Aleafia Health Reports Strong 2021 Second Quarter Financial Results with 53% Sequential Increase in Cannabis Net Revenue

12 August 2021 - 9:17PM

Aleafia Health Inc. (TSX: AH, OTCQX: ALEAF) (“

Aleafia

Health” or the “

Company”) is pleased to

report its financial results for the three and six months ended

June 30th, 2021.

“This quarter clearly demonstrates the success of our expanded

product portfolio, with strong sequential growth across all sales

channels and a shift towards a more balanced mix with sizable

contributions from both the medical and adult-use cannabis markets.

Credit goes to our management team and employees for delivering

record adult-use, and medical cannabis revenue this quarter,” said

Aleafia Health CEO Geoffrey Benic. “Despite industry-wide price

compression, we have maintained robust gross margins on cannabis

revenue when compared to other Canadian licensed producers, based

on most recently reported quarterly results. This was achieved

through our twin pillars of low-cost cultivation and high-quality,

differentiated cannabis derivative formats.

“With an already well-established line of cannabis wellness

products, we were delighted to see sequential revenue increases

driven by our newly launched dried flower and pre-roll portfolio.

Gaining access to the German medical cannabis market marks an

important milestone that, with continued successful shipments, can

contribute revenue growth and gross margin expansion. The

development of our domestic medical cannabis channel and broader

patient ecosystem are well positioned as we continue the ramp-up of

our exclusive partnership with Unifor, Canada’s largest private

sector union.

“Lastly, we were able to complete planting across 86 acres

outdoors, over a full a month earlier than last year, laying the

groundwork for the 2021 harvest. Outdoor cultivation remains a core

competitive advantage both in cost and scale, for our dried flower

portfolio and as input for cannabis product derivative formats.

Likewise, it will allow us to be opportunistic in securing bulk

wholesale revenue later this year and into early 2022.”

CONDENSED INCOME STATEMENT

|

($,000s) |

Three months ended |

Six months ended |

|

Jun 30, 2021 |

Jun 30, 2020 |

Jun 30, 2021 |

Jun 30, 2020 |

|

Net revenue |

10,672 |

9,775 |

17,738 |

24,371 |

| Cannabis net

revenue(1)(3) |

9,583 |

8,995 |

15,828 |

22,722 |

| Adjusted gross profit before

fair value ("FV") adjustments on net cannabis revenue(1)(3) |

4,740 |

2,962 |

8,442 |

14,636 |

| Adjusted gross margin before

FV adjustments on net cannabis revenue(1)(3) |

49% |

33% |

53% |

64% |

|

Adjusted EBITDA(1)(2) |

(3,339) |

3,065 |

(6,372) |

9,829 |

| Net loss |

(36) |

(4,021) |

(11,284) |

(10,176) |

|

1. See "Cautionary Statements Regarding Certain non-IFRS Measures"

section of associated MD&A for term definition. |

|

2. See "Adjusted EBITDA" section of associated MD&A for

reconciliation to IFRS equivalent. |

|

3. See "Revenue" section of associated MD&A for

reconciliation to IFRS equivalent. |

OPERATIONAL RESULTS

|

($,000s, except operational results) |

Three months ended |

% Change |

|

Jun 30,2021 |

Mar 31,2021 |

Jun 30,2020 |

Q/Q |

Y/Y |

|

Net medical cannabis revenue(1)(2) |

3,266 |

2,657 |

1,959 |

23% |

67% |

| Net adult-use cannabis

revenue(1)(2) |

3,217 |

1,722 |

870 |

87% |

270% |

| Net bulk wholesale cannabis

revenue(1)(2) |

3,100 |

1,866 |

6,166 |

66% |

-50% |

|

Cannabis net revenue(1)(2) |

9,583 |

6,245 |

8,995 |

53% |

7% |

| Net

clinic revenue |

1,089 |

821 |

780 |

33% |

40% |

|

|

|

|

|

|

|

| Active, registered

patients |

18,067 |

17,637 |

13,285 |

2% |

36% |

| Average net selling price per

gram of medical cannabis(1) |

$7.25 |

$8.46 |

$7.87 |

-14% |

-8% |

| Average net selling price per

gram of adult-use cannabis(1) |

$5.29 |

$4.89 |

$4.81 |

8% |

10% |

| Average net selling price per

gram of bulk wholesale cannabis(1) |

$0.46 |

$0.75 |

$2.92 |

-39% |

-84% |

| Adjusted gross margin before

FV adjustments on medical cannabis net revenue(1)(2) |

41% |

53% |

41% |

-12% |

0% |

| Adjusted gross margin before

FV adjustments on adult-use cannabis net revenue(1)(2) |

47% |

56% |

37% |

-9% |

10% |

| Adjusted gross margin before

FV adjustments on wholesale cannabis net revenue(1)(2) |

60% |

71% |

30% |

-11% |

30% |

| Gross margin on clinic net

revenue(1)(2) |

61% |

20% |

69% |

41% |

-8% |

| Kilograms sold |

7,811 |

3,155 |

2,545 |

148% |

207% |

|

1. See "Cautionary Statements Regarding Certain non-IFRS Measures"

section of associated MD&A for term definition. |

|

2. See associated MD&A for reconciliation to IFRS

equivalent. |

- During the three months ended June

30, 2021 (“Q2 2021”) cannabis net revenue was $9.6 million, an

increase of 53% over the previous quarter. The sequential increase

was due to increases in the sale of cannabis across the adult-use,

medical and bulk wholesale sales channels.

- Medical cannabis net revenue for Q2

2021 was $3.3 million, a 23% and 67% increase over the previous and

prior year’s quarter respectively, due to improved product

offerings and increased international medical cannabis sales.

- Net adult-use cannabis revenue for

Q2 2021 was $3.2 million, an increase of 87% over the previous

quarter and 270% over the prior year’s quarter. The sequential

increase was primarily due to greater product availability,

including the launch of new product formats and SKUs.

- Net bulk wholesale revenue received

from sales to cannabis licensed producers was $3.1 million,

compared to $1.9 million and $6.2 million in the previous and prior

year’s quarter, respectively. Bulk wholesale was up over Q1 2021,

but lower than the prior year’s quarter, primarily driven by dried

flower allocation, which was redirected to the adult-use sales

channel.

- Adjusted gross margin before FV

adjustments on cannabis net revenue was 49%, compared to 59% and

33% in the previous and prior year’s quarters, respectively. The

sequential decline in gross margin percentage was primarily due to

industry-wide price compression, which was reflected in a lower net

revenue per gram equivalent sold.

- Adjusted EBITDA for Q2 2021 was a

loss of $3.3 million, compared to a profit of $3.1 million in the

prior year’s quarter. The decline over the prior year’s quarter was

primarily due to increases in wages & benefits expense,

partially offset by increased gross profit from the sale of

cannabis.

- Net loss for the three months ended

June 30, 2021 was $36,000, compared to a net loss of $4.0 million

over the prior year’s quarter. The improvement in net loss over the

prior year’s quarter is primarily due to improved gross profit, a

$12.1 million gain on the sale of certain clinic assets in the

transaction with Myconic, partially offset by bad debt expense of

$7.2 million.

PRODUCT LAUNCHES & KEY DEVELOPMENTS

Throughout the reporting period, the Company undertook an

expansion of its cannabis brand and product portfolio, including

differentiated formats and new SKUs in the important value flower

and pre-roll categories.

- Exports to Germany &

Australia: During Q2 2021, the Company announced dried

flower grown at its Niagara greenhouse facility had been exported

to Germany. Gaining access to Europe’s legal cannabis market is an

important breakthrough for Aleafia Health. Shipments of medical

cannabis products to Australia were also completed during the

quarter.

- Dried Flower &

Pre-rolls: The Company has undertaken an expansion of its

dried flower and pre-roll offering, which represents the first and

third largest product categories in the Canadian cannabis market,

respectively. These include a pre-roll line extension with 12

pre-rolls each of 0.35 grams, and larger format 14-gram flower and

10-gram milled flower pouches. Sales of these products and other

new dried flower SKUs commenced during Q2 2021, under the newly

launched brand Divvy.

- Differentiated Wellness

Products: During Q2 2021, the Company launched Lavender

Fizz CBD bath bombs, and CBD Freshly Minted Roll-on, under its

trailblazing wellness brand Noon & Night. The quarter also

featured the launch of the Omega CBD Soft Gels which feature

full-spectrum, single strain CBD extract, and are the first

Canadian cannabis products to be suspended in fish oil containing

omega-3.

- Confectionary

Edibles: The Company strengthened its edibles portfolio

with Salted Caramel Pretzel Bites, which were launched under the

Bogart’s Kitchen edibles brand.

- Unifor Program:

During the reporting period, the Company commenced providing

medical cannabis products and services to unionized employees of

the Ford Motor Company of Canada, through its exclusive partnership

with Unifor, Canada’s largest private sector union.

- 2021 Outdoor Cultivation

Season: On June 18, 2021, the Company completed planting

across 86 acres at the Port Perry Facility outdoor cultivation

site. The milestone was achieved a month earlier, and on a

significantly larger scale, than the 2020 outdoor season, which

yielded 31,200 kgs of dried flower, at a cost of $0.10 per gram to

harvest.

SELECTED BALANCE SHEET INFORMATION

|

($,000s) |

Jun 30, 2021 |

Dec 31, 2020 |

|

Cash, cash equivalents, marketable securities |

17,804 |

30,529 |

| Current assets |

71,055 |

82,923 |

| Current liabilities |

49,901 |

45,041 |

|

Working capital |

21,154 |

37,882 |

| Total assets |

221,423 |

237,283 |

| Total liabilities |

54,866 |

83,062 |

|

|

|

|

|

Capitalization |

|

|

| Lease liability |

2,620 |

3,167 |

|

Convertible debt |

33,931 |

56,802 |

| Total debt |

36,551 |

59,969 |

| Total

equity |

166,557 |

154,221 |

|

Total capitalization |

203,108 |

214,190 |

|

|

|

|

CONFERENCE CALL &

WEBCAST

Date: August 12, 2021Time:

9:30 a.m. ETUSA/Canada Toll-Free Participant

Call-in: (866) 679-9046; Passcode:

6096362International Toll-Free Participant

Call-in: (409) 217-8323; Passcode:

6096362

WEBCAST LINK

This conference call will be webcast live over the internet and

can be accessed through the link provided. Audio of the call will

be available to participants through both the conference call line

and webcast; however, the presentation may only be viewed via the

webcast. A replay of the call be viewed at any time via the link

provided.

For Investor & Media Relations:

Nicholas Bergamini, VP Investor

Relations1-833-879-2533IR@AleafiaHealth.comLEARN MORE:

www.AleafiaHealth.com

About Aleafia Health:

Aleafia Health is a vertically integrated and

federally licensed Canadian cannabis company offering cannabis

health and wellness services and products in Canada. The Company

has developed an international footprint, with subsidiaries or

investments in German and Australian medical cannabis companies and

has products available in both markets. The Company owns and

operates a virtual network of medical cannabis clinics staffed by

physicians and nurse practitioners who have seen over 75,000

patients to date.

Aleafia Health owns three licensed cannabis

production facilities and operates a strategically located

distribution centre all in the province of Ontario, including the

first large-scale, legal outdoor cultivation facility in Canadian

history. The Company produces a diverse portfolio of cannabis

derivative products including oils, capsules, edibles, sublingual

strips, and vapes, for sale in Canada in the medical and adult-use

markets, and in select international jurisdictions.

Forward Looking Information

This news release contains forward-looking information within

the meaning of applicable Canadian and United States securities

laws. Often, but not always, forward-looking information can be

identified by the use of words such as “plans”, “expects”,

“estimates”, “intends”, “anticipates”, or “believes” or variations

of such words and phrases or state that certain actions, events or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved. Forward-looking information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company or its

subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained in this news release. Risks,

uncertainties and other factors involved with forward-looking

information could cause actual events, results, performance,

prospects and opportunities to differ materially from those

expressed or implied by such forward-looking information, including

risks contained in the Company’s annual information form filed with

Canadian securities regulators available on the Company’s SEDAR

profile at www.sedar.com. Although the Company believes that the

assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information and no assurance can be

given that such events will occur in the disclosed time frames or

at all. The forward-looking information included in this news

release are made as of the date of this news release and the

Company does not undertake any obligation to publicly update such

forward-looking information to reflect new information, subsequent

events or otherwise unless required by applicable securities

legislation.

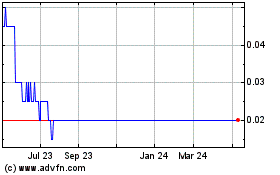

Aleafia Health (TSX:AH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aleafia Health (TSX:AH)

Historical Stock Chart

From Jan 2024 to Jan 2025