Allied Properties Real Estate Investment Trust Announces Distribution Increase for 2013

13 December 2012 - 9:35AM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced that its Trustees have

approved an increase in monthly cash distributions from $0.11 per unit ($1.32

per unit annualized) to $0.1133 per unit ($1.36 per unit annualized). The

increased monthly distribution will commence on January 15, 2013, payable to

unitholders of record on December 31, 2012.

"Management and the Trustees support the two-fold objective of raising

distributions when and to the extent it is prudent to do so while simultaneously

reducing pay-out ratios," said Michael Emory, President and CEO. "Having made

steady progress in establishing the basis for above-average FFO and AFFO per

unit growth in the coming years, we're confident of our ability to meet this

two-fold objective in 2013."

Allied has demonstrated a strong and steady commitment to the balance sheet. The

decision of the Trustees to increase distributions was made in the context of

that commitment. In establishing Allied's distribution policy for 2013, the

Trustees took cognizance of the following ongoing objectives:

-- continuing the reduction of FFO and AFFO pay-out ratios going forward;

-- maintaining conservative debt ratios;

-- maintaining a high interest-coverage ratio; and

-- maintaining a high degree of liquidity.

FFO and AFFO are not financial measures defined by International Financial

Reporting Standards ("IFRS"). Please see Allied's MD&A for a description of

these measures and their reconciliation to net income and comprehensive income

under IFRS, as presented in Allied's condensed interim consolidated financial

statements for the quarter ended September 30, 2012. These statements, together

with accompanying notes and MD&A, have been filed with SEDAR, www.sedar.com, and

are also available on Allied's web-site, www.alliedreit.com.

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. Allied's actual

results and performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Important factors that could cause actual results to differ

materially from expectations include, among other things, general economic and

market factors, competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information Form which is

available at www.sedar.com. The cautionary statements qualify all

forward-looking statements attributable to Allied and persons acting on its

behalf. Unless otherwise stated, all forward-looking statements speak only as of

the date of this press release, and Allied has no obligation to update such

statements.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties REIT

Michael R. Emory

President and Chief Executive Officer

(416) 977-9002

memory@alliedreit.com

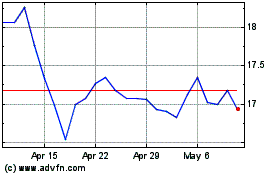

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

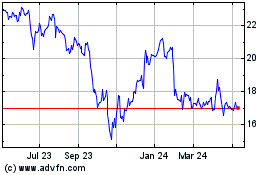

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024