uniQure Announces 2024 Financial Results and Highlights Recent

Company Progress

~ Announced alignment with the U.S. Food and

Drug Administration (FDA) on key elements of the Accelerated

Approval pathway for AMT-130 in Huntington’s disease; Initiated

preparations for a potential Biologics License Application (BLA)

submission ~

~ Completed patient enrollment in the third

cohort of the Phase I/II study of AMT-130 ~

~ Initiated dosing of the Phase I/II study of

AMT-260 in mesial temporal lobe epilepsy (mTLE);

Implementing protocol changes to expand study inclusion

criteria ~

~ Completed enrollment of the first cohorts

in the Phase I/II studies of AMT-191 in Fabry disease and AMT-162

in SOD1-ALS; Received favorable recommendations from the respective

Independent Data Monitoring Committees (IDMC) to proceed with

dosing the second cohorts ~

~ Cash and cash equivalents of approximately

$367.5 million as of December 31, 2024, combined with $80.7 million

in net proceeds from the recently completed financing, are expected

to fund operations into the second half of 2027 ~

LEXINGTON, Mass. and AMSTERDAM, Feb. 27, 2025

(GLOBE NEWSWIRE) -- uniQure N.V. (NASDAQ: QURE), a leading gene

therapy company advancing transformative therapies for patients

with severe medical needs, today reported its financial results for

the fourth quarter and full year of 2024 and highlighted recent

progress across its business.

“This past year was transformative for uniQure,

marked by significant clinical and operational progress,” stated

Matt Kapusta, chief executive officer of uniQure. “On the clinical

front, we made great strides advancing AMT-130 for Huntington’s

disease, including securing alignment with the FDA on key elements

of the Accelerated Approval pathway, a major milestone that brings

us closer to delivering the first potentially disease-modifying

treatment for this devastating condition. With this regulatory

clarity, we have initiated BLA-readiness activities and look

forward to further engagement with the FDA throughout the first

half of 2025. Our RMAT designation has enabled a productive and

expedited dialogue with the FDA, which we will continue leveraging

to advance AMT-130 through the regulatory process as rapidly as

possible. This is welcome news for patients awaiting further

development of our groundbreaking therapies.”

Mr. Kapusta continued, “Beyond AMT-130, we

continue to advance our broader pipeline of investigational gene

therapies, with patient enrollment progressing in the Phase I/II

studies of AMT-191 for Fabry disease and AMT-162 for SOD1-ALS.

Additionally, we are implementing FDA-approved protocol changes to

the Phase I/II study of AMT-260 in mTLE, including broadening the

inclusion criteria for certain patients in the first cohort – a

step we anticipate will help accelerate trial enrollment.”

“Operationally, we took decisive steps in 2024

to streamline our organization, including the sale of our Lexington

manufacturing facility and a company-wide restructuring that

significantly reduced our cash burn and strengthened our financial

position,” Mr. Kapusta continued. “These strategic actions enable

us to prioritize investments and achieve multiple value-creating

milestones, including the potential approval and commercial launch

of AMT-130.”

Recent Company Developments and Updates

- Pursuing Accelerated Approval

of AMT-130 for the treatment of Huntington’s disease

- In May 2024, the FDA granted

Regenerative Medicine Advanced Therapy (RMAT) designation for

AMT-130, stating that preliminary clinical evidence indicates that

AMT-130 has the potential to address unmet medical needs for

treatment of Huntington’s disease.

- In December 2024, uniQure reached

agreement with the FDA on key elements of an Accelerated Approval

pathway for AMT-130 in Huntington’s disease. As part of the RMAT

Type B meeting, the FDA agreed that data from the ongoing Phase

I/II studies, compared to a natural history external control, may

serve as the primary basis for a BLA submission, eliminating the

need for an additional pre-submission study. The FDA also agreed

that the composite Unified Huntington’s Disease Rating Scale

(cUHDRS) may be used as an intermediate clinical endpoint and

reductions in neurofilament light chain (NfL) in the cerebrospinal

fluid (CSF) may serve as supportive evidence of therapeutic

benefit.

- The Company has scheduled a Type B

meeting with the FDA in the first quarter of 2025 to discuss

chemistry, manufacturing and control (CMC) requirements to support

its planned BLA submission. A separate Type B meeting to discuss

the pivotal statistical analysis plan for the BLA is anticipated to

take place in the second quarter of 2025. After the completion of

these interactions, the Company expects to provide a regulatory

update in the second quarter of 2025, including the expected timing

of a potential BLA submission.

- In February 2025, the Company

completed enrollment of all 12 patients in the third cohort

investigating an optimized immunosuppression regimen. The Company

expects to provide an initial safety update on the third cohort in

the second quarter of 2025.

- In the third quarter of 2025, the Company expects to present

data from its ongoing Phase I/II studies of AMT-130 in support of a

potential BLA submission. The update will include follow-up data on

all patients treated with AMT-130 in the first two cohorts,

including three years of follow-up on 24 treated patients.

- Advancing additional clinical

programs to proof-of-concept

- AMT-260 for the treatment of

refractory mesial temporal lobe epilepsy (mTLE) – In November

2024, the Company announced the first patient dosed in the Phase

I/II clinical trial of AMT-260 for the treatment of mTLE. The FDA

recently approved a protocol amendment expanding the inclusion

criteria for certain patients in the first cohort to include

patients with non-lesional mesial temporal lobe epilepsy in the

non-dominant hemisphere. This broader inclusion criteria may assist

in accelerated enrollment. The Company expects to present initial

data from the study in the first half of 2026.

- AMT-162 for the treatment of

SOD1 amyotrophic lateral sclerosis (ALS) – In January 2025,

the Company announced a favorable recommendation from the IDMC

based on the review of 28-day safety data from the first study

cohort in the Phase I/II EPISODE1 study. The Company initiated

enrollment in the second dose cohort in the first quarter of 2025

and expects to present initial data from the study in the first

half of 2026.

- AMT-191 for the treatment of

Fabry disease – In February 2025, the Company announced

completion of enrollment in the first cohort in the Phase I/IIa

clinical trial of AMT-191 and a favorable recommendation from the

IDMC having reviewed safety data from the initial two patients. The

Company expects to initiate enrollment in the second dose cohort in

the second quarter of 2025 and to present initial data from the

study in the second half of 2025.

- Strong financial

position

- In the first quarter of 2025, the

Company completed a public offering of 5.1 million ordinary shares,

including the full exercise of the underwriters’ overallotment

option, at a price of $17.00 per share. Net proceeds from the

offering are expected to fund operations into the second half of

2027, including the potential BLA submission and U.S. commercial

launch of AMT-130.

- In the second quarter of 2024, the

Company completed the sale of its Lexington, MA manufacturing

facility to Genezen and retired $50 million of its outstanding debt

with Hercules Capital.

- In the third quarter of 2024, the

Company announced an organization restructuring which, combined

with the Lexington facility sale, eliminated approximately 65% of

the global workforce and reduced recurring cash burn by

approximately $70 million per year.

Upcoming Investor Events

- TD Cowen 45th Annual

Healthcare Conference, March 3rd – Boston, MA

- Leerink’s Global Healthcare

Conference 2025, March 10th – Miami, FL

- Kempen Life Sciences Conference,

April 3rd – Amsterdam, NL

Financial Highlights

Cash position: As of December

31, 2024, the Company held cash, cash equivalents and investment

securities of $367.5 million, compared to $617.9 million as of

December 31, 2023. Including the net proceeds of $80.7 million from

the recently completed follow-on offering, the Company’s proforma

cash, cash equivalents and investment securities was approximately

$448 million. The reduction in cash was in part driven by

non-recurring payments, including $53 million related to the

retirement of debt, $31.5 million related to milestone payments,

$12.0 million of one-time payments related to the divestment of the

Lexington facility transaction, and $4.7 million of severance

payments related to the Company’s restructuring. Based on the

Company’s current operating plan, including the planned U.S. launch

of AMT-130, the Company expects cash, cash equivalents and

investment securities will be sufficient to fund operations through

the second half of 2027.

Revenues: Revenue for the year

ended December 31, 2024 was $27.1 million, compared to $15.8

million in the same period in 2023. The increase of $11.3 million

in revenue resulted from a $7.4 million increase in license

revenue, an increase of $8.6 million from collaboration revenue,

and a decrease of $4.7 million from contract manufacturing of

HEMGENIX® for CSL Behring. Following the divestment of

the Lexington facility in July 2024, revenue from contract

manufacturing is recorded net of cost within other expenses.

Cost of contract manufacturing

revenues: Cost of contract manufacturing revenues were

$17.1 million for the year ended December 31, 2024, compared to

$13.6 million for the same period in 2023. Following the divestment

of the Lexington facility in July 2024, cost of contract

manufacturing is recorded net of revenue within other expenses.

R&D expenses: Research and

development expenses were $143.8 million for the year ended

December 31, 2024, compared to $214.9 million during the same

period in 2023. The $71.1 million decrease was related to a

decrease of $30.5 million in employee-related expenses, $17.7

million lower expenses related to changes in the fair value of

contingent consideration, a net decrease of $8.3 million in

external program spend and an $8.1 million decrease in costs

related to preclinical supplies.

SG&A expenses: Selling,

general and administrative expenses were $52.7 million for the year

ended December 31, 2024, compared to $74.6 million during the same

period in 2023. The $21.9 million decrease was primarily related to

a $7.6 million decrease in employee-related expenses, a decrease of

$5.4 million in information technology costs, a $4.4 million

decrease in professional fees and a $2.1 million decrease in

intellectual property fees and compared to the prior year

period.

Other income: Other income was

$7.9 million for the year ended December 31, 2024, compared to $6.1

million during the same period in 2023. The increase was primarily

related to the $1.2 million gain recorded on divesting the

Lexington manufacturing facility.

Other expense: Other expense

was $4.6 million for the year ended December 31, 2024, compared to

$1.7 million during the same period in 2023. The increase was

primarily related to $2.5 million of non-cash expense recognized to

amortize the right to purchase HEMGENIX® from Genezen on favorable

terms.

Other non-operating items, net:

Other non-operating items, net was an expense of $52.8 million for

the year ended December 31, 2024, compared to $23.7 million for the

same period in 2023. The $29.1 million increase in other

non-operating items, net was primarily related to an increase in

non-cash interest expense of $23.9 million related to the royalty

agreement that the Company entered into in May 2023 and an increase

in net foreign currency losses of $8.8 million.

Net loss: The net loss for the

year ended December 31, 2024, was $239.6 million, or $4.92 basic

and diluted loss per ordinary share, compared to $308.5 million net

loss for the same period in 2023, or $6.47 basic and diluted loss

per ordinary share.

About uniQure

uniQure is delivering on the promise of gene

therapy – single treatments with potentially curative results. The

approvals of uniQure’s gene therapy for hemophilia B – an historic

achievement based on more than a decade of research and clinical

development – represent a major milestone in the field of genomic

medicine and ushers in a new treatment approach for patients living

with hemophilia. uniQure is now advancing a pipeline of proprietary

gene therapies for the treatment of patients with Huntington's

disease, refractory temporal lobe epilepsy, ALS, Fabry disease, and

other severe diseases. www.uniQure.com

uniQure Forward-Looking

Statements

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as "anticipate," "believe," "could," “establish,” "estimate,"

"expect," "goal," "intend," "look forward to", "may," "plan,"

"potential," "predict," "project," “seek,” "should," "will,"

"would" and similar expressions. Forward-looking statements are

based on management's beliefs and assumptions and on information

available to management only as of the date of this press release.

Examples of these forward-looking statements include, but are not

limited to, statements concerning the Company’s cash runway and its

ability to fund its operations into the second half of 2027 and the

planned use of proceeds from its first quarter 2025 public

offering; the Company’s plans for further interactions with the FDA

to discuss the requirements for its planned BLA submission for

AMT-130; the Company’s ability to utilize an accelerated pathway to

progress AMT-130 through regulatory approval; the Company’s plans

to announce additional interim data and regulatory updates from its

ongoing Phase I/II clinical studies of AMT-130, along with an

initial safety update on the third cohort of the AMT-130 study and

other program updates; the effectiveness of planned protocol

changes in accelerating enrollment in the AMT-260 study; and the

Company’s organizational restructuring and other actions designed

to increase shareholder value and fund its pipeline of gene therapy

candidates. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements for many

reasons. These risks and uncertainties include, among others: risks

associated with the clinical results and the development and timing

of the Company’s programs; the Company’s interactions with

regulatory authorities, which may affect the initiation, timing and

progress of clinical trials and pathways to regulatory approval;

the Company’s ability to continue to build and maintain the company

infrastructure and personnel needed to achieve its goals; the

Company’s effectiveness in managing current and future clinical

trials and regulatory processes; the continued development and

acceptance of gene therapies; the Company’s ability to demonstrate

the therapeutic benefits of its gene therapy candidates in clinical

trials; the Company’s ability to obtain, maintain and protect

intellectual property; and the Company’s ability to fund its

operations and to raise additional capital as needed. These risks

and uncertainties are more fully described under the heading "Risk

Factors" in the Company’s periodic filings with the U.S. Securities

& Exchange Commission (“SEC”), including its Annual Report on

Form 10-K to be filed February 27, 2025 and in other filings that

the Company makes with the SEC from time to time. Given these

risks, uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and the Company

assumes no obligation to update these forward-looking statements,

even if new information becomes available in the future.

uniQure Contacts:

|

FOR INVESTORS: |

FOR MEDIA: |

| |

|

| Chiara

Russo |

Tom

Malone |

| Direct: 617-306-9137 |

Direct: 339-970-7558 |

| Mobile: 617-306-9137 |

Mobile:339-223-8541 |

c.russo@uniQure.com

|

t.malone@uniQure.com

|

|

uniQure N.V. |

|

UNAUDITED CONSOLIDATED BALANCE SHEETS |

|

|

| |

|

December 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

| |

|

(in thousands, except share and per share

amounts) |

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

158.930 |

|

|

$ |

241.360 |

| Current investment

securities |

|

|

208.591 |

|

|

|

376.532 |

| Accounts receivable |

|

|

5.881 |

|

|

|

4.193 |

| Inventories, net |

|

|

— |

|

|

|

12.024 |

| Prepaid expenses |

|

|

9.281 |

|

|

|

15.089 |

| Other current assets and

receivables |

|

|

7.606 |

|

|

|

2.655 |

| Total current

assets |

|

|

390.289 |

|

|

|

651.853 |

| Non-current

assets |

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

$ |

20.424 |

|

|

$ |

46.548 |

| Other investments |

|

|

27.464 |

|

|

$ |

2.179 |

| Operating lease right-of-use

assets |

|

|

13.647 |

|

|

|

28.789 |

| Intangible assets, net |

|

|

71.043 |

|

|

|

60.481 |

| Goodwill |

|

|

22.414 |

|

|

|

26.379 |

| Deferred tax assets, net |

|

|

9.856 |

|

|

|

12.276 |

| Other non-current assets |

|

|

1.399 |

|

|

|

3.184 |

| Total non-current

assets |

|

|

166.247 |

|

|

|

179.836 |

| Total

assets |

|

$ |

556.536 |

|

|

$ |

831.689 |

| Current

liabilities |

|

|

|

|

|

|

| Accounts payable |

|

$ |

7.227 |

|

|

$ |

6.586 |

| Accrued expenses and other

current liabilities |

|

|

29.225 |

|

|

|

30.534 |

| Current portion of contingent

consideration |

|

|

— |

|

|

|

28.211 |

| Current portion of operating

lease liabilities |

|

|

3.601 |

|

|

|

8.344 |

| Total current

liabilities |

|

|

40.053 |

|

|

|

73.675 |

| Non-current

liabilities |

|

|

|

|

|

|

| Long-term debt |

|

|

51.324 |

|

|

|

101.749 |

| Liability from royalty

financing agreement |

|

|

434.930 |

|

|

|

394.241 |

| Operating lease liabilities,

net of current portion |

|

|

11.136 |

|

|

|

28.316 |

| Contingent consideration, net

of current portion |

|

|

10.860 |

|

|

|

14.795 |

| Deferred tax liability,

net |

|

|

7.043 |

|

|

|

7.543 |

| Other non-current

liabilities |

|

|

7.942 |

|

|

|

3.700 |

| Total non-current

liabilities |

|

|

523.235 |

|

|

|

550.344 |

| Total

liabilities |

|

|

563.288 |

|

|

|

624.019 |

| Shareholders'

equity |

|

|

|

|

|

|

| Total shareholders'

equity |

|

|

(6.752 |

) |

|

|

207.670 |

| Total liabilities and

shareholders' equity |

|

$ |

556.536 |

|

|

$ |

831.689 |

|

uniQure N.V. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| |

|

|

|

Year ended December 31, |

|

|

|

2024 |

|

2023 |

|

2022 |

|

|

|

(in thousands, except share and per share

amounts) |

|

License revenues |

|

|

10.133 |

|

|

$ |

2.758 |

|

|

$ |

100.000 |

|

| Contract

manufacturing revenues |

|

|

6.114 |

|

|

|

10.835 |

|

|

|

1.717 |

|

|

Collaboration revenues |

|

|

10.872 |

|

|

|

2.250 |

|

|

|

4.766 |

|

|

Total revenues |

|

|

27.119 |

|

|

|

15.843 |

|

|

|

106.483 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

| Cost of license revenues |

|

|

(1.267 |

) |

|

|

(65 |

) |

|

|

(1.254 |

) |

| Cost of

contract manufacturing revenues |

|

|

(17.060 |

) |

|

|

(13.563 |

) |

|

|

(2.089 |

) |

| Research

and development expenses |

|

|

(143.782 |

) |

|

|

(214.864 |

) |

|

|

(197.591 |

) |

| Selling,

general and administrative expenses |

|

|

(52.657 |

) |

|

|

(74.591 |

) |

|

|

(55.059 |

) |

|

Total operating expenses |

|

|

(214.766 |

) |

|

|

(303.083 |

) |

|

|

(255.993 |

) |

| Other

income |

|

|

7.926 |

|

|

|

6.059 |

|

|

|

7.171 |

|

| Other

expense |

|

|

(4.573 |

) |

|

|

(1.690 |

) |

|

|

(820 |

) |

|

Loss from operations |

|

|

(184.294 |

) |

|

|

(282.871 |

) |

|

|

(143.159 |

) |

|

Non-operating items, net |

|

|

(52.833 |

) |

|

|

(23.686 |

) |

|

|

14.900 |

|

|

Loss before income tax (expense) / benefit |

|

$ |

(237.127 |

) |

|

$ |

(306.557 |

) |

|

$ |

(128.259 |

) |

| Income

tax (expense) / benefit |

|

|

(2.429 |

) |

|

|

(1.921 |

) |

|

|

1.470 |

|

|

Net loss |

|

$ |

(239.556 |

) |

|

$ |

(308.478 |

) |

|

$ |

(126.789 |

) |

|

Earnings per ordinary share - basic and

diluted |

|

|

|

|

|

|

|

|

|

| Basic

and diluted net loss per ordinary share |

|

$ |

(4,92 |

) |

|

$ |

(6,47 |

) |

|

$ |

(2,71 |

) |

| Weighted

average shares - basic and diluted |

|

|

48.649.129 |

|

|

|

47.670.986 |

|

|

|

46.735.045 |

|

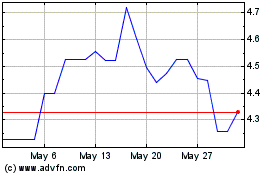

Uniqure NV (TG:UQ1)

Historical Stock Chart

From Feb 2025 to Mar 2025

Uniqure NV (TG:UQ1)

Historical Stock Chart

From Mar 2024 to Mar 2025