Altus Group Report Reveals Commercial Tax Rate in Major Canadian Cities Reaching More than Three Times the Residential Rate

12 October 2023 - 12:00AM

Altus Group Limited (ʺAltus” or “the Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate (“CRE”), in partnership with the Real Property Association

of Canada (“REALPAC”), today released its annual publication of the

Canadian Property Tax Rate Benchmark Report which provides an

in-depth look at commercial and residential property tax rates in

11 major cities across Canada in 2023. The report also includes

regional taxation updates and a fairness review.

Across Canada, all property owners pay tax based

on the assessed value of their property, but the tax rate per

dollar of property value varies depending on whether that property

is used for residential or commercial purposes. This report reviews

how Canadian municipalities respond to the challenges of increased

costs and market fluctuations, and monitors the impacts of

municipal tax policies on commercial taxpayers.

Commercial-to-residential tax

ratio

The commercial-to-residential tax ratio is the

key measure in the report that compares the commercial tax rate to

the residential tax rate. For example, if the ratio is 2.50, this

means that the commercial tax rate is two-and-a-half times (2.5x)

the residential tax rate.

The 2023 report found that six out of the 11

cities surveyed have a commercial tax rate that is more than three

times the residential tax rate, which means that a commercial

property incurs property taxes more than three times the amount of

an equally valued residential property. The average

commercial-to-residential tax ratio in 2023 was 2.82, reflecting a

slight increase of 0.84% from the 2022 average ratio of 2.80. The

rise in the average ratio was largely driven by the ratio increases

in Calgary, Montreal, Halifax and Quebec City. The results raise

questions of inequity in the distribution of the tax burden that

could weigh on Canada’s business viability and community

growth.

|

Year-Over-Year Commercial-to-Residential Tax

Ratios |

|

City |

2023 |

2022 |

% Change 2022

to 2023 |

|

Montreal |

4.33 |

4.21 |

6.08 |

% |

| Quebec City |

3.53 |

3.51 |

1.24 |

% |

| Vancouver |

3.37 |

3.46 |

-2.34 |

% |

| Calgary |

3.36 |

3.07 |

9.49 |

% |

| Toronto |

3.26 |

3.36 |

-3.02 |

% |

| Halifax |

3.10 |

3.06 |

1.27 |

% |

| Average |

2.82 |

2.80 |

0.84 |

% |

| Edmonton |

2.59 |

2.68 |

-3.45 |

% |

| Ottawa |

2.42 |

2.39 |

1.23 |

% |

| Winnipeg |

1.93 |

1.92 |

0.49 |

% |

| Saskatoon |

1.61 |

1.61 |

0.00 |

% |

| Regina |

1.50 |

1.51 |

-0.07 |

% |

"In today's rapidly changing commercial real

estate environment, it is crucial for governments to take a

proactive approach in addressing shifts in property values while

maintaining tax fairness for both commercial and residential

property owners. Jurisdictions such as Ontario need to consider

more frequent property reassessments to align with market

dynamics,” said Ryan Fagan, Head of Operations & Technology,

Tax Canada at Altus Group. "As we assess this ever-changing

landscape of commercial and residential property tax, it becomes

clear that adaptability is key to navigating these times. Property

owners and stakeholders must stay informed about regulatory changes

and leverage data-driven insights to optimize their tax

strategies.”

Regional trend analysis

- Vancouver’s rise

in residential values contributed to a 2.34% decline in its ratio

to 3.37, signaling a downward trend.

- Calgary observed

the largest commercial-to-residential ratio increase of the cities

surveyed, climbing 9.49% to 3.36, continuing the trend of

increasing its rate significantly for the past two years.

- Edmonton’s ratio

has spiked upward at various times over the past two decades but

showed a decrease of 3.45% in 2023, remaining below the average at

2.59.

- Saskatoon and Regina

continued a seven-year trend of posting a ratio below 2.0 at 1.61

and 1.50, respectively, the lowest in the survey. The ratios in

both cities have continuously dropped and since 2017, these two

cities have had the most equitable commercial to residential ratios

in this study.

- Winnipeg’s ratio

remained relatively static and below the average at 1.93, but these

rates do not account for the education tax rebates or the business

tax. Since the province of Manitoba implemented education tax

rebates in 2021, the rebate for residential properties has

increased from 25% to 50%, while the commercial rebate remains at

10%. This difference in rebate, combined with the additional

business tax commercial properties pay based on annual rental

value, means that the effective commercial-to-residential ratio in

Winnipeg is much higher than it appears, and has increased

significantly since 2021.

- Toronto continues its slow progress toward

equity as its commercial-to-residential ratio dropped by just over

3% to 3.26, while Ottawa's ratio crept up slightly

but remains below the average at 2.42. The long delay in Ontario's

reassessment is magnifying the inequities for many commercial

taxpayers.

- Montreal’s

reassessment resulted in greater assessment increases for

residential properties than for commercial and continued a

five-year trend of posting the highest commercial-to-residential

ratio of all cities surveyed, rising more than 6% to 4.33, well

above the national average.

- Quebec City’s

ratio first climbed above the average in 2013 and remained well

above the average in 2023 with a ratio of 3.56. Over the past 20

years, Quebec City has steadily increased commercial tax rates

relative to residential and now it has one of the highest ratios of

the cities in this study.

- Halifax’s new

commercial tax policy took effect this year, adding complexity to

commercial tax bills and increasing tax rates for properties in

business and industrial parks, noting a ratio increase of 1.27% to

3.10.

Ontario’s failure to launch

reassessment

This year’s report provides a spotlight on the extended tax

cycle in Ontario, Canada’s most populous province. The province

recently confirmed that no reassessment will take place for 2024

without providing a timeline for the next assessment update. At a

time when most regions in Canada reassess properties annually – and

even those annual assessments are resulting in tax shifts – next

year’s assessments in Ontario will be nine years out of date. The

ongoing delay in reassessment is compromising the province’s

economic competitiveness and could ultimately translate to higher

property tax rates.

A copy of the Altus Group 2023 Canadian Property Tax Rate

Benchmark Report can be downloaded at:

https://www.altusgroup.com/insights/canadian-property-tax-benchmark-report/

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 2,900 employees across North America, EMEA and

Asia Pacific. For more information about Altus (TSX: AIF) please

visit altusgroup.com.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Elizabeth LambeDirector, Global Communications,

Altus Group(416) 641-9787Elizabeth.Lambe@altusgroup.com

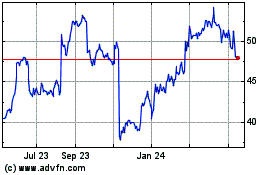

Altus (TSX:AIF)

Historical Stock Chart

From Jan 2025 to Mar 2025

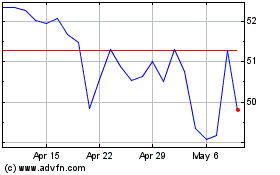

Altus (TSX:AIF)

Historical Stock Chart

From Feb 2024 to Mar 2025