Altus Group Limited (“Altus Group” or the “Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate (“CRE”), announced today that it signed a definitive

agreement to acquire the commercial real estate valuation and

advisory services business of Situs Group LLC (a SitusAMC company)

(“REVS”), for US$225.0 million (approximately C$310.1 million) in

cash, or net approximately US$190.0 million (approximately C$261.9

million) after consideration of an estimated acquisition-related

benefit of the tax step-up, implying a 13.4x 2023 normalized EBITDA

multiple.

“Current market complexity and increasing

financial reporting demands drive the need for high quality and

timely valuations and data driven insights for CRE investors and

operators,” said Jim Hannon, CEO of Altus Group. “We are excited to

have the highly regarded REVS team join the top talent at Altus

Group. Collectively we will expand the scope of valuation offers,

including advanced analytics, that we deliver to clients.”

Acquisition Highlights

The proposed acquisition is expected to provide

Altus Group with the following strategic advantages:

- Enhances valuation

offering: enhances client value with complementary

solutions that are embedded in key client workflows and opens up

new growth avenues for advanced analytics applications.

- Expands talent to

efficiently serve clients: adds bench strength with highly

credentialed and licensed valuation professionals, technologists,

and a scalable service delivery function with synergistic workflow

technology.

- Strengthens financial

profile: supports recurring revenue growth, immediately

accretive to Analytics earnings, and creates operating

efficiencies.

- Enhances strategic

long-term growth opportunities: adds strong technology

assets with expansive valuation datasets that are core to Altus

Group’s strategy to scale advanced analytics.

REVS offers independent valuation management

solutions to some of the largest CRE institutional investors in the

U.S., including pension funds, insurance companies, investment

managers, banks, and other CRE asset owners and investors. The

transaction will include REVS’ key commercial solutions for

valuation management (including its Valuation Management System and

the Daily Valuation System technology platforms), as well as

related appraisal and consulting services such as portfolio

monitoring and reporting, portfolio valuations, pension fund

monitoring and reporting, and other similar services.

The REVS team includes highly credentialed and

licensed valuation professionals who leverage real-time data,

proprietary research, and innovative technology to help clients

monitor and report the value of their commercial real estate

portfolios directly contributing to their investment decision

process and financial reporting requirements. Approximately 350

people are expected to join Altus Group as part of the

acquisition.

“The combination of our market expertise and

expansive valuation datasets will create best-in-class valuation

intelligence,” added Rick Kalvoda, President of Analytics for the

Americas region at Altus Group. “It will elevate the insights and

transparency we bring to clients to help them drive asset

performance and manage risk.”

“Joining Altus Group will create significant

value for our clients, our team and the industry,” added Brian

Velky, Head of REVS. “Coming together will enhance our independent

end-to-end valuation capabilities to ensure we’re best positioned

to meet our clients’ evolving needs.”

Financial Information

The transaction is expected to strengthen the

Company’s recurring revenue base, be immediately accretive to Altus

Group’s Adjusted EBITDA and Adjusted EBITDA margin for its

Analytics reportable segment and create operating efficiencies.

REVS has been consistently growing its topline in the double-digits

and expects to generate approximately US$46.2 million

(approximately C$63.6 million) in revenue and approximately US$14.2

million (approximately C$19.5 million) in normalized EBITDA* for

fiscal 2023.

On closing, Altus Group will pay US$225.0

million (approximately C$310.1 million) in cash, funded by cash on

hand and borrowings under the Company’s credit facilities. In

connection with the acquisition of REVS, the Company obtained a

commitment from lenders to increase its borrowing capacity under

its existing bank credit facilities from up to an aggregate of

C$550 million to up to an aggregate of C$725 million. The increase

to the Company’s borrowing capacity is subject to completion of the

acquisition of REVS, satisfaction of typical conditions precedent,

and definitive documentation.

Assuming that this transaction, as well as the

previously announced acquisition of Forbury Property Valuation

Solutions Limited, both close, the Company’s funded debt to

Adjusted EBITDA leverage ratio is expected to still be below its

4.5x maximum capacity limit under its credit facilities. Given the

expected synergies and existing strong cash flows, Altus Group

expects to steadily de-lever to its target 2.0x – 2.5x funded debt

to Adjusted EBITDA leverage ratio range by the end of 2025.

The acquisition of REVS is expected to

close prior to the end of the first half of 2024, subject

to customary closing conditions, including receipt of regulatory

approvals. Altus Group plans to discuss the transaction during its

Q3 2023 financial results conference call scheduled at 5:00 pm ET

today.

Cravath, Swaine & Moore LLP is serving as

legal counsel to Altus Group. Kramer Levin Naftalis & Frankel

LLP and Kirkland & Ellis LLP are serving as legal counsel and

Evercore is serving as financial advisor to Situs Group LLC.

* Normalized EBITDA is a non-GAAP measure as

defined by Situs Group, LLC

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 3,000 employees across North America, EMEA and

Asia Pacific. For more information about Altus Group (TSX: AIF)

please visit altusgroup.com.

Forward-Looking Information

Certain information in this press release may

constitute “forward-looking information” within the meaning of

applicable securities legislation. All information contained in

this press release, other than statements of current and historical

fact, is forward-looking information, including statements relating

to expected financial and other benefits of the acquisition and the

closing of the acquisition (including the expected timing of

closing), as well as statements relating to the Company’s business,

strategies and leverage (including the commitment to increase

borrowing capacity). Generally, forward-looking information can be

identified by use of words such as “may”, “will”, “expect”,

“believe”, “plan”, “would”, “could”, “remain” and other similar

terminology. Forward-looking information is not, and cannot be, a

guarantee of future results or events. Forward-looking information

is based on, among other things, opinions, assumptions, estimates

and analyses that, while considered reasonable by us at the date

the forward-looking information is provided, inherently are subject

to significant risks, uncertainties, contingencies and other

factors that may cause actual results, performance or achievements,

industry results or events to be materially different from those

expressed or implied by the forward-looking information. Those

risks, uncertainties and other factors that could cause actual

results to differ materially from the forward-looking information

include those described in our publicly filed documents, including

the Annual Information Form for the year ended December 31, 2022

and the Company’s other periodic filings with the securities

commissions or similar regulatory authorities in Canada (which are

available on SEDAR+ at www.sedarplus.com). We believe that the

expectations reflected in forward-looking information are based

upon reasonable assumptions; however, we can give no assurance that

actual results will be consistent with the forward-looking

information. Not all factors which affect the forward-looking

information are known, and actual results may vary from the

projected results in a material respect, and may be above or below

the forward-looking information presented in a material

respect.

Given these risks, uncertainties and other

factors, investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information contained herein is current as of the

date of this press release and, except as required under applicable

law, we do not undertake to update or revise it to reflect new

events or circumstances.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Camilla BartosiewiczChief Communications

Officer, Altus Group(416)

641-9773camilla.bartosiewicz@altusgroup.com

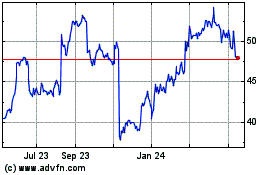

Altus (TSX:AIF)

Historical Stock Chart

From Jan 2025 to Mar 2025

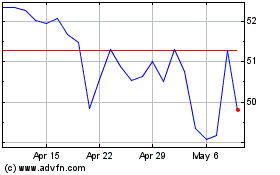

Altus (TSX:AIF)

Historical Stock Chart

From Feb 2024 to Mar 2025