All figures in Canadian dollars unless otherwise noted

Investors, analysts and other interested parties can access

Acadian Timber Corp.'s 2011 Third Quarter Results conference call

via webcast on Friday, October 28, 2011 at 12:00 p.m. ET at

http://www.acadiantimber.com/ or via teleconference at

1-800-319-4610, toll free in North America. For overseas calls

please dial +1-604-638-5340, at approximately 11:50 a.m. ET. The

teleconference taped rebroadcast can be accessed at 1-800-319-6413

or +1-604-638-9010 and enter passcode 2826.

Acadian Timber Corp. ("Acadian" or the "Company") (TSX:ADN)

today reported financial and operating results(1) for the three

months ended September 24, 2011 (the "third quarter").

For the third quarter of 2011, Acadian generated net sales of

$17.5 million on sales volume of 341 thousand m3, which represents

a $0.3 million, or 2%, decrease in net sales compared to the same

period in 2010.

EBITDA of $3.8 million for the third quarter of 2011 was $0.9

million lower than in the third quarter of 2010, and EBITDA margin

decreased to 22% from 26% in the same period of last year. The

decrease in margin is attributed to a lower contribution from the

land management services agreement and a higher percentage of

hardwood harvested during the quarter which typically generates

lower contributions to Acadian than softwoods.

"Acadian performed well in the third quarter despite very wet

weather conditions and challenges with labour supply in Maine" said

Reid Carter, Chief Executive Officer of Acadian. Mr. Carter further

noted that "Operating levels at Acadian's primary sawmill and at

pulp and paper customers are positive and in-yard log inventories

are low suggesting demand and pricing will remain firm."

For the nine months ended September 24, 2011, Acadian generated

net sales of $51.0 million on sales volume of 1,010 thousand m3 as

compared to net sales of $50.4 million on sales volume of 1,017

thousand m3 in the comparable period of 2010. EBITDA of $11.7

million during the nine months ended September 24, 2011 is $0.3

million higher than the comparable period of 2010 reflecting the

strong first quarter 2011 results.

(1)This news release makes reference to earnings before

interest, taxes, depreciation and amortization, and fair value

adjustments ("EBITDA") and free cash flow. Management believes that

EBITDA and free cash flow are key performance measures in

evaluating Acadian's operations and are important in enhancing

investors' understanding of the Company's operating performance. As

EBITDA and free cash flow do not have a standardized meaning

prescribed by International Financial Reporting Standards ("IFRS"),

they may not be comparable to similar measures presented by other

companies. As a result, we have provided in this news release

reconciliations of net income and cash flow from operations, as

determined in accordance with IFRS, to EBITDA and free cash

flow.

Review of Operations

Financial and Operating Highlights

Three Months Ended Nine Months Ended

---------------------------------------------------

(CAD thousands, except Sept 24, Sept 25, Sept 24, Sept 25,

per share information) 2011 2010 2011 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sales volume (000s m3) 340.7 345.8 1,009.8 1,016.8

Net sales $ 17,535 $ 17,820 $ 51,014 $ 50,415

EBITDA 3,811 4,672 11,684 11,382

Free cash flow 3,183 3,608 10,198 8,196

Dividends declared 3,451 837 10,353 2,789

Net income (loss)1 (341) 3,039 2,332 28,684

Per share - fully

diluted

Net income (loss)1 (0.02) 0.18 0.14 1.71

Free cash flow 0.19 0.22 0.61 0.49

Dividends declared 0.21 0.05 0.62 0.17

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net income (loss) includes the impact of deferred income tax expense,

depreciation and amortization expense, and fair value adjustments which

are non-cash items recorded in each respective period and, for 2010

only, the gain resulting from Acadian's corporate conversion on January

1, 2010.

International Financial Reporting Standards

Effective fiscal 2011, Acadian's financial results are reported

in accordance with International Financial Reporting Standards

("IFRS"). Comparative figures in this press release, previously

presented in GAAP, have been adjusted to conform to IFRS.

New Brunswick Timberlands

The table below summarizes operating and financial results for

New Brunswick Timberlands.

Three Months Ended September Three Months Ended September

24, 2011 25, 2010

---------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (thousands) (000s m3) (000s m3) (thousands)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 98.0 99.0 $ 5,174 110.1 98.5 $ 5,150

Hardwood 121.1 119.5 6,886 86.0 96.5 5,587

Biomass 60.3 60.3 795 68.1 68.2 705

----------------------------------------------------------------------------

279.4 278.8 12,855 264.2 263.2 11,442

Other sales 1,418 1,828

----------------------------------------------------------------------------

Net sales $ 14,273 $ 13,270

----------------------------------------------------------------------------

EBITDA $ 3,410 $ 3,594

EBITDA

margin 24% 27%

----------------------------------------------------------------------------

Nine Months Ended September 24, Nine Months Ended September 25,

2011 2010

---------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (thousands) (000s m3) (000s m3) (thousands)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 352.8 351.6 $ 17,888 315.9 293.1 $ 15,358

Hardwood 346.3 337.7 19,807 299.9 337.3 18,933

Biomass 164.2 164.2 2,430 176.3 176.3 2,280

----------------------------------------------------------------------------

863.3 853.5 40,125 792.1 806.7 36,571

Other sales 2,696 2,854

----------------------------------------------------------------------------

Net sales $ 42,821 $ 39,425

----------------------------------------------------------------------------

EBITDA $ 10,904 $ 9,575

EBITDA

margin 25% 24%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 99 thousand m3,

120 thousand m3 and 60 thousand m3, respectively, for the third

quarter of 2011. Approximately 34% was sold as sawlogs, 44% as

pulpwood and 22% as biomass. This compares to 35% sold as sawlogs,

39% as pulpwood and 26% as biomass in the third quarter of

2010.

Net sales for the third quarter of 2011 were $14.3 million (2010

- $13.3 million) with an average selling price across all products

of $46.10 per m3 which compares to an average selling price of

$43.47 per m3 during the third quarter of 2010. The year-over-year

increase in the average selling price resulted from lower biomass

sales during the third quarter of 2011. Pricing across the primary

products was relatively flat compared to the third quarter of 2010.

Net sales for the first nine months ended September 24, 2011 were

$42.8 million, an increase of $3.4 million over the comparable

period of 2010.

Costs for the third quarter were $10.9 million (2010 - $9.7

million). Variable costs per m3 were 6% higher than the third

quarter of 2010 as a result of a 17% increase in hardwood sales

over the prior year. The delivered cost of hardwood logs is

typically higher than softwood because of longer transportation

distances.

EBITDA for the third quarter was $3.4 million, compared to $3.6

million in the comparable period of 2010. For the nine months ended

September 24, 2011, EBITDA was $10.9 million as compared to $9.6

million for the comparable period of 2010. EBITDA margin decreased

to 24%, as compared to 27% for the third quarter of 2010, primarily

reflecting the impact of an increased proportion of hardwood logs

in the sales mix.

During the third quarter of 2011, NB Timberlands experienced

four recordable safety incidents among employees and one recordable

incident among contractors.

Maine Timberlands

The table below summarizes operating and financial results for

Maine Timberlands.

Three Months Ended September Three Months Ended September

24, 2011 25, 2010

---------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (thousands) (000s m3) (000s m3) (thousands)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Softwood 43.8 44.1 $ 2,283 58.4 58.4 $ 3,102

Hardwood 14.0 13.8 781 23.1 21.3 1,275

Biomass 4.0 4.0 41 3.0 2.9 35

---------------------------------------------------------------------------

61.8 61.9 3,105 84.5 82.6 4,412

Other sales 157 138

---------------------------------------------------------------------------

Net sales $ 3,262 $ 4,550

---------------------------------------------------------------------------

EBITDA $ 549 $ 1,246

EBITDA

margin 17% 27%

---------------------------------------------------------------------------

Nine Months Ended September 24, Nine Months Ended September 25,

2011 2010

---------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (thousands) (000s m3) (000s m3) (thousands)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Softwood 113.8 114.1 $ 5,968 152.3 152.0 $ 7,857

Hardwood 30.4 31.6 1,826 51.3 49.2 2,669

Biomass 10.6 10.6 98 9.0 8.9 157

---------------------------------------------------------------------------

154.8 156.3 7,892 212.6 210.1 10,683

Other sales 301 307

---------------------------------------------------------------------------

Net sales $ 8,193 $ 10,990

---------------------------------------------------------------------------

EBITDA $ 1,630 $ 2,669

EBITDA

margin 20% 24%

---------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 44 thousand m3, 14

thousand m3 and 4 thousand m3, respectively, for the third quarter

of 2011. Approximately 60% was sold as sawlogs, 34% as pulpwood and

6% as biomass. This compares to 54% sold as sawlogs, 42% as

pulpwood and 4% as biomass in the third quarter of 2010.

Net sales for the third quarter of 2011 were $3.3 million (2010

- $4.6 million) with an average selling price across all products

of $50.12 per m3 which compares to an average selling price of

$53.38 per m3 during the third quarter of 2010. This variance in

sales price was primarily attributable to foreign exchange as

average pricing across all products was relatively stable in US

dollar terms. Sales volume was limited due to very difficult

operating conditions owing to exceptionally wet weather and

challenging contractor availability due to the Maine government's

efforts to limit Canadian labourer's access to work in the state.

Net sales for the first nine months ended September 24, 2011 were

$8.2 million, a decrease of $2.8 million over the comparable period

of 2010 reflecting a 27% reduction in year-over-year harvest

volume.

Costs for the third quarter were $2.7 million (2010 - $3.3

million). Variable costs per m3 decreased 4% in Canadian dollar

terms as changes to contract rates made late in the second quarter

and increases in fuel costs were offset by foreign exchange.

Variable costs per m3 increased 2% in U.S. dollar terms.

EBITDA for the third quarter was $0.5 million, compared to $1.2

million in the comparable period of 2010. For the nine months ended

September 24, 2011, EBITDA was $1.6 million as compared to $2.7

million for the first nine months of 2010. EBITDA margin averaged

17% in the third quarter of 2011 as compared to 27% during the

third quarter of 2010. The reduction in margin reflects higher

costs and lower sales volume resulting in reduced contribution

towards fixed costs.

We are pleased to report that during the third quarter of 2011,

Maine Timberlands experienced no recordable safety incidents among

employees or contractors.

Market Outlook

The following Market Outlook contains forward-looking statements

about Acadian Timber Corp.'s market outlook for the remainder of

fiscal 2011 and 2012. Reference should be made to the

"Forward-looking Statements" section of this news release. For a

description of material factors that could cause actual results to

differ materially from the forward-looking statements in the

following, please see the Risk Factors section of our management's

discussion and analysis of Acadian's most recent Annual Report and

Annual Information Form available on our website at

www.acadiantimber.com or filed with SEDAR at www.sedar.com.

Signals for recovery of the U.S. housing market continue to be

very weak with most industry watchers suggesting 2012 will look

much like 2011 before a gradual recovery to historic trends during

the 2013 - 2015 period. This outlook suggests that any robust

recovery of Acadian's softwood sawlog market remains somewhat

distant. However, Acadian continues to benefit from most of its

softwood sawmilling customers maintaining active operations and, as

a result, demand for spruce-fir sawlogs continues to be reasonably

strong causing our outlook to be cautiously optimistic for the

remainder of 2011 and into 2012.

Markets for hardwood sawlogs remain stable and appear to have a

similar outlook for the foreseeable future.

Markets for both softwood and hardwood pulp logs remain strong

despite softening global pulp markets. Acadian's major pulpwood

customers are currently operating and actively competing for

deliveries suggesting prices will remain stable through year end.

The expected start-up of a groundwood paper mill in Maine is

expected to add to strong market demand for softwood pulpwood.

Biomass markets continue to face significant market challenges.

Cogeneration plants associated with manufacturing facilities are

generally in good shape, while stand-alone wood-to-energy plants

continue to suffer from depressed prices for electricity and

Renewable Energy Credits. Despite this challenging market

environment, Acadian continues to be able to sell all of its

biomass with a stable price outlook.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share,

payable on January 13, 2012 to shareholders of record on December

30, 2011.

Acadian Timber Corp. is a leading supplier of primary forest

products in Eastern Canada and the Northeastern U.S. With a total

of 2.4 million acres of land under management, Acadian is the

second largest timberland operator in New Brunswick and Maine.

Acadian owns and manages approximately 1.1 million acres of

freehold timberlands in New Brunswick and Maine, and provides

management services relating to approximately 1.3 million acres of

Crown licensed timberlands. Acadian also owns and operates a forest

nursery in Second Falls, New Brunswick. Acadian's products include

softwood and hardwood sawlogs, pulpwood and biomass by-products,

sold to over 100 regional customers.

Acadian's shares are listed for trading on the Toronto Stock

Exchange under the symbol ADN.

For further information, please visit our website at

www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information and other

forward-looking statements within the meaning of applicable

Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Acadian Timber Corp. and its

subsidiaries (collectively, "Acadian"), or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. When used in this News Release, such statements may

contain such words as "may," "will," "intend," "should," "expect,"

"believe," "outlook," "predict," "remain," "anticipate,"

"estimate," "potential," "continue," "plan," "could," "might,"

"project," "targeting" or the negative of these terms or other

similar terminology. Forward-looking information in this News

Release includes, without limitation, statements regarding

management's beliefs, intentions, results, performance, goals,

achievements, future events, plans and objectives, business

strategy, access to capital, liquidity and trading volumes,

dividends, taxes, capital expenditures, projected costs, and

similar statements concerning anticipated future events, results,

achievements, circumstances, performance or expectations that are

not historical facts. These statements which reflect management's

current expectations regarding future events and operating

performance are based on information currently available to

management and speak only as of the date of this News Release. All

forward-looking statements in this News Release are qualified by

these cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as

guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of

whether or not such results will be achieved. Factors that could

cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not

limited to: general economic and market conditions; product demand;

concentration of customers; commodity pricing; interest rate and

foreign currency fluctuations; seasonality; weather and natural

conditions; regulatory, trade or environmental policy changes;

changes in Canadian income tax law; economic situation of key

customers; and other risks and factors discussed under the heading

"Risk Factors" in each of the Annual Information Form dated March

28, 2011 and the Management Information Circular dated March 28,

2011, and other filings of Acadian made with securities regulatory

authorities, which are available on SEDAR at www.sedar.com.

Forward-looking information is based on various material factors

or assumptions, which are based on information currently available

to Acadian. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the

forward-looking information may include, but are not limited to:

anticipated financial performance; business prospects; strategies;

regulatory developments; exchange rates; the sufficiency of

budgeted capital expenditures in carrying out planned activities;

the availability and cost of labour and services and the ability to

obtain financing on acceptable terms, which are subject to change

based on commodity prices, market conditions for timber and wood

products, and the economic situation of key customers. Readers are

cautioned that the preceding list of material factors or

assumptions is not exhaustive. Although the forward-looking

statements contained in this News Release are based upon what

management believes are reasonable assumptions, Acadian cannot

assure readers that actual results will be consistent with these

forward-looking statements. Certain statements in this News Release

may also be considered "financial outlook" for the purposes of

applicable Canadian securities laws, and such financial outlook may

not be appropriate for purposes other than this News Release. The

forward-looking statements in this News Release are made as of the

date of this News Release, and should not be relied upon as

representing Acadian's views as of any date subsequent to the date

of this News Release. Acadian assumes no obligation to update or

revise these forward-looking statements to reflect new information,

events, circumstances or otherwise, except as may be required by

applicable law.

Acadian Timber Corp.

Interim Consolidated Statements of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept. 24, Sept. 25, Sept. 24, Sept. 25,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net sales $ 17,535 $ 17,820 $ 51,014 $ 50,415

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 12,061 11,295 34,285 33,741

Selling, administration

and other 1,498 1,688 4,685 5,113

Depreciation and

amortization 137 122 409 363

----------------------------------------------------------------------------

13,696 13,105 39,379 39,217

----------------------------------------------------------------------------

Operating earnings 3,839 4,715 11,635 11,198

Interest expense, net (745) (962) (2,422) (2,818)

Other items:

Fair value adjustments (177) 84 (575) 1,511

Unrealized exchange loss

on long-term debt (2,941) - (3,928) -

Reforestation (174) (171) (467) (217)

Gain on sale of

timberlands 9 6 107 38

Gain on corporate

conversion - - - 21,086

----------------------------------------------------------------------------

Earnings (loss) before

income taxes (189) 3,672 4,350 30,798

Deferred tax expense (152) (633) (2,018) (2,114)

----------------------------------------------------------------------------

Net income (loss) for the

period $ (341) $ 3,039 $ 2,332 $ 28,684

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per share

- basic $ (0.02) $ 0.18 $ 0.14 $ 1.71

Net income (loss) per share

- diluted $ (0.02) $ 0.18 $ 0.14 $ 1.71

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept. 24, Sept. 25, Sept. 24, Sept. 25,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income (loss) $ (341) $ 3,039 $ 2,332 $ 28,684

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Unrealized foreign

currency translation

income (loss) 3,366 (608) 3,134 (1,508)

Amortization of

derivatives designated as

hedges (48) - (270) -

----------------------------------------------------------------------------

Comprehensive income $ 2,977 $ 2,431 $ 5,196 $ 27,176

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at September 24, December 31, January 1,

(CAD thousands) 2011 2010 2010

----------------------------------------------------------------------------

ASSETS

Current Assets:

Cash and cash equivalents $ 7,735 $ 7,333 $ 2,053

Accounts receivable and other

assets 10,514 7,252 6,265

Inventory 1,422 990 2,289

Derivative asset - 1,557 -

Note receivable - - 4,001

----------------------------------------------------------------------------

19,671 17,132 14,608

Timber 218,200 216,181 216,751

Property, plant and equipment 34,591 34,508 36,275

Investment property 875 875 875

Intangible Assets 6,140 6,140 6,140

Deferred income tax asset 5,431 7,522 -

----------------------------------------------------------------------------

$ 284,908 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable and accrued

liabilities $ 9,136 $ 4,483 $ 4,275

Dividends payable to shareholders 3,451 837 -

Debt - 73,752 -

----------------------------------------------------------------------------

12,587 79,072 4,275

Long-term debt 73,472 - 80,739

Deferred income tax liability 19,672 18,952 34,553

Shareholders' equity 179,177 184,334 155,082

----------------------------------------------------------------------------

$ 284,908 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Cash Flows

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept. 24, Sept. 25, Sept. 24, Sept. 25,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Cash provided by (used

for):

----------------------------------------------------------------------------

Operating activities

Net income (loss) $ (341) $ 3,039 $ 2,332 $ 28,684

Adjustments to net

income (loss):

Deferred tax expense 152 633 2,018 2,114

Depreciation and

amortization 137 122 409 363

Fair value adjustments 177 (84) 575 (1,511)

Unrealized exchange

loss on long term debt 2,941 - 3,928 -

Interest expense, net 745 962 2,422 2,818

Interest paid, net (619) (962) (1,463) (2,818)

Gain on sale of

timberlands (9) (6) (107) (38)

Gain on corporate

conversion - - - (21,086)

----------------------------------------------------------------------------

3,183 3,704 10,114 8,526

Net change in non-cash

working capital

balances and other 1,457 (56) 2,179 (778)

----------------------------------------------------------------------------

4,640 3,648 12,293 7,748

----------------------------------------------------------------------------

Financing activities

Repayment of revolving

facility - (1,000) - (4,500)

Borrowing of term

facility - - 70,608 -

Repayment of bank term

credit facility and

term loan - - (73,639) -

Deferred financing costs - - (1,205) -

Dividends paid to

shareholders (3,451) (837) (7,739) (1,952)

----------------------------------------------------------------------------

(3,451) (1,837) (11,975) (6,452)

----------------------------------------------------------------------------

Investing activities

Additions to timber,

property, plant and

equipment (9) (106) (25) (370)

Proceeds from sale of

timberlands 9 10 109 40

----------------------------------------------------------------------------

- (96) 84 (330)

----------------------------------------------------------------------------

Increase in cash and

cash equivalents during

the period 1,189 1,715 402 996

Cash and cash

equivalents, beginning

of period 6,546 1,304 7,333 2,053

----------------------------------------------------------------------------

Cash and cash

equivalents, end of

period $ 7,735 $ 3,019 $ 7,735 $ 3,019

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliation to EBITDA and Free Cash Flow

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

----------------------------------------------------------------------------

Sept. 24, Sept. 25, Sept. 24, Sept. 25,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income (loss)(1) $ (341) $ 3,039 $ 2,332 $ 28,684

Add (deduct):

Interest expense, net 745 962 2,422 2,818

Deferred tax expense 152 633 2,018 2,114

Depreciation and

amortization 137 122 409 363

Fair value adjustments 177 (84) 575 (1,511)

Unrealized exchange loss on

long-term debt 2,941 - 3,928 -

Gain on corporate conversion - - - (21,086)

----------------------------------------------------------------------------

EBITDA 3,811 4,672 11,684 11,382

Add (deduct):

Interest paid on debt, net (619) (962) (1,463) (2,818)

Capital expenditures (9) (106) (25) (370)

Gain on sale of timberlands (9) (6) (107) (38)

Proceeds on sale of

timberlands 9 10 109 40

----------------------------------------------------------------------------

Free cash flow $ 3,183 $ 3,608 $ 10,198 $ 8,196

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 837 $ 10,353 $ 2,789

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Payout ratio 108% 23% 102% 34%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net income (loss) includes the impact of deferred income tax expense,

depreciation and amortization expense, and fair value adjustments which

are non-cash items recorded in each respective period and, for 2010

only, the gain resulting from Acadian's corporate conversion on January

1, 2010.

Contacts: Acadian Timber Corp. Robert Lee Investor Relations and

Communications

604-661-9607rlee@acadiantimber.comwww.acadiantimber.com

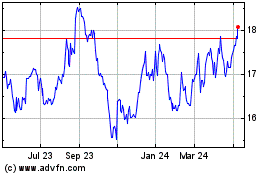

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jul 2023 to Jul 2024