Amalfi Capital Corp. ("Amalfi" or the "Corporation") (TSX VENTURE:ALI.P)

announces amendments to the terms of the CDR Minerals Inc. ("CDR") brokered

private placement previously announced on May 17, 2010. Amalfi also announces

amendments (the "Consequential Amendments") to the terms of the amalgamation

agreement (the "Amalgamation Agreement") between Amalfi and CDR, in addition to

those terms previously announced on May 31, 2010. Pursuant to the Amalgamation

Agreement, Amalfi's wholly-owned subsidiary will amalgamate with CDR (the

"Business Combination") to continue as one company ("Amalco") under the Business

Corporations Act (Ontario). In connection with the successful completion of the

Business Combination, Amalfi will change its name to "Royal Coal Corp." (the

"Resulting Issuer") and its shares will begin trading on the TSX Venture

Exchange ("TSX Venture") under the symbol "RDA".

CDR Private Placement Amendments and Proposed Shares for Debt Transaction

CDR intends to raise $4,606,000 in a private placement of 23,030,000 units (the

"Units") at a price of $0.20 per Unit (the "Private Placement"). Each Unit is

comprised of one common share of CDR (the "CDR Shares") and one common share

purchase warrant ("Warrant"). Each whole Warrant will entitle the holder to

purchase one common share of CDR at a price of $0.20 for a period of five years

from the closing of the Private Placement. CDR has engaged Northern Securities

Inc. ("Northern Securities") as agent on a best efforts basis in connection with

the Private Placement and the previously announced "bought deal" financing will

not be proceeding.

Pursuant to the terms of the Private Placement, Northern Securities received an

engagement fee of $20,000 and was issued 125,000 CDR Shares. On closing,

Northern Securities and other placement agents will receive a commission of up

to 8% of the aggregate gross proceeds of the Private Placement and will be

issued broker warrants equal to up to 10% of the number of Units sold pursuant

to the Private Placement. Each broker warrant will be exercisable to purchase

one Unit at $0.20 for a period of 60 months from the closing of the Private

Placement.

The Private Placement is being completed in connection with the Business

Combination. The closing of the Private Placement is conditional on the

completion of the Business Combination and is expected to close in the next

week. CDR intends to use the gross proceeds of the Private Placement to fund its

current coal projects in the Central Appalachian Basin in the United States, for

repayment of debt, and for general working capital purposes.

CDR has also entered into agreements (the "CDR Debt Settlement") with two arm's

length third parties (the "Trade Creditors"), pursuant to which CDR has agreed

to issue 4,125,000 Units with an aggregate value of $825,000 to the Trade

Creditors in exchange for the cancellation of $825,000 in outstanding trade

payables.

Amendments to Amalgamation Agreement

As a result of the Private Placement and in accordance with the Consequential

Amendments, Amalfi will now consolidate its shares on the basis of one new

Amalfi common share ("Amalfi Share") for every two existing Amalfi common shares

(instead of on the basis of one Amalfi Share for every three and a half existing

Amalfi common shares). As a result, shareholders of Amalfi will receive an

aggregate of 5,800,000 common shares of the Resulting Issuer ("Resulting Issuer

Shares") (instead of 3,866,666 Resulting Issuer Shares) after the completion of

the consolidation and the Business Combination, with a deemed price of $0.20 per

share (instead of $0.50 per share). In addition, each holder of an Amalfi Share

on a post consolidation basis will now receive 0.2857143 of a Resulting Issuer

new common share purchase warrant ("Resulting Issuer New Warrant") for each

Amalfi Share held, each whole warrant entitling the holder to acquire one

Resulting Issuer Share at a price of $0.20 per share for two years from the

closing of the Business Combination (instead of 0.4285714 of a Resulting Issuer

New Warrant for each Amalfi Share held with an exercise price of $0.50 per

share), resulting in the issuance of an aggregate of 1,657,143 Resulting Issuer

New Warrants. Pursuant to the Business Combination, the 1,160,000 outstanding

Amalfi stock options ("Amalfi Options") will be replaced with 580,000 stock

options of the Resulting Issuer ("Resulting Issuer Amalfi Options"), each

entitling the holder to acquire one Resulting Issuer Share at a price of $0.20

per share until November 30, 2012 (instead of 331,429 Resulting Issuer Amalfi

Options with an exercise price of $0.35 per share).

Amendments to Other Debt Arrangements

Third Eye Capital Corporation ("TEC") and Juno Special Situations Corporation

("Juno") have agreed to amend the note purchase agreement dated September 30,

2009 between Juno and TEC (the "TEC Loan") and the corresponding note purchase

agreement dated September 30, 2009 between CDR and Juno (the "Juno Loan", and

together with the TEC loan the "Indebtedness") to waive certain covenants that

were not achieved by CDR, and establish updated financial and production,

interest and repayment covenants. From the proceeds from the Private Placement,

US$1,000,000 will be paid to reduce the Indebtedness (the "Closing Repayment")

and US$450,000, representing unpaid waiver fees, will be added to the

Indebtedness and the outstanding amount of the Indebtedness after payment of the

Closing Repayment will be US$5,750,000, plus the US$2 per ton royalty capped at

3,105,000 tons referenced in the Filing Statement. The royalty payment

commitment maturity date was extended from March 31, 2011 to January 31, 2012.

GC Global Capital Inc.'s convertible debenture with CDR in the amount of

$375,000 has been amended such that $25,000 will be paid on closing of the

Private Placement and the balance of the principal will be repaid over the

period ending December 31, 2011.

Upon closing of the Private Placement, CDR has also agreed to pay Cheyenne

Resources Inc. US$800,000 of the principal amount owing under its convertible

debentures with CDR (the "CDR Cheyenne Debentures"). The principal amount of the

CDR Cheyenne Debentures after this payment will be US$4,200,000 and the maturity

date of the CDR Cheyenne Debentures will be extended to January 31, 2012.

Operations Update

Mining at the Big Branch (Cheyenne) surface mine has been continuous since the

acquisition of the mine on October 1, 2009. CDR has averaged coal production of

30,553 tons per month over the past 8 months and the proceeds of the CDR Private

Placement will be used to increase production to a targeted 65,000 tons per

month beginning October 2010. CDR intends to make capital expenditures of

US$2,400,000 at the Big Branch (Cheyenne) surface mine as follows: US$950,000

will be expended on the current mining fleet to repair key components; the

balance of US$1,450,000 will be used to acquire additional equipment enabling

the production forecast of 65,000 tons per month beginning in October 2010.

Working Capital Projections

Based on current working capital projections, the Resulting Issuer's working

capital available to fund ongoing operations, together with its revenue from

operations and the proceeds of the Private Placement, is expected by management

of CDR to meet its work program and administration costs for a minimum of 18

months without further additional capital. The projections of CDR assume the

following factors: (a) coal production will be from the Big Branch (Cheyenne)

mine only; (b) coal production from the Big Branch (Cheyenne) mine of 34,000

tons per month initially and increasing to 65,000 tons per month beginning

October 2011; (c) further capital equipment expenditures of US$2,400,000 as

described above; (d) average coal prices of US$61 for the balance of 2010 and

US$69.50 in 2011 which are based on existing contracts and contract prices

currently being negotiated by CDR. The price assumptions of CDR for 2011 are

based on prevailing market prices and the forward price curve for CDR's grade of

coal. CDR is currently negotiating coal sales contracts for 2011 at the

projected prices; and (e) average mining costs per ton of US$54 for the balance

of 2010 and US$50 in 2011, which are based on actual costs of CDR experienced to

date and projected to the end of 2010. The average mining costs projected for

2010 are based on current costs of CDR adjusted for anticipated changes in

materials and labour. Significant risks to be considered include, without

limitation, the risk that CDR might not receive the prices for its coal that are

used in its projections; CDR's production costs coming in higher than expected;

CDR's production levels and availability (uptime) of the coal production

equipment being lower than expected; CDR being unable to acquire necessary

equipment for purchase or lease; non-cooperation of suppliers with respect to

significant accrued accounts payable; CDR not being able to renew its lease on

the Charlene rail load-out facility it uses to ship coal; CDR not meeting its

outstanding financial or payment covenants in relevant loan arrangements and

related future production targets; and the other factors discussed under "Risk

Factors" in the Filing Statement.

The minimum 18 month working capital projections of CDR assume that CDR will

exercise its option in March 2011 to convert the principal amount of the Juno

Loan into Resulting Issuer Shares. CDR's option to convert is subject to CDR

using its best efforts to find alternative financings to repay the Juno Loan in

cash, to CDR not being in default under the Juno Loan, and to increased royalty

payments to Juno of US$0.10 per ton of coal for each US$1,000,000 principal

amount of the Juno Loan converted. The Resulting Issuer will remain a guarantor

of Juno's debt obligations to TEC, an arm's length lender, in respect of which

CDR has granted a general security interest over its assets.

Amendment to Previous Financing

In accordance with their agreement with CDR, investors who subscribed for an

aggregate of 2,200,000 units of CDR at a price of $0.50 per unit in January 2010

(the "January Units"), will receive 3,300,000 CDR Shares for no additional

consideration (so they will hold an aggregate of 5,500,000 CDR Shares), and the

underlying 2,200,000 share purchase warrants will be cancelled and they will

instead receive 5,500,000 Warrants.

Filing Statement Amendments

The revised terms of the Business Combination and CDR Private Placement

supersede and replace, as applicable, the description of the Business

Combination and related private placement set out in the Corporation's filing

statement dated March 29, 2010 (the "Filing Statement") which is available on

SEDAR and the Corporations press releases issued on May 17 and May 31, 2010. The

following information updates and replaces the disclosure of the Resulting

Issuer's expected pro forma consolidated capitalization and its fully diluted

share capital.

Capitalized terms used in the following sections that are not otherwise defined

herein have the meanings assigned to them in the Filing Statement.

Consolidated Capitalization of the Resulting Issuer

As a result of the Consequential Amendments, the expected capitalization of the

Resulting Issuer, after giving effect to the Qualifying Transaction and CDR

Private Placement, is as follows:

Outstanding in the Resulting

Issuer After Giving Effect to the

Qualifying Transaction and

Capital Authorized Certain Matters (1)

----------------------------------------------------------------------------

(unaudited)

Long-term Debt N/A US$2,492,340 (2)

Current Portion of Long-Term

Debt N/A US$5,213,102 (2)

Resulting Issuer Shares Unlimited US$19,012,844(3)

(93,786,007)(4)(5)

Resulting Issuer special

shares Unlimited Nil

Notes:

1. Pursuant to the Amalfi Stock Option Plan, the Resulting Issuer will have

reserved 20% of the outstanding Resulting Issuer Shares for stock

options.

2. See the pro forma financial statements of the Resulting Issuer attached

as Schedule "E" to the Filing Statement. Upon completion of the

Qualifying Transaction, the Cheyenne Debentures and the CDR Global

debentures are classified as long term debt, since the undiscounted face

value of $4,550,000 is not payable within 12 months of the Qualifying

Transaction. The Juno Loan maturity date of March 31, 2011 is less than

12 months from the Qualifying Transaction date, resulting in the

$5,750,000 undiscounted face value of the Juno Loan being reclassified

as current debt.

3. In accordance with generally accepted accounting principles for a

reverse takeover transaction, the dollar value of the share capital of

Resulting Issuer after the completion of the Amalgamation will be the

dollar value of the share capital of CDR immediately prior to completion

of the Amalgamation, together with the net value of Amalfi. In addition,

the deficit of Resulting Issuer will be the deficit of CDR immediately

prior to the completion of the Qualifying Transaction, which as at

September 30, 2009 after the deduction of stock-based compensation

costs, commissions, consultant fees and related expenses will be

($4,446,465).

4. Not including any Resulting Issuer Shares issuable pursuant to the

exercise of any convertible securities of the Resulting Issuer.

5. See Fully-Diluted Share Capital Table below.

Fully Diluted Share Capital of the Resulting Issuer

The following table describes the expected the fully-diluted share capital of

the Resulting Issuer, after giving effect to the Qualifying Transaction and CDR

Private Placement.

Number of Resulting

Issuer Shares Assuming Percentage Assuming

Outstanding Resulting Issuer Completion of the Completion of the

Shares Amalgamation(4)(6) Amalgamation

----------------------------------------------------------------------------

Resulting Issuer Shares issued

after Completion of

Amalgamation and

Consolidation to former

holders of Amalfi Shares 5,800,000 3.59%

Resulting Issuer Shares issued

after Completion of

Amalgamation and

Consolidation to former

holders of CDR Shares (as

disclosed in May 31, 2010

press release) 55,678,484 34.45%

Additional Resulting Issuer

Shares issued after

Completion of Amalgamation to

former holders of January

Units 3,300,000 2.04%

Additional Resulting Issuer

Shares issued after

Completion of Amalgamation to

holders of CDR Shares that

exercised their CDR PKM MOU

Rights 1,652,523 1.02%

Resulting Issuer Shares issued

after Completion of

Amalgamation and

Consolidation to Investors in

the CDR Private Placement(4) 23,030,000 14.25%

Resulting Issuer Shares issued

after Completion of

Amalgamation and

Consolidation to Trade

Creditors(4) 4,125,000 2.55%

Resulting Issuer Shares issued

as finder's fee pursuant to

the Qualifying Transaction 200,000 0.12%

-----------------------

Subtotal 93,786,007

Reserved Resulting Issuer

Shares

------------------------------

Securities reserved for

issuance pursuant to

Resulting Issuer CDR New

Warrants 27,155,000 16.80%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR Warrants 7,735,407 4.79%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR 2010

Warrants 5,500,000 3.40%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR Broker

Warrants 518,446 0.32%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR New

Broker Warrants (including

the underlying CDR Warrants)

(5) 4,606,000 2.85%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR Options 8,050,000 4.98%

Securities reserved for

issuance pursuant to

Resulting Issuer CDR Cheyenne

Debentures(1) 8,400,000 5.20%

Securities currently reserved

for issuance pursuant to

Resulting Issuer CDR Global

Debentures(2) 700,000 0.43%

Securities reserved for

issuance pursuant to

Resulting Issuer Amalfi

Options 580,000 0.36%

Securities reserved for

issuance pursuant to

Resulting Issuer New Warrants 1,657,143 1.03%

Securities reserved for

issuance pursuant to

Resulting Issuer New

Options(3) 2,909,902 1.80%

----------------------------------------------

Total Fully-Diluted Resulting

Issuer Shares 161,597,905 100%

Notes:

1. The US$5,000,000 principal amount of CDR Cheyenne Debentures were issued

pursuant to the Big Branch Acquisition and matured on April 1, 2011.

They bear interest at 12% per annum and are convertible into CDR Shares

on the basis of one CDR Share for each US$0.50 principal amount of

debentures until maturity. For additional information see the notes to

the financial statements for the nine months ended September 30, 2009 of

CDR attached as Schedule "D" to the Filing Statement and the notes to

the pro forma financial statements of the Resulting Issuer attached as

Schedule "E" to the Filing Statement. On closing, CDR intends to pay

US$800,000 principal amount of the CDR Cheyenne Debentures, resulting in

a principal amount owing of US$4,200,000 under the CDR Cheyenne

Debentures and the issuance on conversion of up to 8,400,000 Resulting

Issuer Common Shares.

2. The $375,000 principal amount of CDR Global Debentures currently

outstanding matures on December 31, 2010, bear interest at 12% per

annum, and are convertible into CDR Shares on the basis of one CDR Share

for each $0.50 (subject to the adjustment provisions in the CDR Global

Debentures) principal amount of debentures until maturity. For

additional information see the notes to the financial statements for the

nine months ended September 30, 2009 of CDR attached as Schedule "D" to

the Filing Statement and the notes to the pro forma financial statements

of the Resulting Issuer attached as Schedule "E" to the Filing

Statement. On closing, CDR intends to pay $25,000 principal amount of

the CDR Global Debentures, resulting in principal amount owing of

$350,000 under the CDR Global Debentures, and the issuance on conversion

of up to 700,000 Resulting Issuer Common Shares.

3. Assuming the maximum Resulting Issuer New Options are granted.

4. Assuming the completion of the CDR Private Placement and the CDR Debt

Settlement, the Resulting Issuer will issue up to an additional

27,155,000 Resulting Issuer Units, comprised of up to 27,155,000

Resulting Issuer Shares and up to 27,155,000 Resulting Issuer CDR New

Warrants in replacement of the up to 27,155,000 CDR Units issuable

pursuant to the CDR Private Placement and the CDR Debt Settlement. Each

Resulting Issuer CDR New Warrant entitles the holder to acquire one

Resulting Issuer Share at a price of $0.20 per share until the date that

is 60 months from the closing of the CDR Private Placement.

5. The Resulting Issuer will also issue up to 2,303,000 Resulting Issuer

CDR New Broker Warrants in replacement of the up to 2,303,000 CDR New

Broker Warrants issuable pursuant to the CDR Private Placement, each

entitling the holder to acquire one Resulting Issuer Unit at a price of

$0.20 per Unit until two years from the closing of the CDR Private

Placement being comprised of 2,303,000 Resulting Issuer Shares and

2,303,000 Resulting Issuer CDR New Warrants.

6. The Amalfi Agents Options previously disclosed in the Filing Statement

have expired, and no Resulting Issuer Amalfi Agents' Options will be

issued in connection with the Closing of the Business Combination.

Conditions to Completion of Business Combination

The Corporation intends to work with CDR to complete the Business Combination

and Private Placement and will continue to make any additional disclosure

related to these transactions as may be required. As previously announced, the

Business Combination, if completed, is expected to constitute Amalfi's

qualifying transaction for the purposes of Policy 2.4 (the "Policy") of TSX

Venture. The completion of the Private Placement and the Business Combination

are subject to several conditions including, but not limited to, the receipt of

all applicable regulatory approvals, including the approval of the TSX Venture

of which there is no guarantee it will be obtained.

About CDR

CDR is a privately held coal exploration and production company, incorporated

pursuant to the Business Corporations Act (Ontario), headquartered in Toronto,

Ontario, Canada with a regional office in Hazard, Kentucky, U.S.A. CDR is

concentrating its efforts on developing producing surface coal mining operations

in the Central Appalachian coal producing region of the United States, which

includes parts of West Virginia, Virginia, Kentucky, Ohio, and Tennessee.

The completion of the Private Placement and the Business Combination are subject

to a number of conditions, including but not limited to, TSX Venture acceptance.

There can be no assurance that the Private Placement or the Business Combination

will be completed as proposed or at all.

Investors are cautioned that any information released or received with respect

to the Private Placement or the Business Combination may not be accurate or

complete and should not be relied upon. Trading in the securities of the

Corporation should be considered highly speculative.

Except for historical information contained herein, this news release contains

forward-looking statements that involve risks and uncertainties. Actual results

may differ materially. Neither Amalfi nor CDR will update these forward-looking

statements to reflect events or circumstances after the date hereof. More

detailed information about potential factors that could affect financial results

is included in the documents filed from time to time with the Canadian

securities regulatory authorities by Amalfi and CDR.

The securities of Amalfi being offered have not been, nor will be, registered

under the United States Securities Act of 1933, as amended, and may not be

offered or sold within the United States or to, or for the account or benefit

of, U.S. persons absent U.S. registration or an applicable exemption from U.S.

registration requirements. This release does not constitute an offer for sale of

securities in the United States.

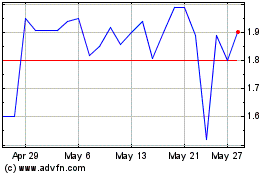

Condor Energies (TSX:CDR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Condor Energies (TSX:CDR)

Historical Stock Chart

From Feb 2024 to Feb 2025