Bitfarms Ltd. (NASDAQ/TSX: BITF), a global vertically integrated

Bitcoin mining company, exercised its previously announced purchase

option for 28,000 Bitmain T21 miners and also purchased an

additional 19,280 Bitmain T21 miners for US$14/TH, 3,888 Bitmain

S21 miners and 740 Bitmain S21 hydro miners for

US$17.50/TH.

“With Bitcoin achieving new all-time high prices

and having already confirmed the tremendous performance from our

T21 miners currently running, Bitfarms acted quickly to secure

additional T21 and S21 miners before anticipated hardware price

increases. These miners are scheduled to be delivered in 2024, we

believe they are sufficient to reach 21 EH/s in 2024 without a

redeployment of our older miners, which we intend to liquidate to

help offset the cost of new miners,” said Geoff Morphy, President

and CEO of Bitfarms.

“These orders solidify our expansion plan for

2024 and provide the pathway to operating one of the newest and

potentially most powerful mining fleets in the industry leading

into what looks to be a promising bull market. Securing these

miners now is a key part of our strategy to drive rapid and

meaningful improvements across our three key operating metrics of

hashrate, energy efficiency and operating costs per terahash with a

plan to capture greater upside from rising Bitcoin prices with

rapidly expanding mining margins,” Morphy concludes.

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global Bitcoin

mining company that contributes its computational power to one or

more mining pools from which it receives payment in Bitcoin.

Bitfarms develops, owns, and operates vertically integrated mining

farms with in-house management and company-owned electrical

engineering, installation service, and multiple onsite technical

repair centers. The Company’s proprietary data analytics system

delivers best-in-class operational performance and uptime.

Bitfarms currently has 11 operating Bitcoin

mining facilities and two under development situated in four

countries: Canada, the United States, Paraguay, and Argentina.

Powered predominantly by environmentally friendly hydro-electric

and long-term power contracts, Bitfarms is committed to using

sustainable and often underutilized energy infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

www.bitfarms.comhttps://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- BTC BTC/day = Bitcoin or Bitcoin per day

- EH or EH/s = Exahash or exahash per second

- MW or MWh = Megawatts or megawatt hour

- w/TH = Watts/Terahash efficiency (includes cost of powering

supplementary equipment

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the Toronto

Stock Exchange, Nasdaq, or any other securities exchange or

regulatory authority accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding the potential performance of new equipment

purchases, projected growth, target hashrate, the benefits of

upgrading and deployment of miners, the potential for improved

financial performance and other statements regarding future growth,

plans and objectives of the Company are forward-looking

information. Any statements that involve discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “prospects”,

“believes” or “intends” or variations of such words and phrases or

stating that certain actions, events or results “may” or “could”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: the construction and operation of the

Company’s facilities may not occur as currently planned, or at all;

expansion may not materialize as currently anticipated, or at all;

the digital currency market; the ability to successfully mine

digital currency; revenue may not increase as currently

anticipated, or at all; it may not be possible to profitably

liquidate the current digital currency inventory, or at all; a

decline in digital currency prices may have a significant negative

impact on operations; an increase in network difficulty may have a

significant negative impact on operations; the volatility of

digital currency prices; the anticipated growth and sustainability

of hydroelectricity for the purposes of cryptocurrency mining in

the applicable jurisdictions; the inability to maintain reliable

and economical sources of power for the Company to operate

cryptocurrency mining assets; the risks of an increase in the

Company’s electricity costs, cost of natural gas, changes in

currency exchange rates, energy curtailment or regulatory changes

in the energy regimes in the jurisdictions in which the Company

operates and the adverse impact on the Company’s profitability; the

ability to complete current and future financings, including the

Company’s ability to utilize the Company’s at-the-market equity

offering program (the “ATM Program”) and the prices at which the

Company may sell Common Shares in the ATM Program;any regulations

or laws that will prevent Bitfarms from operating its business;

historical prices of digital currencies and the ability to mine

digital currencies that will be consistent with historical prices;

and the adoption or expansion of any regulation or law that will

prevent Bitfarms from operating its business, or make it more

costly to do so. For further information concerning these and other

risks and uncertainties, refer to the Company’s filings on

www.SEDAR.com (which are also available on the website of the U.S.

Securities and Exchange Commission at www.sec.gov), including the

MD&A for the year-ended December 31, 2023, filed on March 7,

2024. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those expressed in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended, including factors that are currently unknown to or deemed

immaterial by the Company. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

any forward-looking information. The Company undertakes no

obligation to revise or update any forward-looking information

other than as required by law.

Investor Relations contacts:

Tracy Krumme (Bitfarms)+1

786-671-5638tkrumme@bitfarms.com

David Barnard (LHA)+1

415-433-3777Investors@bitfarms.com

Media contacts:

Actual Agency Khushboo Chaudhary+1

646-373-9946mediarelations@bitfarms.com

Québec Media: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

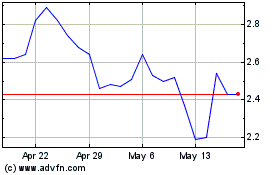

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

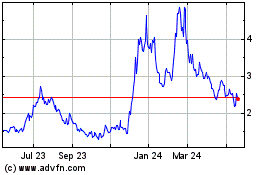

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025