MONTREAL, QUEBEC (TSX: ARA), a Canadian medical device company

and a leader in optical molecular imaging products for the

healthcare and pharmaceutical industries, is pleased to announce

its financial results for the first quarter ended March 31, 2008.

ART reported revenues of $1,241,921 for the three-month period

ended March 31, 2008, compared to $394,214 for the same quarter a

year ago, an increase of 215%. For the 2008 first quarter, the

operating loss decreased by $869,943, or 40%, to $1,334,321 from

$2,204,264 for the same period a year ago. The Company posted a net

loss of $1,279,456 ($0.01 per share) for the 2008 first quarter,

compared to $1,568,686 ($0.03 per share) for the corresponding 2007

period. All dollar amounts referenced herein are in U.S. dollars,

unless otherwise stated.

2008 First Quarter Highlights

- Company maintains upward trend in revenues with over $1

million in sales through its own direct sales force, for the second

quarter in a row.

- ART secures a first breakthrough sale of SoftScan� breast

imaging device to Sunnybrook Health Sciences Centre in Toronto,

where the device is being used to measure treatment response for

breast cancer.

- ART concludes the sale of one Optix� unit and converted

systems at two sites to the new MX2 version of Optix.

- ART recruits two additional sales professionals, with strong

track records in selling imaging instrumentation and in supporting

a high technology user base, to represent the Optix product in

North America.

Post Quarter Events

- ART announced the closing of a private placement of US$1.1

million in preferred shares, resulting in cash and cash equivalents

totaling $4.1 million on a proforma basis as at March 31, 2008.

- ART announced that it has received a letter of intent (LOI) to

purchase its Optix MX2 preclinical optical molecular imaging

system, from the Southern California-based CRO firm BioLaurus.

Revenues

For the three-month period ended March 31, 2008, sales increased

by 215% to $1,241,921, compared to $394,214 for the same quarter a

year ago. During the quarter ended March 31, 2008, the Company sold

the first unit of SoftScan, one Optix unit, and add-ons that

resulted in the conversion of two Optix systems to the MX2 version.

This compares to one Optix unit during the same quarter a year ago.

The increase in product sales in 2008 when compared to 2007 is also

explained by the Company's transition to a direct distribution

model. By selling directly to its customers, the Company now

generates a higher revenue per system since it does not have to

provide discounts to an exclusive distributor. During the quarter

ended March 31, 2008, the Company's sales from add-ons and Fenestra

products were equivalent to those for the quarter ended March 31,

2007. In the first quarter of 2008, the Company recognized revenue

from service contracts in the amount of $35,709, concluded in the

last quarter of 2007.

Gross Margin

During the three-month period ended March 31, 2008, ART

generated a gross margin of 79% from the sales of its products

compared to 44% for the same period in the previous year. The

increase of the gross margin ratio for the three-month period ended

March 31, 2008, compared to the same period of the previous year,

is primarily due to the sale of the SoftScan unit, where the gross

margin represents almost 100% of the sale, given that this unit has

been sold as a prototype and therefore expensed as incurred in

previous years.

Operating Expenses

The Company's research and development ("R&D") expenditures

for the three-month period ended March 31, 2008, net of investment

tax credits amounted to $854,650, compared to $1,208,415 for the

same period a year ago. The R&D expenditures in the first

quarter of 2008 decreased by 29% compared to the same quarter in

2007. The decrease was related to the medical sector given that the

SoftScan program reached important approval milestones in the first

quarter of 2007, by obtaining the CE marking for Europe. As well,

in the preclinical sector, a decrease in R&D expenses was due

to the completion of the project leading to the new Optix MX2

system. The costs associated with the achievement of these

milestones, therefore, did not have to be incurred again in the

first quarter of 2008.

Selling, general, and administrative ("SG&A") expenses for

the 2008 first quarter totaled $1,283,254, compared to $1,084,528

for the same quarter a year ago. The increase in SG&A expenses

for the first quarter of 2008 relative to the 2007 first quarter

was mainly due to the hiring of the new direct sales force, which

was effective in the first quarter of 2008, and the direct

marketing expenses incurred to support the commercialization of the

Optix, SoftScan and Fenestra products.

Net Loss

The net loss for the quarter ended March 31, 2008 was $1,279,456

or $0.01 per share, compared to $1,568,686 or $0.03 per share for

the quarter ended March 31, 2007.

Financial Outlook

As part of its commercial strategy, the Company intends to sell

some of its existing SoftScan prototypes, which could represent

cash inflows of up to $1.5 million. Moreover, $2 to $3 million in

revenue could be generated through its Optix inventory, with

minimal investment. As at March 31, 2008, the Company had a working

capital of $3.5 million, including funded inventory. On a proforma

basis following the recent round of financing, the Company has $4.1

million in cash and cash equivalents as at March 31, 2008.

The financial statements, accompanying notes to the financial

statements, and Management's Discussion and Analysis for the

three-month period ended March 31, 2008, will be available online

at www.sedar.com, or at www.art.ca, in the "Investors" section.

Summary financial tables are provided below. A detailed list of the

risks and uncertainties affecting the Company can be found in the

Management's Discussion and Analysis for the year ended December

31, 2007, and in the Company's most recent Annual Information Form,

available on SEDAR at www.sedar.com.

Conference Call

ART will host a conference call today at 5:00 PM (EDT). The

telephone number to access the conference call is (514) 861-1531

when dialing within the Montreal area, or (877) 667-7766 for the

rest of North America. Outside of North America, please dial (514)

861-1531. A replay of the call will be available until May 27,

2008. To listen to the replay from the Montreal area, please dial

(514) 861-2272, or, (800) 408-3053 for the rest of North America.

From outside of North America, please dial (514) 861-2272. The

access code for the replay is 3260568#.

About ART

ART Advanced Research Technologies Inc. is a leader in molecular

imaging products for the healthcare and pharmaceutical industries.

ART has developed products in medical imaging, medical diagnostics,

disease research, and drug discovery with the goal of bringing new

and better treatments to patients faster. The Optix� optical

molecular imaging system, designed for monitoring physiological

changes in living systems at the preclinical study phases of new

drugs, is used by industry and academic leaders worldwide. The

SoftScan� optical medical imaging device is designed to improve the

diagnosis and treatment of breast cancer. Finally, the Fenestra�

line of molecular imaging contrast products provides image

enhancement for a wide range of preclinical Micro CT applications

allowing scientists to see greater detail in their imaging studies,

with potential extension into other major imaging modalities. ART

is commercializing some of these products in a global strategic

alliance with GE Healthcare, a world leader in mammography and

imaging. ART's shares are listed on the TSX under the ticker symbol

ARA. For more information on ART, visit our website at

www.art.ca.

This press release may contain forward-looking statements

subject to risks and uncertainties that would cause actual events

to differ materially from expectations. These risks and

uncertainties are described in the most recent Annual Information

Form and the financial statements for the year ended December 31,

2007, available on SEDAR (www.sedar.com).

Financial Statements (in U.S. dollars)

ART Advanced Research Technologies Inc.

Balance sheets

(In U.S. dollars)

March 31, 2008 December 31, 2007

(unaudited)

-------------------------------------------------------------------------

ASSETS

Current assets

Cash $1,001,331 $561,325

Term deposits, 3,25% maturing in

April 2008 1,994,357 3,026,329

Accounts receivable 1,318,427 1,768,146

Investment tax credits receivable 389,537 1,558,709

Inventories 1,402,511 1,510,499

Prepaid expenses 1,073,670 260,199

-------------------------------------------------------------------------

7,179,833 8,685,207

Property and equipment 598,249 551,210

Patents 2,013,113 2,135,855

Deferred development costs 1,511,610 1,268,438

-------------------------------------------------------------------------

$11,302,805 $12,640,710

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank loan 583,714 605,266

Accounts payable and accrued

liabilities 2,791,776 2,652,219

Deferred revenues 115,725 156,167

Deferred grant 152,569 152,305

Current portion of obligations under

capital leases 29,557 -

-------------------------------------------------------------------------

3,673,341 3,565,957

Obligations under capital leases 91,441 -

SHAREHOLDERS' EQUITY

Share capital and share purchase

warrants 32,217,942 32,217,942

Contributed surplus 4,574,416 4,537,336

Deficit (32,286,720) (31,007,264)

Accumulated other comprehensive income 3,032,385 3,326,739

-------------------------------------------------------------------------

7,538,023 9,074,753

-------------------------------------------------------------------------

$11,302,805 $12,640,710

-------------------------------------------------------------------------

-------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Shareholders's Equity

As at March 31, 2008

(In U.S. dollars)

Common Shares Preferred Shares

-------------------------------------------------------------------------

Number Amount Number Amount

-------------------------------------------------------------------------

Balance as at

January 1, 2007 52,248,981 $14,561,504 8,341,982 $7,907,043

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for

business acquisition 162,369 95,262

Issue of shares for

cash 42,129,242 8,373,257

Issue of share

purchase warrants

Share and share

purchase warrant

issue expenses

Stock-based

compensation

Expired warrants

-------------------------------------------------------------------------

Balance as at

December 31, 2007 94,540,592 23,030,023 8,341,982 7,907,043

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Balance as at

January 1, 2008 94,540,592 23,030,023 8,341,982 7,907,043

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Stock-based

compensation

-------------------------------------------------------------------------

Balance as at

March 31, 2008 94,540,592 $23,030,023 8,341,982 $7,907,043

-------------------------------------------------------------------------

Share Capital

and Share

Purchase

Warrants Warrants

-------------------------------------------------------------------------

Number Amount Total

-------------------------------------------------------------------------

Balance as at January 1, 2007 3,958,523 $1,562,623 $24,031,170

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

Issue of shares for business

acquisition 95,262

Issue of shares for cash 8,373,257

Issue of share purchase warrants 2,175,841 497,288 497,288

Share and share purchase warrant

issue expenses

Stock-based compensation

Expired warrants (1,278,573) (779,035) (779,035)

-------------------------------------------------------------------------

Balance as at December 31, 2007 4,855,791 1,280,876 32,217,942

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Balance as at January 1, 2008 4,855,791 1,280,876 32,217,942

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Stock-based compensation

-------------------------------------------------------------------------

Balance as at March 31, 2008 4,855,791 $1,280,876 $32,217,942

-------------------------------------------------------------------------

Accumulated

Other

Contributed Comprehensive

Surplus Deficit Income Total

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Balance as at

January 1, 2007 $3,586,059 $(21,247,643) $1,841,127 $8,210,713

Net loss (8,623,447) (8,623,447)

Translation

adjustment 1,485,612 1,485,612

--------------------------------------------------------------------------

Comprehensive

loss (8,623,447) 1,485,612 (7,137,835)

--------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares

for business

acquisition 95,262

Issue of shares

for cash 8,373,257

Issue of share

purchase

warrants 497,288

Share and share

purchase warrant

issue expenses (1,136,174) (1,136,174)

Stock-based

compensation 172,242 172,242

Expired warrants 779,035

--------------------------------------------------------------------------

Balance as at

December 31, 2007 4,537,336 (31,007,264) 3,326,739 9,074,753

--------------------------------------------------------------------------

-------------------------------------------------------------------------

Balance as at

January 1, 2008 4,537,336 (31,007,264) 3,326,739 9,074,753

Net loss (1,279,456) (1,279,456)

Translation

adjustment (294,354) (294,354)

--------------------------------------------------------------------------

Comprehensive loss (1,279,456) (294,354) (1,573,810)

--------------------------------------------------------------------------

-------------------------------------------------------------------------

Stock-based

compensation 37,080 37,080

--------------------------------------------------------------------------

Balance as at

March 31, 2008 $4,574,416 $(32,286,720) $3,032,385 $7,538,023

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Operations

(In U.S. dollars)

(Unaudited)

Three-month Periods ended March 31

-------------------------------------------------------------------------

2008 2007

-------------------------------------------------------------------------

Sales

Products $1,206,212 $394,214

Services and other revenues 35,709 -

-------------------------------------------------------------------------

1,241,921 394,214

-------------------------------------------------------------------------

Cost of sales

Products 247,793 219,484

Services and other revenues 18,105

-------------------------------------------------------------------------

265,898 219,484

-------------------------------------------------------------------------

Gross margin 976,023 174,730

-------------------------------------------------------------------------

Operating expenses

Research and development, net of

investment tax credits 854,650 1,208,415

Selling, general and administrative 1,283,254 1,084,528

Amortization 172,440 86,051

-------------------------------------------------------------------------

2,310,344 2,378,994

-------------------------------------------------------------------------

Operating loss 1,334,321 2,204,264

Financial expenses (revenues) (54,865) 35,096

-------------------------------------------------------------------------

Loss from operations before income taxes 1,279,456 2,239,360

Current income taxes (recovery) - (670,674)

-------------------------------------------------------------------------

Net loss $1,279,456 $1,568,686

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted net loss per share $0.01 $0.03

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted weighted average

number of common shares outstanding 94,540,592 53,759,082

-------------------------------------------------------------------------

-------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Cash Flows

(In U.S. dollars)

(Unaudited)

Three-month Periods ended March 31

-------------------------------------------------------------------------

2008 2007

-------------------------------------------------------------------------

OPERATING ACTIVITIES

Net loss $(1,279,456) $(1,568,686)

Items not affecting cash 86,051

Amortization 172,440

Stock-based compensation 37,080 57,452

Net changes in working capital items

Accounts receivable 395,929 (317,893)

Investment tax credits receivable 1,140,069 (105,974)

Inventories 55,489 23,370

Prepaid expenses (842,236) (14,204)

Accounts payable and accrued liabilities 239,539 (1,562,812)

Deferred revenues (35,709) -

Deferred grant 5,821 -

Income taxes payable - (670,674)

-------------------------------------------------------------------------

Cash flows from operating activities (111,034) (4,073,370)

-------------------------------------------------------------------------

INVESTING ACTIVITIES

Short-term investments - (2,389,894)

Property and equipment - (21,975)

Proceeds from disposal of property and

equipment 25,691 -

Patents (89,175) -

Deferred development costs (295,171) (153,552)

-------------------------------------------------------------------------

Cash flows from investing activities (358,655) (2,565,421)

-------------------------------------------------------------------------

FINANCING ACTIVITIES

Repayment of obligations under capital

leases (5,538) -

Common shares and share purchase

warrants - 3,887,999

Equity and debt issue expenses - (70,675)

-------------------------------------------------------------------------

Cash flows from financing activities (5,538) 3,817,324

Effect of foreign currency translation

adjustments (116,739) 29,851

-------------------------------------------------------------------------

(122,277) 3,847,175

-------------------------------------------------------------------------

Net decrease in cash and cash equivalents (591,966) (2,791,616)

Cash and cash equivalents, beginning

of period 3,587,654 6,546,936

-------------------------------------------------------------------------

Cash and cash equivalents, end of period $2,995,688 $3,755,320

-------------------------------------------------------------------------

-------------------------------------------------------------------------

CASH AND CASH EQUIVALENTS

Cash $1,001,331 $620,888

Term deposits 1,994,357 3,134,432

-------------------------------------------------------------------------

$2,995,688 $3,755,320

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Supplemental disclosure of cash flow

information

Interest paid $8,634 $25,573

Interest received 23,750 4,971

Fixed assets acquired by means of

capital leases 129,403 -

-------------------------------------------------------------------------

Contacts: ART Advanced Research Technologies Inc. Jacques Bedard

Chief Financial Officer 514-832-0777 jbedard@art.ca www.art.ca

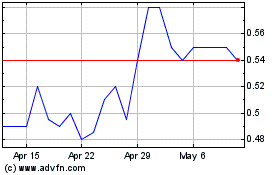

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jun 2024 to Jul 2024

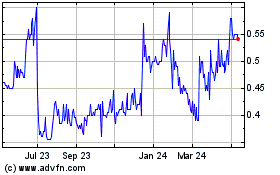

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jul 2023 to Jul 2024