adidas Group: Full Year 2006 Results: Net Income Attributable to Shareholders Up 26%; Currency-Neutral Sales Up 53%; Dividend Pa

07 March 2007 - 5:32PM

Business Wire

adidas Group (FWB:ADS): Full year net sales top 10 billion euro

mark for the first time Currency-neutral sales for the adidas Group

excluding Reebok up 14% Group operating profit increases 25%

Currency-neutral adidas backlogs up 1% Reebok backlogs improve

sequentially to -12% Currency-neutral sales grow 53% In 2006,

adidas Group sales increased 53% on a currency-neutral basis,

strongly supported by the first-time consolidation of Reebok. In

euro terms, Group revenues grew 52% to � 10.084 billion in 2006

from � 6.636 billion in 2005, exceeding the � 10 billion level for

the first time in the Group�s history. Sales for the adidas Group

excluding Reebok increased 14% both on a currency-neutral basis and

in euro terms to � 7.548 billion in 2006 from � 6.636 billion in

the prior year, representing the highest organic growth of the

adidas Group within the last eight years. Double-digit growth was

generated in all regions except Europe, where sales increased by

high-single-digit rates. �2006 was a truly exciting year for the

adidas Group, as we strengthened our brand portfolio by acquiring

Reebok and exceeded the � 10 billion sales mark for the first time

in the Group�s history,� commented adidas AG Chairman and CEO

Herbert Hainer. �Our performance at the 2006 World Cup was a

stand-out in leveraging our brand strength, and we clearly

delivered strong operational and financial results.� Double-digit

growth at adidas and TaylorMade-adidas Golf The adidas segment was

the main driver of the Group�s organic sales growth in 2006.

Currency-neutral adidas revenues grew 14% in 2006 driven by

increases in nearly all Sport Performance categories as well as

double-digit growth in the Sport Heritage and Sport Style

divisions. First-time consolidation of the Reebok segment added �

2.473 billion in sales to the adidas Group. Compared to the prior

year, in which Reebok was not consolidated within the adidas Group,

this represents a decline of 9%. On a like-for-like basis excluding

the effect of the transfer of the NBA and Liverpool licensed

businesses to brand adidas, currency-neutral sales for the Reebok

segment decreased 6%, in line with Management�s initial

expectations. At TaylorMade-adidas Golf, currency-neutral revenues

increased 22%. This strong performance was driven by solid growth

in nearly all major product categories. Further, the inclusion of

the Greg Norman apparel business, which was acquired as part of the

Reebok acquisition, also had a positive impact on the Group�s sales

development. Excluding the Greg Norman apparel business, segment

sales increased 13% on a currency-neutral basis. Sales recorded in

the HQ/Consolidation segment increased by 97% on a currency-neutral

basis, as a result of the Group�s cooperation agreement with Amer

Sports Corporation. Currency translation effects had only a minor

negative impact on sales in euro terms. adidas sales in euros

increased 13% to ��6.626�billion in 2006 from ��5.861�billion in

2005. TaylorMade-adidas Golf sales in euro terms grew 21% to � 856

million in 2006 from � 709 million in 2005. HQ/Consolidation sales

in euro terms increased 96% to � 129 million in 2006 from � 66

million in 2005. Sales increase strongly in all regions adidas

Group sales grew robustly in all regions driven by the first-time

inclusion of Reebok as well as strong revenue increases at both

adidas and TaylorMade-adidas Golf. Group sales in Europe grew 32%

on a currency-neutral basis. This represents an improvement of 31%

in euro terms to � 4.162 billion in 2006 from ��3.166�billion in

the prior year. In North America, Group sales increased 107% on a

currency-neutral basis. In euro terms, sales also grew 107% to

��3.234�billion in 2006 from � 1.561 billion in 2005. Sales for the

adidas Group in Asia increased 35% on a currency-neutral basis. In

euro terms, revenues in Asia grew 33% to ��2.020�billion in 2006

from � 1.523 billion in 2005. In Latin America, currency-neutral

sales increased 53%. In euro terms, sales grew 56% to ��499�million

in 2006 from � 319 million in 2005. For the adidas Group excluding

Reebok, currency-neutral sales grew 8% in Europe, 14% in North

America, 20% in Asia and 31% in Latin America. Group gross profit

increases 41% The Group�s gross margin in 2006 declined 3.6

percentage points to 44.6% of sales in 2006 (2005: 48.2%), mainly

reflecting the first-time consolidation of Reebok, which more than

offset a positive gross margin development in the adidas segment.

Due to Reebok�s strong presence in North America, where average

gross margins are lower than in other regions, Reebok carries a

significantly lower gross margin than the Group average. In

addition, Reebok�s gross profit in 2006 includes negative impacts

from purchase price allocation in an amount of ��76 million. As a

result of the Group�s strong top-line growth, however, gross profit

rose by 41% in 2006 to reach � 4.495 billion versus ��3.197�billion

in the prior year. For the adidas Group excluding Reebok, gross

margin decreased 0.4 percentage points to 47.8% in 2006 (2005:

48.2%), mainly due to a gross margin decline in the Group�s

HQ/Consolidation segment as a result of the Group�s cooperation

agreement with Amer Sports Corporation. Gross profit for the Group

excluding Reebok grew by 13% to � 3.605 billion in 2006 (2005:

��3.197�billion). Operating profit grows 25% Group operating margin

declined 1.9 percentage points to 8.7% of sales in 2006 (2005:

10.7%). This mainly reflects the first-time consolidation of the

Reebok business, which carries a significantly lower operating

margin than the Group average. The segment�s operating margin also

includes a negative impact from purchase price allocation on cost

of sales and operating expenses in a total amount of � 89 million.

These impacts more than compensated Reebok�s lower operating

expenses as a percentage of sales. As a result of strong sales

growth, however, operating profit for the adidas Group rose 25% in

2006 to reach ��881�million versus � 707 million in 2005. For the

adidas Group excluding Reebok, the operating margin decreased 0.2

percentage points to 10.5% in 2006 from 10.7% in the prior year. An

operating margin decline in the Group�s HQ/Consolidation segment as

a result of the Group�s cooperation agreement with Amer Sports

Corporation more than offset operating margin increases at both

adidas and TaylorMade-adidas Golf. Operating profit for the adidas

Group excluding Reebok grew by 12% to � 789 million in 2006 from

��707�million in the prior year. Income before taxes up 10% Income

before taxes (IBT) increased 10% to � 723 million in 2006 from

��655�million in 2005. Operating improvements in the adidas and

TaylorMade-adidas Golf segments more than offset a significant

increase in net financial expenses. Net financial expenses

increased 203% to � 158 million in 2006 from ��52 million in the

prior year, reflecting the financing of the Reebok acquisition. Net

income from continuing operations grows 14% The Group�s net income

from continuing operations increased 14% to ��496�million in 2006

from � 434 million in 2005. The Group�s strong sales increase was

the main driver of this improvement. In addition, net income was

positively impacted by the lower tax rate, which declined 2.3

percentage points to 31.4% in 2006 (2005: 33.7%), mainly due to a

more favorable earnings mix throughout the Group as well as

one-time tax benefits in the fourth quarter of 2006. Net income

attributable to shareholders increases 26% The Group�s net income

attributable to shareholders increased 26% to ��483�million in 2006

from � 383 million in the prior year. This improvement reflects the

outstanding performance of the adidas and TaylorMade-adidas Golf

segments, while Reebok earnings did not exceed additional interest

expenses related to the acquisition and negative purchase price

allocation effects. The non-recurrence of losses from discontinued

operations related to the Salomon business in 2005 also contributed

to this positive development. Basic and diluted earnings per share

up 16% and 17% On June 6, 2006, adidas AG conducted a share split

in a ratio of 1:4, with each existing adidas AG share being divided

into four shares. All numbers of shares have been restated. The

Group�s basic earnings per share from continuing and discontinued

operations increased 16% to � 2.37 in 2006 versus � 2.05 in 2005.

Diluted earnings per share from continuing and discontinued

operations in 2006 increased 17% to ��2.25 from � 1.93 in the prior

year. The dilutive effect mainly results from approximately 16

million potential additional shares that could be created in

relation to the outstanding convertible bond, for which conversion

criteria were met for the first time at the end of 2004.

Inventories and receivables increase due to Reebok consolidation

Group inventories increased 31% to � 1.607 billion in 2006 versus

��1.230�billion in 2005, largely as a result of the first-time

inclusion of � 404 million in inventories related to the Reebok

business. On a currency-neutral basis, this increase was 41%.

Inventories for the adidas Group excluding Reebok declined 2% (+5%

currency-neutral). The increase on a currency-neutral basis

reflects the Group�s growth expectations as well as higher

inventory levels in Latin America in advance of new import

regulations in Brazil and Argentina. Group receivables grew 47%

(+57% currency-neutral) to � 1.415 billion at the end of 2006

versus ��965 million in the prior year, primarily due to the

first-time inclusion of receivables totaling ��461�million related

to the Reebok business. Receivables for the adidas Group excluding

Reebok decreased 1% (+5% currency-neutral). The increase on a

currency-neutral basis is lower than sales growth during the fourth

quarter of 2006. Net borrowings at � 2.231 billion Net debt at

December 31, 2006 was � 2.231 billion, up � 2.782 billion versus a

net cash position of � 551 million in the prior year. This increase

was driven by the payment of around � 3.2 billion for the

acquisition of Reebok International Ltd. (USA), paid on January 31,

2006, including the buyback of employee stock options and Reebok�s

convertible bond. In addition, expenditure of around ��170�million

for the buyback of Reebok�s major properties in the USA and in

Europe influenced this development. The Group�s financial leverage

was 78.9% at the end of 2006, which is clearly below Management�s

original year-end target of 100%. adidas backlogs grow moderately

Backlogs for the adidas brand at the end of 2006 increased 1%

versus the prior year on a currency-neutral basis. This represents

a decrease of 4% in euro terms. Footwear backlogs declined 1% in

currency-neutral terms (�6% in euros). Softness in several

categories in North America and Europe was largely offset by growth

across all major categories in Asia. Apparel backlogs grew 5% on a

currency-neutral basis (stable in euros), driven in particular by

improvements in the Sport Performance training and basketball

categories. Hardware backlogs, particularly in Europe, negatively

affected growth rates due to declines in the football category. The

transfer of the NBA and Liverpool licensed businesses from Reebok

to adidas had a positive impact of approximately 1 percentage point

on the development of brand adidas backlogs. Backlogs at Reebok

brand improve sequentially Backlogs for the Reebok brand at the end

of 2006 decreased 12% versus the prior year on a currency-neutral

basis, showing a sequential improvement from the prior quarter. In

euro terms, this represents a decline of 18%. Higher backlogs in

Asia could not compensate declines in Europe and North America.

Footwear backlogs declined 15% in currency-neutral terms (�21% in

euros), mainly due to decreases in Reebok�s lifestyle offering in

North America. Apparel backlogs were down 9% on a currency-neutral

basis (�14% in euros) as a result of a decline in both Reebok�s

licensed and branded apparel business, particularly in North

America. The transfer of the NBA and Liverpool licensed businesses

from Reebok to adidas also negatively affected apparel backlogs

development. On a like-for-like basis, excluding the effects of

this transfer, total Reebok backlogs decreased 10% on a

currency-neutral basis. Group sales expected to reach new record

level In 2007, adidas Group sales are expected to increase at a

mid-single-digit rate on a currency-neutral basis, driven by growth

at all brands and in all regions. Revenue growth is likely to be

weighted towards the second half of 2007 owing to difficult

comparisons in the first half of the year. Brand adidas is

projected to achieve mid-single-digit currency-neutral sales growth

in 2007. Reported sales in the Reebok segment are expected to grow

at low-single-digit rates. This increase will be positively

impacted by the consolidation of one extra month in 2007

(low-single-digit percentage point impact), compared to the prior

year. Currency-neutral TaylorMade-adidas Golf sales are expected to

grow at mid-single-digit rates on a like-for-like basis. On a

regional basis, adidas Group sales in Asia and Latin America are

expected to grow at double-digit rates in currency-neutral terms,

while low-single-digit growth rates are expected in Europe and

North America. Visible improvement in both gross and operating

margin expected in 2007 The adidas Group gross margin is expected

to increase strongly and be in a range of between 45 and 47%,

driven by improvements in all three brand segments, in particular

Reebok, partly offset by increasing raw material and labor costs as

well as the cooperation agreement with Amer Sports Corporation. The

Group�s operating margin is expected to be around 9%, which will be

modestly higher than in 2006. This development will be driven by

gross margin improvements at all brands, largely offset by higher

operating expenses at Reebok and TaylorMade-adidas Golf. At Reebok,

the increase in operating expenses is mainly due to the � 50

million of additional spend announced in November 2006 necessary to

accelerate the return to growth of the Reebok brand. In addition,

effects from purchase price allocation (in an expected amount of

between � 10 million and � 20 million) will negatively impact

Reebok�s operating margin in 2007. At TaylorMade-adidas Golf,

operating expenses as a percentage of net sales are expected to

increase slightly as a result of a higher marketing working budget

to support new product initiatives. Net income growth in 2007 to

approach 15% Based on the expected top-line improvement and

increased profitability, net income attributable to shareholders

for the adidas Group is expected to grow at double-digit rates,

approaching 15%, outpacing the expected sales development of the

Group in 2007. Dividend Payout Increases 29% At the Group�s Annual

General Meeting on May 10, 2007, the adidas AG Executive and

Supervisory Boards intend to propose a dividend of � 0.42 per share

for the 2006 financial year. As a result, the dividend payout will

increase 29% to ��85�million (2005: � 66 million), outpacing

earnings growth for the year. This represents a payout ratio of 18%

(2005: 17%) and shows Management�s confidence in the Group�s future

business performance. Herbert Hainer stated: �Having turned in a

strong 2006, our focus this year will be on getting Reebok back

onto a growth track and again achieving further improvements in

sales and bottom-line profitability. We are also committed to

delivering on our medium-term goals and expect increasing momentum

throughout the year.� Please visit our corporate website:

www.adidas-Group.com

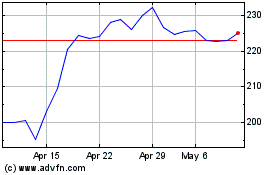

Adidas (TG:ADS)

Historical Stock Chart

From Jun 2024 to Jul 2024

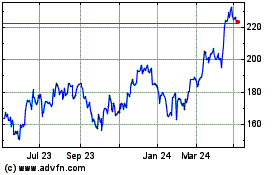

Adidas (TG:ADS)

Historical Stock Chart

From Jul 2023 to Jul 2024