Golden Minerals Company (“Golden Minerals”, “Golden” or the

“Company”) (NYSE-A: AUMN and TSX: AUMN) is pleased to report

results from the final seven holes of its recently completed

21-hole drill program at the Yoquivo gold-silver project in

northwest Chihuahua state, Mexico. Highlights from the drilling

include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220303005318/en/

Yoquivo: Completed drill holes and mapped

veins (Graphic: Business Wire)

- 2.6m @ 7.14 g/t Au and 2,058 g/t Ag

- 2.1m @ 1.26 g/t Au and 169 g/t Ag

- 1.4m @ 0.26 g/t Au and 149 g/t Ag

The drill program was comprised of 21 holes totaling 3,949m and

explored the Pertenencia, Esperanza and Dolar vein systems. Drill

holes were designed to follow up on the high-grade zones

intersected by the Company’s 2020 drill program and to explore

additional veins to identify new high-grade zones. The Company

reported previous results from this drilling program on January 27,

2022 [link] and February 16, 2022 [link]. These results cover the

final seven holes drilled during the 2021 exploration season.

Significant results and drill-hole locations are summarized in

the tables below, with complete results available on the Company

website. [link]

Hole ID

From (m)

To (m)

Interval (m)

True Width (m)

Au g/t

Ag g/t

Target

YQ_021_015

231.8

232.8

1.1

0.7

0.24

15.7

Dolar Vein

YQ_021_015

163.6

165.0

1.4

0.9

0.18

7.2

Dolar Vein

YQ_021_016

64.2

66.8

2.6

1.4

7.14

2058.0

Pertenencia Vein

including

65.0

65.8

0.8

0.5

19.50

5844.0

Pertenencia Vein

YQ_021_016

78.5

79.2

0.7

0.5

0.59

89.4

Pertenencia FW

YQ_021_017

104.5

105.0

0.5

0.3

0.09

55.3

Pertenencia Vein

YQ_021_018

142.7

144.7

2.1

1.2

1.26

168.6

New Vein

including

143.9

144.1

0.2

0.1

10.20

1319.0

New Vein

YQ_021_019

74.8

77.0

2.2

1.8

0.60

64.0

Huga Vein

YQ_021_020

64.8

66.2

1.4

1.1

0.26

149.0

Huga Vein

YQ_021_021

50.5

50.7

0.2

0.2

1.90

148.0

New Vein

YQ_021_021

146.0

146.4

0.3

0.2

0.45

57.5

Tajitos Vein

Hole ID

Easting

Northing

Elevation

Azimuth

Dip

Length

YQ_021_015

789675

3106054

2257

300

-50

150

YQ_021_016

791263

3104870

2021

300

-45

260

YQ_021_017

791264

3104870

2021

140

-65

260

YQ_021_018

791747

3105877

2083

140

-45

140

YQ_021_019

791006

3104812

2019

270

-45

300

YQ_021_020

791005

3104812

2019

180

-45

260

YQ_021_021

791748

3105509

2066

180

-45

300

Coordinates are in WGS84 datum, zone 12N

Drill hole YQ_021_016 was drilled to explore the southern

continuation of the high-grade mineralization intersected by hole

YQ_021_006 (6.2m grading 17.19 g/t Au and 2,403.5 g/t Ag (link)),

and the drill hole intercepted a banded quartz-sulphide vein

containing significant argentite, galena and pyrite, surrounded by

a wide zone of altered and silicified andesites and stockwork

veining.

Two drill holes explored the newly identified “Huga” vein which

is located between the Pertenencia and San Francisco vein systems.

Surface mapping and sampling previously identified a quartz vein

along a 500m strike length along what is now the Huga vein that

returned good gold and silver values in a 2020 surface exploration

program. The drill holes intersected a number of quartz breccia

veins that contained anomalous silver and gold values, with the

best intercept returning 1.4m @ 0.26 g/t Au and 149 g/t Ag.

The Company has also recovered drill core from a 2007 program

completed by West Timmins Mining in which West Timmins Mining

drilled 2,470.75m in 8 holes. Golden Minerals’ geologists are

currently relogging and resampling the drill core and will

incorporate this data into the Golden Minerals database.

The Company has recently submitted an application to the

Secretariat of Environment and Natural Resources (SEMARNAT) for a

50-hole, 10,000m drill program to allow the Company to continue to

drill at Yoquivo, with the aim of fully exploring the four major

vein systems on the property and discovering additional high-grade,

gold-silver zones.

“Yoquivo continues to produce excellent results, with these

final holes demonstrating that the Pertenencia vein has the

potential to contain significant high-grade, gold-silver

mineralization. Our drilling has now extended the Pertenencia vein

system by approximately 700 meters to the north and more than 100

meters to the south, and with the discovery of a new mineralized

structure, the Huga vein, demonstrates that there is unrealized

potential at Yoquivo,” said Warren Rehn, President and Chief

Executive Officer of Golden Minerals. “We anticipate restarting

exploration at Yoquivo in the coming months.”

About Yoquivo

Golden holds an option to purchase seven concessions that

comprise the Yoquivo property, totaling 1,974.8 hectares located in

western Chihuahua State in northern Mexico, for payments totaling

$0.75 million over four years and subject to a 2% net smelter

return royalty on production capped at $2 million. The claims cover

an underexplored epithermal precious metals district that shows

similar mineralization to the adjacent Ocampo mining district, and

the Company, through systematic exploration, hopes to identify

significant high-grade mineralization.

Review by Qualified Person and Quality Control

The technical contents of this press release have been reviewed

by Matthew Booth, a Qualified Person for the purposes of NI 43-101.

Mr. Booth has over 18 years of mineral exploration experience and

is a Qualified Person member of the American Institute of

Professional Geologists (CPG 12044).

To ensure reliable sample results, Golden Minerals uses a

quality assurance/quality control program that monitors the chain

of custody of samples and includes the insertion of blanks,

duplicates, and reference standards in each batch of samples.

Quality Assurance / Quality Control

Diamond drilling was conducted by Eco Drilling México S. de R.L.

de C.V with a Cortech CSD 1300G rig. Drill holes were drilled to

depths ranging from 102m to 351m and were drilled at azimuths of

140° or 310° and a dip ranging from -45° to -75°. No water was

encountered during drilling. Holes were positioned with a hand-held

GPS (accuracy +/- 5 meters) and later surveyed with a Differential

GPS once the drilling campaign was completed.

Samples of the core were obtained using a diamond saw to cut the

core in half, retaining one half for a permanent core record, and

the other sent for analysis.

Drill-core samples were shipped to ALS Chemex sample preparation

facility in Chihuahua, Chihuahua, Mexico for sample preparation and

for analysis at the ALS laboratory in North Vancouver, British

Columbia, Canada. The ALS Chihuahua and North Vancouver facilities

are ISO 9001 and ISO/IEC 17025 certified. ALS Global in North

Vancouver is a facility certified as ISO 9001:2008 and accredited

to ISO/IEC 17025:2005 from the Standards Council of Canada.

Samples were crushed to 70% passing 2mm (PREP-31) with a split

of up to 250 grams pulverized to 85% passing 75 micrometers (-200

mesh). The sample pulps and crushed splits were transferred

internally to ALS Global’s North Vancouver analytical facility for

gold and multi-element analysis. Pulps (30 gram split) are

submitted for Au analysis by fire assay with atomic absorption

finish (Au-AA23) and silver samples were analyzed by atomic

absorption (Ag-AA45).

Over-limit Au (>10.0 g/t Au) and Ag (>1500 g/t Ag) samples

are analyzed by fire assay with gravimetric finish (Au-GRA22 and

Ag-GRA21). Over-limit base metal samples (>10,000 ppm or 1%) are

re-analyzed inductively coupled plasma atomic emission spectrometry

using protocols for higher grade results (ICP-AES) for Cu, Pb and

Zn (Cu-OG62, Pb-OG62, Zn-OG62).

In-house quality control samples (blanks, standards, duplicates,

preparation duplicates) were inserted into the sample set by Golden

Minerals. ALS Global conducts its own internal QA/QC program of

blanks, standards and duplicates, and the results were provided

with the Company sample certificates. The results of the ALS

control samples were reviewed by Golden Minerals and the Company’s

QP and evaluated for acceptable tolerances.

All sample and pulp rejects are stored at the Company’s secure

warehouse in Velardeña, Durango pending full review of the

analytical data, and future selection of pulps for independent

third-party check analyses, if required.

About Golden Minerals

Golden Minerals is a growing gold and silver producer based in

Golden, Colorado. The Company is primarily focused on producing

gold and silver from its Rodeo Mine and advancing its Velardeña

Properties in Mexico and, through partner funded exploration, its

El Quevar silver property in Argentina, as well as acquiring and

advancing selected mining properties in Mexico, Nevada and

Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended, and applicable Canadian securities legislation, including

statements regarding the potential for the Yoquivo property to host

economic grades and the Company’s plans to update the Golden

Minerals data base with results from the relogging and resampling

of the drill core from the 2007 West Timmins program . These

statements are subject to risks and uncertainties, including

changes in interpretations of geological, geostatistical,

metallurgical, mining or processing information, and

interpretations of the information resulting from exploration,

analysis or mining and processing experience. Golden Minerals

assumes no obligation to update this information. Additional risks

relating to Golden Minerals may be found in the periodic and

current reports filed with the SEC by Golden Minerals, including

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220303005318/en/

For additional information please visit

http://www.goldenminerals.com/ or contact:

Golden Minerals Company Karen Winkler, Director of Investor

Relations (303) 839-5060

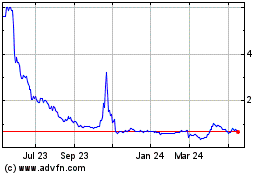

Golden Minerals (TSX:AUMN)

Historical Stock Chart

From Nov 2024 to Dec 2024

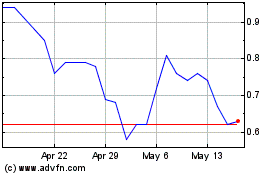

Golden Minerals (TSX:AUMN)

Historical Stock Chart

From Dec 2023 to Dec 2024