the Company, dated as of September 9, 2024. |

| |

|

|

| (a)(5)(D)* |

|

Announcement made by the Company in accordance with Rule 8.2 of the Code on Takeovers and Mergers of Hong Kong, dated as of September 9, 2024. |

| |

|

|

| (a)(5)(E)* |

|

Press Release issued by the Company, dated as of October 16, 2024. |

| |

|

|

| (a)(5)(F)* |

|

Announcement made by the Company in accordance with Rule 19.1 of the Code on Takeovers and Mergers of Hong Kong, dated as of October 16, 2024. |

| |

|

|

| (a)(5)(G)† |

|

Press Release issued by the Company, dated as of October 23, 2024. |

| |

|

|

| (a)(5)(H)† |

|

Announcement made by the Company in accordance with Rule 8 of the Code on Takeovers and Mergers of Hong Kong, dated as of October 23, 2024. |

| |

|

|

| (d)* |

|

Amended and Restated Deposit Agreement among the Company, JPMorgan Chase Bank, N.A., as depositary, and holders and beneficial owners of the American Depositary Receipts issued thereunder dated May 10, 2024. |

| |

|

|

| 107* |

|

Filing Fee Table. |

* Previously

filed.

† Filed

herewith.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Zhihu Inc. |

| |

|

| |

By: |

/s/ Han Wang |

| |

Name: |

Han Wang |

| |

Title: |

Chief Financial Officer |

Dated: October 23,

2024

Exhibit (a)(5)(G)

Zhihu Inc. Updates a Director’s Intention

to Participate in the Tender Offers

BEIJING, China, October 23, 2024 — Zhihu Inc. (NYSE: ZH;

HKEX: 2390) (“Zhihu” or the “Company”), a leading online content community in China, today updated that, in relation

with the Company’s all cash tender offers (the “Offers”) to buy back up to 46,921,448 Class A ordinary shares

of the Company (including in the form of American depositary shares (the “ADSs”)), Mr. Dahai Li, a director of the Company,

has informed the Company of his current intention to accept the Offers related to a part of the Class A ordinary shares (including

in the form of ADS) in which he is interested in.

Certain Information Regarding the U.S. Offer

This press release is for information only and is not an offer to

purchase, a solicitation of an offer to purchase, or a solicitation of an offer to sell any securities of the Company. The U.S. Offer

will be made only pursuant to, and ADS holders and U.S. shareholders may only tender in the U.S. Offer in accordance with, the U.S. Offer

to Purchase and other related materials.

ADS HOLDERS AND U.S. SHAREHOLDERS ARE URGED TO READ THE COMPANY’S

SCHEDULE TO, U.S. OFFER TO PURCHASE, AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT ZHIHU INC. AND THE U.S. OFFER.

Materials filed with the SEC are available electronically without

charge at the SEC’s website, https://www.sec.gov. Documents filed with the SEC may also be obtained without charge

at the Company’s website, https://ir.zhihu.com. ADS holders and U.S. shareholders are also able to obtain a copy of

these documents, without charge, from Broadridge Corporate Issuer Solutions, LLC, the information agent for the U.S. Offer.

About Zhihu Inc.

Zhihu Inc. (NYSE: ZH; HKEX: 2390) is a leading online content community

in China where people come to find solutions, make decisions, seek inspiration, and have fun. Since the initial launch in 2010,

we have grown from a Q&A community into one of the top comprehensive online content communities and the largest Q&A-inspired

online content community in China. For more information, please visit https://ir.zhihu.com.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that

are not historical facts, including statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those

contained in any forward-looking statement. In some cases, forward-looking statements can be identified by words or phrases such as “may,”

“will,” “expect,” “anticipate,” “target,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely

to,” or other similar expressions. Further information regarding these and other risks, uncertainties or factors is included in

the Company's filings with the SEC and the Hong Kong Stock Exchange. All information provided in this press release is as of the date

of this press release, and the Company does not undertake any duty to update such information, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Zhihu Inc.

Email: ir@zhihu.com

Piacente Financial Communications

Helen Wu

Tel: +86-10-6508-0677

Email: zhihu@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Phone: +1-212-481-2050

Email: zhihu@tpg-ir.com

Exhibit (a)(5)(H)

Hong Kong Exchanges and Clearing Limited and

The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its

accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole

or any part of the contents of this announcement.

This announcement has been prepared pursuant

to, and in order to comply with, the Listing Rules and the Codes, and does not constitute an invitation or offer to acquire, purchase

or subscribe for securities of the Company nor shall there be any sale, purchase or subscription for securities of the Company in any

jurisdiction in which such offer, solicitation or sale would be unlawful absent the filing of a registration statement or the availability

of an applicable exemption from registration or other waiver.

Zhihu Inc.

(A company controlled

through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(NYSE: ZH; HKEX: 2390)

CONDITIONAL VOLUNTARY CASH OFFERS OF THE COMPANY

TO BUY BACK UP TO 46,921,448 CLASS A ORDINARY SHARES (INCLUDING IN THE FORM OF AMERICAN DEPOSITARY SHARES) AT A PRICE OF HK$9.11

PER CLASS A ORDINARY SHARE (EQUIVALENT OF US$3.50 PER ADS)

UPDATE ON DIRECTOR’S INTENTION

Financial Adviser to the Company

Independent Financial Adviser to the Independent

Board Committee

References are made to the offer document issued

by Zhihu Inc. in connection with the Non-U.S. Offer in accordance with the Codes on September 9, 2024 (the “Offer Document”).

Unless otherwise defined herein, capitalized terms used herein shall have the same meanings as those defined in the Offer Document.

As disclosed in the Offer Document, as of the

Latest Practicable Date, the Company was aware, after reasonable inquiry, that none of the Directors who hold Shares or persons acting

in concert with any of them will accept the Offers. The Company has been informed by Mr. Dahai Li, a non-executive Director, of his

current intention to accept the Offers related to a part of the Class A Ordinary Shares (including in the form of ADSs) in which

he is interested in.

Save as disclosed above and in the announcement

of the Company pursuant to Rule 3.8 of the Takeovers Code published on October 18, 2024, all other material information in the

Offer Documents shall remain unchanged.

| |

By Order of the Board |

| |

Zhihu Inc. |

| |

Yuan Zhou |

| |

Chairman |

Hong Kong, October 23, 2024

As of the date of this announcement, the board

of Directors comprises Mr. Yuan Zhou as an executive Director, Mr. Dahai Li, Mr. Zhaohui Li, and Mr. Bing Yu as non-executive

Directors, and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen as independent non-executive Directors.

The Directors jointly and severally accept

full responsibility for the accuracy of the information contained in this announcement and confirm, having made all reasonable enquiries,

that to the best of their knowledge, opinions expressed in this announcement have been arrived at after due and careful consideration

and there are no other facts not contained in this announcement, the omission of which would make any statement in this announcement misleading.

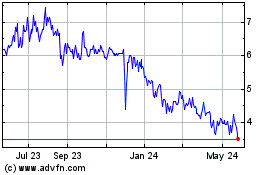

Zhihu (NYSE:ZH)

Historical Stock Chart

From Dec 2024 to Jan 2025

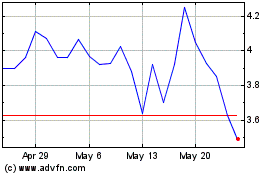

Zhihu (NYSE:ZH)

Historical Stock Chart

From Jan 2024 to Jan 2025