Knight Capital Group and ISE Announce Knight’s Purchase of Competitive Market Maker Trading Rights on ISE

09 December 2009 - 12:30AM

Business Wire

Knight Capital Group, Inc. (Nasdaq: NITE) and the International

Securities Exchange (ISE) are pleased to announce that Knight

Equity Markets, L.P. will become a Competitive Market Maker (CMM)

on ISE’s options exchange, effective in the first quarter 2010.

Knight purchased ten CMM trading rights from TD Options, LLC that

cover every options class listed on the exchange.

“Knight is developing options market making capabilities as an

extension of our equities and fixed income trade execution services

for broker-dealers,” said Thomas M. Joyce, Chairman and Chief

Executive Officer, Knight Capital Group, Inc. “ISE is one of the

most advanced, efficient and transparent options markets for

investors. We look forward to joining as a market maker and

generating additional liquidity for the benefit of all market

participants.”

“ISE is very excited to welcome Knight to its family of world

class liquidity providers,” said Gary Katz, President and Chief

Executive Officer of ISE. “Knight will bring its advanced trading

systems and expertise as a global liquidity provider to its new

market making role at ISE. As a CMM, Knight will play a key role in

providing competitive quotes and deep liquidity for all options

products traded on ISE.”

Knight will maintain its Electronic Access Member (EAM) trading

rights on the exchange.

About Knight

Knight Capital Group, Inc. (Nasdaq: NITE) is a global capital

markets firm that provides market access and trade execution

services across multiple asset classes to buy- and sell-side firms.

Knight’s hybrid market model features complementary electronic and

voice trade execution services in global equities and fixed income

as well as foreign exchange, futures and options. The firm is

consistently ranked as the leading source of off-exchange liquidity

in U.S. equities. Knight also provides capital markets services to

corporate issuers. Knight is headquartered in Jersey City, NJ with

a growing global presence across North America, Europe and the

Asia-Pacific region. For more information, please go to

www.knight.com.

About International Securities Exchange

The International Securities Exchange (ISE) operates the world’s

largest equity options exchange and offers options trading on over

2,000 underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces that foster technology innovation and market

efficiency. Through minority investments, ISE participates in the

securities lending and equities markets. ISE also licenses its

proprietary Longitude technology for trading in event-driven

derivatives markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly operated by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6115689&lang=en

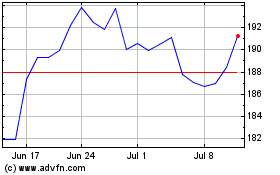

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

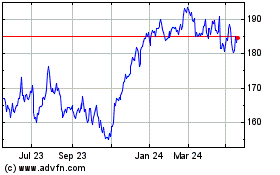

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025